Académique Documents

Professionnel Documents

Culture Documents

Cronograma de Credito2

Transféré par

Gino Laos Acosta0 évaluation0% ont trouvé ce document utile (0 vote)

3 vues11 pagesTitre original

CRONOGRAMA DE CREDITO2

Copyright

© © All Rights Reserved

Formats disponibles

XLSX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme XLSX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

3 vues11 pagesCronograma de Credito2

Transféré par

Gino Laos AcostaDroits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme XLSX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 11

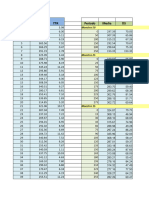

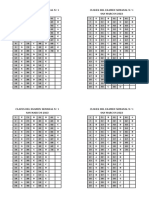

Inmueble 26800

Saldo de deuda 21440

TEA 15.80%

N° Cuotas 60 RPTA

Valor Cuota ?

MES FECHA DE VTO N° DÍAS INTERESES AMORTIZACION CUOTA SALDO DEUDOR

0 6/21/2007 0 0 5360.00 5360 21440

1 8/3/2007 43 378.98 133.53 512.51 21306.47

2 9/3/2007 31 270.85 241.66 512.51 21064.81

3 10/3/2007 30 259.09 253.42 512.51 20811.39

4 11/3/2007 31 264.56 247.95 512.51 20563.44

5 12/3/2007 30 252.92 259.59 512.51 20303.86

6 1/3/2008 31 258.11 254.40 512.51 20049.46

7 2/3/2008 31 254.87 257.64 512.51 19791.82

8 3/3/2008 29 235.27 277.24 512.51 19514.58

9 4/3/2008 31 248.07 264.44 512.51 19250.15

10 5/3/2008 30 236.77 275.74 512.51 18974.41

11 6/3/2008 31 241.21 271.30 512.51 18703.10

12 7/3/2008 30 230.04 282.47 512.51 18420.64

13 8/3/2008 31 234.17 278.34 512.51 18142.29

14 9/3/2008 31 230.63 281.88 512.51 17860.41

15 10/3/2008 30 219.68 292.83 512.51 17567.58

16 11/3/2008 31 223.32 289.19 512.51 17278.40

17 12/3/2008 30 212.52 299.99 512.51 16978.41

18 1/3/2009 31 215.83 296.68 512.51 16681.73

19 2/3/2009 31 212.06 300.45 512.51 16381.28

20 3/3/2009 28 187.97 324.53 512.51 16056.75

21 4/3/2009 31 204.12 308.39 512.51 15748.36

22 5/3/2009 30 193.70 318.81 512.51 15429.55

23 6/3/2009 31 196.14 316.36 512.51 15113.18

24 7/3/2009 30 185.89 326.62 512.51 14786.56

25 8/3/2009 31 187.97 324.54 512.51 14462.02

26 9/3/2009 31 183.84 328.66 512.51 14133.36

27 10/3/2009 30 173.83 338.67 512.51 13794.68

28 11/3/2009 31 175.36 337.15 512.51 13457.54

29 12/3/2009 30 165.52 346.99 512.51 13110.55

30 1/3/2010 31 166.66 345.84 512.51 12764.71

31 2/3/2010 31 162.27 350.24 512.51 12414.47

32 3/3/2010 28 142.45 370.05 512.51 12044.41

33 4/3/2010 31 153.11 359.40 512.51 11685.02

34 5/3/2010 30 143.72 368.79 512.51 11316.23

35 6/3/2010 31 143.85 368.65 512.51 10947.57

36 7/3/2010 30 134.65 377.86 512.51 10569.72

37 8/3/2010 31 134.36 378.14 512.51 10191.57

38 9/3/2010 31 129.56 382.95 512.51 9808.62

39 10/3/2010 30 120.64 391.87 512.51 9416.76

40 11/3/2010 31 119.71 392.80 512.51 9023.96

41 12/3/2010 30 110.99 401.52 512.51 8622.44

42 1/3/2011 31 109.61 402.90 512.51 8219.54

43 2/3/2011 31 104.49 408.02 512.51 7811.52

44 3/3/2011 28 89.64 422.87 512.51 7388.65

45 4/3/2011 31 93.93 418.58 512.51 6970.07

46 5/3/2011 30 85.73 426.78 512.51 6543.29

47 6/3/2011 31 83.18 429.33 512.51 6113.96

48 7/3/2011 30 75.20 437.31 512.51 5676.65

49 8/3/2011 31 72.16 440.35 512.51 5236.31

50 9/3/2011 31 66.56 445.94 512.51 4790.37

51 10/3/2011 30 58.92 453.59 512.51 4336.78

52 11/3/2011 31 55.13 457.38 512.51 3879.40

53 12/3/2011 30 47.71 464.79 512.51 3414.61

54 1/3/2012 31 43.41 469.10 512.51 2945.51

55 2/3/2012 31 37.44 475.06 512.51 2470.44

56 3/3/2012 29 29.37 483.14 512.51 1987.30

57 4/3/2012 31 25.26 487.24 512.51 1500.06

58 5/3/2012 30 18.45 494.06 512.51 1006.00

59 6/3/2012 31 12.79 499.72 512.51 506.28

60 7/3/2012 30 6.23 506.28 512.51 0.00

26800.00

512.51

TEA

PORTES + SEGURO PAGO MES

0.00 5360.00

133.53 512.51

241.66 512.51

253.42 512.51

247.95 512.51

259.59 512.51

254.40 512.51

257.64 512.51

277.24 512.51

264.44 512.51

275.74 512.51

271.30 512.51

282.47 512.51

278.34 512.51

281.88 512.51

292.83 512.51

289.19 512.51

299.99 512.51

296.68 512.51

300.45 512.51

324.53 512.51

308.39 512.51

318.81 512.51

316.36 512.51

326.62 512.51

324.54 512.51

328.66 512.51

338.67 512.51

337.15 512.51

346.99 512.51

345.84 512.51

350.24 512.51

370.05 512.51

359.40 512.51

368.79 512.51

368.65 512.51

377.86 512.51

378.14 512.51

382.95 512.51

391.87 512.51

392.80 512.51

401.52 512.51

402.90 512.51

408.02 512.51

422.87 512.51

418.58 512.51

426.78 512.51

429.33 512.51

437.31 512.51

440.35 512.51

445.94 512.51

453.59 512.51

457.38 512.51

464.79 512.51

469.10 512.51

475.06 512.51

483.14 512.51

487.24 512.51

494.06 512.51

499.72 512.51

506.28 512.51

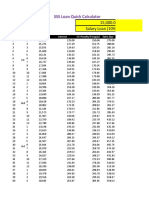

Prestamo 50000

TEA 23.64%

N° Cuotas 18

Valor Cuota 3272.13

MES FECHA DE VTN° DÍAS INTERESES AMORTIZACION CUOTA SALDO DEUD

0 6/13/2017 0 0 0 50000

1 7/30/2017 47 1404.59 0.00 1404.59 50000.00

2 8/30/2017 31 922.05 0.00 922.05 50000.00

3 9/30/2017 31 922.05 0.00 922.05 50000.00

4 10/30/2017 30 892.05 2942.66 3834.71 47057.34

5 11/30/2017 31 867.79 2966.92 3834.71 44090.42

6 12/30/2017 30 786.61 3048.09 3834.71 41042.32

7 1/30/2018 31 756.87 7619.14 3376.00 33423.18

8 2/28/2018 29 576.25 2799.75 3376.00 30623.43

9 3/30/2018 30 546.35 2829.65 3376.00 27793.78

10 4/30/2018 31 512.55 2863.46 3376.00 24930.33

11 5/30/2018 30 444.78 2931.22 3376.00 21999.10

12 6/30/2018 31 405.69 2970.32 3376.00 19028.79

13 7/30/2018 30 339.49 3036.51 3376.00 15992.28

14 8/30/2018 31 294.92 3081.09 3376.00 12911.19

15 9/30/2018 31 238.10 6854.19 2092.28 6057.00

16 10/30/2018 30 108.06 1984.22 2092.28 4072.78

17 11/30/2018 31 75.11 2017.18 2092.28 2055.61

18 12/30/2018 30 36.67 2055.61 2092.28 0.00

50000.00

Para hallar intereses s la funcion de conversion de tasa esta en funcion al num

-3 meses de gracias

-dos prepagos: 5000 soles en la fecha 7 y otros 5000

soles en el mes 15

PREPAGO(AMORTIZACION AL PRINCIPAL)

PORTES + SEGURO PAGO MENSUPAGO MES falta resolver

0.00 0.00 0.00

0.00 180 1584.59

0.00 180 1102.05

0.00 180 1102.05 hora de resoucion de ejer

2942.66 180 4014.71 el ejercicio 3 esta unos 7

2966.92 180 4014.71

3048.09 180 4014.71

7619.14 180 8556.00 aquí se debe hacer una puerba de hipotesis

2799.75 180 3556.00

2829.65 180 3556.00

2863.46 180 3556.00

2931.22 180 3556.00

2970.32 180 3556.00

3036.51 180 3556.00

3081.09 180 3556.00

6854.19 180 7272.28

1984.22 180 2272.28

2017.18 180 2272.28

2055.61 180 2272.28

esta en funcion al numero de días

ora de resoucion de ejercicio 4

l ejercicio 3 esta unos 7 minutos antes

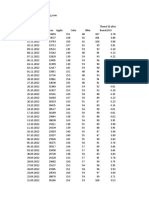

Periodo de Gracia 4

Prestamo 100000 100000

TEA 23.64% 23.64%

N° Cuotas 24 24

Valor Cuota ? ?

Fecha desembolso 7/1/2017 7/1/2017

MES FECHA DE VTO N° DÍAS INTERESES AMORTIZACION CUOTA SALDO DEUDOR

0 7/1/2017 0 0 0 0 100000

1 7/15/2017 14 828.65 0.00 828.65 100000.00

2 7/31/2017 16 947.59 0.00 947.59 100000.00

3 8/15/2017 15 888.10 0.00 888.10 100000.00

4 8/31/2017 16 947.59 0.00 947.59 100000.00

5 9/15/2017 15 888.10 4596.40 5484.50 95403.60

6 9/30/2017 15 847.28 4637.22 5484.50 90766.39

7 10/15/2017 15 806.10 24678.40 5484.50 66087.98

8 10/31/2017 16 626.24 3584.10 4210.34 62503.89

9 11/15/2017 15 555.10 3655.24 4210.34 58848.65

10 11/30/2017 15 522.64 3687.70 4210.34 55160.95

11 12/15/2017 15 489.89 3720.45 4210.34 51440.50

12 12/31/2017 16 487.45 3722.89 4210.34 47717.60

13 1/15/2018 15 423.78 3786.56 4210.34 43931.05

14 1/31/2018 16 416.29 3794.05 4210.34 40136.99

15 2/15/2018 15 356.46 3853.88 4210.34 36283.11

16 2/28/2018 13 279.10 3931.24 4210.34 32351.88

17 3/15/2018 15 287.32 3923.02 4210.34 28428.86

18 3/31/2018 16 269.39 3940.95 4210.34 24487.91

19 4/15/2018 15 217.48 3992.86 4210.34 20495.05

20 4/30/2018 15 182.02 4028.32 4210.34 16466.72

21 5/15/2018 15 146.24 4064.10 4210.34 12402.63

22 5/31/2018 16 117.53 4092.81 4210.34 8309.81

23 6/15/2018 15 73.80 4136.54 4210.34 4173.28

24 6/30/2018 15 37.06 4173.28 4210.34 0.00

100000.00

Para hallar intereses s la funcion de conversion de tasa esta en funcion

TEA a TED

AMORT. ACUMULADA GASTOS + COMISIONES PAGO MENSUAL

0.00 0.00 0.00 LA CUOTA ES

0.00 180 1008.65 5664.50

0.00 180 1127.59

0.00 180 1068.10

0.00 180 1127.59

4596.40 180 5664.50

4637.22 180 5664.50

24678.40 180 25664.50

3584.10 180 4390.34

3655.24 180 4390.34

3687.70 180 4390.34

3720.45 180 4390.34

3722.89 180 4390.34 AMROTIZACION 7 PAGO

3786.56 180 4390.34 20000

3794.05 180 4390.34

3853.88 180 4390.34

3931.24 180 4390.34

3923.02 180 4390.34

3940.95 180 4390.34

3992.86 180 4390.34

4028.32 180 4390.34

4064.10 180 4390.34

4092.81 180 4390.34

4136.54 180 4390.34

4173.28 180 4390.34

n de tasa esta en funcion al numero de días

todos los datos los da el problema excepto la TEM

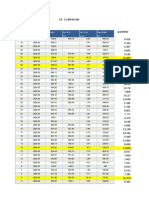

Prestamo 50000

TEA 23.64%

TEM 1.78%

Comisiones 150

N° Cuotas 18

Valor Cuota 3272.13

MES INTERESES AMORTIZACI CUOTA SALDO DEUDAMORTIZ. A COMISIONES PAGO MES

0 0 0 0 50000 0.00 0.00 0.00

1 892.05 2380.08 3272.13 47619.92 2380.08 150 3422.13

2 849.58 2422.55 3272.13 45197.37 2422.55 150 3422.13

3 806.36 2465.77 3272.13 42731.61 2465.77 150 3422.13

4 762.37 2509.76 3272.13 40221.85 2509.76 150 3422.13

5 717.60 2554.53 3272.13 37667.31 2554.53 150 3422.13

6 672.02 2600.11 3272.13 35067.20 2600.11 150 3422.13

7 625.63 2646.50 3272.13 32420.71 2646.50 150 3422.13

8 578.42 2693.71 3272.13 29726.99 2693.71 150 3422.13

9 530.36 2741.77 3272.13 26985.22 2741.77 150 3422.13

10 481.44 2790.69 3272.13 24194.53 2790.69 150 3422.13

11 431.65 2840.48 3272.13 21354.05 2840.48 150 3422.13

12 380.98 2891.15 3272.13 18462.90 2891.15 150 3422.13

13 329.40 2942.73 3272.13 15520.17 2942.73 150 3422.13

14 276.89 2995.24 3272.13 12524.93 2995.24 150 3422.13

15 223.46 3048.67 3272.13 9476.26 3048.67 150 3422.13

16 169.07 3103.06 3272.13 6373.19 3103.06 150 3422.13

17 113.70 3158.43 3272.13 3214.77 3158.43 150 3422.13

18 57.35 3214.78 3272.13 -0.01 3214.78 150 3422.13

Vous aimerez peut-être aussi

- Risk and Return - Monthly DatasetDocument24 pagesRisk and Return - Monthly DatasetHimanshu GuptaPas encore d'évaluation

- UntitledDocument13 pagesUntitledAdrian MoyanoPas encore d'évaluation

- RMIT Classification: TrustedDocument10 pagesRMIT Classification: Trustedayushi kPas encore d'évaluation

- Tarea 3Document8 pagesTarea 3Douglas CubillanPas encore d'évaluation

- Tally Tubería Yar 69Document28 pagesTally Tubería Yar 69Rig 26Pas encore d'évaluation

- FRA A3 Archana N20212259Document12 pagesFRA A3 Archana N202122592123 Archana KhomanePas encore d'évaluation

- Trabajo Simulacion AnnyDocument5 pagesTrabajo Simulacion AnnyAnny MenaPas encore d'évaluation

- Walmart5810 EditedDocument73 pagesWalmart5810 Editedbhanuprasad8648_2009Pas encore d'évaluation

- AFORODocument1 pageAFOROMilagros ValeriaPas encore d'évaluation

- Nifty IN OutDocument2 pagesNifty IN OutLaser ArtzPas encore d'évaluation

- MFE Práctica SAA VaR y ESDocument29 pagesMFE Práctica SAA VaR y ESMR 2Pas encore d'évaluation

- Nivelacion CasimiroDocument5 pagesNivelacion CasimiroCarlos Luis Chuman VillalobosPas encore d'évaluation

- SLPDEXT - NOv10 2021 - Portfolio Optimisation III - PGCHRM 32 - UpdateDocument28 pagesSLPDEXT - NOv10 2021 - Portfolio Optimisation III - PGCHRM 32 - UpdateVinod SBPas encore d'évaluation

- Chi y T NORMALDocument2 pagesChi y T NORMALFCEGRUPO 4Pas encore d'évaluation

- Copia de Equipo - CDocument13 pagesCopia de Equipo - Calejandro.llorensPas encore d'évaluation

- EQUIPO1 Excel DashboardDocument305 pagesEQUIPO1 Excel DashboardAtenas Alan RodriguezPas encore d'évaluation

- Tabla PrestamosDocument5 pagesTabla PrestamosAzomalli Asesoría PsicológicaPas encore d'évaluation

- Sss LoanDocument14 pagesSss LoanJanielee HernandezPas encore d'évaluation

- SSS Loan CalculatorDocument14 pagesSSS Loan CalculatorJAY JOB TabiPas encore d'évaluation

- Embalse de Guadalen 5.0 (2) .OdsDocument30 pagesEmbalse de Guadalen 5.0 (2) .OdssososaPas encore d'évaluation

- If T Has A T-Distribution With Degrees of Freedom, Then, For Each Pair of Values of P And, The Table Gives The Value of T Such That: P (T T) PDocument2 pagesIf T Has A T-Distribution With Degrees of Freedom, Then, For Each Pair of Values of P And, The Table Gives The Value of T Such That: P (T T) Ppatricia eileenPas encore d'évaluation

- Effect of Some Selected Social Economic Indicator On GDP and Fit Appropriate Using Linear ModelDocument4 pagesEffect of Some Selected Social Economic Indicator On GDP and Fit Appropriate Using Linear ModelchrishorlarcyPas encore d'évaluation

- Lista IprDocument7 pagesLista IprJavier Valdez VidalPas encore d'évaluation

- Tally Palagua 262Document2 pagesTally Palagua 262Norbey Ashley Gasca AlzatePas encore d'évaluation

- Gas WellsDocument253 pagesGas WellsAndrei BărbulescuPas encore d'évaluation

- Book 1Document5 pagesBook 1Thảo Nguyễn PhươngPas encore d'évaluation

- Panama NDocument2 pagesPanama NDominikus Mangopo PalangdaPas encore d'évaluation

- Portfolio AnalysisDocument66 pagesPortfolio AnalysisNadinePas encore d'évaluation

- Panama ADocument3 pagesPanama ADominikus Mangopo PalangdaPas encore d'évaluation

- Copia de Emateus6Document33 pagesCopia de Emateus6EDGAR VALDERRAMA RAMIREZPas encore d'évaluation

- Lap Akses Kemajuan KAB Malinau150920Document3 pagesLap Akses Kemajuan KAB Malinau150920RustamEffendyPas encore d'évaluation

- Finaly GannDocument46 pagesFinaly Gannminatawadrous279Pas encore d'évaluation

- Average Monthly Price GOLDDocument6 pagesAverage Monthly Price GOLDpardocamiloPas encore d'évaluation

- Ej BETADocument65 pagesEj BETAAndy KringsPas encore d'évaluation

- Reporte 2 PDFDocument7 pagesReporte 2 PDFCarolina Yepez V.Pas encore d'évaluation

- Tabela de Peso Parafuso SXT Din 933Document1 pageTabela de Peso Parafuso SXT Din 933Patricio SouzaPas encore d'évaluation

- Tabela de Peso Parafuso SXT Din 933Document1 pageTabela de Peso Parafuso SXT Din 933Gabrielle GrossoPas encore d'évaluation

- CryptoDocument23 pagesCryptoAlex MasiasPas encore d'évaluation

- Datos Ejemplo ElektraDocument11 pagesDatos Ejemplo Elektraolgiroud69Pas encore d'évaluation

- Acciones 2Document14 pagesAcciones 2Ariana MedinaPas encore d'évaluation

- Tabla de Aforo TK Estacionario 2020Document13 pagesTabla de Aforo TK Estacionario 2020Joe Perez CoilaPas encore d'évaluation

- M1Document4 pagesM1Eduard Andres Avila MeriñoPas encore d'évaluation

- Data 04242023031711 PMC67 CD3 EB5526 C925Document4 pagesData 04242023031711 PMC67 CD3 EB5526 C925Eduard Andres Avila MeriñoPas encore d'évaluation

- Porta FolioDocument105 pagesPorta FolioJuan CarlosPas encore d'évaluation

- TablaDocument2 pagesTablawilmerPas encore d'évaluation

- Data RM 2022 SolutionDocument152 pagesData RM 2022 SolutionChiks JpegPas encore d'évaluation

- N° de Parte Cantidad PVP Consorcio $ PVP Nestle Desc Ext Consorcio $ DNDocument4 pagesN° de Parte Cantidad PVP Consorcio $ PVP Nestle Desc Ext Consorcio $ DNabrahan de jesus chavez jimenezPas encore d'évaluation

- 100 Questions Generator Gaby 4-6Document2 pages100 Questions Generator Gaby 4-6Darwing LiPas encore d'évaluation

- PDF#43 1035Document2 pagesPDF#43 1035Avril PacioPas encore d'évaluation

- FM Assignment 2Document29 pagesFM Assignment 2Krish KadyanPas encore d'évaluation

- Tablice - GA I RA ArmaturaDocument2 pagesTablice - GA I RA ArmaturapedjaPas encore d'évaluation

- Tablice - GA I RA ArmaturaDocument2 pagesTablice - GA I RA ArmaturapedjaPas encore d'évaluation

- S05Document5 pagesS05Laiiid ChihebPas encore d'évaluation

- Bangso KTL T&FDocument1 pageBangso KTL T&FNgan Dang KieuPas encore d'évaluation

- Une Angle (OK)Document2 pagesUne Angle (OK)Tran Anh TuanPas encore d'évaluation

- Planilla SocavaciónDocument19 pagesPlanilla SocavaciónJosefina TampierPas encore d'évaluation

- Ejercicio 4Document27 pagesEjercicio 4ana narvaezPas encore d'évaluation

- 2018 m8 Viscas m60 MetDocument202 pages2018 m8 Viscas m60 MetJhuliana Patricia Cárdenas JanampaPas encore d'évaluation

- Davy TP Meteorologie FinDocument117 pagesDavy TP Meteorologie FinÉnoch Kazimoto JuniorPas encore d'évaluation

- Missel Messe en Latin pour chaque jour 2021: Rite Tridentin, français-latin Calendrier Catholique TraditionnelD'EverandMissel Messe en Latin pour chaque jour 2021: Rite Tridentin, français-latin Calendrier Catholique TraditionnelÉvaluation : 5 sur 5 étoiles5/5 (1)

- Dois Corações - Partitura CompletaDocument2 pagesDois Corações - Partitura CompletaGustavo SantosPas encore d'évaluation

- MM - Me Estas Sacando La Vuelta PDFDocument15 pagesMM - Me Estas Sacando La Vuelta PDFedxiton tapia tvPas encore d'évaluation

- TATICO ENRIQUE (Alto Sax)Document5 pagesTATICO ENRIQUE (Alto Sax)Salsa RealPas encore d'évaluation

- Crash Test Dummies-Afternoons and CoffeespoonsDocument34 pagesCrash Test Dummies-Afternoons and CoffeespoonsCarlos Ruiz R.Pas encore d'évaluation

- A Nuestro Modo-TrbsoloDocument2 pagesA Nuestro Modo-TrbsoloJavier Andres Cuervo RPas encore d'évaluation

- PH MQTT ADS1115 NodeMCU ESP8266Document1 pagePH MQTT ADS1115 NodeMCU ESP8266Techkom TPas encore d'évaluation

- Bajo Bilirrubina Juan Luis Guerra PDFDocument3 pagesBajo Bilirrubina Juan Luis Guerra PDFJohann Chuquimarca100% (2)

- Patatin PatatanDocument1 pagePatatin Patatandilan febresPas encore d'évaluation

- Banzai (Marcelo Kimura / Bruno Tasso)Document2 pagesBanzai (Marcelo Kimura / Bruno Tasso)Marcelo KimuraPas encore d'évaluation

- Maitriser Les Fonctions de A A Z Sur Excel Dl0mwrDocument231 pagesMaitriser Les Fonctions de A A Z Sur Excel Dl0mwrbenjamin.dervauxPas encore d'évaluation

- Infinite Stream - La Tristesse Durera ToujoursDocument3 pagesInfinite Stream - La Tristesse Durera Toujourstherouanne pascalPas encore d'évaluation

- Alma Llanera Score y Partituras AdaptacionDocument21 pagesAlma Llanera Score y Partituras AdaptacionRox RamírezPas encore d'évaluation

- Udakashanti Sanskrit BW PDFDocument61 pagesUdakashanti Sanskrit BW PDFhaixia42067% (3)

- Devis CorrigeDocument1 pageDevis CorrigeElie Eliezer BopePas encore d'évaluation

- Caldara Op 2 No 12 ScoreDocument6 pagesCaldara Op 2 No 12 ScoreSandro VoltaPas encore d'évaluation

- Deneme Cevap AnahtarıDocument1 pageDeneme Cevap AnahtarıDavid KerimovPas encore d'évaluation

- Expressions Idiomatiques Avec Avoir Et ÊtreDocument2 pagesExpressions Idiomatiques Avec Avoir Et ÊtreEnglish French100% (1)

- AgreementDocument1 pageAgreementShubham PujariPas encore d'évaluation

- Displicente - PixiguinhaDocument2 pagesDisplicente - PixiguinharoberttobrPas encore d'évaluation

- Tan Enamorados Sax Alto OkDocument2 pagesTan Enamorados Sax Alto OkHenryPas encore d'évaluation

- Claves Ex Semanal N°1 - SM 2023Document1 pageClaves Ex Semanal N°1 - SM 2023ANABEL BASILIA VILLALTA YARINGAÑOPas encore d'évaluation

- Dueño de Nsdasda Ada Banda OdiseaDocument17 pagesDueño de Nsdasda Ada Banda Odiseaxpot11Pas encore d'évaluation

- Schematics 2 CH Suhu DS1820 Lm35Document1 pageSchematics 2 CH Suhu DS1820 Lm35ilhamPas encore d'évaluation

- Maldita Traicionera - HuaynoDocument3 pagesMaldita Traicionera - Huaynofrancodelav12huPas encore d'évaluation

- Alegria Da Casa PDFDocument2 pagesAlegria Da Casa PDFcamulPas encore d'évaluation

- Give Thanks - Sax Alto 1 e 2Document1 pageGive Thanks - Sax Alto 1 e 2Alunos CemjkoPas encore d'évaluation

- Besame Mucho FreeDocument2 pagesBesame Mucho FreeJonas VozbutasPas encore d'évaluation

- Sax Circle of FourthsDocument1 pageSax Circle of FourthsAbraham BanjoPas encore d'évaluation

- The - List - Moonchild - GDocument3 pagesThe - List - Moonchild - GMuriel UrquidiPas encore d'évaluation

- On GreenDocument2 pagesOn GreenFermata ArteMusicaPas encore d'évaluation