Académique Documents

Professionnel Documents

Culture Documents

Intraday Trading Strategy FINAL

Transféré par

Jeniffer Rayen50%(2)50% ont trouvé ce document utile (2 votes)

319 vues59 pagesTitre original

Intraday Trading Strategy FINAL.pptx

Copyright

© © All Rights Reserved

Formats disponibles

PPTX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PPTX, PDF, TXT ou lisez en ligne sur Scribd

50%(2)50% ont trouvé ce document utile (2 votes)

319 vues59 pagesIntraday Trading Strategy FINAL

Transféré par

Jeniffer RayenDroits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PPTX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 59

IntraDay Trading Strategy

• Daily Chart : Find out imp psychological level

• IntraDay Chart : After break of that level

execute trade….

Last 100 Days daily chart…

How to find swing high

How to find swing low

Identifying swing high on actual

chart…

Swing high’s on chart…

Identify most nearest swing high…

Draw horizontal line on highest high

between these two highs…

NEAREST previous swing high act as

target…

IntraDay chart

• Time Frame : 3 minutes….

Before market starts….

9:15 …Market open…

Wait till breakout of that level

Breakout happens…

Just focus on breakout and volume at

breakout…

Pay close attention to breakout and

volume at breakout…

Place buy limit order 1-2 tick above

high of breakout candle…

Stop loss should be 1-2 tick low below

the horizontal level…

Risk = difference between buy price

and stop loss price…

Target : NEAREST swing high on DAILY

chart…Make sure that it must have real body

above horizontal level…

Reward = Difference between target

and buy price…

Risk to reward ratio criteria

• It must be greater than 1:3

Check whether criteria fulfilled or not?...If yes

place buy order and wait for execution of that

buy order…

Buy order executed…

Market moving up…

Be patient and observe your

thoughts…

Don’t get panic…

Be patient and observe your thoughts..

Be patient and observe your thoughts..

Be patient and observe your thoughts..

Market is near to target..

Don’t get panic…

Be patient and observe your thoughts..

Market is at target…

Above target level…

More up than target…

Don’t get panic…

Exit @ 3:25 PM…R:R ratio achieved is

1:12…

Market close…

Volume confirmation after breakout

candle

• Volume confirmation should be done on

breakout candle

Re-entry criteria

• Stop loss trigger ,but 3 minute candle unable

to close below horizontal line……Place limit

buy order above swing high made on 3

minutes chart….Calculate risk : reward ratio

and position size accordingly….

Mkt open…

Breakout….Volume confirmation…Risk:Reward

confirmation….TRADE

Trade get executed…

Stop loss trigger…Exit…

Intraday candle unable to close below horizontal

line….time to re-entry…Place limit buy order above

swing high…

Re-entry order get executed….

Now observe your thoughts…

Mkt is at target…don’t get

excited…observe your thoughts…

After breaking target…mkt moves

strongly….

Exit at 3:25 PM…risk : reward ratio

achieved is 1:22

Volume confirmation Criteria

• For buy : volume should be 5 times greater

than LAST 21 candles EMA of volume….

• Vice versa for sell signals….(Only difference is

that you can use 3X increase in volume

confirmation criteria….after 6 moths of

trading)

Money Management

• Which type of trader you are :

• Low risk trader : less than 0.5% risk per trade

• Moderate risk trader : upto 1 % risk per trade

• High risk trader : More than 1% upto 2%

DON’T GO BEYOND 2% RISK PER TRADE….

Lot size /Quantity calculation

• Suppose your portfolio is of 100K

• Risk per trade is 1%

• Means risk per trade is 1000

• Quantity is = risk per trade divide by stop loss

points

• Suppose your stop loss is of rs.2 then quantity

is 1000/2 = 500

Backtesting

• 20 trade sample size exercise

• Total exercises = 5

• Without money…Just like paper trading…

• You will get clear idea how strategy is

performing….this will help to improve your

confidence…

Forward testing

• 20 trade sample size exercise

• Total exercises = 5

• With money….Risk per trade start with

Rs.10…Go on increasing as and when your

confidence increase…

When not to trade

• When market(Spot Nifty) open with more than

2.5% gap

• Union budget day

• Central Govt. election declaration day

• When banking holiday / bank strike / only trading

day but clearing holiday

• RBI credit policy day…avoid banking / finance

sector stock…but you can trade in other sector

stock….

Company Result , board meeting day…

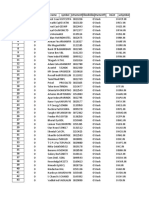

How to select stock

• Stock which are available to trade in derivative

segment (F&O segment) having price more

than rs.20 and less than rs 2000

Vous aimerez peut-être aussi

- Zone Breakout'sDocument78 pagesZone Breakout'sPARTH DHULAM100% (2)

- Day Trading: " Less Is More "Document82 pagesDay Trading: " Less Is More "raydipanjan100% (1)

- Data Trading Nifty StrategyDocument35 pagesData Trading Nifty StrategySharma compPas encore d'évaluation

- 11.BTST Trading StrategyDocument15 pages11.BTST Trading Strategyrocimo100% (1)

- Gap Trading IntradayDocument2 pagesGap Trading IntradayAbhinav KumarPas encore d'évaluation

- Hedge 17Document7 pagesHedge 17vishalastrologer5331Pas encore d'évaluation

- Opening Range BreakoutDocument5 pagesOpening Range BreakoutSangamesh SanguPas encore d'évaluation

- Banknifty IntradayDocument117 pagesBanknifty IntradayUmesh ThakkarPas encore d'évaluation

- Trading Setups 1) Gap Down Opening Below / Cutting Across Previous Day VPLDocument20 pagesTrading Setups 1) Gap Down Opening Below / Cutting Across Previous Day VPLJayakrishnaraj AJDPas encore d'évaluation

- Trading The Pivots, Support and ResistanceDocument6 pagesTrading The Pivots, Support and ResistanceVictoria Schroeder100% (1)

- Trading StrategiesDocument107 pagesTrading Strategiesswetha reddyPas encore d'évaluation

- BANK NIFTY WEEKLY OPTION STRATEGIESDocument20 pagesBANK NIFTY WEEKLY OPTION STRATEGIESfrank georgePas encore d'évaluation

- 50-Sma Strategy PDFDocument1 page50-Sma Strategy PDFfixemiPas encore d'évaluation

- MK Options Trader for NIFTY OptionsDocument4 pagesMK Options Trader for NIFTY Optionsnarendra bholePas encore d'évaluation

- SantuBabaTricks AppDocument41 pagesSantuBabaTricks AppSriheri DeshpandePas encore d'évaluation

- Learn 15 Day Trading Patterns and Strategies in a Single WebinarDocument11 pagesLearn 15 Day Trading Patterns and Strategies in a Single WebinarVinod100% (3)

- Optn StrategyDocument10 pagesOptn StrategyIndraneel BosePas encore d'évaluation

- Price Action & RM-PS Spider PDFDocument28 pagesPrice Action & RM-PS Spider PDFGenrl Use100% (1)

- The Camarilla Equation Explained: How to Anticipate Market Behavior Using This Powerful Price-Based IndicatorDocument9 pagesThe Camarilla Equation Explained: How to Anticipate Market Behavior Using This Powerful Price-Based IndicatorSAM SMITHPas encore d'évaluation

- Follow Strategy: Buy low open equal highDocument5 pagesFollow Strategy: Buy low open equal highrekha patilPas encore d'évaluation

- Identifying UDD JA Patterns for Intraday TradingDocument21 pagesIdentifying UDD JA Patterns for Intraday TradingRakesh Kumar100% (1)

- Chartink Technical Stock ScreenersDocument2 pagesChartink Technical Stock ScreenersMohammad Aamir PerwaizPas encore d'évaluation

- CRUDEOIL INTRADAY STRATEGY - Swapnaja SharmaDocument268 pagesCRUDEOIL INTRADAY STRATEGY - Swapnaja Sharmaআম্লান দত্তPas encore d'évaluation

- Option BuyingDocument14 pagesOption BuyingLuke Whiteman67% (3)

- 315 StrategyDocument33 pages315 StrategyRaghav Sampath100% (1)

- INtraday Trading Methods For NiftyDocument4 pagesINtraday Trading Methods For Niftymuddisetty umamaheswar100% (1)

- Intraday Strategy Using CPR Suresh Kumar047Document13 pagesIntraday Strategy Using CPR Suresh Kumar047KkrkumarPas encore d'évaluation

- BB Trap Hedging Anchored V Wap 13th Feb Class-1Document28 pagesBB Trap Hedging Anchored V Wap 13th Feb Class-1Rakesh Kumar100% (1)

- Nifty Intra Day TradingDocument20 pagesNifty Intra Day Tradingvarun vasurendranPas encore d'évaluation

- 7 Day Trading Rules That Makes A Successful TraderDocument3 pages7 Day Trading Rules That Makes A Successful TraderAbhishek KatkamPas encore d'évaluation

- DAY TRADING WITH PIVOT POINTS & PRICE ACTIONDocument139 pagesDAY TRADING WITH PIVOT POINTS & PRICE ACTIONLavanya Chintu100% (1)

- CPR & OrbDocument21 pagesCPR & OrbHimanshu Singh Rajput100% (2)

- Promodh Kumar OPTION Trading ASTrageyDocument4 pagesPromodh Kumar OPTION Trading ASTrageyRajesh Kumar100% (1)

- HOW TO USE PIVOTS TO TRADE TRENDS AND CATCH REVERSALSDocument8 pagesHOW TO USE PIVOTS TO TRADE TRENDS AND CATCH REVERSALSravi lathiya100% (1)

- Day 1Document51 pagesDay 1Study Byte100% (1)

- Welcome To Momentum Trading SetupDocument12 pagesWelcome To Momentum Trading SetupSunny Deshmukh0% (1)

- Nifty Trading StrategyDocument19 pagesNifty Trading StrategyTopPas encore d'évaluation

- Technical Analysis, Moving Averages & Risk ManagementDocument29 pagesTechnical Analysis, Moving Averages & Risk Managementkmurali100% (1)

- Intraday 890 PDFDocument3 pagesIntraday 890 PDFharishvasanth1982100% (1)

- Intraday Trading Stock SelectionDocument29 pagesIntraday Trading Stock SelectionManikanta SVS100% (1)

- Intraday Trading Strategies For Expanding WealthDocument15 pagesIntraday Trading Strategies For Expanding WealthPam G.100% (2)

- Bank Nifty Weekly FnO Hedging StrategyDocument5 pagesBank Nifty Weekly FnO Hedging StrategySanju GoelPas encore d'évaluation

- NiftyBank Intraday Option Buying Single Successull StrategyDocument30 pagesNiftyBank Intraday Option Buying Single Successull Strategyajayvg50% (2)

- Bank Nifty: Daily StrategyDocument25 pagesBank Nifty: Daily StrategySohil ShahPas encore d'évaluation

- Camarilla - Introduction: Chapter 7 - Pivot BossDocument9 pagesCamarilla - Introduction: Chapter 7 - Pivot Bossvinay kushwahaPas encore d'évaluation

- Intraday GVK StocksDocument9 pagesIntraday GVK Stockssri sriPas encore d'évaluation

- Ultimate Mentorship Options Buying Reversal SetupsDocument16 pagesUltimate Mentorship Options Buying Reversal SetupsANIMESH100% (1)

- Trading Stocks Intraday PDFDocument10 pagesTrading Stocks Intraday PDFSwathy Rai0% (1)

- Pathik StrategiesDocument6 pagesPathik StrategiesMayuresh DeshpandePas encore d'évaluation

- The Mad StrategyDocument28 pagesThe Mad StrategyhrtertgPas encore d'évaluation

- VWAP WITH OH, OL, BB, BB TRAP-converted-compressedDocument14 pagesVWAP WITH OH, OL, BB, BB TRAP-converted-compressedroughimPas encore d'évaluation

- Guruspeak - "My Mantra Is Cutting Loss Early and Riding Profit As Long As Possible"Document11 pagesGuruspeak - "My Mantra Is Cutting Loss Early and Riding Profit As Long As Possible"Ankit Jain100% (1)

- Pivotboss (CPR, Camarilla, Market Profile)Document10 pagesPivotboss (CPR, Camarilla, Market Profile)AamirAbbasPas encore d'évaluation

- Clear Buy Signal Needs To Fulfil The Following Criteria: Clear Sell Signal Should HaveDocument7 pagesClear Buy Signal Needs To Fulfil The Following Criteria: Clear Sell Signal Should HaveKalidas SundararamanPas encore d'évaluation

- VWAP Trading: Trade With TrendDocument22 pagesVWAP Trading: Trade With TrendAvijit Majumdar100% (1)

- Notes: Trading Strategies 3-13-39 Days EMADocument10 pagesNotes: Trading Strategies 3-13-39 Days EMAChenna VenkatasubbaiahPas encore d'évaluation

- Options Mentorship - Day 1Document49 pagesOptions Mentorship - Day 1Unesh JughsPas encore d'évaluation

- Binary Option Trading: Introduction to Binary Option TradingD'EverandBinary Option Trading: Introduction to Binary Option TradingPas encore d'évaluation

- Kaizen PF6Document10 pagesKaizen PF6Jeniffer RayenPas encore d'évaluation

- Warman Ah Pumps BrochureDocument8 pagesWarman Ah Pumps BrochureJeniffer Rayen100% (1)

- Fundametal SelectionDocument48 pagesFundametal SelectionJeniffer RayenPas encore d'évaluation

- PTW Standard Audit Shows ImprovementDocument30 pagesPTW Standard Audit Shows ImprovementJeniffer RayenPas encore d'évaluation

- Auto BuySell+Trend and Targets V4Document10 pagesAuto BuySell+Trend and Targets V4Jeniffer RayenPas encore d'évaluation

- Bull BearDocument1 pageBull BearJeniffer RayenPas encore d'évaluation

- Blazing Tendulkar RSDocument1 pageBlazing Tendulkar RSJeniffer RayenPas encore d'évaluation

- 72s ScriptDocument8 pages72s ScriptJeniffer RayenPas encore d'évaluation

- Minervini Stks Rank JRKGDocument7 pagesMinervini Stks Rank JRKGJeniffer RayenPas encore d'évaluation

- Minervini Stks Rank JRKG BuyDocument1 pageMinervini Stks Rank JRKG BuyJeniffer RayenPas encore d'évaluation

- Indian IPO Details With Company Name, Date, Size and IndustryDocument58 pagesIndian IPO Details With Company Name, Date, Size and IndustryJeniffer RayenPas encore d'évaluation

- Minervini Stks Rank bluedotJrKg BuyDocument1 pageMinervini Stks Rank bluedotJrKg BuyJeniffer RayenPas encore d'évaluation

- Top executives and company symbolsDocument16 pagesTop executives and company symbolsJeniffer RayenPas encore d'évaluation

- Webinar 6 - EPS ModelDocument10 pagesWebinar 6 - EPS ModelJeniffer RayenPas encore d'évaluation

- Minervini Stks Rank BluedotDocument13 pagesMinervini Stks Rank BluedotJeniffer RayenPas encore d'évaluation

- Indian stocks data with instrument detailsDocument46 pagesIndian stocks data with instrument detailsJeniffer RayenPas encore d'évaluation

- OTA CourseDocument5 pagesOTA Coursealok661911Pas encore d'évaluation

- Reliance IndustrDocument10 pagesReliance IndustrJeniffer RayenPas encore d'évaluation

- 114aa ZL Options Writing StrategyDocument8 pages114aa ZL Options Writing StrategyJeniffer RayenPas encore d'évaluation

- 109aa SP Options Buying StrategyDocument8 pages109aa SP Options Buying StrategyJeniffer RayenPas encore d'évaluation

- JSW SteelDocument10 pagesJSW SteelJeniffer RayenPas encore d'évaluation

- Trade Chart Patterns Like The Pros-Suri DuddellaDocument293 pagesTrade Chart Patterns Like The Pros-Suri DuddellaEl Cuz100% (12)

- Trading PsychologyDocument87 pagesTrading PsychologyTapas86% (7)

- q_rank stk_sect q_txt v_rank v_txt f_pts f_txt f_clr sid analysisDocument78 pagesq_rank stk_sect q_txt v_rank v_txt f_pts f_txt f_clr sid analysisJeniffer RayenPas encore d'évaluation

- 101aaa NL Options Trading StrategyDocument10 pages101aaa NL Options Trading StrategyJeniffer RayenPas encore d'évaluation

- Supply and Demand Strategy EbookDocument39 pagesSupply and Demand Strategy EbookNorbert Vrabec90% (63)

- Bajaj FinanceDocument10 pagesBajaj FinanceJeniffer RayenPas encore d'évaluation

- Pix TransmissionDocument10 pagesPix TransmissionJeniffer RayenPas encore d'évaluation

- Futures Oi: Join TelegramDocument3 pagesFutures Oi: Join TelegramJeniffer RayenPas encore d'évaluation

- @FTUTRADING - TimeReversal Excel CalculatorDocument2 pages@FTUTRADING - TimeReversal Excel CalculatorPranjul SahuPas encore d'évaluation

- ICBC Presentation 09Document24 pagesICBC Presentation 09AhmadPas encore d'évaluation

- Chopra Scm5 Ch01Document27 pagesChopra Scm5 Ch01Zohaib AhsonPas encore d'évaluation

- Contemporary World Lesson 11Document5 pagesContemporary World Lesson 11Ellaine De la PazPas encore d'évaluation

- Introduction of Logistic ParkDocument9 pagesIntroduction of Logistic Park9773519426100% (1)

- Stock Market ScamsDocument15 pagesStock Market Scamssabyasachitarai100% (2)

- gr6 Social Studies StandardsDocument11 pagesgr6 Social Studies Standardsapi-325184613Pas encore d'évaluation

- Exercise 1Document2 pagesExercise 1Muneeb_2kPas encore d'évaluation

- TT DL22Document19 pagesTT DL22cluj24Pas encore d'évaluation

- Chapter 29-The Monetary SystemDocument51 pagesChapter 29-The Monetary SystemThảo DTPas encore d'évaluation

- Consumer Behaviour Assignment For Managerial Economics.0Document3 pagesConsumer Behaviour Assignment For Managerial Economics.0Kerty Herwyn GuerelPas encore d'évaluation

- Bali villa invoice for 27 night stayDocument4 pagesBali villa invoice for 27 night staymarkPas encore d'évaluation

- Porter PresDocument8 pagesPorter Presmohitegaurv87Pas encore d'évaluation

- Syllabus - CE469 Environmental Impact AssessmentDocument2 pagesSyllabus - CE469 Environmental Impact AssessmentSreejith Rajendran PillaiPas encore d'évaluation

- Whitepaper ITES Industry PotentialDocument6 pagesWhitepaper ITES Industry PotentialsamuraiharryPas encore d'évaluation

- Jara Strategy 031210Document2 pagesJara Strategy 031210shrideeppatelPas encore d'évaluation

- Handbook of Chemical Processing Equipment: Nicholas Cheremisinoff, PH.DDocument3 pagesHandbook of Chemical Processing Equipment: Nicholas Cheremisinoff, PH.DIrfan SaleemPas encore d'évaluation

- Module III (Exam 2) - Retirement Planning and Employee Benefits (RPEB)Document6 pagesModule III (Exam 2) - Retirement Planning and Employee Benefits (RPEB)Saied MastanPas encore d'évaluation

- Ernesto Serote's Schema On Planning ProcessDocument9 pagesErnesto Serote's Schema On Planning ProcessPatPas encore d'évaluation

- Account Summary: Statement Date:20/12/2021 Loan No: 0036 1150 XXXX 9510 Payment Due Date Total Dues Loan AmountDocument1 pageAccount Summary: Statement Date:20/12/2021 Loan No: 0036 1150 XXXX 9510 Payment Due Date Total Dues Loan AmountbimexetPas encore d'évaluation

- Cambridge International AS & A Level: Economics 9708/13Document12 pagesCambridge International AS & A Level: Economics 9708/13Didier Neonisa HardyPas encore d'évaluation

- 1680881686289Document10 pages1680881686289v9991 v9991Pas encore d'évaluation

- Foreign Tax Credit - Worked Example From IRASDocument1 pageForeign Tax Credit - Worked Example From IRASItorin DigitalPas encore d'évaluation

- Group 5 Slides ER Systems Surveillance AdviceDocument9 pagesGroup 5 Slides ER Systems Surveillance AdviceJoharaPas encore d'évaluation

- Contemporary Global Ummatic Challenges and FutureDocument19 pagesContemporary Global Ummatic Challenges and Futureateeba aslamPas encore d'évaluation

- January Postpay BillDocument4 pagesJanuary Postpay BillestrobetceoPas encore d'évaluation

- LV Capacitor Bank Vendor ListDocument3 pagesLV Capacitor Bank Vendor Listsreejith123456Pas encore d'évaluation

- Inside JobDocument46 pagesInside Jobbibekmishra8107Pas encore d'évaluation

- Taleb Black SwansDocument10 pagesTaleb Black SwansRand FitzpatrickPas encore d'évaluation

- AccountingDocument6 pagesAccountingGourav SaxenaPas encore d'évaluation

- Complete Integration of The Soviet Economy Into The World Capitalist Economy by Fatos NanoDocument4 pagesComplete Integration of The Soviet Economy Into The World Capitalist Economy by Fatos NanoΠορφυρογήςPas encore d'évaluation