Académique Documents

Professionnel Documents

Culture Documents

Sec. 24 A2 (A) - Bertumen, Yzabel Eden

Transféré par

Emrys Pendragon0 évaluation0% ont trouvé ce document utile (0 vote)

30 vues8 pagesTaxation Law

Titre original

Sec. 24 A2 (a) - Bertumen, Yzabel Eden

Copyright

© © All Rights Reserved

Formats disponibles

PPTX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentTaxation Law

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PPTX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

30 vues8 pagesSec. 24 A2 (A) - Bertumen, Yzabel Eden

Transféré par

Emrys PendragonTaxation Law

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PPTX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 8

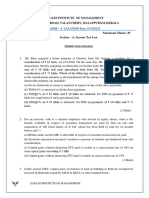

Sec. 24 – Income Tax Rates.

Yzabel Eden Bertumen

NIRC

Sec. 24 – A (2) Rates of Tax on Taxable Income of Individuals. –

The tax shall be computed in accordance with and at the rates

established in the following schedule:

TRAIN

Sec. 24 – A (2) Rates of Tax on Taxable Income of Individuals. –

The tax shall be computed in accordance with and at the rates

established in the following schedule:

For married individuals, the husband and wife,

subject to the provision of Section 51 (D) hereof, shall

compute separately their individual income tax based on

their respective total taxable income: Provided, That if

any income cannot be definitely attributed to or

identified as income exclusively earned or realized by

either of the spouses, the same shall be divided equally

between the spouses for the purpose of determining

their respective taxable income.

Provided, That the minimum wage earners as

defined in Section 22(HH) of this Code shall be exempt

from the payment of income tax on their taxable income.

Provided, further, That the holiday pay, overtime pay,

night shift differential pay and hazard pay received by

such minimum wage earners shall likewise be exempt

from income tax.

Updates under the TRAIN Law

“(b) Rate of Tax on Income of Purely Self-employed Individuals

and/or Professionals Whose Gross Sales or Gross Receipts

and Other Non-operating Income Does not Exceed the Value-

added Tax (VAT) Threshold as Provided in Section 109(BB). –

Self-employed individuals and/or professionals shall have the

option to avail of an eight percent (8%) tax on gross sales or

gross receipts and other non-operating income in excess of

Two hundred fifty thousand pesos (P250,000) in lieu of the

graduated income tax rates under Subsection (A)(2)(a) of this

Section and the percentage tax under Section 116 of this

Code.

“(c) Rate of Tax for Mixed Income Earners. – Taxpayers earning both

compensation income and income from business or practice of

profession shall be subject to the following taxes:

(1) All Income from Compensation – The rates prescribed under

Subsection (A)(2)(a) of this Section.

(2) All Income from Business or Practice of Profession –

(a) If Total Gross Sales and/or Gross Receipts and Other Non-

operating Income Do Not Exceed the VAT Threshold as Provided in

Section 109(BB) of this Code. – The rates prescribed under

Subsection (A)(2)(a) of this Section on taxable income, or eight

percent (8%) income based on gross sales or gross receipts and

other non-operating income in lieu of the graduated income tax

rates under Subsection (A)(2)(a) of this Section and the percentage

tax under Section 116 of this Code.

(b) If Total Gross Sales and/or Gross Receipts and Other

Non-operating Income Exceeds the VAT Threshold as Provided

in Section 109(BB) of this Code. – The rates prescribed under

Subsection (A)(2)(a) of this Section.

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Insurance Cases Assign 2Document78 pagesInsurance Cases Assign 2Emrys PendragonPas encore d'évaluation

- 1976 Amendments To The 1973Document2 pages1976 Amendments To The 1973Emrys PendragonPas encore d'évaluation

- Remolante vs. TibeDocument8 pagesRemolante vs. TibeEmrys PendragonPas encore d'évaluation

- Arnault V Nazareno G.R. No. L-3820 Digest: Ozaeta, J.: Topic: Legislative InquiryDocument3 pagesArnault V Nazareno G.R. No. L-3820 Digest: Ozaeta, J.: Topic: Legislative InquiryEmrys PendragonPas encore d'évaluation

- PALE - Dee Vs CADocument7 pagesPALE - Dee Vs CAEmrys PendragonPas encore d'évaluation

- Demand PaymentDocument4 pagesDemand PaymentEmrys PendragonPas encore d'évaluation

- Expropriation - Republic vs. Andaya - DigestDocument3 pagesExpropriation - Republic vs. Andaya - DigestEmrys PendragonPas encore d'évaluation

- The Lawyer in Maiden PracticeDocument4 pagesThe Lawyer in Maiden PracticeEmrys PendragonPas encore d'évaluation

- Practice of Law Defined in Cayetano vs MonsodDocument2 pagesPractice of Law Defined in Cayetano vs MonsodEmrys PendragonPas encore d'évaluation

- Tan Tek Beng vs Atty David case on solicitation of casesDocument1 pageTan Tek Beng vs Atty David case on solicitation of casesEmrys PendragonPas encore d'évaluation

- Minutes of Preliminary Conference Group 5 FinalDocument6 pagesMinutes of Preliminary Conference Group 5 FinalEmrys PendragonPas encore d'évaluation

- Pale - Dee Vs CA DigestDocument4 pagesPale - Dee Vs CA DigestEmrys PendragonPas encore d'évaluation

- Bernardo B. Pacios vs. Tahanang Walang Hagdan - DigestDocument3 pagesBernardo B. Pacios vs. Tahanang Walang Hagdan - DigestEmrys Pendragon100% (2)

- Fenequito vs. Vergara, Jr.Document3 pagesFenequito vs. Vergara, Jr.Emrys PendragonPas encore d'évaluation

- Court upholds falsification charges based on questioned document reportDocument2 pagesCourt upholds falsification charges based on questioned document reportEmrys PendragonPas encore d'évaluation

- Ortanez Vs CADocument3 pagesOrtanez Vs CAEmrys PendragonPas encore d'évaluation

- AGRA - Landbank vs. Cruz - Digest - OdtDocument2 pagesAGRA - Landbank vs. Cruz - Digest - OdtEmrys PendragonPas encore d'évaluation

- Group 5 Report 1 RevisedDocument7 pagesGroup 5 Report 1 RevisedEmrys PendragonPas encore d'évaluation

- Case Digests On Civil Procedure (Part I)Document17 pagesCase Digests On Civil Procedure (Part I)Danniel James Ancheta100% (4)

- REM 1 - Escobal vs. GarchitorenaDocument4 pagesREM 1 - Escobal vs. GarchitorenaEmrys PendragonPas encore d'évaluation

- Pale Appearance RecitDocument4 pagesPale Appearance RecitEmrys PendragonPas encore d'évaluation

- Alita V CADocument3 pagesAlita V CABoyet CariagaPas encore d'évaluation

- Agan, Jr. vs. PIATCO DigestDocument1 pageAgan, Jr. vs. PIATCO DigestEmrys PendragonPas encore d'évaluation

- REM 1 - Duero vs. CADocument4 pagesREM 1 - Duero vs. CAEmrys PendragonPas encore d'évaluation

- REM 1 - Donato vs. Court of AppealsDocument6 pagesREM 1 - Donato vs. Court of AppealsEmrys PendragonPas encore d'évaluation

- REM 1 - Agan, Jr. Vs Phil International Air Terminal, Co. Inc.Document50 pagesREM 1 - Agan, Jr. Vs Phil International Air Terminal, Co. Inc.Emrys PendragonPas encore d'évaluation

- Liga NG Mga Baranggay Vs AtienzaDocument9 pagesLiga NG Mga Baranggay Vs AtienzaiamchurkyPas encore d'évaluation

- AAA Succession PDFDocument157 pagesAAA Succession PDFBoy Omar Garangan DatudaculaPas encore d'évaluation

- 2016 Bar ResultsDocument54 pages2016 Bar ResultsAntonino Borja BormatePas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Acc and BMDocument8 pagesAcc and BMShawn Mendez100% (1)

- Macroeconomics 9th Edition Mankiw Solutions ManualDocument25 pagesMacroeconomics 9th Edition Mankiw Solutions ManualBethCastillosmoe98% (54)

- Sem-V Principle of Taxation Law PDFDocument3 pagesSem-V Principle of Taxation Law PDFAnantHimanshuEkkaPas encore d'évaluation

- Basis Period ExplainedDocument39 pagesBasis Period ExplainedMuhamad Affandi Mohd SithPas encore d'évaluation

- Fundamentals of Taxation Syllabus BreakdownDocument5 pagesFundamentals of Taxation Syllabus BreakdownGLYDEL ESIONGPas encore d'évaluation

- DTAA AnnexureDocument1 pageDTAA AnnexureNaresh KewalramaniPas encore d'évaluation

- ACCO 20133 - UNIT IX - UpdatedDocument29 pagesACCO 20133 - UNIT IX - UpdatedHarvey AguilarPas encore d'évaluation

- Pay Slip March 2018Document1 pagePay Slip March 2018Anil PuvadaPas encore d'évaluation

- Certificate of Residency Requirements For IndividualsDocument2 pagesCertificate of Residency Requirements For IndividualsViAnne ReyesPas encore d'évaluation

- March 2023 CapgeminiDocument1 pageMarch 2023 CapgeminimanojkallemuchikkalPas encore d'évaluation

- Joint Venture-TaxabilityDocument10 pagesJoint Venture-TaxabilitySyzian ExonyryPas encore d'évaluation

- INCOME TAX Ready Reckoner - by CA HARSHIL SHETHDocument38 pagesINCOME TAX Ready Reckoner - by CA HARSHIL SHETHCA Harshil ShethPas encore d'évaluation

- CIR v. Consuelo Vda. De Prieto (ViDocument2 pagesCIR v. Consuelo Vda. De Prieto (VivictoriaPas encore d'évaluation

- FRM pnd54Document1 pageFRM pnd54GeorgeAzmirPas encore d'évaluation

- De 4Document4 pagesDe 4fschalkPas encore d'évaluation

- Mauritius Personal Income Tax 2023 - 2024Document1 pageMauritius Personal Income Tax 2023 - 2024sr moosunPas encore d'évaluation

- IRAS Singapore Role Explained by RikvinDocument1 pageIRAS Singapore Role Explained by RikvinMarkZaret01Pas encore d'évaluation

- QP - TaxDocument4 pagesQP - Taxcommercetrek21Pas encore d'évaluation

- 8.6 Assignment - Regular Income Tax On CorporationsDocument3 pages8.6 Assignment - Regular Income Tax On CorporationsRoselyn LumbaoPas encore d'évaluation

- Uddhav Galande Income Tax Project (MBA (Finance)Document55 pagesUddhav Galande Income Tax Project (MBA (Finance)Uddhav GalandePas encore d'évaluation

- Sanogo 2019 TFDocument40 pagesSanogo 2019 TFbassomassi sanogoPas encore d'évaluation

- Generation-Skipping Transfer Tax Return For Terminations: General InformationDocument3 pagesGeneration-Skipping Transfer Tax Return For Terminations: General InformationIRSPas encore d'évaluation

- SET OFF AND CARRY FORWARD OF LOSSES RevisedDocument4 pagesSET OFF AND CARRY FORWARD OF LOSSES RevisedprasannacaPas encore d'évaluation

- NIRC Vs TRAIN ComparisonDocument3 pagesNIRC Vs TRAIN ComparisonAngeli PaulinePas encore d'évaluation

- CH 3Document42 pagesCH 3Aarya SharmaPas encore d'évaluation

- Salary Slip (31753687 November, 2019)Document1 pageSalary Slip (31753687 November, 2019)naheedPas encore d'évaluation

- Tax1 DeductionsDocument45 pagesTax1 DeductionsjoPas encore d'évaluation

- Rmo 43-90 PDFDocument5 pagesRmo 43-90 PDFRieland Cuevas67% (3)

- FY 2022-23 (AY 2023-24) - Taxguru - inDocument3 pagesFY 2022-23 (AY 2023-24) - Taxguru - inHarshilPas encore d'évaluation