Académique Documents

Professionnel Documents

Culture Documents

EPC Contracting Strategy Balancing Risk & Rewards For Customers and Contractors

Transféré par

Atomic-Energy.ruTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

EPC Contracting Strategy Balancing Risk & Rewards For Customers and Contractors

Transféré par

Atomic-Energy.ruDroits d'auteur :

Formats disponibles

ATOMEXPO 2009 , 26-28 2009

EPC Contracting Strategy balancing Risk & Rewards for Customers and Contractors

Juan Ccahuana Tito, Director Fossil Power Sector Energy, OOO Siemens Moscow

, 2006

Historic Development of World Power Plant Market Since 1950

GW/a 300 250 200

Penetration of nuclear power

Extraordinary growth in Europe, Russia, China, Middle East and RSA Market boom in S/E Asia replaced by USboom Overestimation of demand, impacts of oil price crises

Slow down due to lower consumption growth, high backlog?

Drivers, uncertainties

Economic growth Energy prices Ecology awareness Power plant types Commodity prices Liberalization Customer behavior Replacements Regional markets Grid extension Production capacity

150 100 50 0 1950

Steep rise in power demand

Fossil Market >100MW Renewables Renewables Hydro Hydro Nuclear

All Types Unit Size > 1 MW

1960

1970

1980

1990

2000

2010

2020

Source: Siemens Energy GS4 Base Case scenario Status: April 2008

Short term is characterized by stagnating market after extraordinary high growth

, 2006

Strong market demand led to bottlenecks in the entire supply chain

Sub-supplier Limited capacities at sub-suppliers Presently no capacity extension in the market available Long lead times for key components High price level for supplies e.g.:

Forging Civil Casting HRSG

Power Plant Manufacturers

Customer / Market

Steep Market Increase

203 144 178 GW/a

05-07

08-10

11-13 135%

Volatile Market Prices

200 200 200 200 200 5 7 Lead times and cost have increased significantly (+35%) within4 3 years 6 last 4

Erection/Commissioning

Engineering Procurement Manufacturing Construction

100% 105%

112%

125%

Feb

Oct

Aug

Jul

Feb

Source:Thermoflow, e.g.Iberian peninsular CCPP

- Current EPC business models need to be rethought by industry e.g. -> EPC-M - Develop alternative business models - Siemens is strengthening its product business by providing pre-engineered product packages to the market.

, 2006

Reference sales models structure the Siemens offerings to our customers

General model: Customer request vs. Siemens offering

Entire Power Plant Power Block Power Island Extended Power Train

Siemens offering

Entire Power Plant as Turnkey business from Siemens -Models: Customer award for an EPC full scope delivery will be served from Siemens and a partner (e.g. EPC Consortium). - Models: Customer awards reduced scope. Integration to complete Power Plant is under responsibility of customer or a 3rd party contracted by the customer (e.g. EPC-M, Architect Engineer)

xa

Entire PP

2a

3a Partner needed

4a

2b 3b

xb

t se uqer r e m t s u C o

Reduced scope

4b

Scope of service and deliveries

Source: New Business Mix Initiative , 2006

Reference sales models cover the full range of solution business

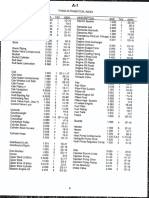

Reference sales models - Overview

Priority

Limited volume depending on resources and project risk

Model

20-30%

Scope of delivery

50-60% 70-80% 100%

Applied principle

1 2a 2b 3a 3b 4a 4b

Power Block Power Block

Turnkey Consortium Partner Customer scope Consortium Partner Customer scope

Entire power plant as General Contractor Appropriate rebalance risk tools to be applied Control over Power Block design (incl. 3D model) Model to cooperate with construction companies Carve-out of civil & erection to ensure ~40% partner scope Control over Power Block design (incl. 3D model) Customer is responsible for scope outside power block Control over process: Min. scope for gross perf. guarantee Model to cooperate with AE/EPC capable of power plant eng. Consortium partner responsible for plant integration Control over process: Min. scope for gross perf. guarantee Customer responsible for plant integration No Siemens plant design Model to cooperate with EPCs in multi block projects Min. scope for SAG (~40%) only in case of multi block projects No Siemens plant design Delivery of components (GTs, STs plus e.g. electrical equipment, I&C, etc.)

3 1 4 2

Power Island Power Island Ext. Power Train Ext. Power Train SAG Customer

For equipment supply only

Consortium Partner Customer scope Consortium Partner

Source: New Business Mix Initiative , 2006

Standard scopes of supply including SGT5-PAC 4000F multi-shaft plants

SGT5-PAC 4000F SCC5-4000F 2x1 Power Island SCC5-4000F 2x1 Turn key

SGT-PAC

Gas fuel and auxiliaries Air intake / exhaust system Gas fuel system Modules Connectiong lines Generator and auxiliary systems Fire extinction system of GT plant Electric and I&C equipment Options

SCC Heat and power equipment

SGT-PAC SST-PAC without condenser Steam turbine and auxiliaries without piping Generator and auxiliary systems Electric and I&C equipment Heat recovery boiler Options

SCC Power Island

SCC heat and power equipment Condenser with air exhaust system Feeding pumps of a boiler Condensate pupms Safety valves Fuel preheaterwith filters, counter unit etc. Power Island monitoring system Options

SCC Turn key

SCC Power island Building and structures Cranes and life support systems of the turbine building Power plant cooling system Water treatment Initial and waste water system Tankage Piping and valves of the plant Electrical equipment I&C of the power plant Additional fire alarm and fire extinctions systems Erection and commissioning Other options Complete turn key delivery of the plant

Manufacturing and delivery

Cycle optimization / Manufacturing solution

System inegration / Optimized solution

, 2006

Flexible Approach to balance Risk Sharing

Sales Model (Customer Value)

e llue a u a gV gV n ci n sk nc i Riis k n alla nd R a a nd b Re b a Re a

Full Scope EPC Turnkey Power Block

Power Island Extended Power Train

Shared Risk

Focus on Customer Value and balanced risk Focus on Customer Value and balanced risk

, 2006

Partnering Initiative: Selected EPC partners worldwide

Boiler IHI Doosan Babcock Burmeister & Wain Water Island Sidem Doosan Water Fisia Hitachi Zoosen Techint AE&E Duro Felguera Iberinco Bilfinger Berger AE&E Bilfinger Berger AE&E Fluor Gama Kentz AE&E Enka SNC Metka Bilfinger Bergar Enka Gama Metka Enka Metka

GS E&C Daewoo Daelim Posco E&C Hanwah E&C SK E&C

Aker Kaeverner Kiewit Worley Parsons Fresh Meadow BE&K Al Ghanim ASTE ETA Doosan Heavy Samsung Daewoo Marubeni HHI HDEC SNC Techint Al Rahji NCC Saudi

Marubeni Samsung Daewoo GS E&C Sumitomo YTL CTCI

Duro Felguera Partner with SAG experience Partner w/o SAG experience Bold Strategic Partner Normal Project Partner

Orascom YTL Daewoo SNC Bilfinger Berger Iberinco Techint

Fluor Bilfinger Berger YTL

John Holland Sumitomo

L&T Daelim Samsung

Source: Partnering Initiative

, 2006

Partner co-operation program covers full life cycle of partner relationship

Partner Development Process

Identification of Partners Perform partner workshop Sign a partnering agreement defining basis of partnership Step 3 Partner agreement signed and projects identified to bid together Co-operation development plans detailed and tasks allocated Dedicated Liaison manager identified. Build up of relationship and bid projects in consortium Step 4 Execute executive relationship mgt., projects developed together, first bids prepared on the basis of partnering agreement Successfully implement projects in consortium Step 5 First project in implementation as per partnering agreement, regular feedbacks, evaluation of the agreed cooperation development plans (1 p.a.)

Step 1 Identify Partners with sales for regions and countries Collect feedback from existing projects with the partners Get partner consent in taking part in program

Step 2 Perform partner workshop, discuss experience and find common ways for future cooperation, identify co-operation development plan and sign a MOU

Source: Partnering Initiative , 2006

ATOMEXPO 2009 , 26-28 2009

Thank you for your attention

, 2006

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Emerging Nuclear and Radiation Technologies by Pavel YakovlevDocument23 pagesEmerging Nuclear and Radiation Technologies by Pavel YakovlevAtomic-Energy.ruPas encore d'évaluation

- The Rhisotope Project by Doctor William FowldsDocument54 pagesThe Rhisotope Project by Doctor William FowldsAtomic-Energy.ruPas encore d'évaluation

- Winfo June 2018Document36 pagesWinfo June 2018Atomic-Energy.ruPas encore d'évaluation

- WiNFO December 2018Document30 pagesWiNFO December 2018Atomic-Energy.ruPas encore d'évaluation

- WiNFO March 2020Document28 pagesWiNFO March 2020Atomic-Energy.ruPas encore d'évaluation

- WiNFO March 2019Document20 pagesWiNFO March 2019Atomic-Energy.ruPas encore d'évaluation

- ISTR2020-Karlsruhe Second AnnouncementDocument2 pagesISTR2020-Karlsruhe Second AnnouncementAtomic-Energy.ruPas encore d'évaluation

- The Rhisotope Project by Professor LarkenDocument18 pagesThe Rhisotope Project by Professor LarkenAtomic-Energy.ruPas encore d'évaluation

- Radiation-Protective Flexible MATS (CLOSED CYCLE)Document8 pagesRadiation-Protective Flexible MATS (CLOSED CYCLE)Atomic-Energy.ruPas encore d'évaluation

- WiNFO December 2019Document56 pagesWiNFO December 2019Atomic-Energy.ruPas encore d'évaluation

- WiNFO December 2017Document24 pagesWiNFO December 2017Atomic-Energy.ruPas encore d'évaluation

- WiNFO Sept Oct 2018Document26 pagesWiNFO Sept Oct 2018Atomic-Energy.ruPas encore d'évaluation

- WiNFO September 2019Document21 pagesWiNFO September 2019Atomic-Energy.ruPas encore d'évaluation

- WiNFO September 2017Document26 pagesWiNFO September 2017Atomic-Energy.ruPas encore d'évaluation

- Manifesto #NuclearEuropeLeadersDocument12 pagesManifesto #NuclearEuropeLeadersAtomic-Energy.ruPas encore d'évaluation

- France Energy PlanDocument3 pagesFrance Energy PlanAtomic-Energy.ruPas encore d'évaluation

- Foratom: Economic and Social Impact ReportDocument76 pagesForatom: Economic and Social Impact ReportAtomic-Energy.ruPas encore d'évaluation

- WiNFO June 2019Document22 pagesWiNFO June 2019Atomic-Energy.ruPas encore d'évaluation

- Экспериментальная верификация расчетных моделей, используемых для оценок параметров безопасности транспортирования отработавшего ядерного топливаDocument14 pagesЭкспериментальная верификация расчетных моделей, используемых для оценок параметров безопасности транспортирования отработавшего ядерного топливаAtomic-Energy.ruPas encore d'évaluation

- Зонирование территорий при авариях на ОИАЭ с целью минимизации вторичного загрязнения территорий, путей сообщения и транспортных средств, и организации их радиационного контроляDocument1 pageЗонирование территорий при авариях на ОИАЭ с целью минимизации вторичного загрязнения территорий, путей сообщения и транспортных средств, и организации их радиационного контроляAtomic-Energy.ruPas encore d'évaluation

- Kvong PDFDocument16 pagesKvong PDFAtomic-Energy.ruPas encore d'évaluation

- Имплементация положений технического документа МАГАТЭ «Комплексное обоснование безопасности транспортирования и хранения отработавшего ядерного топлива в контейнерах двойного назначения» в российском нормативном документеDocument1 pageИмплементация положений технического документа МАГАТЭ «Комплексное обоснование безопасности транспортирования и хранения отработавшего ядерного топлива в контейнерах двойного назначения» в российском нормативном документеAtomic-Energy.ruPas encore d'évaluation

- Система управления знаниями в атомной отраслиDocument44 pagesСистема управления знаниями в атомной отраслиAtomic-Energy.ru100% (1)

- Kronek PDFDocument28 pagesKronek PDFAtomic-Energy.ruPas encore d'évaluation

- Pastina PDFDocument30 pagesPastina PDFAtomic-Energy.ru100% (1)

- Безопасность российских АЭС (Валерий Беззубцев, Ростехнадзор)Document6 pagesБезопасность российских АЭС (Валерий Беззубцев, Ростехнадзор)Atomic-Energy.ruPas encore d'évaluation

- Elter PDFDocument30 pagesElter PDFAtomic-Energy.ruPas encore d'évaluation

- Опыт внедрения интегрированных систем менеджмента в зарубежных проектахDocument15 pagesОпыт внедрения интегрированных систем менеджмента в зарубежных проектахAtomic-Energy.ruPas encore d'évaluation

- Гармонизация международного законодательства по регулированию ответственности за ядерный ущерб и опыт аварии на АЭС «Фукусима-1»Document19 pagesГармонизация международного законодательства по регулированию ответственности за ядерный ущерб и опыт аварии на АЭС «Фукусима-1»Atomic-Energy.ruPas encore d'évaluation

- Становление и опыт обществ взаимного ядерного страхованияDocument27 pagesСтановление и опыт обществ взаимного ядерного страхованияAtomic-Energy.ruPas encore d'évaluation

- Parts List 09 636 02 02: AC Brake Motors BMG05-BMG1 Additional List: BrakeDocument2 pagesParts List 09 636 02 02: AC Brake Motors BMG05-BMG1 Additional List: Brakeali morisyPas encore d'évaluation

- Essential Roof Truss Design TermsDocument45 pagesEssential Roof Truss Design TermsAnkit SuriPas encore d'évaluation

- Please Note That This Form Details Exploration and Production Api Titles Available For OrderDocument8 pagesPlease Note That This Form Details Exploration and Production Api Titles Available For Orderhaotran68Pas encore d'évaluation

- Inspection and Adjustment of Pump Ls ControlDocument10 pagesInspection and Adjustment of Pump Ls ControlHai Van100% (1)

- Using Electricity SafelyDocument1 pageUsing Electricity SafelymariaPas encore d'évaluation

- Michelson Interferometer Na Lamp-1Document11 pagesMichelson Interferometer Na Lamp-1SOHINI KAYALPas encore d'évaluation

- Timing Chain Tensioner ResetDocument4 pagesTiming Chain Tensioner ResetHybrid RacingPas encore d'évaluation

- SDCK CD Ies 01 (Rev B)Document125 pagesSDCK CD Ies 01 (Rev B)Narada HerathPas encore d'évaluation

- Demographically Similar EntriesDocument1 pageDemographically Similar EntriesTahsildar MydukurPas encore d'évaluation

- BPCL Kochi Refinery MS BLOCK PROJECT Piping Material SpecificationDocument1 pageBPCL Kochi Refinery MS BLOCK PROJECT Piping Material SpecificationDeepak DayalPas encore d'évaluation

- Micron Ezeprox Access Control KeypadDocument4 pagesMicron Ezeprox Access Control KeypadThuy VuPas encore d'évaluation

- Service Menu - SamyGODocument5 pagesService Menu - SamyGOVenkatesh SubramanyaPas encore d'évaluation

- XHLE Long Coupled Centrifugal Pump EnglishDocument8 pagesXHLE Long Coupled Centrifugal Pump Englishgagi1994brahimPas encore d'évaluation

- Sinusverteiler Multivalent SolutionsDocument13 pagesSinusverteiler Multivalent SolutionsIon ZabetPas encore d'évaluation

- Mobiltech (Textile Used in Transportation, Automotive & Aerospace)Document12 pagesMobiltech (Textile Used in Transportation, Automotive & Aerospace)cario galleryPas encore d'évaluation

- GRI 20RS-12-B Data SheetDocument6 pagesGRI 20RS-12-B Data SheetJMAC SupplyPas encore d'évaluation

- Lec 958975Document19 pagesLec 958975Rajasekar PichaimuthuPas encore d'évaluation

- Carimin Acacia Stability-Onhire Loading JerunDocument6 pagesCarimin Acacia Stability-Onhire Loading Jerunh2sbnj86b4Pas encore d'évaluation

- Java Topics To Cover in InterviewsDocument5 pagesJava Topics To Cover in InterviewsHemanth KumarPas encore d'évaluation

- Nichrome60 Wire Data SheetDocument2 pagesNichrome60 Wire Data SheetvvingtsabtaPas encore d'évaluation

- Sap MM LSMWDocument18 pagesSap MM LSMWMani balan100% (1)

- Amphenol Musician Range PDFDocument8 pagesAmphenol Musician Range PDFtrc_wmPas encore d'évaluation

- Rockaway Beach Branch Community Impact StudyDocument98 pagesRockaway Beach Branch Community Impact StudyHanaRAlbertsPas encore d'évaluation

- Townsend DischargeDocument6 pagesTownsend DischargeGordon DuffPas encore d'évaluation

- Valvula Selectora Trans.Document4 pagesValvula Selectora Trans.enriquePas encore d'évaluation

- Oil Analysis - Ruller and MPC TestDocument81 pagesOil Analysis - Ruller and MPC Testmaidul.islamPas encore d'évaluation

- FH400 73158464 Pca-6.140Document431 pagesFH400 73158464 Pca-6.140IgorGorduz100% (1)

- Specifications: 3516C - SS Marine PropulsionDocument5 pagesSpecifications: 3516C - SS Marine PropulsionAidel MustafaPas encore d'évaluation

- JLG Lighting Tower 6308AN Series II 20150907Document2 pagesJLG Lighting Tower 6308AN Series II 20150907DwiSulistyo09Pas encore d'évaluation

- Seminar ReportDocument30 pagesSeminar Reportshashank_gowda_7Pas encore d'évaluation