Académique Documents

Professionnel Documents

Culture Documents

Role of Goverment in Entrepreneurship

Transféré par

Daryll Bryan AbacanCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Role of Goverment in Entrepreneurship

Transféré par

Daryll Bryan AbacanDroits d'auteur :

Formats disponibles

1 2 3

Technological University of the Philippines College of Industrial Education

ENTREPRENEURSHIP

Presenter: Sylvia Beltran Guevarra

Role of Goverment in Entrepreneurship Developme

POLICIES AND LAWS

House Bill No. 3825

An act providing for the development of entrepreneurship skills among government employees for an innovation inspired corps of civil servants and productive post-service citizenry.

POLICIES AND LAWS

SECTION 1. Short Title This act shall be known as the Government Employees Entrepreneurship Development Act of 2008

SECTION 2. Declaration of Policy It shall be the policy of the State to enhance the human and intellectual capital of the government and to ensure a healthy and productive life for government employees after they shall have been retired from public service.

POLICIES AND LAWS

SECTION 3. Objectives

(a) To Ensure the continues flow of innovative and development-oriented government programs and projects for entrepreneurial development and

(b) To ensure the maintenance of highly competitive government employees and the creative use of such resources whether in-service or postservice.

POLICIES AND LAWS

SECTION 4. Establishment of Entrepreneurial Programs All government offices and agencies shall prepare a post-service Entrepreneurship Development Program (EDP) for its employees based on guidelines prescribed by the Civil Service Commission

SECTION 5. Establishment of Cooperatives and Service Loan Associations

All government agencies hall promote and support the establishment of cooperatives with the assistance of the Cooperative Development Authority and savings and loan associations, by recognizing, protecting and upholding the right of employees.

POLICIES AND LAWS

SECTION 6. Networking with Government Financial Institutions The agency head concerned shall link with existing government financial institutions (GFIs) to provide sources of financing for the entrepreneurial projects of its employees.

SECTION 7. Creation of a Coordinating Council on Government Employees Entrepreneurship Development Program

A coordinating Council on Government Employees Entrepreneurship Development Program, herein referred to as the Council, is hereby created with shall be headed by the Chairperson Civil Service Commission (CSC).

POLICIES AND LAWS

SECTION 8. Post-Service Assistance All government agencies shall extend post-service assisstance to their retirees and shall include this function in their Human Resources Department (HRD). SECTION 9. Application of Present Law The provision of Republic Act No. 6713, otherwise known as the Code of Conduct and Ethical Standards for the public Officials and Employees, under Section 7, on Prohibited Acts and Transactions, subparagraphs (a), (b) and (c), shall be observed in the implementation of this act.

POLICIES AND LAWS

SECTION 10. Implementing Rules and Regulations The Civil Service Commission, in coordination with the members of the Council, shall promulgate the rules and regulations needed to implement the provisions of the act. SECTION 11. Separability Clause If any section or provision of this Act shall be declared invalid or unconstitutional, such shall not invalidate any other section or provision of this Act.

POLICIES AND LAWS

SECTION 12. Repealing Clause All laws, presidential decrees, executive orders, other executive issuances or parts thereof which are inconsistent with this Act are hereby repealed or modified accordingly.

SECTION 13. Effectivity Clause

This act shall take effect fifteen (15) days after its publication in the Official Gazette or in a national newspaper of general circulation.

Legal Aspects: Philippine SME Best Practices

LEGAL ASPECTS (Philippines SME Best Practices)

Basic SME Policies

I.

Magna Carta for Small Enterprises (RA 6977 as amended by RA 8289)

This Magna Carta is the landmark legislation which reflects the current policy to foster a dynamic SME sector, particularly rural and agri-based manufacturing ventures. This law is guided by three (3) principles: 1. Minimal set of rules and simplification of procedures and requirements 2. Participation of private sector in the implementation of SME policies and programs 3. Coordination of government efforts

LEGAL ASPECTS (Philippines SME Best Practices)

Basic SME Policies

I.

Magna Carta for Small Enterprises (RA 6977 as amended by RA 8289)

Three (3) major provisions contained in the Small Enterprise Act:

1. Creation of the Small and Medium Enterprise Development Council

2. Creation of the Small Business Guarantee and Finance Corporation 3. 8% mandatory allocation to SMEs (6% for Ses, 2% for MEs)

LEGAL ASPECTS (Philippines SME Best Practices)

Basic SME Policies

II. An Act Providing Assistance to Women (RA 7882) These recognizes the special role of women in development and supports women entrepreneurs who are engaged in manufacturing, processing, service and trading businesses. The Government Financing Institutions (GFIs) are mandated to provide assisstance to: 1. Non-government organization (NGOs) engaged in developing womens enterprises to a limit of P2M 2. Existing Women enterprises to the upper limit if P50,000; and 3. Potential women entrepreneurs with sufficient training up to a limit of P25,000 each.

LEGAL ASPECTS (Philippines SME Best Practices)

Basic SME Policies

III. SME Development Strategy, 1998 The SME had its strategies that prioritizes the following five strategic imperatives in SME development: 1. Narrowing the focus by identifying priority sectors 2. Promoting mutually beneficial linkages among small and large firms - Promote industrial-subcontracting exchange schemes.

3. Strengthening technology and R&D initiatives - Boost agencies effort in examining and promoting technologies that would benefit SMEs.

LEGAL ASPECTS (Philippines SME Best Practices)

Basic SME Policies

III. SME Development Strategy, 1998

4. Bolstering human resource development - Create and expand curricular training programs in entrepreneurship, management and technical skills for SMEs.

5. Improving access to finance - Develop innovative financing schemes using non-traditional sources and schemes such as cooperatives and associations and equity financing and venture capital respectively.

LEGAL ASPECTS (Philippines SME Best Practices)

Basic SME Policies

IV. Philippine Export Development, 1999-2001

The PEDP 1999-2001 provides the guide to boost export performance for the next time three years and lay the groundwork to develop a sustainable and globally-competitive export industry. It puts emphasis on the synergy and complementation among the various programs and initiatives to

create a unified and cohesive agenda.

LEGAL ASPECTS (Philippines SME Best Practices)

Basic SME Policies

IV. Philippine Export Development, 1999-2001 The export-led agenda is supported by the following strategies. 1. Provision of a macroeconomic environment that promotes competitiveness, efficiency, and entrepreneurship. This includes maintenance of a low and stable domestic inflation rate, competitive exchange rate and favorable interest policy.

2. Improving market access and mark presence.

Policy Level Opening up of new markets by acceding to various multilateral agreements.

LEGAL ASPECTS (Philippines SME Best Practices)

Basic SME Policies

IV. Philippine Export Development, 1999-2001 Institutional support Department of Trade and Industry will focus no effective

representation and negotiations to improve market access, conduct of commercial intelligence. Private trade and investment promotion through private sector or corporate entities. Promote the development of strong and professional industry associations.

LEGAL ASPECTS (Philippines SME Best Practices)

Basic SME Policies

IV. Philippine Export Development, 1999-2001 Programs

National Communication Plan for Export Promotion

Expand market presence through Electronic Commerce

Use counter-trade and South-South trade as tolls for export expansion Supplement available resources for export promotion through bilateral/multilateral technical cooperation programmes and foreign assisted projects.

LEGAL ASPECTS (Philippines SME Best Practices)

Basic SME Policies

IV. Philippine Export Development, 1999-2001 3. Developing a competitive export base. Policy Level The PEDP presents a comprehensive Export Policy Agenda and outlines specific policy directions and initiatives necessary to support the export drive. It is presented in the following headings Financing Investment and Incentives Cost of Doing Business Agricultural Policies Technology Agenda Education and Training Employment Policy, labor and Productivity Competition Policy, Liberalization, and Intl Commitments Institutional Framework

LEGAL ASPECTS (Philippines SME Best Practices)

Basic SME Policies

IV. Philippine Export Development, 1999-2001 Institutional Reports

Export Development Council provides the forum for participatory governance DTI is the primary agency responsible for the implementation of the plan. DTI will draw sound advice from the Eminent Persons Group, a top level Committee, composed of rejected and accomplished Filipino Expert Involvement of private sectors/industry associations in policy and program formulation and delivery systems for competitive SME planning and implementation.

LEGAL ASPECTS (Philippines SME Best Practices)

Basic SME Policies

IV. Philippine Export Development, 1999-2001 Programs

Clustering of Industries Formulating a policy framework for service exports Developing backward linkages for exports Promotion of global companies: competitiveness upgrading Product search program Promotion of Information Management Conduct of Bilateral and Multilateral programs Investment promotion Identification of materials support clusters

LEGAL ASPECTS (Philippines SME Best Practices)

Basic SME Policies

IV. Philippine Export Development, 1999-2001 4. Information: As core trade development service. Strengthening of primary focal points for delivering, information

services related to export such as the Philippine Trade

Information and Network System (PHILTINS) and, One Stop Export Information Assistance Center (EXPONENT) Electronically linking up all DTI offices and commercial posts around the world to facilitate information exchange.

LEGAL ASPECTS (Philippines SME Best Practices)

Basic SME Policies

V. Other SME Initiatives Preliminary recommendations for the promotion and growth of SMEs: 1. Finance Increase and widen the access of SMEs Promote active participation of industry/trade/professional associations and Provincial SMEDCs in helping SMEs access financing from banks 2. Information Operationalize pro-active, efficient, comprehensive, reliable information delivery systems for competitive SME planning and increased productivity. Align databases according to SMEs needs. Promote IT/E-commerce.

LEGAL ASPECTS (Philippines SME Best Practices)

Basic SME Policies

V. Other SME Initiatives

3. Marketing Expand market share of selected sectors such as garments. Pursue trade promotions such as fairs, missions and promote IT/E-commerce in doing business. 4. Human Resource Development Increase the number of competent owners-managers and workers of SMEs Conduct benchmarking, documentation of best approaches in Human Resource Development

LEGAL ASPECTS (Philippines SME Best Practices)

Basic SME Policies

V. Other SME Initiatives

5. Technology Enhance productivity and competitiveness of SMEs through the effective and judicious application of technologies and related resources. Upgrade database systems on technologies for SMEs Match technology requirements of SMEs with existing programs/resources and conduct benchmarking activities.

LEGAL ASPECTS (Philippines SME Best Practices)

Basic SME Policies

The government of the Philippines is still open to new initiatives to properly position SMEs at competitive level in the global business arena. Similarly, there are efforts to tap the capital market as additional source of funds for SMEs. At present, eight small firms have been qualified for listing at the Philippine Stock Exchange Board but they have requested deferment until such time that the economy, so with the capital market, has fully recovered. Relative to this, there is a pending bill to establish a separate Board for SMEs which will be named as Small and Medium Stock Exchange (SMEX).

Thank you for listening.

rra Sylvia Beltran Guevarra Sylvia Beltran Guevarra Sylvia Beltran Guevarra Sylvia Beltran Guevarra Sylvia Beltran Guevarra Beltran Guevarr

Vous aimerez peut-être aussi

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Nissan E-NV200 Combi UKDocument31 pagesNissan E-NV200 Combi UKMioMaulenovoPas encore d'évaluation

- Prevalence of Peptic Ulcer in Patients Attending Kampala International University Teaching Hospital in Ishaka Bushenyi Municipality, UgandaDocument10 pagesPrevalence of Peptic Ulcer in Patients Attending Kampala International University Teaching Hospital in Ishaka Bushenyi Municipality, UgandaKIU PUBLICATION AND EXTENSIONPas encore d'évaluation

- Powerpoint Presentation R.A 7877 - Anti Sexual Harassment ActDocument14 pagesPowerpoint Presentation R.A 7877 - Anti Sexual Harassment ActApple100% (1)

- MBA - Updated ADNU GSDocument2 pagesMBA - Updated ADNU GSPhilip Eusebio BitaoPas encore d'évaluation

- Intro S4HANA Using Global Bike Solutions EAM Fiori en v3.3Document5 pagesIntro S4HANA Using Global Bike Solutions EAM Fiori en v3.3Thăng Nguyễn BáPas encore d'évaluation

- BACE Marketing Presentation FINALDocument14 pagesBACE Marketing Presentation FINALcarlosfelix810% (1)

- Danube Coin LaundryDocument29 pagesDanube Coin LaundrymjgosslerPas encore d'évaluation

- Design & Construction of New River Bridge On Mula RiverDocument133 pagesDesign & Construction of New River Bridge On Mula RiverJalal TamboliPas encore d'évaluation

- Introduction To Wireless and Mobile Systems 4th Edition Agrawal Solutions ManualDocument12 pagesIntroduction To Wireless and Mobile Systems 4th Edition Agrawal Solutions Manualethelbertsangffz100% (34)

- Dmta 20043 01en Omniscan SX UserDocument90 pagesDmta 20043 01en Omniscan SX UserwenhuaPas encore d'évaluation

- NX CAD CAM AutomationDocument12 pagesNX CAD CAM AutomationfalexgcPas encore d'évaluation

- Modulation and Frequency Synthesis X Digital Wireless RadioDocument233 pagesModulation and Frequency Synthesis X Digital Wireless Radiolcnblzr3877Pas encore d'évaluation

- Introduction To AirtelDocument6 pagesIntroduction To AirtelPriya Gupta100% (1)

- Ms Microsoft Office - WordDocument3 pagesMs Microsoft Office - WordFarisha NasirPas encore d'évaluation

- Active Directory FactsDocument171 pagesActive Directory FactsVincent HiltonPas encore d'évaluation

- Vodafone M2M Integrated M2M Terminals Overview BrochureDocument4 pagesVodafone M2M Integrated M2M Terminals Overview BrochureJamie JordanPas encore d'évaluation

- AkDocument7 pagesAkDavid BakcyumPas encore d'évaluation

- Question Paper: Hygiene, Health and SafetyDocument2 pagesQuestion Paper: Hygiene, Health and Safetywf4sr4rPas encore d'évaluation

- WHO Partograph Study Lancet 1994Document6 pagesWHO Partograph Study Lancet 1994Dewi PradnyaPas encore d'évaluation

- Bug Head - Fromjapanese To EnglishDocument20 pagesBug Head - Fromjapanese To EnglishAnonymous lkkKgdPas encore d'évaluation

- Pega AcademyDocument10 pagesPega AcademySasidharPas encore d'évaluation

- Bill Swad's Wealth Building Strategies - SwadDocument87 pagesBill Swad's Wealth Building Strategies - Swadjovetzky50% (2)

- Home Guaranty Corp. v. Manlapaz - PunzalanDocument3 pagesHome Guaranty Corp. v. Manlapaz - PunzalanPrincess Aliyah Punzalan100% (1)

- Economies and Diseconomies of ScaleDocument7 pagesEconomies and Diseconomies of Scale2154 taibakhatunPas encore d'évaluation

- 7Document101 pages7Navindra JaggernauthPas encore d'évaluation

- UBITX V6 MainDocument15 pagesUBITX V6 MainEngaf ProcurementPas encore d'évaluation

- Fundamental RightsDocument55 pagesFundamental RightsDivanshuSharmaPas encore d'évaluation

- Possession: I. A. Definition and Concept Civil Code Art. 523-530 CasesDocument7 pagesPossession: I. A. Definition and Concept Civil Code Art. 523-530 CasesPierrePrincipePas encore d'évaluation

- Numerical Transformer Differential RelayDocument2 pagesNumerical Transformer Differential RelayTariq Mohammed OmarPas encore d'évaluation

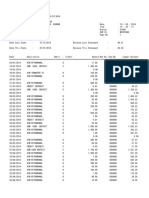

- Bank Statement SampleDocument6 pagesBank Statement SampleRovern Keith Oro CuencaPas encore d'évaluation