Académique Documents

Professionnel Documents

Culture Documents

BKM 10e Ch08 Spreadsheets

Transféré par

Joe IammarinoTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

BKM 10e Ch08 Spreadsheets

Transféré par

Joe IammarinoDroits d'auteur :

Formats disponibles

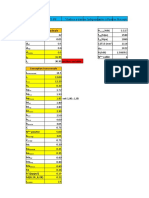

A B C D E F G H I J

1 Panel 1: Risk Parameters of the Investable Universe (annualized)

2

SD of SD of Correlation

3 excess Systematic SD of with the S&P

return Beta component Residual 500

4 S&P 500 0.1358 1.00 0.1358 0 1

5 HP 0.3817 2.03 0.2762 0.2656 0.72

6 DELL 0.2901 1.23 0.1672 0.2392 0.58

7 WMT 0.1935 0.62 0.0841 0.1757 0.43

8 TARGET 0.2611 1.27 0.1720 0.1981 0.66

9 BP 0.1822 0.47 0.0634 0.1722 0.35

10 SHELL 0.1988 0.67 0.0914 0.1780 0.46

11

12 Panel 2: Correlation of Residuals

13

14 HP DELL WMT TARGET BP

15 HP 1

16 DELL 0.08 1

17 WMT -0.34 0.17 1

18 TARGET -0.10 0.12 0.50 1

19 BP -0.20 -0.28 -0.19 -0.13 1

20 SHELL -0.06 -0.19 -0.24 -0.22 0.70

21

22 Panel 3: The Index Model Covariance Matrix

23

24 S&P 500 HP DELL WMT TARGET BP SHELL

25 Beta 1.00 2.03 1.23 0.62 1.27 0.47 0.67

26 S&P 500 1.00 0.0184 0.0375 0.0227 0.0114 0.0234 0.0086 0.0124

27 HP 2.03 0.0375 0.1457 0.0462 0.0232 0.0475 0.0175 0.0253

28 DELL 1.23 0.0227 0.0462 0.0842 0.0141 0.0288 0.0106 0.0153

29 WMT 0.62 0.0114 0.0232 0.0141 0.0374 0.0145 0.0053 0.0077

30 TARGET 1.27 0.0234 0.0475 0.0288 0.0145 0.0682 0.0109 0.0157

31 BP 0.47 0.0086 0.0175 0.0106 0.0053 0.0109 0.0332 0.0058

32 SHELL 0.67 0.0124 0.0253 0.0153 0.0077 0.0157 0.0058 0.0395

33

34 Cells on the diagonal (shadowed) equal to variance

35 formula in cell C26 =B4^2

36 Cells off diagonal equal to covariance

37 formula in Cell C27 =C$25*$B27*$B$4^2

38 multiplies beta from row and column by index variance

39

40 Panel 4: Macro Forecast and Forecasts of Alpha Values

41

42

43 S&P 500 HP DELL WMT TARGET BP SHELL

44 Alpha 0 0.0150 -0.0100 -0.0050 0.0075 0.012 0.0025

45 Risk premium 0.0600 0.1371 0.0639 0.0322 0.0835 0.0400 0.0429

46

47 Table 5: Computation of the Optimal Risky Portfolio

48

49 S&P 500 Active Pf A HP DELL WMT TARGET BP SHELL Overall Pf

50 s2(e) 0.0705 0.0572 0.0309 0.0392 0.0297 0.0317

51 a/s2(e) 0.5505 0.2126 -0.1748 -0.1619 0.1911 0.4045 0.0789

52 W0(i) 1.0000 0.3863 -0.3176 -0.2941 0.3472 0.7349 0.1433

53 [W0(i)]2 0.1492 0.1009 0.0865 0.1205 0.5400 0.0205

54 aA 0.0222 0.0058 0.0032 0.0015 0.0026 0.0088 0.0004

55 s2(eA) 0.0404 0.0105 0.0058 0.0027 0.0047 0.0160 0.0007

56 W0 0.1691

57 W* 0.8282 0.1718 0.0663 -0.0546 -0.0505 0.0596 0.1262 0.0246

58 Beta* (see fn) 1 1.0922 0.7859 -0.3911 -0.1823 0.4400 0.3432 0.0965 1.0158

59 Risk premium* 0.06 0.0878 0.0530 -0.0203 -0.0095 0.0290 0.0294 0.0062 0.0648

60 SD 0.1358 0.2497 0.1422

61 Sharpe Ratio 0.4420 0.3514 0.4556

Vous aimerez peut-être aussi

- BKM 10e Ch07 Appendix SpreadsheetsDocument3 pagesBKM 10e Ch07 Appendix SpreadsheetsJoe IammarinoPas encore d'évaluation

- CG - SI - Cas BNPDocument20 pagesCG - SI - Cas BNPYoussef NejmPas encore d'évaluation

- Tableaux de Compactage Par CouchesDocument17 pagesTableaux de Compactage Par CouchesIbrahim Khadra50% (2)

- 17 Devis WifiDocument24 pages17 Devis WifiVE TOPas encore d'évaluation

- Télécharger Livre Gratuit Beauchamp Hall (PDF - EPub - Mobi) Auteur Danielle SteelDocument10 pagesTélécharger Livre Gratuit Beauchamp Hall (PDF - EPub - Mobi) Auteur Danielle Steelwilly manPas encore d'évaluation

- Facture Rue Du CommerceDocument2 pagesFacture Rue Du CommerceToufikPas encore d'évaluation

- Lydec2 PDFDocument174 pagesLydec2 PDFMariamNourPas encore d'évaluation

- FORMATION COMPTABILITE GENERALE TRESOR ModulesDocument84 pagesFORMATION COMPTABILITE GENERALE TRESOR ModulesdoucourePas encore d'évaluation

- 23 - Dossier - Projet - Vierge - ApiDocument30 pages23 - Dossier - Projet - Vierge - ApiAdrian RenglePas encore d'évaluation

- (KPMG) Aquesition Fusion DicDocument80 pages(KPMG) Aquesition Fusion Dicsamir100% (1)

- TURCO - CorrigéDocument8 pagesTURCO - CorrigéYoann SALIDOPas encore d'évaluation

- Etude de Marche - Version IntegraleDocument68 pagesEtude de Marche - Version IntegraleAlane YoanePas encore d'évaluation

- Modele Excel Budget de TresorerieDocument32 pagesModele Excel Budget de Tresorerieachille TOIMAPas encore d'évaluation

- Copie Simulateur Paie KaramaDocument6 pagesCopie Simulateur Paie KaramaFatma ArfaouiPas encore d'évaluation

- PWC Conference Opci 221012Document54 pagesPWC Conference Opci 221012loca018Pas encore d'évaluation

- Martine Etudiant 1Document10 pagesMartine Etudiant 1api-587574119Pas encore d'évaluation

- Chaine El Aurassi - Etats Financiers 2013 PDFDocument50 pagesChaine El Aurassi - Etats Financiers 2013 PDFRiadh AssouakPas encore d'évaluation

- Exo6 Sortie SAS Car2Document6 pagesExo6 Sortie SAS Car2Viet NguyenPas encore d'évaluation

- Données 2 Classes R+1 FAIDJADocument19 pagesDonnées 2 Classes R+1 FAIDJAnory17fPas encore d'évaluation

- TP-PSP-réctifie - CopieDocument6 pagesTP-PSP-réctifie - Copieoussamahadid93Pas encore d'évaluation

- Trans NumDocument6 pagesTrans Numm'hamed hanchour imad eddinePas encore d'évaluation

- Méthode 1:: Travaux Dirigés - Ecoulements en Charge Correction de L'exercice 11Document4 pagesMéthode 1:: Travaux Dirigés - Ecoulements en Charge Correction de L'exercice 11Gifted MouhcinePas encore d'évaluation

- 01 - Flextreme h07 RN-F ÉnergieDocument1 page01 - Flextreme h07 RN-F Énergiegunabalan2008Pas encore d'évaluation

- Ros RLDocument1 pageRos RLbouzahri boumedienePas encore d'évaluation

- Afc Exemple 1Document16 pagesAfc Exemple 1Jo NathanPas encore d'évaluation

- Prelab 1Document15 pagesPrelab 1Juanita MesaPas encore d'évaluation

- 1.ThuyLucCongTron-nuoc ThaiDocument54 pages1.ThuyLucCongTron-nuoc ThaiChâu Tuấn TrầnPas encore d'évaluation

- Acero 1020Document23 pagesAcero 1020CRISTIAN FELIPE MOYA MORALESPas encore d'évaluation

- Tablas EstadisticaDocument4 pagesTablas EstadisticaAlessandra MaldonadoPas encore d'évaluation

- Mini Projet VIPPDocument35 pagesMini Projet VIPPMouhib GHIDHAOUIPas encore d'évaluation

- Calculo RedDocument7 pagesCalculo RedCiro Arévalo.Pas encore d'évaluation

- Abobo Kennedy Vers Alépé DN2Document3 pagesAbobo Kennedy Vers Alépé DN2Railey KangaPas encore d'évaluation

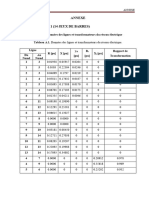

- 25 AnnexeDocument6 pages25 Annexeyounes skikdaPas encore d'évaluation

- Fisica 2Document3 pagesFisica 2Esmeralda ValenciaPas encore d'évaluation

- Utilitaire de CalculDocument52 pagesUtilitaire de CalculNacer IzriPas encore d'évaluation

- PoutreDocument13 pagesPoutreAhmed GabiPas encore d'évaluation

- Elektrisola Sbcuwire Nema Datasheet EngDocument1 pageElektrisola Sbcuwire Nema Datasheet EngHemanth KumarPas encore d'évaluation

- Modelo de Lineweaver-BurkDocument2 pagesModelo de Lineweaver-Burkjimena sanchezPas encore d'évaluation

- TP de TractionDocument9 pagesTP de TractionHatem HamekPas encore d'évaluation

- Pont A Poutre Zied Et IhebDocument430 pagesPont A Poutre Zied Et IhebMahdi KhlifaPas encore d'évaluation

- Chute Tension - Amicale Ain LakhmissDocument7 pagesChute Tension - Amicale Ain LakhmisshananechabaPas encore d'évaluation

- Daily Active Gain Julay 2021Document254 pagesDaily Active Gain Julay 2021wan izzuddinPas encore d'évaluation

- EjemploDocument6 pagesEjemploNicol M. Arredondo SonccoPas encore d'évaluation

- Taller 2 MedirDocument12 pagesTaller 2 Medirmaria isabelPas encore d'évaluation

- Calcul de ButéeDocument3 pagesCalcul de ButéeYélognissê christianePas encore d'évaluation

- Formula RioDocument8 pagesFormula RioMax LópezPas encore d'évaluation

- Exo Contreventement-1Document13 pagesExo Contreventement-1laila sqalli houssainiPas encore d'évaluation

- Diametros Nomi, Inte, ExtDocument8 pagesDiametros Nomi, Inte, ExtDavid CruzPas encore d'évaluation

- Fly Levelling-B4Document1 pageFly Levelling-B4Bimal GhimirePas encore d'évaluation

- Taller MaterialesDocument112 pagesTaller MaterialesDaniel Andres RiosPas encore d'évaluation

- Taller Materiales 1Document112 pagesTaller Materiales 1Daniel Andres RiosPas encore d'évaluation

- Taller Materiales 1Document112 pagesTaller Materiales 1Daniel Andres RiosPas encore d'évaluation

- Excel TaraDocument5 pagesExcel Tarayefri perezPas encore d'évaluation

- 2.TL Cong Chu NhatDocument28 pages2.TL Cong Chu NhatChâu Tuấn TrầnPas encore d'évaluation

- Dimensionnement de La Station de PompageDocument2 pagesDimensionnement de La Station de PompageboscoPas encore d'évaluation

- EssaiDocument22 pagesEssaiSHAMI KHALILPas encore d'évaluation

- Profil de ÎnlocuireDocument2 pagesProfil de ÎnlocuireScortanu ClaudiuPas encore d'évaluation

- Echantillonage 6Document2 pagesEchantillonage 6Majda SerbatPas encore d'évaluation

- Nouveau Document Microsoft WordDocument9 pagesNouveau Document Microsoft WordNtissar OutariPas encore d'évaluation

- Data Analisis NPKCDocument9 pagesData Analisis NPKCbynmsyannaPas encore d'évaluation

- Tarea 3.1.2Document6 pagesTarea 3.1.2Emiliano CrespoPas encore d'évaluation

- CLP Lab3Document4 pagesCLP Lab3Angad ShrivastavaPas encore d'évaluation

- TP Reseux 4Document6 pagesTP Reseux 4wailcsc04Pas encore d'évaluation

- Bac Pratique 29052019 Eco 8hDocument1 pageBac Pratique 29052019 Eco 8hHouvessou Akouègnon PatricePas encore d'évaluation

- CCS3 Manuel.1Document14 pagesCCS3 Manuel.1Narimen Boudilmi100% (1)

- 6 Le Traitement Des ImagesDocument3 pages6 Le Traitement Des ImagesFAYZI MOSTAFAPas encore d'évaluation

- Supports de TransmissionDocument2 pagesSupports de TransmissionsouadPas encore d'évaluation

- EMDCorrigéDocument6 pagesEMDCorrigéRa Nim ghPas encore d'évaluation

- Cetup Formation Dba 2023-2024Document3 pagesCetup Formation Dba 2023-2024Eden CharisPas encore d'évaluation

- Application Mobile Campus: L'application Étudiante de l'INSA Toulouse, Faite Par Des Étudiants !Document33 pagesApplication Mobile Campus: L'application Étudiante de l'INSA Toulouse, Faite Par Des Étudiants !Jo JoPas encore d'évaluation

- Tp1 Reseau Informatique: L3 TelecomDocument38 pagesTp1 Reseau Informatique: L3 TelecomBOUZANA ElaminePas encore d'évaluation

- Checklist Mission DroneDocument3 pagesChecklist Mission DronePaul DioufPas encore d'évaluation

- OffsetDocument12 pagesOffsetmeriem_badjadiPas encore d'évaluation

- Chapitre 1 - Architecture Client-Serveur WebDocument42 pagesChapitre 1 - Architecture Client-Serveur WebPascal KAMGNOPas encore d'évaluation

- Exo1 Shell Linux Corr PDFDocument5 pagesExo1 Shell Linux Corr PDFSamy NaifarPas encore d'évaluation

- IAM Business StrategyDocument25 pagesIAM Business StrategyMed SamouchePas encore d'évaluation

- Chapitre 3 CVDocument4 pagesChapitre 3 CVJr' GueyePas encore d'évaluation

- Slides Modele RelationnelDocument138 pagesSlides Modele RelationnelMakhmout Sy100% (2)

- Chapitre 4 Le Modele OSI Et TCP - IPDocument13 pagesChapitre 4 Le Modele OSI Et TCP - IPLoulica Danielle Gangoue mathosPas encore d'évaluation

- Guide Des Startups Hightech en FranceDocument332 pagesGuide Des Startups Hightech en FranceRehab KindaPas encore d'évaluation

- Serie1 ProbDocument2 pagesSerie1 ProbMouad HadinePas encore d'évaluation

- TP N°4: Les Formulaires en PHP: Exercice 1: Pour CommencerDocument5 pagesTP N°4: Les Formulaires en PHP: Exercice 1: Pour Commencerhell2062018100% (1)

- Internt WifiDocument2 pagesInternt WifiJezB1234Pas encore d'évaluation

- Notion de Base Des RéseauxDocument72 pagesNotion de Base Des RéseauxJawadi HamdiPas encore d'évaluation

- Colloque2015 Vantellerie d3 Marconnet Architecture de Controle-Commande Des Vannes SegmentDocument14 pagesColloque2015 Vantellerie d3 Marconnet Architecture de Controle-Commande Des Vannes SegmentCLAVOTPas encore d'évaluation

- P0 Introduction PIDocument19 pagesP0 Introduction PIHajar RztPas encore d'évaluation

- Contrat Assistance TechniqueDocument9 pagesContrat Assistance TechniqueKp SoroPas encore d'évaluation

- La S閞ieDocument2 pagesLa S閞iebelgoutedouaaPas encore d'évaluation

- Cours 2 ENST 1Document54 pagesCours 2 ENST 1Bă ĶŕPas encore d'évaluation

- CactusDocument302 pagesCactuspelloanderson2014Pas encore d'évaluation