Académique Documents

Professionnel Documents

Culture Documents

The Boston Matrix

Transféré par

rumelrashid0 évaluation0% ont trouvé ce document utile (0 vote)

336 vues15 pagesThe document discusses The Boston Matrix, also known as the BCG Matrix or Growth-Share Matrix. It is a tool that categorizes business units into four categories based on their market share and market growth: Stars (high share, high growth), Cash Cows (high share, low growth), Question Marks (low share, high growth), and Dogs (low share, low growth). The matrix helps businesses analyze which of their products or services have the most potential and where they should allocate resources for maximum returns.

Description originale:

Titre original

The Boston Matrix PPT

Copyright

© Attribution Non-Commercial (BY-NC)

Formats disponibles

PPT, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentThe document discusses The Boston Matrix, also known as the BCG Matrix or Growth-Share Matrix. It is a tool that categorizes business units into four categories based on their market share and market growth: Stars (high share, high growth), Cash Cows (high share, low growth), Question Marks (low share, high growth), and Dogs (low share, low growth). The matrix helps businesses analyze which of their products or services have the most potential and where they should allocate resources for maximum returns.

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PPT, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

336 vues15 pagesThe Boston Matrix

Transféré par

rumelrashidThe document discusses The Boston Matrix, also known as the BCG Matrix or Growth-Share Matrix. It is a tool that categorizes business units into four categories based on their market share and market growth: Stars (high share, high growth), Cash Cows (high share, low growth), Question Marks (low share, high growth), and Dogs (low share, low growth). The matrix helps businesses analyze which of their products or services have the most potential and where they should allocate resources for maximum returns.

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PPT, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 15

The Boston Matrix

(Also called the BCG

Matrix, the Growth-Share

Matrix and Portfolio

Analysis)

Focusing effort to give the greatest

returns

If you enjoy visual representations and vivid

descriptions of your business then you'll love the

Boston Matrix!

Also called the BCG Matrix, it provides a useful

way of looking at the opportunities open to you,

and helps you analyze which segments of your

business are in a good position – and which

ones aren’t. That way, you can decide on the

most appropriate investment strategy for your

business in the future, and where best to

allocate your resources.

Understanding the Model

Market Share and Market Growth

Understanding the Model

To understand the Boston Matrix you need to understand how

market share and market growth interrelate.

Market share is the percentage of the total market that is being

serviced by your company, measured either in revenue terms

or unit volume terms. The higher your market share, the higher

proportion of the market you control.

The Boston Matrix assumes that if you enjoy a high market

share you will normally be making money (this assumption is

based on the idea that you will have been in the market long

enough to have learned how to be profitable, and will be

enjoying scale economies that give you an advantage).

Understanding the Model

The question it asks is, "Should you be investing your

resources into that product line just because it is making

you money?" The answer is, "not necessarily."

This is where market growth comes into play. Market

growth is used as a measure of a market's

attractiveness. Markets experiencing high growth are

ones where the total market is expanding, which should

provide the opportunity for businesses to make more

money, even if their market share remains stable.

By contrast, competition in low growth markets is often

bitter, and while you might have high market share now,

what will the situation look like in a few months or a few

years? This makes low growth markets less attractive.

Understanding the Model

Note:

The origin of the Boston Matrix lies with the

Boston Consulting Group in the early 1970s. It

was devised as a clear and simple method for

helping corporations decide which parts of their

business they should allocate their available cash

to. Today, this is as important as ever because

of the limited availability of credit.

However, the Boston Matrix is also a good tool

for thinking about where to apply other finite

resources: people, time and equipment.

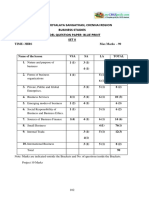

The Matrix Itself

The Boston Matrix

categorizes

opportunities into four

groups, shown on

axes of Market

Growth and Market

Share:

Dogs: Low Market Share / Low

Market Growth

In these areas, your market presence is

weak, so it's going to take a lot of hard

work to get noticed. Also, you won't enjoy

the scale economies of the larger players,

so it's going to be difficult to make a

profit.

Cash Cows: High Market Share / Low Market

Growth

Here, you're well-established, so it's easy

to get attention and exploit new

opportunities. However it's only worth

expending a certain amount of effort,

because the market isn't growing and your

opportunities are limited.

Stars: High Market Share / High Market

Growth

Here you're well-established, and growth

is exciting! These are fantastic

opportunities, and you should work hard

to realize them.

Question Marks (Problem Child):

Low Market Share / High Market Growth

These are the opportunities no one knows what

to do with. They aren't generating much

revenue right now because you don't have a

large market share. But, they are in high growth

markets so the potential to make money is

there.

Question Marks might become Stars and

eventual Cash Cows, but they could just as

easily absorb effort with little return. These

opportunities need serious thought as to

whether increased investment is warranted.

How to Use The Tool:

To use the Boston Matrix to look at your

opportunities, use the following steps:

Step One: Plot your opportunities in terms of

their relative market presence, and market

growth on a blank matrix or a worksheet.

Step Two: Classify them into one of the four

categories. If a product seems to fall right on

one of the lines, take a real hard look at the

situation and rely on past performance to help

you decide which side you will place it.

Step Three: Determine what you will do

with each product/product line. There are

typically four different strategies to apply:

Build Market Share: Make further investments

(for example, to maintain Star status, or turn a

Question Mark into a Star)

Hold: Maintain the status quo (do nothing)

Harvest: Reduce the investment (enjoy positive

cash flow and maximize profits from a Star or

Cash Cow)

Divest: For example, get rid of the Dogs, and

use the capital to invest in Stars and some

Question Marks.

Key Points

The Boston Matrix is an effective tool for quickly

assessing the options open to you, both on a

corporate and personal basis.

With its easily understood classification into

"Dogs", "Cash Cows", "Question Marks" and

"Stars", it helps you quickly and simply screen

the opportunities open to you, and helps you

think about how you can make the most of

them.

Vous aimerez peut-être aussi

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Ariel ResearchDocument8 pagesAriel ResearchMariposa De Barrio0% (1)

- Integrated Advertising, Promotion, and Marketing CommunicationsDocument42 pagesIntegrated Advertising, Promotion, and Marketing Communicationswaleed ahmadPas encore d'évaluation

- ACN202 CaseDocument9 pagesACN202 CaseMohammed RaiyanPas encore d'évaluation

- Blood For SaleDocument2 pagesBlood For SaleJesse Amfra NagaPas encore d'évaluation

- Indian Oil Corporation: Presented By: Gyan Prakash Gupta Pgdm-CiimDocument19 pagesIndian Oil Corporation: Presented By: Gyan Prakash Gupta Pgdm-CiimG P GuptaPas encore d'évaluation

- Assignment # 01: "Treasury and Funds Management"Document5 pagesAssignment # 01: "Treasury and Funds Management"Jahan Zeb KhanPas encore d'évaluation

- Mapping The Influence of Influencer Marketing: A Bibliometric AnalysisDocument25 pagesMapping The Influence of Influencer Marketing: A Bibliometric AnalysisDr. POONAM KAUSHALPas encore d'évaluation

- Production OrderDocument3 pagesProduction OrderBenjamin DalerePas encore d'évaluation

- Country of Origin Master ThesisDocument4 pagesCountry of Origin Master Thesisjpcbobkef100% (2)

- Marketing VS SalesDocument6 pagesMarketing VS Salesprince husainPas encore d'évaluation

- Hafiz Muhammad Faiq 20191-25291 Assignment 1Document3 pagesHafiz Muhammad Faiq 20191-25291 Assignment 1FaiqMullaPas encore d'évaluation

- Bi Questions Unit4Document2 pagesBi Questions Unit4pet tetPas encore d'évaluation

- Business Environment and Starbucks Coffee MarketingDocument8 pagesBusiness Environment and Starbucks Coffee MarketingIrfanul HoquePas encore d'évaluation

- EuropeDocument11 pagesEuropeMohamed ElkashifPas encore d'évaluation

- 089 Mandar Deshmukh MR Case Study 2Document2 pages089 Mandar Deshmukh MR Case Study 2tanya singhPas encore d'évaluation

- Channel Management DecisionDocument9 pagesChannel Management DecisionbriggsjuniorPas encore d'évaluation

- ADM - Trends and Net 12 Q.3 Weeks 1-8Document32 pagesADM - Trends and Net 12 Q.3 Weeks 1-8Tenshi InouePas encore d'évaluation

- 6277 Article Text 19698 1 10 20220722Document14 pages6277 Article Text 19698 1 10 20220722Phạm ThảoPas encore d'évaluation

- Managerial Application of AnalyticsDocument4 pagesManagerial Application of AnalyticsshailajaPas encore d'évaluation

- Going To Pieces, Valuing Users, Subscribers and Customers - DamodaranDocument46 pagesGoing To Pieces, Valuing Users, Subscribers and Customers - DamodaranKári FinnssonPas encore d'évaluation

- Bhaskar Sandeep Rahul Bhalerao Rahul K. G. ShivaramkrishnaDocument10 pagesBhaskar Sandeep Rahul Bhalerao Rahul K. G. ShivaramkrishnaRahul BhaleraoPas encore d'évaluation

- Cbse Class 11 Business Studies Sample Paper 04 - CompressDocument8 pagesCbse Class 11 Business Studies Sample Paper 04 - CompressRahul Kumar (Rahulkumar)Pas encore d'évaluation

- Chapter 2 - Market StudyDocument24 pagesChapter 2 - Market StudyRed SecretarioPas encore d'évaluation

- Business Proposal ChapterDocument7 pagesBusiness Proposal ChapterJULIAJuliaPas encore d'évaluation

- Corporate Strategy: Mgn571: Corporate Strategy and Decision Simulation Unit I Strategic ManagementDocument105 pagesCorporate Strategy: Mgn571: Corporate Strategy and Decision Simulation Unit I Strategic ManagementJyoti Arvind PathakPas encore d'évaluation

- The Ever Changing Market Place of Oman Marketing EssayDocument12 pagesThe Ever Changing Market Place of Oman Marketing EssayakmohideenPas encore d'évaluation

- BusinessPlan Kimbab 1Document8 pagesBusinessPlan Kimbab 1RatuPas encore d'évaluation

- LESSON 2 Opportunity Identification and Developing A Business PlanDocument2 pagesLESSON 2 Opportunity Identification and Developing A Business Planjannconrado bonifacioPas encore d'évaluation

- K-12 School Presentation PDFDocument28 pagesK-12 School Presentation PDFDinabandhu PatraPas encore d'évaluation

- Brand Management - Brand PositioningDocument13 pagesBrand Management - Brand PositioningDrishti AgarwalPas encore d'évaluation