Académique Documents

Professionnel Documents

Culture Documents

Actividad 3

Transféré par

jennifer caro jimenezCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Actividad 3

Transféré par

jennifer caro jimenezDroits d'auteur :

Formats disponibles

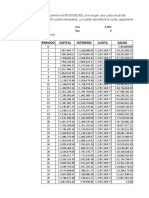

credito de libre inversion $ 26,000,000.

00

tasa de interes 1.30%

numero de cuotas 36

Cuota mensual $ 908,956.66

Monto a pagar durante todo el plazo $ 32,722,439.75

Cuota Saldo inicial Valor de cuota Interes

1 $ 26,000,000.00 $ 908,956.66 $ 338,000.00

2 $ 25,429,043.34 $ 908,956.66 $ 330,577.56

3 $ 24,850,664.24 $ 908,956.66 $ 323,058.64

4 $ 24,264,766.22 $ 908,956.66 $ 315,441.96

5 $ 23,671,251.52 $ 908,956.66 $ 307,726.27

6 $ 23,070,021.13 $ 908,956.66 $ 299,910.27

7 $ 22,460,974.75 $ 908,956.66 $ 291,992.67

8 $ 21,844,010.76 $ 908,956.66 $ 283,972.14

9 $ 21,219,026.24 $ 908,956.66 $ 275,847.34

10 $ 20,585,916.92 $ 908,956.66 $ 267,616.92

11 $ 19,944,577.18 $ 908,956.66 $ 259,279.50

12 $ 19,294,900.02 $ 908,956.66 $ 250,833.70

13 $ 18,636,777.06 $ 908,956.66 $ 242,278.10

14 $ 17,970,098.51 $ 908,956.66 $ 233,611.28

15 $ 17,294,753.13 $ 908,956.66 $ 224,831.79

16 $ 16,610,628.26 $ 908,956.66 $ 215,938.17

17 $ 15,917,609.76 $ 908,956.66 $ 206,928.93

18 $ 15,215,582.03 $ 908,956.66 $ 197,802.57

19 $ 14,504,427.94 $ 908,956.66 $ 188,557.56

20 $ 13,784,028.84 $ 908,956.66 $ 179,192.37

21 $ 13,054,264.56 $ 908,956.66 $ 169,705.44

22 $ 12,315,013.34 $ 908,956.66 $ 160,095.17

23 $ 11,566,151.85 $ 908,956.66 $ 150,359.97

24 $ 10,807,555.16 $ 908,956.66 $ 140,498.22

25 $ 10,039,096.72 $ 908,956.66 $ 130,508.26

26 $ 9,260,648.32 $ 908,956.66 $ 120,388.43

27 $ 8,472,080.09 $ 908,956.66 $ 110,137.04

28 $ 7,673,260.47 $ 908,956.66 $ 99,752.39

29 $ 6,864,056.20 $ 908,956.66 $ 89,232.73

30 $ 6,044,332.27 $ 908,956.66 $ 78,576.32

31 $ 5,213,951.93 $ 908,956.66 $ 67,781.38

32 $ 4,372,776.64 $ 908,956.66 $ 56,846.10

33 $ 3,520,666.08 $ 908,956.66 $ 45,768.66

34 $ 2,657,478.08 $ 908,956.66 $ 34,547.22

35 $ 1,783,068.63 $ 908,956.66 $ 23,179.89

36 $ 897,291.87 $ 908,956.66 $ 11,664.79

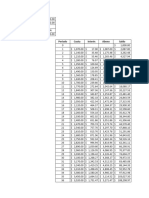

Abono a capital Saldo final

$ 570,956.66 $ 25,429,043.34

$ 578,379.10 $ 24,850,664.24

$ 585,898.02 $ 24,264,766.22

$ 593,514.70 $ 23,671,251.52

$ 601,230.39 $ 23,070,021.13

$ 609,046.39 $ 22,460,974.75

$ 616,963.99 $ 21,844,010.76

$ 624,984.52 $ 21,219,026.24

$ 633,109.32 $ 20,585,916.92

$ 641,339.74 $ 19,944,577.18

$ 649,677.16 $ 19,294,900.02

$ 658,122.96 $ 18,636,777.06

$ 666,678.56 $ 17,970,098.51

$ 675,345.38 $ 17,294,753.13

$ 684,124.87 $ 16,610,628.26

$ 693,018.49 $ 15,917,609.76

$ 702,027.73 $ 15,215,582.03

$ 711,154.09 $ 14,504,427.94

$ 720,399.10 $ 13,784,028.84

$ 729,764.28 $ 13,054,264.56

$ 739,251.22 $ 12,315,013.34

$ 748,861.49 $ 11,566,151.85

$ 758,596.69 $ 10,807,555.16

$ 768,458.44 $ 10,039,096.72

$ 778,448.40 $ 9,260,648.32

$ 788,568.23 $ 8,472,080.09

$ 798,819.62 $ 7,673,260.47

$ 809,204.27 $ 6,864,056.20

$ 819,723.93 $ 6,044,332.27

$ 830,380.34 $ 5,213,951.93

$ 841,175.28 $ 4,372,776.64

$ 852,110.56 $ 3,520,666.08

$ 863,188.00 $ 2,657,478.08

$ 874,409.44 $ 1,783,068.63

$ 885,776.77 $ 897,291.87

$ 897,291.87 -$ 0.00

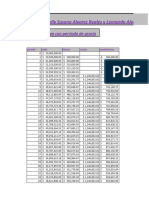

Credito para vehículo $ 45,000,000.00

Tasa de interes 1.60%

Numero de cuotas 48

Cuota mensual $ 1,350,259.12

Monto a pagar durante todo el plazo $ 64,812,437.64

Cuota Saldo inicial Valor de cuota Interes

1 $ 45,000,000.00 $ 1,350,259.12 $ 720,000.00

2 $ 44,369,740.88 $ 1,350,259.12 $ 709,915.85

3 $ 43,729,397.62 $ 1,350,259.12 $ 699,670.36

4 $ 43,078,808.86 $ 1,350,259.12 $ 689,260.94

5 $ 42,417,810.69 $ 1,350,259.12 $ 678,684.97

6 $ 41,746,236.54 $ 1,350,259.12 $ 667,939.78

7 $ 41,063,917.21 $ 1,350,259.12 $ 657,022.68

8 $ 40,370,680.77 $ 1,350,259.12 $ 645,930.89

9 $ 39,666,352.54 $ 1,350,259.12 $ 634,661.64

10 $ 38,950,755.06 $ 1,350,259.12 $ 623,212.08

11 $ 38,223,708.03 $ 1,350,259.12 $ 611,579.33

12 $ 37,485,028.24 $ 1,350,259.12 $ 599,760.45

13 $ 36,734,529.57 $ 1,350,259.12 $ 587,752.47

14 $ 35,972,022.93 $ 1,350,259.12 $ 575,552.37

15 $ 35,197,316.18 $ 1,350,259.12 $ 563,157.06

16 $ 34,410,214.12 $ 1,350,259.12 $ 550,563.43

17 $ 33,610,518.43 $ 1,350,259.12 $ 537,768.29

18 $ 32,798,027.61 $ 1,350,259.12 $ 524,768.44

19 $ 31,972,536.93 $ 1,350,259.12 $ 511,560.59

20 $ 31,133,838.40 $ 1,350,259.12 $ 498,141.41

21 $ 30,281,720.70 $ 1,350,259.12 $ 484,507.53

22 $ 29,415,969.11 $ 1,350,259.12 $ 470,655.51

23 $ 28,536,365.50 $ 1,350,259.12 $ 456,581.85

24 $ 27,642,688.23 $ 1,350,259.12 $ 442,283.01

25 $ 26,734,712.13 $ 1,350,259.12 $ 427,755.39

26 $ 25,812,208.40 $ 1,350,259.12 $ 412,995.33

27 $ 24,874,944.62 $ 1,350,259.12 $ 397,999.11

28 $ 23,922,684.62 $ 1,350,259.12 $ 382,762.95

29 $ 22,955,188.45 $ 1,350,259.12 $ 367,283.02

30 $ 21,972,212.35 $ 1,350,259.12 $ 351,555.40

31 $ 20,973,508.63 $ 1,350,259.12 $ 335,576.14

32 $ 19,958,825.65 $ 1,350,259.12 $ 319,341.21

33 $ 18,927,907.75 $ 1,350,259.12 $ 302,846.52

34 $ 17,880,495.15 $ 1,350,259.12 $ 286,087.92

35 $ 16,816,323.96 $ 1,350,259.12 $ 269,061.18

36 $ 15,735,126.02 $ 1,350,259.12 $ 251,762.02

37 $ 14,636,628.92 $ 1,350,259.12 $ 234,186.06

38 $ 13,520,555.87 $ 1,350,259.12 $ 216,328.89

39 $ 12,386,625.64 $ 1,350,259.12 $ 198,186.01

40 $ 11,234,552.54 $ 1,350,259.12 $ 179,752.84

41 $ 10,064,046.26 $ 1,350,259.12 $ 161,024.74

42 $ 8,874,811.88 $ 1,350,259.12 $ 141,996.99

43 $ 7,666,549.76 $ 1,350,259.12 $ 122,664.80

44 $ 6,438,955.43 $ 1,350,259.12 $ 103,023.29

45 $ 5,191,719.60 $ 1,350,259.12 $ 83,067.51

46 $ 3,924,528.00 $ 1,350,259.12 $ 62,792.45

47 $ 2,637,061.33 $ 1,350,259.12 $ 42,192.98

48 $ 1,328,995.19 $ 1,350,259.12 $ 21,263.92

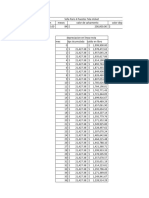

Abono a capital Saldo final

$ 630,259.12 $ 44,369,740.88

$ 640,343.26 $ 43,729,397.62

$ 650,588.76 $ 43,078,808.86

$ 660,998.18 $ 42,417,810.69

$ 671,574.15 $ 41,746,236.54

$ 682,319.33 $ 41,063,917.21

$ 693,236.44 $ 40,370,680.77

$ 704,328.23 $ 39,666,352.54

$ 715,597.48 $ 38,950,755.06

$ 727,047.04 $ 38,223,708.03

$ 738,679.79 $ 37,485,028.24

$ 750,498.67 $ 36,734,529.57

$ 762,506.64 $ 35,972,022.93

$ 774,706.75 $ 35,197,316.18

$ 787,102.06 $ 34,410,214.12

$ 799,695.69 $ 33,610,518.43

$ 812,490.82 $ 32,798,027.61

$ 825,490.68 $ 31,972,536.93

$ 838,698.53 $ 31,133,838.40

$ 852,117.70 $ 30,281,720.70

$ 865,751.59 $ 29,415,969.11

$ 879,603.61 $ 28,536,365.50

$ 893,677.27 $ 27,642,688.23

$ 907,976.11 $ 26,734,712.13

$ 922,503.72 $ 25,812,208.40

$ 937,263.78 $ 24,874,944.62

$ 952,260.00 $ 23,922,684.62

$ 967,496.16 $ 22,955,188.45

$ 982,976.10 $ 21,972,212.35

$ 998,703.72 $ 20,973,508.63

$ 1,014,682.98 $ 19,958,825.65

$ 1,030,917.91 $ 18,927,907.75

$ 1,047,412.59 $ 17,880,495.15

$ 1,064,171.20 $ 16,816,323.96

$ 1,081,197.93 $ 15,735,126.02

$ 1,098,497.10 $ 14,636,628.92

$ 1,116,073.05 $ 13,520,555.87

$ 1,133,930.22 $ 12,386,625.64

$ 1,152,073.11 $ 11,234,552.54

$ 1,170,506.28 $ 10,064,046.26

$ 1,189,234.38 $ 8,874,811.88

$ 1,208,262.13 $ 7,666,549.76

$ 1,227,594.32 $ 6,438,955.43

$ 1,247,235.83 $ 5,191,719.60

$ 1,267,191.60 $ 3,924,528.00

$ 1,287,466.67 $ 2,637,061.33

$ 1,308,066.14 $ 1,328,995.19

$ 1,328,995.19 $ 0.00

¿Cómo afecta el porcentaje en créditos bancarios?

Pienso que es de gran importancia conocer la tasa de interés a la cual nos van

a generar dicho crédito para así mismo conocer el valor que realmente

pagaremos según el plazo al cual lo financiamos, lo que también podemos

evidenciar es que el número de cuotas es directamente proporcional a el valor

que pagaremos al final del plazo, es decir, entre menos plazo menor será el

valor que pagaremos por la financiación, asimismo debemos conocer que cada

entidad bancaria maneja porcentajes de interés según la capacidad de

endeudamiento, entre mayor sea la capacidad de endeudamiento menor será

la tasa de interés.

Vous aimerez peut-être aussi

- Prestamo Financiera Miur Pagos FijosDocument4 pagesPrestamo Financiera Miur Pagos FijosJaime ValenciaPas encore d'évaluation

- Peregrino - Daniel - Creacion Dee ModelosDocument16 pagesPeregrino - Daniel - Creacion Dee ModelosDaniel Isaías Peregrino MadrigalPas encore d'évaluation

- AmornizacionDocument20 pagesAmornizacionANGELICA PAOLA ARIZA URUETAPas encore d'évaluation

- Taller AmortizaciónDocument14 pagesTaller AmortizaciónHeycko CarvajalPas encore d'évaluation

- Taller Parcial Final IngenieriaDocument7 pagesTaller Parcial Final Ingenieriasantigranada821Pas encore d'évaluation

- Taller MATEMATICAS ANUALIDADESDocument23 pagesTaller MATEMATICAS ANUALIDADESValentina ValenciaPas encore d'évaluation

- Entrega 3 FinancieraDocument11 pagesEntrega 3 FinancieraTalia RayoPas encore d'évaluation

- En ParejaDocument9 pagesEn Parejagamer2023infragante0000Pas encore d'évaluation

- Tabla de AmortizacionDocument2 pagesTabla de AmortizacionPALACIO GTPas encore d'évaluation

- Tabla AmortizacionDocument27 pagesTabla Amortizacionmarmolpedrito0Pas encore d'évaluation

- Cap 4 Nivel DesafioDocument45 pagesCap 4 Nivel Desafiobryan alquingaPas encore d'évaluation

- Homework Excel 5.2Document18 pagesHomework Excel 5.2Rodrigo Novo CastilloPas encore d'évaluation

- Economia AbrilDocument17 pagesEconomia AbrilGabriela FlorezPas encore d'évaluation

- Credito de Libre InversionDocument1 pageCredito de Libre InversionASHLEYPas encore d'évaluation

- Ejercicio Parcial 2 HoyDocument99 pagesEjercicio Parcial 2 HoySofi PinedaPas encore d'évaluation

- Pregunta #04Document3 pagesPregunta #04Marvin Duberly Romero BardalesPas encore d'évaluation

- Tabla de Amortizacion 1.0Document4 pagesTabla de Amortizacion 1.0Nicol Daniela Ronceria RodriguezPas encore d'évaluation

- Tabla de AmortizaciónDocument2 pagesTabla de AmortizaciónYULLIANNA LORAINE MESA ROMEROPas encore d'évaluation

- CostosDocument304 pagesCostosJames RuizPas encore d'évaluation

- Ejercicios Con Gradiente - Jhoan AcuñaDocument10 pagesEjercicios Con Gradiente - Jhoan AcuñaMarcelaPachonPas encore d'évaluation

- AmortizacionDocument2 pagesAmortizacionmanuel caballero truyolPas encore d'évaluation

- Decisiones de InversionDocument17 pagesDecisiones de InversionJuan Camilo Gómez RobayoPas encore d'évaluation

- Simulacion de CreditoDocument5 pagesSimulacion de CreditoTurbox BogPas encore d'évaluation

- Modelo Financiera Glox de Pagos Sobre Saldos InsolutosDocument2 pagesModelo Financiera Glox de Pagos Sobre Saldos InsolutosJaime ValenciaPas encore d'évaluation

- Tabla de Amortizacion Automotriz Nissan Versa 2024 JuanDocument5 pagesTabla de Amortizacion Automotriz Nissan Versa 2024 JuanJuan Jose Martinez HernandezPas encore d'évaluation

- Tabla Interes CompuestoDocument2 pagesTabla Interes CompuestoAndrea DazaPas encore d'évaluation

- Tablas de Amortizacion 2Document11 pagesTablas de Amortizacion 2Juan pablo Jiménez silvaPas encore d'évaluation

- Amortiguación Ejercicio Interés BancarioDocument6 pagesAmortiguación Ejercicio Interés BancarioJuan Sebastian Rojas RamirezPas encore d'évaluation

- Depreciacion de BienesDocument24 pagesDepreciacion de Bienesdaniela castillo saavedraPas encore d'évaluation

- AmortizacionDocument12 pagesAmortizacionsalazardamaris269Pas encore d'évaluation

- EjercicioPractica ListoDocument4 pagesEjercicioPractica ListoValentina AristizabalPas encore d'évaluation

- Trabajo AmortizacionDocument3 pagesTrabajo AmortizacionSoyCamiloPas encore d'évaluation

- Pratica 2Document18 pagesPratica 2sergiobu912Pas encore d'évaluation

- Tarea IngecoDocument4 pagesTarea IngecoEdwin Felipe Pinilla PeraltaPas encore d'évaluation

- City V County CompensationDocument2 pagesCity V County CompensationKayla GaffneyPas encore d'évaluation

- Tasa de AmortizaciónDocument9 pagesTasa de Amortizaciónjulieth garciaPas encore d'évaluation

- Ejemplo 2Document4 pagesEjemplo 2Marjorie TuqueresPas encore d'évaluation

- Ejemplo Tabla de AmortizacionDocument2 pagesEjemplo Tabla de AmortizacionDiaz AndrésPas encore d'évaluation

- Tabla de AmortizaciónDocument2 pagesTabla de AmortizaciónYENIFFER CAROLINA GOMEZ PACHECOPas encore d'évaluation

- Ejercicio Macro 11 MayDocument3 pagesEjercicio Macro 11 MayhenestrosamarquezarelyPas encore d'évaluation

- Amoritizacion 1Document5 pagesAmoritizacion 1Camila Arias MolinaPas encore d'évaluation

- Tabla de AmortizacionDocument7 pagesTabla de AmortizacionNaturales CervantesPas encore d'évaluation

- 1 Clase Spi2Document5 pages1 Clase Spi2Estefania Angel ClavijoPas encore d'évaluation

- Tarea Ingeco Michell TrejosDocument4 pagesTarea Ingeco Michell TrejosMichell Adriana Trejos CarbonoPas encore d'évaluation

- Clases de Contabilidad de PasivosDocument3 pagesClases de Contabilidad de PasivosDana GutierrezPas encore d'évaluation

- Tarea 10 Repaso de Matemáticas Financieras.Document10 pagesTarea 10 Repaso de Matemáticas Financieras.LuisaPas encore d'évaluation

- Trabajo Ing - Financiera-Juan Sebastián GaleanoDocument4 pagesTrabajo Ing - Financiera-Juan Sebastián GaleanoJuan S. Galeano PatiñoPas encore d'évaluation

- Matematica Financiera 1Document18 pagesMatematica Financiera 1Adriana YustresPas encore d'évaluation

- UntitledDocument4 pagesUntitledMartinez Laura ValentinaPas encore d'évaluation

- Bbva Fija: Tabla de AmortizaciónDocument47 pagesBbva Fija: Tabla de AmortizaciónJorge AguilarPas encore d'évaluation

- Tabla de Amortización MF - MADocument2 pagesTabla de Amortización MF - MACristina YaguanaPas encore d'évaluation

- AMORTIZACIONDocument65 pagesAMORTIZACIONIngeniero ResidentePas encore d'évaluation

- Examen Ex BMFDocument6 pagesExamen Ex BMFkwjycs8chyPas encore d'évaluation

- Ejercicio Evaluativo ECUACIÓN DE VALOR NicolleDocument203 pagesEjercicio Evaluativo ECUACIÓN DE VALOR NicollestelaPas encore d'évaluation

- Taller Amortizaciones y Anualidad Grupo4Document202 pagesTaller Amortizaciones y Anualidad Grupo4Jallesa Turizo CentenoPas encore d'évaluation

- Amortización 75kDocument6 pagesAmortización 75kGerencia PublimaxPas encore d'évaluation

- Tabla - Amortizacion COMPUTADORDocument6 pagesTabla - Amortizacion COMPUTADORYuliana Martinez montesPas encore d'évaluation

- UntitledDocument47 pagesUntitledmaria isabel trujlloPas encore d'évaluation

- Excel Gradient eDocument13 pagesExcel Gradient estefatati28Pas encore d'évaluation

- Ma Famille Et Mes Amis - RevisionDocument4 pagesMa Famille Et Mes Amis - RevisionsamaadelhelmyPas encore d'évaluation

- Agenda - FRANCISCA LOBOS 2020Document148 pagesAgenda - FRANCISCA LOBOS 2020Marcela Ramirez LlorentePas encore d'évaluation

- Бишоп С. Тренинг ассертивности. СПб.: Питер, 2001. - 208 с.Document174 pagesБишоп С. Тренинг ассертивности. СПб.: Питер, 2001. - 208 с.DinaPas encore d'évaluation

- Domnul Ne-A Creat Dupa Chipul Sau Fa#MajDocument1 pageDomnul Ne-A Creat Dupa Chipul Sau Fa#MajPiotr AvramPas encore d'évaluation

- Tio Arango by Vicente AmigoDocument8 pagesTio Arango by Vicente AmigoBekkar NadjimePas encore d'évaluation

- Poly 1 Exam Hydro SMC s4Document27 pagesPoly 1 Exam Hydro SMC s4Lamsaaf MohamedPas encore d'évaluation

- Amor de MedianocheDocument2 pagesAmor de MedianocheGuillermo CruzadoPas encore d'évaluation

- Robert Lebel - Apprends-Nous, MarieDocument2 pagesRobert Lebel - Apprends-Nous, MarieDenise LUTZ100% (1)

- 6 Hai La Sarba RoataDocument2 pages6 Hai La Sarba RoataEduard Lucian MihailaPas encore d'évaluation

- Le Sanskrit Chap 1Document43 pagesLe Sanskrit Chap 1PauloPas encore d'évaluation

- TOTAL ECILPSE OF THE HEART 2021 - PianoDocument4 pagesTOTAL ECILPSE OF THE HEART 2021 - PianoFredy Benites EscatePas encore d'évaluation

- El Payasito FlautaDocument1 pageEl Payasito FlautaRichard SantaféPas encore d'évaluation

- Pantera - A New Level (Ver 4 by HULK BLOOD)Document7 pagesPantera - A New Level (Ver 4 by HULK BLOOD)Chris TangPas encore d'évaluation

- Practica para GuitarraDocument3 pagesPractica para GuitarraPeter LitwinPas encore d'évaluation

- Sabana Datos 1Document82 pagesSabana Datos 1joaquinamoPas encore d'évaluation

- 16 CarameloDocument1 page16 CarameloFlor VioletaPas encore d'évaluation

- El Requezon (Abozao)Document1 pageEl Requezon (Abozao)alexanderPas encore d'évaluation

- Emplois Du Temps Premiére Année Cycle Préparatoire: Université Cadi Ayyad Ensa - Marrakech Semestre 1 2022 2023Document1 pageEmplois Du Temps Premiére Année Cycle Préparatoire: Université Cadi Ayyad Ensa - Marrakech Semestre 1 2022 2023Hamza FarajiPas encore d'évaluation

- Beati Mortui TTBB Not AngkaDocument2 pagesBeati Mortui TTBB Not AngkaRichard Arnold DumatubunPas encore d'évaluation

- Maldita Traicionera - HuaynoDocument3 pagesMaldita Traicionera - Huaynofrancodelav12huPas encore d'évaluation

- Front Fog LightDocument3 pagesFront Fog LightNam TèoPas encore d'évaluation

- Questionnaire MFI 20 - FR 7 PointsDocument2 pagesQuestionnaire MFI 20 - FR 7 PointsMaradanPas encore d'évaluation

- Tamacun - Rodrigo y GabrialaDocument39 pagesTamacun - Rodrigo y GabrialaColyn JonkerPas encore d'évaluation

- Crocodile RockDocument4 pagesCrocodile RockDoomslasher 666Pas encore d'évaluation

- Mas Que Amor Partes - PianoDocument5 pagesMas Que Amor Partes - PianoCorazón de LimónPas encore d'évaluation

- Attaque PlacéeDocument2 pagesAttaque PlacéebihPas encore d'évaluation

- Tableau + Exercices Subjonctif B1Document2 pagesTableau + Exercices Subjonctif B1Camilla KafinoPas encore d'évaluation

- 1 4951846122600530568Document2 pages1 4951846122600530568Natalia López Aliaga UndaPas encore d'évaluation

- Kur Perendon Dielli - PartsDocument6 pagesKur Perendon Dielli - PartsIsnishahePas encore d'évaluation

- Tabel Harga Kritik Dari R Product Moment22Document1 pageTabel Harga Kritik Dari R Product Moment22ns.thyaPas encore d'évaluation