Académique Documents

Professionnel Documents

Culture Documents

TimeSeries (EX1)

Transféré par

Deep0 évaluation0% ont trouvé ce document utile (0 vote)

19 vues4 pagesTitre original

TimeSeries(EX1) (1)

Copyright

© © All Rights Reserved

Formats disponibles

XLSX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme XLSX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

19 vues4 pagesTimeSeries (EX1)

Transféré par

DeepDroits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme XLSX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 4

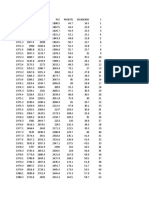

YEAR GDP PDI PCE PROFITS DIVIDENDS

1970.1 2872.8 1990.6 1800.5 44.7 24.5

1970.2 2860.3 2020.1 1807.5 44.4 23.9

1970.3 2896.6 2045.3 1824.7 44.9 23.3

1970.4 2873.7 2045.2 1821.2 42.1 23.1

1971.1 2942.9 2073.9 1849.9 48.8 23.8

1971.2 2947.4 2098 1863.5 50.7 23.7

1971.3 2966 2106.6 1876.9 54.2 23.8

1971.4 2980.8 2121.1 1904.6 55.7 23.7

1972.1 3037.3 2129.7 1929.3 59.4 25

1972.2 3089.7 2149.1 1963.3 60.1 25.5

1972.3 3125.8 2193.9 1989.1 62.8 26.1

1972.4 3175.5 2272 2032.1 68.3 26.5

1973.1 3253.3 2300.7 2063.9 79.1 27

1973.2 3267.6 2315.2 2062 81.2 27.8

1973.3 3264.3 2337.9 2073.7 81.3 28.3

1973.4 3289.1 2382.7 2067.4 85 29.4

1974.1 3259.4 2334.7 2050.8 89 29.8

1974.2 3267.6 2304.5 2059 91.2 30.4

1974.3 3239.1 2315 2065.5 97.1 30.9

1974.4 3226.4 2313.7 2039.9 86.8 30.5

1975.1 3154 2282.5 2051.8 75.8 30

1975.2 3190.4 2390.3 2086.9 81 29.7

1975.3 3249.9 2354.4 2114.4 97.8 30.1

1975.4 3292.5 2389.4 2137 103.4 30.6

1976.1 3356.7 2424.5 2179.3 108.4 32.6

1976.2 3369.2 2434.9 2194.7 109.2 35

1976.3 3381 2444.7 2213 110 36.6

1976.4 3416.3 2459.5 2242 110.3 38.3

1977.1 3466.4 2463 2271.3 121.5 39.2

1977.2 3525 2490.3 2280.8 129.7 40

1977.3 3574.4 2541 2302.6 135.1 41.4

1977.4 3567.2 2556.2 2331.6 134.8 42.4

1978.1 3591.8 2587.3 2347.1 137.5 43.5

1978.2 3707 2631.9 2394 154 44.5

1978.3 3735.6 2653.2 2404.5 158 46.6

1978.4 3779.6 2680.9 2421.6 167.8 48.9

1979.1 3780.8 2699.2 2437.9 168.2 50.5

1979.2 3784.3 2697.6 2435.4 174.1 51.8

1979.3 3807.5 2715.3 2454.7 178.1 52.7

1979.4 3814.6 2728.1 2465.4 173.4 54.5

1980.1 3830.8 2742.9 2464.6 174.3 57.6

1980.2 3732.6 2692 2414.2 144.5 58.7

1980.3 3733.5 2722.5 2440.3 151 59.3

1980.4 3808.5 2777 2469.2 154.6 60.5

1981.1 3860.5 2783.7 2475.5 159.5 64

1981.2 3844.4 2776.7 2476.1 143.7 68.4

1981.3 3864.5 2814.1 2487.4 147.6 71.9

1981.4 3803.1 2808.8 2468.6 140.3 72.4

1982.1 3756.1 2795 2484 114.4 70

1982.2 3771.1 2824.8 2488.9 114 68.4

1982.3 3754.4 2829 2502.5 114.6 69.2

1982.4 3759.6 2832.6 2539.3 109.9 72.5

1983.1 3783.5 2843.6 2556.5 113.6 77

1983.2 3886.5 2867 2604 133 80.5

1983.3 3944.4 2903 2639 145.7 83.1

1983.4 4012.1 2960.6 2678.2 141.6 84.2

1984.1 4089.5 3033.2 2703.8 155.1 83.3

1984.2 4144 3065.9 2741.1 152.6 82.2

1984.3 4166.4 3102.7 2754.6 141.8 81.7

1984.4 4194.2 3118.5 2784.8 136.3 83.4

1985.1 4221.8 3123.6 2824.9 125.2 87.2

1985.2 4254.8 3189.6 2849.7 124.8 90.8

1985.3 4309 3156.5 2893.3 129.8 94.1

1985.4 4333.5 3178.7 2895.3 134.2 97.4

1986.1 4390.5 3227.5 2922.4 109.2 105.1

1986.2 4387.7 3281.4 2947.9 106 110.7

1986.3 4412.6 3272.6 2993.7 111 112.3

1986.4 4427.1 3266.2 3012.5 119.2 111

1987.1 4460 3295.2 3011.5 140.2 108

1987.2 4515.3 3241.7 3046.8 157.9 105.5

1987.3 4559.3 3285.7 3075.8 169.1 105.1

1987.4 4625.5 3335.8 3074.6 176 106.3

1988.1 4655.3 3380.1 3128.2 195.5 109.6

1988.2 4704.8 3386.3 3147.8 207.2 113.3

1988.3 4734.5 3407.5 3170.6 213.4 117.5

1988.4 4779.7 3443.1 3202.9 226 121

1989.1 4809.8 3473.9 3200.9 221.3 124.6

1989.2 4832.4 3450.9 3208.6 206.2 127.1

1989.3 4845.6 3466.9 3241.1 195.7 129.1

1989.4 4859.7 3493 3241.6 203 130.7

1990.1 4880.8 3531.4 3258.8 199.1 132.3

1990.2 4900.3 3545.3 3258.6 193.7 132.5

1990.3 4903.3 3547 3281.2 196.3 133.8

1990.4 4855.1 3529.5 3251.8 199 136.2

1991.1 4824 3514.8 3241.1 189.7 137.8

1991.2 4840.7 3537.4 3252.4 182.7 136.7

1991.3 4862.7 3539.9 3271.2 189.6 138.1

1991.4 4868 3547.5 3271.1 190.3 138.5

1

2

3

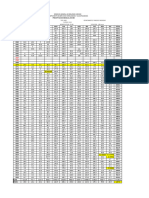

From the data given calculate DF and ADF test for the time series PCE, PDI, Profits, and Dividends. Find out if these series contain a un

How would you decide if the ADF test is more appropriate than the DF test?

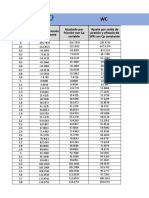

Consider the dividends and profits time series given. Since dividends depend on profits, consider the following simple model:

Dividendst = β1 + β2Profits + ut

a. Would you expect this regression to suffer from the spurious regression phenomenon? Why?

b. Are Dividends and Profits time series cointegrated? How do you test for this explicitly? If, after testing, you find that they are cointeg

c. Assume Dividends and Profits are cointegrated. Then, instead of regressing dividends on profits, you regress profits on dividends. Is s

Vous aimerez peut-être aussi

- TD 5.1Document3 pagesTD 5.1AnhVNPas encore d'évaluation

- Data Simple RegressionDocument3 pagesData Simple RegressionAtika Estining SholehaPas encore d'évaluation

- 0406 Mao ClimaDocument6 pages0406 Mao ClimaCesar AlcantaraPas encore d'évaluation

- Sucre AeropuertoDocument2 pagesSucre AeropuertoMijail Samed Miranda AlbinoPas encore d'évaluation

- Nurul Faoziah - 19.01.031.022 - Ekonometrika MJ ADocument8 pagesNurul Faoziah - 19.01.031.022 - Ekonometrika MJ ANurul FaoziahPas encore d'évaluation

- BD Precipitaciones 1985 2022Document14 pagesBD Precipitaciones 1985 2022Emilio SalazarPas encore d'évaluation

- Oferta Demanda CorrientesDocument16 pagesOferta Demanda CorrientesMaria BotierPas encore d'évaluation

- VVDocument5 pagesVVsskwkyPas encore d'évaluation

- Tablas P3Document7 pagesTablas P3DanielaPerezCastroPas encore d'évaluation

- Baic 0005 PPTMDocument2 pagesBaic 0005 PPTMquinteropeter656Pas encore d'évaluation

- Precipitacion Media Anual de Una CuencaDocument42 pagesPrecipitacion Media Anual de Una CuencaYcriola Alanes FloresPas encore d'évaluation

- BERRIOS LERTORA Renato - PRACTICA - N°1 - E - H - ADocument13 pagesBERRIOS LERTORA Renato - PRACTICA - N°1 - E - H - ARenato BerriosPas encore d'évaluation

- Tablas P2Document13 pagesTablas P2DanielaPerezCastroPas encore d'évaluation

- 2016 04 05Document156 pages2016 04 05Donia MohamedPas encore d'évaluation

- Demand For BeefDocument3 pagesDemand For Beefeva budianaPas encore d'évaluation

- Baic 0007 PPTMDocument2 pagesBaic 0007 PPTMAlejandra Gamez UrbanoPas encore d'évaluation

- Baic 0007 PPTMDocument2 pagesBaic 0007 PPTMAlejandra Gamez UrbanoPas encore d'évaluation

- Baic 0007 PPTMDocument2 pagesBaic 0007 PPTMAlejandra Gamez UrbanoPas encore d'évaluation

- Data para EconometriaDocument5 pagesData para EconometriaDaríoPas encore d'évaluation

- Copia de Copia de Tabla de Aforo Tanque STD 4000-8000 GALDocument10 pagesCopia de Copia de Tabla de Aforo Tanque STD 4000-8000 GALCarmelo Pernett SanchezPas encore d'évaluation

- Generación de Caudales Metodo TransferenciaDocument10 pagesGeneración de Caudales Metodo TransferenciaEDGAR REYNALDO MAMANI APARICIOPas encore d'évaluation

- Task SetupDocument211 pagesTask SetupTJEKEYKURFKRYRKPas encore d'évaluation

- Estaciones Proyecto 0.5Document168 pagesEstaciones Proyecto 0.5An- DPas encore d'évaluation

- AHUALULCODocument4 pagesAHUALULCOoswaldo garciaPas encore d'évaluation

- Calculo HidrologicoDocument14 pagesCalculo Hidrologicoalberto camascaPas encore d'évaluation

- 1 Análisis Precipitación IILA-SENAMHI-UNI 24horasDocument39 pages1 Análisis Precipitación IILA-SENAMHI-UNI 24horasHilary Rafael SicchaPas encore d'évaluation

- Datos DudososDocument47 pagesDatos DudososDavid Mecca PizangoPas encore d'évaluation

- 1 Análisis Precipitación IILA-SENAMHI-UNI Alumno - PracticaDocument40 pages1 Análisis Precipitación IILA-SENAMHI-UNI Alumno - PracticaWalter Paulino Quispe TicsePas encore d'évaluation

- 1 Análisis Precipitación IILA-SENAMHI-UNIDocument36 pages1 Análisis Precipitación IILA-SENAMHI-UNIWalter Paulino Quispe TicsePas encore d'évaluation

- Estaciones ProyectoDocument60 pagesEstaciones ProyectoAn- DPas encore d'évaluation

- 4 Hietograma Ichuña Corr1Document38 pages4 Hietograma Ichuña Corr1edwin rodiguez yaquettoPas encore d'évaluation

- CointDocument15 pagesCointdonalPas encore d'évaluation

- AdvertisingDocument5 pagesAdvertisingJean Ice Zack De LeonPas encore d'évaluation

- Max Q 1964-2006Document20 pagesMax Q 1964-2006Reyna BlasterPas encore d'évaluation

- 05 - Disponibilidad Hidrica HuayrapataDocument23 pages05 - Disponibilidad Hidrica HuayrapataJohann ArcePas encore d'évaluation

- Estacion M0024Document2 pagesEstacion M0024SERGIO PAUL MASABANDA DIAZPas encore d'évaluation

- 2017 02 23Document143 pages2017 02 23Donia MohamedPas encore d'évaluation

- Ectas D Eenterga de BiensumoDocument41 pagesEctas D Eenterga de Biensumojose luis lupaty pumaPas encore d'évaluation

- Task SetupDocument193 pagesTask SetupTJEKEYKURFKRYRKPas encore d'évaluation

- GRÁFICAS DE WC, WT, WNETO VS RP ÓPTIMO, DE TODOS LOS AJUSTES Rene RiveraDocument143 pagesGRÁFICAS DE WC, WT, WNETO VS RP ÓPTIMO, DE TODOS LOS AJUSTES Rene RiveraRene RodriguezPas encore d'évaluation

- Graficas MotoresDocument143 pagesGraficas MotoresRene RodriguezPas encore d'évaluation

- Libro 1Document6 pagesLibro 1ANCCO GUISADO DIEGO DENILSONPas encore d'évaluation

- Data Penfor Percobaan 3Document13 pagesData Penfor Percobaan 3windaru kusumaPas encore d'évaluation

- Datos de PrecipitacionDocument4 pagesDatos de Precipitacion1362010019 JESUS ALBERTO RIVERA ZABALETA ESTUDIANTE ACTIVOPas encore d'évaluation

- PriceDocument3 pagesPricePratik KanpurwarPas encore d'évaluation

- Data Hadiah PertamaDocument33 pagesData Hadiah PertamaEva BudianaPas encore d'évaluation

- Datos de Precipitacion Estacion PisaqDocument2 pagesDatos de Precipitacion Estacion PisaqYadert AlferPas encore d'évaluation

- Rekayasa Irigasi Dan DrainaseDocument10 pagesRekayasa Irigasi Dan DrainaseHERMAWAN NASRUDINPas encore d'évaluation

- Table 3 - 12Document1 pageTable 3 - 12Abdullah AzharPas encore d'évaluation

- Solution TD III - 1EE-1112Document17 pagesSolution TD III - 1EE-1112rabahPas encore d'évaluation

- Edirne PLV (Hyetometograph)Document16 pagesEdirne PLV (Hyetometograph)jassim mohammedPas encore d'évaluation

- Subcuenca #01Document40 pagesSubcuenca #01Frihz Yucra IncaPas encore d'évaluation

- Subcuenca #02Document40 pagesSubcuenca #02Frihz Yucra IncaPas encore d'évaluation

- Pluviograma PB - AtualDocument33 pagesPluviograma PB - AtualJanelson BelarminoPas encore d'évaluation

- 2 C4 U4 VX065 X06 Fwxys 4Document2 332 pages2 C4 U4 VX065 X06 Fwxys 4Donia MohamedPas encore d'évaluation

- Ejercicio TRDocument3 pagesEjercicio TRAndrea PastoPas encore d'évaluation

- Riegos DatosDocument228 pagesRiegos DatosZorayda YasmiraPas encore d'évaluation

- Post MonsoonDocument13 pagesPost Monsoonrashikawrk25Pas encore d'évaluation

- MonthlyRainfall (Formular)Document186 pagesMonthlyRainfall (Formular)NUTH PANHAPas encore d'évaluation