Académique Documents

Professionnel Documents

Culture Documents

Business Finance

Transféré par

Riah M. De Chavez0 évaluation0% ont trouvé ce document utile (0 vote)

36 vues41 pagesFinancial Budget

Copyright

© © All Rights Reserved

Formats disponibles

PPTX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentFinancial Budget

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PPTX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

36 vues41 pagesBusiness Finance

Transféré par

Riah M. De ChavezFinancial Budget

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PPTX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 41

Budget, in short is a company’s annual financial

plan. In long word, it is a set of formal (written)

statements of management’s expectations

regarding sales, expenses, production volume,

and various financial transactions of the firm for

the coming period. Budget is consists of pro

forma statements about the company’s finances

and operations. What steps needed to make a

budget?

It is the company’s tool for both planning and

control. At the beginning of the period, the

budget is a plan or standard; and at the end of

the period, it serves as a control device to help

management measure the firm’s performance

against the plan so that future performance may

be improved.

Through case examples, this post provides a

sequenced step-by-step guide to set up a

budget, since the sales stage until the cash

budget, budgeted income statement and

budgeted balance sheet. The discussion is

started from the general structure of the budget.

It’s a long-long page. For faster page-load, I

splitted them into 11 (eleven) pages (each page

contains one step – one type of budget.) Enjoy!

General Structure Of a Complete Set of Budget

A complete set of budget is classified broadly

into two categories which are inter-related one

to the other:

1. Operational Budget – It reflects the results

of operating decisions, consists of eight

elements follows:

- Sales Budget (including a computation of

“expected cash collection”)

- Production Budget

- Ending Inventory Budget

- Direct Materials Budget (including a

computation of “expected cash

disbursements/payment for materials)

- Direct Labor Budget

- Factory Overhead Budget

- Selling and Administrative Expense Budget

- Pro Forma (or Budgeted) Income Statement

2. Financial budget – It reflects the financial

decisions of the firm, consists two of:

Cash Budget

Pro Forma (Budgeted) Balance Sheet

The major steps in preparing the budget are:

Step-1. Prepare a sales forecast (Sales Budget)

Step-2. Determine production volume (Production

Budget)

Step-3. Estimate manufacturing costs and

operating expenses (Direct Material, Direct

Labor and Factory Overhead Budget)

Step-4. Determine cash flow and other financial

effects (The Cash Budget)

Step-5. Formulate projected financial

statements (Budgeted Income Statement and

Balance Sheet)

Making the Sales Budget

The Sales Budget (some company may call it as “Sales

Forecast” Or “Sales Projection”) is the starting point in

preparing the operating budget, since estimated sales

volume influences almost all other items appearing

throughout the annual budget. The sales budget gives

the quantity of each product expected to be sold. (For

the Lie Dharma Putra Company, there is only one

product. Of course, in a real company, most likely

multiple products—that you can add lines of product

row-by-row).

Basically, there are three ways of making

estimates for the sales budget:

Make a statistical forecast on the basis of an

analysis of general business conditions, market

conditions, product growth curves, etc.

Make an internal estimate by collecting the

opinions of executives and sales staff.

Analyze the various factors that affect sales

revenue and then predict the future behavior of

each of those factors.

After sales volume has been estimated, the sales

budget is constructed by multiplying the estimated

number of units by the expected unit price. Generally,

the sales budget includes a computation of cash

collections anticipated from credit sales, which will be

used later for cash budgeting (see below example).

Example

Assume that of each quarter’s sales as follows:

70 percent is collected in the first quarter of the sale;

28 percent is collected in the following quarter; and

2 percent is uncollectible

Production Budget

After sales are budgeted, the production budget can

be determined. The number of units expected to be

manufactured to meet budgeted sales and inventory

is set forth. The expected volume of production is

determined by subtracting the estimated inventory at

the beginning of the period from the sum of units to

be sold plus desired ending inventory. See below

example.

Example

Assume that ending inventory is 10 percent of the

next quarter’s sales and that the ending inventory for

the fourth quarter is 100 units. Using data from the

“Sales Budget“, here is the “Production Budget”

Direct Materials Budget

When the level of production has been computed, a

direct materials budget is constructed to show how

much material will be required and how much of it

must be purchased to meet production requirements.

The purchase will depend on both expected usage of

materials and inventory levels.

The formula for computing the “Purchase” is as

follow:

[Amount of materials to be purchased in units] =

[Material needed for production un units] +

[Desired ending material inventory in units] –

[Beginning material inventory in units]

The direct materials budget is usually accompanied

by a computation of “Schedule of Expected Cash

Disbursement (Payments)” for the purchased

materials.

Example

Assume that ending inventory is 10 percent of the

next quarter’s production needs; the ending materials

inventory for the fourth quarter is 250 units; and 50

percent of each quarter’s purchases are paid in that

quarter, with the remainder being paid in the following

quarter. Also, 3 pounds of materials are needed per

unit of product at a cost of $2 per pound.

Direct Labor Budget

The production budget also provides the starting point

for the preparation of the “Direct Labor Cost Budget”.

The direct labor hours necessary to meet “Production

Requirements” multiplied by the estimated hourly rate

yields the total direct labor cost.

Example

Assume that 5 hours of labor are required per unit of

product and that the hourly rate is $5. Here is the

Direct Labor Cost Budget:

Factory Overhead Budget

The factory overhead budget is a schedule of all

manufacturing costs other than direct materials and

direct labor. Using the contribution approach to

budgeting requires the development of a

“Predetermined Overhead Rate” for the variable

portion of the factory overhead. Later, in developing

the “Cash Budget”, note that the “Depreciation”

does not entails a cash outlay and therefore must be

deducted from the “Total Factory Overhead” in

computing cash disbursements for factory overhead.

Example

For the following factory overhead budget,

assume that:

Total factory overhead is budgeted at $6,000 per

quarter plus $2 per hour of direct labor.

Depreciation expenses are $3,250 per quarter.

All overhead costs involving cash outlays are paid in

the quarter in which they are incurred.

Ending Inventory Budget

The ending inventory budget provides the information

required for constructing budgeted financial

statements with 2 main functions:

It is useful for computing the cost of goods sold on

the budgeted income statement.

It gives the dollar value of the ending materials and

finished goods inventory that will appear on the

budgeted balance sheet.

Example

For the ending inventory budget, we first need to

compute the unit variable cost for finished goods, as

follows:

Units Cost Qty Amount

Direct materials $2 3 pds $6

Direct labor $5 5 hrs $25

Variable overhead $2 5 hrs $10

Total variable manufacturing cost $41

Here is the “Ending Inventory Budget” shown

below:

Qty Unit Costs Total

Direct materials 250 pounds (pds) $2 $ 500

Finished goods 100 units $41 $4100

Selling and Administrative Expense Budget

The selling and administrative expense budget lists

the operating expenses involved in selling the

products and in managing the business.

Example

Let’s say the variable selling and administrative

expenses amount of $4 per unit of sale, including

commissions, shipping, and supplies; expenses are

paid in the same quarter in which they are incurred,

with the exception of $1,200 in income tax, which is

paid in the third quarter.

Pro forma (Budgeted) Income Statement

The budgeted income statement summarizes the

various component projections of revenue (sales),

costs and expenses that have been figured on the

previous budgets for the budgeting period. For control

purposes, the budget can be divided into quarters, for

example, depending on the need.

Note:

Sales – from the “Sales Budget“

Variable Cost of Goods Sold – from the “Ending Inventory

Budget“

Variable Selling and Administrative – from the “Selling and

Admin Expense Budget“

Factory Overhead – from the “Factory Overhead Budget“

Selling and Administrative – from the “Selling and Admin

Expense Budget“

Interest Expense – from the “Cash Budget“

Pro Forma (Budgeted) Balance Sheet

The budgeted balance sheet is developed by beginning with

the balance sheet for the year just ended (“Previous Year’s

Balance Sheet“), in this example is for the year ended

December 31, 2010, and adjusting it, using all the activities

that are expected to take place during the budget period.

Here is the “Previous Year’s Balance Sheet“:

Some of the reasons why the budgeted balance sheet

must be prepared are:

To disclose any potentially unfavorable financial conditions

To serve as a final check on the mathematical accuracy of

all the other budgets

To help management perform a variety of ratio calculations

To highlight future resources and obligations

Pro Forma (Budgeted) Balance Sheet

The budgeted balance sheet is developed by beginning with

the balance sheet for the year just ended (“Previous Year’s

Balance Sheet“), in this example is for the year ended

December 31, 2010, and adjusting it, using all the activities

that are expected to take place during the budget period.

Note:

Cash – From the “Cash Budget”

Accounts Receivable – From the “Sales Budget” and

“Schedule of Expected Cash Collections“.

==> Accounts receivable = Beginning balance + sales –

receipts

==> $9,500 + $256,000 – $242,460 = $23,040

Material Inventory – From the “Ending Inventory

Budget“.

Land – From the “Previous Year’s Balance Sheet”

(Unchanged).

Building and Equipment – From “Previous Year’s

Balance Sheet ($100,000)” + “Cash Budget ($24,300)” =

$124,300

Accumulated Depreciation – From “Previous Year’s

Balance Sheet ($60,000)” + “Factory Overhead Budget

($13,000)” = $73,000

Building and Equipment – From “Previous Year’s

Balance Sheet ($100,000)” + “Cash Budget

($24,300)” = $124,300

Accumulated Depreciation – From “Previous Year’s

Balance Sheet ($60,000)” + “Factory Overhead

Budget ($13,000)” = $73,000

Income Tax Payable – From “Budgeted Income

Statement“.

Common Stock – From “Previous Year’s

Balance Sheet (Unchanged)“.

Retained Earning – From “Previous Year’s

Balance Sheet ($37,054)” + “Budgeted Income

Statement – Net Income($35,020)” = $72,074

Reference https://accounting-financial-tax.com/2010/08/how-to-make-budgets-complete-steps-with-

examples/

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Name of Investors (Bidders) Interest Rate (%) Auction Volume (Billion Dong)Document2 pagesName of Investors (Bidders) Interest Rate (%) Auction Volume (Billion Dong)Trần Phương AnhPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- A Comparative Study of Home Loan Schemes of Private Sector Banks Public Sector BanksDocument12 pagesA Comparative Study of Home Loan Schemes of Private Sector Banks Public Sector BanksKapil KumarPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Ecuador Bondholder Groups Release Revised Terms - July 13, 2020Document5 pagesEcuador Bondholder Groups Release Revised Terms - July 13, 2020Daniel BasesPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Business 2257 Tutorial #1Document12 pagesBusiness 2257 Tutorial #1westernbebePas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Valuation With Market Multiples Avoid Pitfalls in The Use of Relative ValuationDocument15 pagesValuation With Market Multiples Avoid Pitfalls in The Use of Relative ValuationAlexCooks100% (1)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Model Question For Account409792809472943360Document8 pagesModel Question For Account409792809472943360yugeshPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Sanjay Bakshi: Dear StudentsDocument2 pagesSanjay Bakshi: Dear StudentsBharat SahniPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- International Corporate Finance 11 Edition: by Jeff MaduraDocument34 pagesInternational Corporate Finance 11 Edition: by Jeff MaduraMahmoud SamyPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- JAVA MicroprojectDocument31 pagesJAVA Microprojectᴠɪɢʜɴᴇꜱʜ ɴᴀʀᴀᴡᴀᴅᴇ.Pas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- AIA Philam Life Policy Fund Withdrawal FormDocument2 pagesAIA Philam Life Policy Fund Withdrawal Formippon_osotoPas encore d'évaluation

- Starbucks Corporation - FinancialsDocument3 pagesStarbucks Corporation - FinancialsAtish GoolaupPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

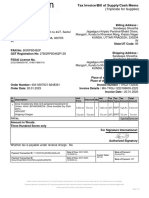

- Invoice DocumentDocument1 pageInvoice DocumentrameshPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Sign. Primary Acc. Holder Sign Acc. Holder Sign Acc. HolderDocument1 pageSign. Primary Acc. Holder Sign Acc. Holder Sign Acc. HolderBrijesh EnterprisesPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Tax SssssssDocument3 pagesTax SssssssJames Francis VillanuevaPas encore d'évaluation

- Tally Accounting Book by Ca MD ImranDocument6 pagesTally Accounting Book by Ca MD ImranMd ImranPas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- 6th NLIU Trilegal Summit 2021 BrochureDocument11 pages6th NLIU Trilegal Summit 2021 Brochuremihir khannaPas encore d'évaluation

- Takeover and AcquisitionsDocument42 pagesTakeover and Acquisitionsparasjain100% (1)

- 2016 SMIC Annual ReportDocument120 pages2016 SMIC Annual ReportPatricia ReyesPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Cost of CapitalDocument37 pagesCost of Capitalwasiq999Pas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Fee Receipt - Lucknow UniversityDocument3 pagesFee Receipt - Lucknow UniversityNirbhay NirajPas encore d'évaluation

- ATA Contract Virtual OfficeDocument6 pagesATA Contract Virtual OfficeGuo YanmingPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Workshop 3Document30 pagesWorkshop 3Jeevika BasnetPas encore d'évaluation

- Pradhan Mantri Fasal Bima Yojna (Pmfby) : Bajaj Allianz General Insurance Company LimitedDocument2 pagesPradhan Mantri Fasal Bima Yojna (Pmfby) : Bajaj Allianz General Insurance Company LimitedRahulSinghPas encore d'évaluation

- Bar Review Material No. 3 PDFDocument2 pagesBar Review Material No. 3 PDFScri Bid100% (1)

- Merger of JSW Steel Limited & Ispat Industries LimitedDocument2 pagesMerger of JSW Steel Limited & Ispat Industries Limitedpriteshvadera12345Pas encore d'évaluation

- Symfonie Angel Ventures AML 20130715Document13 pagesSymfonie Angel Ventures AML 20130715Symfonie CapitalPas encore d'évaluation

- Hull OFOD10e MultipleChoice Questions and Answers Ch17Document7 pagesHull OFOD10e MultipleChoice Questions and Answers Ch17Kevin Molly KamrathPas encore d'évaluation

- 10 Pages Directors' Summary - by CA Harsh GuptaDocument10 pages10 Pages Directors' Summary - by CA Harsh Guptagovarthan1976Pas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Chinmay Kadam Roll No. 21 Black BookDocument55 pagesChinmay Kadam Roll No. 21 Black BookShubh shahPas encore d'évaluation

- Invoice2024 01 06Document1 pageInvoice2024 01 06hugocasdevPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)