Académique Documents

Professionnel Documents

Culture Documents

Healthcare Deal Multiples (Select Transactions) - Part 2

Transféré par

Reevolv Advisory Services Private LimitedCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Healthcare Deal Multiples (Select Transactions) - Part 2

Transféré par

Reevolv Advisory Services Private LimitedDroits d'auteur :

Formats disponibles

Reevolv Advisory Services

Private Limited

Healthcare Deal Multiples (Select Transactions) Part II

For any queries or detailed information

Contact us on +91 22 6002 2001 or

email at research@reevolv.in

July 2014

Select Healthcare Transactions - Valuation Report

2

Table of Contents

Particulars

Page Nos.

1. Executive Summary 3

2. Deal Multiples Summary 4

3. Player Profiles and Deal Multiples

3.1. Beams Hospitals 9

3.2. Enhance Aesthetic 15

3.3. Eye Q 19

3.4. Healthspring 28

3.5. Mewar 36

3.6. My dentist 43

3.7. Nova Medical 50

3.8. Nueclear 64

3.9. R.G. Stone 69

3.10. Suburban Diagnostics 78

3.11. The family doctor 85

4. Annexure 91

Select Healthcare Transactions - Valuation Report

3

1. Executive Summary

Select Healthcare Transactions - Valuation Report

4

2. Deal Multiples Summary

No.

Healthcare

Companies

Name of investor/s Date

Amount

Invested

(Rs. Mn)

Year

Pre-

Money

(Rs. Mn)

EV

(Rs. Mn)

Revenue

(Rs. Mn)

EBITDA

(Rs. Mn)

PAT

(Rs. Mn)

EV /

Sales (x)

EV /

EBITDA

(x)

PE (x)

1

Beams

Hospital

XXX

XXX

XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX

XXX

2

Enhance

Aesthetic

XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

3 Eye - Q

XXX

XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX

XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

Select Healthcare Transactions - Valuation Report

5

No.

Healthcare

Companies

Name of investor/s Date

Amount

Invested

(Rs. Mn)

Year

Pre-

Money

(Rs. Mn)

EV

(Rs. Mn)

Revenue

(Rs. Mn)

EBITDA

(Rs. Mn)

PAT

(Rs. Mn)

EV /

Sales (x)

EV /

EBITDA

(x)

PE (x)

3 Eye - Q XXX

XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX

4 Healthspring

XXX

XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX

XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX

XXX

XXX

5 Mewar XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

Select Healthcare Transactions - Valuation Report

6

No.

Healthcare

Companies

Name of investor/s Date

Amount

Invested

(Rs. Mn)

Year

Pre-

Money

(Rs. Mn)

EV

(Rs. Mn)

Revenue

(Rs. Mn)

EBITDA

(Rs. Mn)

PAT

(Rs. Mn)

EV /

Sales (x)

EV /

EBITDA

(x)

PE (x)

6 My Dentist

XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX

XXX

XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX

7 Nova Medical XXX

XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

Select Healthcare Transactions - Valuation Report

7

No.

Healthcare

Companies

Name of investor/s Date

Amount

Invested

(Rs. Mn)

Year

Pre-

Money

(Rs. Mn)

EV

(Rs. Mn)

Revenue

(Rs. Mn)

EBITDA

(Rs. Mn)

PAT

(Rs. Mn)

EV / Sales

(x)

EV /

EBITDA

(x)

PE (x)

7 Nova Medical

XXX

XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX

XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX

XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

8 Nueclear

XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

Select Healthcare Transactions - Valuation Report

8

No.

Healthcare

Companies

Name of investor/s Date

Amount

Invested

(Rs. Mn)

Year

Pre-

Money

(Rs. Mn)

EV

(Rs. Mn)

Revenue

(Rs. Mn)

EBITDA

(Rs. Mn)

PAT

(Rs. Mn)

EV / Sales

(x)

EV /

EBITDA

(x)

PE (x)

9 R. G. Stone

XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

10

Suburban

Diagnostics

XXX

XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX

11

The Family

Doctor

XXX

XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX

Select Healthcare Transactions - Valuation Report

9

3. Player Profiles and Deal Multiples

3.1. xxx

xxx

3.1.1. Overview

3.1.2. Location

Northern Region

No. of Centres

Main Cities

Eastern Region

No. of Centres

Main Cities

Western Region

No. of Centres

Main Cities

Southern Region

No. of Centres

Main Cities

Source : Company Website and Reevolv Research

Description

Company Name

Founder

Year of Inception/

Incorporation

Brand

Name of Investor/s

Total no. of centres

Treatment

Expansion Plans

Source: Company Website and Reevolv Research

Select Healthcare Transactions - Valuation Report

10

3.1.3. Shareholding Pattern as on xxxx

Equity Shares Preference Shares *

Number of

Shares

Paid up Percentage

Number of

Shares

Paid up Percentage

Director /

Relatives of Director

Foreign Holding

(FIIs/FCs/NRI/OCBs)

Venture Capital

Total

* 16% Compulsorily Convertible Cumulative Preference Shares

Face Value : Equity Share - Rs. xx/- per share, Preference Shares - Rs. xx/- per share

Source : Company Filings

Note :

xxxx

3.1.4. Financials

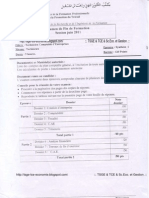

Profit & Loss Account for the year ended 31st March (Rs. Mn)

FY2010 FY2011 FY2012 FY2013

Revenues from Operation

Other Income

Total Revenues

Cost of Materials Consumed

Rent, Rates and Taxes

Administrative and General Expenses

Employee Expenses

Selling and Distribution Expenses

Other Expenses

Total Expenditure

EBITDA

Depreciation

EBIT

Interest

PBT

PAT

Select Healthcare Transactions - Valuation Report

11

Balance Sheet as at 31st March (Rs. Mn)

FY2010 FY2011 FY2012 FY2013

Share Capital

Share Application Money

Reserves & Surplus

Shareholders Funds

Secured Loan

Unsecured Loan

Loan Funds

Deferred Tax Liability

Total Liabilities

Gross Block

Net Block

Capital work in progress

Investments

Inventories

Sundry Debtors

Other Current Assets

Total Current Assets & Advances

Current Liabilities

Provisions

Total Current Liabilities & Provisions

Net Working Capital excl. Cash & Bank

Cash & Bank

Net Working Capital incl. Cash & Bank

Total Assets

Source: Company Filings, Totals may not tally due to rounding off errors

Select Healthcare Transactions - Valuation Report

12

Key Ratios FY2010 FY2011 FY2012 FY2013

Profitability Ratios

EBITDA %

EBIT%

PBT %

PAT %

Return Ratios

ROCE %

ROE %

Financial Ratios

Total Debt / Net Worth

Secured Debt / Net Worth

Total Debt / EBITDA

Turnover Ratios

Working Capital Turnover Ratio

Net Fixed Assets Turnover Ratio

Inventory Days

Debtors Days

Source: Company Filings and Reevolv Research

Select Healthcare Transactions - Valuation Report

13

3.1.5. Valuation

Month & Year

Investor

Investor Company Name

Instrument 1

Instrument 2

Amount invested Instrument 1 (Rs. Mn)

Amount invested Instrument 2 (Rs. Mn)

Total Amount invested (Rs. Mn)

Instrument 1 Equivalent stake (%)

Instrument 2 Equivalent stake (%)

Total equivalent stake (%)

Primary stake %

Secondary stake %

Cumulative stake %

Source : Company Filings and Reevolv Research

Note

xxxx

xxxxxx

Select Healthcare Transactions - Valuation Report

14

XXXX

Month & Year

(Rs. Mn)

Pre-money

Debt

Cash and cash equivalents

Net Debt

EV

Post-money

Revenues

EBITDA

PAT

ROCE %

ROE %

EV/ Sales (x)

EV/EBITDA (x)

PE (x)

Source : Company Filings and Reevolv Research

Note :

XXXXX

XXXXXX

XXXXXXX

Select Healthcare Transactions - Valuation Report

15

4. Annexure

4.1. Ratio

Key Ratios

Cost of Material Consumed %

Cost of Material Consumed

Total Revenues

X 100

Employee Expenses %

Employee Expenses

Total Revenues

X 100

Selling & Distribution Expenses %

Selling & Distribution Expenses

Total Revenues

X 100

Administrative Expenses %

Administrative Expenses

Total Revenues

X 100

EBITDA %

EBITDA

Total Revenues

X 100

EBIT %

EBIT

Total Revenues

X 100

PBT %

PBT

Total Revenues

X 100

PAT %

PAT

Total Revenues

X 100

ROCE %

EBIT

Capital Employed

X 100

ROE %

PAT

Net Worth

X 100

Capital Employed

Total of Asset / Liabilities

(Liabilities = Shareholders funds + Loan Funds + Deferred Tax + Minority Interest)

Working Capital Turnover Ratio

Total Revenues

Net Current Assets excl Cash Bank

Net Fixed Assets Turnover Ratio

Total Revenues

(Net Fixed Assets excl Capital Work in Progress)

Inventory Days

Inventory

(Cost of Material Consumed)

X 365

Debtors Days

Debtors

Total Revenues

X 365

Select Healthcare Transactions - Valuation Report

16

4.2. Abbreviations

Description

CCD Compulsory Convertible Debentures

CCPS Compulsory Convertible Preference Shares

CY Calendar Year

EBIT Earnings before interest and tax

EBITDA Earnings before interest, tax, depreciation and amortisation

EV Enterprise Value

FY Financial Year

NA Not Available

NM Not Meaningful

NR Not Relevant

P/E Price to earnings

PAT Profit after tax

PBT Profit before tax

ROCE Return on capital employed

ROE Return on equity

Select Healthcare Transactions - Valuation Report

17

About Reevolv

Reevolv is a boutique consulting and investment banking company offering a "One Stop Shop" in the

areas of business strategy, financial advisory and operations consulting to corporates and private equity

funds.

We service our clients in their constant re-evolution process through our in-depth industry research,

domain understanding, our timely and superior execution capabilities and strong network to provide

customized solutions to our clients.

With a host of implementation focused services spanning across functions, we ensure that our clients

reach the desired goals and objectives in most efficient manner. We achieve sustainability of our

initiatives by an all round involvement of the client resources. This approach of an integrated improvement

helps build a strong foundation for the forward leap of our clients. Reevolv understands and acts upon the

Strategic, Financial and Operational needs of the clients on a regular basis to ensure adaptability and

flexibility to suit the market and industry dynamics.

Founded in 2008, Reevolv is a team of CAs, MBAs and Engineers with functional and industry expertise

and diverse background of investment banking and management consulting.

Disclaimer

This report is published for information only. Reevolv Advisory Services Pvt. Ltd. or any of its affiliates,

group companies, directors, employees, agents or representatives shall not be liable for any loss or

damages whether direct or indirectthat may arise from or in connection with the use of the information in

this document. This document is the sole property of Reevolv Advisory Services Pvt. Ltd.and prior

permission is required for full or part reproduction.This information is strictly confidential and is being

furnished to you solely for your information. This information should not be reproduced or redistributed or

passed on directly or indirectly in any form to any other person or published, copied, in whole or in part,

for any purpose.

Contact Details

For any queries or detailed information contact us on

+91 22- 6002 2001 or email at research@reevolv.in

Address: No. B/002,Vision Court Staney Fernandes Wadi CHS Ltd., Plot no. 746, MTNL Exchange Lane,

Dadar (West), Mumbai 400 028

You can also email the research analyst at

Shilpa Bhattar

shilpa@reevolv.in

Kaustubh Kulkarni

kaustubh@reevolv.in

Vous aimerez peut-être aussi

- Examen DWHDocument2 pagesExamen DWHthemister83Pas encore d'évaluation

- Centre D'achat de Materiel MedicalDocument2 pagesCentre D'achat de Materiel MedicalDoudouba WadePas encore d'évaluation

- ONCDDocument493 pagesONCDSilviu ConstantinescuPas encore d'évaluation

- Khouloud ZouaiaDocument27 pagesKhouloud ZouaiaKhouloud ZouaiaPas encore d'évaluation

- Analyse PestelDocument2 pagesAnalyse PestelsclsqlPas encore d'évaluation

- R1 FRC - Acides Amines - Acides OrganiquesDocument2 pagesR1 FRC - Acides Amines - Acides OrganiquesfogeltwitPas encore d'évaluation

- Economie de La Sante 1Document81 pagesEconomie de La Sante 1aissa chartoufPas encore d'évaluation

- Analyse FinancièreDocument54 pagesAnalyse FinancièreUlrich AmadjiPas encore d'évaluation

- Working Paper 10 FR OptDocument39 pagesWorking Paper 10 FR OptATTAH Régis Patrick AusséPas encore d'évaluation

- Projet D'appui Budgétaire Pour La Réduction de La Pauvreté PABRP 9/ACP/ CD/004 Etude Sur Le Coûts de Fonctionnement Des Services de Santé (Districts) Au TchadDocument61 pagesProjet D'appui Budgétaire Pour La Réduction de La Pauvreté PABRP 9/ACP/ CD/004 Etude Sur Le Coûts de Fonctionnement Des Services de Santé (Districts) Au TchadKendra MasseyPas encore d'évaluation

- Plan de SecurisatinDocument58 pagesPlan de SecurisatinkadjungaPas encore d'évaluation

- Développement Professionnel ContinuDocument16 pagesDéveloppement Professionnel ContinuLeem100% (1)

- 0CHE29-XC Labo PharmaDocument6 pages0CHE29-XC Labo PharmaSanogo BoubaPas encore d'évaluation

- Revision GeneraleDocument4 pagesRevision Generalehamid marrakechPas encore d'évaluation

- 1 IfrsDocument18 pages1 IfrsEtudiant ProPas encore d'évaluation

- Document PDF F260c466cd2a 1Document1 pageDocument PDF F260c466cd2a 1HatimPas encore d'évaluation

- WHO HIS HGF HFWorkingPaper 16.3 FreDocument47 pagesWHO HIS HGF HFWorkingPaper 16.3 FreDesnosassi08Pas encore d'évaluation

- 1.0. - Statistiques Sanitaires Mondiales-OMS-ClicheDocument12 pages1.0. - Statistiques Sanitaires Mondiales-OMS-ClicheSmail RIHIPas encore d'évaluation

- RAPPORT Suivi Jeux - 13-12Document45 pagesRAPPORT Suivi Jeux - 13-12Régis JuanicoPas encore d'évaluation

- td4 Manti Fages-1Document29 pagestd4 Manti Fages-1api-587593532Pas encore d'évaluation

- Delf Pro b2 Comprehension Des Ecrits Exercice 2Document3 pagesDelf Pro b2 Comprehension Des Ecrits Exercice 2Corina DraguţanPas encore d'évaluation

- MSDS电缆胶B料中英文19 053103 01Document11 pagesMSDS电缆胶B料中英文19 053103 01gabrielPas encore d'évaluation

- Thèse BRANDIN ThibaultDocument146 pagesThèse BRANDIN ThibaultBlast MindPas encore d'évaluation

- Outil D'Amélioration de L'Eau, de L'Assainissement Et de L'Hygiène Dans Les Établissements de Santé (Wash Fit)Document92 pagesOutil D'Amélioration de L'Eau, de L'Assainissement Et de L'Hygiène Dans Les Établissements de Santé (Wash Fit)Profchaari SciencesPas encore d'évaluation

- SothemaDocument23 pagesSothemamaroc0% (2)

- Analyse Des Facteurs de Prédiction de Pérennisation Des Projets Des Médicaments Dans Les Zones de Santé en RDCDocument35 pagesAnalyse Des Facteurs de Prédiction de Pérennisation Des Projets Des Médicaments Dans Les Zones de Santé en RDCWILLY MFUNIPas encore d'évaluation

- Facts and Figures Décembre 2014Document59 pagesFacts and Figures Décembre 2014FranceBiotechPas encore d'évaluation

- Rsi 091 0061Document16 pagesRsi 091 0061mohamedPas encore d'évaluation

- Fiche Partiels 1er NDocument6 pagesFiche Partiels 1er NLindsay TacquetPas encore d'évaluation

- Lettre de Demande D Agrement Sanitaire A La DDSCPP 3365 PDFDocument4 pagesLettre de Demande D Agrement Sanitaire A La DDSCPP 3365 PDFJinny Pierre OnanaPas encore d'évaluation

- Note de Cadrage Protheses Totales de Hanche A Couple de Frottement Metal-MetalDocument28 pagesNote de Cadrage Protheses Totales de Hanche A Couple de Frottement Metal-Metalbilal mereiPas encore d'évaluation

- Economie de Sante Ip 2a 2022-2023Document80 pagesEconomie de Sante Ip 2a 2022-2023hafida boukssim100% (1)

- Devoir Maison N°1 Intro À L'économieDocument2 pagesDevoir Maison N°1 Intro À L'économie576Pas encore d'évaluation

- Livre PDFDocument268 pagesLivre PDFmarco294Pas encore d'évaluation

- 234364ผู้ถือสลาก Strike It Rich วันพ่อ Etsy ThailandDocument22 pages234364ผู้ถือสลาก Strike It Rich วันพ่อ Etsy ThailandbaldoryqiaPas encore d'évaluation

- Creation Comite EthiqueDocument10 pagesCreation Comite Ethiquemouliom fatimaPas encore d'évaluation

- Manuel de Protection Du Consommateur PDFDocument173 pagesManuel de Protection Du Consommateur PDFMUSTAPHA EL BECHARIPas encore d'évaluation

- Alug Inu N TmazivtDocument40 pagesAlug Inu N TmazivtAbdelali AkhouairiPas encore d'évaluation

- 09-0MS Renforcement SS SystémiqueDocument117 pages09-0MS Renforcement SS Systémiqueinan abbassiPas encore d'évaluation

- طرق وأساليب إدارة المخاطر في شركات التأمين على الأشخاص دراسة حالة شركة axaDocument18 pagesطرق وأساليب إدارة المخاطر في شركات التأمين على الأشخاص دراسة حالة شركة axaRooky GamingPas encore d'évaluation

- 03 Dhatu SarataDocument13 pages03 Dhatu SarataYasin Haq KhanjadaPas encore d'évaluation

- TD Eco de La SanteDocument4 pagesTD Eco de La Santebadr2002fennouniPas encore d'évaluation

- ПОДГОТОВКА К СС ПО ECONOMIE DE LA SANTE (копия)Document20 pagesПОДГОТОВКА К СС ПО ECONOMIE DE LA SANTE (копия)henjaemPas encore d'évaluation

- TD StatDesc Serie1 Dec2020Document2 pagesTD StatDesc Serie1 Dec2020Yassine Sekkaf100% (1)

- RapportDocument2 pagesRapportHamza ABBASSIPas encore d'évaluation

- IsocinetismeDocument113 pagesIsocinetismeHAFIDA BENYOUCEFMOSBAH100% (1)

- CH 13 TBDocument65 pagesCH 13 TBAarti JPas encore d'évaluation

- TCE Examen Fin Formation 2011 Synthèse1Document8 pagesTCE Examen Fin Formation 2011 Synthèse1Moha Med100% (4)

- Loi de Finance MarocDocument9 pagesLoi de Finance MarocMohcine Ait HamouPas encore d'évaluation

- Comment Faire Une Analyse PESTEL (Le Guide Complet)Document1 pageComment Faire Une Analyse PESTEL (Le Guide Complet)Abdelkader HachemPas encore d'évaluation

- ASTERES SYNGEV Les Groupes Dexercice VeterinaireDocument36 pagesASTERES SYNGEV Les Groupes Dexercice VeterinairegermiPas encore d'évaluation

- Analyse de Filiere Pharmaceutique en Algerie 2007Document88 pagesAnalyse de Filiere Pharmaceutique en Algerie 2007Badreddine Houhou100% (1)

- Economie de SanteDocument9 pagesEconomie de SanteANDRIANTSEHENO RASOAMAHARO Hary HenintsoaPas encore d'évaluation

- Mesure de La Productivité TotaleDocument20 pagesMesure de La Productivité Totaleamaury cosmePas encore d'évaluation

- Guide - Méthodologie Pour L'analyse D'impact Budgétaire À La HASDocument102 pagesGuide - Méthodologie Pour L'analyse D'impact Budgétaire À La HASSelinger AlicePas encore d'évaluation

- Who Whe Cpi 2017.20 FreDocument87 pagesWho Whe Cpi 2017.20 Frefofana lancinePas encore d'évaluation

- PHRC I 2021 LiDocument8 pagesPHRC I 2021 LiMadablina MadaPas encore d'évaluation

- Analyse Christie Groupe PLCDocument13 pagesAnalyse Christie Groupe PLCsalah slimaniPas encore d'évaluation

- Fin5570 Chapitre 6Document61 pagesFin5570 Chapitre 6Sara MoukhaiberPas encore d'évaluation

- La comptabilité facile et ludique: Il n'a jamais été aussi simple de l'apprendreD'EverandLa comptabilité facile et ludique: Il n'a jamais été aussi simple de l'apprendreÉvaluation : 2 sur 5 étoiles2/5 (1)

- Douville O Enfants Des RuesDocument33 pagesDouville O Enfants Des RuesJean Rigobert MbengPas encore d'évaluation

- Problématique: Comment Marivaux Réussit-Il À Mettre en Abyme Les Différents Niveaux de Stratagèmes Mis en Œuvre Dans Cette Scène ?Document3 pagesProblématique: Comment Marivaux Réussit-Il À Mettre en Abyme Les Différents Niveaux de Stratagèmes Mis en Œuvre Dans Cette Scène ?Louis BoulayPas encore d'évaluation

- CH 1 Analyse Financière ESGDocument8 pagesCH 1 Analyse Financière ESGOualid OunaceurPas encore d'évaluation

- Série de TD 03Document2 pagesSérie de TD 03BilaPas encore d'évaluation

- Roto 16sept 1ed PDFDocument16 pagesRoto 16sept 1ed PDFLa_RotondePas encore d'évaluation

- Thème 3 Le Cid Evaluation BilanDocument3 pagesThème 3 Le Cid Evaluation BilanYounes Larhrib100% (1)

- ComptabiliteDocument503 pagesComptabiliteAhmed JebariPas encore d'évaluation

- M01 Métier Et Formation-GE-TEMIDocument43 pagesM01 Métier Et Formation-GE-TEMIltc100% (1)

- Support Stratégies Des Firmes MultinationalesDocument38 pagesSupport Stratégies Des Firmes MultinationalesmariaPas encore d'évaluation

- Crise 2000 de La Cote D'ivoirDocument4 pagesCrise 2000 de La Cote D'ivoirballa pierre koivoguiPas encore d'évaluation

- Magir1 Devoir Ipv6 2014 2015Document3 pagesMagir1 Devoir Ipv6 2014 2015assouoPas encore d'évaluation

- AlkhawarichtiDocument2 pagesAlkhawarichtisyll.el-hadji-massePas encore d'évaluation

- 4 Atomes MoléculesDocument3 pages4 Atomes MoléculesSidhoum SidPas encore d'évaluation

- Qâsim - Al Firansi PDFDocument6 pagesQâsim - Al Firansi PDFmac51100Pas encore d'évaluation

- Comment Prospecter de Nouveaux ClientsDocument10 pagesComment Prospecter de Nouveaux ClientsAyadi NizarPas encore d'évaluation

- (Free Scores - Com) - 039 Guessan Gna Houa Jean Claude Sanctus Sainte Bernadette 75050Document2 pages(Free Scores - Com) - 039 Guessan Gna Houa Jean Claude Sanctus Sainte Bernadette 75050Edmond NIREMAPas encore d'évaluation

- WTPW-Simon PierreDocument100 pagesWTPW-Simon Pierrekonan kouadio henri franckPas encore d'évaluation

- Moi GianniDocument1 pageMoi GianniIlham BnPas encore d'évaluation

- Cours 2Document4 pagesCours 2free fire xyahiaxPas encore d'évaluation

- PrepECN Item 90 - Infections Naso-Sinusiennes de L'adulte Et de L'enfant - Fiches de Préparation Aux ECN de MédecineDocument7 pagesPrepECN Item 90 - Infections Naso-Sinusiennes de L'adulte Et de L'enfant - Fiches de Préparation Aux ECN de MédecineAdémonla ROUFAÏPas encore d'évaluation

- Interview-Bounajah Compo 1asDocument3 pagesInterview-Bounajah Compo 1asMaache Nadjet100% (1)

- Nouveau Rapport MLADocument20 pagesNouveau Rapport MLAzicozo012Pas encore d'évaluation

- Ichimoku Timespan Theory Nombre9Document2 pagesIchimoku Timespan Theory Nombre9san RayPas encore d'évaluation

- Cor - GEE1 - 1 La Grammaire en Exercices Cahier 1Document71 pagesCor - GEE1 - 1 La Grammaire en Exercices Cahier 1Adriano YamaokaPas encore d'évaluation

- French Writing - QuestionsDocument13 pagesFrench Writing - QuestionsSujithPas encore d'évaluation

- La Gestion de La Paie PDFDocument96 pagesLa Gestion de La Paie PDFYacine AyatPas encore d'évaluation

- P 20133329Document142 pagesP 20133329andoPas encore d'évaluation

- Coaching Personnel IndividuelDocument2 pagesCoaching Personnel Individuelmuller senséPas encore d'évaluation

- MasterDocument1 pageMasterMaoukil TachPas encore d'évaluation