Académique Documents

Professionnel Documents

Culture Documents

Jica Gula - MOST 18 Term Insurance 1M With Savings Plan

Transféré par

Jica GulaTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Jica Gula - MOST 18 Term Insurance 1M With Savings Plan

Transféré par

Jica GulaDroits d'auteur :

Formats disponibles

Name: Ma.

Goretti Jica Sotes Gula INSURANCE PACKAGE COVERAGE ANNUAL PREMIUM

Issue Age: 25 MOST 18 1,000,000 5,590.00

PDF Net Yield Rate: 12% POLICY FEE (only for initial payment) 500

Rating Class: Standard TOTAL 6,090.00

SEMI-ANNUAL PREMIUM QUARTERLY PREMIUM

ANNUAL PREMIUM

Mode: Annual ANNUAL (approx) (approx)

TOTAL FUND 7,180.00 5,590 2,907 1,509

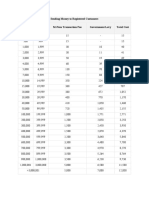

Illustrative Yearend Projected Year End Value at

Year Age Annual Contribution Annual Premium Withdrawal PDF Cash Flow Total Benefit Upon Death

Yield 12%

1 25 12,770 6,090 6,680 802 7,482 1,007,482

2 26 36,000 5,590 30,410 4,547 42,439 1,042,439

3 27 36,000 5,590 0 30,410 8,742 81,590 1,081,590

4 28 36,000 5,590 30,410 13,440 125,440 1,125,440

5 29 36,000 5,590 100,000 -69,590 6,702 62,553 1,062,553

6 30 36,000 5,590 30,410 11,156 104,118 1,104,118

7 31 36,000 5,590 30,410 16,143 150,671 1,150,671

8 32 300,000 5,590 294,410 53,410 498,491 1,498,491

9 33 72,000 5,590 0 66,410 67,788 632,689 1,632,689

10 34 72,000 5,590 66,410 83,892 782,991 1,782,991

11 35 72,000 5,590 66,410 101,928 951,329 1,951,329

12 36 72,000 5,590 66,410 122,129 1,139,868 2,139,868

13 37 72,000 5,590 66,410 144,753 1,351,031 2,351,031

14 38 72,000 5,590 66,410 170,093 1,587,534 2,587,534

15 39 0 5,590 0 -5,590 189,833 1,771,778 2,771,778

16 40 0 5,590 0 -5,590 211,943 1,978,130 2,978,130

17 41 0 5,590 0 -5,590 236,705 2,209,245 3,209,245

18 42 0 5,590 0 -5,590 264,439 2,468,094 3,468,094

TOTAL 960,770 101,120 100,000 2,468,094 3,468,094

Illustrative Yearend Projected Year End Value at

Year Age Annual Contribution Annual Premium Withdrawal PDF Cash Flow Total Benefit Upon Death

Yield 12%

19 43 11,050 2,457,044 294,845 2,751,889 3,751,889

20 44 11,050 -11,050 328,901 3,069,740 4,069,740

21 45 11,050 -11,050 367,043 3,425,732 4,425,732

22 46 11,050 -11,050 409,762 3,824,444 4,824,444

23 47 11,050 -11,050 457,607 4,271,002 5,271,002

24 48 11,050 -11,050 511,194 4,771,146 5,771,146

25 49 11,050 -11,050 571,212 5,331,307 6,331,307

26 50 11,050 -11,050 638,431 5,958,688 6,958,688

27 51 11,050 -11,050 713,717 6,661,355 7,661,355

28 52 11,050 -11,050 798,037 7,448,341 8,448,341

29 53 11,050 -11,050 892,475 8,329,766 9,329,766

30 54 11,050 -11,050 998,246 9,316,962 10,316,962

31 55 11,050 -11,050 1,116,709 10,422,622 11,422,622

32 56 11,050 -11,050 1,249,389 11,660,960 12,660,960

33 57 11,050 -11,050 1,397,989 13,047,900 14,047,900

34 58 11,050 -11,050 1,564,422 14,601,272 15,601,272

35 59 11,050 -11,050 1,750,827 16,341,048 17,341,048

36 60 11,050 -11,050 1,959,600 18,289,598 19,289,598

TOTAL 0 198,900 0 18,289,598 19,289,598

Illustrative Yearend Projected Year End Value at

Year Age Annual Contribution Annual Premium Withdrawal PDF Cash Flow Total Benefit Upon Death

Yield 12%

37 N/A N/A 0 0 0 0

38 N/A N/A 0 0 0 0

39 N/A N/A 0 0 0 0

40 N/A N/A 0 0 0 0

41 N/A N/A 0 0 0 0

42 N/A N/A 1,600,000 0 0 0 0

43 N/A N/A 600,000 0 0 0 0

44 N/A N/A 600,000 0 0 0 0

45 N/A N/A 600,000 0 0 0 0

46 N/A N/A 600,000 0 0 0 0

47 N/A N/A 600,000 0 0 0 0

48 N/A N/A 600,000 0 0 0 0

49 N/A N/A 600,000 0 0 0 0

50 N/A N/A 600,000 0 0 0 0

51 N/A N/A 600,000 0 0 0 0

52 N/A N/A 600,000 0 0 0 0

53 N/A N/A 600,000 0 0 0 0

54 N/A N/A 600,000 0 0 0 0

TOTAL 0 0 8,800,000 0 0

Illustrative Yearend Projected Year End Value at

Year Age Annual Contribution Annual Premium Withdrawal PDF Cash Flow Total Benefit Upon Death

Yield 12%

55 N/A N/A 0 0 0 0

56 N/A N/A 0 0 0 0

57 N/A N/A 0 0 0 0

58 N/A N/A 0 0 0 0

59 N/A N/A 0 0 0 0

60 N/A N/A 0 0 0 0

61 N/A N/A 0 0 0 0

62 N/A N/A 0 0 0 0

63 N/A N/A 0 0 0 0

64 N/A N/A 0 0 0 0

65 N/A N/A 0 0 0 0

66 N/A N/A 0 0 0 0

67 N/A N/A 0 0 0 0

68 N/A N/A 0 0 0 0

69 N/A N/A 0 0 0 0

70 N/A N/A 0 0 0 0

71 N/A N/A 0 0 0 0

72 N/A N/A 0 0 0 0

TOTAL 0 0 0 0 0

ILLUSTRATION OF VARIABILITY

The following table illustrates the accumulation of Fund Value using 4% and 12% interest rates. Interest rates

illustrated are neither an estimate nor a guarantee and will vary depending on the performance of the PDF.

Rate End of 1st year End of 5th year End of 10th year End of 12th year End of 15th year End of 18th year

4% 6,947 38,428 591,394 780,547 1,018,727 1,127,781

12% 7,482 62,553 782,991 1,139,868 1,771,778 2,468,094

Rate End of 19th year End of 23rd year End of 28th year End of 30th year End of 33rd year End of 36th year

4% 1,161,400 1,309,874 1,531,417 1,632,937 1,800,959 1,989,961

12% 2,751,889 4,271,002 7,448,341 9,316,962 13,047,900 18,289,598

Rate End of 37th year End of 41st year End of 46th year End of 48th year End of 51st year End of 54th year

4% 0 0 0 0 0 0

12% 0 0 0 0 0 0

Rate End of 55th year End of 59th year End of 64th year End of 66th year End of 69st year End of 72nd year

4% 0 0 0 0 0 0

12% 0 0 0 0 0 0

1. MOST 18

- The insurance component of the package is an 18-Year Renewable Term purchased from Manila Bankers Life Insurance Corporation (MBLife). In determining the

premium, the rating Standard premium rate was used in the above computation.

- A separate insurance policy contract shall be issued to the policyowner setting forth the specific benefits and other pertinent provisions. This illustration shall not form

part of the contract of insurance.

- Values that appear in this proposal may differ from those of the policy contract due to small rounding off errors. The above has been drafted by the soliciting agent for

illustration purposes. While we have made every effort to ensure accuracy, errors and omissions may have occurred in the preparation of this proposal. The terms and

conditions that shall bind the parties are expressly provided for in the policy contract.

- The policy, if in force, may be converted without evidence of insurability to a new policy on the Insured prior to age 65 of the Insured.

2. Premium Deposit Fund (PDF)

- Payments in excess of the annual premium are automatically invested in the PDF.

- The values above are based on the projected performance of the PDF. Since the PDF performance may vary, the values of the PDF is not guaranteed and will depend

on the actual PDF performance at that given period. The projected returns on the PDF are based on the assumed yield rates which are for illustration purposes only

and do not represent maximum or minimum returns on the PDF.

- The minimum initial contribution to the PDF is Php 6,000 and each additional contribution thereafter is in minimum of Php 1,000.

- Maximum of three (3) withdrawals per year can be done without charges. In excess of three (3) withdrawals per year will be subject to applicable fees.

- To prevent the policy from becoming lapsed, it is advisable to maintain an amount in the PDF that is enough to cover the next premium due.

- Lower interest rate may require the Insured to pay additional premiums to maintain the policy.

PROPOSAL FOR

Ma. Goretti Jica Sotes Gula

Proposed Insured

Issue Age: 25

CONTRIBUTION SCHEDULE

BENEFITS COVERAGE ANNUAL CONTRIBUTION

MOST 18 1,000,000 5,590.00

Deposit to PDF 7,180.00

TOTAL ANNUAL CONTRIBUTION 12,770.00

POLICY FEE (only for initial payment) 500.00

DESCRIPTION OF BENEFITS

MOST18 - pays the beneficiary the face amount if the Insured dies within 18 years from its effective date upon payment of the renewal premium due provided all earlier

premiums have been paid when due and the age of the insured is less than 60. The policy provides guaranteed renewability before age 60 and guaranteed convertability

before age 65.

PREMIUM DEPOSIT FUND (PDF) - the Policy Owner may make annual deposits automatically invested to the PDF. The accumulated value of the PDF may be used to reach

a target amount to be used for living benefits or to shorten premium payment period. PDF is subject to minimum return if withdrawn before the 5th anniversary. PDF is subject

to applicable fees if withdrawal is more than three (3) times a year.

The above are only descriptions and are limited in scope. Only the contract contains the details, conditions, definitions and the complete provisions of the policy.

Vous aimerez peut-être aussi

- Projet Etude de CasDocument4 pagesProjet Etude de CasSayf Elhak MansourPas encore d'évaluation

- KiranDocument30 pagesKiranManiteja JakkampudiPas encore d'évaluation

- Taller de Gradiente, Unidad 1Document15 pagesTaller de Gradiente, Unidad 1CESAR HUMBERTO CUELLAR QUESADAPas encore d'évaluation

- Taller de NUMERO 3 Gradiente, Unidad 1Document15 pagesTaller de NUMERO 3 Gradiente, Unidad 1CESAR HUMBERTO CUELLAR QUESADAPas encore d'évaluation

- CR8 Space Budget - P&L, Rev&HPP 10 TahunDocument1 pageCR8 Space Budget - P&L, Rev&HPP 10 TahunmaznahPas encore d'évaluation

- Carvaan CalculatorDocument1 pageCarvaan Calculatorayanhu69Pas encore d'évaluation

- Lap Penjualan BulananDocument2 pagesLap Penjualan Bulananhadits cipukPas encore d'évaluation

- Paket Suzuki Mei 15% KombinasiDocument1 pagePaket Suzuki Mei 15% KombinasiArdi MimosaPas encore d'évaluation

- CVR Juni 2023 Rm097 PangkalpinangDocument3 pagesCVR Juni 2023 Rm097 PangkalpinangNurul IhsanPas encore d'évaluation

- Flujo de Caja Proyectado 36 MesesDocument7 pagesFlujo de Caja Proyectado 36 Mesesaly quinteroPas encore d'évaluation

- Paket Reguler Suzuki September 2023Document2 pagesPaket Reguler Suzuki September 2023ikhlasfamsPas encore d'évaluation

- Exercises Tutoring ResultsDocument18 pagesExercises Tutoring ResultsomerogolddPas encore d'évaluation

- Plantilla Excel Cuadro de Amortizacion Con Interes FijoDocument24 pagesPlantilla Excel Cuadro de Amortizacion Con Interes Fijojulissa fortinPas encore d'évaluation

- Báo Cáo Doanh Thu 2021Document12 pagesBáo Cáo Doanh Thu 2021Hải ĐìnhPas encore d'évaluation

- Flexi Income 55 Lacs Sum AssuredDocument2 pagesFlexi Income 55 Lacs Sum AssuredVENUGOPAL VPas encore d'évaluation

- Food Court 1 & 2Document4 pagesFood Court 1 & 2Shahzad MalikPas encore d'évaluation

- Basic Pay Scale Chart 2017-2022 - ARA + Spl-AllDocument3 pagesBasic Pay Scale Chart 2017-2022 - ARA + Spl-AllFarooq RanjhaPas encore d'évaluation

- Avide Bilan 2018Document9 pagesAvide Bilan 2018Stéphanie TossouPas encore d'évaluation

- Tarea Opcional 3Document4 pagesTarea Opcional 3Sebastian L.MPas encore d'évaluation

- Asiento de Leasing-Sem 10Document7 pagesAsiento de Leasing-Sem 10Marisol FTPas encore d'évaluation

- Full Cummulative November 2022Document3 pagesFull Cummulative November 2022Luthy ApriadiPas encore d'évaluation

- Paket Suzuki OktoberDocument1 pagePaket Suzuki OktoberGiaPas encore d'évaluation

- Pajak CateringDocument39 pagesPajak CateringciewinkPas encore d'évaluation

- Corrida (3Document10 pagesCorrida (3Juan Carlos Luque EscalantePas encore d'évaluation

- Vo CheckingDocument6 pagesVo CheckingRoy PerochoPas encore d'évaluation

- Sales CA Dip Usu Tu 2022Document12 pagesSales CA Dip Usu Tu 2022Muhammad GandaPas encore d'évaluation

- Gradiente Aritmetico EstebanDocument14 pagesGradiente Aritmetico EstebanEsteban Felipe Muñoz ZuñigaPas encore d'évaluation

- Annex A Op Memo 2022 002 Deped Salary Loan Amortization Updated March 2022Document27 pagesAnnex A Op Memo 2022 002 Deped Salary Loan Amortization Updated March 2022Daiseree SalvadorPas encore d'évaluation

- Costos 2Document15 pagesCostos 2richicuellar62Pas encore d'évaluation

- Grille Indiciaire MagistratsDocument1 pageGrille Indiciaire MagistratsMonica Essoh100% (1)

- PLANEACION. Arrendamineto Financiero - JTCDocument3 pagesPLANEACION. Arrendamineto Financiero - JTCCompuMundoCompuMundoPas encore d'évaluation

- Trading JourneyDocument8 pagesTrading Journeyema.trend007Pas encore d'évaluation

- Calculo InflacionDocument59 pagesCalculo InflacionNilza PerezPas encore d'évaluation

- PrometalplusDocument6 pagesPrometalplusFouad arounPas encore d'évaluation

- SINGLEDocument8 pagesSINGLEb 1Pas encore d'évaluation

- Laporan Bulanan Tbs Dan CPODocument12 pagesLaporan Bulanan Tbs Dan CPOrizaPas encore d'évaluation

- Control de Pagos EntregablesDocument23 pagesControl de Pagos EntregablesGORKIPas encore d'évaluation

- Asb Loan CalculatorDocument5 pagesAsb Loan CalculatorNrlPas encore d'évaluation

- Datos para Declarion ImpuestosDocument26 pagesDatos para Declarion Impuestosamayaoj3016Pas encore d'évaluation

- Salary SummaryDocument4 pagesSalary Summaryমোঃ জহুরুল ইসলামPas encore d'évaluation

- E0000 - Prevision Exploitation JulienDocument10 pagesE0000 - Prevision Exploitation JulienChristian NgoulouPas encore d'évaluation

- Tablas Amortizacion y ComparativasDocument31 pagesTablas Amortizacion y ComparativasLaura GiraldoPas encore d'évaluation

- Single Pricelist Desember 2022Document8 pagesSingle Pricelist Desember 2022NixerPas encore d'évaluation

- Gas NaturalDocument16 pagesGas NaturalWILSON EDUARDO MARTINEZ AGUAREPas encore d'évaluation

- Konsolidasi Budget 2022Document4 pagesKonsolidasi Budget 2022el yasPas encore d'évaluation

- Investasi Saham 2020Document24 pagesInvestasi Saham 2020anes banjarPas encore d'évaluation

- Suzuki Alto AGS PlanDocument1 pageSuzuki Alto AGS PlanAbdullah FasehPas encore d'évaluation

- Rekap Data Lipinski-Farmasi3D-K.hormon SteroidDocument4 pagesRekap Data Lipinski-Farmasi3D-K.hormon SteroidelicenrlPas encore d'évaluation

- M-Pesa FessDocument6 pagesM-Pesa FessJaphet Charles Japhet MunnahPas encore d'évaluation

- XL Edccash JossssssssDocument5 pagesXL Edccash JossssssssJaga Raksa100% (2)

- Screw CapacityDocument5 pagesScrew Capacitybambangpriyanto37480Pas encore d'évaluation

- Tube SoudeDocument4 pagesTube SoudeYounes ChaaPas encore d'évaluation

- Calcul IS PETROSEN 2022Document1 020 pagesCalcul IS PETROSEN 2022Boris-Maxime BAWAMBYPas encore d'évaluation

- Financial Freedom - XLSXMDocument31 pagesFinancial Freedom - XLSXManandPas encore d'évaluation

- Efd June-2023Document1 pageEfd June-2023Faisal AminPas encore d'évaluation

- Distribuição de MassaDocument9 pagesDistribuição de MassaSebastiao da silva vasquesPas encore d'évaluation

- Paket Honda Kombinasi 02-24Document1 pagePaket Honda Kombinasi 02-24Ridwan MuslimPas encore d'évaluation

- Mitsubishi Mei Kombi PDFDocument1 pageMitsubishi Mei Kombi PDFRaista SulisPas encore d'évaluation

- R-Calculation 2012Document13 pagesR-Calculation 2012Vivek PatilPas encore d'évaluation

- Atlanta AssuranceDocument8 pagesAtlanta Assurancesanae100% (1)

- Assurance AutomobileDocument42 pagesAssurance AutomobileMartial WhitlyPas encore d'évaluation

- Mon Rapport de StageDocument16 pagesMon Rapport de StageIntissar Chalwati92% (13)

- Relevé D'informations (Unlocked by WWW - Freemypdf.com)Document1 pageRelevé D'informations (Unlocked by WWW - Freemypdf.com)Lucky LukePas encore d'évaluation

- Devoir D'explication Loi ImmoDocument3 pagesDevoir D'explication Loi ImmobabsmiasPas encore d'évaluation

- Copie de Newsletter Mai Juin Juillet (21 X 34 CM)Document10 pagesCopie de Newsletter Mai Juin Juillet (21 X 34 CM)Zineb NhiriPas encore d'évaluation

- Etude de La Couverture de Réassurance Du Pool Catastrophe Du Bureau Commun Des Assurances Collectives (BCAC)Document255 pagesEtude de La Couverture de Réassurance Du Pool Catastrophe Du Bureau Commun Des Assurances Collectives (BCAC)Jihene ManaiPas encore d'évaluation

- Convention de Stage ViergeDocument4 pagesConvention de Stage ViergeAhmed LahrichPas encore d'évaluation

- Contrat 1437667Document5 pagesContrat 1437667Amine KarmaouiPas encore d'évaluation

- Disposition ParticuliereDocument8 pagesDisposition ParticuliereAit Ben Hssain AbdelhafidPas encore d'évaluation

- Comprendre Bulletin de Paie DetailsDocument4 pagesComprendre Bulletin de Paie DetailsN J MPas encore d'évaluation

- Memoire SarrDocument48 pagesMemoire Sarrcoordinateurlpa coordinateurlpaPas encore d'évaluation

- Formulaire + Fiche Thème 3-4Document3 pagesFormulaire + Fiche Thème 3-4Cynthia ELPas encore d'évaluation

- Pfe Secteur D'assuranceDocument69 pagesPfe Secteur D'assuranceelhamssnisrine100% (1)

- Tlscontact Documents List Be Tun Regroupement Familial Avec Un Conjoint e BelgeDocument2 pagesTlscontact Documents List Be Tun Regroupement Familial Avec Un Conjoint e BelgeWajih Ben OthmanPas encore d'évaluation

- OraaaaaaaaasDocument18 pagesOraaaaaaaaastarification ensseaPas encore d'évaluation

- CIMA Code Assurances 2012Document249 pagesCIMA Code Assurances 2012Boris GbaouPas encore d'évaluation

- 750.cnam Mut Puma 2018 v5 RempDocument1 page750.cnam Mut Puma 2018 v5 RemplhamadouPas encore d'évaluation

- AsshabDocument2 pagesAsshabcontact.Pas encore d'évaluation

- Visa Tourism FRDocument3 pagesVisa Tourism FRyoussef ajarrayPas encore d'évaluation

- Gérer Votre Argent (Sandra Paré (Paré, Sandra) )Document162 pagesGérer Votre Argent (Sandra Paré (Paré, Sandra) )Lovencia Louis100% (2)

- Din Caravane Et RemorqueDocument2 pagesDin Caravane Et RemorqueludovicpanicoPas encore d'évaluation

- PROBTP-Notice Frais Medicaux-01 12 2023Document26 pagesPROBTP-Notice Frais Medicaux-01 12 2023jlavezardPas encore d'évaluation

- Forfait ActivitésDocument2 pagesForfait ActivitésCYRILLE martiniquePas encore d'évaluation

- Cahier - Chef - Entreprise 2018Document116 pagesCahier - Chef - Entreprise 2018MohamedPas encore d'évaluation

- Qu'est-Ce Que L'assurance Multirisque Habitation ?Document13 pagesQu'est-Ce Que L'assurance Multirisque Habitation ?MOUSSAB MOUATARIFPas encore d'évaluation

- La Liasse FiscaleDocument3 pagesLa Liasse FiscaleJmili RaedPas encore d'évaluation

- Cours Fiscalitc3a9 Mehdi Ellouz 2018 PDFDocument255 pagesCours Fiscalitc3a9 Mehdi Ellouz 2018 PDFHayet KhedherPas encore d'évaluation

- Declarations SocialesDocument40 pagesDeclarations Socialesjoseph kodjoPas encore d'évaluation

- Attestation DroitsDocument1 pageAttestation Droitsdaphné LesquinPas encore d'évaluation