Académique Documents

Professionnel Documents

Culture Documents

Quand Sylvie Goulard Recopiait Les Amendements Du Lobby Bancaire Allemand (1/2)

Transféré par

Le magazine "Marianne"0 évaluation0% ont trouvé ce document utile (0 vote)

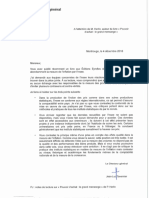

332 vues1 pageAu cours de la réforme bancaire discutée au Parlement européen en 2016, Sylvie Goulard, la probable future commissaire européenne française, a signé deux amendements… quasi-entièrement recopiés d'un argumentaire du lobby des banques allemandes. Contactée par "Marianne", elle assume. Pas de quoi rassurer sur la future ligne de la France à Bruxelles…

Titre original

Quand Sylvie Goulard recopiait les amendements du lobby bancaire allemand (1/2)

Copyright

© © All Rights Reserved

Formats disponibles

PDF ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentAu cours de la réforme bancaire discutée au Parlement européen en 2016, Sylvie Goulard, la probable future commissaire européenne française, a signé deux amendements… quasi-entièrement recopiés d'un argumentaire du lobby des banques allemandes. Contactée par "Marianne", elle assume. Pas de quoi rassurer sur la future ligne de la France à Bruxelles…

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

332 vues1 pageQuand Sylvie Goulard Recopiait Les Amendements Du Lobby Bancaire Allemand (1/2)

Transféré par

Le magazine "Marianne"Au cours de la réforme bancaire discutée au Parlement européen en 2016, Sylvie Goulard, la probable future commissaire européenne française, a signé deux amendements… quasi-entièrement recopiés d'un argumentaire du lobby des banques allemandes. Contactée par "Marianne", elle assume. Pas de quoi rassurer sur la future ligne de la France à Bruxelles…

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 1

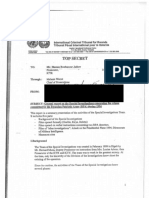

Amendment x6

Mfichwel Theurer. Sylvie Gaulawd. Petr Jeol

Proposal for a regulation

1 point 7

Requlation (EU) No '575/2019

Article 243 paragraph I point aa (new)

Text proposed by the Commission

‘Maximum risk weights for STS ABCP (art. 243 par. 1 (a) CRR-R)

Article 243 par. 1 (a) CRR-R requires for ABCP transactions that the isk ofthe secured exposures

under the Standardised Approach shall not be higher than 100 percert for any non-retal exposure,

‘together end should not be edopted.

At presert, a risk weight f 100 percent would meen that obligors with an extemal reting ofS or worse

(according tothe rating scale of SAP) would have to be excluded from secuntsaton. The resutt would be

that many corporate SME exposures that are successfully securtised today would have to be excluded.

‘This probiem Is likely to compound ata later stage. Based onthe recert consutative paper by the Basel

Comittee of December 2014 on the revision ofthe Standardised Approach to credit rsk, for instance, all

corporate SNES with revenues less than Sm. EUR and an eguity rato of less then 33% mould have tobe

‘excluded from STS securtsations irrespective whether there is a significant single risk or not.

Article 12 par. 5 STS-R already requires that the exposure must be originated in the ordinary course of

the selle’s business pursuant to underwriting standards thet ae not less stringent than these the seller

‘applies to origination of similar exposures not secured. In addition, according to Artide 8 par. 7 STS-R

excludes cresit-mpaired exposures. Thus, we con’ see the need to exclude further exposures.

In recital 14 the EU Commission corectly points out that STS securisations are neither free of risk, nor

do they incicate anything about the credit quality ofthe underlying exposures. Instead the STS label

‘should be understood to indicate that @ prudent and diligent investor willbe able to analyse the risk invol-

ved in the securtisation.

Vous aimerez peut-être aussi

- Avenant Convention USEPPM (83) - CopieDocument2 pagesAvenant Convention USEPPM (83) - CopieLe magazine "Marianne"Pas encore d'évaluation

- Abc - New (1) - 3Document12 pagesAbc - New (1) - 3Le magazine "Marianne"Pas encore d'évaluation

- Le Bingo Du RemaniementDocument1 pageLe Bingo Du RemaniementLe magazine "Marianne"Pas encore d'évaluation

- MGEN - Baromètre de La Santé en Milieu UniversitaireDocument72 pagesMGEN - Baromètre de La Santé en Milieu UniversitaireLe magazine "Marianne"Pas encore d'évaluation

- Abc - New (1) - 3Document12 pagesAbc - New (1) - 3Le magazine "Marianne"Pas encore d'évaluation

- Abc - New (1) - 3Document12 pagesAbc - New (1) - 3Le magazine "Marianne"Pas encore d'évaluation

- Le Bingo Du RemaniementDocument1 pageLe Bingo Du RemaniementLe magazine "Marianne"Pas encore d'évaluation

- Conférence de FinancementDocument15 pagesConférence de FinancementLe magazine "Marianne"Pas encore d'évaluation

- Projet Loi 1 PDFDocument141 pagesProjet Loi 1 PDFLe magazine "Marianne"100% (10)

- Jugt TA - 1089054255 - 1800319 - CLCV - C CPCUDocument7 pagesJugt TA - 1089054255 - 1800319 - CLCV - C CPCULe magazine "Marianne"Pas encore d'évaluation

- Infographie Focus Santé - Baromètre MGENDocument2 pagesInfographie Focus Santé - Baromètre MGENLe magazine "Marianne"Pas encore d'évaluation

- Projet de Loi 2Document9 pagesProjet de Loi 2Le magazine "Marianne"Pas encore d'évaluation

- Lettre À La Garde Des SceauxDocument6 pagesLettre À La Garde Des SceauxLe magazine "Marianne"Pas encore d'évaluation

- Protocole SanitaireDocument7 pagesProtocole SanitaireLe magazine "Marianne"100% (3)

- MGEN - Baromètre Santé ÉtudiantsDocument60 pagesMGEN - Baromètre Santé ÉtudiantsLe magazine "Marianne"Pas encore d'évaluation

- Lettre Edouard PhilippeDocument4 pagesLettre Edouard PhilippeLe magazine "Marianne"Pas encore d'évaluation

- Quand Sylvie Goulard Recopiait Les Amendements Du Lobby Bancaire Allemand (2/2)Document1 pageQuand Sylvie Goulard Recopiait Les Amendements Du Lobby Bancaire Allemand (2/2)Le magazine "Marianne"Pas encore d'évaluation

- Quel Avenir Pour Le Journalisme de Demain ?Document139 pagesQuel Avenir Pour Le Journalisme de Demain ?Le magazine "Marianne"Pas encore d'évaluation

- MAR1145 SONDAGEantisémitDocument1 pageMAR1145 SONDAGEantisémitLe magazine "Marianne"Pas encore d'évaluation

- (Sondage) Gilets Jaunes: Les Raisons de La Colère Sont Toujours LàDocument1 page(Sondage) Gilets Jaunes: Les Raisons de La Colère Sont Toujours LàLe magazine "Marianne"Pas encore d'évaluation

- MAR1145 SONDAGEantisémitDocument1 pageMAR1145 SONDAGEantisémitLe magazine "Marianne"Pas encore d'évaluation

- Note de Lecture Insee - P.HerlinDocument14 pagesNote de Lecture Insee - P.HerlinLe magazine "Marianne"Pas encore d'évaluation

- La Réponse de Philippe Herlin À L'inseeDocument3 pagesLa Réponse de Philippe Herlin À L'inseeLe magazine "Marianne"Pas encore d'évaluation

- 111-2018 D - Courrier Commun SCPN SCSI Au MI - IndemnitaireDocument2 pages111-2018 D - Courrier Commun SCPN SCSI Au MI - IndemnitaireLe magazine "Marianne"100% (3)

- Lettre Du DG de L'insee À Philippe HerlinDocument1 pageLettre Du DG de L'insee À Philippe HerlinLe magazine "Marianne"Pas encore d'évaluation

- Vignette Crit'Air en Ile-de-France: Commune Par Commune, Les Véhicules InterditsDocument16 pagesVignette Crit'Air en Ile-de-France: Commune Par Commune, Les Véhicules InterditsLe magazine "Marianne"100% (1)

- MAR1145 SONDAGEantisémitDocument1 pageMAR1145 SONDAGEantisémitLe magazine "Marianne"Pas encore d'évaluation

- Correspondance Entre Le Parlement Européen Et Jean-Luc MélenchonDocument6 pagesCorrespondance Entre Le Parlement Européen Et Jean-Luc MélenchonLe magazine "Marianne"100% (1)

- Tribunal Pénal International Pour Le Rwanda: Rapport Sur Les Crimes Commis Par l'APR en 1994Document30 pagesTribunal Pénal International Pour Le Rwanda: Rapport Sur Les Crimes Commis Par l'APR en 1994Le magazine "Marianne"88% (16)