Académique Documents

Professionnel Documents

Culture Documents

Tabla Amortizacion

Transféré par

Alejandra Ruiz0 évaluation0% ont trouvé ce document utile (0 vote)

2 vues3 pagesCopyright

© © All Rights Reserved

Formats disponibles

XLSX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme XLSX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

2 vues3 pagesTabla Amortizacion

Transféré par

Alejandra RuizDroits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme XLSX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 3

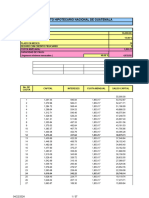

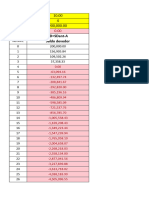

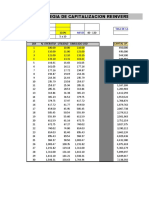

Tabla de Amortización de un préstamo

Periodos (años) Periodos por año Principal Tasa nominal anual

1 12 12,000.00 12.000%

Deuda Cuota de pago Pagos al

Meses Intereses Deuda

Inicial Mensual Fija Principal

1 -12,000.00 -1,066.19 -120.00 -946.19 -11,053.81

2 -11,053.81 -1,066.19 -110.54 -955.65 -10,098.17

3 -10,098.17 -1,066.19 -100.98 -965.20 -9,132.96

4 -9,132.96 -1,066.19 -91.33 -974.86 -8,158.11

5 -8,158.11 -1,066.19 -81.58 -984.60 -7,173.50

6 -7,173.50 -1,066.19 -71.74 -994.45 -6,179.05

7 -6,179.05 -1,066.19 -61.79 -1,004.39 -5,174.66

8 -5,174.66 -1,066.19 -51.75 -1,014.44 -4,160.22

9 -4,160.22 -1,066.19 -41.60 -1,024.58 -3,135.64

10 -3,135.64 -1,066.19 -31.36 -1,034.83 -2,100.81

11 -2,100.81 -1,066.19 -21.01 -1,045.18 -1,055.63

12 -1,055.63 -1,066.19 -10.56 -1,055.63 0.00

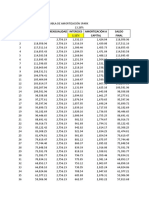

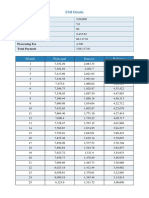

Tabla de Amortización de un préstamo

Periodos (años) Periodos por año Principal Tasa nominal anual

4 12 75,000.00 30.000%

Deuda Cuota de pago Pagos al

Meses Intereses Deuda

Inicial Mensual Fija Principal

1 -75,000.00 -2,700.45 -1,875.00 -825.45 -74,174.55

2 -74,174.55 -2,700.45 -1,854.36 -846.09 -73,328.46

3 -73,328.46 -2,700.45 -1,833.21 -867.24 -72,461.23

4 -72,461.23 -2,700.45 -1,811.53 -888.92 -71,572.31

5 -71,572.31 -2,700.45 -1,789.31 -911.14 -70,661.17

6 -70,661.17 -2,700.45 -1,766.53 -933.92 -69,727.25

7 -69,727.25 -2,700.45 -1,743.18 -957.27 -68,769.98

8 -68,769.98 -2,700.45 -1,719.25 -981.20 -67,788.78

9 -67,788.78 -2,700.45 -1,694.72 -1,005.73 -66,783.05

10 -66,783.05 -2,700.45 -1,669.58 -1,030.87 -65,752.17

11 -65,752.17 -2,700.45 -1,643.80 -1,056.65 -64,695.53

12 -64,695.53 -2,700.45 -1,617.39 -1,083.06 -63,612.47

13 -63,612.47 -2,700.45 -1,590.31 -1,110.14 -62,502.33

14 -62,502.33 -2,700.45 -1,562.56 -1,137.89 -61,364.44

15 -61,364.44 -2,700.45 -1,534.11 -1,166.34 -60,198.10

16 -60,198.10 -2,700.45 -1,504.95 -1,195.50 -59,002.60

17 -59,002.60 -2,700.45 -1,475.07 -1,225.38 -57,777.22

18 -57,777.22 -2,700.45 -1,444.43 -1,256.02 -56,521.20

19 -56,521.20 -2,700.45 -1,413.03 -1,287.42 -55,233.78

20 -55,233.78 -2,700.45 -1,380.84 -1,319.61 -53,914.17

21 -53,914.17 -2,700.45 -1,347.85 -1,352.60 -52,561.58

22 -52,561.58 -2,700.45 -1,314.04 -1,386.41 -51,175.17

23 -51,175.17 -2,700.45 -1,279.38 -1,421.07 -49,754.10

24 -49,754.10 -2,700.45 -1,243.85 -1,456.60 -48,297.50

25 -48,297.50 -2,700.45 -1,207.44 -1,493.01 -46,804.49

26 -46,804.49 -2,700.45 -1,170.11 -1,530.34 -45,274.15

27 -45,274.15 -2,700.45 -1,131.85 -1,568.60 -43,705.56

28 -43,705.56 -2,700.45 -1,092.64 -1,607.81 -42,097.75

29 -42,097.75 -2,700.45 -1,052.44 -1,648.01 -40,449.74

30 -40,449.74 -2,700.45 -1,011.24 -1,689.21 -38,760.53

31 -38,760.53 -2,700.45 -969.01 -1,731.44 -37,029.10

32 -37,029.10 -2,700.45 -925.73 -1,774.72 -35,254.38

33 -35,254.38 -2,700.45 -881.36 -1,819.09 -33,435.29

34 -33,435.29 -2,700.45 -835.88 -1,864.57 -31,570.72

35 -31,570.72 -2,700.45 -789.27 -1,911.18 -29,659.54

36 -29,659.54 -2,700.45 -741.49 -1,958.96 -27,700.58

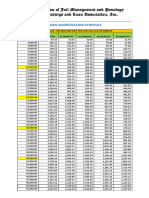

37 -27,700.58 -2,700.45 -692.51 -2,007.94 -25,692.64

38 -25,692.64 -2,700.45 -642.32 -2,058.13 -23,634.51

39 -23,634.51 -2,700.45 -590.86 -2,109.59 -21,524.92

40 -21,524.92 -2,700.45 -538.12 -2,162.33 -19,362.59

41 -19,362.59 -2,700.45 -484.06 -2,216.38 -17,146.21

42 -17,146.21 -2,700.45 -428.66 -2,271.79 -14,874.41

43 -14,874.41 -2,700.45 -371.86 -2,328.59 -12,545.83

44 -12,545.83 -2,700.45 -313.65 -2,386.80 -10,159.02

45 -10,159.02 -2,700.45 -253.98 -2,446.47 -7,712.55

46 -7,712.55 -2,700.45 -192.81 -2,507.64 -5,204.91

47 -5,204.91 -2,700.45 -130.12 -2,570.33 -2,634.58

48 -2,634.58 -2,700.45 -65.86 -2,634.58 0.00

Vous aimerez peut-être aussi

- 1.1.4.6 Lab - Configuring Basic Router Settings With IOS CLI Revisé PDFDocument9 pages1.1.4.6 Lab - Configuring Basic Router Settings With IOS CLI Revisé PDFEdward DossouPas encore d'évaluation

- Discours Politique Générale Jacques LaliéDocument12 pagesDiscours Politique Générale Jacques LaliéFrançoise Tromeur100% (3)

- 1978 Bollas L'esprit de L'objet Et L'épiphanie Du SacréDocument12 pages1978 Bollas L'esprit de L'objet Et L'épiphanie Du SacréKevin McInnes100% (1)

- Chimie Des Matériaux I 2021Document31 pagesChimie Des Matériaux I 2021Rhm Gaming100% (1)

- Richard Danier - Andre Breton Et L'hermétisme Alchimique 1976Document8 pagesRichard Danier - Andre Breton Et L'hermétisme Alchimique 1976helabzPas encore d'évaluation

- Simulador - FGR RomaDocument24 pagesSimulador - FGR Romaartur.ebxPas encore d'évaluation

- Home ProjectionDocument3 pagesHome ProjectionGowtham VananPas encore d'évaluation

- PFi Govt Servants Promo Rate - Payment Table FlyersDocument3 pagesPFi Govt Servants Promo Rate - Payment Table FlyersBazli HelmyPas encore d'évaluation

- COTIZADORES 2021 Usar Solo Este CrisDocument57 pagesCOTIZADORES 2021 Usar Solo Este CrisCarlos LópezPas encore d'évaluation

- B RadescoDocument10 pagesB RadescoAlexandre PabloPas encore d'évaluation

- PF Table Installment BM Ogos 2022 Debt ConsDocument1 pagePF Table Installment BM Ogos 2022 Debt ConsOre MachePas encore d'évaluation

- 2H Ingeniería - Reporte Pagos Ejecutados 31.12.2023Document367 pages2H Ingeniería - Reporte Pagos Ejecutados 31.12.2023Jose Eduardo Arrieta SilvaPas encore d'évaluation

- PCRDocument14 pagesPCRtemp raoPas encore d'évaluation

- PCRDocument14 pagesPCRtemp raoPas encore d'évaluation

- PCRDocument14 pagesPCRtemp raoPas encore d'évaluation

- PCRDocument14 pagesPCRtemp raoPas encore d'évaluation

- PCRDocument14 pagesPCRtemp raoPas encore d'évaluation

- Pagibig Sample ComputationDocument12 pagesPagibig Sample ComputationLucero AngelouPas encore d'évaluation

- Table01 IntercensalDocument3 pagesTable01 IntercensalRedi DelliPas encore d'évaluation

- Tabel DisplacementDocument37 pagesTabel Displacementyolandreynaldo septianPas encore d'évaluation

- Home ProjectionDocument4 pagesHome ProjectionGowtham VananPas encore d'évaluation

- Saldo Awal1Document12 pagesSaldo Awal1Dedy DarmawanPas encore d'évaluation

- Flyers Govt 3Document2 pagesFlyers Govt 3izzuddin iskandarPas encore d'évaluation

- Sebaran Gabungan SMP 20Document1 pageSebaran Gabungan SMP 20WidyaPas encore d'évaluation

- Proyecto Información La Granja de Juan-3entrega - SGMTDocument156 pagesProyecto Información La Granja de Juan-3entrega - SGMTsandra garciaPas encore d'évaluation

- Examen Recuperacion G.Document67 pagesExamen Recuperacion G.LUIS ALONSO BACA RODRIGUEZPas encore d'évaluation

- Examen Recuperacion G.Document101 pagesExamen Recuperacion G.LUIS ALONSO BACA RODRIGUEZPas encore d'évaluation

- Table02 IntercensalDocument3 pagesTable02 IntercensalRedi DelliPas encore d'évaluation

- Bse - Last 20 YrsDocument14 pagesBse - Last 20 YrsBhavin SagarPas encore d'évaluation

- Tabla de AmortizaciónDocument2 pagesTabla de AmortizaciónRaisa RuizPas encore d'évaluation

- AMORTIZATIONDocument17 pagesAMORTIZATIONDimasalang PerezPas encore d'évaluation

- Exel Actividad 3Document20 pagesExel Actividad 3Octavio ReyesPas encore d'évaluation

- Asb Loan CalculatorDocument5 pagesAsb Loan CalculatorNrlPas encore d'évaluation

- Cotizador Tabla de Amortizaciones Sistema Aleman y FrancesDocument17 pagesCotizador Tabla de Amortizaciones Sistema Aleman y Francesm.artesrenacerPas encore d'évaluation

- TP N°8 - Echeancier Emprunt (Corrige)Document38 pagesTP N°8 - Echeancier Emprunt (Corrige)Mohamed FatiniPas encore d'évaluation

- Tarea Grupal 4Document11 pagesTarea Grupal 4Sebastian L.MPas encore d'évaluation

- Amortization & Part Prepayment CalculatorDocument7 pagesAmortization & Part Prepayment Calculatormyloan partnerPas encore d'évaluation

- Amortization Schedule 10.525Document15 pagesAmortization Schedule 10.525inoisraghenigene29Pas encore d'évaluation

- PF Table Installment BM Debt Cons Mei 2023Document1 pagePF Table Installment BM Debt Cons Mei 2023Mohd Naim Bin KaramaPas encore d'évaluation

- Planilhaprice SacDocument56 pagesPlanilhaprice SacFernando KowalskiPas encore d'évaluation

- Jadual Penerbitan Survei Gaji & Upah, Malaysia, 2022Document81 pagesJadual Penerbitan Survei Gaji & Upah, Malaysia, 2022xxxsyafaatxxxPas encore d'évaluation

- Kelompok UmurDocument3 pagesKelompok UmurRuslan RahmanPas encore d'évaluation

- Tarea Opcional 3Document4 pagesTarea Opcional 3Sebastian L.MPas encore d'évaluation

- Costo de CapitalDocument5 pagesCosto de CapitalAlexander SalazarPas encore d'évaluation

- Prospecto - InvestimentoDocument4 pagesProspecto - InvestimentoAlex SilvaPas encore d'évaluation

- R404A TablesDocument4 pagesR404A Tablesabdelmoiz.bouyeghssane19Pas encore d'évaluation

- 24-Aug-22 BNF Option ChainDocument3 pages24-Aug-22 BNF Option ChainMRIGENDRA PRATAP SINGHPas encore d'évaluation

- Curve+44 TemperatureAndResistance NorthStarSensorsDocument6 pagesCurve+44 TemperatureAndResistance NorthStarSensorsHilal Kemal SnylmzPas encore d'évaluation

- Tabel Bunga AnuitasDocument3 pagesTabel Bunga AnuitasHerman SyahPas encore d'évaluation

- 46 How To Calclulate EmiDocument4 pages46 How To Calclulate EmiSanjeev MiglaniPas encore d'évaluation

- Tabel Peluang Hidrologi Analisis Curah HujanDocument1 pageTabel Peluang Hidrologi Analisis Curah HujanNajib KamallPas encore d'évaluation

- InvestimentosDocument1 pageInvestimentostenshinokuma1105Pas encore d'évaluation

- Plan de TradingDocument2 pagesPlan de TradingAmbulancias Respuesta RapidaPas encore d'évaluation

- Irr BCDocument3 pagesIrr BCaryalsajaniPas encore d'évaluation

- e31745b7-955c-4ffc-8c07-96d71bccd902Document20 pagese31745b7-955c-4ffc-8c07-96d71bccd902bigmoudi bigmoudiPas encore d'évaluation

- Data Perhitungan - UasDocument6 pagesData Perhitungan - UasVina Rahma AuliyaPas encore d'évaluation

- EMIDetailDocument2 pagesEMIDetailSuresḫ BujjîPas encore d'évaluation

- REF-22-01-2022-TABELA OFICIAL CORRETORES - CorretoresDocument2 pagesREF-22-01-2022-TABELA OFICIAL CORRETORES - Corretoreslucca santos tiburcioPas encore d'évaluation

- a5b880df-da1c-4420-9eda-94b22a3f609aDocument16 pagesa5b880df-da1c-4420-9eda-94b22a3f609abigmoudi bigmoudiPas encore d'évaluation

- BI Middle Rates 2020Document69 pagesBI Middle Rates 2020dediPas encore d'évaluation

- Cierre Mensual - Marzo Qnal-23Document1 pageCierre Mensual - Marzo Qnal-23Yolanda Martinez MadridPas encore d'évaluation

- Aportes para Renda MensalDocument11 pagesAportes para Renda MensalCLELIO GOMES DE SOUZAPas encore d'évaluation

- Analisa Silver VTRDocument20 pagesAnalisa Silver VTRMuttabi'in BadryPas encore d'évaluation

- 02 - Table de Loi StudentDocument1 page02 - Table de Loi StudentMohamad BouananePas encore d'évaluation

- Les Aigles V3-ArmeesDocument71 pagesLes Aigles V3-Armeeskamenski0% (1)

- TS807 Page 12Document14 pagesTS807 Page 12Soufyane OuhammiPas encore d'évaluation

- Sena, La Nouvelle Terrasse Avec Vue Sur L'île ST Louis Pizzas, Spritzeria, Rooftop Et Pop Up StoreDocument1 pageSena, La Nouvelle Terrasse Avec Vue Sur L'île ST Louis Pizzas, Spritzeria, Rooftop Et Pop Up Storenina SogePas encore d'évaluation

- Presentation Specialite SVTDocument13 pagesPresentation Specialite SVTRosh VDMPas encore d'évaluation

- Mission Indigo 5e - C01 - Diaporama ActiviteDocument18 pagesMission Indigo 5e - C01 - Diaporama ActiviteHéloïsePas encore d'évaluation

- Autumn Waves Poncho Plus Size Evergreen FRDocument9 pagesAutumn Waves Poncho Plus Size Evergreen FRKlaräPas encore d'évaluation

- Capital HumainDocument23 pagesCapital HumainmohamedPas encore d'évaluation

- GF1C2 v2 PDF A4Document78 pagesGF1C2 v2 PDF A4LeïlaPas encore d'évaluation

- Félix Ravaisson - Article Du Dictionnaire Pédagogique de Ferdinand Buisson PDFDocument3 pagesFélix Ravaisson - Article Du Dictionnaire Pédagogique de Ferdinand Buisson PDFCaroline SolievnaPas encore d'évaluation

- 0 INTRODUCTION (Mode de Compatibilité)Document10 pages0 INTRODUCTION (Mode de Compatibilité)Amira Mira KtnPas encore d'évaluation

- Plan de Delimitation: Republique Du CongoDocument1 pagePlan de Delimitation: Republique Du CongoNeige EKANGUIPas encore d'évaluation

- Guide Perfectionnement TiDocument16 pagesGuide Perfectionnement Tijbeli jbeliPas encore d'évaluation

- Esaa J1M PDFDocument69 pagesEsaa J1M PDFSamir LarbiPas encore d'évaluation

- Schematique Din 2Document48 pagesSchematique Din 2MecMilo ḆọɤkảPas encore d'évaluation

- Chapitre1 (Etudiants)Document79 pagesChapitre1 (Etudiants)ABDELALI SASSIOUIPas encore d'évaluation

- L'Abyssinie Et Son Apôtre Ou Vie de MGR Justin de Jacobis, Vicaire Apostolique D'abyssinie (Ethiopie)Document469 pagesL'Abyssinie Et Son Apôtre Ou Vie de MGR Justin de Jacobis, Vicaire Apostolique D'abyssinie (Ethiopie)vbeziauPas encore d'évaluation

- Sujet Et Corrigé Classes SocialesDocument7 pagesSujet Et Corrigé Classes Socialesmathleboss0Pas encore d'évaluation

- Energie Eolienne ELIADocument3 pagesEnergie Eolienne ELIAfaridPas encore d'évaluation

- IntroductionDocument4 pagesIntroductionMohammed ChaouqiPas encore d'évaluation

- Chnoqiue LA CLASSE #09-FEUILLE DE ROUTE 5°AP - 2019-2020 - VERSION DU 27 JANVIER 2020Document25 pagesChnoqiue LA CLASSE #09-FEUILLE DE ROUTE 5°AP - 2019-2020 - VERSION DU 27 JANVIER 2020Enseignante MahmoudiPas encore d'évaluation

- Algeriens BerberesDocument87 pagesAlgeriens BerberesjamilPas encore d'évaluation

- 31esChampionnatsMonde2011 DossierPresseDocument52 pages31esChampionnatsMonde2011 DossierPresseCathy MoreauPas encore d'évaluation

- La Traduction Des Proverbes Du Roumain en FrançaisDocument3 pagesLa Traduction Des Proverbes Du Roumain en FrançaisNicusor CondreaPas encore d'évaluation

- MKG TerrDocument144 pagesMKG TerrMohammed BahjaPas encore d'évaluation

- Le Jour D'algerie Du 04-09-2013 PDFDocument16 pagesLe Jour D'algerie Du 04-09-2013 PDFnidronyPas encore d'évaluation