Académique Documents

Professionnel Documents

Culture Documents

Fnan 301

Transféré par

sheetal_sood_2Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Fnan 301

Transféré par

sheetal_sood_2Droits d'auteur :

Formats disponibles

Time value of money part 1 - 1

FNAN 301 Financial Management

Time value of money Part 1

Time value of money part 1 - 2

Topics Covered

Overview of time value of money Single cash flows

Simple

interest Compound interest Future value Present value Implied rate Length of time Non-current reference point

Timelines

Time value of money part 1 - 3

Time Value of Money

Whats the most you would pay today for the pink piggy bank if it had $100 in it and you could get into it today?

Whats the most you would pay today for the purple piggy bank if it had $100 in it and you could not get into it for one year? Whats the most you would pay today for the yellow piggy bank if it had $100 in it and you could not get into it for five years?

Time value of money part 1 - 4

Time Value of Money

The time value of money involves the concept that a dollar paid or received at one point in time has a different value than a dollar paid or received at a different point in time

A

dollar paid or received today does not have the same value as a dollar paid or received tomorrow A dollar paid or received tomorrow does not have the same value as a dollar paid or received in two days

Time value of money part 1 - 5

Time Value of Money

Initially, assume interest rates, returns, cash flows, and values are known with certainty Later this assumption will be loosened

Time value of money part 1 - 6

Simple Interest

One way that money can grow is by simple interest

Simple

interest involves earning or accruing interest on principal or original investment only Interest is not earned or accrued on prior interest earned or accrued

Time value of money part 1 - 7

Simple Interest

Today is beginning of year 1 (time 0)

You

have $100 that you put in an investment that earns annual simple interest of 6 percent (.06) per year

In 1 year from today

would earn interest of $100 .06 = $6 in year 1 You would have $100 + $6 = $106 in 1 year

You

In 2 years from today

You

would earn interest on the original investment of $100 You would earn interest of $100 .06 = $6.00 in year 2 You would have $106 + $6.00 = $112.00 in 2 years

In 3 years from today

You

would earn interest on the original investment of $100 You would earn interest of $100 .06 = $6.00 in year 3 You would have $112 + $6.00 = $118.00 in 3 years

Time value of money part 1 - 8

Simple Interest

Today is beginning of year 1 (time 0)

You

have $100 that you put in an investment that earns annual simple interest of 6 percent (.06)

In t years with simple interest

You

would earn interest on the original $100 investment You would earn interest of $100 .06 = $6.00 in year t You would have $100 + ($100.00 .06 t) = ($100.00 (1 + (.06 t)) in t years

Value Value Value 100 100 100 100.00 + (100.06) 106.00 + (100.06) 112.00 + (100.06) (value as of t-1) + (100.06) 100 + (100.06t) 100 + (100.061) 100 + (100.062) 100 + (100.063) 112.00 118.00 106.00 100 + (100.06t)

Time

Time value of money part 1 - 9

Simple Interest

In general, if you earn simple interest, then C0 today will grow to be worth the following in t periods: C0 + (C0 simple interest rate per period t) = C0 (1 + (simple interest rate per period t)) = original amount + (interest in dollars per period number of periods) These equations would only be used if it is explicitly noted that interest is simple interest

Value Value Time C0 C0 0 C0 + (C0 r 1) C0 + (C0 r 2) C0 + (C0 r 3) C0 + (C0 r t) C0 (1 + (r 1)) C0 (1 + (r 2)) C0 (1 + (r 3)) C0 (1 + (r t)) 1 2

Time value of money part 1 - 10

Compound Interest

The much more common way that money can grow is by compound interest

Compound

interest involves earning or accruing interest on both principal or original investment and on all prior interest earned or accrued

Time value of money part 1 - 11

Compound Interest

Today is beginning of year 1 (time 0)

You

have $100 that you put in an investment that earns annual compound interest of 6 percent (.06) per year

In 1 year from today

would earn interest of $100 .06 = $6 in year 1 You would have $100 + $6 = $106 in 1 year

You

In 2 years from today

You

would earn interest on the original investment of $100 plus all accrued interest, which would be the $6.00 from year 1 You would earn interest of $106 .06 = $6.36 in year 2 You would have $106 + $6.36 = $112.36 in 2 years

In 3 years from today

You

would earn interest on the original investment of $100 plus all accrued interest, which would be $12.36 from the $6.00 from year 1 and the $6.36 from year 2 You would earn interest of $112.36 .06 = $6.74 in year 3 You would have $112.36 + $6.74 = $119.10 in 3 years

Time value of money part 1 - 12

Compound Interest

7,000 6,000

5,000

The effect of compounding is modest over a short period of time, but can be substantial over a long period of time as the effect of interest on interest can become very large

4,000

3,000

2,000

1,000

Future value of a $100 investment at an interest rate of 6.0 percent over investment horizons of different lengths

Simple interest

Compound interest

Time value of money part 1 - 13

FNAN 301 Note

Only simple and compound interest have been described, but the same concepts can be applied to any simple or compound return or rate whereby the simple rate is only applied to the original amount each period and the compound rate is applied to the original amount and all earned or accrued interest or earnings

Time value of money part 1 - 14

FNAN 301 Note

Assume compound interest unless told otherwise Assume rate that is given is for a year unless told otherwise Rate is typically positive

Assume

positive, unless explicitly noted as negative or given information that indicates rate is or may be negative

Unless told otherwise, assume in x periods is equivalent to in x periods from today

Time value of money part 1 - 15

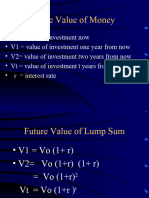

Future Value

Future value is the value at some point in the future (relative to the reference point, often today) of a given amount of money that grows from compounding

It

is the amount to which an investment would grow after earning interest or a return

rate of r per period Cash flow Time C0

Period 1

FVt 0

Period t

0 1

0 2

0 3

0 t

t-1

Time value of money part 1 - 16

Future Value

Computing future value: FVt = C0 (1+r)t

C0

denotes the cash flow (or potential cash flow such as a value) as of the reference point (typically today) t is the length of time (number of periods) until future value is measured r is the interest rate or return and is the rate at which the funds grow

Can be thought of as the exchange rate between time periods Is commonly assumed to be the same for each period

(1+r)t

is called the future value factor

It is how much $1 invested at r per period will be worth in t periods

Time value of money part 1 - 17

Future Value Example

FVt = C0 (1+r)t If an investor can earn 6 percent per year, what is the future value of $100 In 1 year?

FV1 FV2 FV3

= C0 (1+r)t = $100 (1+.06)1 = $106.00 = C0 (1+r)t = $100 (1+.06)2 = $112.36

In 2 years?

In 3 years?

= C0 (1+r)t = $100 (1+.06)3 = $119.10

= C0 (1+r)t = $100 (1+.06)20 = $320.71

In 20 years?

FV20

Time value of money part 1 - 18

Future Value Example

If the return is 25 percent per year, then a $.01 investment will grow to almost $50 million in 100 years

FV100

= $0.01 (1.25)100 = $49,090,935

If the return is 24 percent per year, then a $.01 investment will grow to almost $22 million in 100 years

FV100

= $0.01 (1.24)100 = $21,987,129

A work of art worth $9,000 that will appreciate in value by 4 percent a year will be worth more than $21,000 in 22 years

FV22

= $9,000 (1.04)22 = $21,329.27 $21,329

Time value of money part 1 - 19

Lecture Problems 1

If Eric invests $500 today in an account that earns 8% per year in simple interest, how much will he have in 15 years? If Jane can earn 7% per year in compound interest, how much would Jane need to invest today to have as much as Eric in 15 years? If Martha invests $500 today in an account that earns 9% per year in compound interest, how much will she have in 12 years? If Carl can invest $600 today, then how much would Carl need to earn each year as a simple interest rate to have as much as Martha in 12 years?

Time value of money part 1 - 20

Financial Calculator

A financial calculator is a useful tool for solving many finance problems The key to the process is as follows

Convert

the words in a problem into a timeline Identify what you know and what you want to know Identify how the financial calculator can be used as a tool to use what you know to get what you want to know Use the financial calculator to use what you know to get what you want to know

The key to the process is not about memorizing which buttons to push

Time value of money part 1 - 21

Financial Calculator

In FNAN 301, we will support the TI-83 Plus from Texas Instruments, but other financial calculators can be used

The

Internet has lots of resources for many different calculators

www.tvmcalcs.org is just one possible site

We will support a relatively limited number of functions in FNAN 301

The

calculator is used as a tool

Cell phones and other devices with calculators can not be used on exams

Time value of money part 1 - 22

Financial Calculator

The basic idea is that all variables in a time value of money relationship are entered into the calculator except for one The calculator computes the value of the excluded variable such that a basic relationship is maintained

The

basic relationship involves some money going out and some money coming in and the calculator wants to make their values equal

Time value of money part 1 - 23

Financial Calculator

The five time value of money variables (TI-83 buttons in parentheses)

Number

of periods in analysis (N) Cash flow or value as of the reference point, often today (PV) Cash flow or value expected in the number of periods in analysis (N) from the reference point (FV) Period interest rate or return (I%)

Type interest rate as the number that is before the percentage sign

For example, enter 2.3 for 2.3%

Equal

cash flow occurring every period for the number of periods in analysis (PMT)

Time value of money part 1 - 24

Financial Calculator

Time value of money functions used by financial calculators (and Excel) involve a special sign convention

The

sign entered in or produced by a financial calculator is not necessarily the same sign as the one used on a timeline or the one needed for the answer to the question

The sign convention can be confusing, but becomes increasingly clear as one uses it

Another

reason to do lots and lots of practice problems

Time value of money part 1 - 25

Financial Calculator

Sign convention

All

cash outflows have a negative sign

At the start of the relevant time frame being analyzed, the value of an investment or asset is typically entered or produced as a negative number

We can think of a negative cash flow being required to obtain the investment or asset at the start of the relevant time PV = the opposite of the value of an asset, security, investment, etc.

All

cash inflows have a positive sign

At the end of the relevant time frame being analyzed, the value of an investment or asset is typically entered or produced as a positive number

We can think of a positive cash flow being generated from selling the investment or asset at the end of the relevant time FV = the value of an asset, security, investment, etc.

Time value of money part 1 - 26

Financial Calculator: TI-83 Plus

Make sure your calculator is set to display a large number of decimal places (when necessary)

Press

MODE Push the down arrow key to get to the float line Highlight Float which occurs when the word Float is flashing Press ENTER Press 2ND and press QUIT

Time value of money part 1 - 27

Financial Calculator

Make sure that the rate that is entered in the calculator (I%) is the rate for period of the relevant length and that there are no cash flows assumed to take place in the middle of a period

Set

P/Y = 1 and C/Y = 1 in TVM Solver application

Although P/Y = 1 and C/Y = 1 rarely will be shown in solutions, you should set P/Y = 1 and C/Y = 1 for all problems

Time value of money part 1 - 28

Financial Calculator

When PMT = 0, it does not matter if the financial calculator is in END or BEGIN mode When PMT 0, it matters if the financial calculator is in END or BEGIN mode For now, we are going to look at cases when PMT = 0, but later we will look at cases when PMT 0 and discuss END and BEGIN modes in more detail

Time value of money part 1 - 29

Financial Calculator: TI-83 Plus

Using the financial calculator to find future value when there are no regular, interim cash flows

N

= number of periods from reference point to the time when future value is being determined I% = rate per period PV = opposite of the initial investment or opposite of initial value of an asset or investment as of reference point

Can be thought of as the cash flow associated with making an investment

PMT

= 0, because there are no regular, interim cash flows END/BEGIN mode is irrelevant, since PMT = 0 Solve for FV = future value in N periods from reference point

Cash flow I% per period -PV 0 0 period 1 period 2 0 Future value of 0 -PV = FV period N N-1 N

Time from start 0 1 2 3 Note: Even though this timeline has N > 5, N can be less

Time value of money part 1 - 30

Financial Calculator: TI-83 Plus

Finding unknown values

Go

into TVM Solver application by pressing the APPS key, then pressing 1 (for finance applications), and then pressing 1 (for TVM Solver) Type in desired number for a given variable in appropriate place in TVM Solver application Repeat for all relevant variables When values for all relevant variables are entered, solve by moving cursor to variable you want the calculator to determine, pressing ALPHA, and pressing SOLVE

Time value of money part 1 - 31

Future Value Example

If you have $100 today and can earn 10% per year, how much will you have in 7 years? Solution with formula FV7 = $100 (1.10)7 = $194.87 Solution TI-83 Plus Press APPS Press 1 for finance applications Press 1 for TVM Solver PMT mode is irrelevant, since PMT = 0 Enter desired figures for appropriate variables

Set N = 7 Set I% = 10 Set PV = -100 = opposite of initial value of investment Set PMT = 0 Set P/Y = 1 Set C/Y = 1

Move cursor to space after FV = Press ALPHA Press SOLVE

FV = 194.87171 appears on calculator If you invested $100 and earned 10% for 7 years, you would have $194.87 in 7 years

Time value of money part 1 - 32

Future Value Example

If you have $30,000 today and can earn 6.1% per year, how much will you have in 4 years? Solution with formula

Solution TI-83 Plus

FV4 = $30,000 (1.061)4 = $38,017.43 Press APPS Press 1 for finance applications Press 1 for TVM Solver PMT mode is irrelevant, since PMT = 0 Enter desired figures for appropriate variables

Set N = 4 Set I% = 6.1 Set PV = -30000 = opposite of initial value of investment Set PMT = 0

Move cursor to space after FV = Press ALPHA Press SOLVE

FV = 38017.43 If you invested $30k and earned 6.1% for 4 years, you would have $38,017.43 in 4 years

Time value of money part 1 - 33

Future Value

Future value (FV) in t periods of C invested (or valued) at any point in time (time k)

If

I have C at time k, how much would it be worth in t periods from time 0 if it earns r per period? If I have something worth C at time k, how much will it be worth in t periods from time 0 if its value changes by r per period? FVt = FV at time t = Ck (1+r)t-k

rate of r per period Cash flow 0

Period 1

FVt 0

Period t

Ck k 0

0 k+1 1

0 t-1 t-k-1

Time 0 Alternative time

t t-k

Time value of money part 1 - 34

Future Value Example

FVt = FV at time t = Ck (1+r)t-k If you invest $100 in 3 years, what will that investment be worth in 7 years if r = 10%?

= 3; Ck = C3 = $100; t = 7; t k = 7 3 = 4; r = .10 FVt = Ck (1+r)t-k FV7 = C3 (1+r)7-3 = 100 (1.10)4 = $146.41

k

FV7 = ? Cash flow Time Re-time 0 0 0 1 0 2 100 3 0 0 4 1 0 5 2 0 6 3 0 7 4

Period 1

Time value of money part 1 - 35

Future Value Example

If you invest $100 in 3 years, what will that investment be worth in 7 years if r = 10%? Solution TI-83 Plus

Press

APPS Press 1 for finance applications and press 1 for TVM Solver PMT mode is irrelevant Enter desired figures for appropriate variables

N=tk=73=4

Note that with the financial calculator, the initial investment is scaled back to be at time 0 and the relevant time for the future value is scaled back to be at time t k

I% = 10 PV = -100 PMT = 0

Solve

for FV and get FV = 146.41

Time value of money part 1 - 36

Future Value Example

FVt = Ck (1+r)t-k If you will receive a work of art in 5 years that will be worth $12,000 and appreciate in value by 7 percent a year, how much will it be worth 22 years from now? Solution

= 5; Ck = C5 = $12,000; t = 22; t k = 22 5 = 17; r = .07 FV22 = $12,000 (1.07)22-5 = $12,000 (1.07)17 = $37,905.78 $37,906

k

FV22 = ?

Cash flow Time Re-time

0 0

0 1

12,000 5 0

0 6 1

0 21 16

0 22 17

Period 1

Time value of money part 1 - 37

Future Value Example

If you receive a work of art in 5 years that will be worth $12,000 and appreciate in value by 7 percent a year, how much will it be worth 22 years from now? Solution TI-83 Plus

Press

APPS Press 1 for finance applications and press 1 for TVM Solver PMT mode is irrelevant Enter desired figures for appropriate variables

N = t k = 22 5 = 17

Note that with the financial calculator, the initial investment is scaled back to be at time 0 and the relevant time for the future value is scaled back to be at time t k

I% = 7 PV = -12000 PMT = 0

Solve

for FV and get FV = 37,905.78

Time value of money part 1 - 38

Future Value and Uncertainty

So far, in our analysis of future value, we have assumed that cash flows and returns are known with certainty, but in reality, there is almost never certainty If we dont know what the actual cash flow or value will be with certainty, we can use the expected cash flow or expected value, which are essentially best guesses If we dont know what the actual return or interest rate will be with certainty, we can use expected return or expected interest rate, which are essentially best guesses Expectations can also be used when there is uncertainty and present value is being analyzed and when there is uncertainty in a situation involving multiple cash flows

Topics

that we will cover later

Time value of money part 1 - 39

FV and Uncertainty Example

FVt = Ck (1+r)t-k If you will receive a work of art in 5 years that is expected to be worth $12,000 and is expected to appreciate in value by 7 percent a year, how much is it expected to be worth 22 years from now? Solution

= 5; Ck = C5 = $12,000; t = 22; t k = 22 5 = 17 FV22 = $12,000 (1.07)22-5 = $12,000 (1.07)17 = $37,905.78 $37,906 FV22 = ?

k

Cash flow Time

0 0

0 1

12,000 5

0 6

0 21

0 22

Period 1

Time value of money part 1 - 40

FV and Uncertainty Example

If you anticipate receiving a work of art in 5 years that is expected to be worth $12,000 and is expected to appreciate in value by 7 percent a year, how much is it expected to be worth 22 years from now? Solution TI-83 Plus

Press

APPS Press 1 for finance applications and press 1 for TVM Solver PMT mode is irrelevant Enter desired figures for appropriate variables

N = t k = 22 5 = 17 I% = 7 PV = -12000 PMT = 0

Solve

for FV and get FV = 37,905.78

Time value of money part 1 - 41

Expected Return and Risk

The expected return or interest rate associated with a given investment or asset is related to the risk of the investments or assets cash flows

Riskier

cash flows are associated with higher interest rates and expected returns, as investors demand and receive a greater reward for bearing more risk Less risky cash flows are associated with lower interest rates and expected returns, as investors accept and receive a smaller reward for bearing less risk In FNAN 301, when risk is associated with expected return or interest rates, risk refers to the risk that matters which is a concept covered later in the course

Time value of money part 1 - 42

Expected Return and Risk

In FNAN 301, we are going to impose the simplifying assumption of a flat yield curve

A

flat yield curve means that the rate (interest rate, expected return, etc.) associated with any set of cash flows depends only on the risk of those cash flows The timing of a set of cash flows does not influence the relevant expected return if the yield curve is flat

Note: in a more complex (and realistic world), timing may matter and the relevant relationship would be between an assets level of risk and that assets risk premium (which we will learn about later in the course)

Time value of money part 1 - 43

Expected Return and Risk

In well-functioning capital markets, all investments and assets with the same amount of risk have the same expected return

If

two investments or assets have the same amount of risk, but different expected returns, everyone would want the one with the higher expected return and no one would want the one with the lower expected return Equilibrium exists when both have the same expected return In FNAN 301, we will assume that markets for financial securities, investments, etc. are wellfunctioning

Time value of money part 1 - 44

Lecture Problems 2

Suppose you expect to receive a gold medallion in 2 years when you graduate that will be worth $1,234 when you receive it

How

much will the medallion be worth in 14 years if it will increase in value by 2.3% per year for at least several decades? How much will the medallion be worth in 14 years if its value will change by -1.2% per year for at least several decades?

Time value of money part 1 - 45

Timelines

A good first step to solving any time value of money (TVM) problem is to construct a timeline

Time value of money part 1 - 46

Timelines

Timeline basics

Time

0 is the reference point, often but not necessarily today Time 1 is in 1 period after the reference point Time t is in t periods after the reference point Period 1 is between time 0 and time 1 and ends at time 1 Period t is between time t-1 and time t and ends at time t C0 is the cash flow at time 0 Ct is the cash flow at time t This notation is used to indicate the passage of time:

Cash flow Time C0 0 C1 1 C2 2 C3 3 C4 4 C5 5 Ct-1 t-1 Ct t

Period 1

Period t

Time value of money part 1 - 47

Timelines

The key element to constructing a timeline is determining how long a period is

The

amount of time represented by the space between two notches

Time value of money part 1 - 48

Timelines

The length of a period is the smallest period among the following

The

timing of expected cash flows The compounding period (if given) for a rate The period for a given rate

In many cases, the length of a period is obvious as cash flows, rates, and compounding (if any is given) match each other and the steps described on the next slides are not needed In some cases, the length of a period is less clear and the steps on the next slides are very useful

Time value of money part 1 - 49

Timelines

Timeline construction and use in 4 steps

Step

1: identify the direction, magnitude, and timing of known cash flows and the timing of any unknown cash flows Step 2: identify the length of each period Step 3: obtain the relevant rate or return, which is the one that is relevant for a length of time equal to a period Step 4: identify what is known and what is not known so that the value of any variables that are not known can be found

Time value of money part 1 - 50

Timelines

Step 1: identify the direction, magnitude, and timing of known cash flows and the timing of any unknown cash flows

The

direction of a known cash flow

In timelines, the value of an asset or security that is owned is always treated as a cash inflow, which is not the case with a financial calculator and a value at the start of the timeline

Cash inflows, which involve cash being received, are expressed as positive amounts

Cash outflows, which involve cash being paid out, are expressed as negative amounts

The

magnitude of a known cash flow involves how much cash is either paid or received The timing of a known or unknown cash flow involves when a cash flow takes place, typically with respect to the reference point

Time value of money part 1 - 51

Timelines

Step 2: identify the length of each period

The

length of each period refers to the length of time that corresponds to each notch on the timeline

Common periods of time are a day, month, quarter, semiannual period, and year

This

is the key step in putting together a timeline

The length of a period is the smallest period among the following

The timing of expected cash flows The compounding period (if given) for a rate The period for a given rate

Time value of money part 1 - 52

Timelines

Step 2: identify the length of each period

2A:

identify the largest period of time, up to a year, that can be used to express the timing of cash flows such that all cash flows can be expressed as taking place at time 0 or as a whole number of periods after time 0

If all timing can be expressed as a whole number of years, then the period from this step is a year If all timing can not be expressed as a whole number of years, then see if the period from this step is a half year If all timing can be expressed as a whole number of half years, then the period from this step is a half year If all timing can not be expressed as a whole number of half years, then see if the period from this step is a quarter If all timing can be expressed as a whole number of quarters, then the period from this step is a quarter If all timing can not be expressed as a whole number of quarters, then see if the period from this step is a month If all timing can be expressed as a whole number of months, then the period from this step is a month If all timing can not be expressed as a whole number of months, then the period from this step is a day

Time value of money part 1 - 53

Timelines

Step 2: identify the length of each period

2B:

if given and not continuous, note the period of time over which the rate is compounded

Rates include interest rates, discount rates, and rates of return

For

now, the compounding period will not be needed and will not be given, so this step is not relevant, but later in course, we will learn about compounding and compounding periods, so this step will become relevant

Time value of money part 1 - 54

Timelines

Step 2: identify the length of each period

2C:

note the period that any provided rate reflects

Examples: a monthly interest rate of 1.1% reflects a rate for a month and a quarterly return of 2.4% reflects a rate for a quarter

If

a rate is given and an associated period is not explicitly given, then assume that the rate is an annual rate

Time value of money part 1 - 55

Timelines

Step 2: identify the length of each period

2D:

the shortest of the periods identified in steps 2A, 2B, and 2C is the length that each period on the timeline should reflect

As noted, the timing of cash flows and timing associated with rates will often match, which makes creating a timeline relatively easy

Time value of money part 1 - 56

Timelines Example

Create a timeline for the following question: how much will you have in 1 year if you invest $900 today at an interest rate of 12% per year?

Step

Cash flow today = $900 = value of investment after it is made Value of investment in 1 year = FVt Cash flow at all other times = 0

Step

2A: timing can be expressed in whole numbers of years, so the largest period from this step is a year

$900 at time 0 and unknown value in 1 year

Step

2B: no compounding period given Step 2C: interest rate of 12% reflects rate for a year Step 2D: the shortest period among a year (2A) and a year (2C) is a year, so the length of a period is 1 year

Cash flow 900 Periods from today 0

Year 1

FV1 = 900 1.12 1

Time value of money part 1 - 57

Timelines Example

Create a timeline for the following question: how much will you have in 1 year if you invest $900 today at an interest rate of 6% per half year?

Step

Cash flow today = $900 Value of investment in 1 year = FVt Cash flow at all other times = 0

Step

2A: timing can be expressed in whole numbers of years, so the largest period from this step is a year

$900 at time 0 and unknown value in 1 year

Step

2B: no compounding period given Step 2C: interest rate of 6% reflects rate for a half year Step 2D: the shortest period among a year (2A) and a half year (2C) is a half year, so the length of a period is a half year

Cash flow 900 Periods from today 0

Half year 1 Half year 2

FV2 = 900 1.062 2

Time value of money part 1 - 58

Timelines Example

Create a timeline for the following question: how much will you have in 1 year if you invest $900 today at an interest rate of 1% per month?

Step

Cash flow today = $900 Value of investment in 1 year = FVt Cash flow at all other times = 0

Step

2A: timing can be expressed in whole numbers of years, so the largest period from this step is a year

$900 at time 0 and unknown value in 1 year

Step

2B: no compounding period given Step 2C: interest rate of 1% reflects rate for a month Step 2D: the shortest period among a year (2A) and a month (2C) is a month, so the length of a period is a month

Cash flow 900

Month 1

FV12 = 900 1.0112

Periods from today 0

2 3

4 5 6

7 8

9 10 11 12

Time value of money part 1 - 59

Timelines

Step 3: obtain the relevant rate, which is the one that is relevant for a length of time equal to a period

For

now, the relevant interest rate or return will be explicitly given, but later in course, we will learn more about how to obtain the relevant rate when it is not explicitly given

Time value of money part 1 - 60

Timelines

Step 4: identify what is known and what is not known so that the values of any variables that are not known can be found

We

will be spending much of the course on step 4 for various types of problems and situations

Time value of money part 1 - 61

FNAN 301 Note

Unless more explicit information is given regarding the timing of cash flows, a cash flow that takes place in period t should be assumed to take place in t periods, which is at the end of period t, which is at time t Unless told otherwise, assume in t periods = in t periods from today

Time value of money part 1 - 62

Timelines

For many of the examples and problems in the overheads, timelines are used, but the 4 steps for timeline construction and use are not explicitly noted

Creating

timelines is often fairly straightforward as the relevant period length and rate are given in a relatively explicit way

The solutions to many of the extra problems and some of the examples and problems reviewed after compounding frequency is introduced illustrate the steps more explicitly

Once

compounding frequency is introduced, the relevant period length, and especially the relevant rate, are not always explicitly given and often require some analysis to identify and determine

Time value of money part 1 - 63

Present Value

Present value is the value as of the reference point (often today) of a given amount of money or value as of a given time in the future

How

much is it worth today to receive one dollar in a

year? Discounting refers to finding the present value of some future amount

Present value captures how much would need to be invested today to have some amount at a given point in the future if one could earn a certain return

PV0

Cash flow Time

0

Period 1

0 1

rate of r per period 0 0

0

Period t

Ct t

t-1

Time value of money part 1 - 64

Present Value

Computing present value PV0 = Ct (1+r)t

PV0

denotes present value as of the reference point (often today) Ct denotes the cash flow (or potential cash flow such as a value) at time t (in t periods from the reference point) t is the length of time (number of periods) from reference point until cash flow r is the discount rate

Can be thought of as the exchange rate between time periods Sometimes called the opportunity cost of capital or cost of capital

1/(1+r)t

is called the present value factor

How much needs to be invested at r per period to be worth $1.00 in t periods

The

present value relationship is based on actual returns and cash flows when theres certainty and expected returns and expected cash flows when there is uncertainty

Time value of money part 1 - 65

Present Value Example

If the discount rate is 10 percent, what is the present value of $100 received In 1 year from today?

PV0

= Ct/(1+r)t = $100 / (1+.10)1 = $90.91

In 2 years?

PV0

= Ct/(1+r)t = $100 / (1+.10)2 = $82.64

= Ct/(1+r)t = $100 / (1+.10)20 = $14.86

In 20 years?

PV0

Time value of money part 1 - 66

FNAN 301 Note

The terms value and market value refer to present value unless it is explicitly indicated that some other value (like future value, book value, or face value) is relevant and being referred to

Time value of money part 1 - 67

Present Value

When wearing your finance hat and trying to maximize value, you would

Be

indifferent between

Receiving Ct in t years Receiving an amount equal to the present value of Ct today Currently having something worth the present value of Ct

If you have something worth $X today, you could sell it for $X in cash today

Time value of money part 1 - 68

Present Value

When wearing your finance hat and trying to maximize value, you would

Prefer

to receive Ct in t years more than you would prefer to

Receive an amount today that is less than the present value of Ct Currently have something worth less than the present value of Ct

Time value of money part 1 - 69

Present Value

When wearing your finance hat and trying to maximize value, you would

Prefer

to receive an amount today that is greater than the present value of Ct or to currently have something worth more than the present value of Ct more than you would prefer to

Receive Ct in t years

Time value of money part 1 - 70

Present Value

When wearing your finance hat and trying to maximize value, you would

Be

indifferent between paying Ct in t years and paying an amount equal to the present value of Ct today Prefer to pay an amount today that is less in magnitude than the present value of Ct more than you would prefer to pay Ct in t years

Note that payments involve negative cash flows and that paying an amount involves a negative cash flow of that amount

When paying Ct the cash flow is -Ct < 0

Given choices, you would prefer to pay the one with the smallest magnitude, which actually has the cash flows with greatest value, since it would be the least bad

If X > Z, then X < -Z (for example, 4 > 3 and -4 < -3)

Prefer

to pay Ct in t years more than you would prefer to pay an amount today that is greater than the present value of Ct

Time value of money part 1 - 71

Financial Calculator: TI-83 Plus

Using the financial calculator to find present value when there are no regular, interim cash flows

N

= number of periods from reference point to time when the cash flow occurs or value of asset or investment is determined I% = rate or return per period PMT = 0, because there are no regular, interim cash flows END/BEGIN mode is irrelevant, since PMT = 0 FV = cash flow, asset value, or investment value in N periods from reference point Solve for PV = opposite of the present value of the cash flow, asset value, or investment value as of the reference point

Can be thought of as the cash flow associated with making an investment or acquiring an asset

Present value of FV = -PV Cash flow I% per period 0 0 period 1 period 2 0 0 FV period N N

Time from start 0 1 2 3 Note: Even though this timeline has N > 5, N can be less

N-1

Time value of money part 1 - 72

Present Value Example

What is the present value of $37,000 received in 3 years if the discount rate is 11 percent? Solution formula

PV0 PV0

= Ct / (1+r)t

t = 3; C3 = $37,000; r = 0.11

= $37,000 / (1.11)3 = $27,054.08 $27,054

Solution financial calculator

N

= 3; I% = 11; PMT = 0; FV = 37000 P/Y = 1; C/Y = 1; PMT mode is irrelevant Solve for PV and get PV = -27054.08

The present value is $27,054.08 (note sign convention)

Time value of money part 1 - 73

Present Value Example

If you estimate that your daughter will need $250,000 in 16 years for college and that you can earn 6.5% per year, then how much do you need to invest today to have just enough in 16 years? Solution formula

PV

= Ct / (1+r)t = 250,000 / (1.065)16 = 91,273.83

Solution financial calculator

N

= 16; I% = 6.5; PMT = 0; FV = 250000

PMT

mode is irrelevant Solve for PV and get PV = -91273.83

Note: the negative sign with PV means you would need to pay out $91,273.83 today to have $250,000 in 16 years

Time value of money part 1 - 74

Present Value Example

Which of the following payment options for your new computer would you prefer if the discount rate is 7.2 percent?

Option 1: $1,200 today Option 2: $1,300 in 1 year Since the choice involves paying money, cash flows would be negative, so choose the option with the cash flows with the lower magnitude present value PV (option 1) = -1,200 PV (option 2) = -1,300 / (1.072)1 = -1,212.69 -1,212.69 < -1,200, so choose option 1 N = 1; I% = 7.2; PMT = 0; FV = -1300; PMT mode is irrelevant Solve for PV and get PV = 1,212.69, so the present value of the cash flow is -$1,212.69

Note: be careful with sign convention, especially in a case like this where the appropriate sign to use with terms is not particularly clear

Choose the option with the cash flow with higher present value

Solution formula

Solution financial calculator

-1,212.69 < -1,200 and magnitude of -1200 < magnitude of -1212.69, so choose option 1, because it involves a less valuable payout

Time value of money part 1 - 75

Present Value and Expected Cash Flow

PV0 = Ct / (1+r)t The expected cash flow is important

A

higher expected cash flow leads to higher present value, all else equal (time to payment and discount rate) A lower expected cash flow leads to lower present value, all else equal (time to payment and discount rate)

Time value of money part 1 - 76

PV and Expected Cash Flow Example

What is the present value of $100,000 received in 7 years if the discount rate is 7 percent?

PV0 PV0

= Ct / (1+r)t = $100,000 / (1.07)7 = $62,274.97 $62,275

t = 7; C7 = $100,000; r = 0.07

What is the present value of $200,000 received in 7 years if the discount rate is 7 percent?

PV0 PV0

= Ct / (1+r)t = $200,000 / (1.07)7 = $124,549.95 $124,550

t = 7; C7 = $200,000; r = 0.07

When Ct = 100k < 200k, PV = $62,275 < $124,550

Time value of money part 1 - 77

Present Value and Length of Time

PV0 = Ct / (1+r)t Length of time is important

Longer

time leads to lower present value, all else equal (cash flow amount and positive discount rate), for an asset or investment with positive cash flows Shorter time leads to higher present value, all else equal (cash flow amount and positive discount rate), for an asset or investment with positive cash flows

Time value of money part 1 - 78

PV and Length of Time Example

What is the present value of $100,000 received in 7 years if the discount rate is 7 percent?

PV0 PV0

= Ct / (1+r)t = $100,000 / (1.07)7 = $62,274.97 $62,275

t = 7; C7 = $100,000; r = 0.07

What is the present value of $100,000 received in 14 years if the discount rate is 7 percent?

PV0 PV0

= Ct / (1+r)t = $100,000 / (1.07)14 = $38,781.72 $38,782

t = 14; C14 = $100,000; r = 0.07

When t = 7 yrs < 14 yrs, PV = $62,275 > $38,782

Time value of money part 1 - 79

PV, Risk, and Discount Rate

The discount rate is related to the risk associated with cash flows

Riskier

cash flows are associated with higher discount rates, as investors demand greater reward for bearing more risk

Investment or asset that is expected to be worth a certain amount at a given point in time would be worth relatively little today if it is very risky

Less

risky cash flows are associated with lower discount rates, as investors demand smaller reward for less risk

Investment or asset that is expected to be worth a certain amount at a given point in time would be worth relatively more today if it is not very risky

Time value of money part 1 - 80

PV, Risk, and Discount Rate

PV0 = Ct / (1+r)t Discount rate is important

Higher

discount rate leads to lower present value, all else equal (cash flow amount and timing), for an asset or investment with positive cash flows Lower discount rate leads to higher present value, all else equal (cash flow amount and timing), for an asset or investment with positive cash flows

Time value of money part 1 - 81

PV, Risk, & Discount Rate Example

What is the present value of an expected $100,000 to be received in 7 years if the discount rate is 7%?

PV0 PV0

= Ct / (1+r)t = $100,000 / (1.07)7 = $62,274.97 $62,275

t = 7; C7 = $100,000; r = 0.07

What is the present value of an expected $100,000 to be received in 7 years if the discount rate is 14%?

PV0

= Ct / (1+r)t

t = 7; C7 = $100,000; r = 0.14

PV0

= $100,000 / (1.14)7 = $39,963.73 $39,964

When r = 7% < 14%, PV = $62,275 > $39,964

Time value of money part 1 - 82

PV, Risk, and Discount Rate

In well-functioning capital markets, all investments and assets with the same amount of risk have the same discount rate

Two

investments or assets with the same level of risk and that are expected to be worth the same amount (or produce the same cash flow) at the same point in time would have the same discount rate

Otherwise, the one with the lower discount rate would be more expensive today and no one would want to buy it and the one with the higher discount rate would be less expensive today and everyone would want to buy it Equilibrium exists when both investments or assets have the same present value, which requires the same discount rate

In

FNAN 301, we will assume that markets for financial securities, investments, etc. are well-functioning

Time value of money part 1 - 83

Opportunity Cost of Capital

Firms have (at least) two choices for using cash

Invest

in a project, buy an asset, etc, with certain expected cash flows and some level of risk

Actual cash flows are often uncertain, so analysis is based on expected cash flows, which is a best guess

Invest

in financial securities with same risk as project, asset, etc.

Expected return on those securities determines the relevant discount rate for the project, asset, etc.

Called the opportunity cost of capital or cost of capital Investing in the project, buying the asset, etc. means giving up the opportunity to invest in the securities

Opportunity cost of capital, also called the cost of capital, is the appropriate discount rate

Time value of money part 1 - 84

Opportunity Cost of Capital Example

What is the present value of building A, if it can be sold in 2 years for $420,000 if the cost of capital is 10%? Solution

PV0

= Ct/(1+r)t

Ct = C1 = $420,000 t=2 r = 0.10

PV0

= $420,000 / (1.10)2 = $347,107

Time value of money part 1 - 85

Opportunity Cost of Capital Example

What is the present value of building B, if it can be sold in 1 year for $400,000 if the cost of capital is 10%? Solution

PV0

= Ct/(1+r)t

Ct = C1 = $400,000 t=1 r = 0.10

= $400,000 / (1.10)1 = $363,636 Note: even though building B can be sold for less than building A ($400,000 vs. 420,000), building B is worth more than building A ($363,636 vs. $347,107)

PV0

Time value of money part 1 - 86

Lecture Problems 3

I Scream Ice Cream Company is considering selling several of its plants for the cash flows noted below

Plant

A for $800,000 in 3 years and the cost of capital is 6% Plant B for $800,000 in 3 years and the cost of capital is 8% Plant C for $800,000 in 5 years and the cost of capital is 6%

Questions

Which

plant, A or B, is riskier? What is the value of plant A What is the value of plant B Which plant, A or B, is worth more today? Which plant, A or C, is riskier? What is the value of plant C Which plant, A or C, is worth more today?

Time value of money part 1 - 87

PV and FV: Implied Rate

If you know the value of an investment or other asset at two different points in time and the length of time between the two points in time, then you can find the implied return or rate of interest associated with that information

Common

examples involve finding the return associated with an investment made today and its expected value in future and the return associated with an investment made in past and its current value

You can solve for r

PV0

= Ct / (1 + r)t or FVt = C0 (1 + r)t

You can use the financial functions on the calculator as well

Time value of money part 1 - 88

Financial Calculator: TI-83 Plus

Using the financial calculator to find the implied rate when there are no regular, interim cash flows

N = number of periods between the time when the cash flows occur or value of asset or investment is determined PV = opposite of the cash flow, asset value, or investment value as of the reference point PMT = 0, because there are no regular, interim cash flows

END/BEGIN mode is irrelevant, since PMT = 0

FV = cash flow, asset value, or investment value in N periods from reference point Solve for I% = rate per period = implied rate Future

I% per period -PV 0 0 period 1 period 2 0 1 2 0 3 value of -PV = FV 0 period N N-1 N

Cash flow Time from start

Present value of FV = -PV Cash flow

I% per period 0 0 period 1 period 2

FV period N N

Time from start 0 1 2 3 Note: Even though these timelines have N > 5, N can be less

N-1

Time value of money part 1 - 89

Implied Rate Example

What is the implied rate of return for an investment that sells today for $500 and will pay $1,000 in 5 years? Solution 1 financial calculator

N

= 5; PV = -500; PMT = 0; FV = 1000; PMT mode is irrelevant P/Y = 1; C/Y = 1 Solve for I% and get I% = 14.87

PV = 500, r = ? Cash flow 0 Time Cash flow 0 500 0 1 0 0 2 0 0 3 0 0 4 0 1000 5 FV5 = 1000, 0 r=?

Time

Time value of money part 1 - 90

Implied Rate Example

What is the implied rate of return for an investment that sells today for $500 and will pay $1,000 in 5 years? Solution 2 (based on future value)

FVt

= 500 (1+r)5 (1+r)5 = 1000/500 = 2 [(1+r)5]1/5 = (1+r) = 21/5 = 20.2 = 1.1487 r = 1.1487 1 = .1487 = 14.87% = the implied rate

1,000

k = 0; Ck = C0 = 500; t = 5; t k = 5 0 = 5; FV5 = 1,000;

= Ck (1+r)t-k

Investing $500 today and earning 14.87% per year for 5 years results in $1,000 in 5 years

FV5 = 1000, r=? Cash flow 500 0 0 0 0 0

Time

Time value of money part 1 - 91

Implied Rate Example

What is the implied rate of return for an investment that sells today for $500 and will pay $1,000 in 5 years? Solution 3 (based on present value)

= Ct/(1+r)t 500 = 1,000/(1+r)5 (1+r)5 = 1000/500 = 2 [(1+r)5]1/5 = (1+r) = 21/5 = 20.2 = 1.1487 r = 1.1487 1 = .1487 = 14.87% = the implied rate Investing $500 today and earning 14.87% per year for 5 years results in $1,000 in 5 years

PV0

PV = 500, r = ? Cash flow 0 0 0 0 0 1000

Time

Time value of money part 1 - 92

PV and FV: Number of Periods

If you have the value at two different points in time and the interest rate or rate of return, then you can find the length of time between when the two values were measured

Common

examples involve finding the number of periods in future associated with an investment made today and a target in future and the number of periods in past associated with an investment made in past and its current value

You can solve for t, but it involves logs and can be cumbersome

PV0

= Ct / (1 + r)t or FVt = C0 (1 + r)t

You can use the financial functions on the calculator as well

Time value of money part 1 - 93

Financial Calculator: TI-83 Plus

Using the financial calculator to find the number of periods when there are no regular, interim cash flows

I% = rate per period PV = opposite of the cash flow, asset value, or investment value as of the reference point PMT = 0, because there are no regular, interim cash flows

END/BEGIN mode is irrelevant, since PMT = 0

FV = cash flow, asset value, or investment value in N periods from reference point Solve for N = number of periods between the time when the cash flows occur or value of asset or investment is determined Future

I% per period -PV 0 0 period 1 period 2 0 1 2 0 3 value of -PV = FV 0 period N N-1 N

Cash flow Time from start

Present value of FV = -PV Cash flow

I% per period 0 0 period 1 period 2

FV period N N

Time from start 0 1 2 3 Note: Even though these timelines have N > 5, N can be less

N-1

Time value of money part 1 - 94

Number of Periods Example

You want to purchase a new car and you are willing to pay $20,000. If you can invest at 10% per year and you currently have $15,000, how long will it be before you have enough money to pay cash for the car?

Solution financial calculator

I% = 10; PV = -15000; PMT = 0; FV = 20000; PMT mode is irrelevant Solve for N and get N = 3.018

Solution formula (based on future value)

FVt = C0 (1 + r)t 20,000 = 15,000 (1.10)t 20,000 / 15,000 = 1.10t ln (20,000 / 15,000) = ln (1.10t) = t ln (1.10) t = ln (20,000 / 15,000) / ln (1.10) = 3.018

FVt = 20,000, N=?

It will take just over 3 years to save enough to pay for the car

Cash flow

15,000

Time

Time value of money part 1 - 95

Lecture Problems 4

I Scream Ice Cream Company has 3 plants in Texas that are each worth $1,000,000 and are expected to produce no cash flows other than the cash produced when they are sold Questions

What

cash flow will the sale of plant 1 produce if it is sold in 3 years and has a cost of capital of 10.4 percent? What is the cost of capital associated with plant 2 if it will be sold in 4 years for a cash flow of $1,400,000? When will plant 3 be sold if it will be sold for a cash flow of $1,300,000 and has a cost of capital of 8.2 percent Which plant is the riskiest?

Time value of money part 1 - 96

Non-Current Reference Point

The reference point (time 0) does not necessarily have to be today In some cases, the reference point is some point in the future and some point in the past When you set up a timeline to solve a problem, the earliest relevant time can be defined as time 0

Time value of money part 1 - 97

Non-Current Reference Point Example

What was Yolandas implied return if she invested $1,000 in an account 5 years ago and had $1,200 in that account 1 year ago? Solution

N

= 4; PV = -1000; PMT = 0; FV = 1200; PMT mode is irrelevant; P/Y = 1; C/Y = 1 Solve for I% and get I% = 4.66 Yolandas implied return was 4.66% per year

FV = 1200, r=? Cash flow 1000 Time Re-time -5 0 0 -4 1 0 -3 2 0 -2 3 0 -1 4 0 = today 5

Time value of money part 1 - 98

Non-Current Reference Point Example

If Hans expects to sell his house in 6 years from today for $500,000, then how much is his house expected to be worth in 2 years from today if the discount rate is 8%? Solution

N

= 4; I% = 8; PMT = 0; FV = 500,000; PMT mode is irrelevant; P/Y = 1; C/Y = 1 Solve for PV and get PV = -367,515

His house is expected to be worth $367,515 in 2 years from today Note that 500,000 (1.08)4 = 367,515 PV = ? Cash flow 0 0 1 0 2 0 0 3 1 0 4 2 0 5 3

500,000

6 4

Time 0 = today Re-time

Time value of money part 1 - 99

Conclusion

Time value of money

$1

today is more valuable than $1 in the future $1 today will grow into more than $1 in the future $1 in the future is worth less than $1 today

Timelines are incredibly useful for solving time value of money problems, as they can help bridge the gap between a problem and how to use an equation or a financial calculator to solve that problem Future value, present value, implied rate, and the length of time can be found for situations involving a single cash flow (or value, which is a potential cash flow)

Vous aimerez peut-être aussi

- Fund - Finance - Lecture 2 - Time Value of Money - 2011Document101 pagesFund - Finance - Lecture 2 - Time Value of Money - 2011lucipigPas encore d'évaluation

- The Time Value of MoneyDocument39 pagesThe Time Value of MoneyAbhinav JainPas encore d'évaluation

- Report Group C (M02)Document19 pagesReport Group C (M02)Huynh Anh Thu B1901863Pas encore d'évaluation

- The Time Value of MoneyDocument18 pagesThe Time Value of MoneyRaxelle MalubagPas encore d'évaluation

- The Time Value of Money: (Chapter 9)Document22 pagesThe Time Value of Money: (Chapter 9)ellaPas encore d'évaluation

- Time Value of Money Notes Loan ArmotisationDocument12 pagesTime Value of Money Notes Loan ArmotisationVimbai ChituraPas encore d'évaluation

- Intuition Behind The Present Value RuleDocument34 pagesIntuition Behind The Present Value RuleAbhishek MishraPas encore d'évaluation

- Time Value of MoneyDocument18 pagesTime Value of MoneyJunaid SubhaniPas encore d'évaluation

- FM Practice Questions KeyDocument7 pagesFM Practice Questions KeykeshavPas encore d'évaluation

- Lecture 3 - Time Value of MoneyDocument22 pagesLecture 3 - Time Value of MoneyJason LuximonPas encore d'évaluation

- Connect Chapter 2 Financial Management QuestionsssDocument7 pagesConnect Chapter 2 Financial Management QuestionsssAndrea PradeepPas encore d'évaluation

- AnnuityDocument28 pagesAnnuityHarumi CastanedoPas encore d'évaluation

- TVM Concepts for Financial ManagementDocument32 pagesTVM Concepts for Financial ManagementBhanu PratapPas encore d'évaluation

- Time Value of Money ExplainedDocument37 pagesTime Value of Money Explainedansary75Pas encore d'évaluation

- Present Value of An AnnuityDocument8 pagesPresent Value of An AnnuityirisPas encore d'évaluation

- Time Value of Money - Engineering Economics.Document59 pagesTime Value of Money - Engineering Economics.Quach Nguyen100% (4)

- What Is Time Value of MoneyDocument14 pagesWhat Is Time Value of MoneyJohn Michael EubraPas encore d'évaluation

- Single AmountDocument26 pagesSingle AmountYejiPas encore d'évaluation

- Present Value Calculations for Retirement PlanningDocument38 pagesPresent Value Calculations for Retirement Planningmarjannaseri77100% (1)

- C3-Interest RateDocument39 pagesC3-Interest RateDuong Ha ThuyPas encore d'évaluation

- MENGECO Group 6 - InterestDocument59 pagesMENGECO Group 6 - InterestEarl James RoquePas encore d'évaluation

- Midterm Exam 1 Practice - SolutionDocument6 pagesMidterm Exam 1 Practice - SolutionbobtanlaPas encore d'évaluation

- 02 How To Calculate Present ValuesDocument5 pages02 How To Calculate Present ValuesMộng Nghi TôPas encore d'évaluation

- The Time Value of Money ConceptsDocument28 pagesThe Time Value of Money ConceptsJanzel SantillanPas encore d'évaluation

- The Time Value of MoneyDocument15 pagesThe Time Value of MoneyWan Yusoff Wan MahmoodPas encore d'évaluation

- Rates and Time Value of Money - Basic Tools of Finance-19-10-20Document16 pagesRates and Time Value of Money - Basic Tools of Finance-19-10-20Zewen HEPas encore d'évaluation

- TVM & CompoundingDocument8 pagesTVM & CompoundingUday BansalPas encore d'évaluation

- What Is The Time Value of MoneyDocument6 pagesWhat Is The Time Value of MoneySadia JuiPas encore d'évaluation

- TVM Concepts ExplainedDocument6 pagesTVM Concepts ExplainedSaloni AgrawalPas encore d'évaluation

- Time Value of Money-2Document33 pagesTime Value of Money-2Moe HanPas encore d'évaluation

- Chapter 5 Time Value of Money ReadingDocument30 pagesChapter 5 Time Value of Money ReadingRose Peres100% (1)

- Time Value of Money (TVM) Learning Objectives (CH 4 Parts 1 & 2)Document35 pagesTime Value of Money (TVM) Learning Objectives (CH 4 Parts 1 & 2)Mian SbPas encore d'évaluation

- Time Value of MoneyDocument10 pagesTime Value of MoneyAnu LundiaPas encore d'évaluation

- Ch4 PDFDocument49 pagesCh4 PDFGustavo JimenezxPas encore d'évaluation

- FM I CH IiiDocument8 pagesFM I CH IiiDùķe HPPas encore d'évaluation

- Time Value of MoneyDocument52 pagesTime Value of MoneyJasmine Lailani ChulipaPas encore d'évaluation

- Time Value of Money: Economic Basis To Evaluate Engineering ProjectsDocument23 pagesTime Value of Money: Economic Basis To Evaluate Engineering ProjectsHafiizhNurrahmanPas encore d'évaluation

- The Time Value of MoneyDocument29 pagesThe Time Value of MoneysonalbharatiPas encore d'évaluation

- Finmar Chapter 2 - Structure of Interest RatesDocument15 pagesFinmar Chapter 2 - Structure of Interest RatesErica JoannaPas encore d'évaluation

- Time Value of Money With Marg TaxDocument31 pagesTime Value of Money With Marg Taxmuriithipeter761Pas encore d'évaluation

- Chapter 04Document41 pagesChapter 04Muntasir SizanPas encore d'évaluation

- Mathematics of Finance FormulasDocument29 pagesMathematics of Finance FormulasTareq IslamPas encore d'évaluation

- GL4102-07-Equivalence and Compound Interest-BaruDocument34 pagesGL4102-07-Equivalence and Compound Interest-BaruVicky Faras Barunson PanggabeanPas encore d'évaluation

- Time Value of MoneyDocument8 pagesTime Value of MoneyMuhammad Bilal IsrarPas encore d'évaluation

- Chapter 2 Money Time Relationships and Equivalence 2Document21 pagesChapter 2 Money Time Relationships and Equivalence 2Coreen ElizaldePas encore d'évaluation

- Lectures Stat 485Document44 pagesLectures Stat 485Luyanda BlomPas encore d'évaluation

- Visualizing Cash Flows Over TimeDocument30 pagesVisualizing Cash Flows Over TimekhanPas encore d'évaluation

- Time Value Money ExplainedDocument5 pagesTime Value Money ExplainedUday BansalPas encore d'évaluation

- Financial Management Time Value of Money Lecture 2,3 and 4Document12 pagesFinancial Management Time Value of Money Lecture 2,3 and 4Rameez Ramzan Ali67% (3)

- Chapter 3 Time Value of MoneyDocument103 pagesChapter 3 Time Value of Moneyaqsa_munir0% (1)

- 10 FM 1 TN 1ppDocument101 pages10 FM 1 TN 1ppBobPas encore d'évaluation

- Time Value of MoneyDocument59 pagesTime Value of MoneyjagrenuPas encore d'évaluation

- Engineering EcomomicDocument20 pagesEngineering EcomomicRivaldo AdamPas encore d'évaluation

- Time Value of Money: Gitman and Hennessey, Chapter 5Document43 pagesTime Value of Money: Gitman and Hennessey, Chapter 5Faye Del Gallego EnrilePas encore d'évaluation

- Capital Budgeting and FinancingDocument21 pagesCapital Budgeting and FinancingCérine AbedPas encore d'évaluation

- Topic Two Financial Mathematics/Time Value of MoneyDocument43 pagesTopic Two Financial Mathematics/Time Value of Moneysir bookkeeperPas encore d'évaluation

- Financial Management Time Value of Money Lecture 2 3 and 4Document12 pagesFinancial Management Time Value of Money Lecture 2 3 and 4Kratika Pandey SharmaPas encore d'évaluation

- AM41110 Theory of Interest 2.5 Review QuestionsDocument5 pagesAM41110 Theory of Interest 2.5 Review QuestionsRosalia LiaoPas encore d'évaluation

- What Is The Time Value of MoneyDocument3 pagesWhat Is The Time Value of MoneySadia JuiPas encore d'évaluation

- High-Q Financial Basics. Skills & Knowlwdge for Today's manD'EverandHigh-Q Financial Basics. Skills & Knowlwdge for Today's manPas encore d'évaluation

- Transcripts Moi UniversityDocument4 pagesTranscripts Moi UniversityMelanie GaksPas encore d'évaluation

- Chapter Test 2 ReviewDocument23 pagesChapter Test 2 ReviewSheila Mae AsuelaPas encore d'évaluation

- Handbook of Operational Amplifier ApplicationsDocument94 pagesHandbook of Operational Amplifier Applicationshermiit89% (9)

- Astrophysics and Mathematics With The Constant V 9.209.Document16 pagesAstrophysics and Mathematics With The Constant V 9.209.Mars PartyPas encore d'évaluation

- 1 s2.0 S1110016822005646 MainDocument14 pages1 s2.0 S1110016822005646 MainEss ZeePas encore d'évaluation

- Copper Oxidation LabDocument3 pagesCopper Oxidation Labapi-348321624Pas encore d'évaluation

- Pump CavitationDocument5 pagesPump Cavitationjrri16Pas encore d'évaluation

- Quantitative Techniques for Management DecisionsDocument4 pagesQuantitative Techniques for Management DecisionsFiraa'ool Yusuf100% (1)

- Brent Kung AdderDocument60 pagesBrent Kung AdderAnonymous gLVMeN2hPas encore d'évaluation

- Chapter 1ADocument35 pagesChapter 1ASandip GaikwadPas encore d'évaluation

- Bs 8666 of 2005 Bas Shape CodesDocument5 pagesBs 8666 of 2005 Bas Shape CodesopulithePas encore d'évaluation

- Fatigue Analysis in Ansys WorkbenchDocument14 pagesFatigue Analysis in Ansys WorkbenchAshokkumar VellorePas encore d'évaluation

- K Means QuestionsDocument2 pagesK Means QuestionsShakeeb ParwezPas encore d'évaluation

- Simple Harmonic Motion and ElasticityDocument105 pagesSimple Harmonic Motion and ElasticityyashveerPas encore d'évaluation

- Maths Parent Workshop Jan 2020Document16 pagesMaths Parent Workshop Jan 2020Marjorie MalvedaPas encore d'évaluation

- Risk, Return, and The Capital Asset Pricing ModelDocument52 pagesRisk, Return, and The Capital Asset Pricing ModelFaryal ShahidPas encore d'évaluation

- Decision Modeling Using SpreadsheetDocument36 pagesDecision Modeling Using SpreadsheetamritaPas encore d'évaluation

- SSR in DFIG SystemsDocument49 pagesSSR in DFIG SystemsHossein_jujujuPas encore d'évaluation

- Principles of Robot Autonomy I: Robotic Sensors and Introduction To Computer VisionDocument38 pagesPrinciples of Robot Autonomy I: Robotic Sensors and Introduction To Computer VisionratjerryPas encore d'évaluation

- 1-15-15 Kinematics AP1 - Review SetDocument8 pages1-15-15 Kinematics AP1 - Review SetLudwig Van Beethoven100% (1)

- Head Nurses Leadership Skills Mentoring and Motivating Staff Nurses On Rendering High-Quality Nursing CareDocument23 pagesHead Nurses Leadership Skills Mentoring and Motivating Staff Nurses On Rendering High-Quality Nursing CareDaniel RyanPas encore d'évaluation

- Soil Mechanics: Explain About The Friction Circle MethodDocument2 pagesSoil Mechanics: Explain About The Friction Circle MethodmaniPas encore d'évaluation

- Sachin S. Pawar: Career ObjectivesDocument3 pagesSachin S. Pawar: Career ObjectivesSachin PawarPas encore d'évaluation

- Divya MishraDocument1 pageDivya MishraKashish AwasthiPas encore d'évaluation

- Multi-Objective Optimization For Football Team Member SelectionDocument13 pagesMulti-Objective Optimization For Football Team Member SelectionSezim Tokozhan kyzyPas encore d'évaluation

- 4th Periodical Test in Math 5-NewDocument9 pages4th Periodical Test in Math 5-NewMitchz Trinos100% (2)

- POP 301 Production and Operations Management Final ExamDocument2 pagesPOP 301 Production and Operations Management Final ExamHabib A IslamPas encore d'évaluation

- Etabs NotesDocument11 pagesEtabs Noteskarimunnisa sheikPas encore d'évaluation

- Cast Iron DampingDocument5 pagesCast Iron Dampinggabs88Pas encore d'évaluation

- Transformation of Plane StressDocument27 pagesTransformation of Plane StressDave Harrison FloresPas encore d'évaluation