Académique Documents

Professionnel Documents

Culture Documents

Auditors, Directors &

Transféré par

Monal PatelDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Auditors, Directors &

Transféré par

Monal PatelDroits d'auteur :

Formats disponibles

A companys annual report contains not only the financial statements and notes thereon, but also certain

financial report as well. The most common and statutorily required reports are: [1] Auditors report [2] Directors report [3] Corporate Governance report

Corporate annual reports also contain certain financial reports. Auditors report plays an important role in ensuring financial discipline in a company. Directors report is the is the annual score card of the performance of the company, to its owner.

Requirements of the companies act Companies order, 2003 or CARO [1] applicability [2] matters to be included in the auditors report - fixed assets - inventory - loans granted to/taken from companies and firms in which directors are firms in which directors are interested

- internal control system - transactions with companies and firms in which directors are interested - public deposits - internal audit system - cost accounts and records - statutory dues - accumulated loses - default in repayment in loans - loans granted against securities - chit fund, mutual benefit fund/societies - companies dealing in securities

- third party guarantees - application of loan for the intended purpose - use of short term funds for long term investment - preferential allotment - creation of charge on debentures - end use of public issue - frauds Reason to be stated for unfavourable or qualified answers Significance and implications of auditors report

Reasons to be stated for unfavourable or qualified answers. Significance and implications of auditors report Corporate financial practices Analysis of the auditors report

Requirements of the companies act Corporate financial practices Analysis of directors report

INTRODUCTION:

The fundamental objective of corporate governance is investor protection & enhancement of shareholder's wealth, keeping in view the interests of other stakeholders. Corporate governance report seeks to report the effectiveness with which the mgt is discharging its responsibilities towards attaining its objectives.

In 1996, the confederation of Indian industry[CII] took a special initiative on corporate governance- the first institutional initiative in the Indian industry on the subject. A national task force was set up with Rahul Bajaj, chairman & managing director, Bajaj Auto Ltd, as its chairman. The objective was to develop & promote a code for corporate governance to be adopted & followed by Indian companies.

Kumar Mangalam Birla committee on corporate governance Scope & importance of corporate governance. Fundamental objective

SEBI considered the recommendations of the Kumar Mangalam Birla Committee & directed stock exchanges on 21st February,2000 to incorporate a new clause on corporate governance, namely clause49, in the listing agreement. The clause was amended a number of times & was applicable upto 31st december,2005.

Clause 49: corporate governance: The company agrees to comply with the following provisions: Board of directors 1.composition of board 2.non executive directors compensation & disclosures 3.other provisions as to board & committees 4.code of conduct

Audit committee 1.qualified & independent audit committee 2.meeting of audit committee 3.powers of audit committee 4.role of audit committee 5.review of information by audit committee Subsidiary companies Disclosures 1.basis of related party transactions 2.disclosures of accounting treatment 3.board disclosures-risk mgt 4.proceeds from public issues, right issues, preferential issues etc.

5.remunaration of directors 6.mgt 7.shareholders CEO/CFO certification Report on Corporate Governance Compliance

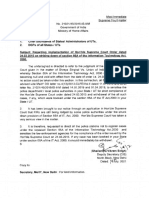

Listing agreement refers to audit committee set up pursuant to the provisions of the companies act, section 292A which deals with the Audit committee, was introduced in the Companies act by the companies act, 2000 with effect from 13th December 2000.

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Prepared By:: Monal Patel Mohshinali MominDocument21 pagesPrepared By:: Monal Patel Mohshinali MominMonal PatelPas encore d'évaluation

- Chapter 14Document24 pagesChapter 14Monal PatelPas encore d'évaluation

- 07 00Document128 pages07 00Monal PatelPas encore d'évaluation

- Ch01 Ten Priciples of EconomicsDocument27 pagesCh01 Ten Priciples of EconomicsMonal PatelPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Answering Brief of Defendants-Appellees: Ronald Pierce et al vs. Chief Justice Tani Cantil-Sakauye Judicial Council Chair and Steven Jahr Judicial Council Administrative Director - Federal Class Action Lawsuit for Alleged Illegal Use of California Vexatious Litigant Law by Family Court Judges in Child Custody Disputes - Ventura County - Tulare County - Sacramento County - San Mateo County - Santa Clara County - Riverside County - San Francisco County - US District Court for the Northern District of California Judge Jeffrey S. White - US Courts for the Ninth Circuit - 9th Circuit Court of Appeal Class Action for Injunctive and Declaratory ReliefDocument171 pagesAnswering Brief of Defendants-Appellees: Ronald Pierce et al vs. Chief Justice Tani Cantil-Sakauye Judicial Council Chair and Steven Jahr Judicial Council Administrative Director - Federal Class Action Lawsuit for Alleged Illegal Use of California Vexatious Litigant Law by Family Court Judges in Child Custody Disputes - Ventura County - Tulare County - Sacramento County - San Mateo County - Santa Clara County - Riverside County - San Francisco County - US District Court for the Northern District of California Judge Jeffrey S. White - US Courts for the Ninth Circuit - 9th Circuit Court of Appeal Class Action for Injunctive and Declaratory ReliefCalifornia Judicial Branch News Service - Investigative Reporting Source Material & Story Ideas100% (1)

- Demand of NoticeDocument6 pagesDemand of NoticeBhuvneshwari RathorePas encore d'évaluation

- PwC Webinar on the Extractive Sector Transparency Measures Act (ESTMADocument40 pagesPwC Webinar on the Extractive Sector Transparency Measures Act (ESTMAShravan EtikalaPas encore d'évaluation

- Heirs of Hilario Ruiz Vs Edmond RuizDocument2 pagesHeirs of Hilario Ruiz Vs Edmond RuizParis Valencia100% (1)

- Competition Project - CartelsDocument18 pagesCompetition Project - CartelsalviraPas encore d'évaluation

- PCW Barangay VAW Desk Handbook Tagalog December 2019Document112 pagesPCW Barangay VAW Desk Handbook Tagalog December 2019Genele PautinPas encore d'évaluation

- CAVB - Appointment BookingHERODEDocument2 pagesCAVB - Appointment BookingHERODEmerlinebelony16Pas encore d'évaluation

- Unit Nature of ContractDocument102 pagesUnit Nature of ContractdanielPas encore d'évaluation

- CHAPTER 4 - Basic Numbering System of Police ReportsDocument4 pagesCHAPTER 4 - Basic Numbering System of Police ReportsAilyne CabuquinPas encore d'évaluation

- Leyte-Samar Sales Co. vs. Cea and LastrillaDocument7 pagesLeyte-Samar Sales Co. vs. Cea and LastrillaVeepee PanzoPas encore d'évaluation

- in Re Buscayno v. MIlitary CommissionDocument4 pagesin Re Buscayno v. MIlitary CommissionKim B.Pas encore d'évaluation

- Balancing Fairness in Illegal ContractsDocument14 pagesBalancing Fairness in Illegal ContractsNii ArmahPas encore d'évaluation

- Slump Sale AgreementDocument35 pagesSlump Sale AgreementSagar Teli100% (1)

- Sworn Statement of Accountability of The PreparersDocument2 pagesSworn Statement of Accountability of The PreparersLugid YuPas encore d'évaluation

- PRC-Hospital Blood Services AgreementDocument4 pagesPRC-Hospital Blood Services Agreementagelesswap100% (2)

- Flowchart Institution of Proceedings For The Discipline of Judges and JusticesDocument1 pageFlowchart Institution of Proceedings For The Discipline of Judges and JusticesKristine Delos SantosPas encore d'évaluation

- Application For Subsequent Release of Educational Assistance LoanDocument2 pagesApplication For Subsequent Release of Educational Assistance LoanNikkiQuirantePas encore d'évaluation

- OrdinanceDocument5 pagesOrdinancearnelditanPas encore d'évaluation

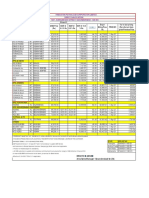

- HPCL PRICE LIST FOR VISAKH, MUMBAI, CHENNAI, VIJAYAWADA AND SECUNDERABAD DEPOTSDocument1 pageHPCL PRICE LIST FOR VISAKH, MUMBAI, CHENNAI, VIJAYAWADA AND SECUNDERABAD DEPOTSaee lwePas encore d'évaluation

- Job Completion TempDocument1 pageJob Completion Temprichard2509Pas encore d'évaluation

- United States v. Bruce Hoover, United States of America v. Michael Tete Simmons, A/K/A Money, 23 F.3d 403, 4th Cir. (1994)Document3 pagesUnited States v. Bruce Hoover, United States of America v. Michael Tete Simmons, A/K/A Money, 23 F.3d 403, 4th Cir. (1994)Scribd Government DocsPas encore d'évaluation

- Leave PolicyDocument5 pagesLeave PolicyanamikabmwPas encore d'évaluation

- Taningco v. Fernandez, Gr. No. 215615, December 9,2020Document3 pagesTaningco v. Fernandez, Gr. No. 215615, December 9,2020Jemielle Patriece Narcida100% (1)

- SC examines validity of Maratha reservation and 102nd Constitution AmendmentDocument569 pagesSC examines validity of Maratha reservation and 102nd Constitution AmendmentKrushna PanchalPas encore d'évaluation

- District Court - Online Public Records - Remote TerminalDocument5 pagesDistrict Court - Online Public Records - Remote TerminalSELA - Human Rights Alert - IsraelPas encore d'évaluation

- Mha Advisory 396650Document1 pageMha Advisory 396650Qwerty541Pas encore d'évaluation

- The ICC and Confronting Myths in AfricaDocument24 pagesThe ICC and Confronting Myths in AfricaWendel DamascenoPas encore d'évaluation

- NM Civil Guard Filed Verified ComplaintDocument39 pagesNM Civil Guard Filed Verified ComplaintAlbuquerque JournalPas encore d'évaluation

- RA 10927 An Act Designating Casinos As Covered Persons Under RA 9160 Anti Money Laundering ActDocument4 pagesRA 10927 An Act Designating Casinos As Covered Persons Under RA 9160 Anti Money Laundering ActRMN Rommel DulaPas encore d'évaluation

- 2019 New Civil ProcedureDocument47 pages2019 New Civil ProcedureJayPas encore d'évaluation