Académique Documents

Professionnel Documents

Culture Documents

Chapter 4 Financial Market: 1 Reference: Macroeconomics, Blanchard 5/e Updated

Transféré par

rnitchDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Chapter 4 Financial Market: 1 Reference: Macroeconomics, Blanchard 5/e Updated

Transféré par

rnitchDroits d'auteur :

Formats disponibles

Chapter 4 Financial Market

1

Reference: Macroeconomics, Blanchard

5/e Updated

1. The Demand for Money

(1) Semantic traps:

Income: is what you earn from working plus

what your receive in interest and dividends.

It is a flow variable something expressed in

units of time weekly income, monthly

income, or yearly income. For example, J.

Paul Getty was once asked what his income

was . Getty answered: $1000. He meant,

but did not say, $1000 per minute!

Reference: Macroeconomics, Blanchard

5/e Updated

2

Saving: is part of disposable income that you

do not spend. Y T C. It is also a flow

variable. If you save 10% of your income, and

your income is $3000 per month, then you

save $300 per month.

Savings: is sometimes used as a synonym for

wealth the value of what you have

accumulated over time.

(Financial) wealth: is the value of all your

financial assets minus all your financial

liabilities. It is a stock variable. It is the value

of wealth at a given moment in time.

Reference: Macroeconomics, Blanchard

5/e Updated

3

Money: Financial assets that can be used

directly to buy goods and services are called

money. Money includes currency and

checkable deposits. Money is a stock variable.

Investment: is a term economists reserved for

the purchase of new capital goods, from

machines to plants to office buildings. When

you want to talk about the purchase of shares

or other financial assets, you should refer

them as a financial investment.

Reference: Macroeconomics, Blanchard

5/e Updated

4

(2) How to allocate wealth between money and bonds?

Suppose your financial wealth today is $50,000. You may

intend to keep saving in the future and increase your

wealth further, but its value today is given. Suppose also

that you only have the choice between two assets, money

and bonds.

Money: pays no interest. You can use it for transactions.

Bonds: pays a positive interest rate, i. But you can not use

them for transactions. In the real world, there are many

types of bonds, each associated with a specific interest

rate. We will simply assume that there is just one type of

bond and that it pays, i, the rate of interest. (MMMF)

How much of your $50,000 should you hold in money and

how much in bonds?

All in money. All in bonds. If should hold both money and

bonds, how much money?

Reference: Macroeconomics, Blanchard

5/e Updated

5

(3) Determinants of your demand for money

Your level of transactions: you will want to

have enough money on hand to avoid having

to sell bonds too often.

The interest rate on bonds: the reason to hold

bonds is that they pay interest. The higher the

interest rate, the more you will be willing to

hold bonds, the less you will be willing to hold

money. (money market accounts in early

1980s)

Reference: Macroeconomics, Blanchard

5/e Updated

6

(4) Deriving the equation of the demand for money for

the economy, M

d

:

Overall level of transactions: The demand for money in

the economy as a whole depends on the sum of all the

individual transaction demands for money. The overall

level of transactions in the economy is hard to

measure, but it is likely to be proportional to nominal

GDP, denoted by $Y.

M

d

| as $Y|. (M

d

and $Y are positively related.)

The interest rate on bonds: the reason to hold bonds is

that they pay interest. The higher the interest rate, the

more we all will be willing to hold bonds, and the less

we all will be willing to hold money.

M

d

+ as i|. (M

d

and i are negatively related.)

Reference: Macroeconomics, Blanchard

5/e Updated

7

The equation of the demand for money for the economy:

Read this equation in the following way:

The demand for money, M

d

, is equal to nominal income, $Y,

times a function of the interest rate, i, with the function

denoted by L(i ).

The demand for money:

-- M

d

| as $Y|. (M

d

and $Y are positively related.)

-- M

d

+ as i|. (M

d

and i are negatively related.)

The graph of the demand for money for the economy:

Given $Y, M

d

+ as i|. A movement up along the M

d

curve.

Given $Y, M

d

| as i+. A movement down along the M

d

curve.

Given i, M

d

| as $Y|. A shift out of the M

d

curve.

Given i, M

d

+ as $Y+. A shift in of the M

d

curve.

Reference: Macroeconomics, Blanchard

5/e Updated

8

$ ( )

d

M Y L i =

( )

Reference: Macroeconomics, Blanchard

5/e Updated

9

Figure 4-1 The demand for money

2. The Supply of Money and

Determining the interest rate, i

(1) The supply of money

In the real world, there are two types of

money, currency, which is supplied by the

central bank, and checkable deposits, which

are supplied by banks. For this moment, we

assume the only money in the economy is

currency. Suppose that the central bank

decides to supply an amount of money equal

to M, which is independent of interest rate, so

M

S

=M.

Reference: Macroeconomics, Blanchard

5/e Updated

10

(2) Money demand, money supply and the

equilibrium interest rate

Equilibrium in financial markets requires that

money supply be equal to money demand

M

S

=M

d

M=$Y L(i)

This equation tells us that the interest rate i,

must be such that, given income, people are

willing to hold an amount of money equal to

the existing money supply. This equilibrium

relation is called the LM relation. Graphically

Reference: Macroeconomics, Blanchard

5/e Updated

11

Reference: Macroeconomics, Blanchard

5/e Updated

12

Figure 4-2 The determination of the equilibrium interest rate

(3) Changes in equilibrium and equilibrium interest rate:

The effects of an increase in nominal income on the

equilibrium interest rate:

$Y|M

d

curve shifts outi|

Reason: At the initial interest rate, M

d

>M

S

. An increase in

the interest rate is needed to decrease the amount of

money people want to hold and to reestablish equilibrium.

The effects of an increase in the money supply on the

equilibrium interest rate:

M

S

|M

S

curve shifts outi+

Reason: At the initial interest rate, M

d

<M

S

. A decrease in

the interest rate is needed to increase the amount of

money people want to hold and to reestablish equilibrium.

Reference: Macroeconomics, Blanchard

5/e Updated

13

Reference: Macroeconomics, Blanchard

5/e Updated

14 Figure 4-3 The effect of an increase in nominal income on the interest rate

Reference: Macroeconomics, Blanchard

5/e Updated

15 Figure 4-4 The effect of an increase in the money supply on the interest rate

(4) Monetary policy and open market operations

Recall that currency is supplied by the central bank, so

how the central bank actually changes the money

supply.

Open market operations

In modern economics, the way central banks change

the supply of money is by buying and selling bonds in

the bond market.

-- If a central bank wants to increase M

S

, it buys bonds

and pays for them by creating money.

-- If a central bank wants to decrease M

S

, it sells bonds

and removes from circulation the money it receives in

exchange for the bonds.

-- These actions are called open market operations,

expansionary for the former and contractionary for the

latter.

Reference: Macroeconomics, Blanchard

5/e Updated

16

-- The balance sheet of the central bank:

The assets of the central bank are the bonds it

holds in its portfolio. Its liabilities are the stock

of money in the economy. Open market

operations lead to equal changes in assets and

liabilities. For example, if the central bank

buys, say, $1 million worth of bonds, the

amount of bonds it holds is higher by $1

million, and so is the amount of money in the

economy. Such an operation is called an

expansionary open market operation.

Reference: Macroeconomics, Blanchard

5/e Updated

17

Reference: Macroeconomics, Blanchard

5/e Updated

18

Figure 4-5 The balance sheet of the central bank and the effects of an expansionary

open market operation

Bond prices and bond yields

We havent discussed a lot about the interest rate on

bonds. In fact, what is determined in bond markets is

not interest rates but bond prices; the interest rate on

a bond can then be inferred from the price of the

bond. Suppose the bonds in our economy are one-year

bonds bonds that promise a payment of a given

number of dollars, say, $100, one year from now. In the

United States, bonds issued by the government

promising payment in a year or less are called Treasury

bills, or T-bills. Let the price of a bond today be $P

B

. If

you buy the bond today and hold it for a year, the rate

of return on holding the bond for a year is ($100-$P

B

)/

$P

B

. Therefore, the interest rate on the bond is given by

Reference: Macroeconomics, Blanchard

5/e Updated

19

If $P

B

=$95, i=0.053=5.3%

If $P

B

=$90, i=0.111=11.1%

The higher the price of the bond, the lower the interest

rate.

If we are given the interest rate, we can figure out the

price of the bond using the same formula. Reorganizing

the formula above, then

The higher the interest rate, the lower the price of the

bond today. So $P

B

and i are negatively related.

Reference: Macroeconomics, Blanchard

5/e Updated

20

i

P

P

B

B

=

$100 $

$

$

$100

P

i

B

=

+ 1

An expansionary open market operation

revisited:

Central bank buys bonds in the bond market and

pays for them by creating money. As the central

bank buys bonds, the demand for bonds goes up,

increasing their price. Conversely, the interest

rate on bonds goes down.

A contractionary open market operation

revisited:

Central bank sells bonds in the bond market and

removes money from circulation. As the central

bank sells bonds, the supply of bonds goes up,

decreasing their price. Conversely, the interest

rate on bonds goes up.

Reference: Macroeconomics, Blanchard

5/e Updated

21

(5) Choosing money or

choosing the interest rate?

Choosing interest rate

because this is what

modern central banks,

including the Fed, typically

do. They typically think

about the interest rate they

want to achieve and then

move the money supply so

as to achieve it. Figure 4-4

could also be used to

describe that the central

bank decides to lower the

interest rate by increasing

the money supply.

Reference: Macroeconomics, Blanchard

5/e Updated

22

Figure 4-4 The effect of an increase in the

money supply on the interest rate

(6) Money, bonds, and other assets

We have been looking at an economy with only

two assets: money and bonds. This is obviously

a much simplified version of actual economies,

with their many financial assets and many

financial markets.

There is one dimension, however, to which our

model must be extended. We have assumed that

all money in the economy consists of currency

supplied by the central bank. In the real world,

money includes not only currency but also

checkable deposits.

Reference: Macroeconomics, Blanchard

5/e Updated

23

3. The Determination of Interest Rate, ii*

(1) What banks do

To understand what determines the interest rate in an

economy with both currency and checkable deposits, we must

look at what banks do. Modern economies are characterized by

the existence of many types of financial intermediaries.

-- Financial intermediaries are institutions that receive funds

from people and firms and use those funds to buy financial

assets or to make loans to other people and firms.

-- The assets: are the financial assets they own and loans they

have made.

-- The liabilities: are what they owe to the people and firms

from whom they have received funds.

-- Banks are one type of financial intermediary. What makes

banks special is that their liabilities are money checkable

deposits.

-- The balance sheet of banks

Reference: Macroeconomics, Blanchard

5/e Updated

24

Figure 4-6 (b):

Liabilities: people and

firms either deposit

funds directly or have

funds sent to their

checking accounts. The

liabilities of the banks

are equal to the value

of these checkable

deposits.

Reference: Macroeconomics, Blanchard

5/e Updated

25

Figure 4-6 The balance sheet of banks and

The balance sheet of the central bank revisited

Figure 4-6 (b):

Assets: banks keep as reserves

some of the funds they receive.

The reserves are held partly in

cash and partly in an account the

banks have at the central bank,

which they can draw on when

they need to. Banks hold reserves

for three reasons: (1)

precautionary to meet

withdrawal purposes. (2)

precautionary to meet clearing

purposes. (3) regulatory to meet

central banks reserve

requirements, which say that

they MUST hold reserves in some

proportion of their checkable

deposits. The ratio of bank

reserves to bank checkable

deposits is about 10% in the U.S.

Banks can use the other 90% to

make loans or buy bonds.

Reference: Macroeconomics, Blanchard

5/e Updated

26

Figure 4-6 The balance sheet of banks and

The balance sheet of the central bank revisited

Figure 4-6 (b):

Assets: loans represents

roughly 70% of banks

nonreserve assets. Bonds

account or the rest 30%.

The distinction between

bonds and loans is

unimportant for our

purpose which is to

understand how the

money supply is

determined. For this

reason, we will assume

that banks do not make

loans and that they hold

only reserves and bonds

as assets.

Reference: Macroeconomics, Blanchard

5/e Updated

27

Figure 4-6 The balance sheet of banks and

The balance sheet of the central bank revisited

But the distinction between loans and bonds

is important for other purposes, from the

possibility of bank runs to the role of federal

deposit insurance. See Focus on page 74.

Figure 4-6 (a):

Assets: are the bonds it

holds.

Liabilities: are the

money it has issued,

central bank money.

The new feature is that

not all central bank

money is held as

currency by the public.

Some of it is held as

reserves by banks.

Reference: Macroeconomics, Blanchard

5/e Updated

28

Figure 4-6 The balance sheet of banks and

The balance sheet of the central bank revisited

(2) The supply and the demand for central bank money

Reference: Macroeconomics, Blanchard

5/e Updated

29

Figure 4-7 Determinants of the demand and the supply of central bank money

The demand for money by people is for both checkable deposits and currency. Because

banks have to hold reserves against checkable deposits, the demand for checkable

deposits leads to a demand for reserves by banks. Consequently, the demand for central

bank money is equal to the demand for reserves by banks plus the demand for currency.

The supply of central bank money is determined by the central bank. The interest rate

must be such that the demand and the supply of central bank money are equal.

The demand for money:

The demand for currency:

The demand for checkable deposits:

where c represents that people hold a fixed

proportion of their money in currency. In the

United States, c = 40%. People hold 40% of their

money in the form of currency, therefore, 60% of

their money in checkable deposits.

Reference: Macroeconomics, Blanchard

5/e Updated

30

d d

CU c M =

D c M

d d

= ( ) 1

The demand for bank reserves:

The relation between reserves (R) and deposits (D):

where u is the reserve ratio.

The demand for reserves by banks is given by:

Reference: Macroeconomics, Blanchard

5/e Updated

31

R D u =

( )

1

d d

R c M u =

The demand for central bank money:

Call H

d

the demand for central bank money. This

demand is equal to the sum of the demand for

currency and the demand for reserves.

The supply of central bank money:

Let H be the supply of central bank money. The

central bank can change the amount of H through

open market operations.

Reference: Macroeconomics, Blanchard

5/e Updated

32

H CU R

d d d

= +

( ) ( )

1 1

d d d d

H cM c M c c M u u = + = + (

( ) ( )

1 $

d

H c c Y L i u = + (

The supply and the demand for central bank money:

Reference: Macroeconomics, Blanchard

5/e Updated

33

Figure 4-7 Determinants of the demand and the supply of central bank money

(3) The determination of the interest rate

Equilibrium interest rate:

In equilibrium, the supply of central bank money (H) is

equal to the demand for central bank money (H

d

):

Or restated as:

H = [c+u(1-c)]$YL(i)

Note: As long as people hold some checkable deposits

(0<c<1), the term in brackets is less than 1. This means

that the demand for central bank money is less than

the overall demand for money. This is due to the fact

that the demand for reserves by banks is only a

fraction of the demand for checkable deposits.

Reference: Macroeconomics, Blanchard

5/e Updated

34

H H

d

=

The determination of

the interest rate:

The equilibrium interest

rate is such that the

supply of central bank

money is equal to the

demand for central

bank money.

Reference: Macroeconomics, Blanchard

5/e Updated

35

Figure 4-8 Equilibrium in the market for

central bank money and the determination

of the interest rate

4. Two alternative ways of looking at the equilibrium

(1) The federal funds market and the federal funds rate

The supply and the demand for bank reserves:

This alternative way of looking at the equilibrium is

attractive because, in the United States, there is indeed an

actual market for bank reserves, where interest rate moves

up and down to balance the supply and demand for

reserves. This market is called the federal funds market.

Banks that have excess reserves at the end of the day lend

them to banks that have insufficient reserves. In

equilibrium, .

Reference: Macroeconomics, Blanchard

5/e Updated

36

The left hand side: The supply of reserves is equal to the supply of

central bank money, H, minus the demand for currency by the public, CU

d

.

H CU R

d d

=

H CU R

d d

=

The federal funds rate:

The interest rate determined in this market is

called the federal funds rate. Because the Fed

can in effect choose the federal funds rate it

wants by changing the supply of central bank

money, H, the federal funds rate is typically

thought of as the main indicator of U.S.

monetary policy. This is why so much

attention is focused on it and why changes in

the federal funds rate typically make front-

page news.

Reference: Macroeconomics, Blanchard

5/e Updated

37

Reference: Macroeconomics, Blanchard

5/e Updated

38

Source: http://www.stlouisfed.org/.

(2) The supply of money, the demand for money, and

the money multiplier

We can think of the equilibrium in terms of the equality of the supply and demand of

central bank money, or in terms of the equality of the supply and demand of reserves.

There is yet another way of thinking about the equilibrium in terms of the equality of

the overall supply and the overall demand for money (currency and checkable

deposits).

Supply of money = Demand for money

The overall supply of money is equal to central bank

money times the money multiplier:

High-powered money is the term used to reflect the

fact that the overall supply of money depends in the

end on the amount of central bank money (H), or

monetary base.

Reference: Macroeconomics, Blanchard

5/e Updated

39

1

$ ( )

[ (1 )]

H Y L i

c c u

=

+

( ) ( )

1/ 1 c c u +

(3) Understanding the money multiplier

For simplicity, set c=0 and u=0.1. The

multiplier=10. (Implication: people hold only

checkable deposits, reserve ratio equals 0.1.) An

increase of $100 of high-powered money leads to

an increase of $1000 in the money supply. How

the initial increase in central bank money leads to

a tenfold increase in the overall money supply?

Suppose the Fed buys $100 worth of bonds in an

open market operation. It pays the seller Seller

1 - $100. To pay Seller 1, the Fed creates $100 in

central bank money. The increase in central bank

money is $100.

Reference: Macroeconomics, Blanchard

5/e Updated

40

Seller 1 deposits the $100 in a checking account at his bank bank

A. This leads to an increase in checkable deposits of $100.

Bank A keeps $100*0.1=$10 in reserves and buys bonds with the

rest $100*(1-0.1) . It pays $100*(1-0.1) to the seller of those bonds

call her Seller 2.

Seller 2 deposits $100*(1-0.1) in a checking account at her bank

bank B. This leads to an increase in checkable deposits of $100*(1-

0.1).

Bank B keeps $100*(1-0.1)*0.1 in reserves and buys bonds with the

rest $100*(1-0.1)*(1-0.1), that is $100*(1-0.1)

2

. It pays $100*(1-

0.1)

2

to the seller of those bonds call him Seller 3.

Seller 3 deposits $100*(1-0.1)

2

in a checking account at his bank

bank C. This leads to an increase in checkable deposits of $100*(1-

0.1)

2

.

Bank C keeps $100*(1-0.1)

2

*0.1 in reserve and buys bonds with the

rest $100 *(1-0.1)

2

*(1-0.1), that is $100*(1-0.1)

3

. It pays $100*(1-

0.1)

3

to the seller of those bonds call her Seller 4.

$100+ $100*(1-0.1) + $100*(1-0.1)

2

+ = $1000

Reference: Macroeconomics, Blanchard

5/e Updated

41

We can think of the ultimate increase in the

money supply as the result of successive

rounds of purchases of bondsthe first

started by the Fed in its open market

operation, the following rounds by banks.

Each successive round leads to an increase in

the money supply, and eventually the increase

in the money supply is equal to 1/u

times the initial increase in the central bank

money.

Reference: Macroeconomics, Blanchard

5/e Updated

42

Vous aimerez peut-être aussi

- Loan Agreement Corporate SimpleDocument2 pagesLoan Agreement Corporate SimpleJennifer Deleon100% (1)

- Payday Loans PDFDocument33 pagesPayday Loans PDFRyan HayesPas encore d'évaluation

- Finance 100Document865 pagesFinance 100jhamez16Pas encore d'évaluation

- Macroeconomics Key GraphsDocument5 pagesMacroeconomics Key Graphsapi-243723152Pas encore d'évaluation

- The Behavior of Interest RatesDocument39 pagesThe Behavior of Interest RatesRhazes Zy100% (1)

- Levich Ch13 Net Assignment SolutionsDocument24 pagesLevich Ch13 Net Assignment Solutionsveda20Pas encore d'évaluation

- Financial Management - PPT - Pgdm2010Document94 pagesFinancial Management - PPT - Pgdm2010Prabhakar Patnaik100% (1)

- Economics/05 Monetary and Fiscal PolicyDocument45 pagesEconomics/05 Monetary and Fiscal PolicyHarshavardhan SJPas encore d'évaluation

- Wings 2017Document197 pagesWings 2017amarPas encore d'évaluation

- TML Gasket vs. BPI Family Savings Jan 2013Document2 pagesTML Gasket vs. BPI Family Savings Jan 2013Sam LeynesPas encore d'évaluation

- Etextbook 978 0132992282 MacroeconomicsDocument61 pagesEtextbook 978 0132992282 Macroeconomicslee.ortiz429100% (49)

- Economics 302 (Sec. 001) Intermediate Macroeconomic Theory and Policy Theory and PolicyDocument15 pagesEconomics 302 (Sec. 001) Intermediate Macroeconomic Theory and Policy Theory and Policytai2000Pas encore d'évaluation

- Week 2 Part OneDocument20 pagesWeek 2 Part OneLisimoana TupouPas encore d'évaluation

- Eco ch4Document2 pagesEco ch4fatema hosseiniPas encore d'évaluation

- Money and BankingDocument10 pagesMoney and BankingMaruf AhmedPas encore d'évaluation

- Money Supply and Money Demand: Chapter EighteenDocument16 pagesMoney Supply and Money Demand: Chapter EighteenSharad Ranjan TyagiPas encore d'évaluation

- The Financial Sector of The Economy: Money and BankingDocument12 pagesThe Financial Sector of The Economy: Money and BankingNefta BaptistePas encore d'évaluation

- Assignment 1Document6 pagesAssignment 1Ken PhanPas encore d'évaluation

- Topic 4 Saving and Investment (Updated 15 May 2017)Document15 pagesTopic 4 Saving and Investment (Updated 15 May 2017)Arun GhatanPas encore d'évaluation

- Practice For Chapter 5 SolutionsDocument6 pagesPractice For Chapter 5 SolutionsAndrew WhitfieldPas encore d'évaluation

- MIT14 02F09 Lec10Document27 pagesMIT14 02F09 Lec10mkmusaPas encore d'évaluation

- 10 Rules of EconomicsDocument4 pages10 Rules of EconomicsJames GrahamPas encore d'évaluation

- Chapter#04: Financial MarketsDocument4 pagesChapter#04: Financial Marketshifza anwarPas encore d'évaluation

- 5 WEEK GEHon Economics IIth Semeter Introductory MacroeconomicsDocument14 pages5 WEEK GEHon Economics IIth Semeter Introductory Macroeconomicskasturisahoo20Pas encore d'évaluation

- Presentation EcoDocument9 pagesPresentation EcoDipayan DebnathPas encore d'évaluation

- Task M3Document2 pagesTask M3bendermacherrickPas encore d'évaluation

- Money Growth and Inflation: The Classical Theory of InflationDocument5 pagesMoney Growth and Inflation: The Classical Theory of InflationIzzahPas encore d'évaluation

- Financial MarketsDocument32 pagesFinancial MarketsArief Kurniawan100% (1)

- A. Money and The Banking SystemDocument9 pagesA. Money and The Banking SystemShoniqua JohnsonPas encore d'évaluation

- ECON1132 Midterm2 2013springDocument4 pagesECON1132 Midterm2 2013springexamkillerPas encore d'évaluation

- Financial IntermediariesDocument3 pagesFinancial IntermediariesSanchit MiglaniPas encore d'évaluation

- Chapter 25Document7 pagesChapter 25Tasnim SghairPas encore d'évaluation

- Unit V Behavioural Foundations: InvestmentDocument10 pagesUnit V Behavioural Foundations: InvestmentRonak PoddarPas encore d'évaluation

- Money Is Defined As Any Asset That People Are Willing To Accept in Exchange For Goods andDocument4 pagesMoney Is Defined As Any Asset That People Are Willing To Accept in Exchange For Goods andVũ Hồng PhươngPas encore d'évaluation

- The Money Supply and Inflation PPT at Bec DomsDocument49 pagesThe Money Supply and Inflation PPT at Bec DomsBabasab Patil (Karrisatte)Pas encore d'évaluation

- Group 3 Money Banking and Monetary PolicyDocument46 pagesGroup 3 Money Banking and Monetary PolicyjustinedeguzmanPas encore d'évaluation

- Chapter 13 & 14 Money, Banks, The Federal Reserve System and Monetary PolicyDocument7 pagesChapter 13 & 14 Money, Banks, The Federal Reserve System and Monetary PolicyDiamante GomezPas encore d'évaluation

- Principles of MacroeconomicsDocument52 pagesPrinciples of Macroeconomicsmoaz21100% (1)

- Money and Inflation: Questions For ReviewDocument6 pagesMoney and Inflation: Questions For ReviewErjon SkordhaPas encore d'évaluation

- Financial Markets: ECON 2123: MacroeconomicsDocument40 pagesFinancial Markets: ECON 2123: MacroeconomicskatecwsPas encore d'évaluation

- Chapters 26 and 27 Principles of Economics, Fourth Edition N. Gregory MankiwDocument42 pagesChapters 26 and 27 Principles of Economics, Fourth Edition N. Gregory MankiwDao Tuan Anh100% (2)

- PP6Document10 pagesPP6Sambit MishraPas encore d'évaluation

- Group 6.time Value of Money and Risk and Return - FinMan FacilitationDocument95 pagesGroup 6.time Value of Money and Risk and Return - FinMan FacilitationNaia SPas encore d'évaluation

- Money and Monetary Policy: Chapter 11Document18 pagesMoney and Monetary Policy: Chapter 11Ji YuPas encore d'évaluation

- Goods and Money Market: Unit 3Document28 pagesGoods and Money Market: Unit 3Mrigesh AgarwalPas encore d'évaluation

- Money Lecture 1 2020Document40 pagesMoney Lecture 1 2020vusal.abdullaev17Pas encore d'évaluation

- The Money MarketDocument20 pagesThe Money MarketNick GrzebienikPas encore d'évaluation

- Chapter 3Document11 pagesChapter 3Tasebe GetachewPas encore d'évaluation

- Learning OutcomesDocument10 pagesLearning OutcomesRajesh GargPas encore d'évaluation

- Money Supply NotesDocument10 pagesMoney Supply Notesmary wanjiruPas encore d'évaluation

- Problem Set (LSE)Document3 pagesProblem Set (LSE)ARUPARNA MAITYPas encore d'évaluation

- Monetary PolicyDocument10 pagesMonetary PolicykafiPas encore d'évaluation

- Engaging Activity A Financial MarketsDocument2 pagesEngaging Activity A Financial MarketsMary Justine ManaloPas encore d'évaluation

- Session 11 - Money Demand - Equil Interest RateDocument7 pagesSession 11 - Money Demand - Equil Interest Rates0falaPas encore d'évaluation

- Summary-Chapter 8Document3 pagesSummary-Chapter 8DhrushiPas encore d'évaluation

- FM Unit 4 Lecture Notes - Time Value of MoneyDocument4 pagesFM Unit 4 Lecture Notes - Time Value of MoneyDebbie DebzPas encore d'évaluation

- Groups 3 Qna The Monetary System What It Is and How It Works PDFDocument8 pagesGroups 3 Qna The Monetary System What It Is and How It Works PDFNing Ai SatyawatiPas encore d'évaluation

- 6 Money SupplyDocument6 pages6 Money SupplySaroj LamichhanePas encore d'évaluation

- Lecture Yeid To MaturityDocument32 pagesLecture Yeid To MaturityUmerPas encore d'évaluation

- Ec103 Week 03 s14Document20 pagesEc103 Week 03 s14юрий локтионовPas encore d'évaluation

- TVM Stocks and BondsDocument40 pagesTVM Stocks and Bondseshkhan100% (1)

- Chapter 2Document22 pagesChapter 2Tiến ĐứcPas encore d'évaluation

- Macroeconomics Unit 4 Multiple ChoiceDocument13 pagesMacroeconomics Unit 4 Multiple ChoiceAleihsmeiPas encore d'évaluation

- Time Value of Money - TheoryDocument7 pagesTime Value of Money - TheoryNahidul Islam IUPas encore d'évaluation

- Modern Measures of MoneyDocument6 pagesModern Measures of MoneyCrisly-Mae Ann AquinoPas encore d'évaluation

- Loans ReceivableDocument3 pagesLoans ReceivableGee Lysa Pascua VilbarPas encore d'évaluation

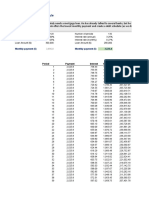

- Excel Student Loan Amortization TableDocument18 pagesExcel Student Loan Amortization TableIsmail UsmanPas encore d'évaluation

- Tobin's Theory of Demand For MoneyDocument6 pagesTobin's Theory of Demand For MoneyShofi R Krishna100% (20)

- Mortgage Pools, Pass-Throughs, and CmosDocument24 pagesMortgage Pools, Pass-Throughs, and CmossamuelPas encore d'évaluation

- Home Loan EMI Calculator Amortization ScheduleDocument4 pagesHome Loan EMI Calculator Amortization ScheduleMahatoPas encore d'évaluation

- B.Sc. Economics Honours - Detailed SyllabusDocument49 pagesB.Sc. Economics Honours - Detailed SyllabusNeelarka RoyPas encore d'évaluation

- Al-Rahnu VS Conventional Pawn Broking: Group 12 Maybank Islamic BankDocument14 pagesAl-Rahnu VS Conventional Pawn Broking: Group 12 Maybank Islamic BanknghingliungPas encore d'évaluation

- EMI Calculator 02/02/2022: Please Click On The Link Below To Download The ApplicationDocument11 pagesEMI Calculator 02/02/2022: Please Click On The Link Below To Download The ApplicationAmar KambalePas encore d'évaluation

- Loan Application ProcessDocument17 pagesLoan Application Processsamm yuuPas encore d'évaluation

- 3.2 70. Exercise Loan Schedule SolvedDocument6 pages3.2 70. Exercise Loan Schedule SolvedAniket KarnPas encore d'évaluation

- MakroekonomiDocument3 pagesMakroekonomiYew SeangPas encore d'évaluation

- GI Book 6e-170-172Document3 pagesGI Book 6e-170-172ANH PHAM QUYNHPas encore d'évaluation

- You Exec - Ultimate Loan FreeDocument174 pagesYou Exec - Ultimate Loan FreeVíctor Hugo TeránPas encore d'évaluation

- Simple Interest GameDocument4 pagesSimple Interest GameCarmina CunananPas encore d'évaluation

- Chapter 20 Problems and SolutionsDocument5 pagesChapter 20 Problems and Solutionsfahmeed786Pas encore d'évaluation

- Loan Prob SolDocument3 pagesLoan Prob SolAnonymous pH3jHscX9Pas encore d'évaluation

- 1 GENMATH DiomampoAyessa Brochure SA2Document2 pages1 GENMATH DiomampoAyessa Brochure SA2Marjorie ChavezPas encore d'évaluation

- Credit Eda Case Study: Aparna Trivedi Ashish Nipane DS C29Document13 pagesCredit Eda Case Study: Aparna Trivedi Ashish Nipane DS C29aparnaPas encore d'évaluation

- Singapore Property Weekly Issue 284Document11 pagesSingapore Property Weekly Issue 284Propwise.sgPas encore d'évaluation

- Money Demand, The Equilibrium Interest Rate, and Monetary PolicyDocument29 pagesMoney Demand, The Equilibrium Interest Rate, and Monetary PolicyAbood AlissaPas encore d'évaluation

- TVR Format - Shrikrushn Namdev Kavar - TF4343554Document19 pagesTVR Format - Shrikrushn Namdev Kavar - TF4343554Nikhil MohanePas encore d'évaluation

- Caraga Administrative Region Division of Surigao Del NorteDocument21 pagesCaraga Administrative Region Division of Surigao Del NorteLex AmariePas encore d'évaluation

- Chapter 18Document4 pagesChapter 18Alex GuPas encore d'évaluation