Académique Documents

Professionnel Documents

Culture Documents

Financial Statement Analysis - 10e by K. R. Am & John J. Wild Chapter02

Transféré par

Salem FirstDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Financial Statement Analysis - 10e by K. R. Am & John J. Wild Chapter02

Transféré par

Salem FirstDroits d'auteur :

Formats disponibles

McGrau-Hl||/lruln

Corlght 2009 b The McGrau-Hl|| Comanles. lnc. A|| rlghts reserted.

FinanciaI

Statement

AnaIysis

K R Subramanyam

John J Wild

2-2

!%#

FinanciaI Reporting

and AnaIysis

2-3

Statutory FinanciaI Reports

2-4

AAP

Types of Accounting ruIes and guideIines

4 Statements of Financial Accounting Standards

4 APB Opinions.

4 Accounting Research Bulletins (ARB).

4 ACPA pronouncements. The ACPA issues guidelines

for certain topics yet to be addressed by the FASB in its

Statements of Position (SOP) or for those involving

industry-specific matters in its ndustry Audit and

Accounting Guidelines.

4 ETF Bulletins. ETF Bulletins are issued by the FASB's

Emerging ssues Task Force.

4 ndustry practices.

2-5

nvironmentaI Factors

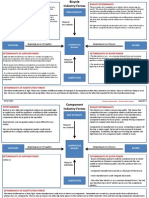

FinanciaI Accounting Standards Board FinanciaI Accounting Standards Board

eneraIIy Accepted Accounting PrincipIes eneraIIy Accepted Accounting PrincipIes

Provide input to Provide input to

HeIp set HeIp set

Securities and

change

Commission

Securities and

change

Commission

Unions Unions

Investors Investors

Accountants Accountants

PoIiticians PoIiticians

Lenders Lenders

Others Others

AICPA AICPA

FinanciaI Accounting Standards Board

eneraIIy Accepted Accounting PrincipIes

Provide input to

HeIp set

Securities and

change

Commission

Unions

Investors

Accountants

PoIiticians

Lenders

Others

AICPA

2-6

nvironmentaI Factors

Securities and change Commission (SC) Securities and change Commission (SC)

4 Independent, quasi-judiciaI government agency

4 Administer securities reguIations & discIosures

4 Can modify & set AAP, if necessary

4 RareIy directIy chaIIenges FASB

4 Major pIayer in gIobaI accounting

4 Independent, quasi-judiciaI government agency

4 Administer securities reguIations & discIosures

4 Can modify & set AAP, if necessary

4 RareIy directIy chaIIenges FASB

4 Major pIayer in gIobaI accounting

2-7

nvironmentaI Factors

InternationaI FinanciaI Reporting

Standards (IFRS)

Set by InternationaI

Accounting Standards Board

Not currentIy accepted in U.S.

SC under pressure to accept

IAS

2-8

nvironmentaI Factors

Managers of Companies

4 Primary responsibiIity for fair & accurate

reports

4 AppIies accounting to refIect business

activities

4 ManageriaI discretion is necessary in

accounting

4 Major Iobbyist on AAP

2-9

nvironmentaI Factors

Auditing

4 SEC requires Audit Report

4 Audit opinion can be:

4 clean (fairly presented)

4 qualified (except for)

4 disclaimer (no opinion)

4 Check Auditor quality & independence

Auditors

2-10

nvironmentaI Factors

Corporate overnance

4 Board of directors oversight

4 Audit committee of the board

4 oversee accounting process

4 oversee internal control

4 oversee internal/external audit

4 nternal Auditor

2-11

nvironmentaI Factors

InternaI Users InternaI Users ternaI Users ternaI Users

ControIIer

Budget Officers

SaIes Managers

InternaI Auditors

Officers

Managers

Customers

ternaI Auditors

Labor Unions

overnments

SharehoIders

Lenders

2-12

AIternative information sources

VoIuntary DiscIosure

conomic, Industry & Company News

4 mpacts current & future financial condition and performance

Information Intermediaries

4 ndustry devoted to collecting, processing, interpreting &

disseminating company information

4 ncludes analysts, advisers, debt raters, buy- and

sell-side analysts, and forecasters

4 Major determinant of GAAP

Motivation - Legal liability, Expectations Adjustment, Signaling,

Managing expectations

2-13

DesirabIe QuaIities of Accounting

Information

4 ReIevance - the capacity of information to affect a

decision

4 ReIiabiIity - For information to be reliable it must be

verifiable, representationally faithful, and neutral.

4 Verifiability means the information is confirmable.

4 faithfulness means the information reflects reality,

and

4 neutrality means it is truthful and unbiased.

2-14

FinanciaI Accounting

4 HistoricaI Cost - fair & objective values from arm's-length

bargaining

4 AccruaI Accounting - recognize revenues when earned,

expenses when incurred

4 MateriaIity - threshold when information impacts decision

making

4 Conservatism reporting or disclosing the least optimistic

information about uncertain events and transactions

Important Accounting PrincipIes

2-15

FinanciaI Accounting

ReIevance of Accounting Information

ReIation between Accounting Numbers and Stock Prices

2-16

FinanciaI Accounting

4 TimeIiness - periodic disclosure, not real-time

basis

4 Frequency - quarterly and annually

4 Forward Looking - limited prospective

information

Limitations of Accounting Information

2-17

AccruaIs-The Cornerstone

4 Establish company and invest $700 equity

4 Purchase plain T-shirts for $5 each

4 Fixed screen cost of $100

4 Variable print cost of $0.75 per T-shirt

4 Sold 25 T-shirts at $10 each for cash

4 Sold 25 T-shirts at $10 each on credit

IIIustration - Case Facts

2-18

Receipts Assets

T-Shirt saIes $250 Cash $275

!ayments

T-Shirt purchases $500 Equity

Screen purchase 100 Beginning quity $700

Printing charges 75 Less net cash outfIow (425)

TotaI payments $(675) TotaI equity $275

Net cash outfIow $(425)

AccruaIs- The Cornerstone

Case IIIustration - Cash Accounting

Statement of Cash FIows BaIance Sheet (Cash basis)

2-19

Revenues Assets

T-Shirt saIes $500.00 Cash $275.00

T-Shirt inventory 337.50

Expenses ReceivabIes 250.00

T-Shirts costs $250.00 TotaI assets $862.50

Screen depreciation 50.00

Printing charges 37.50 Equity

TotaI epenses (337.50) Beginning equity $700.00

Add net income 162.50

Net income $162.50 TotaI equity $862.50

Accruals-The Cornerstone

Case IIIustration - AccruaI Accounting

BaIance Sheet (AccruaI basis) Income Statement

2-20

AccruaIs-The Cornerstone

Net

ncome

=

Accruals

Operating

Cash Flow

+

=

+

2-21

Revenue Recognition recognize revenues when

(1) Earned

(2) Realized or Realizable

Expense Matching match with corresponding revenues

- Product costs

- Period costs

AccruaIs-The Cornerstone

Foundations of AccruaI Accounting

2-22

AccruaIs-The Cornerstone

ReIation between Cash FIows and AccruaIs

Operating cash flow (OCF)

-/+ Cash investment & divestment in operating assets

= Free cash flow (FCF)

+/- Financing cash flows (including investment &

divestment in financing assets)

= Net cash flow (NCF)

Operating cash flow (OCF)

-/+ Cash investment & divestment in operating assets

= Free cash flow (FCF)

+/- Financing cash flows (including investment &

divestment in financing assets)

= Net cash flow (NCF)

Operating cash flow (OCF)

-/+ Cash investment & divestment in operating assets

= Free cash flow (FCF)

+/- Financing cash flows (including investment &

divestment in financing assets)

= Net cash flow (NCF)

2-23

AccruaIs-The Cornerstone

Short-Term and Long-Term AccruaIs

Short-Term AccruaIs: Yield current assets and current liabilities (also called

4rking capital accruals)

Long-Term AccruaIs: Yield non-current assets and non-current liabilities (arise

mainly from capitalizati4n)

Note: Analysis research suggests short-term accruals

are more useful in company valuation

2-24

AccruaIs-The Cornerstone

AccruaIs and Cash FIows - Myths

4 Myth: Since company value depends on future cash

flows, only current cash flows are relevant for

valuation.

4 Myth: All cash flows are value relevant.

4 Myth: All accrual accounting adjustments are value

irrelevant.

4 Myth: Cash flows cannot be manipulated.

4 Myth: All income is manipulated.

4 Myth: t is impossible to consistently manage

income upward in the long run.

2-25

AccruaIs-The Cornerstone

AccruaIs and Cash FIows - Truths

4 Truth: Accrual accounting inc42e) is more

relevant than cash flow.

4 Truth: Cash flows are more reliable than

accruals.

4 Truth: Accrual accounting numbers are subject

to accounting distortions.

4 Truth: Company value can be determined by

using accrual accounting numbers.

2-26

conomic concepts of income

Economic income Economic income

Permanent income Permanent income

Operating income Operating income

conomic income

4 Measures changes in Shareholders wealth.

4 Cash flows + Present value of expected future cash flows.

4 Useful when the objective of analysis is determining the exact

return to the shareholder for the period.

4 Less useful for forecasting future earnings potential.

2-27

Accounting concept of income

4 Based on the concept of accrual accounting

4 Main purpose is income measurement

4 Two main processes

4 Revenue recognition

4 Expense matching

2-28

Accounting Vs conomic income

Reasons for difference

4 Alternative income concepts

4 Historical cost

4 Transaction basis

4 Conservatism

4 Earnings management

2-29

Fair vaIue accounting

Asset and liability values are determined on the

basis of their fair values (typically market prices)

on the measurement date (i.e., approximately

the date of the financial statements).

2-30

HistoricaI cost Vs Fair vaIue

2-31

Advantages & Disadvantages

Advantages

4 Reflects current information.

4 Consistent measurement criteria.

4 Comparability

4 No conservative bias

4 More useful for equity analysis

Disadvantages

4 Lower objectivity

4 Susceptibility to manipulation. Use of Level 3 inputs.

4 Lack of conservatism.

4 Excessive income volatility.

2-32

ImpIications for AnaIysis

4 Focus on the balance sheet.

4 Restating income.

4 Analyzing use of inputs.

4 Analyzing financial liabilities.

2-33

Accounting AnaIysis

Demand for Accounting AnaIysis

4 Adjust for acc4unting dist4rti4ns so financial

reports better reflect economic reality

4 Adjust general-purpose financial statements to

meet specific analysis 4bjectives of a particular

user

2-34

Accounting AnaIysis

Sources of Accounting Distortions

4 Accounting Standards attributed to

1) political process of standard-setting,

2) accounting principles and assumptions, and

3) conservatism

4 stimation rrors attributed to estimation errors inherent in accrual

accounting

4 ReIiabiIity vs ReIevance attributed to over-emphasis on reliability at

the loss of relevance

4 arnings Management attributed to window-dressing of financial

statements by managers to achieve personal benefits

2-35

Accounting AnaIysis

AnaIysis Objectives

4 Comparatives AnaIysis demand for financial comparisons

across companies and/or across

time

4 Income Measurement - demand for (1) equity wealth

changes and (2) measure of

earning power. These correspond

to two alternative income

concepts

(1) Economic ncome (or

empirically, ec4n42ic pr4fit)

(2) Permanent ncome (or

empirically, sustainable pr4fit)

Chapter 6 discusses these measures in detaiI

2-36

Accounting AnaIysis

arnings Management - Frequent Source of Distortion

arning Management strategies:

4 Increasing Income managers adjust accruals to increase

reported income

4 Big Bath managers record huge write-offs in one period to

relieve other periods of expenses

4 Income Smoothing managers decrease or increase reported

income to reduce its volatility

2-37

Accounting AnaIysis

arnings Management - Motivations

4 Contracting Incentives - managers adjust numbers used in

contracts that affect their wealth (e.g., compensation contracts)

4 Stock Prices managers adjust numbers to influence stock

prices for personal benefits (e.g., mergers, option or stock

offering)

4 Other Reasons - managers adjust numbers to impact

1) labor demands,

2) management changes, and

3) societal views

2-38

Accounting AnaIysis

arnings Management - Mechanics

4 Incoming Shifting:

Accelerate or delay recognition of revenues or expenses to

shift income from one period to another

4 CIassificatory arnings Management:

Selectively classify revenues Earnings and expenses in

certain parts Management of the income statement to affect

analysis inferences regarding the recurring nature of these

items

2-39

Accounting AnaIysis

Process of Accounting AnaIysis

Accounting analysis involves several inter-related processes and

tasks that can be grouped into two broad areas:

4 vaIuating arning QuaIity: Steps

1) dentify and assess key accounting policies

2) Evaluate extent of accounting flexibility

3) Determine the reporting strategy

4) dentify and assess red flags

4 Adjusting FinanciaI Statements:

dentify, measure, and make necessary adjustments to financial

statements to better serve one's analysis objectives;

Chapters 3-6 focus on adjusting (recasting) the statements

2-40

Auditing And FinanciaI Statement AnaIysis

Vous aimerez peut-être aussi

- Chapter 02 Financial Reporting and AnalysisDocument40 pagesChapter 02 Financial Reporting and Analysisshabrina r56% (9)

- Financial Statement Analysis - Chapter 02Document40 pagesFinancial Statement Analysis - Chapter 02Muthia KhairaniPas encore d'évaluation

- Chapter 04Document40 pagesChapter 04joyabyss100% (1)

- Financial Statement Analysis, 10e by K. R. Subramanyam & John J. Wild Chapter03Document40 pagesFinancial Statement Analysis, 10e by K. R. Subramanyam & John J. Wild Chapter03RidhoVerianPas encore d'évaluation

- Chapter 06Document40 pagesChapter 06Faisal JiwaniPas encore d'évaluation

- Financial Statement Analysis: K R Subramanyam John J WildDocument39 pagesFinancial Statement Analysis: K R Subramanyam John J WildGilang W Indrasta0% (1)

- Chapter 10Document40 pagesChapter 10joyabyss100% (1)

- Financial Statement Analysis - 10e by K. R. Am & John J. Wild Chapter01Document40 pagesFinancial Statement Analysis - 10e by K. R. Am & John J. Wild Chapter01Rifqi Ahmad Aula100% (2)

- FSA 8e Ch11 SMDocument62 pagesFSA 8e Ch11 SMhomeworkping1Pas encore d'évaluation

- Chap 11 - Equity Analysis and ValuationDocument26 pagesChap 11 - Equity Analysis and ValuationWindyee TanPas encore d'évaluation

- Chapter 9 " Prospective Analysis" FINANCIAL ANALYSIS STATEMENTDocument23 pagesChapter 9 " Prospective Analysis" FINANCIAL ANALYSIS STATEMENTBayoe Ajip75% (4)

- Comprehensive CaseDocument23 pagesComprehensive CaseKhoirunnisa DwiastutiPas encore d'évaluation

- Chapter 10 Guide to Credit AnalysisDocument53 pagesChapter 10 Guide to Credit AnalysisJogja AntiqPas encore d'évaluation

- Subramanyam Chapter07Document34 pagesSubramanyam Chapter07Saras Ina Pramesti100% (2)

- Financial Statement Analysis: K R Subramanyam John J WildDocument40 pagesFinancial Statement Analysis: K R Subramanyam John J WildManusha ErandiPas encore d'évaluation

- Chapter 8Document35 pagesChapter 8najascj100% (1)

- Chapter 11Document39 pagesChapter 11Muthia Khairani100% (1)

- Chapter 9 Prospective AnalysisDocument23 pagesChapter 9 Prospective AnalysisPepper CorianderPas encore d'évaluation

- Slide Chapter 3 Analyzing Financing ActivitiesDocument40 pagesSlide Chapter 3 Analyzing Financing ActivitiesardhikasatriaPas encore d'évaluation

- Solution Manual Advanced Financial Accounting 8th Edition Baker Chap012 PDFDocument79 pagesSolution Manual Advanced Financial Accounting 8th Edition Baker Chap012 PDFYopie ChandraPas encore d'évaluation

- FSA 8e Ch04 SMDocument63 pagesFSA 8e Ch04 SMmonhelPas encore d'évaluation

- Applying FSA to Campbell SoupDocument9 pagesApplying FSA to Campbell SoupIlham Muhammad AkbarPas encore d'évaluation

- Project Financials with Prospective AnalysisDocument34 pagesProject Financials with Prospective AnalysisAzhar SeptariPas encore d'évaluation

- Financial Statement Analysis: K R Subramanyam John J WildDocument40 pagesFinancial Statement Analysis: K R Subramanyam John J WildEmma SuryaniPas encore d'évaluation

- SMChap 006Document63 pagesSMChap 006Rola KhouryPas encore d'évaluation

- COM670 Chapter 4Document28 pagesCOM670 Chapter 4aakapsPas encore d'évaluation

- Management Control System - Revenue & Expense CenterDocument23 pagesManagement Control System - Revenue & Expense CenterCitra Dewi Wulansari0% (1)

- BAB 4 Analyzing Investing Activities 220916 PDFDocument15 pagesBAB 4 Analyzing Investing Activities 220916 PDFHaniedar NadifaPas encore d'évaluation

- Analyzing Intercorporate Investments and DerivativesDocument33 pagesAnalyzing Intercorporate Investments and DerivativesKhoirunnisa DwiastutiPas encore d'évaluation

- Tradeoff Relevance and Reliability Cash Flow EstimatesDocument5 pagesTradeoff Relevance and Reliability Cash Flow EstimatesKrithika NaiduPas encore d'évaluation

- Analyze Special Topics in Intercompany and International ActivitiesDocument39 pagesAnalyze Special Topics in Intercompany and International ActivitiesnufusPas encore d'évaluation

- Chap 9 - Prospective Analysis PDFDocument19 pagesChap 9 - Prospective Analysis PDFWindyee TanPas encore d'évaluation

- Financial Statement Analysis (Tenth Edition) Solution For CH - 07 PDFDocument50 pagesFinancial Statement Analysis (Tenth Edition) Solution For CH - 07 PDFPrince Angel75% (20)

- Tugas Week 10Document6 pagesTugas Week 10Carissa WindyPas encore d'évaluation

- Measurement: ©2018 John Wiley & Sons Australia LTDDocument50 pagesMeasurement: ©2018 John Wiley & Sons Australia LTDdickzcaPas encore d'évaluation

- Analyzing Investing Activities Chapter 5Document29 pagesAnalyzing Investing Activities Chapter 5Agathos Kurapaq0% (1)

- BAB 11 - SubramanyamDocument8 pagesBAB 11 - SubramanyamServitalle100% (1)

- Financial Shenanigans-Earning ManipulationDocument23 pagesFinancial Shenanigans-Earning ManipulationFani anitaPas encore d'évaluation

- CH 8 Palepu JW C PDFDocument14 pagesCH 8 Palepu JW C PDFcherry winePas encore d'évaluation

- Palepu AVB Edisi 5 - CH 1Document17 pagesPalepu AVB Edisi 5 - CH 1angel0% (1)

- Chapter 7Document28 pagesChapter 7Shibly SadikPas encore d'évaluation

- Chapter 4 Cash Flow Financial PlanningDocument63 pagesChapter 4 Cash Flow Financial PlanningThenivaalaven VimalPas encore d'évaluation

- C4 Accrual Accounting ConceptDocument72 pagesC4 Accrual Accounting ConceptAllen Allen100% (2)

- Financial Accounting For ManagersDocument127 pagesFinancial Accounting For ManagerssowmtinaPas encore d'évaluation

- Financial Forecasting: Mcgraw-Hill/IrwinDocument39 pagesFinancial Forecasting: Mcgraw-Hill/IrwinAllaine Vera MercadoPas encore d'évaluation

- Accounting Principles: Second Canadian EditionDocument30 pagesAccounting Principles: Second Canadian EditionJain EktaPas encore d'évaluation

- Ccounting Principles,: Weygandt, Kieso, & KimmelDocument45 pagesCcounting Principles,: Weygandt, Kieso, & KimmelmanduramPas encore d'évaluation

- Harrison FA IFRS 11e CH04 SMDocument46 pagesHarrison FA IFRS 11e CH04 SMLi Kin LongPas encore d'évaluation

- Corporate FinanceDocument51 pagesCorporate FinanceAnna FossiPas encore d'évaluation

- Foundations of Entrepreneurship: Basic Accounting and Financial StatementsDocument89 pagesFoundations of Entrepreneurship: Basic Accounting and Financial StatementsTejaswi BandlamudiPas encore d'évaluation

- Lecture NotesDocument111 pagesLecture NotesdoofwawdPas encore d'évaluation

- Chap 004Document36 pagesChap 004Cyn SyjucoPas encore d'évaluation

- Understand Financial Reports in 40 CharactersDocument26 pagesUnderstand Financial Reports in 40 CharactersmhikeedelantarPas encore d'évaluation

- CH 12Document45 pagesCH 12Pulkit AggarwalPas encore d'évaluation

- Lec 2Document37 pagesLec 2charlie simoPas encore d'évaluation

- Finance. Lecture 01Document5 pagesFinance. Lecture 01Leire Garcia ZabalaPas encore d'évaluation

- Cash Flow and Financial PlanningDocument64 pagesCash Flow and Financial PlanningAmjad J AliPas encore d'évaluation

- Impact of Accounting Standards and Regulations On Financial ReportingDocument68 pagesImpact of Accounting Standards and Regulations On Financial ReportingRicha AnandPas encore d'évaluation

- Chapter 2Document31 pagesChapter 2Renz Gerard AmorPas encore d'évaluation

- Review Audit Working Papers TechniquesDocument62 pagesReview Audit Working Papers TechniquesraditePas encore d'évaluation

- 5fdbb98b29d37cc26751e750 - Ecommerce Business Plan Example - BlueCartDocument10 pages5fdbb98b29d37cc26751e750 - Ecommerce Business Plan Example - BlueCartella diazPas encore d'évaluation

- The Cost of CapitalDocument20 pagesThe Cost of CapitalSyedMmohammadKashanPas encore d'évaluation

- Annexes TOS Effective October 2022Document38 pagesAnnexes TOS Effective October 2022cleona elsiePas encore d'évaluation

- Jawaban Mojakoe-UTS Akuntansi Keuangan 1 Ganjil 2020-2021Document22 pagesJawaban Mojakoe-UTS Akuntansi Keuangan 1 Ganjil 2020-2021Vincenttio le CloudPas encore d'évaluation

- Differential Cost AnalysisDocument19 pagesDifferential Cost Analysisbobo kaPas encore d'évaluation

- Essentials of Services Marketing 3rd Edition Wirtz Test BankDocument8 pagesEssentials of Services Marketing 3rd Edition Wirtz Test Bankblackenanthracic.f7h09100% (25)

- The Impact of Corporate Rebranding On Brand Equity and Firm PerformanceDocument11 pagesThe Impact of Corporate Rebranding On Brand Equity and Firm PerformanceCent BPas encore d'évaluation

- Factors Influencing Consumer Purchase of ShampooDocument13 pagesFactors Influencing Consumer Purchase of ShampooKHUSHI VERMAPas encore d'évaluation

- BBA 1st - 8th Semester Syllabus - 1546787544 PDFDocument84 pagesBBA 1st - 8th Semester Syllabus - 1546787544 PDFMausam GhimirePas encore d'évaluation

- Kuliah - 2 - Channel StructureDocument44 pagesKuliah - 2 - Channel StructureWildan HakimPas encore d'évaluation

- Financial Statements from Trial BalancesDocument2 pagesFinancial Statements from Trial BalancesAmzarPas encore d'évaluation

- Marketing Week 15Document2 pagesMarketing Week 15Lillian KobusingyePas encore d'évaluation

- Shimano 2Document10 pagesShimano 2Tigist AlemayehuPas encore d'évaluation

- New Age of IB Opportunities With Grand CapitalDocument6 pagesNew Age of IB Opportunities With Grand CapitalSayed Younis SadaatPas encore d'évaluation

- Blue Nile IncDocument13 pagesBlue Nile IncMuhammad NaveedPas encore d'évaluation

- Increase Online Escort Business Visibility, Traffic & RevenueDocument6 pagesIncrease Online Escort Business Visibility, Traffic & RevenueJohn DavidPas encore d'évaluation

- Finance Project Report TopicsDocument4 pagesFinance Project Report TopicsLufang FengPas encore d'évaluation

- ACCT 504 Midterm Exam 2Document7 pagesACCT 504 Midterm Exam 2DeVryHelpPas encore d'évaluation

- DM Report Structure in TemplateDocument14 pagesDM Report Structure in TemplateTejaswini MahendraPas encore d'évaluation

- Do It!: SolutionDocument9 pagesDo It!: Solutionaura fitrah auliya SomantriPas encore d'évaluation

- Starbucks Australia Marketing Plan Targeting Students and Young ProfessionalsDocument18 pagesStarbucks Australia Marketing Plan Targeting Students and Young ProfessionalsNikhil Niks100% (1)

- Ferns and Petals: Group - 7 Ankit Ranjan Ghosh Ishita Jain Kshitij Goyal Nilay Ranjan Taru ChaurasiaDocument9 pagesFerns and Petals: Group - 7 Ankit Ranjan Ghosh Ishita Jain Kshitij Goyal Nilay Ranjan Taru Chaurasiaishita jainPas encore d'évaluation

- Gul AhmedDocument62 pagesGul AhmedMuhammad Bilal75% (8)

- A-Level Economics - The Price System and The Micro Economy (Objectives of Firms)Document43 pagesA-Level Economics - The Price System and The Micro Economy (Objectives of Firms)l PLAY GAMESPas encore d'évaluation

- Strategic Management Midterm ReviewerDocument15 pagesStrategic Management Midterm ReviewerAlthea SantillanPas encore d'évaluation

- Voltas ACs: From the Verge of Bankruptcy to the Market LeaderDocument8 pagesVoltas ACs: From the Verge of Bankruptcy to the Market LeaderAmandeep Singh100% (1)

- CHAVEZ 2017 Data Driven Supply Chains Manufacturing Capability and Customer SatisfactionDocument14 pagesCHAVEZ 2017 Data Driven Supply Chains Manufacturing Capability and Customer SatisfactionRodolfo StraussPas encore d'évaluation

- Subhash Dey's ACC XII Partnership Theory (1 Page)Document1 pageSubhash Dey's ACC XII Partnership Theory (1 Page)Darshpreet SinghPas encore d'évaluation

- IBS Case Study IndexDocument19 pagesIBS Case Study IndexMala M PrasannaPas encore d'évaluation

- Ke1155 Xls EngDocument167 pagesKe1155 Xls EngKit KatPas encore d'évaluation