Académique Documents

Professionnel Documents

Culture Documents

Amort OPTIONS - AUTO de Leon

Transféré par

Rowena Lalongisip De LeonTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Amort OPTIONS - AUTO de Leon

Transféré par

Rowena Lalongisip De LeonDroits d'auteur :

Formats disponibles

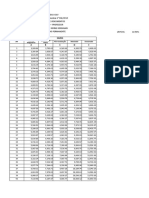

OPTION 2: "LADDERIZED" AMORTIZATION WITH TERM EXTENSION

A. AMORTIZATION SCHEDULE

PRINCIPAL 505,645.01 INT RATE 17.89%

TERM 60 SHOULD BE AMORTIZATION 12,809.82

DUE DATE -

ACCRUED MOTOR

MONTHS PRINCIPAL INTEREST TOTAL INTEREST INSURANCE TOTAL BALANCE

1ST YEAR 505,645.01

1 - 3,999.79 7,538.32 11,538.11 - 11,538.11 501,645.22

2 4,059.42 7,478.69 11,538.11 - 11,538.11 497,585.81

3 4,119.93 7,418.18 11,538.11 - 11,538.11 493,465.87

4 4,181.36 7,356.75 11,538.11 - 11,538.11 489,284.52

5 4,243.69 7,294.42 11,538.11 - 11,538.11 485,040.82

6 4,306.96 7,231.15 11,538.11 - 11,538.11 480,733.86

7 4,371.17 7,166.94 11,538.11 - 11,538.11 476,362.70

8 4,436.34 7,101.77 11,538.11 - 11,538.11 471,926.36

9 4,502.47 7,035.64 11,538.11 - 11,538.11 467,423.88

10 4,569.60 6,968.51 11,538.11 - 11,538.11 462,854.29

11 4,637.72 6,900.39 11,538.11 - 11,538.11 458,216.56

12 4,706.86 6,831.25 11,538.11 - 11,538.11 453,509.70

2ND YEAR

TERM 48 SHOULD BE AMORTIZATION 13,295.79

453,509.70

13 4,777.04 6,761.07 11,538.11 11,538.11 448,732.66

14 4,848.25 6,689.86 11,538.11 11,538.11 443,884.41

15 4,920.53 6,617.58 11,538.11 11,538.11 438,963.87

16 4,993.89 6,544.22 11,538.11 11,538.11 433,969.98

17 5,068.34 6,469.77 11,538.11 11,538.11 428,901.64

18 5,143.90 6,394.21 11,538.11 11,538.11 423,757.74

19 5,220.59 6,317.52 11,538.11 11,538.11 418,537.15

20 5,298.42 6,239.69 11,538.11 11,538.11 413,238.73

21 5,377.41 6,160.70 11,538.11 11,538.11 407,861.32

22 5,457.58 6,080.53 11,538.11 11,538.11 402,403.75

23 5,538.94 5,999.17 11,538.11 11,538.11 396,864.81

24 5,621.52 5,916.59 11,538.11 11,538.11 391,243.29

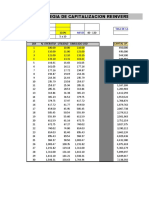

3RD YEAR ONWARDS (REGULAR AMORTIZATIONS)

TERM 36 SHOULD BE AMORTIZATION 14,122.80

391,243.29

25 8,290.02 5,832.79 14,122.80 14,122.80 382,953.27

26 8,413.61 5,709.20 14,122.80 14,122.80 374,539.67

27 8,539.04 5,583.76 14,122.80 14,122.80 366,000.63

28 8,666.34 5,456.46 14,122.80 14,122.80 357,334.28

29 8,795.54 5,327.26 14,122.80 14,122.80 348,538.74

30 8,926.67 5,196.13 14,122.80 14,122.80 339,612.07

31 9,059.75 5,063.05 14,122.80 14,122.80 330,552.32

32 9,194.82 4,927.98 14,122.80 14,122.80 321,357.50

33 9,331.90 4,790.90 14,122.80 14,122.80 312,025.60

34 9,471.02 4,651.78 14,122.80 14,122.80 302,554.58

35 9,612.22 4,510.58 14,122.80 14,122.80 292,942.36

36 9,755.52 4,367.28 14,122.80 14,122.80 283,186.84

37 9,900.96 4,221.84 14,122.80 14,122.80 273,285.88

38 10,048.57 4,074.24 14,122.80 14,122.80 263,237.32

39 10,198.37 3,924.43 14,122.80 14,122.80 253,038.95

40 10,350.41 3,772.39 14,122.80 14,122.80 242,688.53

41 10,504.72 3,618.08 14,122.80 14,122.80 232,183.81

42 10,661.33 3,461.47 14,122.80 14,122.80 221,522.48

43 10,820.27 3,302.53 14,122.80 14,122.80 210,702.21

44 10,981.58 3,141.22 14,122.80 14,122.80 199,720.63

45 11,145.30 2,977.50 14,122.80 14,122.80 188,575.33

46 11,311.46 2,811.34 14,122.80 14,122.80 177,263.87

47 11,480.09 2,642.71 14,122.80 14,122.80 165,783.78

48 11,651.24 2,471.56 14,122.80 14,122.80 154,132.54

49 11,824.94 2,297.86 14,122.80 14,122.80 142,307.59

50 12,001.23 2,121.57 14,122.80 14,122.80 130,306.36

51 12,180.15 1,942.65 14,122.80 14,122.80 118,126.21

52 12,361.74 1,761.06 14,122.80 14,122.80 105,764.47

53 12,546.03 1,576.77 14,122.80 14,122.80 93,218.44

54 12,733.07 1,389.73 14,122.80 14,122.80 80,485.37

55 12,922.90 1,199.90 14,122.80 14,122.80 67,562.47

56 13,115.56 1,007.24 14,122.80 14,122.80 54,446.91

57 13,311.09 811.71 14,122.80 14,122.80 41,135.82

58 13,509.54 613.27 14,122.80 14,122.80 27,626.29

59 13,710.94 411.86 14,122.80 14,122.80 13,915.35

60 13,915.35 207.45 14,122.80 14,122.80 (0.00)

Vous aimerez peut-être aussi

- Proyecto Información La Granja de Juan-3entrega - SGMTDocument156 pagesProyecto Información La Granja de Juan-3entrega - SGMTsandra garciaPas encore d'évaluation

- Tabela 40 Horas (1)Document1 pageTabela 40 Horas (1)Luiz Fernando Souza de AndradePas encore d'évaluation

- Exel Actividad 3Document20 pagesExel Actividad 3Octavio ReyesPas encore d'évaluation

- FireguardDipChart 15000LDocument2 pagesFireguardDipChart 15000LGoutam BiswasPas encore d'évaluation

- AmortizaciónDocument5 pagesAmortizaciónLindsey MontoyaPas encore d'évaluation

- Calibration For DieselTank1Document1 pageCalibration For DieselTank1annoPas encore d'évaluation

- Tabella Rapporti PDFDocument1 pageTabella Rapporti PDFmarcalliPas encore d'évaluation

- PC20109 Cbba Sexo EdadDocument165 pagesPC20109 Cbba Sexo EdadPipo Salazar ChavezPas encore d'évaluation

- Tabella Dei RapportiDocument1 pageTabella Dei RapporticactusmtbPas encore d'évaluation

- Interest CalcDocument8 pagesInterest CalcMark Dennis PrejulesPas encore d'évaluation

- 23-03-TARIFA CatacDocument24 pages23-03-TARIFA CatacMatíasPas encore d'évaluation

- Examen Recuperacion G.Document67 pagesExamen Recuperacion G.LUIS ALONSO BACA RODRIGUEZPas encore d'évaluation

- Examen Recuperacion G.Document101 pagesExamen Recuperacion G.LUIS ALONSO BACA RODRIGUEZPas encore d'évaluation

- Mitraguna Rs Pns Bsi 2023Document1 pageMitraguna Rs Pns Bsi 2023yumnirumiwangPas encore d'évaluation

- Tarea Tablas de AmortizaciónDocument28 pagesTarea Tablas de Amortizacióncrsflrosario11Pas encore d'évaluation

- Aportes para Renda MensalDocument11 pagesAportes para Renda MensalCLELIO GOMES DE SOUZAPas encore d'évaluation

- Cronograma CuotasDocument6 pagesCronograma CuotasJenixitah XtalPas encore d'évaluation

- Financiamento Loja 24Document3 pagesFinanciamento Loja 24Mislene Pereira GomesPas encore d'évaluation

- Square Root TableDocument3 pagesSquare Root TableMoloy SantraPas encore d'évaluation

- EMIDetailDocument2 pagesEMIDetailSuresḫ BujjîPas encore d'évaluation

- Plan de TradingDocument2 pagesPlan de TradingAmbulancias Respuesta RapidaPas encore d'évaluation

- Tabla Uvr FinalDocument36 pagesTabla Uvr FinalLeidy OspinaPas encore d'évaluation

- e31745b7-955c-4ffc-8c07-96d71bccd902Document20 pagese31745b7-955c-4ffc-8c07-96d71bccd902bigmoudi bigmoudiPas encore d'évaluation

- Pembiayaan Peribadi-I Awam (Kadar Tetap) Pembayaran Secara ElektronikDocument1 pagePembiayaan Peribadi-I Awam (Kadar Tetap) Pembayaran Secara Elektronikfatin amiraPas encore d'évaluation

- Irr BCDocument3 pagesIrr BCaryalsajaniPas encore d'évaluation

- Estados Financieros BANPRODocument28 pagesEstados Financieros BANPROjorlennyPas encore d'évaluation

- Matematica 4.2Document4 pagesMatematica 4.2-Pre-Mil: Limachi Cauna Ivan Elvis-Pas encore d'évaluation

- Tabel Mitraguna Berkah - BSIDocument1 pageTabel Mitraguna Berkah - BSImUH.tHAMRINPas encore d'évaluation

- FedEx FinalDocument4 pagesFedEx FinalRuwani PeduruhewaPas encore d'évaluation

- PolarDocument14 pagesPolarmauriciolozano10Pas encore d'évaluation

- AMORTIZATIONDocument17 pagesAMORTIZATIONDimasalang PerezPas encore d'évaluation

- Estimación de Beneficiarios Del ProyectoDocument3 pagesEstimación de Beneficiarios Del ProyectoSharon LeonPas encore d'évaluation

- Assignment 3Document10 pagesAssignment 3Muhammad Mustafo LutfullayevPas encore d'évaluation

- CA So Nuevo de Leasing Financier oDocument8 pagesCA So Nuevo de Leasing Financier oJose GALLARDOPas encore d'évaluation

- Népszámlálás 2011 - Területi Adatok Vas Megye: 1.1.2.1 A Népesség Korcsoport És Nemek SzerintDocument2 pagesNépszámlálás 2011 - Területi Adatok Vas Megye: 1.1.2.1 A Népesség Korcsoport És Nemek SzerintMelinda NagyPas encore d'évaluation

- 23 10 Tarifa Cereales NacionalDocument6 pages23 10 Tarifa Cereales NacionallucreacuPas encore d'évaluation

- PC S1 G3Document17 pagesPC S1 G3maricieloPas encore d'évaluation

- BUSM365 CH4 Homework Answes (Prob 1-10)Document22 pagesBUSM365 CH4 Homework Answes (Prob 1-10)ArjhiePalaganasDioquinoPas encore d'évaluation

- 5yrs Loan TermDocument6 pages5yrs Loan TermAlex Tapayan100% (1)

- 5yrs Loan TermDocument6 pages5yrs Loan TermAlex TapayanPas encore d'évaluation

- a5b880df-da1c-4420-9eda-94b22a3f609aDocument16 pagesa5b880df-da1c-4420-9eda-94b22a3f609abigmoudi bigmoudiPas encore d'évaluation

- Tabel Angsuran & Persyaratan PPPK BaruDocument1 pageTabel Angsuran & Persyaratan PPPK BaruRifani MarozsanPas encore d'évaluation

- Função de RiscoDocument16 pagesFunção de RiscoFábio SoaresPas encore d'évaluation

- Trading JourneyDocument8 pagesTrading Journeyema.trend007Pas encore d'évaluation

- Processo Seletivo 2021.2Document9 pagesProcesso Seletivo 2021.2Italo RafaelPas encore d'évaluation

- FUELDocument34 pagesFUELAdriant WidayatPas encore d'évaluation

- BJMP Coop Amortization Schedule NewDocument6 pagesBJMP Coop Amortization Schedule NewAlex TapayanPas encore d'évaluation

- 23 03 Tarifa Nacional CerealesDocument6 pages23 03 Tarifa Nacional CerealesJoaquín CañonPas encore d'évaluation

- Cuadro #10.01.06 Producto Interno Bruto Per Cápita A Precios de Mercado en Bolivianos, Según Departamento, 1988 - 2022Document1 pageCuadro #10.01.06 Producto Interno Bruto Per Cápita A Precios de Mercado en Bolivianos, Según Departamento, 1988 - 2022Jorge C.CPas encore d'évaluation

- Starch Slurry Baume TableDocument4 pagesStarch Slurry Baume TableKebo NdigarPas encore d'évaluation

- Sistem Perbankan: Jumlah Deposit Dan Perjanjian Belian Balik Mengikut Penyimpan Banking System: Total Deposits and Repurchase Agreement by HolderDocument5 pagesSistem Perbankan: Jumlah Deposit Dan Perjanjian Belian Balik Mengikut Penyimpan Banking System: Total Deposits and Repurchase Agreement by HolderFredPas encore d'évaluation

- BROSURDocument1 pageBROSURRoemian 2Pas encore d'évaluation

- 1fa2ad9f-82b6-434f-a2a5-39fb9637e2b7Document16 pages1fa2ad9f-82b6-434f-a2a5-39fb9637e2b7bigmoudi bigmoudiPas encore d'évaluation

- Suku Bunga EfektifDocument1 pageSuku Bunga EfektifPutu AstrePas encore d'évaluation

- Non Package 5Document1 pageNon Package 5alPas encore d'évaluation

- Tabel Angsuran Briguna ASTRI 2022Document2 pagesTabel Angsuran Briguna ASTRI 2022Indra SaputraPas encore d'évaluation

- 08tabla FisherSnedecor01Document3 pages08tabla FisherSnedecor01Martin Nicolas LuceroPas encore d'évaluation

- Simulador de Independência FinanceiraDocument20 pagesSimulador de Independência FinanceiraPaula SerejoPas encore d'évaluation

- Gaza Idade SimplesDocument2 119 pagesGaza Idade SimplessteliojoelPas encore d'évaluation

- Método de Violino - CajatiDocument41 pagesMétodo de Violino - CajatiWalmir PaiãoPas encore d'évaluation

- Les Corriges Essai District Kanel Jan 2024 - 061004Document8 pagesLes Corriges Essai District Kanel Jan 2024 - 061004souleymanehousnaPas encore d'évaluation

- RapportDocument125 pagesRapportKawtar L AzaarPas encore d'évaluation

- Corrige Serie5Document4 pagesCorrige Serie5Chef FatimaPas encore d'évaluation

- TP Controle Optimal PDFDocument29 pagesTP Controle Optimal PDFHamza El-houariPas encore d'évaluation

- Formation - PDF - Robotique - Mécatronique PDFDocument9 pagesFormation - PDF - Robotique - Mécatronique PDFHachicha SaberPas encore d'évaluation

- Biochimie 08 - Réplication Et Réparation Des Erreurs AssociéesDocument14 pagesBiochimie 08 - Réplication Et Réparation Des Erreurs AssociéesNathan CohenPas encore d'évaluation

- Les Approches Managériales Basées Sur Les Parties PrenantesDocument4 pagesLes Approches Managériales Basées Sur Les Parties PrenantesNohaila BencherquiPas encore d'évaluation

- Serveur D'impression Sous Windows 2003Document6 pagesServeur D'impression Sous Windows 2003Issam BammouPas encore d'évaluation

- Brochure Nissan Urvan N350 15 PlacesDocument14 pagesBrochure Nissan Urvan N350 15 PlaceskonePas encore d'évaluation

- Transformateurs MonophasésDocument51 pagesTransformateurs MonophasésDo OuPas encore d'évaluation

- Manuel C2Document140 pagesManuel C2Daniel AndriamananaPas encore d'évaluation

- Laddition Des Nombres Entiers CM2Document8 pagesLaddition Des Nombres Entiers CM2chantal.aboujaoudehPas encore d'évaluation

- World of Warcraft - Wrath of The Lich King - Arthas, My SonDocument4 pagesWorld of Warcraft - Wrath of The Lich King - Arthas, My SonAdrian Angel LagrecaPas encore d'évaluation

- Exercice 3Document1 pageExercice 3test lili100% (1)

- Laboratoire Biolab Bamako - Recherche GoogleDocument1 pageLaboratoire Biolab Bamako - Recherche GoogleAlou CoulibalyPas encore d'évaluation

- 1 - Cours2 Hydraulique Et Pneumatique (2éme Année Électromécanique)Document16 pages1 - Cours2 Hydraulique Et Pneumatique (2éme Année Électromécanique)Mohamed Hechmi JERIDIPas encore d'évaluation

- Catalogue OKOFEN 2018 2019Document68 pagesCatalogue OKOFEN 2018 2019joseph38Pas encore d'évaluation

- QP1C General 1 PDFDocument5 pagesQP1C General 1 PDFSamson KlouganPas encore d'évaluation

- RIB CopieDocument1 pageRIB CopieAbdoulaye CisséPas encore d'évaluation

- EKIP360 PrestationsTarifications LFRDocument30 pagesEKIP360 PrestationsTarifications LFRtouzanimahdiPas encore d'évaluation

- Examen Blanc Physique Chimie Bac DDocument4 pagesExamen Blanc Physique Chimie Bac Dkouassi hermann ulrich koffi100% (1)

- MicrobiologieDocument5 pagesMicrobiologieInes FirasPas encore d'évaluation

- ContexteDocument2 pagesContextehibaouafi502Pas encore d'évaluation

- Examen Corrigé Marketing - Questionnaire À Choix Multiple (QCM)Document7 pagesExamen Corrigé Marketing - Questionnaire À Choix Multiple (QCM)Mar IemPas encore d'évaluation

- Secours en Cours de RouteDocument32 pagesSecours en Cours de Routeantonio59100Pas encore d'évaluation

- Cevap AnahtarıDocument1 pageCevap AnahtarıVeliPas encore d'évaluation

- Phrases À Remettre Dans L'ordreDocument9 pagesPhrases À Remettre Dans L'ordreSylvie DinisPas encore d'évaluation

- DRAFT - Cours OCO - Part1Document32 pagesDRAFT - Cours OCO - Part1Khennoune WissamPas encore d'évaluation

- ProjetDocument4 pagesProjetEya AwadiPas encore d'évaluation

- Le Joueur d'échecs de Stefan Zweig (Fiche de lecture): Analyse complète de l'oeuvreD'EverandLe Joueur d'échecs de Stefan Zweig (Fiche de lecture): Analyse complète de l'oeuvrePas encore d'évaluation

- Le Guide Du Leader Tome Iii: Etude Offre Aux Leaders-FormateursD'EverandLe Guide Du Leader Tome Iii: Etude Offre Aux Leaders-FormateursPas encore d'évaluation

- Match pour le titre de champion du monde d'échecs: Wilhlem Steinitz - Johannes ZukertortD'EverandMatch pour le titre de champion du monde d'échecs: Wilhlem Steinitz - Johannes ZukertortPas encore d'évaluation