Académique Documents

Professionnel Documents

Culture Documents

Ic 33 Questions

Transféré par

Anoop AppukuttanCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Ic 33 Questions

Transféré par

Anoop AppukuttanDroits d'auteur :

Formats disponibles

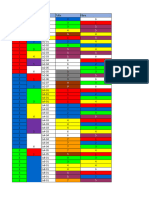

Summary of IRDA Question Set Chapter III Weightage Questions Available in per Question SET - 01 chapter Bank

Ch 01 Ch 02 Ch 03 Ch 04 Ch 05 Ch 06 Ch 07 Ch 08 Ch 09 Ch 10 Ch 11 Ch 12 Ch 13 Ch 14 Ch 15 Grand Total

6% 6% 18% 8% 4% 10% 8% 6% 4% 8% 8% 2% 4% 4% 4% 100%

3 3 9 4 2 5 4 3 2 4 4 1 2 2 2 50

11 8 46 20 28 23 29 10 14 16 14 9 6 16 4 254

9 4 15 7 16 7 9 6 4 5 7 4 2 8 0 103

on Set SET - 02

2 4 31 13 12 16 20 4 10 11 7 5 4 8 4 151

TAG-ID QB1-IRF-Ch 01-01-PS QB1-IRF-Ch 01-02-PS QB1-IRF-Ch 01-03-PS QB1-IRF-Ch 01-04-PS QB1-IRF-Ch 01-05-PS QB1-IRF-Ch 01-06-PS

Question Set 1 1 1 1 1 1

SR.NO 01 02 03 04 05 06

Chapter Ch 01 Ch 01 Ch 01 Ch 01 Ch 01 Ch 01

QB1-IRF-Ch 01-07-PS QB1-IRF-Ch 01-08-PS QB1-IRF-Ch 01-09-PS QB2-IRF-Ch 01-10-PS QB2-IRF-Ch 01-11-PS QB1-IRF-Ch 02-12-PS QB1-IRF-Ch 02-13-PS QB1-IRF-Ch 02-14-PS QB1-IRF-Ch 02-15-PS QB2-IRF-Ch 02-16-PS QB2-IRF-Ch 02-17-PS QB2-IRF-Ch 02-18-PS QB2-IRF-Ch 02-19-PS QB1-IRF-Ch 03-20-PS QB1-IRF-Ch 03-21-PS QB1-IRF-Ch 03-22-PS QB1-IRF-Ch 03-23-PS QB1-IRF-Ch 03-24-PS

1 1 1 2 2 1 1 1 1 2 2 2 2 1 1 1 1 1

07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24

Ch 01 Ch 01 Ch 01 Ch 01 Ch 01 Ch 02 Ch 02 Ch 02 Ch 02 Ch 02 Ch 02 Ch 02 Ch 02 Ch 03 Ch 03 Ch 03 Ch 03 Ch 03

QB1-IRF-Ch 03-25-PS QB1-IRF-Ch 03-26-PS QB1-IRF-Ch 03-27-PS QB1-IRF-Ch 03-28-PS QB1-IRF-Ch 03-29-PS QB1-IRF-Ch 03-30-PS QB1-IRF-Ch 03-31-PS QB1-IRF-Ch 03-32-PS QB1-IRF-Ch 03-33-PS QB1-IRF-Ch 03-34-PS QB2-IRF-Ch 03-35-PS QB2-IRF-Ch 03-36-PS QB2-IRF-Ch 03-37-PS QB2-IRF-Ch 03-38-PS QB2-IRF-Ch 03-39-PS QB2-IRF-Ch 03-40-PS QB2-IRF-Ch 03-41-PS QB2-IRF-Ch 03-42-PS QB2-IRF-Ch 03-43-PS QB2-IRF-Ch 03-44-PS QB2-IRF-Ch 03-45-PS QB2-IRF-Ch 03-46-PS QB2-IRF-Ch 03-47-PS QB2-IRF-Ch 03-48-PS QB2-IRF-Ch 03-49-PS QB2-IRF-Ch 03-50-PS QB2-IRF-Ch 03-51-PS

1 1 1 1 1 1 1 1 1 1 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2

25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51

Ch 03 Ch 03 Ch 03 Ch 03 Ch 03 Ch 03 Ch 03 Ch 03 Ch 03 Ch 03 Ch 03 Ch 03 Ch 03 Ch 03 Ch 03 Ch 03 Ch 03 Ch 03 Ch 03 Ch 03 Ch 03 Ch 03 Ch 03 Ch 03 Ch 03 Ch 03 Ch 03

QB2-IRF-Ch 03-52-PS QB2-IRF-Ch 03-53-PS QB2-IRF-Ch 03-54-PS QB2-IRF-Ch 03-55-PS QB2-IRF-Ch 03-56-PS QB2-IRF-Ch 03-57-PS QB2-IRF-Ch 03-58-PS QB2-IRF-Ch 03-59-PS

2 2 2 2 2 2 2 2

52 53 54 55 56 57 58 59

Ch 03 Ch 03 Ch 03 Ch 03 Ch 03 Ch 03 Ch 03 Ch 03

QB2-IRF-Ch 03-60-PS

60

Ch 03

QB2-IRF-Ch 03-61-PS QB2-IRF-Ch 03-62-PS QB2-IRF-Ch 03-63-PS QB2-IRF-Ch 03-64-PS QB2-IRF-Ch 03-65-PS QB1-IRF-Ch 04-66-PS QB1-IRF-Ch 04-67-PS QB1-IRF-Ch 04-68-PS QB1-IRF-Ch 04-69-PS QB1-IRF-Ch 04-70-PS QB1-IRF-Ch 04-71-PS QB1-IRF-Ch 04-72-PS QB2-IRF-Ch 04-73-PS QB2-IRF-Ch 04-74-PS QB2-IRF-Ch 04-75-PS QB2-IRF-Ch 04-76-PS QB2-IRF-Ch 04-77-PS

2 2 2 2 2 1 1 1 1 1 1 1 2 2 2 2 2

61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77

Ch 03 Ch 03 Ch 03 Ch 03 Ch 03 Ch 04 Ch 04 Ch 04 Ch 04 Ch 04 Ch 04 Ch 04 Ch 04 Ch 04 Ch 04 Ch 04 Ch 04

QB2-IRF-Ch 04-78-PS QB2-IRF-Ch 04-79-PS QB2-IRF-Ch 04-80-PS QB2-IRF-Ch 04-81-PS QB2-IRF-Ch 04-82-PS QB2-IRF-Ch 04-83-PS QB2-IRF-Ch 04-84-PS QB2-IRF-Ch 04-85-PS QB1-IRF-Ch 05-86-PS QB1-IRF-Ch 05-87-PS QB1-IRF-Ch 05-88-PS QB1-IRF-Ch 05-89-PS QB1-IRF-Ch 05-90-PS QB1-IRF-Ch 05-91-PS QB1-IRF-Ch 05-92-PS QB1-IRF-Ch 05-93-PS QB1-IRF-Ch 05-94-PS QB1-IRF-Ch 05-95-PS

2 2 2 2 2 2 2 2 1 1 1 1 1 1 1 1 1 1

78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95

Ch 04 Ch 04 Ch 04 Ch 04 Ch 04 Ch 04 Ch 04 Ch 04 Ch 05 Ch 05 Ch 05 Ch 05 Ch 05 Ch 05 Ch 05 Ch 05 Ch 05 Ch 05

QB1-IRF-Ch 05-96-PS

96

Ch 05

QB1-IRF-Ch 05-97-PS

97

Ch 05

QB1-IRF-Ch 05-98-PS QB1-IRF-Ch 05-99-PS QB1-IRF-Ch 05-100-PS

1 1 1

98 99 100

Ch 05 Ch 05 Ch 05

QB1-IRF-Ch 05-101-PS QB2-IRF-Ch 05-102-PS QB2-IRF-Ch 05-103-PS QB2-IRF-Ch 05-104-PS QB2-IRF-Ch 05-105-PS QB2-IRF-Ch 05-106-PS QB2-IRF-Ch 05-107-PS QB2-IRF-Ch 05-108-PS QB2-IRF-Ch 05-109-PS QB2-IRF-Ch 05-110-PS QB2-IRF-Ch 05-111-PS QB2-IRF-Ch 05-112-PS QB2-IRF-Ch 05-113-PS QB1-IRF-Ch 06-114-PS QB1-IRF-Ch 06-115-PS QB1-IRF-Ch 06-116-PS QB1-IRF-Ch 06-117-PS QB1-IRF-Ch 06-118-PS QB1-IRF-Ch 06-119-PS QB1-IRF-Ch 06-120-PS QB2-IRF-Ch 06-121-PS QB2-IRF-Ch 06-122-PS QB2-IRF-Ch 06-123-PS QB2-IRF-Ch 06-124-PS QB2-IRF-Ch 06-125-PS QB2-IRF-Ch 06-126-PS

1 2 2 2 2 2 2 2 2 2 2 2 2 1 1 1 1 1 1 1 2 2 2 2 2 2

101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 124 125 126

Ch 05 Ch 05 Ch 05 Ch 05 Ch 05 Ch 05 Ch 05 Ch 05 Ch 05 Ch 05 Ch 05 Ch 05 Ch 05 Ch 06 Ch 06 Ch 06 Ch 06 Ch 06 Ch 06 Ch 06 Ch 06 Ch 06 Ch 06 Ch 06 Ch 06 Ch 06

QB2-IRF-Ch 06-127-PS QB2-IRF-Ch 06-128-PS QB2-IRF-Ch 06-129-PS QB2-IRF-Ch 06-130-PS QB2-IRF-Ch 06-131-PS QB2-IRF-Ch 06-132-PS QB2-IRF-Ch 06-133-PS QB2-IRF-Ch 06-134-PS

2 2 2 2 2 2 2 2

127 128 129 130 131 132 133 134

Ch 06 Ch 06 Ch 06 Ch 06 Ch 06 Ch 06 Ch 06 Ch 06

QB2-IRF-Ch 06-135-PS QB2-IRF-Ch 06-136-PS QB1-IRF-Ch 07-137-PS QB1-IRF-Ch 07-138-PS

2 2 1 1

135 136 137 138

Ch 06 Ch 06 Ch 07 Ch 07

QB1-IRF-Ch 07-139-PS QB1-IRF-Ch 07-140-PS QB1-IRF-Ch 07-141-PS QB1-IRF-Ch 07-142-PS QB1-IRF-Ch 07-143-PS QB1-IRF-Ch 07-144-PS QB1-IRF-Ch 07-145-PS QB2-IRF-Ch 07-146-PS QB2-IRF-Ch 07-147-PS QB2-IRF-Ch 07-148-PS QB2-IRF-Ch 07-149-PS QB2-IRF-Ch 07-150-PS QB2-IRF-Ch 07-151-PS

1 1 1 1 1 1 1 2 2 2 2 2 2

139 140 141 142 143 144 145 146 147 148 149 150 151

Ch 07 Ch 07 Ch 07 Ch 07 Ch 07 Ch 07 Ch 07 Ch 07 Ch 07 Ch 07 Ch 07 Ch 07 Ch 07

QB2-IRF-Ch 07-152-PS QB2-IRF-Ch 07-153-PS QB2-IRF-Ch 07-154-PS QB2-IRF-Ch 07-155-PS QB2-IRF-Ch 07-156-PS QB2-IRF-Ch 07-157-PS QB2-IRF-Ch 07-158-PS QB2-IRF-Ch 07-159-PS QB2-IRF-Ch 07-160-PS QB2-IRF-Ch 07-161-PS QB2-IRF-Ch 07-162-PS QB2-IRF-Ch 07-163-PS QB2-IRF-Ch 07-164-PS QB2-IRF-Ch 07-165-PS QB1-IRF-Ch 08-166-PS

2 2 2 2 2 2 2 2 2 2 2 2 2 2 1

152 153 154 155 156 157 158 159 160 161 162 163 164 165 166

Ch 07 Ch 07 Ch 07 Ch 07 Ch 07 Ch 07 Ch 07 Ch 07 Ch 07 Ch 07 Ch 07 Ch 07 Ch 07 Ch 07 Ch 08

QB1-IRF-Ch 08-167-PS

167

Ch 08

QB1-IRF-Ch 08-168-PS QB1-IRF-Ch 08-169-PS QB1-IRF-Ch 08-170-PS QB1-IRF-Ch 08-171-PS QB2-IRF-Ch 08-172-PS QB2-IRF-Ch 08-173-PS QB2-IRF-Ch 08-174-PS

1 1 1 1 2 2 2

168 169 170 171 172 173 174

Ch 08 Ch 08 Ch 08 Ch 08 Ch 08 Ch 08 Ch 08

QB2-IRF-Ch 08-175-PS QB1-IRF-Ch 09-176-PS QB1-IRF-Ch 09-177-PS QB1-IRF-Ch 09-178-PS QB1-IRF-Ch 09-179-PS QB2-IRF-Ch 09-180-PS QB2-IRF-Ch 09-181-PS QB2-IRF-Ch 09-182-PS QB2-IRF-Ch 09-183-PS QB2-IRF-Ch 09-184-PS QB2-IRF-Ch 09-185-PS

2 1 1 1 1 2 2 2 2 2 2

175 176 177 178 179 180 181 182 183 184 185

Ch 08 Ch 09 Ch 09 Ch 09 Ch 09 Ch 09 Ch 09 Ch 09 Ch 09 Ch 09 Ch 09

QB2-IRF-Ch 09-186-PS QB2-IRF-Ch 09-187-PS QB2-IRF-Ch 09-188-PS QB2-IRF-Ch 09-189-PS QB1-IRF-Ch 10-190-PS QB1-IRF-Ch 10-191-PS QB1-IRF-Ch 10-192-PS QB1-IRF-Ch 10-193-PS QB1-IRF-Ch 10-194-PS QB2-IRF-Ch 10-195-PS QB2-IRF-Ch 10-196-PS QB2-IRF-Ch 10-197-PS QB2-IRF-Ch 10-198-PS QB2-IRF-Ch 10-199-PS

2 2 2 2 1 1 1 1 1 2 2 2 2 2

186 187 188 189 190 191 192 193 194 195 196 197 198 199

Ch 09 Ch 09 Ch 09 Ch 09 Ch 10 Ch 10 Ch 10 Ch 10 Ch 10 Ch 10 Ch 10 Ch 10 Ch 10 Ch 10

QB2-IRF-Ch 10-200-PS QB2-IRF-Ch 10-201-PS QB2-IRF-Ch 10-202-PS QB2-IRF-Ch 10-203-PS QB2-IRF-Ch 10-204-PS QB2-IRF-Ch 10-205-PS QB1-IRF-Ch 11-206-PS QB1-IRF-Ch 11-207-PS QB1-IRF-Ch 11-208-PS QB1-IRF-Ch 11-209-PS QB1-IRF-Ch 11-210-PS QB1-IRF-Ch 11-211-PS QB1-IRF-Ch 11-212-PS QB2-IRF-Ch 11-213-PS QB2-IRF-Ch 11-214-PS QB2-IRF-Ch 11-215-PS QB2-IRF-Ch 11-216-PS QB2-IRF-Ch 11-217-PS QB2-IRF-Ch 11-218-PS QB2-IRF-Ch 11-219-PS QB1-IRF-Ch 12-220-PS QB1-IRF-Ch 12-221-PS QB1-IRF-Ch 12-222-PS QB1-IRF-Ch 12-223-PS QB2-IRF-Ch 12-224-PS QB2-IRF-Ch 12-225-PS QB2-IRF-Ch 12-226-PS

2 2 2 2 2 2 1 1 1 1 1 1 1 2 2 2 2 2 2 2 1 1 1 1 2 2 2

200 201 202 203 204 205 206 207 208 209 210 211 212 213 214 215 216 217 218 219 220 221 222 223 224 225 226

Ch 10 Ch 10 Ch 10 Ch 10 Ch 10 Ch 10 Ch 11 Ch 11 Ch 11 Ch 11 Ch 11 Ch 11 Ch 11 Ch 11 Ch 11 Ch 11 Ch 11 Ch 11 Ch 11 Ch 11 Ch 12 Ch 12 Ch 12 Ch 12 Ch 12 Ch 12 Ch 12

QB2-IRF-Ch 12-227-PS QB2-IRF-Ch 12-228-PS QB1-IRF-Ch 13-229-PS QB1-IRF-Ch 13-230-PS QB2-IRF-Ch 13-231-PS QB2-IRF-Ch 13-232-PS QB2-IRF-Ch 13-233-PS QB2-IRF-Ch 13-234-PS QB1-IRF-Ch 14-235-PS QB1-IRF-Ch 14-236-PS QB1-IRF-Ch 14-237-PS QB1-IRF-Ch 14-238-PS

2 2 1 1 2 2 2 2 1 1 1 1

227 228 229 230 231 232 233 234 235 236 237 238

Ch 12 Ch 12 Ch 13 Ch 13 Ch 13 Ch 13 Ch 13 Ch 13 Ch 14 Ch 14 Ch 14 Ch 14

QB1-IRF-Ch 14-239-PS

239

Ch 14

QB1-IRF-Ch 14-240-PS QB1-IRF-Ch 14-241-PS QB1-IRF-Ch 14-242-PS QB2-IRF-Ch 14-243-PS QB2-IRF-Ch 14-244-PS QB2-IRF-Ch 14-245-PS QB2-IRF-Ch 14-246-PS QB2-IRF-Ch 14-247-PS QB2-IRF-Ch 14-248-PS QB2-IRF-Ch 14-249-PS QB2-IRF-Ch 14-250-PS QB2-IRF-Ch 15-251-PS

1 1 1 2 2 2 2 2 2 2 2 2

240 241 242 243 244 245 246 247 248 249 250 251

Ch 14 Ch 14 Ch 14 Ch 14 Ch 14 Ch 14 Ch 14 Ch 14 Ch 14 Ch 14 Ch 14 Ch 15

QB2-IRF-Ch 15-252-PS QB2-IRF-Ch 15-253-PS QB2-IRF-Ch 15-254-PS

2 2 2

252 253 254

Ch 15 Ch 15 Ch 15

Question Weekly premiums are generally collected for which type/range of plans Who is the customer of a Re insurer What facility do insurers use to cover risks beyond their exposure limits Which market areas do Micro Insurance product concentrate What are the benefits in investing in insurance plans ? What is IRDA & its Responsibilities

What is IRDA stands for & year of Incorporation Why is Insurance required When was IRDA formed?? Insurance company selling products through newspaper advertisements is called Sanjeev is an insurance expert who has rich experience in determining premium levels for product, what is his profile like Law of large number helps Insurer to analyse which key area Which statement is correct? What is the death benefit if the person has multiple sums assured under different policies? Which of the following risks are insurable? Sahil & Vijay , both health status same, however Vijay was triggered with medicals. What are the reasons? The type of risk that can be insured against is In insurance terms, the risk of suffering a disability is best described as what type of risk? Insurance is a mechanism of A client has taken an endowment policy with SA- 800000 and vested bonuses- 60000. He paid 8 annual premiums in the 30 year plan. Calculate paid-up SA? When does cooling off period begin in an insurance policy? When is insurable interest required in an life insurance contract? A claim intimation leads to the publishing of an advertisement in the newspaper. This means A policy has two nominations. What amount should be given to the two nominees

Mr. X is illiterate and is buying insurance. Mr. Y fill up the proposal form on behalf of Mr. X and also endorses and signs an attestation in the proposal form. In addition to all document what else should be taken On Maturity of an insurance policy only 25% of the amount can is paid. This is due to A person paying 1 lakh yearly premium discontinue the policy after the first year premium and surrender the same on the second year what will be the surrender value Jay buys a policy on the life of Nazia. Who is Jay? A Client can reject a policy after how many days of receiving the same. For Logging a policy which document is more preferable Baptism Certificate or Ration Card as age proof? The risk commencement date of policy is Principle of Indemnity applicable to ........... is the basis of contract A & B in enters into a Contract & B accepts the Contract with a condition. Will this be considered as a Contract Between A & B? The condition that the policy holder should pay the premiums regularly is mentioned in The insurance cover Starts after the issue of Except Surrender, how one policy holder can transfer money to a third party , barring Nominee? Insurance Contract without any Insurable Interest will result? a Policy holder takes a insurance contract for 30 years and the SA reduces after 25 years what could be the likely reason Amit is illiterate. He wants to take policy his friend Surya help him in knowing the question and filling the proposal form. What extra requirement is required in this case A life insurance policy can only be made paid up if what particular policy feature exists? Appointee's role Harish takes a life insurance policy for Ramesh. Which of the following statement best describes the principle of Insurable Interest. Limit of nominees can be attached to a term insurance policy In a whole life plan - The policyholder's responsibility to give disclosure Mr. ABC buying Term insurance policy, insurer should mention Ombudsman address in which part of policy document? Reasons for surrender of the policy To be a valid contract ,the declaration is necessary in which document Types of assignment what is the min age to enter into the contract of insurance why does an insurer insist on age proof document . To assess

A policy document for a money-back policy includes the statement the proposal and declaration signed by the proposer form the basis of the contract. In which main section of the policy document will this normally appear? Changes in policy can be made by If someone of age group 15 /16 having a contract with insurance companies that contract would fall under which category The obligation of the insurer for the whole life policy is mentioned in Husband and wife jointly taking insurance policy what is the reason that they need not mention nominee under this insurance policy In which kind of policy the insurable interest should exist at the time of claim only Indisputability clause is applicable for Insurable interest on one's own life limited upto Two endowment policies A and B are issued in the same time on the quarterly mode. In both the policies 22 quarterly installments are paid. Both are surrendered immediately after paying 22nd installment. But in policy A surrender value is significantly higher than policy B because What is the minimum age of the customer for entering the Insurance contract? When will the Principle of Utmost Good faith apply in Term insurance plan? A policy was earlier issued with premium extra, where are the details of the customer available An agent surrendered the policy of a client on 10 Feb. 2011, when can this client buy new plan? When does insurable interest exist? While underwriting Mr. X proposal form it is found out that there is a criminal case against him for fraudulent activities. What type of risk would this fall in How much insurance can be given to a working person ? While calculating Human life value (HLV) two components need to be kept in mind , the one is take home salary and other is Two People with same term, one person had more premium than others because TWO FRIENDS HAVE TAKEN SAME POLICY BUT THEIR PREMIUMS ARE DIFFERENT WHY? In a 20 year with profit policy, persistency Bonus is paid at the end of Which of the following statements is correct? Till what period is the interim bonus valid Annual premium of insurance product is Rs. 32,000, 4% loading on Quarterly mode of payment What is the quarterly premium? As per the norms of risk assessment by U/W both the parents of a policy holder died in their early 30s due to Heart disease, what is the risk assessed Investment by NRI(Non Resident Indian) will be Mr.Sunil is doing premium calculation for his company, as per which authority is his profession related to

what is the special report that is asked by the underwriter from the officer of the insurer why ACR required? A human being is Claim was settled however full Sum assured not paid though the policy was in force due to Mr. A wants insurance cover . But he is drinks alcohol frequently . What kind of hazard you may categorize? Insurer appoints a candidate of this professional qualification ,who decides the amount of premium in insurance products Proposal decision to be communicated to the client with in When an interim bonus is paid under with profit policy, This normally represents a bonus covering what period What tax rate, if any, will be applicable to a life insurance policy holder for the maturity proceeds of a Rs 50,000 life insurance policy What is maximum level of Insurance premium for which Income Tax benefit is available Who is the primary underwriter of the clients Mr. X wants a life cover for the term of 20 Yrs. Also he wants a modest amount if he survives through the term. Which plan should he buy In which policy can policy holder take loan ? Which plan will suits a customer need who is just looking for protection of family. If 50000 is invested in Single Premium ULIP than what will be the minimum SA applicable? What is the maximum cover that can be provided in micro insurance? State which of the following statements are correct? Mr. A has a son who is 5 yrs and he wants to save funds for his education. Both the parents are risk adverse. Which plan is suitable for them? A Couple has 7 year kid & wants to Buy some Policy. Which is the best suitable policy for his Son? Ajay is 35 years old and works for a multinational corporation (MNC). He has a ten-year-old son, Vijay, whom he dreams will one day become a doctor. Ajays spouse is a housewife, and his parents are retired and dependent on him. Ajay has a home loan of 40Lakhs. He has an endowment plan with a cover of 2Lakhs only. What is most immediate need for Insurance Client has taken Joint Life Policy.. Whose responsible in the contract? If a person has taken a Pure Endowment Policy, then what will be the death benefit if he dies during term of policy? Two People of the same policy Term, one person pays more premium because

Micro insurance is transacted by Adverse selection occurs when a group of individuals try to If raju wants to accumulate a lump sum for 20 yrs but does not require life cover, which policy will be suitable? In a joint life plan for a husband & wife, where should the agent' principal loyalty lay? Hari wants a constant life cover till his 31st birthday. But he cant afford to pay high premiums. The best suited products for him would be what is the special feature of ULIP that ensures customer risk profile for long time insurance policies At the time of maturity , quarter of the SA is paid though the policy was in force Rahul has taken a joint life policy with his wife .Who is responsible for premium payment ? Krishna and Laxmi are married having 7 years old child. Which policy will satisfy the long term protection needs for both Term insurance if best suited for the following need A group of people insured in a policy . They belong to which category In endowment policy we give SA + BonusWhich factor needs to be kept in mind before deciding a child policy ? Suresh wants to transfer his physical gold to gold exchange traded fund, in relation to access, this change will ULIP & NSC which is giving more tax benefit The advantage/disadvantages within cumulative and fixed traditional deposits pertain toAjay is 35 years old and works for a multinational corporation (MNC) **Ajay salary is 80,000 he want home lone. what is maximum installment? ULIP & NSC which is giving tax benefit u/s 80C Under which section of the Income Tax Act can an individual get a deduction from taxable income for the What period of time a client has to be invested to get tax benefit under postal scheme? If a person is going to face jobless for a temporary period, then what is the ideal instrument to invest money apart from Bank FD? Mr. X Invested in a Bank FD with 6% Return, However his actual returns deemed to be 4% What are the reasons ? A person planning to invest in Kisan Vikas Patra will go to A person Wants to invest in a FD for Tax benefit , How many years he has to take the term of the FD ? aditya wants to take home loan and his monthly take home is 80,000 what as a best practice should be the maximum EMI A customer while investing in to Recurring deposit or Cumulative deposit what are the key factors which will matter

A person is holding 100 units of GOLD ETF certificates . How many grams of GOLD does he Have ? Manoj a 26 year old is having 7 years old son. What will happen to his monthly disposable income after 15 years of job Ramesh has invested in Post office Monthly Income Scheme. The interest rate was set at 6%. What will be the effect of rate till the maturity. If a person chooses Cumulative deposit than Recurring deposit ,difference will be in Kishan Vikas 's payment gets cleared at RBI increased interest rates 2 times, then the stock prices will Rahul switch from direct holding of shares to equity based mutual funds. The impact on risk would be Raj and akshat of same age are paying the same annual premium for the health policy taken on the same date for the same term. But raj is getting higher deduction for income tax as compared to akshat Raj is married with two children. Age 9 and 11 years. What should be the last priority for him among the life, health , retirement and child investment policy What is the frequency of interest in Cumulative deposit account What is the amount of money a client can take out as a lumpsum from a pension policy? Omkar Started a pension policy with provider A but ended up in taking the annuity payment from provider B.The result directly reflect the which feature available with this policy Denny is married and has 2 children age 6 and 10. His parents are alive and are 70 and 68. Who all can be included under the family floater health plan Critical illness rider was taken and the rider benefit has been claimed , the rider benefit now gets In a Guaranteed annuity option of 5 years , the policy holder will get annuity till What frequencies can one take in annuity Why is there a waiting period in health insurance policies? How is No Claim Bonus is given in a Health Insurance Policy What is importance of Health insurance? A person retiring within 3 months need return as pension. What kind of investment plan he need to choose. An individual need a lump sum at the age of retirement, the amount he need to invest annually for the goal will depend on What are the Special features of Health plan? What will be maturity benefit under health insurance plan Which is the suitable savings plan for a senior citizen Claim Amount received under CIBR Rider ,can be spend for

What could be the percentage of guaranteed return in all ULIP pension plan. A person has taken a term insurance of 4 Lac. What is the maximum Critical Illness Rider he can take commutation is a feature of which type of policy Mr. Sharma buy term insurance policy along with Accident and Disability benefits rider cost restricted upto the base premium of the policy? Mr.Ramesh invested Rs:50000 in pension policy, what is the percentage he can avail as exemption in Income tax. Mr.Sumesh takes a policy and pays premium of 20000 with a sum assured of 300000, what will be the tax implication on his maturity amount Yash wants to take open market option in Pension plan. What is the benefit? In rising life expectancy the need for pension policy is increasing as retirement planning is Ramesh wants to buy 15 years pension plan for retirement while calculating gaps required at the end the gratuity amount was completely ignored because he is While calculating pension figures, required at the time of retirement, two factors should be considered while planning, One is taxation and other is A invested money in Sr Citizen scheme. What is the tax benefit he receives? If Rs.30000/- has been invested in insurance for tax benefit than how many years does one have to wait for maturity ? Mr.Arvind has 2 children aged 13 & 15, he wants to buy 2 health plans, one for himself & one for his wife, what will you recommend. Which fund needs to be selected to receive a 4.5% guarantee on Pension ? In which of the recognized life stages an individual does not required any protection cover Mr. X fact find shows he need a term insurance for his future income protection, A family health plan to cover medical needs, a children's plan to cover his son's education and a endowment policy for his daughter's marriage. Which of these is the first priority Why need do self employed people have to buy medical insurance than that of a person employed with a public sector company A family consisting of husban,wife and two children aged 6 and 10 what kind of insurance plan can be suggested ? Rajiv is married & has 4 year old son. Which insurance plan is suitable for him? What to be considered while taking first policy Samir is married and he has only one partner, with dependant parents and no child, which should be his priority The sole focus during a clients fact-find session was healthcare requirements and estate planning. Which main life stage is he most likely to fall into? The main protection need of a 19-year-old is most likely to be

With profit policies can be given to Benefit Illustration given to a customer quantifies an amount by which investment return is reduced. This reduction reflect the impact of Fact Find Process helps to A Person Need to do Estate Planning when Which plan should an agent suggest In a fact find, a couple discovered their need to be estate planning? In what life stage will they be in? Mr. Prasanth 25 Age Govt: job, Bachelor - how many years policy can be given Sanju & vikram are both 22 yrs old. Sanju has dependent parents and vikram has no dependants. What will be sanjus preference over vikrams preference? A Couple has 7 years old son, What solution would they be looking for The commission payable in a ULIP plan to the Advisors is mention in... An agent has recommended an investment product with nonguaranteed benefits. The benefit illustration passed to his client will therefore use assumed annual growth rates of The rates of assumed annual growth to be shared in the benefit illustration has been decided by which of the authority While recommending a solution to the client, the advisor should, establish the link between, client needs and A 38 year old married with 2 children, her husband dies and left huge legacy behind. What should be top priority? A young couple wants to invest for their daughter, and their income will increase with time horizon and suggest investment plan? The best way to prove that customer of a ULIP policy is given awareness about the commission paid to the agent is An agent reveals the commission received from Insurance sales to X and Y. Both are for the same duration. Why is commission of X far higher than commission received for Y An agent should disclose the commission if Nikhil explaining ULIP plan to a customer doesn't know answer of a doubt regarding the product that the customer has. What should he do? Churning is considered bad for a customer. Why is it? What is the reason , that an advisor is getting more than 35% Commission in the 1st Year? Churning is bad , based on which aspect Higher persistency to the insurer ensures what ? Persistency =has increased from 82 % in previous year to 86 % this year . That means A satisfied client will lead to

An Agent can receive maximum of ________ %of the premium as commission in the first year Customer asks the agent to disclose the commission . The agent should If Sales Target get reduced then Churning will Advisor motivate the client to surrender the existing Endowment plan and buy new Whole life policy for gaining higher commission, is the example of? An advisor will do a churn to What are the key aspects of advisors do for better persistency? If a person is missing then after how many years will he be considered as dead & SA paid to the nominee. What is the death benefit if the person has multiple sums assured under different policies? Client died in 89th day from DOC. In which category he is not eligible for claim Mr. Customer has taken a policy and died before receiving the document which was dispatched by the insurer. In a claim, the customer got much more than the Sum Assured. Why? Without submitting any form of claim, a life insurance policy holder received payments of maturity then what type of policy he is holding If a person is absconding then after how many years will he be considered as dead & SA paid to the nominee. No of days in which the death claim has to be paid after the necessary documents have been received Mr.Suresh dies one day before the grace period without paying the premium, what is the claim payable The delay in settling claim by any insurance co, as per IRDA norms has to pay....% if the present bank interest rate is 5.2% What is the maximum Time in which The insurer should settle a claim when all documents are submitted During claim insurer deduct Rs. 10,000 in spite of having no Lien and all due premiums are paid. What are the other reason for deducting the same? In case of confirmed accidental death, the benefit is paid in the form of Under Indian Evidence Act 1872, after which year presumption clause will apply if the person is not heard of Which institution was incorporated by the Insurance Act 1938 License of candidate passing insurance exam is valid for ___ years? The controller of insurance in India is Who is regulating Advisor's Licencing If the policy is endorsed under MWP Act - then the beneficiaries are wife and ? Consumer Forum at district level will hear complaints up to Mr. ABC cleared the IRDA exam on 2010 got license but he did not work , In which of the year again he will apply for insurance license?

What is the Thresh hold limit of premium in cash insurance as per monetary policy? Who is regulatory body of money laundering in insurance sector? Which is the training institute for providing training to insurance agents? What is the eligible age for Life Insurance Agent? Board of Insurance is related to basic qualifications of agent Investment by foreign direct investors in to Insurance co's is restricted to What is the role of National Insurance Academy? Karthik written to his insurer about non settlement of a maturity claim, as per regulations, the insurer has to reply to this within how many working days When was Ombudsmen Created? Insurance companies are required to honor the awards passed by the Insurance Ombudsman Matters referring to ombudsman? Client rejecting after taking a policy in how many days.When the insured disagrees with any of the terms or conditions of the policy after the policy is issued, they have the option to return the policy stating the reasons for their objection. Within how many days they can return the poly? Consumer can call Toll free No. for any Grievance or he can also contact What is the free look time available after receiving policy Documents? What is the limit of Ombudsman claim settlement? Regulation issued by IRDA required that the decision on the proposal must be conveyed to the proposer within Whom should customer contact in case of any dispute for a claim more than 20 lakhs Complaint council bodies other than IRDA grievance readdress forum & COPA What are the ways by which a policy holder can make complaints what is the maximum level of complaint that can be considered and taken action by ombudsmen What is the period of award passed to the customer decided by ombudsman? An Award is passed by Ombudsman .In how many days it should be honored by Insurance Co If the complainant is disagreeing with the decision of the company on the claim then he can approach to ombudsman in A policy has been rejected by the company under direct intimation to the customer and copy to the Agent, what is the next action of the Agent

An advisor while explaining the policy and to sell he accepts to give a part of his Agents commission, what is the limits Raju is a certified license holder under what circumstances he needs to hold his certified license with him that is issued by IrDA ___________ has laid down the Code of Conduct for all agents

Answer choice 1 Banca assurance High Net worth Individual Bancassurance People with large families In Family Protection

Answer choice 2 Health plans Insurance Companies Reinsurance people with low income

Child education & marriage planning Insurance Regulatory and Development IRDA is a Government body Authority (IRDA) was constituted as an formulated for policing the activities of autonomous body Insurance companies in 1999 to regulate and develop the insurance industry Insurance Regulatory and Development Authority (IRDA) . The Insurance Regulatory and Development IRDA was incorporated as an Authority (IRDA) was constituted in 1956 autonomous body in April 1999 To Cover Risks of Life To plan for Future goals 2000 1999 Indirect Selling an actuary Administrative expenses lung cancer is peril and smoking is a hazard Sum Assured will be paid as total of all insurance plans Financial Risk Difference in age Speculative Risk Financial. Retention of risk 89,333 When risk commences At inception of the policy Policy is assigned 10% to each nominee 273,333 When proposal form filled At the time of maturity proceeds Policy document is lost 25% to each nominee Awareness loss adjuster in fixing the correct premium smoking is peril and lung cancer is hazard Sum Assured will be paid for only one plan with highest SA Non-financial Risk Difference in family health status Pure Risk Fundamental. Transfer of Risk

Mr. X photograph It is assigned Premium Return Life Assured 30 Ration Card After the U/W process Life Insurance Policy bond Contract is created only when the acceptance is unconditional. Policy document Policy Document By Will Wagering Contract No bonus accumulated Amit photograph Indexing contribution. Signature on the proposal Ramesh declares all his liabilities one at the beginning of the contract operative clause SA Policy Document Absolute 16 SA

Mr. Y photograph It is a money back policy Premium with Interest Nominee 15 Baptism Certificate Premium receipted General Insurance Proposal form Contract is created only when the acceptance is conditional. Prospectus First Renewal Receipt By doing Assignment Legal Contract Age proof was substantially wrong Amit thump impression Only Nomination facility. Medical exams Ramesh is elder than Harish two through out the contract Preamble advisor induced proposal form Term assignment 18 Risk assessment

Attestation. Issuing a new policy Valid operative clause Whole life Motor insurance 6months 20 times of Gross Annual income Term of A policy is higher than B policy

Operative clause. Endorsement Invalid Preamble Return of premium Marine insurance 12months Liabilities Term of B policy is higher than A policy

16 years Throughout the policy contract Proposal form 2014 A inception of the contract Fundamental risk As per Human life Value Bank Fixed deposit rate Married AGE 1 year Smoking invites extra premium as long as the policy is inforce 7680 Moral Hazard No risk Council of Actuaries Physical hazard 10L discount rate Wife Younger MEDICAL 10th year

17 years before premium deposit Medical reports 2012 At claims

Drinking invites extra premium Till the next declaration of bonus 8000 Medical Hazard Low risk Insurance council of India

HLV report To calculate Premium An economic asset Lien Physical hazard Actuary 7 days Policy start date to the 1st Anniversary Nil 25000 Insurer's doctor Term Plan Health Policies Term Insurance 50000 5000 In ULIPs riders can be attached Convertible plan

Client confidentiality report To Calculate the commission due for the agent Has a capacity to generate the income Bonus Moral Hazard Underwriters 10 days Policy start date to the end of the 1st calendar year 0.1 50000 Underwriter Endowment plan Term Policies ULIP 75000 10000 In ULIPs death benefit will be the basic SA only Term Insurance

Only ULIP Plans

Only Endowment Policies

term plan

health plan

Insurer No Death Benefit Married

Proposer Sum Assured will be paid Wife Younger

Life Insurers only Non-Life Insurers only cover only particular members of to cover all members the group Term insurance plan Insurance company Pure Endowment fund switching Endowment Rahul Endowment home loan Same Age Outstanding premium Mode of the premium Increase his liquidity ULIP Returns 8,000 ULIP S. 80D 10 Years Debt Funds of MF Inflation Insurance Branch 5 year 20000 Taxation Money back Husband only Anticipated endowment partial with drawl Lien His wife Money back education needs Employees Commission outstanding Inflation Decrease his liquidity NSC Taxation 16000 NSC S. 80C 8 years NSC Charges Post Office 4 year 24000 frequency of payment

10- 20 gms Marginally decrease Increase gradually frequency of interest calculation Bank increase Less transparent Raj is married and akshat is single

20- 50 gms Significantly increase Decrease gradually Tax Post office decrease More diversified Raj is above 65 years and Akshat is below 65 years Health Insurance cover Quarterly one-third Differed Annuity Option

Life Insurance Monthly One-tenth Commutation Option

Denny only Reduced the base SA entire life term monthly,quarterly,half yearly, yearly Pre-existing illnesses By way of Cash Discount meet any medical emergencies Immediate Annuity the deferment period Covers disease expenses Fund value Term insurance plan Health Expenses Only

Denny and his wife terminated till 5 years and continue till annuitant lives fortnightly,quarterly,monthly,yearly Change in premium terms Discount in Renewal Premium Major hospitalisation and treatment expenses Deferred Annuity amount which required Helps in Tax Benefits Paid premium Money back Household expenses Only

0.06 1 Lac annuity 20% 33.33% Fully taxable save more tax Less expensive self employed Health Amt will be deducted from taxable income upto 1 lakh 5 YRS Family floater ULIP Childhood Young Married

0.085 2 Lac joint life policy 30% Pension plan is not eligible for tax exemption 10% switch the underlying fund Less Transparent Widower Charges Rs 1000 will be deducted 10 YRS Health plan ENDOWMENT

Term Insurance

Medical Insurance

Public sector employees do not get sick very often Protection plan Child plan Personal Details income protection Young married couple self-protection.

public sector employees enjoy medical cover related to the Job child plan convertible plan Family Details inheritance planning Young married with children. home loan protection.

surety Charges Ensure a sale is achieved Young Person A Plan based on needs to the Client Married Short term Investment Retirement Illustration benefit 5% and 8% Interest

keyman

Identify Client need 30-40 years age group A plan based on paying capacity of the client Married with children long term Health Insurance cover health care Premium receipt 5% and 10%

IRDA Advisor need estate plan term plan Ask the insurer to give a policy endorsement letter

Life insurance council Product features loan protection endowment From the fact details

Only X has bought other product from Only Y has a Single premium Product the agent the commission is low Ask the customer to check it himself Impact of charges on customer fund Not possible Agents earn Lower Commission on churning More productivity more lapsation Word of mouth publicity for the agent the commission is high tell him what ever he thinks Higher commission to advisor Alternate channel Policyholder gets more benefits Higher attrition more attrition Chances of up selling

Thirty Percent disclose on demand Increase switching Avoid a customer complaint Selling product as per need & policy servicing 5 7

Twenty percent Not disclose Decrease Building long term relations Minimize paper work Surrender

Death Benefit will be the amount with No amount will be paid highest SA policy Murder Entitled for full claim Nature of payment ULIP 10 years 15 days No claims payable 7.00% 3 days Premium Rate increase Life time annuity 6 years Insurance Institute of India 1 IRDA IRDA parents 20L 2013 Deep Illness Entitled for partial claim Investment Frequency Term 20 years 30 days All premiums paid 8.50% 15 days Loan facility Lumsum sum assured plus accidental sum assured 7 years Insurance brokers association of India 3 RBI Insurance Act 1938 ex wife 40L 2014

10000 SEBI Insurance Institute of India 16 SEBI sound mind & graduate 12% To regulate 3 1998 15 days partial or total repudiation of claims by the insurer 5 1986 10 days IRDA 15

20000 RBI

IRDA sound mind & good income level 25% To advise Government

dispute with regard to premium paid or payable

30

15

Consumer Affairs Department of the IRDA 30 insurance contracts of value not exceeding Rs. 20 lakhs 15 days Forum at district level Ombudsman email 20 lac 2months 15 days 1 month he has to inform the customer that the co has broken relationship with the customer

Insurance Ombudsman 15 insurance contracts of value not exceeding Rs. 25 lakhs 20 days Forum at state level Insurance Institute of India Toll free No. 25 lac 3 months 30 days 6 weeks he plans to change the plan

10% when he sells term insurance Insurance Institute of India

20% when he represents himself as another insurer Insurance Regulatory & Development Authority

Answer choice 3 Micro Insurance Licensed Insurance Agents Both a & b people employed with the government Retirement planning IRDA is an independent body constituted to address the grievances of the insurance policy holder IRDA is an independent body constituted to address the grievances of the insurance policy holder For Savings 2001 Direct Selling risk manager to remove adverse selection Both the statement is correct No SA will be Paid. Both are correct Difference in hobbies Pure & Speculative risk Homogenous. Avoidance of Risk 289,333 When policy received At time of claims Policy is in lien

Answer choice 4 Term Insurance Non Government Organization Neither a nor b people with high income All of the above None of the above

Correct Answer No 3 2 2 2 4 2

None of the above All of the above 1998 Wrong Selling underwriter Non of the above Both the statement is incorrect None of the above None of them All of the above Non Financial Risk Speculative. Reduction of risk 219,333 When premium is paid At time of outset and claims Any one of the above

1 4 2 3 1 2 1 1 1 4 2 1 2 2 3 1 2 4

Nominee one should not be paid There is no specified limit more than nominee two like that

Mr. X thumb impression It is paid up Premium less charges Proposer 50 Elder Declaration Policy is dispatched Both a & b Premium Both are Correct Proposal form First Premium Receipt Claim Void Contract Policy has become paid up policy document need to be registered Rider benefits. insurable interest Ramesh owes money form Harish three Revival stage Information statement no commission FPR Conditional 20 Identity verification

Mr. Y thumb impression Any one of the above Nothing as surrender is not allowed before 5 policy years Appointee 20 Voter card policy is received Neither a nor b Health report Both are Incorrect All of the above None of the above not possible to transfer All of the above Its a ULIP Plan Left thumb Impression of Amit along with a declaration of his friend Savings element. when Nominee is Minor Harish suffers financial loss incase of death of Ramesh not specific both a & c schedule Has Financial Problems RPR Absolute & Conditional 21 Financial assessment

3 3 4 3 2 2 2 2 2 1 4 3 2 1 3 4 4 4 4 4 4 3 4 2 4 2 2

Preamble. Corrections on the policy Void Proviso Joint Life Policy Liability insurance 2years Assets

Terms and conditions. Not allowed Illegal Endorsement Endowment policy Travel insurance 5years Unlimited

3 2 2 1 3 2 3 4

Policy A is assigned and B is not Policy B is assigned and A is assigned not assigned

18 years before receiving policy document Client confidential reports 2013 at survival benefits Moral Hazard 50L Estimated life expectancy Health deterioration SA 15th year None is correct Till the next validation date 8320 Occupational Hazard Medium risk Insurance institute of India

21 years After receiving the policy document Medical referees report Anytime Through out the term No Risk 1 Crore Estimated amount at retirement Dirrerence in caste ALL THE ABOVE 20th year Both are correct none of the above 8500 Physical Hazard High risk IRDA

3 1 1 4 1 3 1 3 3 4 4 4 2 3 4 4 1

moral hazard report To verify the Plan proposed Has a finite life span Surrender financial risk Sales Officer 15 days Previous valuation date to claim date 0.2 100000 Agent Convertible plan Endowment Policies Endowment 62500 50000 both statements are correct Endowment Plan

medical report To help the underwriter to asses the Risk All of the above Accidental death Pure risk Advisor 30 days claim date to next valuation date 0.3 150000 Nominee ULIP All of the above Moneyback 100000 100000 Both statement are wrong ULIP Plan Child insurance plans can be taken out in the form of endowment plans, moneyback plans or ULIPs

2 4 4 1 2 1 3 3 1 3 3 2 3 1 3 3 2 3

only Term Plans

endowment plan

traditional plan

Proposer & Wife Both are correct Health deterioration

Insurer and both the Life Insured both are incorrect Higher Age

4 1 4

non-life and life insurers have uniform coverage pure endowment policy Husband & wife Term plan premium holiday Money back children Term Insurance marriage of kids Family Both of the above Maturity Value

None of them None of the above Whole life Insurance company, husband & wife ULIP riders Surrender Both a & b Child Investment policy Retirement needs Acc to height None of the above Vesting Age

1 1 3 4 3 1 3 1 3 1 2 1 2 1 1 1 4 3 1 4

Reduce his encashabilty for next Create a future exit liability six months Both with same benefit Look-in Period 24000 ULIP & NSC S 80E 6 years Corporate bonds Current Market Scenario Internet 3 Year 28000 interest rates None of them having any tax benefit Investment Frequency 32000 None of them S. 80F 5 years Govt Bonds All of the above Mutual Fund Office 2 Year 32000 tenure

1 1 2 1 4 3

50-100 gms less than after 15 years Remain Constant Interest tax Insurance company volatile Less return Raj is in the good health and akshat is in poor health Retirement plan Half Yearly one-fifth Guaranteed period option half

10 gms will remain same Change as per market fluctuation Tenure Any one of the above same Steep rise Raj is earning more and akshat is earning less Child Investment policy Yearly

3 2 3 1 2 2 2 2

3 2 2 4

Open Market option Denny, His wife and children and parents will discontinue for 1 months None of the above

Denny, His wife and children continues as it is annuity only for 5 years

3 2 2 1 1 4 4 1 4 4 4 4 3

fortnightly, monthly ,half yearly, None of the above yearly Cooling off period for Nature of risk insurers Free increase in Sum Free Renewbality Assured meet expenses post All of the above hospitalisation due to loss of income Anticipated Endowment investment tools used for investment covers hospitalization cost Paid premium with interest ULIP Plan Unspecified reason ULIP All of the above All of the above No maturity benefit Pension plan to pay the further premium of base plan

0.045 3 Lac pure endowment policy 40% 1 20% improved annuity rate More necessary Savings are significantly higher Inflation 10% of the amt will be deducted 7 YRS Endowment plan POST OFFICE Pre Retirement Retirement

0.1 4 Lac policy of another person 50% will depend on his income slab Tax fully exempted To continue life cover Tax efficient Govt employee Interest rates 20% of the amt will be deducted 3 YRS Term Plan BANK

3 4 1 2 4 4 3 3 1 3 1 1 1 1 4

Children's Policy

Endowment Policy

Self employed person fall sick quite often Saving plan pension plan Employment details investment efficiency Pre-retirement. protection of Dependants.

Self employed person give more priorities to health All of the above ULIP Plan All of the above long term savings Retirement protection of childrens future.

2 4 1 4 1 4 1

partner Inflation Create an audit trail for future complaints Married A Plan based on the clients dreams Married with older children As per his goal Life insurance cover child education Product Brochure 6% and 8%

Individual Taxation Provide regulatory body about agents data base About to get retired None of the Above Retirement both b & c No preference life cover Proposal Form 6% and 10%

4 1 2 4 1 4 4 3 3 1 4

The Royal Bank Client income pension annuity From signed copy of benefit illustration X is married and Y is Single Customer asks for it Refer to the product brochure Both a & b Mis-selling Policyholders suffer due to surrender charges and benefits Higher Profits less lapsation More reference generation for the agent

SEBI Client expenditure wealth creation flexible plan From ticked columns of proposal form Y is young customer not asks for it must not shown any interest in the doubt Neither a nor b Higher charge products Insurance companies get good branding Higher S.A No profits All the above

2 2 1 4 3 2 3 3 1 2 3 3 3 4

Thirty Five Percent Should call up the Insurer Will not affect Revisit the financial planning Service the customer Selling products having higher Commission 10 Sum of all SA in different policies Accident Not entitled Nature of Death Money Back 7 years 45 days Sum assured 7.20% 30 days Mode of Payment Sum Assured 10 years Life Insurance Council 5 SEBI LIC Act 1956 children 1Cr 2015

None of this Should avoid the topic Partially Churning To earn extra commission Not keeping in touch with client 12 Not more than 20lacs Suicide Return of Premium Survival Benefits Health 12 years 60 days Sum Assured less the undue premium 8.20% 10 days Loading Lump Sum plus life time annuity 12 years None of the above 7 Insurance ombudsmen None of the Above mother 10L 2016

3 1 2 4 4 1 2 3 4 1 1 3 3 2 4 3 3 2 2 2 4 2 1 2 3 1 1

50000 IRDA RBI 18 Insurance Association Age and income level 40% To undertake training activities 7 1989 20 days delay in settlement of claims SEBI 17

100000 TRAI

3 3 1

None of the above His contacts in the market to solicit Insurance 26% To Advertise globally on Indian Insurance 10 1990 3 days ALL THE ABOVE

3 2 1 4 3 4 1 1 4

20

25

Insurance Company 20

All of the above 45

4 2 1 1 2 1 4 1 2 1 1 3

insurance contracts of value not insurance contracts of value exceeding Rs. 30 lakhs not exceeding Rs. 50 lakhs 1 month National commission Insurance Association Newspaper 30 lac 5 months 60 days 12 weeks He has to explain the reasons for rejection to the customer no time bar Ombudsman FERA Email or Toll free Number 50 lac 6 months 90 days 2 months He takes up with the higher authorities

He cannot offer any commission when he sells pension policies Indian penal code

He can offer up to 50% under all circumstances Reserve bank of India

3 4 2

Vous aimerez peut-être aussi

- KF1 HSDocument17 pagesKF1 HSJuan Carlos Rodriguez RomeroPas encore d'évaluation

- CVA Precios Uruq6dz4bqDocument343 pagesCVA Precios Uruq6dz4bqes10101010100% (1)

- Test Technology: Test Method(s)Document16 pagesTest Technology: Test Method(s)Marco AntonioPas encore d'évaluation

- C ResultsDocument467 pagesC ResultsTomPas encore d'évaluation

- SteelDocument8 pagesSteelNemanja DespotovicPas encore d'évaluation

- Final LIst For Sunil CustomerDocument37 pagesFinal LIst For Sunil CustomerMuhanad AlashterPas encore d'évaluation

- NSN Active Alarm WB@20171101 130002Document3 298 pagesNSN Active Alarm WB@20171101 130002Manas Kumar MohapatraPas encore d'évaluation

- Listado de Equipos2Document1 436 pagesListado de Equipos2Giovanny Moronta VillaroelPas encore d'évaluation

- NSN Active Alarm WB@20170608 070002Document2 647 pagesNSN Active Alarm WB@20170608 070002Manas Kumar MohapatraPas encore d'évaluation

- IPP Deltaflex Ductile Iron ANSI MetricDocument1 pageIPP Deltaflex Ductile Iron ANSI MetricluiscamilofonsecacruzPas encore d'évaluation

- HLG 01Document186 pagesHLG 01kemal alifPas encore d'évaluation

- Andrew Jumper CatalogDocument60 pagesAndrew Jumper CatalogMuzammil WepukuluPas encore d'évaluation

- Loi d'AGEC-fiche RecyclableDocument5 pagesLoi d'AGEC-fiche RecyclableDabi YannPas encore d'évaluation

- Welding BOQ-1Document30 pagesWelding BOQ-1Sheik MohamedPas encore d'évaluation

- CitroenDocument301 pagesCitroenAnonymous YVmNTQuKUPas encore d'évaluation

- CatCFDI (GPA 2018)Document234 pagesCatCFDI (GPA 2018)Jhonny Alejo YucraPas encore d'évaluation

- R5463 Secondary Supports - PO 2432400994Document9 pagesR5463 Secondary Supports - PO 2432400994sparkengineering05Pas encore d'évaluation

- Manuel - Vol - PA28 Cherokee PDFDocument157 pagesManuel - Vol - PA28 Cherokee PDFberjarryPas encore d'évaluation

- Inverter 4000 013056Document7 pagesInverter 4000 013056Micu Adrian DanutPas encore d'évaluation

- 1S01121 2Document623 pages1S01121 2DurgeshPas encore d'évaluation

- Document 569111Document157 pagesDocument 569111Gaoussou DoucouréPas encore d'évaluation

- 2GDocument65 pages2GPradeep PandeyPas encore d'évaluation

- Schema Elec Gys 3200Document6 pagesSchema Elec Gys 32002RtiPas encore d'évaluation

- Gysel Gysmi133 PDFDocument6 pagesGysel Gysmi133 PDFxxxPas encore d'évaluation

- CODE ImmoDocument10 pagesCODE ImmoyacsonyackPas encore d'évaluation

- Chapter 5Document15 pagesChapter 5Abigael SantianezPas encore d'évaluation

- Acra Ewd Xaa21310bsDocument38 pagesAcra Ewd Xaa21310bsAN Nhiên100% (2)

- ACRA Wiring Diagram - XAA21310BS-1Document38 pagesACRA Wiring Diagram - XAA21310BS-1Eri Wanto SihombingPas encore d'évaluation

- Schedule 2023 PT MeiDocument353 pagesSchedule 2023 PT MeiVyno TriasPas encore d'évaluation

- PV FittingDocument12 pagesPV FittingMourad AIT EMRARPas encore d'évaluation

- PV FITTING (Enregistré Automatiquement) ModDocument10 pagesPV FITTING (Enregistré Automatiquement) ModMourad AIT EMRARPas encore d'évaluation

- 100% Consolidado de Partes Copia EricDocument51 pages100% Consolidado de Partes Copia EricAldair Brayan Francia FloresPas encore d'évaluation

- Problema 2023Document5 pagesProblema 2023sosososiPas encore d'évaluation

- Cek SpoolDocument14 pagesCek SpoolAngga HartonoPas encore d'évaluation

- Pep KgaDocument4 pagesPep KgaVictor BravoPas encore d'évaluation

- Línea Número de Típicos Equipo 1 Línea 1 Equipo 2 Línea 2Document10 pagesLínea Número de Típicos Equipo 1 Línea 1 Equipo 2 Línea 2Luis Fernando Alcalá GonzálezPas encore d'évaluation

- Rec Pbo84 Rego 023Document4 pagesRec Pbo84 Rego 023kadourPas encore d'évaluation

- GEORGE ST FIBER ReviewdDocument2 pagesGEORGE ST FIBER ReviewdFarhan MohaimenPas encore d'évaluation

- Inventario - de - AlarmasDocument25 pagesInventario - de - Alarmassebastian campo betancurPas encore d'évaluation

- Lista de Ips para VPN Gemae - 3roDocument4 pagesLista de Ips para VPN Gemae - 3rofernando.longo79Pas encore d'évaluation

- Edproins 20180907 12400381Document83 pagesEdproins 20180907 12400381moas moas1Pas encore d'évaluation

- Item Master - Stock Report, HexawareDocument632 pagesItem Master - Stock Report, HexawarenikhilshindethanePas encore d'évaluation

- Matriz General Subida Por El Grupo Del EtiquetadoDocument568 pagesMatriz General Subida Por El Grupo Del EtiquetadoMelany Bridneth Rodriguez SolorzanoPas encore d'évaluation

- RecvpacketsDocument16 pagesRecvpacketsJohan KurniawanPas encore d'évaluation

- Anexo 4. TABLA DE REFERENCIA REGULACIÓN DE PRECIOS Y VMR DE MEDICAMENTOSDocument12 172 pagesAnexo 4. TABLA DE REFERENCIA REGULACIÓN DE PRECIOS Y VMR DE MEDICAMENTOSfirulais firulaisPas encore d'évaluation

- Copia de Programacion Diaria 14.06.2023Document22 pagesCopia de Programacion Diaria 14.06.2023Alex - MariaPas encore d'évaluation

- Copia de Plantilla Glicol Refrigerante 2021Document15 pagesCopia de Plantilla Glicol Refrigerante 2021rpumacayovPas encore d'évaluation

- Welder Wise 2Document14 pagesWelder Wise 2FELIX GOMINTONGPas encore d'évaluation

- Antigüedad de Saldos de ProveedoresDocument71 pagesAntigüedad de Saldos de ProveedoresSergio Joshua Molina GonzalezPas encore d'évaluation

- FinloDocument928 pagesFinloJuliana Lopez Molina100% (1)

- Item Mes FG (FC)Document2 pagesItem Mes FG (FC)Yulius SanjayaPas encore d'évaluation

- Analyse Fonctionnnelle NestléDocument6 pagesAnalyse Fonctionnnelle NestléGilles Roland KamgnoPas encore d'évaluation

- BRs TAANTDocument11 pagesBRs TAANTfaycelPas encore d'évaluation

- Sites 20130102Document1 033 pagesSites 20130102Sardar A A KhanPas encore d'évaluation

- 2484cc41-5821-4bbe-aeeb-e0aa86d7886cDocument99 pages2484cc41-5821-4bbe-aeeb-e0aa86d7886climkahshoonlimPas encore d'évaluation

- 04 07 2016 2Document1 785 pages04 07 2016 2Bogdan JbkPas encore d'évaluation

- Catalogo de Variedad.Document613 pagesCatalogo de Variedad.FANUELPas encore d'évaluation

- Memoire Licence Eneam Tossou Florida 1Document68 pagesMemoire Licence Eneam Tossou Florida 1Gloria Dele100% (2)

- Compta 1Document68 pagesCompta 1Zaineb ErPas encore d'évaluation

- Avis - de - Taxes - Foncieres - 2021 KerinouDocument2 pagesAvis - de - Taxes - Foncieres - 2021 KerinouFalilou DiopPas encore d'évaluation

- Couts-Conjoints SolutionDocument4 pagesCouts-Conjoints SolutionH SPas encore d'évaluation

- Processus de Gestion Budgétaire Camtel RefaitDocument15 pagesProcessus de Gestion Budgétaire Camtel Refaitfridolin sombesPas encore d'évaluation

- Le PIB-PNB-Balance de Paiement Et Balance CommercialeDocument13 pagesLe PIB-PNB-Balance de Paiement Et Balance Commercialeangelo miharimananaPas encore d'évaluation

- PRESENTATION TVA FranceDocument11 pagesPRESENTATION TVA FrancegeradavPas encore d'évaluation

- RYANAIR - La Face Cachée PDFDocument12 pagesRYANAIR - La Face Cachée PDFMaxime OlivierPas encore d'évaluation

- Gestion Fin InternationalDocument19 pagesGestion Fin InternationalMafico FsjesPas encore d'évaluation

- CV Dpaag PDFDocument4 pagesCV Dpaag PDFwikilikPas encore d'évaluation

- ANSEJDocument6 pagesANSEJKaciHaPas encore d'évaluation

- Le Rapport National Sur Le Climat Et Le Développement Pour Le #Bénin??Document118 pagesLe Rapport National Sur Le Climat Et Le Développement Pour Le #Bénin??cosselaincyrano02Pas encore d'évaluation

- La Constitution de La Société AnonymeDocument8 pagesLa Constitution de La Société AnonymebennounanadaPas encore d'évaluation

- Série 1 AmortissementDocument2 pagesSérie 1 AmortissementJABRANE67% (3)

- Mon Rapport de Stage Ouedraogo Moumouni YannDocument52 pagesMon Rapport de Stage Ouedraogo Moumouni YannYann relwindé OuedraogoPas encore d'évaluation

- TD Is LF 2020Document4 pagesTD Is LF 2020Said Ezzorkani100% (1)

- Audit FinancierDocument25 pagesAudit Financierfomi90Pas encore d'évaluation

- CDG Ra 2018 - Apres Bat 2Document116 pagesCDG Ra 2018 - Apres Bat 2intis conferencesPas encore d'évaluation

- La Constitution Des Sociétés CommercialesDocument17 pagesLa Constitution Des Sociétés CommercialesAnouar HaffafPas encore d'évaluation

- Rentabilité Des Banuques Et Ses DeterminantsDocument40 pagesRentabilité Des Banuques Et Ses DeterminantsAbdou Diouf SoumahPas encore d'évaluation

- صوفيان شعبان PDFDocument346 pagesصوفيان شعبان PDFمكتبة التميزPas encore d'évaluation

- Fiche 05Document9 pagesFiche 05I COPas encore d'évaluation

- Anales Compta de GestionDocument16 pagesAnales Compta de GestionMohamed ErrassafiPas encore d'évaluation

- سبل تفعيل السوق النقدي في الجزائرDocument37 pagesسبل تفعيل السوق النقدي في الجزائرRomy north CoastPas encore d'évaluation

- La BalanceDocument23 pagesLa BalanceJohanne MaugerPas encore d'évaluation

- Econometrie Et Risque de CreditDocument21 pagesEconometrie Et Risque de CreditJean Rigobert Mbeng100% (1)

- Document de Référence IAM 2015Document262 pagesDocument de Référence IAM 2015Ashraf BorzymPas encore d'évaluation

- EMF1-Chap01 - QCMDocument4 pagesEMF1-Chap01 - QCMfrisSa beautyPas encore d'évaluation

- Délit D'initiéDocument2 pagesDélit D'initiésalma zeroualPas encore d'évaluation

- Rapport Saham GroupDocument3 pagesRapport Saham GroupAnonymous B5XTZkKPas encore d'évaluation