Académique Documents

Professionnel Documents

Culture Documents

Taxation Trends in The European Union - 2012 226

Transféré par

d05register0 évaluation0% ont trouvé ce document utile (0 vote)

4 vues1 pageTitre original

Taxation trends in the European Union - 2012 226

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

4 vues1 pageTaxation Trends in The European Union - 2012 226

Transféré par

d05registerDroits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 1

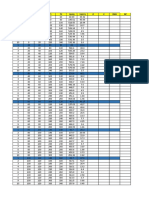

Tables

Annex A

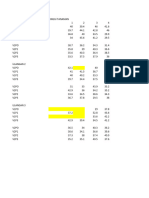

Table 46: Taxes on Labour as % of Total Taxation - Total

(2)

Difference(1) Ranking Revenue

1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 1995 to 2010 2000 to 2010 2010 2010

BE 55.5 54.5 54.4 53.9 53.6 53.7 54.7 54.9 54.9 53.5 52.9 51.8 52.4 53.3 55.0 54.1 -1.3 0.5 6 84 237

BG 42.1 40.6 41.9 40.5 43.7 44.3 40.5 41.8 40.9 38.5 37.0 32.8 31.1 30.2 33.7 32.9 -9.2 -11.4 26 3 243

CZ 49.6 51.5 52.2 53.3 51.8 52.7 52.2 52.9 52.4 51.0 51.3 52.0 51.7 52.3 50.8 52.3 2.7 -0.4 10 26 392

DK 55.9 55.5 55.0 53.3 53.8 53.9 55.6 54.5 54.1 51.4 48.8 49.6 51.1 53.3 56.6 51.7 -4.2 -2.1 13 58 032

DE 60.4 59.6 60.1 59.4 57.9 58.2 60.3 60.7 60.3 59.3 58.0 56.2 54.1 55.4 56.8 56.2 -4.2 -2.0 3 530 260

EE 56.3 55.4 53.6 55.0 57.2 56.4 56.0 55.0 54.3 53.6 50.2 49.9 50.8 55.3 52.4 53.9 -2.4 -2.5 7 2 633

IE 40.9 39.8 39.2 38.0 37.0 36.3 37.0 35.2 33.7 34.4 33.8 32.5 34.2 38.0 41.6 41.4 0.5 5.1 20 18 196

(3)

EL 36.1 37.0 37.4 37.1 36.6 35.9 36.7 38.9 40.1 40.3 40.5 39.2 39.5 40.0 40.1 39.9 3.8 4.0 23 28 112

ES 50.4 51.0 48.9 47.8 46.3 45.8 47.5 47.4 46.7 45.6 44.4 43.9 45.1 50.5 53.7 52.2 1.9 6.4 11 175 397

FR 53.2 52.2 51.9 51.7 51.6 52.0 52.2 52.7 53.4 52.9 52.8 52.1 52.0 52.7 55.4 54.3 1.1 2.3 5 446 383

IT 45.5 47.5 47.6 48.9 47.9 47.5 48.7 49.5 49.1 49.6 50.5 48.6 48.6 50.4 51.1 51.6 6.1 4.1 14 339 599

CY 37.0 36.0 38.0 36.8 35.1 31.9 32.6 32.5 33.4 32.3 32.4 31.0 27.0 28.8 34.8 35.5 -1.5 3.5 25 2 196

LV 52.0 51.6 49.7 48.5 50.7 51.7 51.1 51.7 51.3 51.1 48.4 48.2 48.0 49.7 52.0 52.5 0.5 0.8 9 2 580

LT 46.8 48.9 48.6 50.2 52.6 54.1 53.9 52.4 51.9 52.0 50.7 49.8 49.0 49.3 51.3 49.5 2.7 -4.7 15 3 687

LU 41.2 40.8 39.5 38.2 38.8 38.5 39.7 38.5 39.5 40.2 40.3 40.6 41.1 42.6 43.7 43.3 2.1 4.8 18 6 471

HU 49.8 49.5 51.4 50.5 48.8 48.7 49.8 50.3 48.8 47.8 48.9 49.1 49.7 51.4 49.8 48.3 -1.4 -0.4 16 17 703

MT 36.1 36.8 37.0 37.3 36.6 37.3 37.7 36.2 35.6 34.4 32.7 32.9 29.9 30.4 31.0 32.2 -3.9 -5.1 27 660

NL 54.8 52.1 50.7 50.7 51.3 51.9 48.3 49.7 51.2 50.6 49.7 51.3 51.1 52.7 55.4 55.0 0.2 3.1 4 125 360

AT 57.2 55.6 55.7 55.3 56.0 55.6 53.8 55.2 55.9 55.3 55.4 55.9 55.3 55.8 56.7 56.8 -0.4 1.2 1 68 238

PL 45.9 46.1 46.4 47.6 45.0 43.7 44.8 41.1 41.1 39.7 39.0 39.7 37.3 38.1 38.6 36.3 -9.6 -7.4 24 40 898

PT 38.0 37.0 36.8 36.2 36.0 37.0 38.2 37.7 38.0 38.3 38.0 37.9 38.0 38.4 42.1 40.9 2.9 4.0 21 22 279

RO 43.0 43.8 38.6 41.7 41.8 43.8 44.9 43.9 40.1 39.4 39.6 40.6 40.8 41.2 43.8 41.5 -1.6 -2.4 19 13 777

SI 55.9 54.0 54.7 53.6 52.2 54.2 55.4 54.3 54.1 54.1 52.9 52.3 50.2 51.2 52.0 51.8 -4.1 -2.4 12 6 965

SK 38.2 41.9 44.4 44.5 43.8 44.1 45.5 45.3 43.8 40.4 39.1 38.2 38.4 41.2 42.1 43.4 5.2 -0.7 17 8 021

FI 55.2 55.3 52.0 51.3 50.6 49.3 52.2 52.2 52.2 51.6 52.1 51.7 51.1 52.7 55.1 53.4 -1.8 4.1 8 40 564

SE 62.1 62.5 61.8 62.5 61.4 59.7 62.3 62.5 62.5 61.5 59.5 58.7 57.6 59.7 58.7 56.4 -5.7 -3.3 2 89 605

UK 39.8 38.1 36.8 37.8 38.2 39.0 39.5 39.2 39.2 39.5 39.8 39.2 40.0 38.7 41.7 40.2 0.4 1.2 22 243 651

NO 43.9 42.9 43.6 47.4 46.0 40.4 41.3 43.2 43.8 41.3 38.3 36.8 38.7 38.5 42.9 41.5 -2.4 1.1 56 127

IS : : : : : : : : : : : : : : : : : : :

EU-27 averages 2 405 138

weighted 52.6 51.9 51.1 50.9 50.2 50.1 50.8 51.0 51.1 50.4 49.9 48.9 48.6 50.0 52.1 51.2 -1.4 1.1

arithmetic 48.1 48.0 47.6 47.5 47.3 47.3 47.8 47.6 47.4 46.6 45.9 45.4 45.0 46.4 48.0 47.3 -0.8 0.0

EA-17 averages 1 905 570

weighted 54.1 53.4 53.0 52.8 52.0 52.0 52.7 53.1 53.1 52.4 51.9 50.8 50.3 52.1 53.9 53.4 -0.7 1.4

arithmetic 47.8 47.5 47.2 46.8 46.4 46.2 46.8 46.8 46.8 46.3 45.6 45.1 44.6 46.5 48.2 48.0 0.2 1.8

EU-25 averages

weighted 52.7 51.9 51.1 50.9 50.2 50.1 50.8 51.1 51.2 50.5 49.9 49.0 48.7 50.1 52.2 51.3 -1.4 1.2

arithmetic 48.5 48.4 48.2 48.0 47.6 47.6 48.2 48.0 47.9 47.2 46.5 46.1 45.7 47.3 48.7 48.1 -0.4 0.6

(1) In percentage points

(2) In millions of euro

(3) Data for Greece is provisional for years 2003-2010

See explanatory notes in Annex B

Source: Eurostat (online data code gov_a_tax_ag)

Date of extraction: 13/01/2012

Taxation trends in the European Union 225

Vous aimerez peut-être aussi

- ZG Roots BlowerDocument9 pagesZG Roots BlowerSalomon Mendoza MarcialPas encore d'évaluation

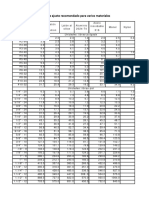

- TTVA003 - Rating Pressione-Temperatura A Norme ANSI B16 - 34Document3 pagesTTVA003 - Rating Pressione-Temperatura A Norme ANSI B16 - 34Gianni SavesiPas encore d'évaluation

- SU InfoDocument27 pagesSU Infoghost46Pas encore d'évaluation

- SU InfoDocument27 pagesSU InfoMauricio Pozo AlmendrasPas encore d'évaluation

- Slurry. Property Equations and FunctionsDocument95 pagesSlurry. Property Equations and FunctionsbipradasdharPas encore d'évaluation

- Data MST JagungDocument5 pagesData MST JagungYazid SiregarPas encore d'évaluation

- Pipes. Flow Rate and Pressure Loss EquationsDocument92 pagesPipes. Flow Rate and Pressure Loss EquationsParbat SinghPas encore d'évaluation

- SU InfoDocument27 pagesSU Infolaz mejPas encore d'évaluation

- pipe규격표Document1 pagepipe규격표김동하Pas encore d'évaluation

- S Lon PE Pipe DetialsDocument25 pagesS Lon PE Pipe DetialsNiruban ThaventhiranPas encore d'évaluation

- Awwa FlangesDocument5 pagesAwwa Flangesbardianabavi.bnPas encore d'évaluation

- AEPDocument5 pagesAEPmohamed bouressasPas encore d'évaluation

- Tabla 2 TP4-3Document5 pagesTabla 2 TP4-3pilarprimololiPas encore d'évaluation

- Pipe SchedulesDocument1 pagePipe SchedulesArokiaraj Prabhu CPas encore d'évaluation

- BalastoDocument26 pagesBalastoAlexis MasamiPas encore d'évaluation

- Hdpe Pe100 DimDocument2 pagesHdpe Pe100 DimArse AbiPas encore d'évaluation

- Advanced Rate CardDocument6 pagesAdvanced Rate CardMufakir Qamar AnsariPas encore d'évaluation

- Báo CáoDocument102 pagesBáo CáoNguyễn Việt HảiPas encore d'évaluation

- Libreta Topografica Ejemplo CunoriDocument12 pagesLibreta Topografica Ejemplo CunoriJimmy Alexander Barrera ÁlvarezPas encore d'évaluation

- Flanges & Pipe DimensionsDocument16 pagesFlanges & Pipe DimensionsYaakoubi FethiPas encore d'évaluation

- R410A PT ChartDocument1 pageR410A PT ChartRhys DucotePas encore d'évaluation

- MbeweDocument12 pagesMbeweJoseph MushikaPas encore d'évaluation

- Water Pipes As Per ISO-4427 Dim Tables - Annex-2b PDFDocument1 pageWater Pipes As Per ISO-4427 Dim Tables - Annex-2b PDFnagarjuna reddy mPas encore d'évaluation

- R410a PT Chart 2Document1 pageR410a PT Chart 2Ahmed S. El DenPas encore d'évaluation

- NKD Rev.2 - soMKpodrska - 2019-09-05Document36 pagesNKD Rev.2 - soMKpodrska - 2019-09-05Andreja JovanovskiPas encore d'évaluation

- Data Percobaan KA LTK-II-03Document6 pagesData Percobaan KA LTK-II-03Rifa FadhilahPas encore d'évaluation

- Buku Panen 1Document123 pagesBuku Panen 1ahmad chephelistPas encore d'évaluation

- Tabla de Torque de TornillosDocument2 pagesTabla de Torque de TornillosAndrés Tuesca Clase de inglesPas encore d'évaluation

- PEK HDPE PipeDocument2 pagesPEK HDPE PipealiPas encore d'évaluation

- SIK HomogenitasDocument2 pagesSIK HomogenitasWINDUADI BAGUS PRAMONOPas encore d'évaluation

- CALCULO DE BANCOS-reactanciaDocument9 pagesCALCULO DE BANCOS-reactanciaFrancis Manuel Ancco FuentesPas encore d'évaluation

- Tarifa Arqualuz 2Document139 pagesTarifa Arqualuz 2David Muñoz gilPas encore d'évaluation

- Chart Is 4984 2016 Pe 63Document1 pageChart Is 4984 2016 Pe 63bipradasdharPas encore d'évaluation

- Profil TablosuDocument8 pagesProfil TablosuKürşat ÇELİKPas encore d'évaluation

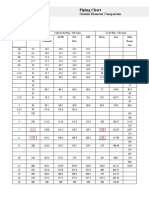

- Piping ChartDocument1 pagePiping ChartTrajko GjorgjievskiPas encore d'évaluation

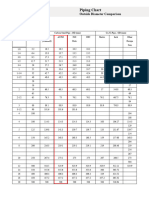

- Piping ComparisonDocument1 pagePiping ComparisonIBRAHIM GaramanliPas encore d'évaluation

- Piping ChartDocument1 pagePiping ChartTrajko GjorgjievskiPas encore d'évaluation

- Bs 10 Pipe FlangeDocument3 pagesBs 10 Pipe FlangeTIME STAR COMPOSITEPas encore d'évaluation

- MASTER de GRUAS ESTRUCTURALES (30122010)Document6 pagesMASTER de GRUAS ESTRUCTURALES (30122010)krlitos_mPas encore d'évaluation

- BD Precipitaciones 1985 2022Document14 pagesBD Precipitaciones 1985 2022Emilio SalazarPas encore d'évaluation

- Hidrogramas R100 y R 10000Document5 pagesHidrogramas R100 y R 10000Ignacio MeineroPas encore d'évaluation

- Parameters of GRP Pipes With Aggregates PDFDocument1 pageParameters of GRP Pipes With Aggregates PDFN.S CompanyPas encore d'évaluation

- ANGA Garnitures Mecaniques - FRA - 2015Document52 pagesANGA Garnitures Mecaniques - FRA - 2015Nicha OuiksPas encore d'évaluation

- Labft1 Post4Document17 pagesLabft1 Post4Maria Jose AyalaPas encore d'évaluation

- Pilsa Koruge Katalog PDF Icin - fh10Document1 pagePilsa Koruge Katalog PDF Icin - fh10Süleyman SARAYLIPas encore d'évaluation

- Escala Notas Dif PuntosDocument3 pagesEscala Notas Dif PuntosTesisBlogPas encore d'évaluation

- Pipes. Slope Required For A Pipe To Avoid Fluid AccumulationDocument35 pagesPipes. Slope Required For A Pipe To Avoid Fluid AccumulationSaid SOUKAHPas encore d'évaluation

- HDPE Pipe Catalog PDFDocument4 pagesHDPE Pipe Catalog PDFCalvin KewPas encore d'évaluation

- NSB 100FT RED Battery: Discharge Tables at 20°C (68°F)Document10 pagesNSB 100FT RED Battery: Discharge Tables at 20°C (68°F)Juan Felipe MartinezPas encore d'évaluation

- Perfil HuancayoDocument25 pagesPerfil HuancayoJOHANNESUNI_2009Pas encore d'évaluation

- Data Line 1Document3 pagesData Line 1Donattianus PebriadiPas encore d'évaluation

- Eaton 6 MarchasDocument2 pagesEaton 6 MarchasPedro MelloPas encore d'évaluation

- Calculo HidrologicoDocument14 pagesCalculo Hidrologicoalberto camascaPas encore d'évaluation

- Asme B16.48Document7 pagesAsme B16.48Roman Semenov100% (1)

- Iqa 222 2022 S1 Ap6 Inf GeDocument23 pagesIqa 222 2022 S1 Ap6 Inf GeBenja GarridoPas encore d'évaluation

- 4 Hietograma Ichuña Corr1Document38 pages4 Hietograma Ichuña Corr1edwin rodiguez yaquettoPas encore d'évaluation

- Le syndrome périodique associé à la cryopyrine (CAPS)D'EverandLe syndrome périodique associé à la cryopyrine (CAPS)Pas encore d'évaluation

- Taxation Trends in The European Union - 2012 226Document1 pageTaxation Trends in The European Union - 2012 226d05registerPas encore d'évaluation

- Taxation Trends in The European Union - 2012 227Document1 pageTaxation Trends in The European Union - 2012 227d05registerPas encore d'évaluation

- Taxation Trends in The European Union - 2012 218 PDFDocument1 pageTaxation Trends in The European Union - 2012 218 PDFd05registerPas encore d'évaluation

- Taxation Trends in The European Union - 2012 204Document1 pageTaxation Trends in The European Union - 2012 204d05registerPas encore d'évaluation

- Taxation Trends in The European Union - 2012 212 PDFDocument1 pageTaxation Trends in The European Union - 2012 212 PDFd05registerPas encore d'évaluation

- Taxation Trends in The European Union - 2012 186 PDFDocument1 pageTaxation Trends in The European Union - 2012 186 PDFd05registerPas encore d'évaluation

- Taxation Trends in The European Union - 2012 192 PDFDocument1 pageTaxation Trends in The European Union - 2012 192 PDFd05registerPas encore d'évaluation

- MRT 112892Document19 pagesMRT 112892Ariane KINGPas encore d'évaluation

- Loi N 01-07 FRDocument23 pagesLoi N 01-07 FRsylia ferhaniPas encore d'évaluation

- Regard Sur Le Décret N°2023/042 Du 25 Janvier 2023 Portant Statut Et Organisation de La Profession D'huissier de Justice Et D'agent D'exécutionDocument15 pagesRegard Sur Le Décret N°2023/042 Du 25 Janvier 2023 Portant Statut Et Organisation de La Profession D'huissier de Justice Et D'agent D'exécutionJoemou Patio Fernand100% (1)

- ORDONNANCE 91-232 du 15 août 1991 portant règlement d'administration relatif au personnel des établissements publics d'enseignement maternel, primaire, secondaire et professionnel. (Présidence de la République)Document12 pagesORDONNANCE 91-232 du 15 août 1991 portant règlement d'administration relatif au personnel des établissements publics d'enseignement maternel, primaire, secondaire et professionnel. (Présidence de la République)Michael T-mic TshitengePas encore d'évaluation

- Regime RetraiteDocument36 pagesRegime RetraiteNarcisse Tuina100% (1)

- La Securite Incendie Cle78cf81Document33 pagesLa Securite Incendie Cle78cf81Youssouf FOFANAPas encore d'évaluation

- MinesecDocument25 pagesMinesecBilong yebga patrice100% (1)

- lettreRejetAutreDocument2 pageslettreRejetAutreABDEKPas encore d'évaluation

- Cours de Relations Prof. Internes 1 Et 2Document43 pagesCours de Relations Prof. Internes 1 Et 2rosairesimoPas encore d'évaluation

- CPS Lot UniqueDocument77 pagesCPS Lot UniqueOthmane BoualamPas encore d'évaluation

- synthese-DB - Rapport RH - FRDocument14 pagessynthese-DB - Rapport RH - FRAissamPas encore d'évaluation

- 10 Techniciens Cadastre FRDocument3 pages10 Techniciens Cadastre FRndongmo aldoPas encore d'évaluation

- Res File 864Document39 pagesRes File 864AshashwatmePas encore d'évaluation

- Centres Municipaux: Haute Kabylie en 1945Document12 pagesCentres Municipaux: Haute Kabylie en 1945TasedlistPas encore d'évaluation

- Baromètre de L'action Sociale Dans Les Collectivités Territoriales - La Gazette - PLURELYADocument22 pagesBaromètre de L'action Sociale Dans Les Collectivités Territoriales - La Gazette - PLURELYALa Gazette des communesPas encore d'évaluation

- Salaire Augmentation Decret Fevrier 2023 PDFDocument8 pagesSalaire Augmentation Decret Fevrier 2023 PDFOlivier Eyamo OmokoPas encore d'évaluation

- Enam GreffeDocument368 pagesEnam GreffeisaacPas encore d'évaluation

- Joe 20221027 0250 p000Document264 pagesJoe 20221027 0250 p000park_kattPas encore d'évaluation

- TD2 Adm SepiDocument9 pagesTD2 Adm SepiOthniel GbaliaPas encore d'évaluation

- LégalisationDocument1 pageLégalisationYa Cine Fqih BerradaPas encore d'évaluation

- Cours de Droit Des Collectivités TerritorialesDocument35 pagesCours de Droit Des Collectivités TerritorialesIbrahim Gonda ZadaPas encore d'évaluation

- Medias Sociaux Et Relations PubliquesDocument8 pagesMedias Sociaux Et Relations PubliquesLlanetes CortesPas encore d'évaluation

- Ramtane Lamamra Remis en Selle: Les Étudiants Au Rendez-Vous Au Rendez-Vous de L'Histoire de L'HistoireDocument28 pagesRamtane Lamamra Remis en Selle: Les Étudiants Au Rendez-Vous Au Rendez-Vous de L'Histoire de L'Histoirechouaib kennichePas encore d'évaluation

- Mli 109343Document3 pagesMli 109343Anty MahamadouPas encore d'évaluation

- Joe 20091217 0292 p000Document257 pagesJoe 20091217 0292 p000Marcus BragaPas encore d'évaluation

- Joe 20230720 0166 p000Document156 pagesJoe 20230720 0166 p000Eiffel RocketPas encore d'évaluation

- Conseil Des Ministres N°039 Du 13 Decembre 2023Document17 pagesConseil Des Ministres N°039 Du 13 Decembre 2023Zaki KonfePas encore d'évaluation

- Jurisprudence de La CEDH Sur Le - Conflit - Entre - L - Art - 8 - Et - L - Art - 10 - Dans Les Affaires Relatives Aux Personnages PublicsDocument70 pagesJurisprudence de La CEDH Sur Le - Conflit - Entre - L - Art - 8 - Et - L - Art - 10 - Dans Les Affaires Relatives Aux Personnages PublicsAnonymous nRkOpHzPas encore d'évaluation