Académique Documents

Professionnel Documents

Culture Documents

Islamic Banking - Group Presentation BBA - Final Version (Sept 2010)

Transféré par

Zul Aizat HamdanCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Islamic Banking - Group Presentation BBA - Final Version (Sept 2010)

Transféré par

Zul Aizat HamdanDroits d'auteur :

Formats disponibles

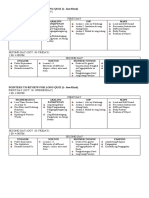

ISLAMIC BANKING TERM PAPER PRESENTATION by Asmah Mohd Jaapar Hishamuddin Abdul Wahab Khusmuhammad Sulistya Rusgianto Yusif

BBA HOME FINANCING: CASE STUDIES CIMB ISLAMIC HOME FINANCING-i AND FLEXI HOME FINANCING-i

SEPT 2010 INCEIF

OBJECTIVES

Contract (Aqd)

Legal Documentation

Financial Reporting

Maq

id al-Shar ah

O jective

To understand the basic concept of CIMB Islamic Home Financing-i and Flexi Home Financing-i To determine shar ah legitimacy of CIMB Islamic Home Financing-i and Flexi Home Financing-I using contract (aqd), legal documentation, financial reporting and Maq id al-Shar ah parameters

YUSIF

Objectives

CONTRACT (AQD)

Legal Documentation

Financial Reporting

Maq

id al-Shar ah

B i Bit

Ajil (BBA) (Deferre -

e t S le)

Bai Bithaman Ajil is a contract of sale and purchase of an asset in which the payment of price is deferred and paid in installment within an agreed period of time. The selling price includes profit. The margin is up to 90% Financing all types of completed or under construction residential properties Required documents are PPA, PSA, Deed of Assignment (by way of security)

KHUSMUHAMMAD 3

Objectives

CONTRACT (AQD)

Legal Documentation

Financial Reporting

Maq

id al-Shar ah

(C

t.)

Customer has executed a Sale and Purchase Agreement with the vendor Customer has the right to sell the property to bank by executing Property Purchase Agreement with the Bank Bank Resells the property to the customer by executing the Property Sale Agreement(Fixed or Floating rate) This falls under the concept of Bay Inah, where the bank buys directly from customer and resells the same property to same customer without incurring any risk

KHUSMUHAMMAD 4 4

Objectives

CONTRACT (AQD)

Legal Documentation

Financial Reporting

Maq

id al-Shar ah

CIMB I l

ic H

e Fi

ci

-i

Home Financing-i, is fixed rate home financing for 3-years, 5-years 10 or 20 years A sample calculation for 20 years of house of 225000RM, at profit rate of 5.88% is as follows (Payment of monthly installment)=[Facility amount(1+profit rate)xnxr]/[1+(1+pr)xn-1] Monthly installment=[225000(1+5.88/12)x240x5.88/12]/[1+(1+5.66/12)x2401]=1,596RM The bank contract /selling price will be 1596.43x240=383,143RM The contract does not allow bank to adjust their profit rate and contracted price will remain fixed in 158,143RM

KHUSMUHAMMAD

Objectives

CONTRACT (AQD)

Legal Documentation

Financial Reporting

Maq

id al-Shar ah

CIMB I l

ic Flexi H

e Fi

ci

-i

Variable rate home financing based floating rate features based on the movement of Base Financing Rate (BFR), with capped at an agreed ceiling rate, this is actually BBA financing with Ibra features, any shortfall will be treated as rebate given to client The bank sets ceiling price of 10.75% per annum whatever above this will be rebate to the customer The bank purchase is RM114,986 The bank selling price RM280,169, installment in 20 years Contracted profit rate/Ceiling rate 10.75% p.a Base financing rate on the time of offer latter is 6.5% The monthly payment amount is calculated based on the Effective Profit Rate which is the current Base Financing Rate - /+Spread per annum which 1-240 month, BFR-1.95% p.a. the amount = RM730.57

KHUSMUHAMMAD

Objectives

CONTRACT (AQD)

Legal Documentation

Financial Reporting

Maq

id al-Shar ah

Req ire e t f Aq /C

tr ct

A e t f C tr ct - Customer - Bank O jective f C tr ct - BBA Property Financing S ject M tter t e rice f C tr ct - Fixed/Floating Financing Rate- House financing Offer Acce t ce - Bank buys the house and resells the product by contracted profit rate installment - Customer accepts the selling price and monthly installment The whole arrangement of purchase and resale involves Bai-al-Inah concept

KHUSMUHAMMAD 7

Objectives

Contract (Aqd)

LEGAL DOCUMENTATION

Financial Reporting

Maq

id al-Shar ah

Le

lD c

e t f rH

e Fi

ci

Conventional Sale and Purchase Agreement (S&P) or Memorandum of Contract Loan Agreement Deed of Assignments/Charge Islamic banking Sales and Purchase Agreement (S&P) or Memorandum of Contract Property Purchase Agreement (PPA) Property Sale Agreement (PSA) Deed of Assignments/Charge

SULISTYA RUSGIANTO 8

Objectives

Contract (Aqd)

LEGAL DOCUMENTATION

Financial Reporting

Maq

id al-Shar ah

S le

P rc

e A ree e t

The customer(s) purchase the property from the developer/vendor In this case, SPA in the form of the Memorandum of Contract (MoC) endorsed by the Auctioneer which indicate that the customer(s) is the successful bidder and the successful bid price is declared The customer(s) paid 10% down payment There is a transfer of ownership and title but has not been issued by the relevant authorities.

SULISTYA RUSGIANTO 9 9

Objectives

Contract (Aqd)

LEGAL DOCUMENTATION

Financial Reporting

Maq

id al-Shar ah

Pr

ert P rc

e A ree e t

The bank purchase the property from the customer(s) There is no title transfer, but beneficial ownership in and/or rights to the property only. The bank pay the purchase price (bid price down payment) to the developer/vendor for benefit of the customer(s)

SULISTYA RUSGIANTO 10 10

Objectives

Contract (Aqd)

LEGAL DOCUMENTATION

Financial Reporting

Maq

id al-Shar ah

Pr

ert S le A ree e t

Agreement between the Bank as selling party and the customer as buyer Consists information on the rights and contractual obligation of the contracting parties, the property, the price, monthly payment, period of financing and other terms and conditions Attached with the Letter of Offer and Deed of Assignment/Charge The Bai al-Inah concept is explained in this agreement and so, the BBA mode of payment which allow the customer to settle the banks selling price on deferred payment basis.

ASMAH MOHD JAAPAR

11

11

Objectives

Contract (Aqd)

LEGAL DOCUMENTATION

Financial Reporting

Maq

id al-Shar ah

Def

lt

Definition 1) Failure to pay the monthly payment or any sum of money due and payable to the bank under the BBA facility 2) An act of bankruptcy under Bankruptcy Act 1983 has been committed 3) If Section 25 (1) of the Islamic Banking Act 1983 is triggered 4) Insanity or death of any of the customer(s) 5) Breach of any terms, conditions or approval contained in PSA and the Legal Docs. In the event of default, the customer(s) have to pay the whole banks selling price and all other sums payable under the BBA facility

ASMAH MOHD JAAPAR 12 12

Objectives

Contract (Aqd)

LEGAL DOCUMENTATION

Financial Reporting

Maq

id al-Shar ah

e t

Installment based on the EPR=BFR-1.95% p.a. on daily rest throughout the facility period The installment is adjusted to reflect the changes of EPR based on the movement of BFR but shall not > CPR of 10.75% p.a. Automatic monthly ibra is given based on difference between EPR and CPR

ASMAH MOHD JAAPAR 13 13

Objectives

Contract (Aqd)

LEGAL DOCUMENTATION

Financial Reporting

Maq

id al-Shar ah

L te P

e t

Tawidh During the facility period: 1% p.a. on the overdue amount or a minimum of RM1 whichever is higher or any other method approved by BNM After the facility period: based on the banks current Islamic Interbank Money Market (IIMM) rate on the outstanding principal balance or any other method approved by BNM Tawidh shall not be compounded on the principal amount

ASMAH MOHD JAAPAR 14 14

Objectives

Contract (Aqd)

LEGAL DOCUMENTATION

Financial Reporting

Maq

id al-Shar ah

E rl Settle e t/ Re e

ti

f F cilit

During lock-in period (5 years) Settlement/redemption is allow at the banks sole discretion and ibra may not be granted or granted at lower rate After the lock-in period Ibra of any unearned profit over the banks selling price may be permitted Ibra computation shall be treated as final and binding Partial payment of the BBA facility is allowed through excess payment of the customer(s) by way of withdrawal of EPF or additional payment

ASMAH MOHD JAAPAR 15 15

Objectives

Contract (Aqd)

LEGAL DOCUMENTATION

Financial Reporting

Maq

id al-Shar ah

GMTP

The property must be covered with a TO on the Banks panel naming the Bank as beneficiary The GMTP contribution is either self-financed by the customer or the Bank For single applicant, the coverage is 100% For joint applicants, the coverage is about 50% each In the event GMTP is cancelled for whatsoever reason, the customer will be charge extra 1% of the profit rate

ASMAH MOHD JAAPAR 16 16

Objectives

Contract (Aqd)

Legal Documentation

FINANCIAL REPORTING

Maq

id al-Shar ah

Fi

ci l Re

rti

Financial Reporting can be defined as a process of recording all business financial transactions and activities. The importance of the Financial Reports has been clearly emphasized from the Quranic Verse as follows: Never get bored with recording it, however small and large, up to its maturity date, for this is seen by Allah as closer to justice, more supportive to testimony and more resolving to doubt [Al-Baqara: 2, 82]. The true source of financial reporting will be based on Annual Report of CIMB Islamic Bank Bhd in year 2009 which in accordance with the requirements of the Companies Act 1965 (Malaysia), MASB Approved Accounting Standard and BNM Guidelines. For the purpose of testing the level of conformity with Shariah Injunction, we use Accounting, Auditing and Governance Standards For Islamic Financial Institutions (2008) published by AAOIFI (the Accounting and Auditing Organization for Islamic Financial Institutions) as yardstick

HISHAMUDDIN ABDUL WAHAB 17

Objectives

Contract (Aqd)

Legal Documentation

FINANCIAL REPORTING

Maq

id al-Shar ah

Acc

ti

St

f rM r

(BBA)

AAOIFI FAS 1 FAS 2

Bank Negara GP8-i

MASB FRS i12004

HISHAMUDDIN ABDUL WAHAB

18

18

Objectives

Contract (Aqd)

Legal Documentation

FINANCIAL REPORTING

Maq

id al-Shar ah

Pr

le

fI c

i te c i Fi

ci l Re

rti

In the real Balance Sheet of CIMB Islamic Bank Bhd, all the entries have been recorded such Murabaha financing, cash, account receivable and profit realized from financing except for the asset purchase transaction. The inconsistency of financial reporting of CIMB Islamic Bank Bhd arises from BBA transactions - absence of the financial records of the property buying by the bank from the customer. It violates the Hadith One must not sell what one does not own. It makes buy-sell (bay al-enah) procedures only fictitious since no transaction recorded for asset buying

HISHAMUDDIN ABDUL WAHAB 19 19

Objectives

Contract (Aqd)

Legal Documentation

FINANCIAL REPORTING

Maq

id al-Shar ah

Jour

No 1

l E tr for BBA (or Mur

Transactions/ Events Purchase of Asset by bank

) (S

Dr Equipment Murabaha

ul H

ee , 2009)

Cr Cash/Creditor

Murabaha (BBA) sale

financing (cost + profit)

Equipment at cost of deferred profit with profit Murabaha Financing Profit n Loss Murabaha Financing Murabaha Financing

20 20

3 4

Installment receipt Recognition of profit as each installment received

Cash Deferred profit A/c receivable Deferred profit

5 6

Termination of contract Rebate for early payment

HISHAMUDDIN ABDUL WAHAB

Objectives

Contract (Aqd)

Legal Documentation

FINANCIAL REPORTING

Maq

id al-Shar ah

Ge er l Pre e t tion nd Di closure Rel ting to BBA

St ndard General Presentation and Disclosure In Balance sheet, on the asset side, BBA financing is pooled together with other types of financing into category of Financing, advances and other loans. No presentation for the asset purchased by bank before sell to customer. In notes to financial statement, under category of Financing, advances and other loans, theres specification for BBA by contract. From definition of paragraph 6, the standard defines BBA as : Bai Bithaman Ajil (lit., deferred payment sale) - A form of financing in which an IFI finances a customer who wishes to acquire a given asset and who agrees to repay by instalments within an agreed period. The IFI will purchase the asset required by the customer and subsequently sells it to him at an agreed price inclusive of the IFI's profit margin. Paragraph 10, the standard only mentions about requirement of information for financial statement such asset, liabilities, equity, income and expenses, changes in equity and cash flows. No specifications of items for assets except for paragraph 41 on Information to be presented on face of balance sheets The assets of an IFI include cash balances and short-term funds, placements with other financial institutions, dealing and investment securities, and financing of customers...The financing of customers usually comprises financing extended to customers based on various Shariah principles. Other items include receivables, statutory deposits with BNM, and property, plant and equipment.

GP8-i

FRS-i2004

HISHAMUDDIN ABDUL WAHAB

21

21

Objectives

Contract (Aqd)

Legal Documentation

FINANCIAL REPORTING

Maq

id al-Shar ah

(Cont.)

Standard General Presentation and Disclosure

Regarding to BBA, one close paragraph mention about it is in paragraph 27. The paragraph basically mentioning about the permissibility of offsetting certain items in assets and liabilities, and income and expenses. The paragraph 27 as below:

FRS-i2004 (cont)

27. Offsetting of balances may be made in respect of unearned profit for murabahah, BBA and Ijarah financing against murabahah, BBA and rental receivables. In FAS (1), the asset purchased by bank is recorded in the inventory account. In para 37 FAS(1) of Statement of Financial Position, the Disclosure should be made on the face of financial statement including:

FAS 1

Inventories (including goods purchased for Murabaha customers prior to consummation of Murabaha agreement)

HISHAMUDDIN ABDUL WAHAB 22 22

Objectives

Contract (Aqd)

Legal Documentation

FINANCIAL REPORTING

Maq

id al-Shar ah

Extract of Annual Re ort CIMB Islamic Bank B d (2009)

HISHAMUDDIN ABDUL WAHAB

23

23

Objectives

Contract (Aqd)

Legal Documentation

FINANCIAL REPORTING

Maq

id al-Shar ah

Extract of Annual Re ort CIMB Islamic Bank B d (2009)

HISHAMUDDIN ABDUL WAHAB

24

24

Objectives

Contract (Aqd)

Legal Documentation

Financial Reporting

MAQ ID ALSHAR AH

Introduction to Maq

id Al-shar ah

Consist of the deeper meanings (ma n ) and inner aspects of wisdom ( ikam) considered by the Lawgiver (Sh ri) in all or most of the areas and circumstances of legislation (a w l al-tashr ) (Ibn Ashur, 2006). Either the realization of benefit (ma la ah)or the repulsion of harm (mafsadah) or achieving both at the same time. (Ibn Ashur, 2006). Maq id al-shar ah: Necessities ( ar riyy t): Preserves ones faith, soul, wealth, mind, and offspring Needs ( jiyy t) Luxuries (ta s niyy t)

YUSIF

25

Objectives

Contract (Aqd)

Legal Documentation

Financial Reporting

MAQ ID ALSHAR AH

Importance of Home in Islam

Abu Musa reported AlL h's Apostle (SAW) as saying: The house in which remembrance of AlL h is made and the house in which AlL h is not remembered are like the living and the dead (Sahih Muslim, Book 4, Hadith 1706) And stay in your houses, and do not display yourselves like that of the times of ignorance [alAhzaab 33:33]

YUSIF

26

26

Objectives

Contract (Aqd)

Legal Documentation

Financial Reporting

MAQ ID ALSHAR AH

CIMB Home Financing

Repulsion of harm: No actual transfer of ownership (-) Involve property under construction (-) Realization of benefit: Preservation of faith, soul, wealth, mind, and offspring (+)

YUSIF

27

27

Thank You

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- REINZ Useful Clauses and AuthoritiesDocument43 pagesREINZ Useful Clauses and AuthoritiesAriel LevinPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- WhittardsDocument7 pagesWhittardsAaron ShermanPas encore d'évaluation

- Lenovo Legion Y920-17IKB LCFC-DS321 NM-B311 R 0.2 SchematicDocument61 pagesLenovo Legion Y920-17IKB LCFC-DS321 NM-B311 R 0.2 SchematicYetawa GuaviarePas encore d'évaluation

- Please Choose at Least 3 Cluster For Each CourseDocument11 pagesPlease Choose at Least 3 Cluster For Each CourseZul Aizat HamdanPas encore d'évaluation

- Jan: Feb: Mar: Apr: May: Jun: Jul: Aug: Sep: Oct: Nov: DecDocument1 pageJan: Feb: Mar: Apr: May: Jun: Jul: Aug: Sep: Oct: Nov: DecZul Aizat HamdanPas encore d'évaluation

- EXAMPLEDocument2 pagesEXAMPLEZul Aizat HamdanPas encore d'évaluation

- Complete Report White Collar CrimeDocument11 pagesComplete Report White Collar CrimeZul Aizat HamdanPas encore d'évaluation

- Maybank DataDocument6 pagesMaybank DataZul Aizat HamdanPas encore d'évaluation

- MAYBANK and CIMB Factor LATESTDocument11 pagesMAYBANK and CIMB Factor LATESTZul Aizat HamdanPas encore d'évaluation

- MAYBANK and CIMB FactorDocument6 pagesMAYBANK and CIMB FactorZul Aizat HamdanPas encore d'évaluation

- Hadis 40 RingkasanDocument8 pagesHadis 40 RingkasanZul Aizat HamdanPas encore d'évaluation

- List of SourcesDocument1 pageList of SourcesZul Aizat HamdanPas encore d'évaluation

- Print Jadual PerlawananDocument16 pagesPrint Jadual PerlawananZul Aizat HamdanPas encore d'évaluation

- Company Memorandum Packet 4Document4 pagesCompany Memorandum Packet 4Zul Aizat HamdanPas encore d'évaluation

- Information ViewDocument1 pageInformation ViewZul Aizat HamdanPas encore d'évaluation

- Cimb DataDocument6 pagesCimb DataZul Aizat HamdanPas encore d'évaluation

- Hadis 40 RingkasanDocument8 pagesHadis 40 RingkasanZul Aizat HamdanPas encore d'évaluation

- Operational RiskDocument10 pagesOperational RiskZul Aizat HamdanPas encore d'évaluation

- Hadis 40 RingkasanDocument8 pagesHadis 40 RingkasanZul Aizat HamdanPas encore d'évaluation

- Micro EnterprisesDocument3 pagesMicro EnterprisesZul Aizat HamdanPas encore d'évaluation

- Islamic Banking Operation-DepositDocument24 pagesIslamic Banking Operation-DepositZul Aizat HamdanPas encore d'évaluation

- TAHAP CELIK KEWANGAN DALAM KALANGAN PELAJAR POLITEKNIK: POLITEKNIK NILAI (Responses) PDFDocument1 pageTAHAP CELIK KEWANGAN DALAM KALANGAN PELAJAR POLITEKNIK: POLITEKNIK NILAI (Responses) PDFZul Aizat HamdanPas encore d'évaluation

- Ijara-Based Financing: Definition of Ijara (Leasing)Document13 pagesIjara-Based Financing: Definition of Ijara (Leasing)Nura HaikuPas encore d'évaluation

- 1 - Introduction To Islamic EconomicDocument35 pages1 - Introduction To Islamic EconomicZul Aizat HamdanPas encore d'évaluation

- TAHAP CELIK KEWANGAN DALAM KALANGAN PELAJAR POLITEKNIK: POLITEKNIK NILAI (Responses) PDFDocument1 pageTAHAP CELIK KEWANGAN DALAM KALANGAN PELAJAR POLITEKNIK: POLITEKNIK NILAI (Responses) PDFZul Aizat HamdanPas encore d'évaluation

- All About IjaraDocument3 pagesAll About IjaraZul Aizat HamdanPas encore d'évaluation

- 3.2: Credit AssessmentDocument1 page3.2: Credit AssessmentZul Aizat HamdanPas encore d'évaluation

- Chapter 3.2Document5 pagesChapter 3.2Zul Aizat HamdanPas encore d'évaluation

- Project Group 1 EthicsDocument2 pagesProject Group 1 EthicsZul Aizat HamdanPas encore d'évaluation

- Hadis 40 RingkasanDocument8 pagesHadis 40 RingkasanZul Aizat HamdanPas encore d'évaluation

- Project Group 1 EthicsDocument2 pagesProject Group 1 EthicsZul Aizat HamdanPas encore d'évaluation

- Chapter 5Document7 pagesChapter 5Zul Aizat HamdanPas encore d'évaluation

- 3.2: Credit AssessmentDocument1 page3.2: Credit AssessmentZul Aizat HamdanPas encore d'évaluation

- Human Resource Management Project Topics, Ideas and Abstracts, Thesis, DissertationDocument4 pagesHuman Resource Management Project Topics, Ideas and Abstracts, Thesis, DissertationArcot Ellender Santhoshi PriyaPas encore d'évaluation

- M Fitra Rezeqi - 30418007 - D3TgDocument6 pagesM Fitra Rezeqi - 30418007 - D3TgNugi AshterPas encore d'évaluation

- Home / Publications / Questions and AnswersDocument81 pagesHome / Publications / Questions and AnswersMahmoudPas encore d'évaluation

- Managing Human Resources 17Th Edition by Scott A Snell Full ChapterDocument35 pagesManaging Human Resources 17Th Edition by Scott A Snell Full Chapterhenry.pralle792100% (25)

- Concrete Calculator Steel Calculator Brick Calculator: Atish Kumar EmailDocument12 pagesConcrete Calculator Steel Calculator Brick Calculator: Atish Kumar EmailAnil sainiPas encore d'évaluation

- LDocument408 pagesLvmarthyPas encore d'évaluation

- SES 4 at 22. °W: Advertisements AdvertisementsDocument6 pagesSES 4 at 22. °W: Advertisements Advertisementsemmanuel danra10Pas encore d'évaluation

- Humanrigtsni: Human Rights: Developmen in IndiaDocument71 pagesHumanrigtsni: Human Rights: Developmen in IndiaAastha AgarwalPas encore d'évaluation

- Judicial Affidavit - Arselita AngayDocument6 pagesJudicial Affidavit - Arselita AngayJay-ArhPas encore d'évaluation

- The Ugly Duckling - ScriptDocument5 pagesThe Ugly Duckling - Scriptapi-620031983Pas encore d'évaluation

- AG V Manjeet Singh DhillonDocument26 pagesAG V Manjeet Singh Dhillonfaiz0% (1)

- Garment Manufacturing TechnologyDocument3 pagesGarment Manufacturing TechnologyamethiaexportPas encore d'évaluation

- Pointers To Review For Long QuizDocument1 pagePointers To Review For Long QuizJoice Ann PolinarPas encore d'évaluation

- CCMT SC ST Format FormatDocument1 pageCCMT SC ST Format FormatAnweshaBosePas encore d'évaluation

- 2059 s16 in 02 PDFDocument4 pages2059 s16 in 02 PDFAsif NazeerPas encore d'évaluation

- Bajrang Lal Sharma SCCDocument15 pagesBajrang Lal Sharma SCCdevanshi jainPas encore d'évaluation

- Created Ruby & Diamond Stackable Ring in Sterling Silver 9T69000 BevillesDocument1 pageCreated Ruby & Diamond Stackable Ring in Sterling Silver 9T69000 Bevillesnick leePas encore d'évaluation

- Offshore banking_ financial secrecy, tax havens_ evasion, asset protection, tax efficient corporate structure, illegal reinvoicing, fraud concealment, black money _ Sanjeev Sabhlok's revolutionary blog.pdfDocument23 pagesOffshore banking_ financial secrecy, tax havens_ evasion, asset protection, tax efficient corporate structure, illegal reinvoicing, fraud concealment, black money _ Sanjeev Sabhlok's revolutionary blog.pdfVaibhav BanjanPas encore d'évaluation

- 6 Surprising Ways To Beat The Instagram AlgorithmDocument5 pages6 Surprising Ways To Beat The Instagram AlgorithmluminenttPas encore d'évaluation

- Rubberworld (Phils.), Inc. v. NLRCDocument2 pagesRubberworld (Phils.), Inc. v. NLRCAnjPas encore d'évaluation

- B.ed SyllabusDocument9 pagesB.ed SyllabusbirukumarbscitPas encore d'évaluation

- Resort Operations ManagementDocument15 pagesResort Operations Managementasif2022coursesPas encore d'évaluation

- TFL Fares StudyDocument33 pagesTFL Fares StudyJohn Siraut100% (1)

- Besanko SummaryDocument30 pagesBesanko SummaryCindy OrangePas encore d'évaluation

- Mark The Letter A, B, C, or D On Your Answer Sheet To Indicate The Word(s) OPPOSITE in Meaning To The Underlined Word(s) in Each of The Following QuestionsDocument10 pagesMark The Letter A, B, C, or D On Your Answer Sheet To Indicate The Word(s) OPPOSITE in Meaning To The Underlined Word(s) in Each of The Following QuestionsPhạm Trần Gia HuyPas encore d'évaluation

- Stross ComplaintDocument7 pagesStross ComplaintKenan FarrellPas encore d'évaluation

- Fleeting Moments ZineDocument21 pagesFleeting Moments Zineangelo knappettPas encore d'évaluation