Académique Documents

Professionnel Documents

Culture Documents

CRM

Transféré par

Ankush GuptaDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

CRM

Transféré par

Ankush GuptaDroits d'auteur :

Formats disponibles

5/4/12

Customer Profitability and Customer Relationship Management (Abridged) RBC FINANCIAL GROUP

Click to edit Master subtitle style

Ankush Gupta

5/4/12

To Be Cont

RBC Group: RBC Royal Bank, RBC Insurance, RBC Investments, RBC Capital Markets, RBC Global Services. RBC Royal Bank is accounted for 50% of RBCs cash net income. 20% of RBC customers are responsible for 100% profit of RBC. CRM to gain competitive advantage and to increase customer profitability.

5/4/12

Situation

Bank has adopted CRM in early 90s to gain competitive advantage. the time of installation, it keeps on upgrading the program. of worry is: Though fresh CRM program is more effective but on revenues, previous one scored better.

From

Point

5/4/12

Lets go

Bank

Started with the basic mode of upon:

CRM.

Emphasizing

Self Service Hours

Convenient

Accessibility Reach

ability

5/4/12

CRM at Royal Bank

Click to edit Master subtitle style

1997, A study was conducted to find out what aspect of banking, customers value most. Involving 2000

5/4/12

Marketing Study Results

Reorganization around CRM

5/4/12

Primary customer segmentsKey, Growth, and Primewere used to realign Royal Banks business . This friendly competition was designed to foster close collaboration between functional areas, product and segment managers, and centers of expertise (such as marketing, CRM, and SMR&A).

5/4/12

5/4/12

CRM, then what?

Through CRM, one can get customer profitability data, personal details like needs, expectations and preferences. Now what to do?

What How

do we do with this information?

can the Bank derive value from CRM and customer profitability?

5/4/12

Bank

to centralize sales lead generation, locating the sales and marketing groups. and future customer profitability to determine targeted direct marketing campaigns, levels of

current

customer service other customer-oriented decision-making.

Customer Profitability & Potential Measurement @ Royal Bank

To find out the potential customers, Royal Bank segmented its customers into 3 buckets 1. A Most Profit Generating Customers 2. B Some Profit generating customers 3. C Broke even or lost money It helps the Royal bank to align the sales force & to fish out the New

5/4/12

5/4/12

Value Analyzer (developed by NCR group)

To manage huge database and maintaining good processing , even when the transactions were on. This problem is solved by adopting Value Analyzer, which it is used to calculate the customer profitability as fast as it required

5/4/12

Output From Value Analyzer

By

using Value Analyzer, bank found profitability ranking changed at least 70% of rankings changed by 1. More accurate separate information 2. Customer specific risk assessment 3. Transactions based fee 4. Cost element

5/4/12

Nexus (for potentially profitable customers)

Profitability model designed by using 1. Detailed & accurate data of customers 2. Activity Based Costing (ABC) of customer

5/4/12

Activity based costing

5/4/12

Lifetime Value Personal direct marketing

5/4/12

Bank Client Card

SMR&A comes with a smart card for all account holders with Royal Bank. It includes all the client information such as 1. Age 2. Address 3. Who product the customer holds. 4. Targeted for particular lone of credit product. It emphasis branches to make better

5/4/12

Comparision

Based on how people rate on each model they are classified into 14 categories, for which banks have a specific objective: 1. Retain 2. Grow 3. Manage Client Risk 4. Optimize Cost These categories are used for 1. Marketing Effectiveness

Customer profitability for Customer Decision

5/4/12

Customers decision depends upon 1. Customized marketing campaign 2. Alignment of pricing discretion 3. Alignment of level of service Based up on the depth & potential of a relationship. Customer decision refer to customer strategies that are build in decision engine. Engine contains a multitude of

5/4/12

Vous aimerez peut-être aussi

- AOL.com (Review and Analysis of Swisher's Book)D'EverandAOL.com (Review and Analysis of Swisher's Book)Pas encore d'évaluation

- CRMDocument23 pagesCRMAnkush GuptaPas encore d'évaluation

- Prevalent Practices: Group 03 Jindi EnterprisesDocument3 pagesPrevalent Practices: Group 03 Jindi EnterprisesNamit RastogiPas encore d'évaluation

- How To Avoid CatastropheDocument17 pagesHow To Avoid CatastropheMonika AgarwalPas encore d'évaluation

- Jindi EnterprizeDocument11 pagesJindi EnterprizeRahul NagrajPas encore d'évaluation

- JINDI Group 5Document12 pagesJINDI Group 5Ankit VarshneyPas encore d'évaluation

- Quality Function Deployment (QFD) PDFDocument5 pagesQuality Function Deployment (QFD) PDFJohn David BaraquiaPas encore d'évaluation

- World Economic Forum in Collaboration With Accenture Noted That This Sector Is Not Only An "Important Enabler of The Fourth Industrial Revolution,"Document5 pagesWorld Economic Forum in Collaboration With Accenture Noted That This Sector Is Not Only An "Important Enabler of The Fourth Industrial Revolution,"Sunny JoonPas encore d'évaluation

- How Smart, Connected Products Are Transforming CompetitionDocument14 pagesHow Smart, Connected Products Are Transforming CompetitionReshma MajumderPas encore d'évaluation

- DMM09 Customer Relationship Management: Assignment IDocument15 pagesDMM09 Customer Relationship Management: Assignment ICharu Modi100% (1)

- Case Analysis by Group 7Document5 pagesCase Analysis by Group 7Dandamudi RamyaPas encore d'évaluation

- Jindi Enterprises: Anushka Gambhir Section - B 170101121Document9 pagesJindi Enterprises: Anushka Gambhir Section - B 170101121Himanish BhandariPas encore d'évaluation

- What Is CRM?Document30 pagesWhat Is CRM?Kv ArunPas encore d'évaluation

- Jindi ShikhaDocument11 pagesJindi ShikhaShikha TickooPas encore d'évaluation

- CRM DellDocument10 pagesCRM DellSaurabh SharmaPas encore d'évaluation

- RBC LTVDocument4 pagesRBC LTVShikha GuptaPas encore d'évaluation

- PV Technologies, Inc.:: Were They Asleep at The Switch?Document11 pagesPV Technologies, Inc.:: Were They Asleep at The Switch?Sumedh BhagwatPas encore d'évaluation

- Cathay Pacific Airways Assignment-2 QuestionsDocument2 pagesCathay Pacific Airways Assignment-2 Questionssiddharth arkhePas encore d'évaluation

- Vertical NetDocument35 pagesVertical NetAkshay TalrejaPas encore d'évaluation

- E Business Model Metal JunctionDocument7 pagesE Business Model Metal Junctionmonendra_ritPas encore d'évaluation

- "Think Fresh, Deliver More": A PresentationDocument63 pages"Think Fresh, Deliver More": A PresentationKapil Kumar JhaPas encore d'évaluation

- E - Choupal - Critical AnalysisDocument10 pagesE - Choupal - Critical AnalysisRajatPas encore d'évaluation

- Harrah'S Crm-Capitalising On Customer Lifetime ValueDocument20 pagesHarrah'S Crm-Capitalising On Customer Lifetime ValueSuvashis MahapatraPas encore d'évaluation

- CroonDocument6 pagesCroonLakshmi SrinivasanPas encore d'évaluation

- Mahindra & MahindraDocument4 pagesMahindra & MahindramailtovinayvermaPas encore d'évaluation

- Real Options: We Will Maintain Our Highly Disciplined Approach To CapitalDocument32 pagesReal Options: We Will Maintain Our Highly Disciplined Approach To CapitalAbhishek PuriPas encore d'évaluation

- Hunter Business GroupDocument2 pagesHunter Business GroupPratyushGarewalPas encore d'évaluation

- How Did The CMR-Blackstone Relationship Evolve Over TimeDocument3 pagesHow Did The CMR-Blackstone Relationship Evolve Over TimeUday KumarPas encore d'évaluation

- Case Analysis IPremierDocument18 pagesCase Analysis IPremieravigupta91Pas encore d'évaluation

- HW 9 (JSNT)Document10 pagesHW 9 (JSNT)Kunal BPas encore d'évaluation

- Case - JD-Invoice and BlockchainDocument14 pagesCase - JD-Invoice and BlockchainALI SHANPas encore d'évaluation

- Flexcon 1Document2 pagesFlexcon 1api-534398799100% (1)

- MDCM CaseDocument4 pagesMDCM CaseSabyasachi SahuPas encore d'évaluation

- Class Assignment: Minhaj University Lahore Hamdard Chowk Township LahoreDocument3 pagesClass Assignment: Minhaj University Lahore Hamdard Chowk Township LahoreJunaid AhmadPas encore d'évaluation

- Delivery Strategy At: Supply Chain Management (IE 659) Professor - Dr. Sanchoy K. DasDocument19 pagesDelivery Strategy At: Supply Chain Management (IE 659) Professor - Dr. Sanchoy K. DasNicolas TellezPas encore d'évaluation

- CRM 101Document25 pagesCRM 101sayansambitPas encore d'évaluation

- RPG Spencer Case SolutionDocument14 pagesRPG Spencer Case Solutionnisaant001100% (1)

- Mumbai Dabbawala CaseDocument33 pagesMumbai Dabbawala CaseAbhijit DasPas encore d'évaluation

- Supply Chain Management: Post Graduate Programme in ManagementDocument3 pagesSupply Chain Management: Post Graduate Programme in Managementvijay kumarPas encore d'évaluation

- 14 - Case Study 1 - International Marketing Strategy in The Retail Banking Industry - The Case of ICICI Bank in CanadaDocument18 pages14 - Case Study 1 - International Marketing Strategy in The Retail Banking Industry - The Case of ICICI Bank in CanadaSaiby99Pas encore d'évaluation

- Infosys ConsultingDocument16 pagesInfosys ConsultingSaurabh VickyPas encore d'évaluation

- Group2 SectionA ReshapingITGovernanceInOctoDocument12 pagesGroup2 SectionA ReshapingITGovernanceInOctoDiksha SinghPas encore d'évaluation

- Developing Professionals: The BCG WayDocument7 pagesDeveloping Professionals: The BCG WayNitish KishorePas encore d'évaluation

- Roland Berger Study Banking Myanmar Sept PDFDocument28 pagesRoland Berger Study Banking Myanmar Sept PDFYosia SuhermanPas encore d'évaluation

- Marketing When Customer Equity MattersDocument2 pagesMarketing When Customer Equity MattersDevante DixonPas encore d'évaluation

- Le PetitDocument3 pagesLe PetitHarish Chandra JoshiPas encore d'évaluation

- IBM-Managing Brand EquityDocument78 pagesIBM-Managing Brand EquityTry Lestari Kusuma Putri0% (1)

- Candy and Chocolate India (CCI) - Last Mile Distribution ChallengeDocument6 pagesCandy and Chocolate India (CCI) - Last Mile Distribution ChallengeUmesh SonawanePas encore d'évaluation

- A Presentation By: Syndicate 8 Systems and FinanceDocument13 pagesA Presentation By: Syndicate 8 Systems and FinanceArun Koshy Thomas100% (2)

- SDM Assignment 5 (Group 9) - Understanding Customer ValueDocument3 pagesSDM Assignment 5 (Group 9) - Understanding Customer ValueSAMIKSHAPas encore d'évaluation

- Vendor Managed Inventory FinaleDocument14 pagesVendor Managed Inventory FinaleApurva DagliPas encore d'évaluation

- AmulDocument9 pagesAmulAshik NavasPas encore d'évaluation

- Moller IndustriesDocument6 pagesMoller IndustriesAshu SinghPas encore d'évaluation

- (Group9) Cyworld Case StudyDocument8 pages(Group9) Cyworld Case StudyamiutamiPas encore d'évaluation

- Pricing To Capture ValueDocument30 pagesPricing To Capture ValueArshad RS100% (1)

- Ques TestDocument3 pagesQues Testaastha124892823Pas encore d'évaluation

- Infosys: Growing Share of Customers Business: Murtaza Adenwala Roll No. 016 Organization: Experian IndiaDocument8 pagesInfosys: Growing Share of Customers Business: Murtaza Adenwala Roll No. 016 Organization: Experian IndiaArun PatilPas encore d'évaluation

- CRM RBCDocument14 pagesCRM RBCKarthik ArumughamPas encore d'évaluation

- Customer Relationship Management: Present By:-Ravi JainDocument16 pagesCustomer Relationship Management: Present By:-Ravi JainAnthonyPas encore d'évaluation

- RBC Financial GroupDocument25 pagesRBC Financial GroupRangan Majumder100% (1)

- Pricing Case Study - Penetrative Pricing of Jio (Impact On The Industry) 4Document4 pagesPricing Case Study - Penetrative Pricing of Jio (Impact On The Industry) 4Vyshnavi L RPas encore d'évaluation

- E Payments in MauritiusDocument3 pagesE Payments in Mauritiuskurs23Pas encore d'évaluation

- Trust ReceiptsDocument23 pagesTrust ReceiptskarenkierPas encore d'évaluation

- Swot Analysis of The Manufacturing and Service IndustryDocument15 pagesSwot Analysis of The Manufacturing and Service Industrypramita160775% (8)

- Internship Report Bank IslamicDocument53 pagesInternship Report Bank Islamicnizihunzai80% (5)

- Your Barclays Bank Account StatementDocument1 pageYour Barclays Bank Account StatementНазарій ТершівськийPas encore d'évaluation

- Third Div PNB Vs Pasimio 2015Document16 pagesThird Div PNB Vs Pasimio 2015Jan Veah CaabayPas encore d'évaluation

- The Effect of The Liquidity Management On Profitability in The Jordanian Commercial BanksDocument11 pagesThe Effect of The Liquidity Management On Profitability in The Jordanian Commercial BanksSAMIR GAMITPas encore d'évaluation

- A Joint Development Between S R Jindal Group & Prestige GroupDocument2 pagesA Joint Development Between S R Jindal Group & Prestige GroupSampath Kumar RPas encore d'évaluation

- Administered Interest Rates in IndiaDocument17 pagesAdministered Interest Rates in IndiatPas encore d'évaluation

- JLPT Application Form Method-December 2023Document3 pagesJLPT Application Form Method-December 2023Sajiri KamatPas encore d'évaluation

- China in AfricaDocument22 pagesChina in AfricaayankayodePas encore d'évaluation

- Presentation - RbiDocument10 pagesPresentation - Rbianandvishnubnair72% (18)

- Statement Jazzy1 EstatementDocument2 pagesStatement Jazzy1 EstatementJoshua HansonPas encore d'évaluation

- Documentary Credit ApplicationDocument4 pagesDocumentary Credit ApplicationThanh HuyenPas encore d'évaluation

- FT Business EducationDocument76 pagesFT Business EducationDenis VarlamovPas encore d'évaluation

- Generate BillDocument3 pagesGenerate Billmpumi.lelo12Pas encore d'évaluation

- Sale, Lease and Credit Agreements 2009Document3 pagesSale, Lease and Credit Agreements 2009qanaqPas encore d'évaluation

- BOC Main Branch ContactDocument3 pagesBOC Main Branch ContactshakecokePas encore d'évaluation

- Analyze The Roles of International Payment in An Open EconomyDocument22 pagesAnalyze The Roles of International Payment in An Open EconomyNgô Giang Anh ThưPas encore d'évaluation

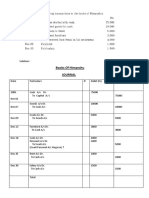

- Books of Himanshu JournalDocument4 pagesBooks of Himanshu Journalrakesh19865Pas encore d'évaluation

- VFIPL Annual Report FY 2022 23Document134 pagesVFIPL Annual Report FY 2022 23Shiva BhardwajPas encore d'évaluation

- TifrDocument3 pagesTifrgrasheedPas encore d'évaluation

- Preparing FinancialDocument18 pagesPreparing FinancialAbhishek VermaPas encore d'évaluation

- Company Profile of HDFC BankDocument3 pagesCompany Profile of HDFC BankAkash Ðaya Sinha50% (4)

- GFC2007Document15 pagesGFC2007Nur Hidayah JalilPas encore d'évaluation

- III.j-solid Builders v. China Banking, 695 SCRA 101Document2 pagesIII.j-solid Builders v. China Banking, 695 SCRA 101Jerwin Cases TiamsonPas encore d'évaluation

- Summary of ChargesDocument12 pagesSummary of ChargesVinayPas encore d'évaluation

- Economics Art IntegrationDocument19 pagesEconomics Art IntegrationAditi AKPas encore d'évaluation

- Cash & Cash EquivalentsDocument5 pagesCash & Cash EquivalentsVanessa DozonPas encore d'évaluation