Académique Documents

Professionnel Documents

Culture Documents

Ch06-Investors in The Share Market

Transféré par

Trần AnhTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Ch06-Investors in The Share Market

Transféré par

Trần AnhDroits d'auteur :

Formats disponibles

Chapter 6

Investors in

the Share Market

Websites:

www.ato.gov.au

www.asx.com.au

Copyright 2007 McGraw-Hill Australia Pty Ltd

PPTs t/a McGrath’s Financial Institutions, Instruments and Markets 5e by Viney 6-1

Slides prepared by Anthony Stanger

Learning Objectives

• Appreciate the range of investment choices

available for the investor

• Understand the process of buying and selling

shares, the risks involved, and the importance of

taxation when investing

• Describe indicators of financial performance

• Explain share pricing methods

• Consider the importance of share-market indices

and published share information

Copyright 2007 McGraw-Hill Australia Pty Ltd

PPTs t/a McGrath’s Financial Institutions, Instruments and Markets 5e by Viney 6-2

Slides prepared by Anthony Stanger

Chapter Organisation

6.1 Stock Exchange and Share-Market Investment

6.2 Buying and Selling Shares

6.3 Taxation

6.4 Financial Performance Indicators

6.5 Pricing of Shares

6.6 Stock-Market Indices and Published Share

Information

6.7 Summary

Copyright 2007 McGraw-Hill Australia Pty Ltd

PPTs t/a McGrath’s Financial Institutions, Instruments and Markets 5e by Viney 6-3

Slides prepared by Anthony Stanger

6.1 Stock Exchange and Share-Market

Investment

• Investors buy shares to receive returns from

dividends and capital gains (losses)

• Other factors encouraging investment in securities

quoted on a stock exchange (SX)

– Depth of the market

Overall capitalisation of corporations listed on a SX

– Liquidity of the market

Volume of trading relative to the size of the market

– Efficient price discovery

Speed and efficiency with which new information is reflected

in the current share price

Copyright 2007 McGraw-Hill Australia Pty Ltd

PPTs t/a McGrath’s Financial Institutions, Instruments and Markets 5e by Viney 6-4

Slides prepared by Anthony Stanger

6.1 Stock Exchange and Share-Market

Investment (cont.)

• The SX offers a wide range of security types to the

investor

• Securities listed on the SX are categorised into

industry groups allowing investors a choice within

a range of economic sectors

Copyright 2007 McGraw-Hill Australia Pty Ltd

PPTs t/a McGrath’s Financial Institutions, Instruments and Markets 5e by Viney 6-5

Slides prepared by Anthony Stanger

6.1 Stock Exchange and Share-Market

Investment (cont.)

• Two types of risk impact on security returns

– Systematic risk

Factors that generally impact on share prices in the market,

e.g. economic growth, and changes in interest rates and

exchange rates

– Unsystematic risk

Factors that specifically impact on the share price of a

corporation, e.g. resignation of the CEO, technology failure,

board problems

Copyright 2007 McGraw-Hill Australia Pty Ltd

PPTs t/a McGrath’s Financial Institutions, Instruments and Markets 5e by Viney 6-6

Slides prepared by Anthony Stanger

6.1 Stock Exchange and Share-Market

Investment (cont.)

• Diversified investment portfolio

– A portfolio containing a wide range of securities

– Diversifies most of the unsystematic risk of the individual

securities

Investors will not receive higher returns for unnecessarily

bearing unsystematic risk

– The remaining risk is systematic risk, which is measured

by beta

Beta is a measure of the sensitivity of the price of an asset

relative to the market

Copyright 2007 McGraw-Hill Australia Pty Ltd

PPTs t/a McGrath’s Financial Institutions, Instruments and Markets 5e by Viney 6-7

Slides prepared by Anthony Stanger

6.1 Stock Exchange and Share-Market

Investment (cont.)

• Diversified investment portfolio (cont.)

– Expected portfolio return is the weighted average of

expected returns of each share

– Portfolio variance (risk) is the correlation of pairs of

securities within the portfolio

Copyright 2007 McGraw-Hill Australia Pty Ltd

PPTs t/a McGrath’s Financial Institutions, Instruments and Markets 5e by Viney 6-8

Slides prepared by Anthony Stanger

6.1 Stock Exchange and Share-Market

Investment (cont.)

• Investors may take one of two approaches

– Active investment approach

Portfolio structure is based on share analysis, new

information and risk-return preferences

– Passive investment approach

Portfolio structure is based on the replication of a specific

share-market index, e.g. industrial or telecommunications

sector index

• Some managed funds are index funds

– Portfolios are structured to fully or partially replicate a

specific share-market index

Copyright 2007 McGraw-Hill Australia Pty Ltd

PPTs t/a McGrath’s Financial Institutions, Instruments and Markets 5e by Viney 6-9

Slides prepared by Anthony Stanger

6.1 Stock Exchange and Share-Market

Investment (cont.)

• Investors need to consider asset allocation within a

share portfolio

Risk versus return

Investment time horizon

Income versus capital growth

Domestic and international shares

• Asset allocation may be

Strategic

Tactical

Copyright 2007 McGraw-Hill Australia Pty Ltd

PPTs t/a McGrath’s Financial Institutions, Instruments and Markets 5e by Viney 6-10

Slides prepared by Anthony Stanger

Chapter Organisation

6.1 Stock Exchange and Share Investment

6.2 Buying and Selling Shares

6.3 Taxation

6.4 Financial Performance Indicators

6.5 Pricing of Shares

6.6 Stock-Market Indices and Published Share

Information

6.7 Summary

Copyright 2007 McGraw-Hill Australia Pty Ltd

PPTs t/a McGrath’s Financial Institutions, Instruments and Markets 5e by Viney 6-11

Slides prepared by Anthony Stanger

6.2 Buying and Selling Shares

• Direct investment in shares

– Investor buys and sells shares through a stockbroker

Discount broker, i.e. phone and Internet

Full-service advisory broker

– Consideration of liquidity, risk, return, charges, taxation,

social security etc.

• Indirect investment in shares

– Investor purchases units in a unit trust or managed fund,

e.g. equity trust

Copyright 2007 McGraw-Hill Australia Pty Ltd

PPTs t/a McGrath’s Financial Institutions, Instruments and Markets 5e by Viney 6-12

Slides prepared by Anthony Stanger

Chapter Organisation

6.1 Stock Exchange and Share Investment

6.2 Buying and Selling Shares

6.3 Taxation

6.4 Financial Performance Indicators

6.5 Pricing of Shares

6.6 Stock-Market Indices and Published Share

Information

6.7 Summary

Copyright 2007 McGraw-Hill Australia Pty Ltd

PPTs t/a McGrath’s Financial Institutions, Instruments and Markets 5e by Viney 6-13

Slides prepared by Anthony Stanger

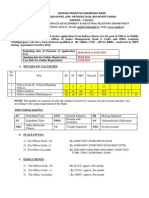

6.3 Taxation

• Pre-dividend imputation (prior to 1987)

– Dividends were taxed twice—first at company level (as

profits) and then at the investor’s marginal rate

• Dividend imputation (since 1987)

– Removed the double taxation of dividends

– Investors receive franking credit for the tax a company

pays on a franked dividend

Copyright 2007 McGraw-Hill Australia Pty Ltd

PPTs t/a McGrath’s Financial Institutions, Instruments and Markets 5e by Viney 6-14

Slides prepared by Anthony Stanger

6.3 Taxation (cont.)

Copyright 2007 McGraw-Hill Australia Pty Ltd

PPTs t/a McGrath’s Financial Institutions, Instruments and Markets 5e by Viney 6-15

Slides prepared by Anthony Stanger

6.3 Taxation (cont.)

• Capital gains tax on shares purchased

– Prior to 19/9/1985 tax free

– 19/9/1985–21/9/1999

Taxpayer’s marginal tax rate applied if held less than 12

months

Taxpayer’s marginal tax rate applied to indexed capital gain

if held over 12 months

– Since 21/9/1999

50% discounted gain if held at least 12 months or

Indexed capital gain or 50% discounted gain if purchased

19/9/1985–21/9/1999

Copyright 2007 McGraw-Hill Australia Pty Ltd

PPTs t/a McGrath’s Financial Institutions, Instruments and Markets 5e by Viney 6-16

Slides prepared by Anthony Stanger

Chapter Organisation

6.1 Stock Exchange and Share Investment

6.2 Buying and Selling Shares

6.3 Taxation

6.4 Financial Performance Indicators

6.5 Pricing of Shares

6.6 Stock-Market Indices and Published Share

Information

6.7 Summary

Copyright 2007 McGraw-Hill Australia Pty Ltd

PPTs t/a McGrath’s Financial Institutions, Instruments and Markets 5e by Viney 6-17

Slides prepared by Anthony Stanger

6.4 Financial Performance Indicators

• Potential investors are concerned with the future

level of a company’s performance

• Company’s performance affects both the

profitability of the company and the variability of

the cash flows

Copyright 2007 McGraw-Hill Australia Pty Ltd

PPTs t/a McGrath’s Financial Institutions, Instruments and Markets 5e by Viney 6-18

Slides prepared by Anthony Stanger

6.4 Financial Performance Indicators

(cont.)

• Indicators of company performance

– Capital structure

– Liquidity

– Debt servicing

– Profitability

– Share price

– Risk

Copyright 2007 McGraw-Hill Australia Pty Ltd

PPTs t/a McGrath’s Financial Institutions, Instruments and Markets 5e by Viney 6-19

Slides prepared by Anthony Stanger

6.4 Financial Performance Indicators

(cont.)

Capital structure

• Proportion of company assets (funding) obtained

through debt and equity

– Usually measured by debt to equity ratio (D/E)

Higher debt levels increase financial risk, i.e. firm may not

be able to meet interest payments

Copyright 2007 McGraw-Hill Australia Pty Ltd

PPTs t/a McGrath’s Financial Institutions, Instruments and Markets 5e by Viney 6-20

Slides prepared by Anthony Stanger

6.4 Financial Performance Indicators

(cont.)

Capital structure (cont.)

• Proportion of company assets (funding) obtained

through debt and equity (cont.)

– Also measured by proprietorship ratio, which is the ratio

of shareholders’ funds to total assets

Indicates firm’s longer-term financial viability/stability. A

higher ratio indicates less reliance on external funding

Copyright 2007 McGraw-Hill Australia Pty Ltd

PPTs t/a McGrath’s Financial Institutions, Instruments and Markets 5e by Viney 6-21

Slides prepared by Anthony Stanger

6.4 Financial Performance Indicators

(cont.)

Liquidity

• The ability of a company to meet its short-term

financial obligations

• Measured by current ratio

– Fails to consider the not very liquid nature of certain

current assets like inventory

Current ratio current assets (maturing within one year)

current liabilities (due within one year)

(6.2)

Copyright 2007 McGraw-Hill Australia Pty Ltd

PPTs t/a McGrath’s Financial Institutions, Instruments and Markets 5e by Viney 6-22

Slides prepared by Anthony Stanger

6.4 Financial Performance Indicators

(cont.)

Liquidity (cont.)

• Measured by liquid ratio

• The higher the current and liquid ratios, the better

the liquidity position of a firm

Liquid ratio current assets - inventory stock (on hand)

current liabilities - bank overdraft

Copyright 2007 McGraw-Hill Australia Pty Ltd

PPTs t/a McGrath’s Financial Institutions, Instruments and Markets 5e by Viney 6-23

Slides prepared by Anthony Stanger

6.4 Financial Performance Indicators

(cont.)

Debt servicing

• Ability to meet debt-related obligations, i.e. interest

and repayment of debt

• Measured by debt to gross cash flow ratio

– Indicates number of years of cash flow required to repay

firm debt

Copyright 2007 McGraw-Hill Australia Pty Ltd

PPTs t/a McGrath’s Financial Institutions, Instruments and Markets 5e by Viney 6-24

Slides prepared by Anthony Stanger

6.4 Financial Performance Indicators

(cont.)

Debt servicing (cont.)

• Measured by interest coverage ratio

Interest cover earnings before finance lease charges, interest and tax

finance lease charges and interest

(6.4)

Copyright 2007 McGraw-Hill Australia Pty Ltd

PPTs t/a McGrath’s Financial Institutions, Instruments and Markets 5e by Viney 6-25

Slides prepared by Anthony Stanger

6.4 Financial Performance Indicators

(cont.)

Profitability

• Wide variation in the measurement of profitability

– Earnings before interest and tax (EBIT) to total funds

ratio

– Earnings per share (EPS)

EBIT to total funds ratio

EBIT

total funds employed (shareholders' funds and borrowings)

(6.5)

Copyright 2007 McGraw-Hill Australia Pty Ltd

PPTs t/a McGrath’s Financial Institutions, Instruments and Markets 5e by Viney 6-26

Slides prepared by Anthony Stanger

6.4 Financial Performance Indicators

(cont.)

Profitability (cont.)

• Wide variation in the measurement of profitability

(cont.)

– EBIT to long-term funds ratio

EBIT to long- term funds ratio

EBIT

long- term funds (i.e. total funds less short - term debt)

(6.6)

Copyright 2007 McGraw-Hill Australia Pty Ltd

PPTs t/a McGrath’s Financial Institutions, Instruments and Markets 5e by Viney 6-27

Slides prepared by Anthony Stanger

6.4 Financial Performance Indicators

(cont.)

Profitability (cont.)

• Wide variation in the measurement of profitability

(cont.)

– Return on equity (net income/equity)

– Higher ratios indicate greater profitability

Return on equity net income

equity (shareholders' funds)

(6.7)

Copyright 2007 McGraw-Hill Australia Pty Ltd

PPTs t/a McGrath’s Financial Institutions, Instruments and Markets 5e by Viney 6-28

Slides prepared by Anthony Stanger

6.4 Financial Performance Indicators

(cont.)

Share price

• Represents investors’ view of the present value of

future net cash flows of a firm

• Share price performance indicators

– Price to earnings ratio (P/E)

Share price divided by earnings per share

A higher P/E indicates more growth in future net cash flows

– Share price to net tangible assets ratio (P/NTA)

Measures the theoretical premium or discount a firm’s share

price is trading relative to its NTA

Copyright 2007 McGraw-Hill Australia Pty Ltd

PPTs t/a McGrath’s Financial Institutions, Instruments and Markets 5e by Viney 6-29

Slides prepared by Anthony Stanger

6.4 Financial Performance Indicators

(cont.)

Risk

• Variability (uncertainty) of the share price

• Two components

– Systematic risk (often referred to as beta)

Arises from factors affecting the whole market, e.g. state of

the domestic economy and world economy

– Non-systematic risk

Arises from firm-specific factors, e.g. management

competence, labour productivity, financial and operational

risks

Can be eliminated in a well-diversified portfolio

Copyright 2007 McGraw-Hill Australia Pty Ltd

PPTs t/a McGrath’s Financial Institutions, Instruments and Markets 5e by Viney 6-30

Slides prepared by Anthony Stanger

Chapter Organisation

6.1 Stock Exchange and Share Investment

6.2 Buying and Selling Shares

6.3 Taxation

6.4 Financial Performance Indicators

6.5 Pricing of Shares

6.6 Stock-Market Indices and Published Share

Information

6.7 Summary

Copyright 2007 McGraw-Hill Australia Pty Ltd

PPTs t/a McGrath’s Financial Institutions, Instruments and Markets 5e by Viney 6-31

Slides prepared by Anthony Stanger

6.5 Pricing of Shares

• Share price is mainly a function of supply and

demand for a share

– Supply and demand are influenced mainly by information

– Share price is considered to be the present value of

future dividend payments to shareholders

– New information that changes investors’ expectations

about future dividends will result in a change in the share

price

Copyright 2007 McGraw-Hill Australia Pty Ltd

PPTs t/a McGrath’s Financial Institutions, Instruments and Markets 5e by Viney 6-32

Slides prepared by Anthony Stanger

6.5 Pricing of Shares (cont.)

• Estimating the price of a share

– General dividend valuation model

D t

P t1 t

1rs

0

P current share price

0

Where D expected dividend per share in period t

t

(6.8)

r required rate of return

s

Copyright 2007 McGraw-Hill Australia Pty Ltd

PPTs t/a McGrath’s Financial Institutions, Instruments and Markets 5e by Viney 6-33

Slides prepared by Anthony Stanger

6.5 Pricing of Shares (cont.)

• Estimating the price of a share (cont.)

– Valuing a share with a constant dividend (D0)

D

P

0

0

rs

(6.9)

– Valuing a share with constant dividend growth (g)

1g

P D

0 0

r g

s

(6.12)

Copyright 2007 McGraw-Hill Australia Pty Ltd

PPTs t/a McGrath’s Financial Institutions, Instruments and Markets 5e by Viney 6-34

Slides prepared by Anthony Stanger

6.5 Pricing of Shares (cont.)

• Cum-dividend and ex-dividend

– Dividends are payments made to shareholders,

expressed as cents per share

– Dividends are declared at one date and paid at a later

specified date

– During the period between the two dates, the shares

have the future dividend entitlement attached, i.e. cum-

dividend

Copyright 2007 McGraw-Hill Australia Pty Ltd

PPTs t/a McGrath’s Financial Institutions, Instruments and Markets 5e by Viney 6-35

Slides prepared by Anthony Stanger

6.5 Pricing of Shares (cont.)

• Cum-dividend and ex-dividend (cont.)

– Once the dividend is paid the shares are traded ex-

dividend

– Theoretically the share price will fall on the ex-dividend

date by the size of the dividend

Example

Share price cum-dividend $1.00

Dividend paid 0.07

Theoretical ex-dividend price 0.93

Copyright 2007 McGraw-Hill Australia Pty Ltd

PPTs t/a McGrath’s Financial Institutions, Instruments and Markets 5e by Viney 6-36

Slides prepared by Anthony Stanger

6.5 Pricing of Shares (cont.)

• Bonus share issues

– Where a company has accumulated reserves, it may

distribute these to existing shareholders by making a

bonus issue of additional shares

– As with dividends, there will be a downward adjustment

in share price when shares go ex-bonus

Copyright 2007 McGraw-Hill Australia Pty Ltd

PPTs t/a McGrath’s Financial Institutions, Instruments and Markets 5e by Viney 6-37

Slides prepared by Anthony Stanger

6.5 Pricing of Shares (cont.)

• Bonus share issues (cont.)

– As no new capital is raised, there is no change in the

assets or expected earnings of the company

Example—if a bonus 1:4 issue is made

Cum-bonus price $5.00

Market value of 4 cum-bonus shares $20.00

Theoretical value of 5 ex-bonus shares $20.00

Theoretical value of 1 ex-bonus share $4.00

Copyright 2007 McGraw-Hill Australia Pty Ltd

PPTs t/a McGrath’s Financial Institutions, Instruments and Markets 5e by Viney 6-38

Slides prepared by Anthony Stanger

6.5 Pricing of Shares (cont.)

• Share splits

– Involves division of the number of shares on issue

– Involves no fundamental change in the structure or asset

value of the company

– Theoretically the share price will fall in the proportion of

the split

Example—5 for 1 split

Pre-split share price $50.00

Theoretical ex-split share price $10.00

Copyright 2007 McGraw-Hill Australia Pty Ltd

PPTs t/a McGrath’s Financial Institutions, Instruments and Markets 5e by Viney 6-39

Slides prepared by Anthony Stanger

6.5 Pricing of Shares (cont.)

• Pro-rata rights issue

– Involves an increase in the company’s issued capital

– Typically issued at a discount to market price

– Theoretically, the market price will fall by an amount

dependent on

The number of shares issued

The size of the discount

Copyright 2007 McGraw-Hill Australia Pty Ltd

PPTs t/a McGrath’s Financial Institutions, Instruments and Markets 5e by Viney 6-40

Slides prepared by Anthony Stanger

6.5 Pricing of Shares (cont.)

• Pro-rata rights issue (cont.)

– Example—market price cum-rights $1.00, with 1:5 rights

issue priced at $0.88

Cum-rights share price $1.00

Market value of 5 cum-rights shares 5.00

Plus new cash from 1:5 issue 0.88

Market value of 6 ex-rights shares 5.88

Theoretical ex-rights share price 0.98

Copyright 2007 McGraw-Hill Australia Pty Ltd

PPTs t/a McGrath’s Financial Institutions, Instruments and Markets 5e by Viney 6-41

Slides prepared by Anthony Stanger

6.5 Pricing of Shares (cont.)

• Pro-rata rights issue (cont.)

– A renounceable right is a right that can be sold before it is

exercised

The value of the right is determined by Equation 6.13

Value of right N (cum rights price - subscription price)

N 1

Where N is the number of shares required

to obtain the rights issue share, and the subscription

price is the discounted price of the additional share.

(6.13)

Copyright 2007 McGraw-Hill Australia Pty Ltd

PPTs t/a McGrath’s Financial Institutions, Instruments and Markets 5e by Viney 6-42

Slides prepared by Anthony Stanger

Chapter Organisation

6.1 Stock Exchange and Share Investment

6.2 Buying and Selling Shares

6.3 Taxation

6.4 Financial Performance Indicators

6.5 Pricing of Shares

6.6 Stock-Market Indices and Published Share

Information

6.7 Summary

Copyright 2007 McGraw-Hill Australia Pty Ltd

PPTs t/a McGrath’s Financial Institutions, Instruments and Markets 5e by Viney 6-43

Slides prepared by Anthony Stanger

6.6 Stock-Market Indices and Published

Share Information

• Stock-market indices

– Measure of the price performance of a share market or

industry sector, e.g.

Performance benchmark index

• Measures overall share-market performance based on

capitalisation and liquidity

Tradeable benchmark index

• A narrow index used as the basis for pricing certain derivative

products

Market indicator index

• Measure of overall share-market performance

Copyright 2007 McGraw-Hill Australia Pty Ltd

PPTs t/a McGrath’s Financial Institutions, Instruments and Markets 5e by Viney 6-44

Slides prepared by Anthony Stanger

6.6 Stock-Market Indices and Published

Share Information (cont.)

• Market indicator indices

– Price-weighted, e.g. Dow Jones

Weighting of a company proportional to its share price

– Capitalisation-weighted, e.g. S&P/ASX All Ords

Weighting of a company proportional to market

capitalisation

– Share-price index measures capital gains/losses from

investing in an index-related portfolio

– Accumulation index includes share price changes and

reinvestment of dividends

Copyright 2007 McGraw-Hill Australia Pty Ltd

PPTs t/a McGrath’s Financial Institutions, Instruments and Markets 5e by Viney 6-45

Slides prepared by Anthony Stanger

6.6 Stock-Market Indices and Published

Share Information (cont.)

• Market indicator indices (cont.)

– Global industry classification standard (GICS) comprises

10 standard international industry sector indices, e.g.

energy, materials, industrials

• Published share information

– Newspapers and financial journals provide share-market

information to varying degrees of detail, e.g. Australian

Financial Review

Copyright 2007 McGraw-Hill Australia Pty Ltd

PPTs t/a McGrath’s Financial Institutions, Instruments and Markets 5e by Viney 6-46

Slides prepared by Anthony Stanger

Chapter Organisation

6.1 Stock Exchange and Share Investment

6.2 Buying and Selling Shares

6.3 Taxation

6.4 Financial Performance Indicators

6.5 Pricing of Shares

6.6 Stock-Market Indices and Published Share

Information

6.7 Summary

Copyright 2007 McGraw-Hill Australia Pty Ltd

PPTs t/a McGrath’s Financial Institutions, Instruments and Markets 5e by Viney 6-47

Slides prepared by Anthony Stanger

6.7 Summary

• Factors a share investor should consider

– Diversification, portfolio return and risk

– Active or passive investment

– Direct or indirect investment

– Taxation

– Company financial performance indicators

Capital structure, liquidity, debt servicing, profitability, share

price, risk

Copyright 2007 McGraw-Hill Australia Pty Ltd

PPTs t/a McGrath’s Financial Institutions, Instruments and Markets 5e by Viney 6-48

Slides prepared by Anthony Stanger

6.7 Summary (cont.)

• Factors that influence a company’s share price

– Expected future dividends

– Bonus shares issues

– Share splits

– Pro-rata rights issues

• Various share-market indices exist that provide a

measure of the price performance of a sector or of

the market overall

Copyright 2007 McGraw-Hill Australia Pty Ltd

PPTs t/a McGrath’s Financial Institutions, Instruments and Markets 5e by Viney 6-49

Slides prepared by Anthony Stanger

Vous aimerez peut-être aussi

- ACCA F2 Course NotesDocument494 pagesACCA F2 Course NotesТурал Мансумов100% (4)

- Strategic Factor Analysis Summary (Marvel - Case Study)Document31 pagesStrategic Factor Analysis Summary (Marvel - Case Study)Surjit Puruhutjit100% (8)

- Sweet and Snack Show Part 2 PDFDocument9 pagesSweet and Snack Show Part 2 PDFDurban Chamber of Commerce and IndustryPas encore d'évaluation

- Non Bank Financial InstitutionsDocument53 pagesNon Bank Financial InstitutionsKHANG THÁIPas encore d'évaluation

- MASDocument13 pagesMASchloe maePas encore d'évaluation

- The Poultry Market in Nigeria: Market Structures and Potential For Investment in The MarketDocument26 pagesThe Poultry Market in Nigeria: Market Structures and Potential For Investment in The MarketJakePas encore d'évaluation

- Food Labelling Requirements in MalaysiaDocument15 pagesFood Labelling Requirements in MalaysiaanisPas encore d'évaluation

- Investment ProposalDocument17 pagesInvestment Proposalaidan2008100% (1)

- India's Pharmaceutical TradeDocument21 pagesIndia's Pharmaceutical Tradeprat1401Pas encore d'évaluation

- BIR audit program guidelinesDocument10 pagesBIR audit program guidelinesEcarg EtrofnomPas encore d'évaluation

- An Assignment On: The Marketing Plan of "Pure Honey"Document19 pagesAn Assignment On: The Marketing Plan of "Pure Honey"wasab negiPas encore d'évaluation

- Accounting For Partnerships: Basic Considerations and FormationDocument38 pagesAccounting For Partnerships: Basic Considerations and FormationRaihanah008100% (2)

- Food Survey of IndiaDocument258 pagesFood Survey of Indiameenx100% (1)

- S.no Importers Contact Details Phone Contact Email FAX: Tarpaulin ExportersDocument2 pagesS.no Importers Contact Details Phone Contact Email FAX: Tarpaulin ExportersSyed Faizan AhmedPas encore d'évaluation

- Cheesemaking FundamentalsDocument39 pagesCheesemaking FundamentalsPreeti Sharma100% (1)

- Cold Press TechnologyDocument3 pagesCold Press TechnologyaditijhalaPas encore d'évaluation

- Cost Volume Profit AnalysisDocument25 pagesCost Volume Profit Analysisnicole bancoro100% (1)

- Medicinal and Aromatic Plants Processing Firms in Nepal PDFDocument5 pagesMedicinal and Aromatic Plants Processing Firms in Nepal PDFDeepak Kumar KhadkaPas encore d'évaluation

- Cost Volume Profit Analysis (CVP Analysis) : Incremental Contribution"Document14 pagesCost Volume Profit Analysis (CVP Analysis) : Incremental Contribution"Corin Ahmed CorinPas encore d'évaluation

- Dairy Industry in India: Growth of Value Added ProductsDocument24 pagesDairy Industry in India: Growth of Value Added ProductsMelissa MejiaPas encore d'évaluation

- Food AdultrationDocument6 pagesFood AdultrationSachin SharmaPas encore d'évaluation

- Adulteration and MisbrandingDocument26 pagesAdulteration and Misbrandingtahilsharma91Pas encore d'évaluation

- Saffola OilDocument13 pagesSaffola OilLiza HuangPas encore d'évaluation

- Beef Industry National RD and E Strategy PDFDocument56 pagesBeef Industry National RD and E Strategy PDFEd ZPas encore d'évaluation

- Developing Organic Marketing for Bangkok RetailersDocument114 pagesDeveloping Organic Marketing for Bangkok RetailersSashi RajPas encore d'évaluation

- Agro Tech FoodsDocument2 pagesAgro Tech FoodssushantbharagavaPas encore d'évaluation

- Maize Demand and Value Chains Inasia PDFDocument44 pagesMaize Demand and Value Chains Inasia PDFKrishna VeniPas encore d'évaluation

- Apeda, Bis, Mpeda, Spice BoardDocument19 pagesApeda, Bis, Mpeda, Spice BoardArchana MadpathiPas encore d'évaluation

- Intellectual Property RightsDocument13 pagesIntellectual Property Rightsn.t100% (2)

- Saffola Oil Marketing PlanDocument6 pagesSaffola Oil Marketing PlanPreet KapadiaPas encore d'évaluation

- Olympic Industries LimitedDocument18 pagesOlympic Industries LimitedRakib HasanPas encore d'évaluation

- Mixed Fruit JamDocument13 pagesMixed Fruit Jamनिशांत मित्तलPas encore d'évaluation

- Contract Farming in PoultryDocument17 pagesContract Farming in PoultryHiral Joysar100% (1)

- Business Plan QuestionnaireDocument4 pagesBusiness Plan Questionnaireshantanu_malviya_1Pas encore d'évaluation

- Modern TradeDocument7 pagesModern Traderhythm001Pas encore d'évaluation

- Fruit and Vegetable Powder Project ReportDocument2 pagesFruit and Vegetable Powder Project ReportSCINTILLA AGRO BUSINESS SOLUTIONS LLP100% (1)

- ExportDocument42 pagesExportAzharuddinShaikhPas encore d'évaluation

- Business Model CanvasDocument4 pagesBusiness Model CanvasAndre CarrilloPas encore d'évaluation

- Centre For Entrepreneurship Development Madhya Pradesh (CEDMAP)Document31 pagesCentre For Entrepreneurship Development Madhya Pradesh (CEDMAP)Pramod ShrivastavaPas encore d'évaluation

- Financial Analysis of Food IndustryDocument8 pagesFinancial Analysis of Food Industrysona0% (1)

- Mula Ko Achar Ko BusinessDocument23 pagesMula Ko Achar Ko BusinessGrishma Dangol100% (1)

- Business PlanDocument70 pagesBusiness PlanSurya PrakashPas encore d'évaluation

- Export of Cashew Nuts: Presented By: Gargi Vohra, R740209037, Mba - Ibm III - Sem UpesDocument39 pagesExport of Cashew Nuts: Presented By: Gargi Vohra, R740209037, Mba - Ibm III - Sem UpesPriyanka Kulshrestha50% (4)

- Wheyless Cheese Manufacture Based On Novel Cheese Technology Platform NCTP Licensing OpportunityDocument1 pageWheyless Cheese Manufacture Based On Novel Cheese Technology Platform NCTP Licensing OpportunityOsman Aita100% (1)

- Ready To Cook FoodDocument4 pagesReady To Cook FoodManish JhaPas encore d'évaluation

- HedgingDocument18 pagesHedgingzakirno19248Pas encore d'évaluation

- Understanding the VC ProcessDocument13 pagesUnderstanding the VC ProcessStXvrPas encore d'évaluation

- MangoDocument5 pagesMangoSandip KardilePas encore d'évaluation

- Report of The PLAN Nigeria Symposium at 3AAHC 2016 - Final AO Sept 14 2016 PDFDocument34 pagesReport of The PLAN Nigeria Symposium at 3AAHC 2016 - Final AO Sept 14 2016 PDFAugustine OkoruwaPas encore d'évaluation

- Introduction & Profile Note - InDIAGRODocument7 pagesIntroduction & Profile Note - InDIAGROPooja RathiPas encore d'évaluation

- Meat Distributer Management PlanDocument19 pagesMeat Distributer Management PlanMachelPas encore d'évaluation

- Chapter-I: Executive SummaryDocument95 pagesChapter-I: Executive Summary9579645387Pas encore d'évaluation

- Gujarat State Fertilizer & Chemicals LimitedDocument33 pagesGujarat State Fertilizer & Chemicals LimitedPRATIKPas encore d'évaluation

- HUL's Strategic AnalysisDocument14 pagesHUL's Strategic AnalysisAmit B0% (1)

- EggDocument33 pagesEggrajesh100% (3)

- Nsel ScamDocument13 pagesNsel Scamkinjalkapadia087118Pas encore d'évaluation

- Natural Food PreservativesDocument5 pagesNatural Food Preservativesdevendra kumarPas encore d'évaluation

- How To Start Grasscutter Farming BusinessDocument12 pagesHow To Start Grasscutter Farming BusinessOpirexPas encore d'évaluation

- Dairy Business in IndiaDocument21 pagesDairy Business in IndiaShubham GuptaPas encore d'évaluation

- Fast Moving Consumer GoodsDocument11 pagesFast Moving Consumer GoodsPradip SinghPas encore d'évaluation

- DFM Foods 11feb2014Document10 pagesDFM Foods 11feb2014equityanalystinvestorPas encore d'évaluation

- Presentaion On Ready To Eat Meal Brand (Kazi Farm)Document18 pagesPresentaion On Ready To Eat Meal Brand (Kazi Farm)bashirPas encore d'évaluation

- Fish BusinessDocument30 pagesFish BusinessToha Hossain Utsha100% (1)

- Kothala HimbutuDocument2 pagesKothala HimbutuHashan ErandaPas encore d'évaluation

- GA Product LaunchDocument27 pagesGA Product LaunchRuchi KankariyaPas encore d'évaluation

- Venkys ChickenDocument20 pagesVenkys ChickenNilesh AhujaPas encore d'évaluation

- Food Additives GuideDocument12 pagesFood Additives GuideSherylleneAguileraPas encore d'évaluation

- Ch07-Forecasting Share Price MovementsDocument40 pagesCh07-Forecasting Share Price MovementsTrần AnhPas encore d'évaluation

- Over View of Financial ManagementDocument24 pagesOver View of Financial ManagementTrần AnhPas encore d'évaluation

- Analyzing Transactions: Student VersionDocument56 pagesAnalyzing Transactions: Student VersionTrần AnhPas encore d'évaluation

- 1 Directional Trading Strategies: 1.1 The Strategy MatrixDocument10 pages1 Directional Trading Strategies: 1.1 The Strategy MatrixTrần AnhPas encore d'évaluation

- Ch07-Forecasting Share Price MovementsDocument40 pagesCh07-Forecasting Share Price MovementsTrần AnhPas encore d'évaluation

- Game Theory: Competitive Positioning in Retail MarketDocument19 pagesGame Theory: Competitive Positioning in Retail MarketTrần AnhPas encore d'évaluation

- Income Taxation Term Assessment 2 SEM SY 2019 - 2020: Coverage: Chapter 8 - 11Document4 pagesIncome Taxation Term Assessment 2 SEM SY 2019 - 2020: Coverage: Chapter 8 - 11Nhel AlvaroPas encore d'évaluation

- Giaa in Flash - 9m15Document7 pagesGiaa in Flash - 9m15Saionji IzumiPas encore d'évaluation

- AUDIT PROBS-2nd MONTHLY ASSESSMENTDocument7 pagesAUDIT PROBS-2nd MONTHLY ASSESSMENTGRACELYN SOJORPas encore d'évaluation

- Quiz 3 Cost AccountingDocument2 pagesQuiz 3 Cost AccountingRocel DomingoPas encore d'évaluation

- CMP: INR2,022 TP: INR2,636 (+30%) Stellar Growth, RM Exerts Pressure On MarginDocument10 pagesCMP: INR2,022 TP: INR2,636 (+30%) Stellar Growth, RM Exerts Pressure On MarginPoonam AggarwalPas encore d'évaluation

- Portfolio Management Process and Life Cycle InvestingDocument9 pagesPortfolio Management Process and Life Cycle InvestingOsama MuzamilPas encore d'évaluation

- Human Resoruces Development & Industrial Relations Department Phones: 08562 250137, Email: Apgbhrd@apgb - In, Web: WWW - Apgb.inDocument8 pagesHuman Resoruces Development & Industrial Relations Department Phones: 08562 250137, Email: Apgbhrd@apgb - In, Web: WWW - Apgb.inJeshiPas encore d'évaluation

- Essar ReportDocument236 pagesEssar Reportasit kumar sahooPas encore d'évaluation

- Strategic Management of Resources (SMR) Practice Questions - APICS CPIMDocument17 pagesStrategic Management of Resources (SMR) Practice Questions - APICS CPIMCerticoPas encore d'évaluation

- Tugas PT CIPUTRA DEVELOPMENT TBKDocument100 pagesTugas PT CIPUTRA DEVELOPMENT TBKNiezar Sii Chaby-Chaby MayniezPas encore d'évaluation

- FM Chapter 1 & 2Document10 pagesFM Chapter 1 & 2Ganesh VmPas encore d'évaluation

- ACCT801 219 Assignment 2 TemplateDocument2 pagesACCT801 219 Assignment 2 TemplateAcademic ServicesPas encore d'évaluation

- Private Firm as Producer & EmployerDocument63 pagesPrivate Firm as Producer & EmployermohdportmanPas encore d'évaluation

- Events OrganizerDocument32 pagesEvents OrganizerChristian LimPas encore d'évaluation

- Six Years Financial SummaryDocument133 pagesSix Years Financial Summarywaqas_haider_1Pas encore d'évaluation

- Pyq Acc 116Document7 pagesPyq Acc 116HaniraMhmdPas encore d'évaluation

- Form 709 United States Gift Tax ReturnDocument5 pagesForm 709 United States Gift Tax ReturnBogdan PraščevićPas encore d'évaluation

- Mathematics PDFDocument316 pagesMathematics PDFShawn JacobPas encore d'évaluation

- Google 10k 2015Document3 pagesGoogle 10k 2015EliasPas encore d'évaluation

- Compute Break-Even PointDocument16 pagesCompute Break-Even PointSampath SanguPas encore d'évaluation

- All About Home Loan - Razabpn@gmail - Com - Biswa Prakash Nayak - 21apr2011Document10 pagesAll About Home Loan - Razabpn@gmail - Com - Biswa Prakash Nayak - 21apr2011Biswa Prakash NayakPas encore d'évaluation

- Quail Meat and Egg Production Business PlanDocument3 pagesQuail Meat and Egg Production Business PlanPrayleen Baluran DusbangPas encore d'évaluation