Académique Documents

Professionnel Documents

Culture Documents

Acc418 ch4 q8

Transféré par

SARA ALKHODAIRTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Acc418 ch4 q8

Transféré par

SARA ALKHODAIRDroits d'auteur :

Formats disponibles

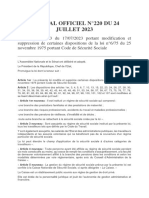

Peanut Company Snoopy Company

i/s

Debit Credit Debit Credit Revenue 800,000 250,000 1050000

cogs 15,000 15,000

Cash 158,000 80,000 Salaries Exp -200,000 -125,000

-325,000

Accounts Receivable 165,000 65,000 Dep Exp -50,000 -10,000 5,000 -65,000

Inventory 200,000 75,000 a&s Exp -225,000 -40,000 -265,000

Investment in Snoopy Income from

475,000 0 75,000 75,000

Stock Snoopy

10,000 -10,000

Land 200,000 100,000 Net Income 400,000 75,000 400000

Buildings &

700,000 200,000 Restatment

Equipment

Dividends

Salaries Expenses 200,000 125,000 -100,000 -20,000 20,000 -100,000

Declared

Retained

Depreciation Expense 50,000 10,000 225,000 100,000 100,000 225,000

Earnings

Selling &

Administrative 225,000 40,000 NI

Expense 400,000 75,000 400,000

Dividends Declared 100,000 20,000 re ending 525,000 155,000 525,000

Accumulated

450,000 20,000 B/S

Depreciation

Accounts Payable 75,000 60,000 Cash 158,000 80,000 238,000

Accounts

Bonds Payable 348,000 85,000 165,000 65,000

Receivable 230,000

Common Stock 500,000 200,000 Inventory 200,000 75,000 15,000 260,000

Investment

Retained Earnings 225,000 100,000 in Snoopy 475,000 0 475,000

Stock 0

Revenue 800,000 250,000 Land 200,000 100,000 300,000

Buildings &

Income from Snoopy 75,000 0 700,000 200,000

Equipment

50,000 950,000

Total 2,473,000 2,473,000 715,000 715,000 Acc Dep -450,000 -20,000 -470,000

goodwill 85,000 85,000

total assets 1,448,000 500,000 1,593,000

CS 200,000 L+OE

Accounts

100,000 75,000 60,000

RE Payable 135,000

Bonds

75,000 348,000 85,000

income in sub Payable 433,000

Dividends Common

20,000 500,000 200,000 200,000

Declared Stock 500,000

Invrsment 355,000 re ending 525,000 155,000 525,000

goodwill=420,000-(300,000+50,000-15,000)=85,000 toral L+OE 1,448,000 500,000 1,593,000

buil&equip 50,000

goodwill 85,000

Inventory 15,000

invesment 120,000

cogs 15,000

dep acc 5000

income in sub 10,000

Vous aimerez peut-être aussi

- Fiche de PayeDocument1 pageFiche de Payekellyescada3Pas encore d'évaluation

- Dossier Loc Saint Maur BNP BNP BNPDocument58 pagesDossier Loc Saint Maur BNP BNP BNPjuliefleur chironPas encore d'évaluation

- Bulletin 2022 12 553Document2 pagesBulletin 2022 12 553Lucie Burtin100% (1)

- Budget Salariale Version BetaDocument11 pagesBudget Salariale Version BetaAbdelmajid SaouPas encore d'évaluation

- Ipid PR IncapaciteDocument2 pagesIpid PR Incapacitejacques albertPas encore d'évaluation

- Cahier de Charges 1Document4 pagesCahier de Charges 1jeanhermesmoussaPas encore d'évaluation

- RejetDocument4 pagesRejetRemy CrfPas encore d'évaluation

- TD Éco SES - 1Document40 pagesTD Éco SES - 1Demba KanoutePas encore d'évaluation

- Prvoyance Pro 20200219Document3 pagesPrvoyance Pro 20200219jacques albertPas encore d'évaluation

- Exercices IsDocument2 pagesExercices IsnezhaessaliminezhaPas encore d'évaluation

- Impôt 2021Document3 pagesImpôt 2021Eric Mgt100% (1)

- Ribeiro STCDocument2 pagesRibeiro STC2016jboudetPas encore d'évaluation

- Bulletin de PayeDocument2 pagesBulletin de PayeLuiz BritoPas encore d'évaluation

- Introduction À Létude Du Droit FiscalDocument13 pagesIntroduction À Létude Du Droit FiscalAyeb GhassenPas encore d'évaluation

- Pyt423s EeDocument1 pagePyt423s Eegillrajkamal9Pas encore d'évaluation

- TD Fiscalite 2023 SoaDocument12 pagesTD Fiscalite 2023 SoaCAM10 télévisionPas encore d'évaluation

- Bordereau de Declaration Des SalariesDocument2 pagesBordereau de Declaration Des SalariesLouazna YoussefPas encore d'évaluation

- Serie 2 Comptabilisation Des SalairesDocument3 pagesSerie 2 Comptabilisation Des SalairesAsma Bouzgarrou BahraouiPas encore d'évaluation

- Guide DRG ParticuliersDocument12 pagesGuide DRG ParticulierslillyPas encore d'évaluation

- Calcule Congés Annuel Constatation Provision ICP Et SalaireDocument11 pagesCalcule Congés Annuel Constatation Provision ICP Et SalaireMerouane AllalouPas encore d'évaluation

- S Ch91numDocument76 pagesS Ch91numMaurice BOUVERETPas encore d'évaluation

- Révue de La LittératureDocument5 pagesRévue de La LittératureChristian Mubeno100% (1)

- Complémentaire Santé D'entreprise (Mutuelle Santé)Document4 pagesComplémentaire Santé D'entreprise (Mutuelle Santé)jacques albertPas encore d'évaluation

- Droit de Grève EmcDocument4 pagesDroit de Grève EmcOe NonPas encore d'évaluation

- Modèle Fiche de Paie - EuréciaDocument36 pagesModèle Fiche de Paie - EuréciaBienvenu EzinPas encore d'évaluation

- 2022 06 BMS JuinDocument1 page2022 06 BMS Juinphilippe ehlersPas encore d'évaluation

- BoursseDocument2 pagesBoursseFawzi AyoudjPas encore d'évaluation

- 1533 Is Not - 3108Document2 pages1533 Is Not - 3108Nancy GUELDRYPas encore d'évaluation

- Code Des S Curit Sociale Gabonais 1701289827Document13 pagesCode Des S Curit Sociale Gabonais 1701289827casam3730Pas encore d'évaluation

- Assurance Survie - Sara ZouheirDocument2 pagesAssurance Survie - Sara ZouheirAbdessamad JeraouiPas encore d'évaluation