Académique Documents

Professionnel Documents

Culture Documents

Berkshire Threaded Fasteners Co.: Question 1: Drop 300 As of 1/1/74?

Transféré par

YousifDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Berkshire Threaded Fasteners Co.: Question 1: Drop 300 As of 1/1/74?

Transféré par

YousifDroits d'auteur :

Formats disponibles

Berk 1

Berkshire Threaded Fasteners Co.

Question 1: Drop 300 as of 1/1/74?

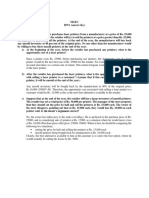

Volume = 501,276 units of 100 items each CM/100 = $1.15 (2.70 - 1.55) CM = ~$576,000, rounded or more precisely $1,355 - $773 = $582 Profit now Lost CM Loss $70 ($576) ($506) $70 ($582) ($512)

An alternative format to show the same result is: Std. profit on 100 Std. loss on 200 Fixed costs from 300 (still incurred)(693) + the variances * (favorable) 138 (103)

146 (512)

*This assumes there is no volume effect in these variances, the bulk of which come from over absorption of fixed costs due to the volume increase in 1974.

Berk 2

Other Issues For Discussion in Conjunction with Question 1

Define variable cost. Table TC-1 is a useful summary for Berkshire.

Define fixed cost. What does it mean when the accountant states the cost is fixed?

Should labor be considered variable? In many foreign countries and many leading U.S. firms (IBM, Hallmark, HP) this cost is considered fixed. When labor is treated as variable cost, the behavioral implications regarding motivation and commitment can be serious management problems. Is the problem insufficient volume? Can you reasonably expect to get more? [A commodity product in a down market and in an industry in long-term decline.]

Berk 3

TC-1 Contribution Margin by Product1973

Per Unit

List Price Net Price Variable Costs Per Table 3) Factory Labor Raw Materials Power Repairs Total Contribution Margin Allocated Fixed Expenses Full Cost Profit

#100

$2.45 $2.42 .61 .63 .01 .01 $1.26 $1.16 $1.02 $ .14

#200

$2.58 $2.52 .59 .75 .02 .01 $1.37 $1.15 $1.29 ($ .14)

#300

$2.75 $2.70 .70 .81 .03 .01 $1.55 $1.15 $1.38 ($ .23)

Berk 4

TC-2 Berkshire1973 Earning StatementContribution Format

Units (100) CM/100 CM $(000)

Fixed Costs Rent Factory Overhead Selling Administration Depreciation Interest Total Fixed Costs Allocated Fixed Cost Full Cost Profit $2,199 $ 295 $1,323 ($ 149) $1,364 ($ 219) #100 2,132K $ 1.16 $2,494 #200 1,030K $ 1.15 $1,174 #300 987K $ 1.15 $1,145 Total

$4,813 530 360 1,839 653 1,359 145 4,886 ($ 73)

Berk 5

Management Inferences Regarding Series 300

1. If only contribution analysis is used, a company will never drop any product since it is rare for a product not to cover its variable costs. 2. What should be done when a once successful product stops covering its full costs, as product 300 has? One possibility: develop a product with a higher margin that will use the same assets and can be priced in excess of its full costs. 3. Would you want all your products to have the same characteristics as the 300 line?

Berk 6

Drop 300 Series?

World View In the long run, all costs are variable In the long run, 300 is a loser on a full cost basis In the long run, were all dead Never drop products with positive CM, in spite of negative profit Long run never starts! Keep 300 Right answer in the short run

Long run starts today! Managerial Implication: Drop 300 Right answer in the long run

When do you decide to take action on a product that is OK on a short-run basis but terrible on a long-run basis? When does the long-run start, if not NOW?

Berk 7

Question 2

Here is the conventional relevant cost analysis for the pricing choice:

Net Revenue 2.42 Less Variable Costs 1.26 Unit Contribution Margin 1.16 Volume 750,000 (2) Total Contribution $ $870,000 Pricing Decision 2.22 1.26 .96 1,000,000 (1) $960,000

1.This represents holding on to current volume levels. How likely is this when the overall market is weakening and we are matching industry price? 2.This represents holding on to 75% of current volume in a weakening market (for a commodity product) while charging 10% above market price. How plausible is this? Is this a long-run or short-run view?

3. Will the fixed costs be the same across these two production levels?

Berk 8

Comparative Contribution Margin vs Comparative Profit

The contribution margin approach to Question 2 provides a rationale for cutting the price. This can be interpreted as saying that the lower price is more profitable. Actually, the lower price is not viable, long run, although it results in a lower loss!

Is contribution margin thinking helpful here? Or, is it a trap which camouflages the long run loss position? A CM perspective suggests higher volume can compensate for lower margin per unit:

Price CM

$2.42 1.16

$2.22 .96

(Can I get enough more volume at the $.96CM/unit to compensate in total CM dollars?) A full cost perspective suggests clearly that volume cannot compensate for a losing price:

Profit

$.14

($.06)

No volume level can make a losing price equally profitable with a profitable price!

Berk 9

Management Inferences Regarding the Pricing Decision

1. Berkshire sells a commodity product in an industry where several of its competitors are much larger. Bosworth, the dominant company, has announced a price reduction on product line 100. 2. Berkshire has no alternative but to meet Bosworths price. The choice is to match the new price or exit the business. We do not need any financial analysis to reach this conclusion. 3. However, financial analysis can point out that product line 100, on a full cost basis, is now a big loser. Thus, the low price (which Berkshire is forced to meet) is hardly a viable option for the company in the future. 4. When do we take some substantial action about positioning or cost for this product?

Berk 10

The Managerial View on Fixed Costs

One view: Incorporating fixed costs while making decisions is clearly suspect because:

The resulting per unit amount is only accurate at one particular volume level. It may confuse people by making a fixed cost appear to be a variable cost. It involves arbitrary allocation rules which cannot be justified/verified. It distorts Cost-Volume-Profit (CVP) relationships. Economic theory suggests that fixed costs are irrelevant for short-run decisions.

Berk 11

The Counterview

Economic theory suggests that fixed costs are relevant in the long run.

Many decisions are more long run than short run (there are very few pure short run decisions) Fixed costs must be covered by the products in aggregate, so why not charge each product for a fair share? Whereas full cost distorts the short run perspective, incremental cost distorts the long run view... Which is a bigger sin? Business history reveals as many sins by taking an incremental view as by taking a full cost view (consider the Braniff Fallacy!).

Berk 12

The Braniff Fallacy

Full fare from Dallas to New York? Full cost + return on investment = $500 Incremental cost = $.79 [for the extra meal (sic)] If charge $99, to fill up the airplane, contribution per passenger = $98.21 There will be contribution, But no profit!

Berk 13

Are the Fixed Costs Relevant for Pricing Decisions?

In Cost Driven Businesses (The seller is a pure price taker.) Cost is clearly irrelevant for pricing. But, Price < Full Cost says: Exit the business or cut cost. In Imperfect Competition (Far and away the more typical situation. All players offer a somewhat unique blend of Product Features/Availability/Terms/Quality/Service/Image/...) Fixed Expenses represent, ex ante, attempts to create monopoly rents. They thus represent a going-in proxy for anticipated value to the customer. If a firm does not attempt to price for them, the firm is disavowing the ex ante differentiation strategy!

Berk 14

Fixed Overhead Allocations1973

(percent of total)

Product Volumes Net Sales ($) Sales (Units) 100 49.5% 51.4% 200 24.9% 24.8% 27.0% 300 25.6% 23.8% 27.9%

The Overall Allocation % 45.1% Individual Overhead Items Selling 49.5% Depreciation 41.6% Other Factory 38.9% General Administration52.8% Rent 35.3% Interest 35.9%

24.9% 31.5% 30.6% 19.9% 29.5% 27.6%

25.6% <=Based on Sales $ 26.9% 30.6% 27.2% 35.1% 36.2%

NOTE: However they allocated the costs, it isnt a simple rule!

Berk 15

Question 3: Which is Berkshires most profitable product?

Some Possible Measures of Profitability #100 #200 #300 1. PBTFull Cost Basis $295 (149) (219) 2. PBT/UnitFull Cost Basis .14 (.14) (.23) 3. Contribution: Total $ 2,494 1,174 1,145 As % of sales revenue 48% 45% 43% Per Unit 1.16 1.15 1.15 4. Assume Labor is the Scarce resource. The idea here is CM per unit of scarce resource. Contribution per DL Hour DL$/4.20= DLH/unit #100 .61/4.20 = .145238 #200 .59/4.20 = .140476 #300 .70/4.20 = .166667

CM/DLH per unit $1.16/.145238 $1.15/.140476 $1.15/.166667

$7.99 $8.18 $6.90

5. Contribution per machine hour? 6. Value added: Sales Price - (Raw Material + Power) 7. Other Measures... ?

1.78

1.75

1.86

Berk 16

Some Observations About The Comparative Product Profitability Analysis

1. Other than selling expense, which is clearly allocated on the basis of sales revenue, the other allocations are somewhat puzzling and seem to favor product 100 (50% of sales but only 45% of overhead) and penalize product 200 and product 300 (25% of sales and ~28% of overhead). 2. Alternative ways of allocating what are apparently common costs (Selling, Depreciation, Rent, Administration) can change the ranking of products and can make any of the three a net loser. Does this mean cost allocation is meaningless, or that we should make sure we do the cost allocation as carefully as possible? 3. No one financial metriccontribution per unit, profit per unit, contribution as % of sales, profit as % of sales, product level ROIis defensible across all decision contexts. 4. Each of the three products excels on at least one metric. 5. None of the products looks like a real winner, in the long run. That is, from a broad managerial context, Berkshire has no most profitable product. All three products are dogs!

Berk 17

An Approximate Balance Sheet (000)

ASSETS Cash $ 1.0M Accounts Receivables 1.3M Inventory 1.3M Equipment-Cost* $27.2M Accumulated Deprn*(13.6M) 13.6M Total $17.2M ASSUMPTIONS: CASHCase says $1 million kept on hand. One months revenue is equal to about $.9M. ACCOUNTS RECEIVABLE45 days sales revenue would be about average for an industrial firm. This is 12.5% of sales. INVENTORY12.5% of sales is 1.3M which implies 6 inventory turns (7.9 1.3 = 6). *EQUIPMENT COSTthis is 20 times the yearly depreciation expense, per case Exhibit 3. ACCUMULATED DEPRECIATIONassumes that equipment is 1/2 depreciated, on average. Older $13.6 (10.0) 3.6 Newer $13.6 (3.6) 10.0 LIABILITIES & OWNERS EQUITY Accounts Payable $ .4M Long Term Debt Owners Equity (Plug) Total 2.4M 14.4M $17.2M

ACCOUNTS PAYABLEassume 45 days raw material purchases. LONG TERM DEBTcalculated from the interest expense, using a 6% interest rate as shown in Exhibit 3 of the case. EQUITY is a plug, given the other assumptions.

Berk 18

Dupont Analysis

Profit Margin =

Net Income Sales Sales Assets

Asset Turns =

=

ROA =

Net Income Assets

Leverage =

Assets Equity

=

ROE =

Net Income Equity

Berk 19

Dupont Analysis 1974, Annualized

Profit Margin = Asset Turns = = ROA = Leverage = = ROE =

Net Income Sales

= =

140 11,163

= 1.2% = .64

Sales Assets

11,163 17,400

Net Income Assets

=

=

140 17,400

= .8%

= 1.2

Assets Equity

17,400 14,500

=

Net Income Equity 140 14,500

= 1%

Berk 20

Situation Recap

Inferences

Profit contribution > 40% of sales price for all 3 products Fixed costs as a percent of sales @ 47% Specifically, selling cost as a percent of sales (17%) is very high High direct labor as a percent of sales (25%)

Implications

Not bad for an industrial commodities firm Very high for a commodity producer Berkshire spends too much in the sales channel. Or, cost is high because its hard to move me too items! Might imply a highly skilled workforce. Or, we did not cut back the workforce as markets weakened? Capacity not fully utilized Metal fasteners in New England after the post WWII boom of the 50s and 60s?!? Current situation is terminal A grocery store business with jewelry store cost structure Competition (Bosworth) has lower costs, if we can interpret the $2.25 price on 100 as a signal, vs. A stupid gambit. Me too Moi aussi Mir auch Stuck in the Middle

High depreciation as a percent of sales Not likely to see volume growth in this industry All 3 products are long-term, full-cost losers (@ $2.25 on the 100 series) Berkshire does not achieve differentiation Berkshire does not achieve cost leadership

Berk 21

The Strategic Position?

Berkshire does not achieve product differentiation.

Berkshire does not achieve low cost leadership. Berkshire is stuck in the middle in a seriously declining industry. Given this assessment of the current position of Berkshire, what choices do they have? Slide 22 shows some of their options. We dont plan to spend much time on this list or to push very hard for a firm solution, but we believe it is useful to provide this kind of context at the end of the class. Taking a narrow perspective on questions 1, 2, and 3 using relevant cost analysis just does not capture the richness of the management dilemma in this case. In summary, we think this is an excellent case near the beginning of the course. It provides good reinforcement on basic cost analysis concepts for add/drop, product emphasis, and competitive pricing. But it also shows these concepts in the context of a much richer management setting which can be used to illustrate a broader vision of the role of managerial cost analysis.

Berk 22

Berkshire FastenersBasic Strategic Options

I. Change the Product Mix Note that no mix of 3 losing products can gain real success. II. Cost Reduction (Retrench?) Note that a small player like Berkshire is never likely to win the cost leadership battle.

III. SWOT Analysis might imply trying to become a Contract Manufacturing Shop

We have good machines, workers and sales people but poor products. Can we sell our manufacturing capability to firms who are willing to buy manufacturing? IV. New Products - Evaluate key strengths we could use for new products - Find niches that play to our strengths V. Sell the Company Quick!! To whom? Why? What will they do with it? Does Bosworth need extra capacity? (Unlikely.) Is there really any going concern value (goodwill) for Berkshire?

VI. Hunker Down & Hope

Rationalize do nothing by more study!

Berk 23

Top 10 Reasons Why Berkshire Isnt A Particularly Well-Managed Firm

10. They are not a market leaderlack of vision? They are just a me too player, stuck in the packIf you arent the lead dog, the view is pretty much the same all the time! 9. They accept the idea that their products are commodities. No attempts at differentiation. Strictly a price-taker (no apparent marketing strategy at all). A dangerously useless variance reporting format (Exhibit 4). No kaizen perspective1974 standards equal 1973 actual costs.

8. 7. 6.

Berk 24

Top 10 Reasons Why Berkshire Isnt A Particularly Well-Managed Firm

5. 4. 3. They treat the labor force as a variable cost. They use inspectors (treat quality as an inspection issue). They treat repairs as a variable cost (vs. programmable maintenance). How would you like to fly an airline that treats maintenance as a variable cost? They build allowable scrap rates into the standard materials cost and thus condone normal waste. How much waste should be allowable?

2.

1.

The firm is earning seriously inadequate returns on invested capitalunintended gradual liquidation of shareholder value.

Vous aimerez peut-être aussi

- Gyaan Kosh: Global EconomicsDocument19 pagesGyaan Kosh: Global EconomicsU KUNALPas encore d'évaluation

- BendingDocument3 pagesBendingSatyamPas encore d'évaluation

- MGEC2 MidtermDocument7 pagesMGEC2 Midtermzero bubblebuttPas encore d'évaluation

- DMOP Homework 1 Q6Document1 pageDMOP Homework 1 Q6khushi kumariPas encore d'évaluation

- CFL Adoption at WalmartDocument3 pagesCFL Adoption at WalmartShorya PariharPas encore d'évaluation

- Berkshire Threaded Fasteners Company CaseDocument2 pagesBerkshire Threaded Fasteners Company Casesmart200100% (2)

- MGECDocument8 pagesMGECSrishtiPas encore d'évaluation

- PRICING EXERCISES ANALYSISDocument14 pagesPRICING EXERCISES ANALYSISvineel kumarPas encore d'évaluation

- TFC Scenario AnalysisDocument3 pagesTFC Scenario AnalysisAshish PatelPas encore d'évaluation

- Victoria Project TemplateDocument15 pagesVictoria Project TemplateAbhijit KoundinyaPas encore d'évaluation

- Cost Volume ProfitDocument15 pagesCost Volume Profitprashant0071988Pas encore d'évaluation

- Harrington Collection Explores Growth in Active-Wear MarketDocument13 pagesHarrington Collection Explores Growth in Active-Wear MarketPoonam Chauhan100% (2)

- Pricing To Capture ValueDocument30 pagesPricing To Capture ValueArshad RSPas encore d'évaluation

- Problem Set 6 - Mixed SetDocument3 pagesProblem Set 6 - Mixed SetRitabhari Banik RoyPas encore d'évaluation

- MGEC HW1 Answer Key ExplainedDocument8 pagesMGEC HW1 Answer Key ExplainedAnujain JainPas encore d'évaluation

- Eco 4Document5 pagesEco 4SamidhaSinghPas encore d'évaluation

- Hypothesis Testing QuestionsDocument20 pagesHypothesis Testing QuestionsAbhinav ShankarPas encore d'évaluation

- Multivariate Data Analysis Assignment: Discriminant Analysis (3 Groups)Document6 pagesMultivariate Data Analysis Assignment: Discriminant Analysis (3 Groups)Niharika MondalPas encore d'évaluation

- Virgin Mobile USA: Pricing for the First TimeDocument5 pagesVirgin Mobile USA: Pricing for the First Timebonfument100% (1)

- QMDocument87 pagesQMjyotisagar talukdarPas encore d'évaluation

- 1 Sampling DistDocument35 pages1 Sampling DistYogeshPas encore d'évaluation

- Glenorna Coffee PDFDocument10 pagesGlenorna Coffee PDFAMITPas encore d'évaluation

- Sale Value (5b) Sales Growth 5 (A) & 4 (A) (%) (6b) Sales Growth (6 (A) and 4 (A) (%)Document4 pagesSale Value (5b) Sales Growth 5 (A) & 4 (A) (%) (6b) Sales Growth (6 (A) and 4 (A) (%)SMRITI MEGHASHILAPas encore d'évaluation

- Wills LifestyleDocument2 pagesWills LifestylekrunalpshahPas encore d'évaluation

- B2B-End Term-2016 PDFDocument5 pagesB2B-End Term-2016 PDFSubrat Rath50% (2)

- Kingfisher Vs Fosters With Porters Five ForcesDocument32 pagesKingfisher Vs Fosters With Porters Five Forcesvenkataswamynath channa100% (5)

- Social Class Influences on Consumer Purchase CriteriaDocument29 pagesSocial Class Influences on Consumer Purchase CriteriaIshtiaq IshaqPas encore d'évaluation

- CH 2ansDocument3 pagesCH 2ansab khPas encore d'évaluation

- ME Problem Set-IX (2019)Document4 pagesME Problem Set-IX (2019)Divi KharePas encore d'évaluation

- hw#2 PDFDocument5 pageshw#2 PDFEkta VaswaniPas encore d'évaluation

- Natureview FarmDocument2 pagesNatureview FarmBen Hiran100% (1)

- Hospital Supply Inc.Document4 pagesHospital Supply Inc.alomelo100% (2)

- Cashlet 4Document3 pagesCashlet 4Vinay SharmaPas encore d'évaluation

- Assignment 8Document3 pagesAssignment 8Priyadarshini BalamuruganPas encore d'évaluation

- 5dbdcadfc4731 Hul TechtonicDocument1 page5dbdcadfc4731 Hul TechtonicARVINDPas encore d'évaluation

- Asian PaintsDocument13 pagesAsian PaintsGOPS000Pas encore d'évaluation

- Technological Change Best Explains Wage InequalityDocument7 pagesTechnological Change Best Explains Wage InequalityDoshi VaibhavPas encore d'évaluation

- Ome Merged PDFDocument311 pagesOme Merged PDFNavya MohankaPas encore d'évaluation

- LP Formulation ExercisesDocument10 pagesLP Formulation ExercisesLakshay NagpalPas encore d'évaluation

- Amal EPGP10 008 Atlantic ComputersDocument5 pagesAmal EPGP10 008 Atlantic ComputersAMAL ARAVINDPas encore d'évaluation

- Group4 CMRDocument11 pagesGroup4 CMRTarun N. O'Brain GahlotPas encore d'évaluation

- Sample ProblemsDocument9 pagesSample ProblemsDoshi VaibhavPas encore d'évaluation

- The Company: Strength WeaknessDocument10 pagesThe Company: Strength Weaknessvky2929Pas encore d'évaluation

- ERR Lyle SugarDocument3 pagesERR Lyle SugarShubham GuptaPas encore d'évaluation

- The Firm's Approach To Pollution ControlDocument1 pageThe Firm's Approach To Pollution ControlSean Chris ConsonPas encore d'évaluation

- Netflic Case StudyDocument7 pagesNetflic Case Studyaatish100% (1)

- Atlantic ComputerDocument4 pagesAtlantic Computerrahul agarwalPas encore d'évaluation

- SCM - Managing Uncertainty in DemandDocument27 pagesSCM - Managing Uncertainty in DemandHari Madhavan Krishna KumarPas encore d'évaluation

- MADM - IN-CLASS QUIZ SOLUTIONSDocument11 pagesMADM - IN-CLASS QUIZ SOLUTIONSPiyush SharmaPas encore d'évaluation

- Berkshire Threaded FastenersDocument3 pagesBerkshire Threaded FastenersVenkatesh Gopal100% (1)

- Service Operations Management Lecture IIDocument9 pagesService Operations Management Lecture IISiddharthaChowdaryPas encore d'évaluation

- ECO7 WorksheetDocument9 pagesECO7 WorksheetSaswat Kumar DeyPas encore d'évaluation

- IIMA Daksh PGPX Resume PreparationDocument13 pagesIIMA Daksh PGPX Resume PreparationUtkarsh SinhaPas encore d'évaluation

- ExercisesDocument3 pagesExercisesrhumblinePas encore d'évaluation

- Break Even Analysis - Biopure CaseDocument4 pagesBreak Even Analysis - Biopure CaseYagyaaGoyalPas encore d'évaluation

- Abhishek 2 - Asset Id 1945007Document3 pagesAbhishek 2 - Asset Id 1945007Abhishek SinghPas encore d'évaluation

- Cambridge Software Corp Modeler Version & Pricing StrategyDocument1 pageCambridge Software Corp Modeler Version & Pricing Strategynikhil_200011Pas encore d'évaluation

- ISBAMPI Studenthandbook 2018Document1 pageISBAMPI Studenthandbook 2018ravindrarao_mPas encore d'évaluation

- OM Case Presentation - Group9Document12 pagesOM Case Presentation - Group9ptgoel100% (1)

- Drop Product 300 Due to Insufficient Contribution MarginDocument13 pagesDrop Product 300 Due to Insufficient Contribution MarginMridu ChadhaPas encore d'évaluation

- 10% Off Geomancy Services Promotion Ending Feb 4Document34 pages10% Off Geomancy Services Promotion Ending Feb 4Lisa SusiloPas encore d'évaluation

- 2012 Significant Astrological DatesDocument4 pages2012 Significant Astrological DatesYousifPas encore d'évaluation

- The Apple Iphone: Successes and Challenges For The Mobile IndustryDocument35 pagesThe Apple Iphone: Successes and Challenges For The Mobile IndustryYousifPas encore d'évaluation

- 2012 Operational CalendarDocument1 page2012 Operational CalendarYousifPas encore d'évaluation

- CH 06 Examples Long Term ContractsDocument15 pagesCH 06 Examples Long Term ContractsYousifPas encore d'évaluation

- CH 01 HarrisonDocument65 pagesCH 01 HarrisonYousifPas encore d'évaluation

- Processing Accounting Information: QuestionsDocument57 pagesProcessing Accounting Information: QuestionsYousifPas encore d'évaluation

- 1.0 DefinitionDocument43 pages1.0 DefinitionfloraPas encore d'évaluation

- M12 Bade 9418 04 Ch10aDocument16 pagesM12 Bade 9418 04 Ch10aVanny Van Sneidjer100% (2)

- AI APPLICATION TO SEGMENTED MARKETINGDocument4 pagesAI APPLICATION TO SEGMENTED MARKETINGjafmanPas encore d'évaluation

- Solution Manual Strategic Management An Integrated Approach 10th Edition by Charles W. L. HillDocument6 pagesSolution Manual Strategic Management An Integrated Approach 10th Edition by Charles W. L. HillJam PotutanPas encore d'évaluation

- ECO 514 - Section 1Document7 pagesECO 514 - Section 1fnusrat.duPas encore d'évaluation

- Honda's Success in the US Auto IndustryDocument2 pagesHonda's Success in the US Auto IndustryAira Gene MenesesPas encore d'évaluation

- IIMA CasebookDocument106 pagesIIMA CasebookTanujPas encore d'évaluation

- Relevant Costing and DMDocument10 pagesRelevant Costing and DMabdulqadeersoomro50Pas encore d'évaluation

- IGCSE Economics Self Assessment Chapter 15 AnswersDocument3 pagesIGCSE Economics Self Assessment Chapter 15 AnswersDesre100% (1)

- International E-Marketing Opportunities and IssuesDocument13 pagesInternational E-Marketing Opportunities and IssuesKrisztina GyorfiPas encore d'évaluation

- MS EconomicsDocument16 pagesMS EconomicsSachinPas encore d'évaluation

- Baudrillard's Hyperreality Theory ExplainedDocument58 pagesBaudrillard's Hyperreality Theory ExplainedJerryPas encore d'évaluation

- IGCSE Economics Notes With Syllabus StatmentsDocument48 pagesIGCSE Economics Notes With Syllabus StatmentsMeemzii79% (14)

- AterheafsDocument96 pagesAterheafsMarielle AlcantaraPas encore d'évaluation

- MyPhone - Digital MarketingDocument21 pagesMyPhone - Digital MarketingNathanael Talatala67% (3)

- Avlonitis Pricing Objectives and Pricing Methods inDocument11 pagesAvlonitis Pricing Objectives and Pricing Methods inBianca CotellessaPas encore d'évaluation

- Porter Five Forces Analysis Steel IndustryDocument8 pagesPorter Five Forces Analysis Steel Industrydivakar62100% (3)

- Mosey, David. PPC 2000 - The First Standard Form of Contract For Project PartneringDocument18 pagesMosey, David. PPC 2000 - The First Standard Form of Contract For Project Partnering1NFORMA2 1nforma2Pas encore d'évaluation

- Business Plan Tote Bag CompanyDocument64 pagesBusiness Plan Tote Bag CompanyMuhamad RiskiPas encore d'évaluation

- Aditya Birla Group: Strategic Business Unit-Idea Cellular LimitedDocument20 pagesAditya Birla Group: Strategic Business Unit-Idea Cellular LimitedParth ShashooPas encore d'évaluation

- Chapter 6 Production and Cost Analysis in The Long RunDocument16 pagesChapter 6 Production and Cost Analysis in The Long Runtk_atiqahPas encore d'évaluation

- Defining Public EnterprisesDocument11 pagesDefining Public EnterprisesHoney Jane Tabugoc TajoraPas encore d'évaluation

- IIM B CasebookDocument174 pagesIIM B CasebookKajal Joshi100% (1)

- Effectiveness of Marketing Strategies in Sales Performance of Local Food Businesses in Silang Cavite During The PandemicDocument39 pagesEffectiveness of Marketing Strategies in Sales Performance of Local Food Businesses in Silang Cavite During The PandemicJuvilyn SolisPas encore d'évaluation

- Download ebook Economics For Business Pdf full chapter pdfDocument60 pagesDownload ebook Economics For Business Pdf full chapter pdfcurtis.williams851100% (21)

- NikeDocument2 pagesNikeTran Thanh Ha (K15 HL)Pas encore d'évaluation

- First Periodical Examination Part 1. Multiple Choice (1 Pt. Each)Document6 pagesFirst Periodical Examination Part 1. Multiple Choice (1 Pt. Each)Febby Grace Villaceran Sabino0% (1)

- Bgcse Coursework CommerceDocument8 pagesBgcse Coursework Commercepkhdyfdjd100% (2)

- Endogenous Growth Model: Romer ModelDocument24 pagesEndogenous Growth Model: Romer ModelMehran Usmani100% (1)

- Hill PPT 13e chp01Document40 pagesHill PPT 13e chp01tatischanho61Pas encore d'évaluation