Académique Documents

Professionnel Documents

Culture Documents

K Valuation 14-12-60

Transféré par

Ping KSomsup0 évaluation0% ont trouvé ce document utile (0 vote)

14 vues3 pagesTitre original

k Valuation 14-12-60

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

14 vues3 pagesK Valuation 14-12-60

Transféré par

Ping KSomsupDroits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 3

#N/A #N/A #N/A #N/A n.a. #N/A #N/A #N/A #N/A #N/A n.a. n.a.

#N/A #N/A #N/A #N/A #N/A n.a. n.a. #N/A #N/A #N/A n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. #N/A #N/A #N/A

December 14, 2017

KS Valuations

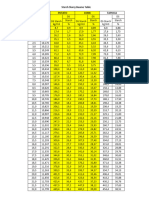

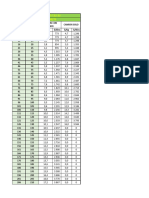

Stocks Rating Target price Price (Bt) Upside Target P/E # shares Market Cap % Beta Current EV Reported Profit (Btmn) Reported EPS (Bt) EPS Growth (%) DPS (Bt) PER (x) * Dividend Yield (%) * P/BV (x) * ROE (%)

(Bt) 13-Dec-17 (%) 17E/18E m (Btmn) of SET 1 Yr (Btmn) 2016 2017E 2018E 2016 2017E 2018E 2016 2017E 2018E 2016 2017E 2018E 2016 2017E 2018E 2016 2017E 2018E 2016 2017E 2018E 2016 2017E 2018E

Agribusiness & Food Neutral 0.00 13703.09 n.a. 2,683 117,495 0.69 1.65 115,882 2,682 2,493 3,027 37.25 (7.03) 21.39 46.4 47.1 38.8 1.5 1.2 1.6 11.2 9.7 8.8 25.2 20.9 22.9

CBG Outperform 94.00 81.00 16.05 67.32 1,000 81,000 0.47 1.60 80,877 1,490 1,396 1,558 1.49 1.40 1.56 18.66 (6.27) 11.56 1.00 0.75 0.84 51.2 58.0 52.0 1.3 0.9 1.0 11.1 10.8 9.8 22.6 19.4 19.8

SAPPE Neutral 25.00 25.25 (0.99) 18.23 303 7,653 0.04 1.67 7,067 410 414 448 1.36 1.37 1.48 36.06 0.90 8.21 0.54 0.54 0.59 23.4 18.4 17.0 1.7 2.2 2.3 4.8 3.4 3.0 22.1 19.4 18.7

TKN Outperform 26.40 20.90 26.32 53.35 1,380 28,842 0.17 1.80 27,938 782 683 1,021 0.57 0.49 0.74 96.96 (12.66) 49.53 0.49 0.40 0.59 49.4 42.2 28.2 1.8 1.9 2.8 17.4 12.2 11.3 38.5 29.8 41.6

Banking Overweight 0.00 567.51 n.a. 73,330 1,788,300 10.47 0.90 12,065,203 157,902 150,671 165,888 4.74 (4.55) 10.08 10.2 11.9 10.8 3.9 3.4 3.8 1.1 1.2 1.1 11.1 9.9 10.2

BAY Neutral 42.00 38.50 9.09 13.34 7,356 283,197 1.66 0.69 1,830,656 21,404 23,162 25,426 2.91 3.15 3.46 14.87 8.21 9.77 0.85 1.05 1.15 13.7 12.2 11.1 2.1 2.7 3.0 1.4 1.3 1.2 10.7 10.7 10.9

BBL Outperform 230.00 203.00 13.30 13.81 1,909 387,495 2.27 0.95 2,768,270 31,815 31,796 35,724 16.67 16.66 18.71 (6.92) (0.06) 12.35 6.50 6.50 7.00 9.6 12.2 10.8 4.1 3.2 3.4 0.8 1.0 0.9 8.6 8.2 8.7

KKP Neutral 75.00 77.75 (3.54) 10.92 847 65,835 0.39 0.89 239,224 5,547 5,818 6,007 6.55 6.87 7.09 67.24 4.88 3.25 6.00 5.98 5.97 9.0 11.3 11.0 10.2 7.7 7.7 1.2 1.6 1.6 14.1 14.4 14.8

KTB Outperform 20.50 19.50 5.13 11.86 13,976 272,533 1.60 0.98 2,501,905 32,278 24,162 28,705 2.31 1.73 2.05 13.28 (25.14) 18.80 0.86 0.64 0.77 7.7 11.3 9.5 4.9 3.3 3.9 0.9 0.9 0.9 11.6 8.2 9.2

SCB Outperform 160.00 151.00 5.96 12.28 3,395 512,706 3.00 0.91 2,706,491 47,612 44,285 46,320 14.01 13.03 13.63 0.91 (6.99) 4.60 5.50 5.50 6.00 10.9 11.6 11.1 3.6 3.6 4.0 1.6 1.4 1.3 14.8 12.8 12.4

TCAP Neutral 54.00 55.50 (2.70) 9.15 1,206 66,959 0.39 1.15 921,703 6,013 6,874 6,800 5.16 5.90 5.84 11.96 14.33 (1.08) 2.00 2.15 2.25 8.5 9.4 9.5 4.5 3.9 4.1 0.9 1.1 1.0 10.6 11.4 10.9

TISCO Outperform 93.00 85.00 9.41 12.13 801 68,055 0.40 0.92 297,600 5,005 6,137 6,913 6.25 7.67 8.63 17.77 22.61 12.64 3.50 4.29 4.84 9.6 11.1 9.8 5.8 5.0 5.7 1.5 2.0 1.8 16.8 18.6 19.0

TMB Outperform 3.20 3.00 6.67 16.60 43,840 131,520 0.77 0.80 799,354 8,227 8,435 9,993 0.19 0.19 0.23 (11.86) 2.53 18.47 0.06 0.06 0.07 11.2 15.6 13.1 2.9 2.0 2.3 1.1 1.5 1.4 10.3 9.7 10.7

Commerce Overweight 0.00 42702.18 n.a. 45,679 1,532,224 8.97 1.08 1,875,514 37,800 44,715 51,808 7.89 17.80 15.63 34.5 34.3 29.6 1.7 1.7 2.0 5.6 6.0 5.5 19.7 17.3 18.4

BEAUTY Outperform 22.30 18.70 19.25 56.25 3,003 56,151 0.33 1.15 55,254 656 1,189 1,582 0.22 0.40 0.53 62.99 81.30 33.03 0.22 0.36 0.47 53.5 47.2 35.5 1.9 1.9 2.5 26.6 39.0 35.1 53.2 86.2 104.2

BIG Outperform 4.70 3.22 45.96 19.15 3,529 11,363 0.07 1.11 11,041 846 866 985 0.24 0.25 0.28 84.22 2.32 13.79 0.14 0.15 0.17 22.1 13.1 11.5 2.6 4.6 5.2 14.6 6.9 5.5 77.4 59.1 53.2

BJC Neutral 56.50 57.75 (2.16) 40.60 3,996 230,750 1.35 1.38 388,351 4,001 5,551 6,856 1.00 1.39 1.72 (42.80) 38.75 23.38 0.42 0.59 0.77 50.1 41.5 33.6 0.8 1.0 1.3 2.0 2.2 2.1 3.9 5.2 6.2

COL Underperform 50.50 71.00 (28.87) 23.65 320 22,720 0.13 0.36 22,061 384 683 829 1.20 2.14 2.59 (2.38) 77.77 21.40 0.55 0.92 1.11 26.6 33.3 27.4 1.7 1.3 1.6 1.9 4.0 3.7 7.4 12.5 14.1

COM7 Outperform 17.50 14.90 17.45 36.17 1,200 17,880 0.10 1.89 18,162 407 581 726 0.34 0.48 0.61 51.44 42.83 25.11 0.25 0.32 0.41 38.7 30.8 24.6 1.9 2.2 2.7 7.9 8.2 7.4 21.7 27.9 31.6

CPALL Outperform 79.00 75.25 4.98 37.44 8,983 675,978 3.96 1.00 834,949 16,599 18,954 21,888 1.85 2.11 2.44 21.28 14.18 15.48 1.00 1.14 1.31 33.8 35.7 30.9 1.6 1.5 1.7 10.2 10.4 8.8 30.1 29.0 28.4

GLOBAL Neutral 17.00 16.80 1.19 38.27 3,841 64,536 0.38 1.53 72,186 1,495 1,703 1,977 0.41 0.44 0.49 61.69 8.71 11.08 0.22 0.20 0.22 42.2 37.8 34.0 1.3 1.2 1.3 5.1 4.8 4.6 12.1 12.7 13.6

HMPRO Outperform 13.30 12.20 9.02 36.55 13,151 160,445 0.94 1.25 173,599 4,125 4,785 5,223 0.31 0.36 0.40 17.90 16.00 9.15 0.27 0.31 0.34 32.5 33.5 30.7 2.6 2.6 2.8 7.7 8.8 8.5 23.6 26.4 27.7

KAMART Outperform 10.00 7.35 36.05 31.07 880 6,468 0.04 0.97 6,727 264 283 337 0.40 0.32 0.38 25.84 (19.55) 19.23 0.58 0.26 0.28 23.1 22.8 19.2 6.3 3.6 3.8 7.6 6.6 6.0 34.8 31.8 32.9

MAKRO Neutral 38.50 35.50 8.45 30.68 4,800 170,400 1.00 0.41 176,139 5,413 6,024 6,724 1.13 1.26 1.40 0.63 11.30 11.62 0.81 0.88 0.98 31.0 28.3 25.3 2.3 2.5 2.8 10.7 9.6 8.4 34.4 34.1 33.3

MEGA Neutral 44.00 39.50 11.39 32.74 865 34,177 0.20 1.26 33,630 795 1,163 1,385 0.92 1.34 1.58 14.26 46.27 17.90 0.47 0.69 0.81 27.5 29.4 24.9 1.9 1.7 2.1 4.7 6.6 5.7 17.6 23.6 24.7

ROBINS Outperform 85.50 73.25 16.72 32.37 1,111 81,356 0.48 1.44 83,415 2,815 2,933 3,294 2.53 2.64 2.97 30.75 4.20 12.31 1.25 1.32 1.48 25.1 27.7 24.7 2.0 1.8 2.0 4.7 5.0 4.5 18.6 17.9 18.1

Commercial 0.00 0.00 n.a. 4,488 363,528 2.13 1.20 379,196 9,244 13,784 12,185 17.30 49.11 (11.60) 27.6 26.4 29.8 1.5 1.5 1.3 4.9 5.8 5.3 18.5 23.7 18.3

CPN Outperform 92.00 81.00 13.58 29.96 4,488 363,528 2.13 1.20 379,196 9,244 13,784 12,185 2.06 3.07 2.72 17.30 49.11 (11.60) 0.83 1.23 1.09 27.6 26.4 29.8 1.5 1.5 1.3 4.9 5.8 5.3 17.8 22.1 17.7

Construction Materials Neutral 0.00 12443.93 n.a. 11,617 778,040 4.55 0.67 1,001,296 67,056 66,814 61,656 13.59 (6.40) (7.71) 11.1 11.6 12.6 4.1 3.6 3.7 2.6 2.3 2.1 22.2 19.0 15.4

DCC Neutral 3.50 3.64 (3.85) 19.99 6,528 23,762 0.14 0.49 25,059 1,422 1,143 1,040 0.22 0.18 0.16 3.59 (19.60) (9.01) 0.16 0.13 0.12 20.4 20.8 22.8 3.7 3.6 3.3 8.7 6.7 6.2 42.7 32.2 27.0

SCC Neutral 512.00 480.00 6.67 10.30 1,200 576,000 3.37 0.72 770,991 56,084 59,655 51,089 46.74 49.71 42.57 23.53 6.37 (14.36) 19.00 19.00 19.00 10.6 9.7 11.3 3.8 4.0 4.0 2.5 2.1 1.9 25.1 23.1 17.6

SCCC Neutral 260.00 281.00 (7.47) 44.46 298 83,738 0.49 0.61 107,584 3,914 1,743 4,182 17.02 5.85 14.03 (14.52) (65.64) 140.00 15.00 10.00 10.00 15.4 48.1 20.0 5.7 3.6 3.6 2.7 2.3 2.2 17.7 4.8 11.1

TASCO Outperform 25.25 20.90 20.81 15.60 1,562 32,656 0.19 1.26 34,066 3,110 2,515 3,031 2.00 1.62 1.95 (39.12) (19.19) 20.51 0.90 0.65 0.78 9.5 12.9 10.7 4.7 3.1 3.7 2.4 2.4 2.1 27.7 19.8 21.2

TOA Outperform 35.00 30.50 14.75 40.40 2,029 61,885 0.36 - 63,597 2,526 1,758 2,314 2.81 0.87 1.14 18.51 (69.13) 31.60 0.90 0.17 0.46 n.a. 35.2 26.7 n.a. 0.6 1.5 n.a. 7.2 5.8 93.4 37.3 24.1

Contractor Neutral 0.00 115.38 n.a. 16,554 124,848 0.73 1.15 205,735 5,250 1,257 4,349 (21.85) (76.05) 246.18 29.7 98.5 28.5 1.5 1.2 1.6 2.5 2.0 1.8 8.0 1.9 6.4

CK Outperform 36.00 25.75 39.81 30.55 1,694 43,618 0.26 0.98 88,758 2,002 1,996 1,823 1.18 1.18 1.08 (8.68) (0.32) (8.67) 0.65 0.57 0.65 26.2 21.9 23.9 2.1 2.2 2.5 2.4 2.0 1.8 9.3 9.0 7.4

ITD Neutral 4.18 4.00 4.50 50.47 5,280 21,119 0.12 1.09 56,676 (109) 437 327 (0.02) 0.08 0.06 69.79 n.m. (25.23) 0.01 0.00 0.00 n.m. 48.3 64.6 0.2 0.0 0.0 2.0 1.6 1.5 (0.8) 3.3 2.4

STEC Outperform 30.50 23.20 31.47 48.21 1,525 35,382 0.21 1.30 34,400 1,381 965 1,421 0.91 0.63 0.93 (9.55) (30.13) 47.24 0.22 0.22 0.33 30.7 36.7 24.9 0.8 1.0 1.4 4.1 3.2 2.9 13.3 8.8 11.8

STPI Underperform 4.78 5.50 (13.09) n.m. 1,625 8,938 0.05 1.24 3,261 1,366 (2,462) 23 0.84 (1.51) 0.01 (47.36) n.m. n.m. 0.25 0.00 0.00 13.2 n.m. 381.5 2.3 0.0 0.0 1.7 1.2 1.2 13.3 (26.7) 0.3

TRC Neutral 1.05 1.03 1.94 75.51 5,870 6,046 0.04 0.93 6,325 298 71 265 0.06 0.01 0.05 (14.35) (76.01) 270.85 0.03 0.01 0.03 21.6 74.1 20.0 2.3 0.7 2.5 2.4 2.0 1.9 11.0 2.8 9.4

TTCL Neutral 19.40 17.40 11.49 43.51 560 9,744 0.06 1.49 16,315 312 250 490 0.56 0.45 0.88 (26.14) (19.99) 96.42 0.42 0.20 0.39 35.0 39.0 19.9 2.2 1.2 2.3 2.1 1.7 1.6 5.9 4.5 8.3

Electronics Underweight 0.00 1983.58 n.a. 4,904 202,138 1.18 1.04 173,679 12,263 10,715 11,458 (6.34) (12.63) 6.93 17.7 18.9 17.6 3.2 3.5 3.4 3.1 2.8 2.6 18.5 15.1 15.3

DELTA Neutral 86.00 82.00 4.88 22.16 1,247 102,285 0.60 0.90 82,490 5,516 4,840 5,759 4.42 3.88 4.62 (17.84) (12.26) 19.00 3.00 3.00 2.77 18.4 21.1 17.8 3.7 3.7 3.4 3.2 3.1 2.9 17.7 14.9 16.9

HANA Neutral 46.00 48.25 (4.66) 12.74 805 38,835 0.23 1.06 29,650 2,105 2,906 2,420 2.62 3.61 3.01 1.89 38.01 (16.72) 2.00 2.00 2.20 15.1 13.4 16.0 5.1 4.1 4.6 1.6 1.8 1.8 10.7 14.1 11.2

KCE Outperform 94.25 87.75 7.41 22.03 586 51,456 0.30 1.20 55,131 3,039 2,509 2,800 5.18 4.28 4.77 33.03 (17.48) 11.58 2.20 2.55 2.57 23.5 20.5 18.4 1.8 2.9 2.9 7.2 4.7 4.2 33.6 23.9 24.0

SVI Underperform 3.70 4.22 (12.32) 18.19 2,266 9,561 0.06 1.56 6,409 1,603 461 479 0.71 0.20 0.21 (21.02) (71.24) 3.92 0.08 0.07 0.08 7.2 20.7 20.0 1.6 1.7 2.0 1.6 1.3 1.2 25.1 6.4 6.4

Energy Neutral 0.00 23451.48 n.a. 22,611 2,045,789 11.97 1.29 2,803,727 145,211 189,377 189,618 1256.02 30.34 0.13 12.8 10.8 10.8 4.2 3.9 3.9 1.3 1.3 1.2 8.0 9.6 8.8

BANPU Neutral 17.00 17.20 (1.16) 10.26 5,162 88,785 0.52 1.30 205,298 1,677 8,554 10,625 0.34 1.66 2.06 n.m. 387.63 24.22 0.50 0.75 0.65 56.5 10.4 8.4 2.6 4.4 3.8 1.2 1.0 1.0 2.4 10.4 11.8

BCP Neutral 37.50 38.00 (1.32) 9.11 1,377 52,323 0.31 0.95 75,270 4,773 5,671 5,445 3.47 4.12 3.95 15.00 18.80 (3.99) 1.80 1.50 1.50 9.7 9.2 9.6 5.4 3.9 3.9 1.2 1.2 1.1 12.7 13.6 12.0

PTG Outperform 25.80 21.20 21.70 45.79 1,670 35,404 0.21 1.83 38,788 1,073 941 1,301 0.64 0.56 0.78 64.96 (12.35) 38.27 0.30 0.28 0.39 51.0 37.6 27.2 0.9 1.3 1.8 12.0 6.8 5.9 23.5 18.2 21.6

PTT Outperform 464.00 426.00 8.92 10.14 2,856 1,216,784 7.12 1.32 1,846,903 94,609 130,704 116,461 33.12 45.76 40.77 374.55 38.15 (10.90) 16.00 16.00 16.00 11.2 9.3 10.4 4.3 3.8 3.8 1.4 1.3 1.2 13.0 15.7 12.2

PTTEP Outperform 99.00 93.50 5.88 29.50 3,970 371,194 2.17 1.26 328,551 12,860 13,324 30,486 3.24 3.36 7.68 n.m. 3.61 128.81 3.25 3.50 3.75 29.7 27.9 12.2 3.4 3.7 4.0 0.9 0.9 0.9 3.1 3.3 7.4

SCN Neutral 6.30 5.05 24.75 25.67 1,200 6,060 0.04 2.03 7,224 308 295 456 0.26 0.25 0.38 36.63 (4.37) 54.96 0.14 0.12 0.19 35.1 20.6 13.3 1.6 2.4 3.8 4.3 2.3 2.0 12.8 11.4 16.2

SPRC Neutral 16.00 16.90 (5.33) 8.67 4,336 73,277 0.43 0.99 79,464 8,688 8,004 7,469 2.00 1.85 1.72 5.60 (7.88) (6.68) 1.18 1.11 1.03 6.2 9.2 9.8 9.5 6.6 6.1 1.3 1.6 1.5 22.2 18.5 16.1

TOP Neutral 94.75 99.00 (4.29) 8.83 2,040 201,963 1.18 1.26 222,230 21,222 21,886 17,376 10.40 10.73 8.52 74.22 3.13 (20.61) 4.50 4.00 4.00 6.9 9.2 11.6 6.2 4.0 4.0 1.4 1.7 1.6 21.3 19.4 14.2

Finance & Securities Neutral 0.00 3278.99 n.a. 3,715 220,555 1.29 1.25 352,430 8,371 10,965 12,868 24.85 29.74 16.20 18.6 20.1 17.3 1.3 1.2 1.3 4.2 4.8 3.9 24.2 25.7 24.3

AEONTS Outperform 114.00 104.00 9.62 10.24 250 26,000 0.15 0.58 78,093 2,403 2,783 2,944 9.61 11.13 11.78 (1.75) 15.80 5.79 3.45 4.01 4.24 10.8 9.3 8.8 3.3 3.9 4.1 1.9 1.7 1.5 18.5 18.9 17.7

KTC Neutral 170.00 175.50 (3.13) 14.09 258 45,250 0.26 1.15 95,172 2,495 3,111 3,422 9.68 12.06 13.27 20.31 24.69 10.00 4.00 4.83 5.31 14.3 14.5 13.2 2.9 2.7 3.0 3.4 3.6 3.1 26.2 27.4 25.4

MTLS Outperform 44.00 38.50 14.29 38.01 2,120 81,620 0.48 1.59 97,730 1,464 2,454 3,222 0.69 1.16 1.52 77.47 67.63 31.29 0.10 0.17 0.22 35.8 33.3 25.3 0.4 0.4 0.6 7.8 9.1 6.9 23.7 31.4 31.1

SAWAD Outperform 71.00 62.25 14.06 29.50 1,087 67,685 0.40 1.16 81,435 2,009 2,617 3,280 1.92 2.41 2.90 46.68 25.27 20.51 0.01 0.01 0.01 20.6 25.9 21.5 0.0 0.0 0.0 6.1 7.2 5.6 34.5 29.8 26.5

ICT Neutral 0.00 160.08 n.a. 49,682 1,094,333 6.41 1.27 1,288,447 49,211 50,452 81,977 (40.09) 1.75 62.02 20.1 21.7 13.4 5.1 3.1 3.1 3.9 4.0 3.4 21.4 18.9 27.3

ADVANC Outperform 207.00 186.00 11.29 20.53 2,973 552,996 3.24 1.07 637,904 30,666 29,975 31,393 10.31 10.08 10.56 (21.67) (2.25) 4.73 10.08 7.06 7.39 14.3 18.4 17.6 6.9 3.8 4.0 10.3 11.2 9.4 67.4 65.2 58.0

DTAC Neutral 41.00 44.75 (8.38) 56.80 2,368 105,960 0.62 1.84 136,832 2,086 1,709 1,631 0.88 0.72 0.69 (64.61) (18.05) (4.55) 0.42 0.00 0.00 42.9 62.0 65.0 1.1 0.0 0.0 3.3 3.7 3.5 7.7 6.1 5.5

INTUCH Outperform 64.00 56.00 14.29 17.16 3,206 179,560 1.05 1.02 177,809 14,659 11,957 12,959 4.57 3.73 4.04 (1.71) (18.43) 8.38 4.60 2.86 2.80 10.9 15.0 13.9 9.2 5.1 5.0 5.7 5.8 5.2 69.3 40.6 39.5

JAS Underperform 5.50 7.00 (21.43) 16.15 6,671 46,694 0.27 1.32 53,701 3,002 2,272 2,457 0.51 0.34 0.33 (77.04) (32.63) (2.18) 0.61 0.49 0.33 15.6 20.6 21.0 7.7 7.0 4.8 4.6 4.3 3.7 23.0 21.5 19.8

THCOM Neutral 11.00 12.70 (13.39) 18.38 1,096 13,920 0.08 1.00 18,335 1,612 656 1,468 1.47 0.60 1.34 (24.05) (59.30) 123.70 0.70 0.24 0.54 13.2 21.2 9.5 3.6 1.9 4.2 1.1 0.8 0.7 8.9 3.6 7.7

TRUE Outperform 7.00 5.85 19.66 60.16 33,368 195,204 1.14 1.75 263,867 (2,813) 3,883 32,069 (0.08) 0.12 0.96 n.m. n.m. 725.93 0.00 0.00 0.00 n.m. 50.3 6.1 0.1 0.0 0.0 1.8 1.5 1.2 (2.7) 2.9 21.3

Industrial Estate Neutral 0.00 0.00 n.a. 2,901 57,122 0.33 1.31 86,008 1,473 1,633 2,683 (33.72) (1.47) 64.31 25.8 35.0 21.3 1.5 1.3 2.4 1.4 1.5 1.4 5.8 5.0 6.5

AMATA Neutral 25.00 25.00 0.00 20.35 1,067 26,675 0.16 1.79 33,614 1,198 1,311 1,529 1.12 1.23 1.43 (1.46) 9.41 16.65 0.45 0.50 0.58 10.2 20.3 17.4 3.9 2.0 2.3 1.0 2.1 1.9 10.4 10.6 11.6

TICON Outperform 18.50 16.60 11.45 105.48 1,834 30,447 0.18 0.89 52,395 275 322 1,153 0.25 0.18 0.63 (64.27) (29.90) 258.54 0.08 0.12 0.40 66.3 94.6 26.4 0.5 0.7 2.4 1.6 1.2 1.2 2.4 1.8 4.6

Insurance Neutral 0.00 13867.46 n.a. 1,708 65,314 0.38 0.57 295,312 5,110 3,408 3,823 24.10 (33.35) 12.17 17.7 19.1 17.1 1.4 1.3 1.5 2.7 1.7 1.6 16.9 9.6 9.8

BLA Neutral 39.00 38.25 1.96 19.52 1,708 65,314 0.38 0.57 295,312 5,110 3,408 3,823 3.00 2.00 2.24 24.10 (33.35) 12.17 0.75 0.50 0.56 17.7 19.1 17.1 1.4 1.3 1.5 2.7 1.7 1.6 16.9 9.6 9.8

Personal Products & Pharmaceuticals 0.00 534.19 300 5,490 0.03 1.51 5,616 194 164 248 (46.86) (15.69) 51.69 47.9 33.5 22.1 0.2 1.2 1.8 10.3 5.2 4.4 25.5 16.8 21.7

TNR Neutral 20.00 18.30 9.29 36.66 300 5,490 0.03 1.51 5,616 194 164 248 0.65 0.55 0.83 (46.86) (15.69) 51.69 0.05 0.22 0.33 47.9 33.5 22.1 0.2 1.2 1.8 10.3 5.2 4.4 25.5 16.8 21.7

#N/A #N/A #N/A #N/A n.a. #N/A #N/A #N/A #N/A #N/A n.a. n.a. #N/A #N/A #N/A n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. #N/A #N/A #N/A

December 14, 2017

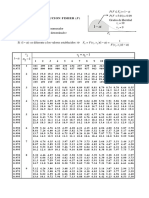

KS Valuations

Stocks Rating Target price Price (Bt) Upside Target P/E # shares Market Cap % Beta Current EV Reported Profit (Btmn) Reported EPS (Bt) EPS Growth (%) DPS (Bt) PER (x) * Dividend Yield (%) * P/BV (x) * ROE (%)

(Bt) 13-Dec-17 (%) 17E/18E m (Btmn) of SET 1 Yr (Btmn) 2016 2017E 2018E 2016 2017E 2018E 2016 2017E 2018E 2016 2017E 2018E 2016 2017E 2018E 2016 2017E 2018E 2016 2017E 2018E 2016 2017E 2018E

Petrochemical Underweight 0.00 1386.67 n.a. 30,189 775,859 4.54 1.53 990,657 51,520 64,519 64,529 42.76 21.54 (0.05) 10.5 12.1 12.1 3.8 2.9 3.2 1.3 1.6 1.5 12.6 13.7 11.9

IRPC Outperform 7.00 6.60 6.06 13.74 20,434 134,867 0.79 1.26 195,497 9,721 10,414 11,528 0.48 0.51 0.56 3.39 7.13 10.70 0.23 0.20 0.23 10.1 13.0 11.7 4.8 3.1 3.4 1.2 1.6 1.4 12.4 12.4 12.8

IVL Outperform 55.75 51.50 8.25 20.07 5,245 270,139 1.58 2.01 370,824 16,197 14,712 18,888 3.36 2.78 3.57 145.07 (17.43) 28.39 0.66 0.96 1.23 10.0 18.5 14.4 2.0 1.9 2.4 1.8 2.3 2.1 19.2 14.2 15.1

PTTGC Outperform 87.00 82.25 5.78 9.96 4,509 370,853 2.17 1.28 424,337 25,602 39,393 34,113 5.68 8.74 7.57 24.87 53.87 (13.40) 2.85 3.00 3.00 11.1 9.4 10.9 4.5 3.6 3.6 1.2 1.4 1.3 10.7 15.2 12.1

Property Fund 0.00 189.49 n.a. 1,483 21,200 0.12 - 0.02 24,337 999 1,284 1,398 (16.25) 28.55 8.89 21.7 16.5 15.2 4.5 5.4 5.5 1.4 1.3 1.3 6.2 8.0 8.6

IMPACT Outperform 15.60 14.30 9.09 18.02 1,483 21,200 0.12 - 0.02 24,337 999 1,284 1,398 0.67 0.87 0.94 (16.25) 28.55 8.89 0.66 0.77 0.79 21.7 16.5 15.2 4.5 5.4 5.5 1.4 1.3 1.3 6.2 8.0 8.6

Residential Neutral 0.00 323.41 n.a. 51,857 376,909 2.21 0.99 546,013 33,395 37,077 38,825 (2.08) 9.55 1.37 9.6 10.1 10.0 6.1 4.8 5.5 1.6 1.7 1.6 16.6 17.0 16.2

AP Neutral 8.70 8.80 (1.14) 9.22 3,146 27,684 0.16 0.98 41,339 2,703 2,970 3,466 0.86 0.94 1.10 3.02 9.88 16.73 0.30 0.33 0.38 8.7 9.3 8.0 4.0 3.8 4.3 1.2 1.3 1.2 14.6 14.5 15.3

LH Outperform 12.30 10.30 19.42 13.69 11,950 123,082 0.72 0.96 164,764 8,618 10,739 8,766 0.73 0.90 0.73 8.29 22.91 (18.37) 0.65 0.71 0.64 13.4 11.5 14.0 6.6 6.8 6.2 2.5 2.4 2.4 18.6 22.1 17.2

LPN Underperform 10.40 13.20 (21.21) 14.47 1,476 19,479 0.11 1.15 23,167 2,176 1,061 1,652 1.47 0.72 1.12 (9.83) (51.26) 55.73 0.90 0.39 0.60 8.2 18.4 11.8 7.4 2.9 4.5 1.4 1.6 1.5 18.1 8.5 12.8

ORI Outperform 24.70 20.20 22.28 15.61 1,626 32,851 0.19 1.80 35,357 638 2,570 3,195 0.58 1.58 1.96 (10.09) 173.35 23.78 0.52 0.63 0.78 9.9 12.8 10.3 9.1 3.1 3.9 2.9 5.7 4.1 32.4 64.9 46.7

PSH Outperform 26.50 24.30 9.05 10.13 2,187 53,139 0.31 0.68 72,957 5,940 5,723 6,424 2.72 2.62 2.94 (21.06) (3.70) 12.25 1.40 1.35 1.48 8.3 9.3 8.3 6.2 5.5 6.1 1.4 1.4 1.3 17.1 15.6 16.1

QH Outperform 3.40 3.04 11.84 10.50 10,714 32,572 0.19 1.02 55,685 3,085 3,468 3,462 0.29 0.32 0.32 (0.69) 12.43 (0.18) 0.15 0.17 0.16 9.0 9.4 9.4 5.8 5.5 5.3 1.2 1.3 1.2 13.9 14.5 13.4

SC Outperform 4.00 3.90 2.56 10.83 4,179 16,299 0.10 0.70 30,943 1,968 1,544 2,094 0.47 0.37 0.50 3.85 (21.57) 35.67 0.19 0.16 0.21 7.3 10.6 7.8 5.6 4.0 5.5 1.0 1.1 1.0 14.2 10.4 13.2

SIRI Neutral 2.46 2.14 14.95 11.14 14,863 31,806 0.19 1.47 60,497 3,380 3,162 3,565 0.24 0.22 0.25 (3.58) (6.72) 12.75 0.12 0.11 0.12 7.0 9.7 8.6 7.2 5.2 5.8 0.8 1.0 1.0 12.2 10.9 11.6

SPALI Outperform 26.80 23.30 15.02 7.88 1,717 39,996 0.23 0.51 61,305 4,887 5,841 6,200 2.85 3.40 2.89 12.37 19.54 (15.09) 1.05 0.00 1.15 8.8 6.8 8.1 4.2 0.0 4.9 1.9 1.4 1.4 22.8 23.0 19.9

Transportation Underweight 0.00 365.19 n.a. 54,164 1,253,544 7.34 1.00 1,451,653 28,899 24,769 32,307 73.31 (15.00) 30.43 32.9 50.6 38.8 1.8 1.2 1.2 3.3 4.4 4.1 10.0 8.3 10.5

AAV Outperform 7.30 6.25 16.80 22.40 4,850 30,313 0.18 0.70 46,052 1,869 1,581 1,528 0.39 0.33 0.32 73.34 (15.44) (3.34) 0.15 0.10 0.09 15.7 19.2 19.8 2.5 1.6 1.5 1.4 1.3 1.2 9.0 7.0 6.3

AOT Neutral 51.50 62.75 (17.93) 35.91 14,286 896,428 5.25 1.12 867,650 19,683 20,488 23,268 1.38 1.43 1.63 3.82 4.09 13.57 0.68 0.57 0.65 28.9 43.8 38.5 1.7 0.9 1.0 4.7 7.2 6.5 17.1 16.6 17.6

BA Neutral 17.40 17.20 1.16 n.m. 2,100 36,120 0.21 0.50 41,013 1,768 (274) 20 0.84 (0.13) 0.01 (1.58) n.m. n.m. 0.00 0.00 0.00 27.0 n.m. 1,840.0 0.0 0.0 0.0 1.5 1.2 1.2 5.6 (0.9) 0.1

BEM Neutral 7.90 7.60 3.95 36.53 15,285 116,166 0.68 0.74 156,463 2,606 3,306 3,678 0.17 0.22 0.24 (1.66) 26.86 11.25 0.11 0.16 0.18 43.7 35.1 31.6 1.5 2.1 2.4 3.8 3.8 3.7 8.9 11.0 11.9

BTS Outperform 9.40 8.35 12.57 25.08 11,940 99,702 0.58 0.51 119,652 2,003 4,474 2,993 0.17 0.37 0.25 (51.56) 123.29 (33.10) 0.34 0.30 0.20 50.9 22.3 33.3 4.0 3.6 2.4 2.4 2.2 2.3 4.6 10.3 6.8

JWD Outperform 13.60 12.00 13.33 61.53 1,020 12,240 0.07 1.10 13,952 (9) 225 382 (0.01) 0.22 0.37 n.m. n.m. 69.26 0.08 0.12 0.20 n.m. 54.3 32.1 1.0 1.0 1.6 3.1 4.5 4.1 (0.3) 8.6 13.5

PRM Outperform 12.40 10.10 22.77 41.13 2,500 25,250 0.15 - 30,217 963 754 1,070 0.48 0.30 0.43 (57.62) (37.39) 41.95 0.25 0.09 0.13 n.a. 33.5 23.6 n.a. 0.9 1.3 n.a. 3.6 3.2 54.9 15.7 14.4

THAI Outperform 19.70 17.10 15.20 n.m. 2,183 37,325 0.22 1.51 176,655 15 (5,785) (630) 0.01 (2.65) (0.29) n.m. n.m. 89.10 0.00 0.00 0.00 3,272.8 n.m. n.m. 0.0 0.0 0.0 1.5 1.7 1.7 0.0 (20.8) (2.9)

Utilities Underweight 0.00 0.00 n.a. 32,758 868,885 5.09 1.16 1,174,386 39,197 49,934 46,989 11.43 25.17 (6.02) 17.1 17.4 18.6 3.6 2.8 3.1 2.0 2.3 2.2 11.5 12.8 11.0

BCPG Neutral 20.60 22.30 (7.62) 19.82 1,992 44,428 0.26 1.12 46,518 1,541 2,068 2,551 0.77 1.04 1.28 (72.50) 34.16 23.35 0.69 0.54 0.64 18.1 21.5 17.4 4.9 2.4 2.9 2.1 3.0 2.8 11.4 14.1 15.9

BGRIM Neutral 27.40 26.00 5.38 27.92 2,607 67,779 0.40 1.82 119,095 1,380 2,558 2,146 0.73 0.98 0.82 1489.13 34.38 (16.10) 0.27 0.28 0.38 n.a. 26.5 31.6 n.a. 1.1 1.5 n.a. 3.5 3.3 31.9 20.2 10.7

BPP Neutral 28.25 26.00 8.65 21.61 3,048 79,257 0.46 1.35 81,081 4,138 4,046 5,324 1.36 1.31 1.72 (15.05) (3.79) 31.57 0.71 0.67 0.88 18.0 19.9 15.1 2.9 2.6 3.4 2.0 2.0 1.8 11.1 10.0 12.2

CKP Neutral 4.02 3.94 2.03 180.94 7,370 29,038 0.17 1.38 63,355 55 164 523 0.01 0.02 0.07 (86.63) 197.41 219.38 0.06 0.01 0.03 476.6 177.3 55.5 1.7 0.2 0.7 1.5 1.7 1.6 0.3 0.9 2.9

DEMCO Neutral 6.60 6.00 10.00 23.49 730 4,382 0.03 1.06 6,167 (161) 205 186 (0.22) 0.28 0.25 68.47 n.m. (9.48) 0.00 0.00 0.10 n.m. 21.4 23.6 0.0 0.0 1.7 2.1 1.4 1.3 (5.4) 6.5 5.5

EA Neutral 42.00 49.00 (14.29) 37.27 3,730 182,770 1.07 1.59 208,481 3,252 4,204 6,072 0.87 1.13 1.63 21.01 29.29 44.43 0.15 0.20 0.28 34.1 43.5 30.1 0.5 0.4 0.6 9.7 12.2 9.0 28.6 28.0 29.8

EGCO Neutral 225.00 220.00 2.27 8.36 526 115,822 0.68 0.54 212,010 8,321 14,168 8,275 15.81 26.91 15.72 92.66 70.27 (41.59) 6.50 8.00 8.25 12.6 8.2 14.0 3.3 3.6 3.8 1.3 1.3 1.2 10.2 15.3 8.6

GLOW Neutral 87.50 85.75 2.04 14.50 1,463 125,441 0.73 0.86 171,007 8,953 8,830 7,752 6.12 6.04 5.30 7.15 (1.38) (12.20) 5.75 5.75 5.75 12.9 14.2 16.2 7.3 6.7 6.7 2.4 2.6 2.7 18.3 18.2 16.5

GPSC Neutral 53.00 59.75 (11.30) 26.93 1,498 89,523 0.52 1.55 101,914 2,700 2,949 3,570 1.80 1.97 2.38 41.66 9.22 21.06 1.15 1.28 1.43 20.7 30.4 25.1 3.1 2.1 2.4 1.5 2.3 2.2 7.3 7.5 8.8

GUNKUL Outperform 4.60 3.96 16.16 63.73 7,419 29,378 0.17 0.99 39,999 538 573 1,116 0.08 0.07 0.14 (36.65) (14.64) 95.00 0.08 0.04 0.06 57.2 54.9 28.1 1.7 1.1 1.4 3.4 2.6 2.5 5.9 4.8 8.8

RATCH Outperform 58.25 56.00 4.02 10.88 1,450 81,200 0.48 0.50 93,460 6,166 7,764 6,868 4.25 5.35 4.74 93.41 25.93 (11.54) 2.35 2.68 2.68 11.8 10.5 11.8 4.7 4.8 4.8 1.2 1.2 1.2 9.9 11.7 9.9

SPCG Neutral 23.10 21.50 7.44 8.87 924 19,866 0.12 0.77 31,298 2,314 2,405 2,605 2.50 2.60 2.82 5.66 3.94 8.31 1.10 1.21 1.27 8.5 8.3 7.6 5.1 5.6 5.9 2.4 2.1 1.8 27.9 25.3 23.7

MAI Industry 0.00 531.51 n.a. 1,323 13,751 0.08 0.16 18,604 649 570 933 331.59 (28.56) 63.71 36.1 24.1 14.7 0.2 0.9 1.7 3.7 2.4 2.1 19.5 11.2 13.5

SSP Neutral 10.10 8.30 21.69 24.73 922 7,653 0.04 - 10,956 447 376 550 0.65 0.41 0.60 (9.92) (36.94) 46.26 0.00 0.12 0.24 n.a. 20.3 13.9 n.a. 1.4 2.9 n.a. 2.1 1.9 36.0 10.3 13.6

TPCH Outperform 18.40 15.20 21.05 38.10 401 6,098 0.04 0.35 7,649 201 194 383 0.50 0.48 0.95 331.59 (3.70) 97.60 0.03 0.03 0.03 36.1 31.5 15.9 0.2 0.2 0.2 3.7 2.8 2.4 10.7 9.4 16.3

KS coverage (excl MAI) 410,623 11,691,572 68.43 1.11 24,835,092 655,777 724,031 785,637 30.02 9.04 8.26 15.3 16.1 14.9 3.4 2.8 3.0 1.9 2.1 1.9 11.9 11.9 11.8

KS coverage (excl MAI, Banking, F&S) 333,578 9,682,717 56.68 1.15 12,417,459 489,504 562,395 606,880 41.13 13.01 7.62 16.9 17.2 16.0 3.4 2.7 2.9 2.2 2.3 2.2 12.1 12.4 12.2

KS coverage (excl MAI, Energy, Petrochem) 357,823 8,869,924 51.92 1.03 21,040,707 459,046 470,135 531,489 0.19 0.98 12.68 16.7 18.9 16.7 3.2 2.6 2.8 2.3 2.5 2.3 14.0 12.9 13.4

SET Index 1706.93

KS coverage (total) 411,946 11,705,323 68.51 24,853,697 656,425 724,601 786,570 30.05 9.00 8.31 15.3 16.2 14.9 3.4 2.8 3.0 1.9 2.1 1.9 11.9 11.9 11.8

Remark: * Calculation of PER, P/BV and Dividend Yield ratios are based on historical prices for 2016 and current prices for 2017E and 2018E.

Outperform (ซือ), Neutral (ถือ), Underperform (ขาย)

Source : KS

#N/A #N/A n.a. #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A n.a. n.a. n.a. #N/A #N/A #N/A n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. #N/A #N/A #N/A

December 14, 2017

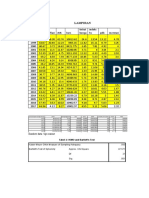

Stocks in the SET100 Index which are NOT under KS coverage *

Stocks Target price Price (Bt) Upside Target m shares Market Cap % Beta Net Profit (Btmn) EPS(Bt) EPS Growth (%) DPS (Bt) PER (x) ** Dividend Yield (%) ** P/BV (x) ** ROE (%)

(Bt) 13-Dec-17 (%) PER 17 E (Btmn) of SET 1Yr 2016 2017E 2018E 2016 2017E 2018E 2016 2017E 2018E 2016 2017E 2018E 2016 2017E 2018E 2016 2017E 2018E 2016 2017E 2018E 2016 2017E 2018E

Agribusiness

GFPT 19.22 13.80 39.28 12.7 1,254 17,303 0.1 1.2 1,644 1,891 1,955 1.31 1.51 1.57 37.89 15.50 3.77 0.30 0.38 0.38 10.53 9.12 8.79 2.17 2.78 2.78 1.62 1.43 1.28 16.45 16.25 14.84

Banking

LHBANK 1.94 1.71 13.60 14.94 21,184 36,224 0.2 0.3 2,696 2,474 2,733 0.20 0.13 0.14 63.25 (34.24) 7.69 0.05 0.05 0.05 8.70 13.15 12.21 3.02 2.98 2.87 1.15 0.95 0.90 14.09 8.55 7.90

Construction Materials

EPG 13.73 11.20 22.62 24.18 2,800 31,360 0.2 1.0 1,413 1,552 1,432 0.51 0.57 0.53 87.04 12.48 (7.57) 0.10 0.21 0.23 25.54 19.72 21.33 0.78 1.88 2.05 3.92 3.05 3.61 16.24 15.82 13.47

TPIPL 2.82 2.06 36.65 n.a. 20,190 41,591 0.3 0.7 (521) (1,262) 107 (0.03) (0.06) 0.01 58.73 (130.77) n.m. 0.02 n.a. 0.02 (94.62) (34.33) 206.00 0.81 n.a. 0.97 0.89 0.79 0.77 (0.94) (1.66) 1.42

Construction Services

UNIQ 21.76 16.10 35.14 25.30 1,081 17,404 0.1 1.2 883 948 1,130 0.82 0.86 1.00 23.98 5.26 16.51 0.27 0.34 0.40 19.71 18.72 16.07 1.68 2.14 2.50 2.58 2.39 2.19 13.69 13.43 14.57

Energy

SUPER n.a. 1.17 n.a. n.a. 27,349 31,999 0.2 0.9 362 n.a. n.a. 0.01 n.a. n.a. n.m. n.a. n.a. 0.00 n.a. n.a. 88.64 n.a. n.a. 0.00 n.a. n.a. 2.80 n.a. n.a. 3.21 n.a. n.a.

Finance and Securities

THANI 8.80 9.70 -9.28 18.33 2,416 23,437 0.2 0.8 881 1,118 1,439 0.36 0.48 0.58 16.13 33.33 20.83 0.21 0.22 0.30 14.58 20.21 16.72 4.00 2.29 3.11 2.53 4.22 3.73 18.41 20.96 23.71

Food and Beverage

CPF 31.14 24.40 27.64 16.79 8,611 210,114 1.3 1.0 14,703 14,963 14,744 1.99 1.86 1.77 32.67 (6.78) (4.80) 0.95 0.84 0.85 14.82 13.15 13.82 3.89 3.42 3.48 1.63 1.19 1.15 11.76 7.91 8.42

MALEE 47.40 37.25 27.24 34.98 280 10,430 0.1 1.5 530 389 533 1.90 1.36 1.83 59.92 (28.50) 35.13 0.95 0.81 1.10 30.34 27.49 20.34 2.55 2.17 2.96 10.23 6.20 5.30 37.54 23.89 28.59

MINT 47.85 41.75 14.62 38.44 4,619 192,840 1.2 1.3 6,590 5,649 6,630 1.50 1.25 1.45 (6.48) (16.75) 16.71 0.35 0.38 0.44 23.91 33.53 28.73 0.84 0.90 1.04 4.22 4.16 3.78 18.77 13.53 13.92

TU 22.14 19.20 15.30 19.42 4,772 91,619 0.6 0.7 5,254 5,403 6,140 1.10 1.14 1.30 (2.65) 3.64 13.86 0.63 0.63 0.69 19.09 16.84 14.79 3.28 3.29 3.57 2.32 1.90 1.77 11.88 12.14 12.55

TVO 30.41 30.50 -0.28 20.59 809 24,663 0.2 0.7 2,755 1,204 1,642 3.41 1.48 2.03 45.11 (56.69) 37.24 1.25 1.27 1.76 11.88 20.65 15.05 3.09 4.17 5.78 3.83 2.89 2.77 34.26 14.21 19.48

Health Care

BCH 18.93 15.80 19.80 52.72 2,494 39,401 0.3 1.0 753 896 1,048 0.30 0.36 0.42 42.86 19.67 16.99 0.17 0.20 0.23 52.67 44.01 37.62 1.08 1.24 1.48 8.28 7.56 6.51 16.52 17.95 18.14

BDMS 23.42 21.50 8.93 37.53 15,491 333,056 2.1 0.3 8,386 9,907 9,097 0.54 0.62 0.59 3.85 15.56 (5.45) 0.29 0.29 0.30 39.81 34.46 36.44 1.35 1.36 1.38 5.98 5.45 5.05 15.50 15.60 14.42

BH 207.71 195.00 6.52 40.80 729 142,094 0.9 1.0 3,626 4,016 4,348 4.98 5.09 5.69 5.51 2.23 11.77 2.50 2.67 2.92 39.16 38.30 34.27 1.28 1.37 1.50 9.82 8.57 7.59 26.66 25.34 24.43

CHG 2.52 2.04 23.30 48.37 11,000 22,440 0.1 1.4 564 602 688 0.05 0.05 0.07 4.08 1.96 28.85 0.04 0.04 0.04 40.00 39.23 30.45 1.76 1.76 1.72 7.17 6.69 6.11 18.52 18.33 19.35

Media

BEC 14.61 13.30 9.83 54.50 2,000 26,600 0.2 1.8 1,218 500 825 0.61 0.27 0.42 (59.06) (56.07) 58.21 0.54 0.23 0.36 27.21 49.63 31.37 3.25 1.76 2.71 4.82 4.05 3.86 16.41 7.98 12.53

MAJOR 35.53 28.50 24.66 25.09 895 25,498 0.2 0.7 1,188 1,258 1,336 1.33 1.42 1.52 1.53 6.47 7.20 1.20 1.26 1.26 24.62 20.13 18.77 3.66 4.42 4.42 4.41 3.72 3.54 17.98 17.37 18.85

MONO 5.05 3.94 28.17 87.07 3,391 13,360 0.1 1.3 (250) 164 398 (0.08) 0.06 0.11 50.00 n.m. 82.76 0.03 0.01 0.04 (35.95) 67.93 37.17 1.06 0.33 1.02 3.84 4.62 4.10 (10.42) 6.25 13.35

PLANB 7.69 6.50 18.33 56.97 3,530 22,942 0.1 1.0 352 501 668 0.10 0.14 0.19 (15.05) 34.70 39.26 0.04 0.08 0.10 57.87 48.15 34.57 0.60 1.29 1.51 6.51 6.63 6.02 11.54 14.78 17.96

VGI 6.08 5.90 3.00 48.62 6,864 40,500 0.3 0.9 941 828 881 0.14 0.13 0.13 16.67 (10.71) 2.40 0.11 0.10 0.08 40.00 47.20 46.09 1.96 1.66 1.39 17.14 15.45 14.05 46.20 34.67 35.35

WORK 99.87 83.25 19.96 46.56 439 36,535 0.2 0.5 199 913 1,303 0.48 2.15 3.01 31.42 350.63 40.37 0.27 1.36 1.97 92.44 38.81 27.65 0.61 1.63 2.36 6.16 9.55 7.72 6.91 25.69 29.67

Packaging

PTL 0.00 12.20 -100.00 n.a. 900 10,980 0.1 1.5 (123) n.a. n.a. (0.15) n.a. n.a. n.m. n.a. n.a. 0.10 n.a. n.a. (103.18) n.a. n.a. 0.65 n.a. n.a. 1.51 n.a. n.a. (1.56) n.a. n.a.

Property

ANAN 6.63 6.15 7.75 12.27 3,333 20,498 0.1 1.1 1,501 1,882 2,252 0.42 0.54 0.66 15.48 29.89 21.30 0.13 0.15 0.18 14.79 11.39 9.39 2.03 2.46 2.91 2.34 1.61 1.44 16.81 15.73 16.80

BLAND n.a. 1.78 n.a. n.a. 20,662 36,779 0.2 0.8 3,443 1,732 n.a. 0.18 0.08 0.00 193.33 (54.55) (100.00) 0.07 0.05 0.00 10.11 22.25 n.a. 3.93 2.81 0.00 0.73 0.76 n.a. 7.45 3.63 n.a.

S 5.60 3.56 57.30 280.00 6,854 24,399 0.2 0.7 170 257 705 0.03 0.02 0.07 n.a. (33.33) 250.00 0.00 n.a. n.a. 147.33 178.00 50.86 0.00 n.a. n.a. 2.00 2.27 2.05 1.36 1.50 3.75

WHA 4.30 3.70 16.22 22.63 14,322 52,993 0.3 1.2 2,898 2,848 3,524 0.20 0.19 0.25 29.83 (6.13) 28.95 0.15 0.10 0.12 14.62 19.47 15.10 5.19 2.62 3.14 1.98 2.21 2.02 14.46 12.45 13.46

Tourism & Leisure

CENTEL 52.76 54.25 -2.74 34.6 1,350 73,238 0.5 0.7 1,850 2,052 2,324 1.37 1.52 1.72 11.38 11.24 12.93 0.55 0.60 0.69 39.60 35.60 31.52 1.01 1.11 1.26 7.04 6.17 5.50 18.85 17.99 18.10

Transportation

TTA 12.35 9.20 34.24 51.5 1,822 16,767 0.1 1.0 (418) 522 709 (0.23) 0.24 0.25 96.52 n.m. 4.17 0.00 0.15 0.17 (40.00) 38.33 36.80 0.00 1.63 1.85 0.80 0.83 0.80 (1.97) 2.13 2.78

Remark:

* SET100 Index during Jul 1, 2017 - Dec 31, 2017.

** Calculation of PER, P/BV and Dividend Yield ratios are based on historical prices for 2016 and current prices for 2017E and 2018E.

Source : Bloomberg consensus

Vous aimerez peut-être aussi

- Tasas de Interes, Inflacion, TCEDocument6 pagesTasas de Interes, Inflacion, TCEleandro tejedaPas encore d'évaluation

- Starch Slurry Baume TableDocument4 pagesStarch Slurry Baume TableKebo NdigarPas encore d'évaluation

- Balance Prod. - Embarques Sugraone - (Despertar)Document27 pagesBalance Prod. - Embarques Sugraone - (Despertar)Yohan sanchoPas encore d'évaluation

- Factores de Seguridad (Metodo Fellenius, Bishop)Document8 pagesFactores de Seguridad (Metodo Fellenius, Bishop)Cristhian Mamani MarcaniPas encore d'évaluation

- Tabela Tubos Quadrados Parede GrossaDocument5 pagesTabela Tubos Quadrados Parede GrossaCLAUDIOPas encore d'évaluation

- Tabel Baja MetrikDocument12 pagesTabel Baja MetrikAvita Nurul HPas encore d'évaluation

- Laporan PTW 08 - 14 JUNI 2022 - Hari Jual 01Document9 pagesLaporan PTW 08 - 14 JUNI 2022 - Hari Jual 01afdaluzikri46Pas encore d'évaluation

- Periodic Table of CNTDocument2 pagesPeriodic Table of CNTtaizokaiPas encore d'évaluation

- Costos EjercicioDocument4 pagesCostos EjercicioAlanPas encore d'évaluation

- Sesión 2.6 Simulador de PréstamosDocument3 pagesSesión 2.6 Simulador de PréstamosWillan Tello HerreraPas encore d'évaluation

- Données Précipitations BerkaneDocument4 pagesDonnées Précipitations BerkaneAnass AynaouPas encore d'évaluation

- Setting Ne HcuDocument8 pagesSetting Ne HcuGraha Sehat medikaPas encore d'évaluation

- Pluie Mens AghbalouDocument2 pagesPluie Mens AghbalouAMINAPas encore d'évaluation

- Gre PipeDocument2 pagesGre PipeshajivlrPas encore d'évaluation

- Vo CheckingDocument6 pagesVo CheckingRoy PerochoPas encore d'évaluation

- IFRS9Document31 pagesIFRS9Thị Loan TrầnPas encore d'évaluation

- Standard ANSI Pipes - R0Document3 pagesStandard ANSI Pipes - R0Asep DarojatPas encore d'évaluation

- Pipe's Wall ThicknessDocument1 pagePipe's Wall ThicknessAliPas encore d'évaluation

- Pipe's Wall ThicknessDocument1 pagePipe's Wall ThicknessRijwan KhanPas encore d'évaluation

- Resumer DIN8074Document11 pagesResumer DIN8074yassinePas encore d'évaluation

- Distribucion Fisher 1Document1 pageDistribucion Fisher 1Alexander Salazar MottaPas encore d'évaluation

- Tee BeamDocument13 pagesTee BeamLan MendietaPas encore d'évaluation

- Calidad Huacho - Diciembre 2010Document5 pagesCalidad Huacho - Diciembre 2010Leishner Dextre TapiaPas encore d'évaluation

- Tablas Estadisticas - Distribucion x2Document1 pageTablas Estadisticas - Distribucion x2Frans BernsPas encore d'évaluation

- 001 XyzDocument9 pages001 Xyznelson jose romero montielPas encore d'évaluation

- Sim Ula Dora Nuali Dad EsDocument3 pagesSim Ula Dora Nuali Dad EsNohelia Tito ZelaPas encore d'évaluation

- Examen 2do ParcialDocument15 pagesExamen 2do ParcialFernando LópezPas encore d'évaluation

- Thvinh Long 60mDocument6 pagesThvinh Long 60mtrong lePas encore d'évaluation

- GRAFICA CONTROL 2020 (Septiembre)Document10 pagesGRAFICA CONTROL 2020 (Septiembre)Leydi Rojas VeizagaPas encore d'évaluation

- 3-Ftp Polyma Pe100Document3 pages3-Ftp Polyma Pe100Mehdi JabranePas encore d'évaluation

- Costos 2Document15 pagesCostos 2richicuellar62Pas encore d'évaluation

- Espesor CañeriasDocument2 pagesEspesor CañeriasPeterWayPas encore d'évaluation

- 1 API 5L LINE PIPES Utp - UnlockedDocument2 pages1 API 5L LINE PIPES Utp - Unlockedrashid isaarPas encore d'évaluation

- LAMPIRANDocument8 pagesLAMPIRANAudre AprilliaPas encore d'évaluation

- Kelompok 21 - M1 (Excel) - Asis 3 - Kayana Indah CahyaningrumDocument18 pagesKelompok 21 - M1 (Excel) - Asis 3 - Kayana Indah Cahyaningrumalya prasetyaraniPas encore d'évaluation

- Aplicacion Niif16 Leasing y Arrendamientos 2022 - PortegaDocument10 pagesAplicacion Niif16 Leasing y Arrendamientos 2022 - PortegaPaula OrtegaPas encore d'évaluation

- April 20Document57 pagesApril 20SupriyantiPas encore d'évaluation

- MODALIDAD PENSION 1 CON 15 AÑOS DE GARANTIA AntonioDocument3 pagesMODALIDAD PENSION 1 CON 15 AÑOS DE GARANTIA AntonioJose Arteta SalasPas encore d'évaluation

- Tarifa Fletes Patagoniafresh - T22-23 - Desde 030123Document2 pagesTarifa Fletes Patagoniafresh - T22-23 - Desde 030123Jonn LdsPas encore d'évaluation

- Brasil UFSerie HistDocument15 pagesBrasil UFSerie HistchavedaculturaPas encore d'évaluation

- Tabel Profil Baja Seri MetrikDocument30 pagesTabel Profil Baja Seri MetrikRoro FatmawatiPas encore d'évaluation

- Regresion LinealDocument15 pagesRegresion LinealViridianaPas encore d'évaluation

- Zonificacion de La CuencaDocument9 pagesZonificacion de La CuencaBeymar QuispePas encore d'évaluation

- Aplicacion Niif16 Leasing y Arrendamientos 2022 - Portega - EpjDocument8 pagesAplicacion Niif16 Leasing y Arrendamientos 2022 - Portega - EpjPaula OrtegaPas encore d'évaluation

- Pipe Wall ThicknessDocument1 pagePipe Wall ThicknessVijay Kumar RashimalaluPas encore d'évaluation

- Pipe-Wall-Thickness 6Document1 pagePipe-Wall-Thickness 6pjcs1974Pas encore d'évaluation

- Deflacionamento de Série HistóricaDocument3 pagesDeflacionamento de Série HistóricaHadassa HevenyPas encore d'évaluation

- Pricelist Pipa PE - 100 Maspion 2023Document5 pagesPricelist Pipa PE - 100 Maspion 2023jeppo LepuenPas encore d'évaluation

- Calculos Superficies de Tuberias - ML de Soldadura - ConsumiblesDocument4 pagesCalculos Superficies de Tuberias - ML de Soldadura - Consumibleswilber gomezPas encore d'évaluation

- MacroeconomiaDocument5 pagesMacroeconomiaJamy RamírezPas encore d'évaluation

- Calculos Sup. Tuberias - ML de Soldadura - Consumibles - Rend Sold.Document4 pagesCalculos Sup. Tuberias - ML de Soldadura - Consumibles - Rend Sold.wilber gomezPas encore d'évaluation

- Dante Callo CcanqqueriDocument10 pagesDante Callo CcanqqueriELIAS LEVA SIMARAURAPas encore d'évaluation

- Interaction Diagram 030723Document4 pagesInteraction Diagram 030723Phanathon OunonPas encore d'évaluation

- Empleo y Desempleo y TasaDocument3 pagesEmpleo y Desempleo y TasaErika Galicia GonzalezPas encore d'évaluation

- Pipe Dimensions ANSI-B36.10-Sch 5-80Document1 pagePipe Dimensions ANSI-B36.10-Sch 5-80Abel Lopez JoachinPas encore d'évaluation

- Pipe Dimensions ANSI-B36.10-Sch 5-80 PDFDocument1 pagePipe Dimensions ANSI-B36.10-Sch 5-80 PDFMartín SosaPas encore d'évaluation

- Clase 04 - 11Document14 pagesClase 04 - 11Brandon AfanadorPas encore d'évaluation

- Fundatii 1Document1 pageFundatii 12minimini12Pas encore d'évaluation

- Fiche Des RapportsDocument9 pagesFiche Des RapportsNogning ta kam zidanePas encore d'évaluation

- Giss Protection 2016 PDFDocument148 pagesGiss Protection 2016 PDFeuqehtbPas encore d'évaluation

- Sae 1008 CR PDFDocument3 pagesSae 1008 CR PDFBurak KececiPas encore d'évaluation

- Fs Materiaux PDFDocument2 pagesFs Materiaux PDFAyoub LaouinatePas encore d'évaluation

- CSTB Avis Technique Elasto. Soprel FlamDocument22 pagesCSTB Avis Technique Elasto. Soprel Flamedima79Pas encore d'évaluation

- Confection de La PPAC Au LaboDocument30 pagesConfection de La PPAC Au LaboMina KDPas encore d'évaluation

- Traitement de Surface Metalliq - Souad IZLANE - 4126Document37 pagesTraitement de Surface Metalliq - Souad IZLANE - 4126Wassef KobbiPas encore d'évaluation

- Robot Millennium - Affaire - Structure - Résultats MEF - Calculs en CoursDocument2 pagesRobot Millennium - Affaire - Structure - Résultats MEF - Calculs en Coursrami feki100% (1)

- Chapitre IDocument10 pagesChapitre IRap DzPas encore d'évaluation

- Lot PlomberieDocument24 pagesLot PlomberienbnbPas encore d'évaluation

- Catalogue-Complet (Tolérance Sur Les Profilés)Document85 pagesCatalogue-Complet (Tolérance Sur Les Profilés)buffle08Pas encore d'évaluation

- Reload IIIDocument19 pagesReload IIIMOTARD81210Pas encore d'évaluation

- Despieces PDFDocument64 pagesDespieces PDFHerrediaz HerrediazPas encore d'évaluation

- Réparation Et Renovation Des Structures MetalliquesDocument198 pagesRéparation Et Renovation Des Structures Metalliquesmehdi100% (1)

- 09 - Chevillage ChimiqueDocument38 pages09 - Chevillage ChimiqueMahdi DalyPas encore d'évaluation

- Classification Des MétauxDocument17 pagesClassification Des Métauxameg15100% (3)

- ABRAfrance Creusabro 8000Document3 pagesABRAfrance Creusabro 8000Ayman MarkPas encore d'évaluation

- FT Raccord Inox Embouti ZSM PDFDocument2 pagesFT Raccord Inox Embouti ZSM PDFMessouaf FouadPas encore d'évaluation

- M11 - Réalisation D'opérations de Rectification PDFDocument71 pagesM11 - Réalisation D'opérations de Rectification PDFMohamed LarbiPas encore d'évaluation

- Guide de Fabrication de Pompe Élévatrice À GodetsDocument15 pagesGuide de Fabrication de Pompe Élévatrice À GodetsSawab MadenePas encore d'évaluation

- PDFDocument354 pagesPDFAit Abderrahman AbderrahimPas encore d'évaluation

- PontsV3 Académie de RennesDocument56 pagesPontsV3 Académie de RennesAmine JdiraPas encore d'évaluation

- LLPSI Vocabula - Multilingue PDFDocument48 pagesLLPSI Vocabula - Multilingue PDFcerberusalexPas encore d'évaluation

- Magnesium Et AlliagesDocument2 pagesMagnesium Et AlliagesChristopher Sevilla (EXPERT HYDROGENE)Pas encore d'évaluation

- Chap-1-Materiaux Et Désignation V02Document11 pagesChap-1-Materiaux Et Désignation V02Wael Ben Salem100% (1)

- Alliages DaluminiumDocument26 pagesAlliages Daluminiumnesrine derPas encore d'évaluation

- Procede D Elaboration Des Pieces MecaniquesDocument151 pagesProcede D Elaboration Des Pieces MecaniquesFosseni DialloPas encore d'évaluation

- 06 Cours Sur Les Materiaux 2Document3 pages06 Cours Sur Les Materiaux 2Franck Jordan NOZAKAP FOSSI100% (1)

- Fagor TablesDocument34 pagesFagor Tablesolivierc100% (1)

- Roches MagmatiquesDocument5 pagesRoches MagmatiquesArmel HamidouPas encore d'évaluation