Académique Documents

Professionnel Documents

Culture Documents

Equity Comparison Between Alberta & British Columbia On

Transféré par

Kamal Kaur GrewalDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Equity Comparison Between Alberta & British Columbia On

Transféré par

Kamal Kaur GrewalDroits d'auteur :

Formats disponibles

Equity comparison between alberta & british columbia on the basis of personal income tax systems

Click to edit Master subtitle style

4/10/12

Why is this issue important ?

It affects the economic wellbeing of the residents (taxpayers) of both provinces.

4/10/12

Issues being addressed

Is Progressive tax system fairer than proportional tax system? Which tax system promotes better equity (vertical and horizontal)? Which tax system reduces income inequalities?

4/10/12

hypothesis

Progressive tax system in BC leads to better equity as compared to the proportionate tax system in Alberta

4/10/12

Few Facts about the provinces

British Columbia

Alberta

Population - 4,400,057 GDP - C$191.006billion Population - 3,779,400 GDP per capita - C$41,689 GDP - C$178.225 billion Unemployment rate 6.9% GDP per capita - C$49,563 (Feb 2012) Unemployment rate 5.4% Minimum Wage (Sept 2011) May 1, 2011 $8.75/hour; Minimum Wage November 1, 2011 September 2011 9.40/hour $9.50/hour; May 1, 2012 $10.25/hour Main industries Forestry, Main industries Oil and Gas, Petrochemicals, Agriculture, Mining, Fisheries, Agriculture, Food and Beverages, Tourism, Energy and transportation Industry Machinery and Equipment

4/10/12

Tax systems

Proportional Tax Progressive Tax System

Progressive tax system levies taxes according to the individuals income Rich pay more Poor pay less Stable income stream for the government Promotes horizontal and vertical equity

Proportional tax system is a system in which the proportion of income paid in taxes is the same for all income levels. Rich pay more Poor pay more Revenues vary according to the income Promotes horizontal equity only

4/10/12

Tax brackets

British Columbia

2012 Tax Rates 5.06%

Alberta

2012 Tax Rates

2012 Taxable Income first $37,013

2012 Taxable Income Total taxable income

over $37,013 up 7.70% to $74,028 over $74,028 up 10.50% to $84,993 over $84,993 up 12.29% to $103,205 over $103,205 14.70%

10%

4/10/12

Hey, wait a minute..!!

4/10/12

Fact BC has the highest income inequality in canada

4/10/12

Methodology for analysis

Comparison of Gini coefficients for Market Income, Total Income and After tax income to identify income inequalities between BC and Alberta

Market Income - Total income before tax minus income from government sources. Total Income - Total income refers to income from all sources including government transfers and before deduction of federal and provincial income taxes. After-tax Income - After-tax income is total income, which includes government transfers, less income tax.

4/10/12

GINI coefficient

The Gini coefficient is a number between zero and one that measures the relative degree of inequality in the distribution of income. The coefficient would register zero (minimum inequality) and it would register a coefficient of one (maximum inequality). To calculate the Gini coefficient, you divide the orange area (A) by the sum of the orange and blue areas (A + B).

4/10/12

Income inequality in canada is on rise

Statistics Canada. Table 202-0705 - Gini coefficients of market, total and after-tax income, by economic family type, annual (number)

4/10/12

Gini coefficients for market income

Statistics Canada. Table 202-0705 - Gini coefficients of market, total and after-tax income, by economic family type, annual (number)

4/10/12

Gini coefficients for total income

Statistics Canada. Table 202-0705 - Gini coefficients of market, total and after-tax income, by economic family type, annual (number)

4/10/12

Gini coefficients for after-tax income

Statistics Canada. Table 202-0705 - Gini coefficients of market, total and after-tax income, by economic family type, annual (number) 4/10/12

Reasons explaining inequality

1. Low Wages A particular job in Alberta pays you more as compared to the same job in BC.

Source Living in Canada Website

2. Low Tax Credits as compared to Alberta

4/10/12

PROVINCIAL COMPARISON - AVERAGE WEEKLY WAGE RATE

4/10/12

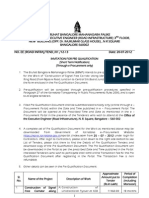

Non-refundable Tax credits

2012 Tax Credits (in dollars) Basic personal amount Spousal amount

British Columbia

Alberta 17,282 17,282 10,004 13,331 10,004 1,331 2,233 202 672 4,816 4/10/12

11,354 9,964

Infirm dependent amount 4,250 (18+) Disability amount Caregiver amount Pension income amount Medical expense 7,285 4,250 1,000 2,020

Education part time per 60 month Education full time per month Age amount 200 4,356

What can help?

What should alberta do?

Increase the minimum wage Public Interest Alberta discussed under the living wage campaign that a living wage would be much more than $12/hour

Start progressive tax system

4/10/12

What can help?

What should BC do? Increase the tax credits so that more money can stay in poor persons pocket. Increase the marginal tax rates for higher income brackets. Demolish PST.

4/10/12

Questions?

4/10/12

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (120)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Capacity Can Be Defined As The Ability To HoldDocument6 pagesCapacity Can Be Defined As The Ability To HoldAlex Santito KoK'sPas encore d'évaluation

- European Green Deal Commission Proposes Transformation of EU Economy and Society To Meet Climate AmbitionsDocument5 pagesEuropean Green Deal Commission Proposes Transformation of EU Economy and Society To Meet Climate AmbitionsclarencegirlPas encore d'évaluation

- MGT604 Assessment 2.aDocument9 pagesMGT604 Assessment 2.aGoyal PrachiPas encore d'évaluation

- Test Bank For International Economics 14th Edition Robert CarbaughDocument24 pagesTest Bank For International Economics 14th Edition Robert Carbaughcourtneyharrisbpfyrkateq100% (43)

- ContemporaryDocument104 pagesContemporaryJunna May AradoPas encore d'évaluation

- Increased Decreased: Sample: Cash in Bank Account Was DebitedDocument3 pagesIncreased Decreased: Sample: Cash in Bank Account Was DebitedAtty Cpa100% (2)

- Abeel V Bank of America Etal Trillions 4 12Document390 pagesAbeel V Bank of America Etal Trillions 4 12James SempseyPas encore d'évaluation

- 1-2150585510952 431765387 70080XXXXX 11 2022Document4 pages1-2150585510952 431765387 70080XXXXX 11 2022jagadishporichhaPas encore d'évaluation

- Ee Roadinfra Tend 01Document3 pagesEe Roadinfra Tend 01Prasanna VswamyPas encore d'évaluation

- Assessment Test Week 6 (ECO 2) - Google FormsDocument3 pagesAssessment Test Week 6 (ECO 2) - Google FormsNeil Jasper CorozaPas encore d'évaluation

- Addresses of AMC Branches 160711Document40 pagesAddresses of AMC Branches 160711kimsrPas encore d'évaluation

- Excel Modeling in Investments 4th Edition Holden Solutions ManualDocument87 pagesExcel Modeling in Investments 4th Edition Holden Solutions Manualvictoriawaterswkdxafcioq100% (16)

- Convenience Stores AnalysisDocument8 pagesConvenience Stores AnalysisPedro ViegasPas encore d'évaluation

- The Importance of Work EthicsDocument5 pagesThe Importance of Work Ethicsalimoya13Pas encore d'évaluation

- BCG Matrix of Itc LTD v02 1222197387335911 8Document25 pagesBCG Matrix of Itc LTD v02 1222197387335911 8Shaswat NigamPas encore d'évaluation

- Macro and Micro Economics of MalaysiaDocument13 pagesMacro and Micro Economics of MalaysiaGreyGordonPas encore d'évaluation

- Unit 2 Paper 2 QuestionsDocument5 pagesUnit 2 Paper 2 QuestionsStacy Ben50% (2)

- OPER8340 - Assignment #2 - F20Document3 pagesOPER8340 - Assignment #2 - F20Suraj Choursia0% (1)

- m1 InstDocument28 pagesm1 Instdpoole99Pas encore d'évaluation

- (PDF) The Impact of Financial Education in High School and College On Financial Literacy and Subsequent Financial Decision MakingDocument71 pages(PDF) The Impact of Financial Education in High School and College On Financial Literacy and Subsequent Financial Decision MakingJerry LacsamanaPas encore d'évaluation

- Intelligent Business: Management in Mid-Sized German CompaniesDocument8 pagesIntelligent Business: Management in Mid-Sized German Companiesrafael goesPas encore d'évaluation

- Ch17 WagePayDocument14 pagesCh17 WagePaydaPas encore d'évaluation

- Cap2 Sfma Summer Paper 2013 - FinalDocument6 pagesCap2 Sfma Summer Paper 2013 - FinalXiaojie LiuPas encore d'évaluation

- Voltas Annual Report 2009-2010Document120 pagesVoltas Annual Report 2009-2010L R SADHASIVAMPas encore d'évaluation

- Factors in Engineering Economy Excel FunctionsDocument12 pagesFactors in Engineering Economy Excel FunctionsHerliaa AliaPas encore d'évaluation

- GCG MC 2017-03, Implementing Rules and Guidelines of EO No 36, S 2017Document13 pagesGCG MC 2017-03, Implementing Rules and Guidelines of EO No 36, S 2017bongricoPas encore d'évaluation

- Enginuity Kronos SpecsDocument33 pagesEnginuity Kronos SpecsmandapatiPas encore d'évaluation

- Strategy, Organization Design and EffectivenessDocument16 pagesStrategy, Organization Design and EffectivenessJaJ08Pas encore d'évaluation

- Corporate Finance Project On Descon in PakistanDocument43 pagesCorporate Finance Project On Descon in PakistanuzmazainabPas encore d'évaluation

- Compensation of General Partners of Private Equity FundsDocument6 pagesCompensation of General Partners of Private Equity FundsManu Midha100% (1)