Académique Documents

Professionnel Documents

Culture Documents

Accounting Standard

Transféré par

SHASHWAT MISHRA0 évaluation0% ont trouvé ce document utile (0 vote)

14 vues11 pagesppt

Titre original

Accounting Standard - Copy

Copyright

© © All Rights Reserved

Formats disponibles

PPTX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentppt

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PPTX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

14 vues11 pagesAccounting Standard

Transféré par

SHASHWAT MISHRAppt

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PPTX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 11

TOPIC

The paradigm shift in the economic environment in India during

last few years has led to increasing attention being devoted to

accounting standards as a means towards ensuring potent and

transparent financial reporting by corporate. Further, cross-

border raising of huge amount of capital has also generated

considerable interest in the generally accepted accounting

principles in advanced countries such as USA. Initiatives taken by

International Organisation Securities Commission (IOSCO)

towards propagating International Accounting Standards (IASs)/

International Financial Reporting Standards (IFRSs), issued by

the International Accounting Standards Board (IASB), as the

uniform language of business to protect the interests of

international investors have brought into focus the IASs/ IFRSs.

Accounting as a “language of business” communicates the financial

performance and position of an enterprise to various interested

parties by means of financial statements which have to exhibit a

‘true and fair’ view of financial results and its states of affairs.

Like any other language, accounting has its own complicated set

of rules. The basic conventions or rules used in preparing

financial statements had evolved over many years as a product of

the collective experience of practicing accountants. As a result a

wide variety of accounting methods were used by different

companies. It was, then, felt that there should be some

standardized set of rules and accounting principles to reduce or

eliminate confusing variations in the methods used to prepare

financial statements.

The draft of the proposed standard will normally include the

following:

(a) Objective of the Standard,

(b) Scope of the Standard,

(c) Definitions of the terms used in the Standard,

(d) Recognition and measurement principles, wherever

applicable,

(e) Presentation and disclosure requirements.

However, such accounting rules should have a reasonable

degree of flexibility in view of specific circumstances of an

enterprise and also in line with the changes in the economic

environment, social needs, legal requirements and technological

developments. In order to suggest rules and criteria of

accounting measurements, several accounting standard setting

bodies were established in developed and developing countries.

The setting of accounting standards is a social decision.

Standards place restrictions on behaviour and therefore they

must be accepted by affected parties. The accounting standards

seek to describe the accounting principles, the valuation

techniques and the methods of applying the accounting

principles in the preparation and presentation of financial

statements so that they may give a true and fair view. The

ostensible purpose of the standard setting bodies is to promote

the dissemination of timely and useful financial information to

investors and certain other parties having an interest in

company’s economic performance.

The ASB will consider the preliminary draft prepared by the

Study Group and if any revision of the draft is required on the

basis of deliberations, the ASB will make the same or refer the

same to the Study Group. The ASB will circulate the draft of

the Accounting Standard to the Council members of the ICAI

and the following specified bodies for their comments:

Department of Company Affairs (DCA)

Comptroller and Auditor General of India (C and AG)

Central Board of Direct Taxes (CBDT)

The Institute of Cost and Works Accountants of India (ICWAI)

The Institute of Company Secretaries of India (ICSI)

Associated Chambers of Commerce and Industry

(ASSOCHAM), Confederation of Indian Industry (CII) and

Federation of Indian Chambers of Commerce and Industry

(FICCI)

Reserve Bank of India (RBI)

Securities and Exchange Board of India (SEBI)

Standing Conference of Public Enterprises (SCOPE)

Indian Banks’ Association (IBA)

Any other body considered relevant by the ASB keeping in view

the nature of the Accounting Standard. The ASB will hold a

meeting with the representatives of specified bodies to ascertain

their views on the draft of the proposed Accounting Standard. On

the basis of comments received and discussion with the

representatives of specified bodies, the ASB will finalize the

Exposure Draft of the proposed Accounting Standard.

The Exposure Draft of the proposed Standard will be issued for

comments by the members of the Institute and the public. The

exposure Draft will specifically be sent to specified bodies (as

listed above), stock exchanges, and other interest groups, as

appropriate. After taking into consideration the comments

received, the draft of the proposed Standard will be finalized by

the ASB and submitted to the Council of the ICAI.

The Council of the ICAI will consider the final draft of the

proposed Standard, and if found necessary, modify the same in

consultation with the ASB. The Accounting Standard on the

relevant subject will then be issued by the ICAI.

ACCOUNTING STANDARDS IN INDIA

The need for accounting standards specifically for the

country’s economic environment was also felt in India.

Recognizing the need to harmonize the diverse

accounting policies and practices in India and keeping in

view the international developments in the field of

accounting, the Council of Institute of Chartered

Accountants of India (ICAI) constituted the Accounting

Standards Boards (ASB) in April, 1977. Over a period,

the ASB has issued 32 Accounting Standards till date.

CONCLUSION

From the above discussion, it is clear that Accounting Standards

play a very vital role in preparation of Financial Statements.

Considering the need for accounting standards specifically

suitable for our economic environment and recognizing the need

to harmonies the diverse accounting policies and practices in

India and keeping in view the international developments in the

field, the council of Institute of Chartered Accountants of India

(ICAI) constituted the Accounting Standards Board (ASB)

which takes care of development, revision and issuance of

Accounting Standards in India.

PRESENTED BY-

SHASHWAT MISHRA

SAURABH KUMAR YADAV

SHASHANK DIXIT

RAHUL TIWARI

YASH SHUKLA

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- CH 31 Open-Economy Macroeconomics Basic ConceptsDocument52 pagesCH 31 Open-Economy Macroeconomics Basic ConceptsveroirenPas encore d'évaluation

- Patent System Study India PCT TreatyDocument10 pagesPatent System Study India PCT TreatySHASHWAT MISHRAPas encore d'évaluation

- Witness Competency & CompellabilityDocument22 pagesWitness Competency & CompellabilityPrashant MahawarPas encore d'évaluation

- In The Court of The Civil Judge Senior Division LucknowDocument4 pagesIn The Court of The Civil Judge Senior Division LucknowSHASHWAT MISHRAPas encore d'évaluation

- TPA S 41Document19 pagesTPA S 41SHASHWAT MISHRAPas encore d'évaluation

- Evolving Competition Jurisprudence in IndiaDocument3 pagesEvolving Competition Jurisprudence in IndiaSHASHWAT MISHRAPas encore d'évaluation

- Title: Author: Sarthak Sharma: Abuse of The Right of Private Defence: Case Based AnalysisDocument3 pagesTitle: Author: Sarthak Sharma: Abuse of The Right of Private Defence: Case Based AnalysisSHASHWAT MISHRAPas encore d'évaluation

- IPR Assignment PDFDocument10 pagesIPR Assignment PDFSHASHWAT MISHRAPas encore d'évaluation

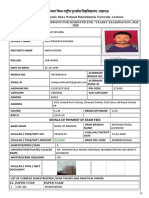

- Details of Payment of Exam FeesDocument2 pagesDetails of Payment of Exam FeesSHASHWAT MISHRAPas encore d'évaluation

- IPR Assignment ON PATENT LAWDocument10 pagesIPR Assignment ON PATENT LAWSHASHWAT MISHRAPas encore d'évaluation

- AssignmentDocument14 pagesAssignmentSHASHWAT MISHRAPas encore d'évaluation

- MBA April 2010: Assignment 1 Miss Shivani MalikDocument14 pagesMBA April 2010: Assignment 1 Miss Shivani MalikSHASHWAT MISHRAPas encore d'évaluation

- MBA April 2010: Assignment 1 Miss Shivani MalikDocument14 pagesMBA April 2010: Assignment 1 Miss Shivani MalikSHASHWAT MISHRAPas encore d'évaluation

- Transfer by Ostensible OwnerDocument7 pagesTransfer by Ostensible OwnerMOHIT100% (2)

- MBA April 2010: Assignment 1 Miss Shivani MalikDocument14 pagesMBA April 2010: Assignment 1 Miss Shivani MalikSHASHWAT MISHRAPas encore d'évaluation

- Accounting StandardDocument11 pagesAccounting StandardSHASHWAT MISHRAPas encore d'évaluation

- Stare DecisisDocument12 pagesStare DecisisSHASHWAT MISHRA100% (5)

- IpcDocument4 pagesIpcSHASHWAT MISHRAPas encore d'évaluation

- Unsound MindDocument13 pagesUnsound MindSHASHWAT MISHRAPas encore d'évaluation

- IpcDocument11 pagesIpcSHASHWAT MISHRAPas encore d'évaluation

- IpcDocument11 pagesIpcSHASHWAT MISHRAPas encore d'évaluation

- Agricultural Mechanisation Investment Potential in TanzaniaDocument2 pagesAgricultural Mechanisation Investment Potential in Tanzaniaavinashmunnu100% (3)

- The Investment Method of Sir John Maynard KeynesDocument3 pagesThe Investment Method of Sir John Maynard KeynesRiselda Myshku KajaPas encore d'évaluation

- Information Technology Telecommunications and Information ExchangeDocument48 pagesInformation Technology Telecommunications and Information Exchangescribd4tavoPas encore d'évaluation

- The Welcome Magazine FLORENCEDocument52 pagesThe Welcome Magazine FLORENCEJohn D.Pas encore d'évaluation

- Construction EngineeringDocument45 pagesConstruction EngineeringDr Olayinka Okeola100% (4)

- ABPS Infra - Cap - Stat - Energy Efficiency & DSM - June 2013 PDFDocument18 pagesABPS Infra - Cap - Stat - Energy Efficiency & DSM - June 2013 PDFamitsh20072458Pas encore d'évaluation

- Russia and Lithuania Economic RelationsDocument40 pagesRussia and Lithuania Economic RelationsYi Zhu-tangPas encore d'évaluation

- Annual Report 2019 Final TCM 83-498650 PDFDocument153 pagesAnnual Report 2019 Final TCM 83-498650 PDFzain ansariPas encore d'évaluation

- Science and Technology and Nation BuildingDocument3 pagesScience and Technology and Nation BuildingJasmine CarpioPas encore d'évaluation

- 2022-11-13 2bat TDR Francesc MorenoDocument76 pages2022-11-13 2bat TDR Francesc MorenoFrancesc Moreno MorataPas encore d'évaluation

- Josh Magazine NMAT 2007 Quest 4Document43 pagesJosh Magazine NMAT 2007 Quest 4Pristine Charles100% (1)

- Basel III: Bank Regulation and StandardsDocument13 pagesBasel III: Bank Regulation and Standardskirtan patelPas encore d'évaluation

- Downfall of Kingfisher AirlinesDocument16 pagesDownfall of Kingfisher AirlinesStephen Fiddato100% (1)

- CMATking Innovation 35 Must Do Questions On CMAT NTA NET Innovation and Entrepreneurship ManagementDocument10 pagesCMATking Innovation 35 Must Do Questions On CMAT NTA NET Innovation and Entrepreneurship ManagementCharusat UniversityPas encore d'évaluation

- Business Model Analysis of Wal Mart and SearsDocument3 pagesBusiness Model Analysis of Wal Mart and SearsAndres IbonPas encore d'évaluation

- We Are All ImmigrantsDocument106 pagesWe Are All ImmigrantsHerman Legal Group, LLCPas encore d'évaluation

- SEMINAR KERJA PRAKTIK EVALUATES CDU FURNACESDocument41 pagesSEMINAR KERJA PRAKTIK EVALUATES CDU FURNACESMuhammad AswanPas encore d'évaluation

- AMULDocument27 pagesAMULSewanti DharPas encore d'évaluation

- Tour Guiding Introduction to the Tourism IndustryDocument13 pagesTour Guiding Introduction to the Tourism Industryqueenie esguerraPas encore d'évaluation

- Sample Chapter PDFDocument36 pagesSample Chapter PDFDinesh KumarPas encore d'évaluation

- Provident Fund InformationDocument2 pagesProvident Fund Informationsk_gazanfarPas encore d'évaluation

- Commercial BanksDocument9 pagesCommercial BanksPrathyusha ReddyPas encore d'évaluation

- March-April - The Indian Down UnderDocument60 pagesMarch-April - The Indian Down UnderindiandownunderPas encore d'évaluation

- Oxylane Supplier Information FormDocument4 pagesOxylane Supplier Information Formkiss_naaPas encore d'évaluation

- Cargo MarDocument6 pagesCargo MarJayadev S RPas encore d'évaluation

- Cold Chain Infrastructure in IndiaDocument17 pagesCold Chain Infrastructure in Indiainammurad12Pas encore d'évaluation

- Gul Ahmed ReportDocument1 pageGul Ahmed ReportfahadaijazPas encore d'évaluation

- 0065 Ir Iv 2013Document1 page0065 Ir Iv 2013Soccir DrraPas encore d'évaluation

- IAS 2 InventoriesDocument13 pagesIAS 2 InventoriesFritz MainarPas encore d'évaluation