Académique Documents

Professionnel Documents

Culture Documents

High RoE Stocks

Transféré par

Kaushik Ar0 évaluation0% ont trouvé ce document utile (0 vote)

6 vues6 pagesCopyright

© © All Rights Reserved

Formats disponibles

XLSX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme XLSX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

6 vues6 pagesHigh RoE Stocks

Transféré par

Kaushik ArDroits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme XLSX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 6

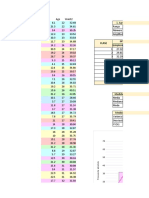

COMPANIES WITH HIGH OPM, ROE,

OPERATING PROFIT MARGIN

5 Year

STOCK NAME 2016 2017 2018 2019 2020

Average

TITAN INDS 8.07 8.41 9.93 10.17 10.79 9.47

PAGE INDUSTRIES 20.15 19.40 20.93 21.81 16.83 19.82

MARICO INDS 17.44 19.70 17.92 17.69 19.86 18.52

ASIAN PAINTS 18.96 19.34 18.17 17.54 18.23 18.45

BERGER PAINTS 13.75 14.60 14.10 13.26 14.74 14.09

HUL 18.92 18.92 20.71 22.55 23.85 20.99

ITC 38.02 37.50 39.30 39.67 40.91 39.08

DABUR 20.59 21.86 22.79 21.83 21.61 21.74

BRITANNIA 14.59 14.46 15.39 16.08 16.70 15.44

TCS 29.33 29.28 27.73 28.51 27.50 28.47

INFOSYS 30.01 29.17 28.84 25.45 24.42 27.58

L&T INFOTECH 17.79 19.05 19.94 21.57 19.17 19.50

NESTLE INDIA 16.11 16.34 19.29 22.50 22.59 19.37

HDFC ASSET MANAGEMENT 49.09 54.03 60.23 71.77 82.96 63.62

ICICI PRU LIFE INSUR 97.88 99.22 93.88 67.46 40.24 79.74

HDFC LIFE 93.69 89.40 86.76 78.45 78.83 85.43

SBI LIFE 88.19 92.27 92.42 91.27 72.88 87.41

ICICI LOMBARD GEN INSUR 99.29 92.19 92.97 96.86 86.47 93.56

COAL INDIA 27.97 18.94 12.99 27.52 25.57 22.60

BAJAJ CONSUMER 37.19 37.36 32.76 30.95 26.89 33.03

GODREJ CONSUMER 19.22 19.76 20.51 19.93 20.76 20.04

MAHANAGAR GAS 22.80 29.58 32.53 29.99 30.32 29.04

GUJ STATE PETRONET 73.62 22.18 23.32 23.65 22.97 33.15

HAVELLS 9.32 13.57 12.53 11.51 9.78 11.34

PIDILITE INDS 21.46 22.37 22.53 19.52 21.32 21.44

PETRONET LNG 5.29 10.43 10.51 8.66 10.08 8.99

SONATA SOFTWARE 11.82 9.60 10.75 11.82 10.54 10.91

DIVIS LAB 36.98 34.38 31.67 37.57 33.84 34.89

TORRENT PHARMA 40.69 22.24 20.71 18.53 20.62 24.56

VIP INDS 7.91 10.08 13.46 12.12 12.79 11.27

GILLETTE 15.73 21.98 20.99 18.63 19.02 19.27

COLGATE 20.64 21.38 23.75 24.97 23.26 22.80

EICHER MOTORS 28.04 31.95 31.95 31.09 25.58 29.72

H HIGH OPM, ROE, ROCE & VERY LOW DEBT (YEAR 2020 DATA)

RETURN ON EQUITY RETURN ON CAPITAL EMPLOYE

5 Year

2016 2017 2018 2019 2020 2016 2017 2018

Average

19.23 16.81 22.20 23.13 22.51 20.78 18.57 25.46 30.75

46.04 39.99 40.95 50.83 41.86 43.93 36.81 56.68 59.08

35.26 34.33 32.03 37.44 33.77 34.57 34.41 33.50 31.04

26.74 25.50 24.24 22.76 26.70 25.19 23.54 34.13 32.76

23.72 24.90 20.99 20.13 24.72 22.89 19.99 20.95 18.13

62.96 66.37 71.61 76.95 82.00 71.98 53.56 78.54 82.03

21.89 22.16 21.46 21.29 23.44 22.05 20.75 32.86 31.03

29.99 26.34 23.73 25.61 21.87 25.51 26.74 23.18 28.08

39.41 32.80 29.48 27.25 31.85 32.16 38.10 32.00 28.36

34.14 30.49 30.33 35.18 38.44 33.72 33.00 38.92 38.59

21.84 20.80 24.68 23.71 25.35 23.28 21.71 28.81 30.92

39.36 30.87 28.80 30.97 28.12 31.62 47.87 30.42 27.75

19.98 30.74 35.81 43.74 101.92 46.44 28.61 29.13 32.90

41.51 38.66 31.55 30.30 31.33 34.67 60.73 56.17 46.13

30.99 26.29 23.60 16.22 14.79 22.38 not applicable

26.31 23.17 23.38 22.64 19.09 22.92 not applicable

17.83 17.46 17.62 17.51 16.26 17.34 not applicable

15.33 17.99 18.23 18.54 20.92 18.20 19.88 19.16 21.46

40.95 37.84 35.37 66.00 51.97 46.43 17.51 20.12 14.54

40.83 44.16 42.86 47.41 28.28 40.71 40.77 44.09 54.94

19.39 24.59 26.11 32.22 18.94 24.25 11.75 13.45 16.67

17.98 21.38 22.80 22.77 26.87 22.36 25.41 30.16 31.77

11.67 12.25 30.52 30.30 35.40 24.03 8.67 12.96 19.03

42.94 15.09 17.76 18.63 17.05 22.29 22.54 24.44 25.03

30.43 23.77 26.92 22.29 25.05 25.69 28.63 22.92 34.27

13.92 21.06 21.51 21.80 24.30 20.52 8.52 21.86 24.97

33.67 26.47 29.47 32.44 41.35 32.68 29.40 24.48 28.12

26.22 19.79 14.80 19.44 18.83 19.82 25.68 25.41 20.10

49.60 21.46 14.67 9.23 21.24 23.24 47.13 13.40 7.50

19.58 20.88 25.91 24.98 18.31 21.93 19.28 30.28 38.03

24.83 50.55 32.99 32.49 25.25 33.22 24.73 71.30 48.25

56.55 45.33 44.16 53.60 51.21 50.17 52.07 64.10 62.91

36.62 31.18 27.87 24.69 18.30 27.73 35.83 41.01 39.47

TA)

DEBT-

N ON CAPITAL EMPLOYED EQUITY

RATIO

5 Year

2019 2020 LATEST

Average

32.16 28.67 27.12 0.35

76.19 51.85 56.12 0.03

40.75 45.16 36.97 0.11

30.42 31.30 30.43 0.03

28.40 29.34 23.36 0.20

88.98 87.58 78.14 0.00

31.04 29.80 29.10 0.00

32.18 27.24 27.48 0.07

40.49 36.72 35.13 0.34

44.97 46.00 40.30 0.00

31.83 30.83 28.82 0.00

40.58 32.11 35.75 0.01

40.76 56.91 37.66 0.03

44.19 40.70 49.58 0.00

ot applicable 0.00

ot applicable 0.00

ot applicable 0.00

26.66 28.05 23.04 0.09

31.52 24.19 21.58 0.20

60.81 35.09 47.14 0.03

20.00 19.76 16.33 0.34

31.95 31.12 30.08 0.00

23.33 27.45 18.29 0.49

25.04 19.46 23.30 0.00

29.95 31.61 29.48 0.04

26.07 21.75 20.63 0.01

43.13 50.83 35.19 0.13

25.84 23.99 24.20 0.00

15.88 19.13 20.61 0.91

36.32 27.27 30.24 0.05

40.45 32.83 43.51 0.00

70.74 60.73 62.11 0.00

32.79 22.46 34.31 0.01

Vous aimerez peut-être aussi

- Calc Nuevas Curvas Idtr UnlDocument12 pagesCalc Nuevas Curvas Idtr UnlALBERTO MARTINEZPas encore d'évaluation

- Modelo Bulbo HumedoDocument2 pagesModelo Bulbo HumedoJose SotoPas encore d'évaluation

- RTSF_characteristicsDocument29 pagesRTSF_characteristicsMonu KumarPas encore d'évaluation

- Tabla Chi CuacradaDocument1 pageTabla Chi CuacradaSabrina RodriguezPas encore d'évaluation

- Tabla Chi2Document18 pagesTabla Chi2deividsdavoPas encore d'évaluation

- Bar-Litres Conversion TableDocument4 pagesBar-Litres Conversion TablePutra LotusPas encore d'évaluation

- Pub175bk 7Document1 pagePub175bk 7atangby tangPas encore d'évaluation

- Data RegresionesDocument33 pagesData RegresionesANGELA CAROLINA SOLSOL HUAMUROPas encore d'évaluation

- Calculo IMSSDocument21 pagesCalculo IMSSEduardo GomezPas encore d'évaluation

- IDF - Juan DiegoDocument60 pagesIDF - Juan DiegokarensouthworthPas encore d'évaluation

- Tablas de Fitto CorviniDocument3 pagesTablas de Fitto CorviniRicardo A Salazar Pardo78% (18)

- Table Du Khi DeuxDocument1 pageTable Du Khi Deuxgaetan.filyPas encore d'évaluation

- Ayudas de Diseño de Concreto ReforzadoDocument9 pagesAyudas de Diseño de Concreto ReforzadoDiego Mauricio Ortiz RamirezPas encore d'évaluation

- Chi Square TableDocument1 pageChi Square TablesaraPas encore d'évaluation

- Costos UnitariosDocument11 pagesCostos Unitariosmaria caquiPas encore d'évaluation

- Table ReinforcementDocument2 pagesTable ReinforcementCatalin SasPas encore d'évaluation

- Anexo Iccv Indices Series Empalme Mar21Document3 pagesAnexo Iccv Indices Series Empalme Mar21Fabian RojasPas encore d'évaluation

- Wages by EducationDocument14 pagesWages by EducationnamakujunaPas encore d'évaluation

- Tire Wear IgpDocument4 pagesTire Wear IgpAzizi FauzaniPas encore d'évaluation

- 1.1 Revision - INVIAS2008 - PlantaDocument8 pages1.1 Revision - INVIAS2008 - Plantaazaly suárezPas encore d'évaluation

- Tabela Dimensionamento-Portal PDFDocument1 pageTabela Dimensionamento-Portal PDFTsukíí Marília BelmontePas encore d'évaluation

- Tabela Flexao Simples PDFDocument1 pageTabela Flexao Simples PDFAlleff MesaquePas encore d'évaluation

- ASA - Butterfly 100 LCM SlowDocument2 pagesASA - Butterfly 100 LCM SlowManuel Lopez100% (1)

- Area FierrosDocument3 pagesArea FierrosRaul VargasPas encore d'évaluation

- Table Du Khi DeuxDocument1 pageTable Du Khi DeuxmokranimaminePas encore d'évaluation

- Book 3Document2 pagesBook 3ghufran azizPas encore d'évaluation

- Anexo Iccv Indices Series Empalme Jul21Document3 pagesAnexo Iccv Indices Series Empalme Jul21Daniel ForeroPas encore d'évaluation

- ChisqDocument1 pageChisqfcykrx8fc6Pas encore d'évaluation

- ASA - Backstroke 100 LCM Fast PDFDocument2 pagesASA - Backstroke 100 LCM Fast PDFanon_784665687100% (1)

- Tarea 3-ExplosivosDocument1 pageTarea 3-ExplosivosSergio RecavPas encore d'évaluation

- Tablas de Factores de Diversidad de Epsa y EMCALIDocument4 pagesTablas de Factores de Diversidad de Epsa y EMCALIcesarieeePas encore d'évaluation

- Plage 3Document11 pagesPlage 3Drissa FanePas encore d'évaluation

- Fabricant EsDocument2 pagesFabricant EsAndrea VasquezPas encore d'évaluation

- Uzunluk Metre Feet Kulac CevrimmDocument1 pageUzunluk Metre Feet Kulac Cevrimmİbrahim AçıkgözPas encore d'évaluation

- Tabla Chi CuadradoDocument1 pageTabla Chi CuadradoFLOR CARIZA URACCAHUA CABRERAPas encore d'évaluation

- Chi Sqaured TableDocument1 pageChi Sqaured Tableml.amel.zerPas encore d'évaluation

- Chi Sqaured TableDocument1 pageChi Sqaured TableBenkhellaf MehdiPas encore d'évaluation

- Calc Crashworthiness ParametersDocument10 pagesCalc Crashworthiness ParametersPRAVEEN KUMAR APas encore d'évaluation

- Tabla Chi CuadradoDocument1 pageTabla Chi CuadradoROC�O AYDE TRINIDAD SANTAMARIAPas encore d'évaluation

- Coefficients de Portance - Fondations SuperficiellesDocument1 pageCoefficients de Portance - Fondations SuperficiellesAlec WalkerPas encore d'évaluation

- Coefficients de Portance - Fondations SuperficiellesDocument1 pageCoefficients de Portance - Fondations SuperficiellesAlec WalkerPas encore d'évaluation

- P-V Diagram CO2 VDWDocument32 pagesP-V Diagram CO2 VDWAndrea GFloresPas encore d'évaluation

- Tarea MecaDocument2 pagesTarea MecaJuan JosePas encore d'évaluation

- Tabela Distacia e Angulo de ProteçãoDocument10 pagesTabela Distacia e Angulo de ProteçãojeffersonjenzuraPas encore d'évaluation

- Rocas Sedimentarias Clasificacion Ternario en ExcelDocument21 pagesRocas Sedimentarias Clasificacion Ternario en ExcelCoke LobosPas encore d'évaluation

- BA23 Mock MidtermDocument69 pagesBA23 Mock MidtermAryaman JainPas encore d'évaluation

- Keaktifan Satker Per 21 Juni 2023Document4 pagesKeaktifan Satker Per 21 Juni 2023kholidahPas encore d'évaluation

- IEEE14 BusdataDocument11 pagesIEEE14 Busdataosama atiqPas encore d'évaluation

- PAL-Daya Dukung Tiang Berdasarkan NSPT r0Document44 pagesPAL-Daya Dukung Tiang Berdasarkan NSPT r0HasanSibugaPas encore d'évaluation

- Abaque Section D'acierDocument3 pagesAbaque Section D'acierGodwinPas encore d'évaluation

- Resposta Segunda Avaliação 2022 - 2Document5 pagesResposta Segunda Avaliação 2022 - 2Kelisson DinizPas encore d'évaluation

- Tabela de CzernyDocument2 pagesTabela de CzernyPedro Henrique Bruder DeckerPas encore d'évaluation

- Class ActivityDocument54 pagesClass ActivityAmtul AyoubPas encore d'évaluation

- AnguloDocument6 pagesAnguloNéstor Raúl Pineda JaraPas encore d'évaluation

- Borrador Proba1Document19 pagesBorrador Proba1Karen Xiomara Galeano ContrerasPas encore d'évaluation

- Encomendas PRATA 31.01.2022Document19 pagesEncomendas PRATA 31.01.2022fabio garciaPas encore d'évaluation

- Data 1Document2 pagesData 1gdteyuj123Pas encore d'évaluation

- UntitledDocument3 pagesUntitledCahya NalendriPas encore d'évaluation