Académique Documents

Professionnel Documents

Culture Documents

Taxation Trends in The European Union - 2012 228

Transféré par

d05register0 évaluation0% ont trouvé ce document utile (0 vote)

4 vues1 pageTitre original

Taxation trends in the European Union - 2012 228

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

4 vues1 pageTaxation Trends in The European Union - 2012 228

Transféré par

d05registerDroits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 1

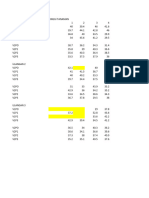

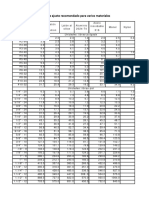

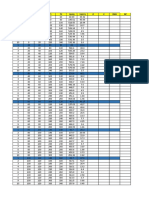

Tables

Annex A

Table 48: Taxes on Labour as % of Total Taxation - Employed

(2)

Difference(1) Ranking Revenue

1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 1995 to 2010 2000 to 2010 2010 2010

BE 50.9 49.8 49.6 49.2 49.1 49.2 50.1 50.2 50.2 49.5 48.9 47.9 48.4 49.1 50.7 49.8 -1.1 0.6 7 77 463

BG 41.9 40.6 41.9 40.5 43.6 44.1 40.3 41.7 40.8 38.3 36.9 32.6 31.0 30.0 33.5 32.6 -9.3 -11.5 26 3 216

CZ 47.2 48.8 49.4 49.9 48.0 49.1 48.7 49.4 49.0 47.8 48.3 48.4 48.0 48.8 46.9 48.1 1.0 -0.9 12 24 308

DK 43.3 43.2 43.8 42.7 43.6 44.0 45.6 44.3 43.5 41.3 39.3 40.1 41.4 43.2 43.3 41.0 -2.4 -3.0 18 45 926

DE 53.5 52.0 52.4 51.9 50.7 51.5 53.4 53.3 52.9 51.6 50.1 48.8 47.3 48.6 49.9 50.0 -3.5 -1.5 5 471 981

EE 55.6 54.8 53.0 54.4 55.9 55.2 55.0 53.8 53.2 52.0 48.8 48.6 49.7 53.8 50.7 52.1 -3.5 -3.0 2 2 548

IE 40.5 39.3 38.7 37.6 36.7 36.0 36.7 35.0 33.4 34.2 33.6 32.3 34.0 37.8 41.4 41.2 0.7 5.2 17 18 097

(3)

EL 33.7 34.6 34.8 34.3 33.7 33.2 34.0 36.2 37.7 37.6 37.5 36.0 36.4 36.8 36.4 36.5 2.7 3.3 23 25 678

ES 47.2 48.0 46.1 45.2 44.0 44.3 45.9 45.7 45.2 44.0 42.8 42.3 43.4 48.6 51.3 49.8 2.6 5.5 6 167 320

FR 51.1 50.1 49.9 50.2 50.0 50.3 50.6 51.2 51.8 51.2 51.1 50.6 50.5 51.3 53.8 52.8 1.7 2.4 1 433 810

IT 40.8 43.0 42.9 43.9 43.1 42.8 43.5 44.4 44.0 44.3 45.1 43.3 43.5 45.0 45.2 45.5 4.7 2.8 15 299 626

CY 36.0 35.1 37.1 35.9 34.2 31.2 31.8 32.2 33.1 32.1 32.1 30.7 26.8 28.6 34.6 35.2 -0.8 4.0 25 2 181

LV 52.0 51.6 49.7 48.5 50.4 51.4 50.8 51.4 51.0 50.8 48.0 47.9 47.9 49.3 51.0 51.0 -1.0 -0.5 3 2 504

LT 46.7 48.8 48.5 50.1 52.5 54.0 53.5 51.9 51.3 51.4 50.1 49.1 48.2 48.2 50.2 48.5 1.9 -5.4 11 3 617

LU 37.1 37.0 35.7 35.0 35.5 35.2 36.8 35.7 36.3 36.5 36.8 37.2 37.6 39.0 40.0 39.7 2.6 4.5 20 5 937

HU 47.7 47.8 49.9 48.8 47.0 46.8 48.0 49.5 48.0 46.9 47.9 48.2 47.7 49.0 47.4 46.0 -1.7 -0.8 14 16 869

MT 33.6 34.5 34.6 34.7 33.8 34.4 34.7 33.3 32.6 31.5 29.8 29.8 27.2 27.8 28.1 29.1 -4.5 -5.3 27 596

NL 44.2 42.5 41.6 43.2 43.8 44.5 41.7 43.0 44.2 43.6 42.7 44.2 45.2 46.6 49.0 48.7 4.4 4.2 10 110 976

AT 52.4 50.7 50.6 50.0 50.5 50.2 48.3 49.4 49.9 49.4 49.8 50.1 49.6 50.0 50.8 50.8 -1.6 0.6 4 61 101

PL 39.5 39.9 41.1 42.2 42.6 41.4 42.3 38.8 38.8 37.6 36.9 37.2 35.0 35.7 36.1 35.4 -4.1 -6.0 24 39 870

PT 36.5 35.4 35.3 34.8 34.5 35.3 36.4 35.8 35.9 36.1 35.7 35.5 35.3 35.8 39.0 38.0 1.5 2.7 22 20 669

RO 42.9 43.7 38.6 41.7 41.8 43.8 44.9 43.9 40.0 39.3 39.5 40.4 40.6 41.0 43.2 40.7 -2.2 -3.0 19 13 539

SI 54.8 52.7 53.2 52.0 51.0 53.2 53.4 52.4 52.1 51.9 51.2 50.6 48.6 49.6 49.8 49.5 -5.3 -3.8 8 6 652

SK 38.1 41.3 44.1 44.0 43.1 43.4 44.5 44.1 42.6 40.4 39.1 38.2 38.4 41.2 42.1 43.4 5.3 -0.1 16 8 021

FI 47.9 48.1 45.6 45.6 45.3 44.0 47.0 46.7 46.7 46.0 46.4 46.2 45.7 47.4 49.2 47.8 -0.2 3.7 13 36 287

SE 52.6 53.8 53.5 54.5 53.5 52.2 54.4 54.1 53.1 52.0 50.8 49.8 49.5 51.6 50.3 48.8 -3.8 -3.4 9 77 552

UK 39.4 37.6 36.4 37.3 37.8 38.5 39.0 38.6 38.7 39.0 39.4 38.7 39.5 38.2 41.1 39.7 0.3 1.2 21 240 374

NO 41.0 40.0 40.7 44.1 42.7 37.5 38.4 40.3 40.8 38.5 35.7 34.3 36.0 36.0 39.9 38.5 -2.5 1.0 52 101

IS : : : : : : : : : : : : : : : : : : :

EU-27 averages 2 216 718

weighted 47.8 47.0 46.4 46.5 46.0 46.1 46.8 47.0 46.9 46.3 45.7 44.9 44.8 46.1 47.8 47.2 -0.6 1.0

arithmetic 44.7 44.6 44.4 44.4 44.3 44.4 44.9 44.7 44.3 43.6 42.9 42.4 42.1 43.4 44.6 44.1 -0.6 -0.3

EA-17 averages 1 748 943

weighted 49.1 48.3 48.0 48.0 47.4 47.6 48.3 48.6 48.5 47.8 47.3 46.3 46.1 47.8 49.4 49.0 -0.1 1.4

arithmetic 44.4 44.1 43.8 43.6 43.2 43.2 43.8 43.7 43.6 43.0 42.4 41.9 41.6 43.4 44.8 44.7 0.3 1.5

EU-25 averages

weighted 47.8 47.1 46.4 46.5 46.0 46.1 46.9 47.0 47.0 46.3 45.8 45.0 44.9 46.2 47.9 47.2 -0.6 1.1

arithmetic 44.9 44.8 44.7 44.6 44.4 44.5 45.1 44.8 44.6 43.9 43.3 42.9 42.6 44.0 45.1 44.7 -0.2 0.3

(1) In percentage points

(2) In millions of euro

(3) Data for Greece is provisional for years 2003-2010

See explanatory notes in Annex B

Source: Eurostat (online data code gov_a_tax_ag)

Date of extraction: 13/01/2012

Taxation trends in the European Union 227

Vous aimerez peut-être aussi

- Le syndrome périodique associé à la cryopyrine (CAPS)D'EverandLe syndrome périodique associé à la cryopyrine (CAPS)Pas encore d'évaluation

- TTVA003 - Rating Pressione-Temperatura A Norme ANSI B16 - 34Document3 pagesTTVA003 - Rating Pressione-Temperatura A Norme ANSI B16 - 34Gianni SavesiPas encore d'évaluation

- SU InfoDocument27 pagesSU Infoghost46Pas encore d'évaluation

- SU InfoDocument27 pagesSU InfoMauricio Pozo AlmendrasPas encore d'évaluation

- Slurry. Property Equations and FunctionsDocument95 pagesSlurry. Property Equations and FunctionsbipradasdharPas encore d'évaluation

- Data MST JagungDocument5 pagesData MST JagungYazid SiregarPas encore d'évaluation

- Pipes. Flow Rate and Pressure Loss EquationsDocument92 pagesPipes. Flow Rate and Pressure Loss EquationsParbat SinghPas encore d'évaluation

- SU InfoDocument27 pagesSU Infolaz mejPas encore d'évaluation

- pipe규격표Document1 pagepipe규격표김동하Pas encore d'évaluation

- S Lon PE Pipe DetialsDocument25 pagesS Lon PE Pipe DetialsNiruban ThaventhiranPas encore d'évaluation

- Awwa FlangesDocument5 pagesAwwa Flangesbardianabavi.bnPas encore d'évaluation

- ZG Roots BlowerDocument9 pagesZG Roots BlowerSalomon Mendoza MarcialPas encore d'évaluation

- AEPDocument5 pagesAEPmohamed bouressasPas encore d'évaluation

- Tabla 2 TP4-3Document5 pagesTabla 2 TP4-3pilarprimololiPas encore d'évaluation

- Pipe SchedulesDocument1 pagePipe SchedulesArokiaraj Prabhu CPas encore d'évaluation

- BalastoDocument26 pagesBalastoAlexis MasamiPas encore d'évaluation

- Hdpe Pe100 DimDocument2 pagesHdpe Pe100 DimArse AbiPas encore d'évaluation

- Advanced Rate CardDocument6 pagesAdvanced Rate CardMufakir Qamar AnsariPas encore d'évaluation

- Báo CáoDocument102 pagesBáo CáoNguyễn Việt HảiPas encore d'évaluation

- Libreta Topografica Ejemplo CunoriDocument12 pagesLibreta Topografica Ejemplo CunoriJimmy Alexander Barrera ÁlvarezPas encore d'évaluation

- Flanges & Pipe DimensionsDocument16 pagesFlanges & Pipe DimensionsYaakoubi FethiPas encore d'évaluation

- R410A PT ChartDocument1 pageR410A PT ChartRhys DucotePas encore d'évaluation

- MbeweDocument12 pagesMbeweJoseph MushikaPas encore d'évaluation

- Water Pipes As Per ISO-4427 Dim Tables - Annex-2b PDFDocument1 pageWater Pipes As Per ISO-4427 Dim Tables - Annex-2b PDFnagarjuna reddy mPas encore d'évaluation

- R410a PT Chart 2Document1 pageR410a PT Chart 2Ahmed S. El DenPas encore d'évaluation

- NKD Rev.2 - soMKpodrska - 2019-09-05Document36 pagesNKD Rev.2 - soMKpodrska - 2019-09-05Andreja JovanovskiPas encore d'évaluation

- Data Percobaan KA LTK-II-03Document6 pagesData Percobaan KA LTK-II-03Rifa FadhilahPas encore d'évaluation

- Buku Panen 1Document123 pagesBuku Panen 1ahmad chephelistPas encore d'évaluation

- Tabla de Torque de TornillosDocument2 pagesTabla de Torque de TornillosAndrés Tuesca Clase de inglesPas encore d'évaluation

- PEK HDPE PipeDocument2 pagesPEK HDPE PipealiPas encore d'évaluation

- SIK HomogenitasDocument2 pagesSIK HomogenitasWINDUADI BAGUS PRAMONOPas encore d'évaluation

- CALCULO DE BANCOS-reactanciaDocument9 pagesCALCULO DE BANCOS-reactanciaFrancis Manuel Ancco FuentesPas encore d'évaluation

- Tarifa Arqualuz 2Document139 pagesTarifa Arqualuz 2David Muñoz gilPas encore d'évaluation

- Chart Is 4984 2016 Pe 63Document1 pageChart Is 4984 2016 Pe 63bipradasdharPas encore d'évaluation

- Profil TablosuDocument8 pagesProfil TablosuKürşat ÇELİKPas encore d'évaluation

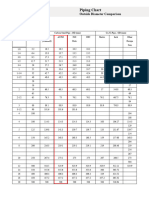

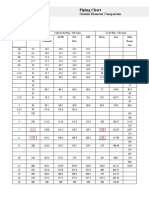

- Piping ChartDocument1 pagePiping ChartTrajko GjorgjievskiPas encore d'évaluation

- Piping ChartDocument1 pagePiping ChartTrajko GjorgjievskiPas encore d'évaluation

- Piping ComparisonDocument1 pagePiping ComparisonIBRAHIM GaramanliPas encore d'évaluation

- MASTER de GRUAS ESTRUCTURALES (30122010)Document6 pagesMASTER de GRUAS ESTRUCTURALES (30122010)krlitos_mPas encore d'évaluation

- Bs 10 Pipe FlangeDocument3 pagesBs 10 Pipe FlangeTIME STAR COMPOSITEPas encore d'évaluation

- BD Precipitaciones 1985 2022Document14 pagesBD Precipitaciones 1985 2022Emilio SalazarPas encore d'évaluation

- Hidrogramas R100 y R 10000Document5 pagesHidrogramas R100 y R 10000Ignacio MeineroPas encore d'évaluation

- Parameters of GRP Pipes With Aggregates PDFDocument1 pageParameters of GRP Pipes With Aggregates PDFN.S CompanyPas encore d'évaluation

- ANGA Garnitures Mecaniques - FRA - 2015Document52 pagesANGA Garnitures Mecaniques - FRA - 2015Nicha OuiksPas encore d'évaluation

- Pilsa Koruge Katalog PDF Icin - fh10Document1 pagePilsa Koruge Katalog PDF Icin - fh10Süleyman SARAYLIPas encore d'évaluation

- Labft1 Post4Document17 pagesLabft1 Post4Maria Jose AyalaPas encore d'évaluation

- Escala Notas Dif PuntosDocument3 pagesEscala Notas Dif PuntosTesisBlogPas encore d'évaluation

- Pipes. Slope Required For A Pipe To Avoid Fluid AccumulationDocument35 pagesPipes. Slope Required For A Pipe To Avoid Fluid AccumulationSaid SOUKAHPas encore d'évaluation

- HDPE Pipe Catalog PDFDocument4 pagesHDPE Pipe Catalog PDFCalvin KewPas encore d'évaluation

- NSB 100FT RED Battery: Discharge Tables at 20°C (68°F)Document10 pagesNSB 100FT RED Battery: Discharge Tables at 20°C (68°F)Juan Felipe MartinezPas encore d'évaluation

- Perfil HuancayoDocument25 pagesPerfil HuancayoJOHANNESUNI_2009Pas encore d'évaluation

- Data Line 1Document3 pagesData Line 1Donattianus PebriadiPas encore d'évaluation

- Eaton 6 MarchasDocument2 pagesEaton 6 MarchasPedro MelloPas encore d'évaluation

- Calculo HidrologicoDocument14 pagesCalculo Hidrologicoalberto camascaPas encore d'évaluation

- Asme B16.48Document7 pagesAsme B16.48Roman Semenov100% (1)

- Iqa 222 2022 S1 Ap6 Inf GeDocument23 pagesIqa 222 2022 S1 Ap6 Inf GeBenja GarridoPas encore d'évaluation

- 4 Hietograma Ichuña Corr1Document38 pages4 Hietograma Ichuña Corr1edwin rodiguez yaquettoPas encore d'évaluation

- Le Monde Du 11.10.11Document32 pagesLe Monde Du 11.10.11Paco AlpiPas encore d'évaluation

- Procédure de Cooptation-Employee Referral ProgramDocument2 pagesProcédure de Cooptation-Employee Referral Programghiz-Pas encore d'évaluation

- Tract PDF Difference Employé CarrefourDocument1 pageTract PDF Difference Employé CarrefourMETENIER CHRISTOPHEPas encore d'évaluation

- Le Journal 8 Septembre 2010Document214 pagesLe Journal 8 Septembre 2010stefanoPas encore d'évaluation

- Sujets BAC 2015 PDFDocument9 pagesSujets BAC 2015 PDFAbdou IbrahimPas encore d'évaluation

- YASSINEDocument15 pagesYASSINEMohamed HamzaPas encore d'évaluation

- 928 Class-10th MathDocument4 pages928 Class-10th MathChauyPas encore d'évaluation

- CLT09 Jan 1982 PDFDocument67 pagesCLT09 Jan 1982 PDFSebastianPas encore d'évaluation

- Aux Origines de L'anti-TravailDocument34 pagesAux Origines de L'anti-TravailTachPas encore d'évaluation

- Indice de GiniDocument2 pagesIndice de GiniAbd EssamadPas encore d'évaluation

- 2014 - 35 - EU - Low - Voltage - Summary List of Harmonised Standards - Generated On 30.8.2021Document276 pages2014 - 35 - EU - Low - Voltage - Summary List of Harmonised Standards - Generated On 30.8.2021Joel AndradePas encore d'évaluation

- Duree de Travail Des AEDDocument2 pagesDuree de Travail Des AEDIrbaf SanojPas encore d'évaluation

- Bâtiment Et Travaux Publics Au MarocDocument6 pagesBâtiment Et Travaux Publics Au Marocserec1Pas encore d'évaluation

- Duree TravailDocument59 pagesDuree TravailApollinaire TahangPas encore d'évaluation

- Liste Des Signataires SyndicatsDocument3 pagesListe Des Signataires SyndicatsAnonymous HWc1oSoPas encore d'évaluation

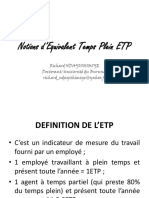

- Notions ETP Richard BurundiDocument16 pagesNotions ETP Richard BurundirichardPas encore d'évaluation

- Stat Probabilite ExerciceDocument105 pagesStat Probabilite Exerciceando50% (2)

- APznzaaTdLYaEv9HQJYHfyF1DFRdHrqzJ PwwDJiFmrYh8Gd3x7NwKR RQc9axTVamstjOztEVGXphuGuSHWqDlWnZWjRUp25hp0LAFuiJcaqYtEcdUxcbGqt1uX8wTw5lBc2turQvmdMoRnJ6bUeLOKgVb5O-Y5710nYfeQHpQyU2s6vTq67m EExeW8T557uPcD- h8k24VFpi XfbPDocument3 pagesAPznzaaTdLYaEv9HQJYHfyF1DFRdHrqzJ PwwDJiFmrYh8Gd3x7NwKR RQc9axTVamstjOztEVGXphuGuSHWqDlWnZWjRUp25hp0LAFuiJcaqYtEcdUxcbGqt1uX8wTw5lBc2turQvmdMoRnJ6bUeLOKgVb5O-Y5710nYfeQHpQyU2s6vTq67m EExeW8T557uPcD- h8k24VFpi XfbPCernat CosminPas encore d'évaluation

- Liste Synthetique Des Centres AFPA PDFDocument2 pagesListe Synthetique Des Centres AFPA PDFAbdelouaheb BendjedouPas encore d'évaluation

- Type TFI - Comprehension Ecrite Section 5Document5 pagesType TFI - Comprehension Ecrite Section 5Icaro CameloPas encore d'évaluation

- Le Journal 12 Septembre 2010Document148 pagesLe Journal 12 Septembre 2010stefanoPas encore d'évaluation

- Niyamitikaran Aavedan ShanshodhanDocument10 pagesNiyamitikaran Aavedan Shanshodhanvinaydixit12Pas encore d'évaluation

- Unit 17Document13 pagesUnit 17TAAK-Ak47Pas encore d'évaluation

- Liberte: Mehal Annonce Une Révision Du Code de L'InformationDocument19 pagesLiberte: Mehal Annonce Une Révision Du Code de L'InformationRedhouane OudjidaPas encore d'évaluation

- Rara Drome - Fiche Horaires 2022-23 v7 Web d30Document2 pagesRara Drome - Fiche Horaires 2022-23 v7 Web d30jo 26 jo 26Pas encore d'évaluation

- EDC Le CreusotDocument3 pagesEDC Le CreusothgplacePas encore d'évaluation

- Acte Unique EuropéenDocument28 pagesActe Unique EuropéenDamien VERRIEREPas encore d'évaluation

- Numbers - LessonDocument6 pagesNumbers - Lessonguerincedric31Pas encore d'évaluation

- 6 6854 6f68acd6Document24 pages6 6854 6f68acd6Soufiane HàllaouiPas encore d'évaluation

- Les Industries Électriques Et Électroniques Au MarocDocument6 pagesLes Industries Électriques Et Électroniques Au Marocserec10% (1)