Académique Documents

Professionnel Documents

Culture Documents

D00051

Transféré par

Asia SentinelCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

D00051

Transféré par

Asia SentinelDroits d'auteur :

Formats disponibles

LIl

Yrt^e..1 . .Lw

. f-,rvs:c

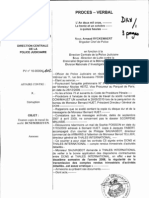

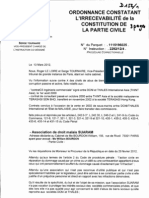

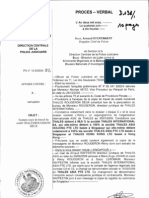

PROCES - VERBAL

L' An deux mille dix.---------

&rtanJ Fc APArE

si

RR ORLA Y

Le premier avril---------

DIRECTION GENERALE DE LA POLICE NATIONALE

Nous, Arnaud RYCKEWAERT Brigadier Chef de Police En fonction la Sous - Direction de la Lutte contre la Criminalit Organise et la Dlinquance Financire Division Nationale des Investigations Financires

DIRECTION CENTRALE DE LA POLICE JUDICIAIRE .s.

PV n 10-00004-

AFFAIRE: C/X...

OBJET: Transport Bibliothque Nationale de France Paris 13.

Annexes.

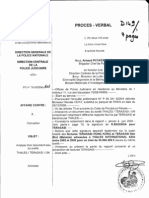

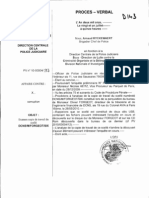

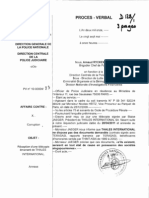

---Officier de Police Judiciaire en rsidence au Ministre de l'Intrieur 11, rue des Saussaies 75008 PARIS.----------------------------- -----Ayant la comptence nationale,-----------------Agissant dans le cadre du soit transmis n P 09441.9202/4, dlivr le 28/12/2009 par Monsieur Nicolas HEITZ, Substitut du Procureur de la Rpublique prs le Tribunal de Grande Instance de Paris.-------Poursuivant l'enqute prliminaire----------------Vu les articles 75 et suivants du code de procdure pnale.-----Nous trouvant au service Nanterre,---------En compagnie du Gardien de la Paix Jrme HEARD, du service.----Nous sommes transports ce jour la Bibliothque Nationale de France sise quai Franois Mauriac Paris 13me aux fins de consulter les bases de donnes relatives au monde de l'entreprise et d'en extraire notamment les lments suivants : ----------------------- Base de donne ORBIS: - la socit PERIMEKAR SDN BHD immatricule en Malaisie sous le numro MY 905147636 est dtenue hauteur de 20% par la socit BOUSTEAD HOLDINGS BHD . - la socit BOUSTEAD HOLDINGS est domicilie TINGKAT 28 MENARA BOUSTEAD 69, JALAN RAJA CHULAN 50200 KUALA LUMPUR (Malaysia), tel +60 3 2141 9044, fax +60 3 2141 9750, elle ---est immatricule en Malaisie sous le numro MY3871-H. - - la socit BOUSTEAD HOLDINGS est notamment dtenue hauteur de 58,91 % par le GOUVERNEMENT DE MALAISIE, hauteur de 5,57 % par la PUBLIC BANK BERHAD, hauteur de 2,42% par la OVERSEA CHINESE BANKING CORPORATION LIMITED OCBC. ------------------------- _____w--_--_ --Base de donnes DAFSALIENS: - la socit anonyme DCN International est domicilie 10 rue Sextius Michel 75015 Paris, n de siren 379777733, objet social : construction de btiments de guerre. L'actionnaire est la DCNS hauteur de 100 % et le groupe d'ppartenance est l'Etat frana_isJ hauteur de 100 %. -\ONA! <.

0

\\F^^TRlL E

;yc`

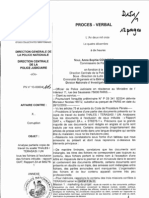

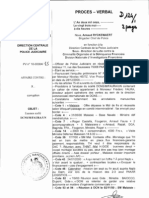

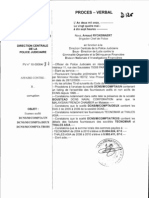

- DCN International dtient des participations dans les socits suivantes : Euroslat (33%), Geie Eurotorp (26%), Brest Offshore (20%), Cedec (9,86 %), Sofema (9, 60 %), Socit Franaise d'Exportation de Systmes Avancs (7 %)------------- ID 9 Z - Le PDG est Monsieur Philippe JAPIOT, le DG est Alex FABAREZ.--- la socit anonyme ARMARIS est domicilie 19/21 rue du Colonel Pierre Avia 75015 Paris, n de siren 424441228, objet social : construction de btiments de guerre. L'actionnaire est la DCNS hauteur de 100%. le Prsident du conseil d'administration est Jean Marie POIMBOEUF.------------------- ARMARIS dtient des participations dans les socits suivantes Underwater Dfense Systems International (100%), Eurosysnav SAS (50%) et Horizon SAS (50%).------------- la socit anonyme DCNS est domicilie 10 rue Sextius Michel 75015 Paris, n de siren 441133808, objet social : Ingnierie, tudes techniques. Les actionnaires sont I' Etat franais (75%) et Thales (25 %). le groupe d'appartenance est l'Etat franais hauteur de 82, 26 %. - le Prsident du conseil d'administration est Monsieur Patrick BOISSIER, le DG est Monsieur Bernard PLANCHAIS.---- la socit anonyme SOCIETE NAVALE FRANCAISE DE FORMATION ET DE CONSEIL, sigle NAVFCO domicilie 2 place Rio de Janeiro 75008 Paris, siren n 318825916, objet social : formation des adultes et formation continue, l'actionnaire est la socit Dfense Conseil International hauteur de 99,99 %. Le Prsident du conseil d'administration est Monsieur Bruno DURIEUX.--------------Dont acte,----------------

L'assistant

L,OFJ

'RALE t.

-,

---De mme sue,--------------Annexons au prsent les documents extraits des bases de donnes de la Bibliothque Nationale de France.------Dont mention.-------------

\^F DE. t

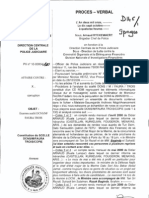

DAFSALIENS- Report

Page 1 of 1

Ra pport

IDENTIFICATION Socit Navale Franaise de Formation et de Conseil 2, place Rio-de-Janeiro 75008 PARIS FRANCE Tel : 01 44 95 28 00 Fax : 01 44 95 28 97 Compartiment de cotation : Non Cote FR

I n

(01/04/2010)

St Anonyme SIREN : 318825916 NAF : 804C Formation des adultes et formation continue Sigle :NAVFCO

4CTIONNAIRES CONNUS AU 22/02/2001 Designation Pays Valide le % Source QUEST Date Source Evnement suivant L. Dfense Conseil International FRA 01/03/200099.99 PARTICIPATIONS CONNUES AU 22/02/2001 ADMINISTRATEURS CONNUS AU 22/02/2001 Nom RepresentantFonction PDT CA ADM. 1. Durieux (M. Bruno) Dfense Conseil International Valide le Source Date Source Evnement suivant 18/06/2000 BODACC 18/06/2000 23/02/2001: fin du mandat 17/03/1997 A.LOI 12/03/1997 23/02/2001: fin du mandat

2_

http://www.dafsaliens.fr/liensreport.vsp?DFID=8050 111 &cbOwner=on&cb Subs=on... 01/04/2010

DAFSALIENS- Report

Page 1 of 1

Rapp ort

IDENTIFICATION

Dcn International 10, rue Sextius Michel 75015 PARIS

a s a

n s (01/04/2010)

FRANCE

Tel : 01 41 08 51 00 Fax : 01 41 08 00 27 Compartiment de cotation : Non Cote FR

St Anonyme' SIREN : 379777733 NAF : 351A Construction de btiments de guerre Sigle : Dcni

CA 2005

957,390,000

rm r

EFFECTIF : 60

ACTIONNAIRES

Designation 1.DCNS Pays Valide le % Source Date Source A.G.O CA Dev SIREN FRA 31/12/2007100.00 31/12/20072,249,601,000EUR44113380e

PARTICIPATIONS

Designation 1. 2. 3. Euroslat (GEIE) Geie Eurotorp Brest Offshore Pays Valide le % Source A.G.0 A.G.0 J.0. Date Source 31/12/2007 31/12/2007 28/05/2000 CA Dev SIREN 428263859 391371101 FRA 31/12/200733.00 FRA 31/12/200726.00 FRA 16/05/200020.00

4.

5. 6.

Cedec

Sofema Socit Franaise d' Exportation de Systmes

FRA 31/12/2005 9.86

FRA 15/11/2006 9.60 FRA 31/12/2005 7.00

A.G.O

QUEST A.G.O

02/05/2006

394329841

55,072,000EUR562074476.

31/12/2005 193,233,000EUR301073086

Avancs

3ROUPE(S) D'APPARTENANCE Designation L. Etat Franais Pays NAF FRA Controle(%) Niveau 100.00 2 CA De%

Administrateurs et leurs Reprsentants Nom 1.Japiot (M. Philippe) 2.Fabarez (M. Alex) 3.DCNS 4.Elbaz (M. Francis) Fonction Valide le PDG 09/07/2003 ADM.DG DLG 09/07/2003 Le Franois des Courtis (M. Jean)ADM. 09/07/2003 ADM. 09/07/2003 Representant Source V.JUD V.JUD V.JUD V.JUD Date Source 14/08/2003 14/08/2003 14/08/2003 14/08/2003

S.Idier (M. Jean)

6.Sauser (M. Jean-Marc) 7.Suveran (M. Denis) 8.Gatin (M. Marc)

ADM.

ADM. ADM. COM.GOUV.

09/07/2003

09/07/2003 09/07/2003 07/07/2003

V.JUD

V.JUD V.JUD J.O.

14/08/2003

14/08/2003 14/08/2003 09/08/2003

^,^.^; ^ r

^^ ^ ^^^y'^^ ,fr;^^^ t iti,

http://www.dafsaliens.fr/liensreport.vsp?DFID=8746985&cbOwner=on&cbSubs=on.. . 01/04/2010

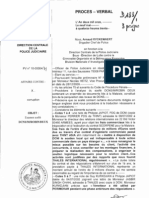

DAFSALIENS- Report

Page 1 of 1

Rappo rt

IDENTIFICATION

Arma ris 19/21, rue du Colonel Pierre Avia 75015 PARIS

ta

n S (01/04/2010)

St Anonyme : 424441228 NAF : 351A SIREN Construction de btiments de guerre

FRANCE

Tel : 01 41 08 71 71 Fax : 01 41 08 00 27 Compartiment de cotation : Non Cote FR CA 2006 : 440,559,000 no3-

EFFECTIF : 203

Q)

4CTIONNAIRES CONNUS AU 29/09/2009 Designation L. DCNS Pays Valide le % Source Date Source 31/12/2007 Evnement suivant FRA 31/12/2007100.00 A.G.O

Q)

C C o

Li

PARTICIPATIONS CONNUES AU 29/09/2009 Designation Pays Valide le % Source Date Source A.G.O 15/05/2006 Evnement suivant Underwater Dfense Systems FRA 31/12/2005100.00 International

o

Q)

2.

3.

Eurosysnav SAS

Horizon SAS

FRA 31/12/2005 50.00

FRA 31/12/2005 50.00

A.G.O

A.G.O

15/05/2006

15/05/2006

ADMINISTRATEURS CONNUS AU 29/09/2009 Nom 1. Poimboeuf (M. Representant Fonction PCS Valide le 25/09/2003 Source BODACC Date Source Evnement suivant

2. 3. 4. 5.

Jean-Marie) Le Franois des Courtis (M. Jean) Michot (M. Yves) Retat (M. Bernard) Gatin (M. Marc)

25/09/2003 30/09/2009: fin du mandat

MCS MCS MCS COM.GOUV.

25/09/2003 22/05/2003 20/08/2004 01/09/2003

BODACC A.G.O BODACC J.O.

25/09/2003

30/09/2009: fin du mandat

22/05/2003 30/09/2009: fin du mandat 20/08/2004 30/09/2009: fin du mandat 09/08/2003 30/09/2009 : fin du mandat

`t

(4 I ^^I

'x' ` F OE LN

G '

http://www.dafsaliens.fr/liensreport.vsp?DFID=1826121 &cbOwner=on&cbSubs=on... 01/04/2010

DAFSALIENS- Report

Page 1 of 1

Ra p p ort

DCNS

2, rue Sextius Michel 75732 PARIS Cedex 15

Df

h e x (01/04/2010)

St Anonyme NAF : 742C SIREN : 441133808 Ingnierie, tudes techniques

FRANCE

Tel : 01 40 59 50 00 Fax : 01 40 59 56 48 Compartiment de cotation : Non Cote FR CA 2005 : 2,249,601,000 EFFECTIF : 4431 m0r"

v

D

ACTIONNAIRES

Designation 1.Etat Franais Z.Thales Pays Valide le % FRA 31/12/2007 75.00 FRA 15/10/2008 25.00 Source A.G.0 ECHOS Date Source CA Dev SIREN 31/12/2007 15/10/2008 180,000,000 EUR552059024

,

C

D o o. v

PARTICIPATIONS

Designation 1. 2. 3. 4. Dcn Far East Services Dcn International DCN Services Far East DCN Servizzi Italia Pays Valide le % Source INT. A.G.0 QUEST QUEST Date Source CA Dev SIREN SGP 31/07/2009100.00 FRA 31/12/2007100.00 SGP 16/01/2007100.00 ITA 16/01/2007100.00 31/07/2008 31/12/2007 957,390,000EUR379777733

5.

6. ^.

Mopa2

FRA 31/12/2007100.00

A.G.0

A.G.0 INT. J.O. INT. INT. ECHOS QUEST

31/12/2007

30/09/2009 07/03/2008

480092014

32,897,000EUR401083027 2,961,000EUR337680342

8. 9. 10. 11. 12.

Thales Naval S.A. FRA 31/12/2007100.00 Underwater Dfense Systems FRA 30/09/2009100.00 International Socit d' Ingnierie de Recherches et d'Etudes en FRA 03/03/2008 64.60 Hydrodynamique Navale Eurosysnav SAS FRA 30/09/2009 50.00 Horizon SAS FRA 30/09/2009 50.00 Dfense Environnement FRA 29/06/2009 49.00 Services FRA 16/01/2007 11.00 La Financire de Brienne

31/12/2007489,229,000EUR399021369

30/09/2009 145,239,000EUR430407593 30/09/2009462,007,000EUR428677777 29/06/2009 494321862 389983735

GROUPE(S) D'APPARTENANCE Designation 1. Etat Franais Pays NAF FRA Controle(%) Niveau 82.26 1 CA De%

Administrateurs et leurs Reprsentants 1. 2. 3. 4. 5. 6. ^. 8. 9. 10. Nom Boissier (M. Patrick) Auboin (M. Pierre) Bello (M. Raphal) Bied-Charreton (M. Hugues) Burg (M. Christophe) Gillet (M. Jean-Baptiste) Querenet de Breville (M. Eric) Denoyel (M. Gilles) Michot (M. Yves) Planchais (M. Bernard) Representant Fonction PDT CA ADM.RE .ETAT

ADM.RE.ETAT

Valide le 08/03/2010 17/12/2009 17/12/2009 17/12/2009 17/12/2009 31/12/2007 17/12/2009 31/12/2007 31/12/2007 29/03/2007

Source J.0. J.O. 3.0. J.0. 3.0. A.G.0 J.0.

Date Source 10/03/2010 17/12/2009 17/12/2009 17/12/2009 17/12/2009 31/12/2007 17/12/2009

ADM.RE.ETAT

ADM.RE.ETAT ADM.RE.ETAT

ADM.RE .ETAT ADM. ADM. DG DLG

A.G.O 31/12/2007 A-G O---^, 31/12/2007 ,y_IEW5 'OA;' 04/04/2007

l etc

} v

r^

^

http://www.dafsaliens.fr/liensreport.vsp?DFID=4705268&cbOwner=on&cbSubs=on.. . 01/04/2010

Orbis - Company Report

Page 1 of 1

PERIMEKAR SDN BHD Malaysia BvD ID number : MY*905147636

Type of account available : No financial data at ail

J"

Status Private company Type of company

: Active

: Industrial company : 1 ANo of rec. subsidiaries :0

No of rec. shareholders BvD Independence Indicator

This is a record retrieved from the BvD ownership database; little information is available.

SHAREHOLDERS BvDEP Independence Indicator: ACurrent definition of the UO : path of min 25.01 % of control, known shareholders

Filters No filter

:

................................................................................__.......................__........_.......................__.........................................................................................................:....................................................................................... The companies underlined and displayed in blue - bold are available on Orbis. Company Inform. Op. Country Type Direct Total Source Date of Closing Revenue No of (%) (%) ident. inform. Date (mil employees USD)* Source C 20.00 n.a. RM 12/2007 >< 2,044 n.a. Ownership

Shareholder name

Shareholders 1. BOUSTEAD HOLDINGS BHD MY

* For an insurance company the corresponding value is the Gross Premium Written and for a bank it is the Operating Income (memo). SUBSIDIARIES (Roll-.up structure)

There is no subsidiary information available for this company.

https://orbis.bvdep.com/version-2010326/cgi/report.dll?context=DL8L W2&SEQNR=... 01/04/2010

Orbis - Company Report

Page 1 of 13

BOUSTEAD HOLDINGS BHD TINGKAT 28 MENARA BOUSTEAD 69, JALAN RAJA CHULAN 50200 KUALA LUMPUR Malaysia BvD ID number BvD account number WVB company number Trade register number ISIN number SEDOL number VALOR number : MY3871-H : MY3871-HIC : 01106FM : 3871-H MYL277100003 : 6114659 : 000778911

Phone number +60 3 2141 9044 Fax number : +6032141 9750 Website address : www.boustead.com.my Status : Active Publicly quoted company

Date of incorporation : 1960 Reporting basis : Consolidated data Latest account date : 30/09/2009 Account published in MYR Type of account available: Consolidated Filing type : Annual report

Main exchange Ticker symbol

: Kuala Lumpur Stock Exchange : 2771 : 2,044 mil USD : 935 mil USD P/L for period Employees : 167 mil USD : n.a.

Operating revenue! Turnover Market Cap (26/0312010) Type of company Primary US SIC code Peer Group

: Industrial company : 0139 - Field crops, except cash grains, flot elsewhere classified : 0111-VL - Growing of cereals (except rice), leguminous crops and oit seeds (Very Large Companies) 35,994 companies in this Peer Group : 41 :D No of rec. subsidiaries : 85

No of rec. shareholders BvD Independence Indicator

FINANCIAL PROFILE Consolidated data 31/12/2008 12 months Unqual th MYR IFRS AR Operating Revenue/Turnover PIL before Tax PIL for Period (= Net Income] Cash Flow Total Assets Shareholders Funds Current Ratio (x) Profit Margin (%) Return on shareholders Funds (%) Return on Capital Employed (%) Solvency Ratio (%) Price Earning Ratio (x) Employees 7,081,337 678,902 578,786 684,763 8,679,091 2,910,771 0.45 9.59 23.32 20.56 33.54 3.85 n.a. 31/1212007 12 months Unqual th MYR IFRS AR 5,794,654 828,814 477,736 568,864 8,441,110 2,360,921 0.56 14.30 35.11 21.31 27.97 8.49 n.a. 31/12/2006 12 months Unqual th MYR Local GAAP AR 4,140,519 386,431 210,184 293,385 5,765,860 1,923,665 0.70 9.33 20.09 14.44 33.36 5.49 n.a. 31/12/2005 12 months Unqual A. n .th,MYR 9 Local GARP '; ri4R^

1^.,._

^ ' i '~

1,953,271' / 300,076 190,503 ,,{ 244,689.C1 1 , 5,221,128 . C:, . .: 1,722,084 '

.

-' , r

'

0.62 15.36 17.43 12.27 32.98 5.50 12,064

FINANCIAL PROFILE Consolidated data 31/12/2004 12 months 31/12/2003 12 months 31/12/2002 12 months 31112/2001 12 months

Unqual

th MYR Local GAAP

Unqual

th MYR Local GAAP

Unqual

th MYR Local GAAP

Unqual

th MYR Local GAAP

AR

OperatingRevenue/Turnover P/L before Tax P/L forPeriod f=Netlncome] Cash Flow Total Assets Shareholders Funds 1,267,743 246,754 119,160 159,380 4,642,580 1,873,288

AR

1,089,988 207,933 112,512 146,113 4,341,181 1,871,049

AR

982,230 154,919 51,189 79,063 4,001,376 1,400,498 919,734 -14,577 -111,575 -82,591 3,933,205 1,356,210

https://orbis.bvdep.com/version-2010326/cgi/report.dll?context=DL8LW2&bitnr=150.. . 01/04/2010

Orbis - Company Report

Page 2 of 13

Current Ratio (x) Profit Margin (%) Return on shareholders Funds (%) Return on Capital Employed (%) So/vency Ratio (%) Price Earning Ratio (x) Employees

0.66 19.46 13.17 10.00 40.35 8.22 11,451

0.51 19.08 11.11 9.38 43.10 8.30 11,538

0.50 15.77 11.06 7.89 35.00 n.a. 10,416

0.56 -1.58 -1.07 1.20 34.48 n.a. n.a.

FINANCIAL PROFILE

Consolidated data 31/12/2000 12 months No opinion th MYR Local GAAP Operating RevenuelTurnover 31/12/1999 18 months Unqual th MYR Local GAAP 1,578,187 366,776 220,607 257,275 3,652,931 1,533,295 0.56 23.24 15.95 11.58 41.97 n.a. n.a.

Q)

Q) C C

PIL before Tax PIL for Period (= Net Income]

Cash Flow Total Assets Shareholders Funds Current Ratio (x) Profit Margin (%) Retum on shareholders Funds (%) Return on Capital Employed (%) Solvency Ratio (%) Price Earning Ratio (x) Employees

o

0 Q)

o.

903,871 86,240 5,401 30,074 3,994,060 1,501,239 0.57 9.54 5.75 4.26 37.59 n.a. n.a.

INDUSTRY / ACTIVITIES Type of company: Industrial company Trade Description Boustead holdings berhad was incorporated in malaysia in 1960 as an investment holding company. during the year, the company was involved in oil palm plantation through the acquisition of oil palm estate and mill from a subsidiary, boustead plantations berhad. the group currently comprises more than eighty subsidiary and associated companies, the principal activities of which are investment holdings, oil palm plantations & property investments; hire purchase & lease financing; engineering equipment & chemicals distributor; consumer goods distributor; building products distributor and travel agent.

With the acquisition of boustead petroleum marketing sdn bhd (bpm) during the year, the group also commenced marketing of petroleum products.

US SIC code(s) Core code: 013 - Field crops, except cash grains Primary code(s) : 0139 - Field crops, except cash grains, not elsewhere classified Secondary code(s) : 6719 - Offices of holding companies, not elsewhere classified 6531 - Real estate agents and managers NACE Rev. 1.1 code(s) {derived from US SIC codes) Core code: 0111 - Growing of cereals and other crops n.e.c. Primary code(s) : 0111 - Growing of cereals and other crops n.e.c. Secondary code(s) : 7031 - Real estate agencies 7032 - Management of real estate on a fee or contract basis 7415 - Management activities of holding companies NAGE Rev. 2 code(s) {derived from US SIC codes) Core code : 0111 - Growing of cereals (except rice), leguminous crops and oil seeds Primary code(s):

https://orbis.bvdep.comlversion-2010326/cgi/report . dll?context=DL8L W2&bitnr= 150

01/04/2010

Orbis - Company Report

Page 3 of 13

- Growing of cereals (except rice), leguminous crops and oil seeds 0111 Secondary code(s) : - Activities of holding companies 6420 - Real estate agencies 6831 - Management of real estate on a fee or contract basis 6832 NAICS 2007 code(s) {derived from US SIC codes} Core code: 1119 - Other Crop Farming Primary code(s) : 111998 - All Other Miscellaneaus Crop Farming Secondary code(s) : 551112 - Offices of Other Holding Companies 531390 - Other Activities Related to Real Estate

Q)

Description and history Boustead is a conglomerate with diverse business operations. it has interests in plantations including plantation management, financial services, property development and construction, manufacturing and trading, transportation and education services.

v

C

o

D

The plantation interests are held under listed subsidiary, kuala sidim. the group's total mature oil palm hectarage is 39,173 ha and total immature area is 23,193 ha, while the mature rubber hectarage is 2,790 ha. its plantations are ail located in peninsular malaysia and in sabah and sarawak.

0 The majority of the group's residential, industrial and commercial properties together with plantation properties with development potential are housed under scb developments, also a listed company. some of the property development projects undertaken by the group are mutiara rini in johor and taman jernih in bukit mertajam. construction projects include phase 111 of the west port in klang and the 50,000 sq m diethelm central distribution centre at bukit kemuning. this is south east asia's biggest covered warehouse.

Integrated financial services, including insurance services, are offered by the boustead gr6up. these operations are mainly carried out by affin holdings and its companies. }^r:.

The products manufactuired and traded by the group companies cover a diverse range, from * / building materials and electrical equipment to consumer and household goods and food.

*TR

BALANCE SHEET Consolidated data 3111212008 12 months Unqual th MYR IFRS 31/1212007 12 months Unqual th MYR IFRS 31/12/2006 12 months Unqual th MYR Local GAAP

/4 t /

31/12/2005 12 months Unqual th MYR Local GAAP

AR

FixedAssets Intangible Fixed Assets Tangible Fixed Assets Other Fixed Assets CurrentAssets Stocks Debtors Other Current Assets Cash & Cash Equivalent Total Assets Shareholders Funds Capital Other Shareholders Funds Non Current Liabilities LongTermDebt Other Non-Current Liabilities Provisions Current Liabilities Loans 6,599,933 1,068,458 2,183,050 3,348,425 2,079,158 230,752 689,536 1,158,870 669,449 8,679,091 2,910,771 325,516 2,585,255 1,135,894 624,719 511,175 n.a. 4,632,426 814,843

AR

6,213,300 972,284 1,812,419 3,428,597 2,227,810 195,370 702,259 1,330,181 753,831 8,441,110 2,360,921 314,520 2,046,401 2,117,667 1,152,124 965,543 n.a. 3,962,522 591,346

AR

4,179,607 107,949 1,513,599 2,558,059 1,586,253 186,983 399,913 999,357 190,553 5,765,860 1,923,665 299,135 1,624,530 1,573,233 672,775 900,458 n.a. 2,268,962 438,912

AR

4,054,372 107,949 1,537,108 2,409,315 1,166,756 170,691 309,675 686,390 356,376 5,221,128 1,722,084 296,045 1,426,039 1,616,399 895,133 721,266 n.a. 1,882,645 250,383

https://orbis.bvdep.comlversion-2010326/cgi/report.dll?context=DL8LW2&bitnr= 150... 01/04/2010

Orbis - Company Report

Page 4 of 13

Creditors Other Current Liabilities Total Shareh. Funds & Liab. Memo lines Working Capital Net Current Assets Enterprise Value Employees

471,578 3,346,005 8,679,091

561,957 2,809,219 8,441,110

362,435 1,467,615 5,765,860

397,861 1,234,401 5,221,128

\^

448,710 -2,553,268 5,060,460 n.a.

335,672 -1,734,712 6,686,705 n.a.

224,461 -682,709 3,265,124 n.a.

82,505 -715,889 2,724,276 12,064

BALANCE SHEET Consolidated data 31/12/2004 12 months 31/1212003 12 months 31/12/2002 12 months 31112/2001 12 months

Q)

Q)

Unqual

th MYR Local GAAP

Unqual

th MYR Local GAAP

Unqual

th MYR Local GAAP

Unqual

th MYR Local GAAP

Q)

c o

o 0 o. Q)

AR

FixedAssets Intangible Fixed Assets Tangible Fixed Assets Other Fixed Assets Current Assets Stocks Debtors Other Current Assets Cash & Cash Equivalent Total Assets Shareholders Funds Capital Other Shareholders Funds Non Current Liabilities Long Term Debt Other Non-Current Liabilities Provisions Current Liabilities 3,796,226 4,571 1,668,656 2,122,999 846,354 90,114 254,643 501,597 214,775 4,642,580 1,873,288 289,770 1,583,518 1,478, 331 924,201 554,130 n.a. 1,290, 961

AR

3,652,273 4,226 1,574,192 2,073,855 688,908 73,663 246,637 368,608 132,632 4,341,181 1,871,049 272,873 1,598,176 1,128, 843 634,130 494,713 n.a. 1,341,289

AR

3,332,619 0 1,489,557 1,843,062 668,757 95,100 292,050 281,607 92,973 4,001,376 1,400,498 136,435 1,264,063 1,268, 365 481,114 787,251 n.a. 1,332,513 3,184,736 0 1,411,164 1,773,572 748,469 106,438 392,389 249,642 54,593 3,933,205 1,356,210 136,376 1,219,834 1,230, 616 490,232 740,384 n.a. 1,346, 379

Loans

Creditors Other Current Liabilities Total Shareh. Funds & Liab. Memo lins Working Capital Net Current Assets Enterprise Value Employees

603,702

158,207 529,052 4,642,580

256,146

146,749 938,394 4,341,181

0

160,103 1,172,410 4,001,376

0

128,881 1,217,498 3,933,205

186,550 -444,607 2,599,058 11,451

173,551 -652,381 2,466,548 11,538

227,047 -663,756 n.a. 10,416

369,946 -597,910 n.a. n.a.

o

o

o

Q)

BALANCE SHEET Consolidated data 31/12/2000 12 months No opinion th MYR Local GAAP Fixed Assets Intangible Fixed Assets Tangible Fixed Assets Other Fixed Assets CurrentAssets Stocks 3,309,346 0 1,342,098 1,967,248 684,714 112,145 31/12/1999 18 months Unqual th MYR Local GAAP 3,047,924 0 1,243,269 1,804,655 605,007 122,603

"' ` 4 Ctr l. Of i, Q I_ " j '\ y d`- 1/ *' " ,- .' ., t

E

o-

o .

```^j.. r I

J'

c ro

LL

Q)

N

Q)

F D`

p ^^ ^ \c

C o C

Q)

6'Q)

https://orbis.bvdep.comlversion-2010326/cgilreport.dll?context=DL8L W2&bitnr=150... 01/04/2010

Orbis - Company Report

Page 5 of 13

328,551 244,018 47,314 3,994,060 1,501,239 136,376 1,364,863 1,300,866 566,007 734,859 3,384 1,191,955 134,740 1,057,215 3,994,060

Debtors Other Current Assets Cash & Cash Equivalent Total Assets Shareholders Funds Capital Other Shareholders Funds Non Current Liabilities Long Term Debt Other Non-Current Liabilities Provisions Current Liabilities

267,269 215,135 35,002 3,652,931 1,533,295 136,376 1,396,919 1,035,217 360,447 674,770 2,900 1,084,419 0 178,468 905,951 3,652,931

J51/ L

Loans 0

Q)

Creditors Other Current Liabilities Total Shareh. Funds & Liab.

`C hl A T/O^

o

D

L)

Memo fines Working Capital Net Current Assets Enterprise Value 305,956 -507,241 n.a. 211,404 -479,412 n.a.

o

v

^ ,^ H 'gvt r ^'^^^ ^n ..'^1rTM^ , ., r

Employees n.a.

n.a.

-.

fM

P & L ACCOUNT Consolidated data 31/12/2008 12 months Unqual th MYR IFRS 31/12/2007 12 months Unqual th MYR IFRS 31112/2006 12 months 31/12/2005 12 months Unqual th MYR Local GAAP

Unqual

th MYR Local GAAP

AR

Operating Revenuefrurnover Sales Costs of Goods Sold Gross Profit Other Operating Expenses Operating PIL (=EBIT] Financial Revenue Financial Expenses Financial PIL PIL before Tax & Extr. Items

o o

N

AR

5,794,654 5,751,919 4,502,076 1,292, 578 413,416 879,162 12,439 62,787 -50,348 828,814 174,278 654,536

AR

4,140, 519 4,114, 326 3,380,499 760,020 516,768 243,252 3,980 -139,199 143,179 386,431 35,033 351,398

AR

1,953,271 1,924,170 1,631,473

7,081, 337 7,029,818 5,862,544 1,218,793 545,461 673,332 22,100 16,530 5,570 678,902 11,228 667,674

321,798

79,091 242,707 4,187 -53,182 57,369 300,076 69,629 230,447

Taxation PIL alter Tax Extr. and Other Revenue Extr. and Other Expenses Extr. and Other PIL PIL for Period (= Net Income] Memo fines

n.a.

n.a. -88,888 578,786

o

Q)

n.a. n.a.

-176,800 477, 736

n.a. n.a.

-141,214 210,184

n.a. n.a.

-39,944 190,503

E

n.

L) C

Export Turnover

Material Costs Costs of Employees Depreciation lnterest Paid Research & Development expenses Cash Flow Added Value

n.a. n.a.

370,250 105,977 153,042 5,494 684,763 1,196,827

n.a. n.a.

254,936 91,128 125,607 5,307 568,864 775,129

n.a. n.a.

179,544 83,201 118,457 4,724 293,385 556,353

n.a. n.a.

149,492 54,186 109,669 5,812 244,689 434,221

c o tC C Q)

o

O_

https://orbis.bvdep.com/version-2010326/cgi/report.dll?context=DL8L W2&bitnr=150... 01/04/2010

rbis - Company Report

Page 6 of 13

779,309 970,290

EBITDA

326,453

296,893 ",

P & L ACCOUNT

Consolidated data 3111212004 31/12/2003 31/12/2002 31/12/2001 12 months 12 months 12 months 12 months Unqual Unqual Unqual Unqual th MYR th MYR th MYR th MYR Local GAAP Local GAAP Local GAAP Local GAAP

AR

AR

AR

Operating Revenue/Turnover 1,267,743 1,089,988 Sales 1,267,743 1,081,496

982,230 983,214 796,770

919,734 1,024,251

Costs of Goods So/d 900,764 765,241

n.a

n.a

Gross Profit 324,747 366,979

Other Operating Expenses 4,203 44,809 Operating PIL (=EBIT] 362,776 279,938 2,426 1Financial Revenue ,865 Financial Expenses 118,448 73,870 Financial PIL -116,022 -72,005 PIL before Tax & Extr. Items 246,754 207,933 Taxation 70,794 59,827 PIL after Tax 175,960 148,106 Extr. and Other Revenue n.a. n.a. Extr. and Other Expenses n.a. n.a. Extr. and Other P/L -56,800 -35,594 PIL for Period (= Net Income] 112,512 119,160

185,460 -52,924 238,384 83,465 -83,465 154,919 63,432 91,487 n.a.

892,313 27,421 3,425 45,423 -41,998 -14,577 57,825 -72,402 n.a.

n.a.

n.a.

-40,298

n.a.

-39,173

51,189

-111,575

Memo Unes

Export Turnover n.a. n.a. Material Costs n.a. n.a. Costs of Employees 129,724 132,435 Depreciation 40,220 33,601 Interest Paid 88,509 73,547 Research & Development expenses 3,109 3,485

Cash Flow 159,380 146,113 Added Value 309,530 289,557 EBITDA 402,996 313,539 P& L ACCOUNT Consolidated data 31/12/2000 12 months No opinion th MYR Local GAAP Operating Revenue!Turnover Sales Costs of Goods So/d 903,871 890,345

n.a. 135,807 27,874 55, 654 2,098 79,063 207,092 266,258

n.a.

n.a. n.a. n.a.

28,984 45, 652

n.a.

-82,591 n.a. 56,405

a o

o o

V

31/12/1999 18 months Unqual th MYR Local GAAP 1,578,187 1,453, 508

t\^,.^ Pn r ' 7:t

E

E

L) ro

G)

o.

n.a. n.a.

787,850

n.a. n.a.

1,151,516 426,671

Gross Profit

Other Operating Expenses

Operating PIL (=EBIT] Financial Revenue Financial Expenses Financial PIL PIL before Tax & Extr. Items

116,021

3,200 32,981 -29,781 86,240

ro

19,127

79,022 -59,895 366,776

o ro

C

Cr ,v

_o m

https://orbis.bvdep.comlversion-20103261cgi/report.dll?context=DL8LW2&bitnr=150.. . 01/04/2010

Orbis - Company Report

Page 7 of 13

Taxation P/LafterTax Extr. and Other Revenue Extr. and Other Expenses Extr. and Other P/L

53,202 33,038 n.a. n.a. -27,637 5,401

8,190 358,586 n.a. n.a. -137,979 220,607

PIL for Period (= Net Income]

Memo fines Export Turnover Material Costs Costs of Employees Depreciation Interest Paid Research & Development expenses

G)

n.a. n.a. n.a. 24,673 33,213 n.a. 30,074 n.a. 140,694

n.a. n.a. n.a. 36,668 79,520 n.a. 257,275 n.a. 463,339

`

'.1..

r1

4 r

``

Q) C

Cash Flow Added Value EBITDA

o o

0

s=

RATIOS Consolidated data 31/12/2008 12 months Unqual th MYR IFRS AR Profitability ratios Return on Shareholder Funds (%) Return on Capital Employed (%) Return on Total Assets (%) Profit Margin (%) Gross Margin (%) EBITDA Margin (%) EBIT Margin (%) Cash Flow/ Turnover (%) Operational ratios Net Assets Turnover (x) Interest Cover (x) Stock Turnover(x) Collection period (days) Credit period (days) Export Turnover! Total Turnover (%) Structure ratios Current Ratio (x) Liquidity Ratio (x) 31/1212007 12 months Unqual th MYR IFRS AR 31/12/2006 12 months Unqual th MYR Local GAAP AR 31/1212005 12 months Unqual th MYR Local GAAP AR

o. e

23.32 20.56 7.82 9.59 17.21 11.01 9.51 9.67

35.11 21.31 9.82 14.30 22.31 16.75 15.17 9.82

20.09 14.44 6.70 9.33 18.36 7.88 5.88 7.09

17.43 12.27 5.75 15.36 16.48 15.20 12.43 12.53

1.75 4.40 30.69 35 24 n.a.

1.29 7.00 29.66 44 35 n.a.

1.18 2.05 22.14 35 32 n.a.

0.58 2.21 11.44 57 73 n.a.

Shareholders Liquidity Ratio (x)

o o

Solvency Ratio (%) Gearing (%) Per employee ratios Profit per Employee (Th.) Operating Revenue per Employee (Th.) Costs of Employees 1 Operating Revenue (%) Average Cost of Employee (Th.) Shareholders Funds per Employee (Th.) Working Capital per Employee (Th.) Total Assets per Employee (Th.)

0.45 0.40 2.56 33.54 67.02

0.56 0.51 1.12 27.97 114.74

0.70 0.62 1.22 33.36 104.60

0.62 0.53 1.06 32.98 108.40

n.a. n.a. 5.23 n.a. n.a. n.a. n.a.

n.a. n.a. 4.40 n.a. n.a. n.a. n.a.

n.a. n.a. 4.34 n.a. n.a. n.a. n.a.

25 162 7.65 12 143 7 433

o

G)

E o. E ar

o C

ro

LL

v v

RATIOS Consolidated data 31/12/2003 12 months Unqual th MYR 31112/2002 12 months Unqual th MYR 31/12/2001 12 months Unqual th MYR

C 31/12/2004 o 12 months Unqual C G) th MYR CY ,v

o

https://orbis.bvdep.comlversion-2010326/cgi/report.dll?context=DLBL W2&bitnr=150... 01/04/2010

Orbis - Company Report

Page 8of13

Local GAAP

Local GAAP

Local GAAP

Local GAAP

AR

Profitability ratios Return on Shareholder Funds (%) Return on Capital Employed (%) Return on Total Assets (%) Profit Margin (%) Cross Margin (%) EBITDA Margin (%) EBIT Margin (%) Cash Flow/ Turnover (%) 13.17 10.00 5.32 19.46 28.95 31.79 28.62 12.57

AR

11.11 9.38 4.79 19.08 29.79 28.77 25.68 13.40

AR

11.06 7.89 3.87 15.77 18.88 27.11 24.27 8.05 -1.07 1.20 -0.37 -1.58 n.a. 6.13 2.98 -8.98

Operational ratios

Net Assets Turnover (x) Interest Cover (x) Stock Turnover (x) Collection period (days) Credit period (days) Export Turnover / Total Turnover (%) v

C o

L)

0.38 4.10 14.07 72 45 n.a.

0.36 3.81 14.80 81 48 n.a.

0.37 4.28 10.33 107 59 n.a.

0.36 0.60 8.64 154 50 n.a.

Structure ratios Current Ratio (x) Liquidity Ratio (x) Shareholders Liquidity Ratio (x) Solvency Ratio (%) Gearing (%) Per employee ratios Profit per Employee (Th.) Operating Revenue per Employee (Th.) Costs of Employees / Operating Revenue(%) Average Cost of Employee (Th.) Shareholders Funds per Employee (Th.) Working Capital per Employee (Th.) Total Assets per Employee (Th.)

0.66 0.59 1.27 40.35 111.14

0.51 0.46 1.66 43.10 74.02

0.50 0.43 1.10 35.00 90.56

0.56 0.48 1.10 34.48 90.74

22 111 10.45 12 164 16 405

18 94 11.90 11 162 15 376

15 94 13.83 13 134 22 384

n.a. n.a. n.a. n.a. n.a. n.a. n.a.

RATIOS

Consolidated data

31/12/2000 12 months No opinion th MYR Local GAAP Profitability ratios Return on Shareholder Funds (%) Return on Capital Employed (%) Return on Total Assets (%) Profit Margin (%) Gross Margin (%) EBITDA Margin (%) EBIT Margin (%) Cash Flow/ Turnover (%) 31/12/1999 18 months Unqual th MYR Local GAAP

Gr

- .^^; c ^^;Y'^ ! '.... i4 cf

.

'.

5.75 4.26 2.16 9.54 n.a. 15.57 12.84 3.33

15.95 11.58 6.69 23.24 n.a. 29.36 27.04 16.30

_^... 'jc nr

Operational ratios

Net Assets Turnover (x) Interest Cover (x) Stock Turnover (x) Collection period (days) Credit period (days) Export Turnover / Total Turnover (%) Structure ratios Current Ratio (x) Liquidity Ratio (x) Shareholders Liquidity Ratio (x) Solvency Ratio (%) Gearing (%) Per employee ratios Profit per Employee (Th.) Operating Revenue per Employee (Th.) Costs of Employees / Operating 0.32 3.49 8.06 131 54 n.a. 0.41 5.37 8.58 91 61 n.a.

0.57 0.48 1.15 37.59 86.65

0.56 0.44 1.48 41.97 67.52

n.a. n.a.

n.a. n.a.

https://orbis.bvdep.comlversion-2010326/cgi/report.dll?context=DL8L W2&bitnr=150... 01/04/2010

Orbis - Company Report

n.a. n.a. n.a. n.a. n.a.

Page 9 of 13

Revenue (%) Average Cost of Employee (Th.) Shareholders Funds per Employee (Th.) Working Capital per Employee (Th.) Total Assets per Employee (Th.)

n.a. n.a. n.a. n.a. n.a.

BOARD MEMBERS & OFFICERS. 1. 2. 3. 4. 5. 6. 7. 8. MOHD GHAZALI BIN HAJI CHE MAT SHARIFAH BINTI MALEK MEGAT ABDUL RAHMAN BIN MEGAT

CHAIRMAN OF THE BOARD

SECRETARY

INDEPENDENT NON-EXECUTIVE DIRECTOR INDEPENDENT NON-EXECUTIVE DIRECTOR NON-INDEPENDENT NON-EXECUTIVE DIRECTOR DIRECTOR MANAGING DIRECTOR EXECUTIVE

AHMAD

MOHD YUSOF BIN DIN AllAT BIN KAMALUDIN GHAZALI BIN MOHD ALI LODIN BIN WOK KAMARUDDIN HAJI LODIN BIN WOK KAMARUDDIN

ai

D

AUDITORS & ADVISORS

c o

L;

Auditor: Banker:

ERNST & YOUNG MALAYAN BANKING BERHAD THE BANK OF NOVA SCOTIA BERHAD

o a a

CIMB BANK BERHAD

HSBC BANK MALAYSIA BERHAD RHB BANK BERHAD BANK PEMBANGUNAN MALAYSIA BHD AFFIN BANK BERHAD OCBC BANK (MALAYSIA) BERHAD ALLIANCE BANK MALAYSIA BERHAD Registrar: BOUSTEAD MANAGEMENT SERVICES SDN BHD

^^ a Y+^^q t t (ntlr^n

1 1 ^ 4'

_ -

S'es

MERGERS AND ACQUISITIONS

1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. 2/03/2010: Boustead Holdings to sel/ BH Insurance (M) to AXA Affin (deal no. 1603018592) 20/01/2010: Boustead Holdings issues shares on convertible bond conversion (deal no. 1603048935) 31/1212009: Diageo-Moet Hennessey fully acquires Riche Monde (deal no. 1603046722) 15/1212009: Boustead Holdings terminates share acquisition in Atlas Hall (deal no. 1603040644) 1511212009: Boustead Holdings not taking majority stake in Atlas Hall (deal no. 1603040646) 1511212009: Boustead Holdings to buy shares in Atlas Hall (deal no. 1603045483) 1511212009: Boustead Holdings to up stake in Atlas Hall (deal no. 1603045484) 9/09/2009: Boustead Holdings rights issue oversubscribed (deal no. 1603024610) 14/0512009: Tan Sri Dato Lodin Wok Kamaruddin buys shares in Boustead Holdings (deal no. 1603023175) 8/08/2008: Boustead Holdings take over Boustead Properties (deal no. 1603001851) 3/09/2007: Boustead Holdings Bhd takes minority stake in Royal & Sun Alliance Insurance (M) Bhd (deal no. 1000005577) 4/07/2007: Boustead Holdings fils to take UAC private (deal no. 536984) 1110412007: Boustead Holdings increases stake in Affin Holdings (deal no. 551383) 15/0212007: Affin Bank to sell stake in PSC-Naval Dockyard to Boustead Holdings (deal no. 402631) 4/08/2006: Boustead Holdings to increase stake in PSC-Naval Dockyard (deal no. 465566) 4/08/2006: Boustead Holdings may be obliged to make offer for remainder of PSC-Naval Dockyard (deal no. 465568) 24/0512006: Boustead Holdings sells stake in P&O Nedlloyd M.A. Sdn Bhd to Maersk Holdings (deal no. 445492) 30/1212005: PSC Industries acquires Asia Coins (deal no. 411227) 16/09/2005: Boustead Holdings to acquire stake in PSC-Naval Dockyard (deal no. 379293) 25/0712005: Boustead Holdings in talks to acquire stake in Royal & Sun Alliance Insurance (M) Bhd (deal no. 363857) 5/07/2005: Boustead Holdings increases stake in PSC Industries (deal no. 327829) 27/05/2004: Boustead Properties to acquire Boustead Johan Edaran from Boustead Holdings (deal no. 251156) 29/08/2003: Boustead Holdings acquires Kuala Sidim (deal no. 155199) 5/08/2003: Boustead Holdings in rights issue (deal no. 182960) 28/0612003: Boustead Holdings may sell Kuala Sidim (deal no. 176853) 11/10/2001: Syed Zikiri Syed Hassan buys Phoenix Heights from Boustead (deal no. 395400)

SHAREHOLDERS

https://orbis.bvdep.comlversion-2010326/cgi/report.dll?context=DL8LW2&bitnr 150... 01/04/2010

DE

Travail : <PAST2330> <FP>

Nom : https://orbis.bvdep.com/version-2010326/cgi/report.dll?context=

Orbis - Company Report

Page 10 of 13

BvDEP Independence Indicator: D Current definition of the UO : path of min 25.01 % of control, known shareholders This is a quoted company. .... ..... .. ................. ........................ .. . _........

Filters Nofilter

trrt,

-. -,

T1

^,^ \ \^

l^

.......

^a r

The companies underlined and displayed in blue - bold are available on Orbis. Ownership Shareholder name Country Type Direct (%)

.- "` Source

Cbmny lnform. Op. Total Source Date of Closing Revenue No of (%) ident. inform. Date (mil USD) employees

Global and Domestic Ultimate Owner (qualification: UO) MY GOVERNMENT OF MALAYSIA G)

- 58.91 VD 02/2010

Shareholders

C

o L) V c

o

G)

1. 2. 3. 4.

0 Q.

GOVERNMENT OF MALAYSIA via its funds LEMBAGA TABUNG ANGKATAN TENTERA PUBLIC BANK BERHAD via its funds MALAYSIA NOMINEES (ASING) SDN BHD GREAT EASTERN LIFE ASSURANCE (MALAYSIA) BERHAD (PAR 1)

MY MY MY MY

S F B A

56.41 3.11

58.91 n.a. 5.57 n.a.

FS RS FS RS

02/2010 01/2008 01/2009 01/2008

n.a. >< n.a.

n.a. 1,789 n.a.

n.a. 16,160 n.a.

5.

6.

TAN SRI DATO' LODIN WOK KAMARUDDIN

MY

7.

SCOTIA NOMINEES (TEMPATAN) SDN BHD MY - PLEDGED SECURITIES ACCOUNT FOR CHE LODIN BIN WOK KAMARUDDIN SG OVERSEA-CHINESE BANKING CORPORATION LIMITED OCBC via its

I E

2.89 2.70

n.a. n.a.

SE RS

10/2009 01/2008

n.a.

n.a.

n.a.

2.42

FS

01/2009

><

3,479

19,561

funds

8. MAYBAN NOMINEES (TEMPATAN) SDN BHD - MAYBAN TRUSTEES BERHAD FOR PUBLIC REGULAR SAVINGS FUND

MY

1.17

n.a.

RS

01/2008

n.a.

n.a.

n.a.

(N14011940100)

9. CITIGROUP NOMINEES (ASING) SDN BHD - MY CBHK FOR KUWAIT INVESTMENT AUTHORITY (FUND 202)

1.15

n.a.

RS

01/2008

n.a.

n.a.

n.a.

10.

11. 12.

ENG HUENG FOOK HENRY

DIMENSIONAL FUND ADVISORS LP via its

n.a. US MY

E E

1.07 0.97

n.a. 0.98 n.a.

RS FS RS

01/2008 11/2009 01/2008

>< n.a.

n.a. n.a.

255 n.a.

funds

AMANAH RAYA NOMINEES (TEMPATAN) SDN BHD - PUBLIC SOUTH EAST ASIA SELECT FUND CARTABAN NOMINEES (ASING) SDN BHD EXEMPT AN FOR CACEIS BANK LUXEMBOURG (CLT ACCT LUX) AMANAH RAYA NOMINEES (TEMPATAN) SDN BHD - PUBLIC GROWTH FUND AMANAH RAYA NOMINEES (TEMPATAN) SDN BHD - PUBLIC EQUITY FUND MALAYSIA NOMINEES (ASING) SDN BHD GREAT EASTERN LIFE ASSURANCE (MALAYSIA) BERHAD (PAR 2) CHINCHOO INVESTMENT SDN BERHAD AMANAH RAYA NOMINEES (TEMPATAN) SDN BHD - PUBLIC FAR ASIA SELECT

13.

MY

0.94

n.a.

RS

01/2008

n.a.

n.a.

n.a.

14. 15. 16.

MY MY MY

E E E

0.80 0.73 0.68

n.a. n.a. n.a.

RS RS RS

01/2008 01/2008 01/2008

n.a. n.a. n.a.

n.a. n.a. n.a.

n.a. n.a. n.a.

o o

o o G)

17. 18.

MY MY

E E

0.67 0.66

n.a. n.a.

RS RS

01/2008 01/2008

n.a. n.a.

n.a. n.a.

n.a. n.a.

.v

E

FUND

19. HSBC NOMINEES (ASING) SDN BHD HSBC-FS FOR EK ASIA FUND

MY n.a. MY

0.65 0.64 0.55

n.a. n.a. n.a.

RS RS RS

01/2008 01/2008 01/2008

n.a. n.a.

n.a. n.a.

n.a. n.a.

Q.

E Q.)

C

20.

21.

YONG SIEW YOON

AMANAH RAYA NOMINEES (TEMPATAN) SDN BHD - PUBLIC FAR EAST DIVIDEND

L)

ro -

FUND

22. CITIGROUP NOMINEES (ASING) SDN BHD - MY CBNY FOR DFA EMERGING MARKETS

v v

m

c o CG CG C Cu M

0.53

n.a.

RS

01/2008

n.a.

n.a.

n.a.

23.

FUND CITIGROUP NOMINEES (TEMPATAN) SDN

BHD - ING INSURANCE BERHAD (INV IL PAR)

MY

0.52

n.a.

RS

01/2008

n.a.

n.a.

n.a.

Cr o_

https://orbis.bvdep.comlversion-2010326/cgi/report.dll?context=DL8L W2&bitnr--150... 01/04/2010

Orbis - Company Report

Page 11 of 13

24.

25.

MY HSBC NOMINEES ASING SDN BHD EXEMPT AN FOR THE HONG KONG SHANGHAI BANKING CORPORATION LTD HBFS I CLT ACCT CARTABAN NOMINEES (ASING) SDN BHD - MY CREDIT INDUSTRIAL ET COMMERCIAL SINGAPORE FOR ENG HUENG FOOK

0.49

n.a. RS 01/2008 n.a.

n.a.

n.a.

0.44

n.a.

RS

01/2008

n.a.

n.a.

n.a.

HENRY

26. MAYBAN NOMINEES (TEMPATAN) SDN BHD - MAYBAN TRUSTEES BERHAD FOR PUBLIC AGGRESSIVE GROWTH FUND

MY

0.41

n.a.

RS

01/2008

n.a.

n.a.

n.a.

(N14011940110)

AMANAH RAYA NOMINEES (TEMPATAN) SDN BHD - PUBLIC DIVIDEND SELECT FUND CITIGROUP NOMINEES (ASING) SDN BHD 28. CTCL FOR INVESCO PERPETUAL INTERNATIONAL EQUITY FUND GAN TENG SIEW REALTY SDN BERHAD 29. KEY DEVELOPMENT SDN BHD 30. MAYBN NOMINEES (TEMPATAN) SDN 31. BHD - MAYBAN TRUSTEES BERHAD FOR PB ASEAN DIVIDEND FUND (270334) MAYBAN NOMINEES (TEMPATAN) SDN 32. fl BHD - MAYBAN TRUSTEES BERHAD FOR PUBLIC BALANCED FUND (N14011950210) BHLB TRUSTEE BERHAD - FOR PUBLIC 33. FOCUS SELECT FUND CIMSEC NOMINEES (ASING) SDN BHD 34. o CIMB BANK FOR SONG KEE LING M( M0873) ING GROEP NV via its funds 35. 36. EK INVESTMENT MANAGEMENT LTD. via a its funds 37. INVESCO LTD via its funds rn V 38. CAPITAL DYNAMICS ASSET MANAGEMENT SDN. BHD. via its funds GOVERNMENT OF NORWAY via its funds 39. 27.

MY

0.39

n.a.

RS

01/2008

n.a.

n.a.

n.a.

MY

0.39

n.a.

RS

01/2008

n.a.

n.a.

n.a.

MY MY MY

C C E

0.39 0.37 0.35

n.a. n.a. n.a.

RS RS RS

01/2008 01/2008 01/2008

n.a. n.a. n.a.

n.a. n.a. n.a.

n.a. n.a. n.a.

MY

0.34

n.a.

RS

01/2008

n.a.

n.a.

n.a.

MY MY

E E

0.31 0.31

n.a. n.a.

RS RS

01/2008 01/2008

n.a. n.a.

n.a. n.a.

n.a. n.a.

NL HK BM MY NO MY MY

B E F E S I I

- 0.04 0.01

0.31 0.30 0.29 0.24 0.17 n.a. n.a.

FS FS FS FS FS SE SE

01/2009 01/2009 01/2009 01/2009 12/2008 08/2007 09/2009

>< n.a. n.a. n.a. - - -

25,579 n.a. n.a. n.a. - - -

124,661 n.a. n.a. n.a. -

40. 41.

DATO' GHAZALI MOHD ALI DATUK AllAT BIN KAMALUDIN

, Vie- p For an insurance company the corresponding value is the Gross Premium Written and for a bank. t is eratri'- 4ncome `{. i^^rt (memo).

'A i

r^ilCiA.?

!` J.. F1 l

1i^

SUBSIDIARIES (Roll-up

structure),

r,^ ^^^ il'e r.,. '.:' ....................

Current definition of the UO : path of min...... ... % of control, known shareholders 25.01 . ..... ........... .. ....... Filters : No filter ............_ .................................................................................__..............__........_................................................................................ ._................:...:.,_....' The companies underlined and displayed in blue - bold are available on Orbis. Ownership Subsidiary name Coun Source

_'f'^" f{f Dt

ry

1. 2. 3. 4. AB SHIPPING SDN BHD BESTARI MARINE SDN BHD BOUNTY CORP SDN BHD BOUSTEAD ADVISORY AND CONSULTANCY SERVICES SDN BHD BOUSTEAD CONSTRUCTION SDN BHD 5. BOUSTEAD CREDIT SDN BHD 6. BOUSTEAD ELDRED SDN BHD 7. BOUSTEAD EMASEWA SDN BHD 8. BOUSTEAD EMASTULIN SDN BHD 9. BOUSTEAD ENGINEERING SDN BHD 10. 11. BOUSTEAD ESTATES AGENCY SDN

Direct (%)

Company Inform. Op. ev e Total Source Date of Closing Revenue No of of Status inform. Date (mil USD) employee (%) N. 1 1 1 1 1 1 1 1 1 1 1 . RM RM RM RM RM RM RM RM RM RM RM 12/2007 12/2007 12/2007 12/2007 12/2007 12/2007 12/2007 12/2007 12/2007 12/2007 12/2007 n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. >< n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. 7 n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a.

MY MY MY MY MY MY MY MY MY MY MY

100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00

BHD

https://orbis.bvdep.comlversion-2010326/cgi/report.dll?context=DL8LW2&bitnr=150.. . 01/04/2010

Orbis - Company Report

Page 12 of 13

12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22.

Q)

BOUSTEAD GLOBAL TRADE NETWORK SDN BHD BOUSTEAD GRADIENT SDN BHD BOUSTEAD HEAH JOO SEANG SDN

MY MY MY MY MY MY MY MY MY MY MY MY MY MY MY MY MY MY MY ID ID MY MY MY MY MY n.a. MY MY MY MY MY MY MY MY MY MY MY MY MY MY MY MY MY MY MY MY

100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 WO n.a. n.a. 95.00 90.00 88.00 88.00 80.00 75.00 73.00 70.00 70.00 70.00 70.00 66.00 65.00 65.00 65.00 65.00 65.00 65.00 65.00 - 65.00 65.00 65.00 65.00 65.00 65.00 65.00 65.00 60.00 n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. 65.00 n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a.

1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

RM RM RM RM RM RM OS RM RM RM RM RM RM RM RM RM RM OS RM

12/2007 12/2007 12/2007 12/2007 12/2007 12/2007 05/2008 12/2007 12/2007 12/2007 12/2007 12/2007 12/2007 12/2007 12/2007 12/2007 12/2007 05/2009 12/2007

n.a. n.a. n.a. n.a. n.a. n.a. >< n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. = n.a. n.a. n.a. n.a. >< n.a. n.a. n.a. n.a. n.a. n.a. n.a n.a. ><

n.a. n.a. n.a. n.a. n.a. n.a. 144 n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. 83 n.a. n.a. n.a. n.a. 14 n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. 159 n.a.

n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. 232 n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a.

BHD

BOUSTEAD INFORMATION TECHNOLOGY SDN BHD BOUSTEAD MANAGEMENT SERVICES SDN BHD BOUSTEAD PLANTATIONS BERAHD BOUSTEAD PROPERTIES BERHAD BOUSTEAD RIMBA NILAI SDN BHD BOUSTEAD SEDILI SDN BHD BOUSTEAD SEGARIA SDN BHD BOUSTEAD SHIPPING AGENCIES SDN

BHD

Q)

23. 24. 25. 26. 27. 28. 29. 30. 31. 32. 33. 34. 35. 36. 37. 38. 39. 40. 41. 42. 43. 44. 45. 46. 47. 48. 49. 50. 51. 52. 53. 54. 55. 56. 57.

BOUSTEAD SOLANDRA SDN BHD BOUSTEAD SUTERA SDN BHD BOUSTEAD TRAVELS SERVICES SDN

BHD

BOUSTEAD TRUKLINE SDN BHD BOUSTEAD WELD QUAY SDN BHD TATAB CONCESSIONERS SDN BHD MUTIARA RINI SDN BHD BOUSTEAD BUILDING MATERIALS SDN BHD DENDYMARKER INDAHLESTARI PT ANAM KOTO PT MINAT WARISAN SDN BHD BH INSURANCE (M) BHD MALAYSIA WELDING INDUSTRIES SDN

L)

o

v

RM 12/2007 RM 12/2007 RM .12/2007 RM 12/2007 RM 12/2007 RM RM RM RM RM RM RM RM RM RM RM RM RM RM RM RM RM RM 12/2007 12/2007 12/2007 12/2007 12/2007 12/2007 12/2007 12/2007 12/2007 12/2007 12/2007 12/2007 12/2007

BHD

BOUSTEAD NAVAL SHIPYARD SDN

BHD

BOUSTEAD KANOWIT OIL MILL SDN

BHD

BOUSTEAD SHIPPING AGENCIES (B) SDN BHD BOUSTEAD SISSONS PAINTS SDN BHD CARGO FREIGHT SHIPPING SDN BHD UNIVERSITY OF NOTTINGHAM IN MALAYSIA (THE) SDN BHD AEROMARINE MAINTENANCE SERVICE BAKTI WIRA DEVELOPMENT SDN BHD BRIC DEFENCE TECHNOLOGIES SDN

BHD

BHIC PETROLEUM SDN BHD BOUSTAED CUVE SDN BHD BOUSTAED HOTELS AND RESORTS SDN BHD BOUSTEAD HEAVY INDUSTRIES CORPORATION BERHAD BOUSTEAD PENANG SHIPYARD SDN

N_

o o o o ni

'V-

12/2007 . n.a. 12/2007 12/2007 12/2007 n.a. n.a. n.a.

BHD

BOUSTEAD REALTY SDN BHD BOUSTEAD WELD COURT SDN BHD DOMINION DEFENCE & INDUSTRIES SDN BHD NAVAL DEFENCE AND COMMUNICATION SYSTEM SDN BHD PERSTIM INDUSTRIES SDN BHD SB INDUSTRIES (SDN) BHD UAC BERHAD UAC STEEL SYSTEMS SDN BHD BOUSTEAD PELITA KONOWIT SDN

E

oE

, L) c ro

Q-)

LL

Q)

Q)

C o ro C

Q-) C Cr

58.

RM RM RM RM RM

BHD

12/2007 nia L'^^Ia^ i 12/2007 1 ria. 12/2007 n.a. n, 12/2007 >< 12/2007 n.a. ` ' y , 12/2007 na. .rc f 0E t

n.a. n.a. n.a. n.a. gin, ^_^' n.a. `'!" ` N7 n "- , ,`i 2 q ria a 45 l r:

o_

https://orbis.bvdep.com/version-2010326/cgi/report.dll?context=DLSLW2&bitnr 150... 01/04/2010

Orbis - Company Report

Page 13 of 13

n.a. BOUSTEAD PELITA TINJAR SDN BHD MY 60.00 59. MY 53.00 BOUSTEAD PETROLEUM SDN BHD 60. MY 51.00 BOUSTAED OIL BULKING SDN BHD 61. 51.00 BOUSTEAD ANWARSYUKUR ESTATE MY 62. 63. 64. 65. 66. 67. 68. 69. 70. 71. 72. 73. 74. 75. 76. 77. 78. 79. 80. 81. 82. 83. 84. 85.

AGENCY SDN BHD BOUSTEAD INDONESIA MANAGEMENT CONSULTANCY SERVICES PT IDAMAN PHARMA MANUFACTURING SDN BHD JERNIH REZEKI SDN BHD WAVEMASTER LANGKAWI YACHT CENTRE SDN BHD APPLIED AGRICULTURAL RESOURCES SDN BHD ASIA SMART CARDS CENTRE (M) SDN BHD DREW AMEROID (MALAYSIA) SDN BHD LIKOM CASEWORKS SDN BHD PAVILION ENTERTAINMENT CENTRE (M) SDN BHD WAH SEONG BOUSTEAD CO LTD ATLAS DEFENCE TECHNOLOGY SDN

n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a.

1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1

- - - - - - - - - - - - - - - - - - - - - - - - - -

RM RM RM RM RM RM RM RM RM RM RM RM RM RM RM RM RM RM RM RM RM RM RM RM RS RM RM

12/2007 12/2007 12/2007 12/2007 12/2007 12/2007 12/2007 12/2007 12/2007 12/2007 12/2007 12/2007 12/2007 12/2007 12/2007 12/2007 12/2007 12/2007 12/2007 12/2007 12/2007 12/2007 12/2007 12/2007 02/2009 12/2007 12/2007

n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a.

><

n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. 35 n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. 325 n.a. n.a.

n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. 600 n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a.

ID MY MY MY MY MY MY MY MY MM MY

51.00 51.00 51.00 51.00 50.00 50.00 50.00 50.00 50.00 50.00 46.00 45.00 43.00 39.00 39.00 39.00 37.00 33.00 30.00 25.00 20.69 20.00 20.00

n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. = n.a. n.a.

BHD MY KAO (MALAYSIA) SDN BHD MY BOUSTEAD BULKING SDN BHD BOUSTAED LINEAR CORPORATION MY SDN BHD MALAYSIAN HEAVY INDUSTRY GROUP MY SDN BHD PSC TEMA SHIPYARD LIMITED GH BOUSTAED PETROLEUM MARKETING MY SDN BHD BHIC BOFORS DEFENCE SDN BHD MY MY K LINE KINKAI (MALAYSIA) SDN BHD MY CADBURY CONFECTIONERY MALAYSIA SDN BHD ' MY AFFIN HOLDINGS BERHAD JENDELA HIKMAT SDN BHD MY MY PERIMEKAR SDN BHD

* For an insurance company the corresponding value is the Gross Premium Written and for a bank it is the Operating Income (memo).

tli::;t..:

'

https ://orbis.bvdep. comlversion-2010326/cgi/report.dll?context=DL8L W2&bitnr= 150... 01/04/2010

Vous aimerez peut-être aussi

- D00148Document3 pagesD00148Asia SentinelPas encore d'évaluation

- D00153Document1 pageD00153Asia SentinelPas encore d'évaluation

- D00150Document2 pagesD00150Asia SentinelPas encore d'évaluation

- D00151Document12 pagesD00151Asia SentinelPas encore d'évaluation

- D00149Document7 pagesD00149Asia SentinelPas encore d'évaluation

- D00152Document3 pagesD00152Asia SentinelPas encore d'évaluation

- D00141Document3 pagesD00141Asia SentinelPas encore d'évaluation

- D00145Document9 pagesD00145Asia SentinelPas encore d'évaluation

- D00147Document9 pagesD00147Asia SentinelPas encore d'évaluation

- D00143Document1 pageD00143Asia SentinelPas encore d'évaluation

- D00144Document4 pagesD00144Asia Sentinel100% (1)

- Proces - Verbal: Le Dix Neuf AvrilDocument1 pageProces - Verbal: Le Dix Neuf AvrilAsia SentinelPas encore d'évaluation

- D00146Document9 pagesD00146Asia SentinelPas encore d'évaluation

- D00142Document1 pageD00142Asia SentinelPas encore d'évaluation

- D00133Document3 pagesD00133Asia SentinelPas encore d'évaluation

- D00139Document1 pageD00139Asia SentinelPas encore d'évaluation

- D00140Document5 pagesD00140Asia SentinelPas encore d'évaluation

- D00135Document2 pagesD00135Asia SentinelPas encore d'évaluation

- D00136Document17 pagesD00136Asia SentinelPas encore d'évaluation

- D00137Document3 pagesD00137Asia SentinelPas encore d'évaluation

- D00132Document2 pagesD00132Asia SentinelPas encore d'évaluation

- D00131Document3 pagesD00131Asia SentinelPas encore d'évaluation

- D00130Document2 pagesD00130Asia SentinelPas encore d'évaluation

- D00138Document10 pagesD00138Asia SentinelPas encore d'évaluation

- D00134Document2 pagesD00134Asia SentinelPas encore d'évaluation

- D00127Document1 pageD00127Asia SentinelPas encore d'évaluation

- D00128Document3 pagesD00128Asia SentinelPas encore d'évaluation

- D00124Document2 pagesD00124Asia SentinelPas encore d'évaluation

- D00126Document1 pageD00126Asia SentinelPas encore d'évaluation

- D00125Document2 pagesD00125Asia SentinelPas encore d'évaluation

- Comptabilite Generale 1 ActualiséDocument15 pagesComptabilite Generale 1 ActualiséemmayumbaPas encore d'évaluation

- Compta 2Document4 pagesCompta 2joobenPas encore d'évaluation

- 2010 Application Hotel Regence Gestion Stocks CorrigeDocument4 pages2010 Application Hotel Regence Gestion Stocks CorrigeLahcen SoussiPas encore d'évaluation

- DF Nadia Ben YahiaDocument224 pagesDF Nadia Ben YahiaOumayma JouiniPas encore d'évaluation

- MP 1cpa 01Document39 pagesMP 1cpa 01Oumar KOITAPas encore d'évaluation

- Cas de Synthèse Diagnostic Financier PDFDocument9 pagesCas de Synthèse Diagnostic Financier PDFIbrahim Aguettoi100% (1)

- Equilibre FinancierDocument54 pagesEquilibre FinancierMeriem EL ABBASYPas encore d'évaluation

- Comptabilite Generale Ucao - LicenceDocument29 pagesComptabilite Generale Ucao - Licencekevin DEBADE100% (1)

- Comptabilité Générale Chap 3Document26 pagesComptabilité Générale Chap 3Saad ThaminePas encore d'évaluation

- Cours 2015Document75 pagesCours 2015belkahla.rafik9015Pas encore d'évaluation

- Etude de Cas l'ISDocument17 pagesEtude de Cas l'ISMohamed KadiriPas encore d'évaluation

- IFRS Parcours Audit 2021 2022 - Partie I - Etudiants Extraits 2Document68 pagesIFRS Parcours Audit 2021 2022 - Partie I - Etudiants Extraits 2Fatine Rhazi100% (1)

- Correction Fiche de TD ComptaDocument9 pagesCorrection Fiche de TD ComptaOrnel DJEUDJI NGASSAMPas encore d'évaluation

- PtabilitéDocument22 pagesPtabilitéDiarra RadiaPas encore d'évaluation

- Diagnostic de L'entreprise KALYPSODocument72 pagesDiagnostic de L'entreprise KALYPSOmarwa alaouiPas encore d'évaluation

- Fiche 5 - Immobilisations IncorporellesDocument14 pagesFiche 5 - Immobilisations IncorporellesHassane OumarouPas encore d'évaluation

- Geosi - SI ComptableDocument13 pagesGeosi - SI ComptablerzygasPas encore d'évaluation

- Fondement de Base de La CGDocument47 pagesFondement de Base de La CGMeGa ZoldyKPas encore d'évaluation

- ExerciceDocument17 pagesExerciceWalid BouzidiPas encore d'évaluation

- Support 2 Cours Normes IfrsDocument163 pagesSupport 2 Cours Normes IfrsHBHBPas encore d'évaluation

- 2 Bac Eco Exercice 10 AmortissementsDocument1 page2 Bac Eco Exercice 10 AmortissementsAyoub Fakir100% (1)

- Audit Comptable Et FinancierDocument90 pagesAudit Comptable Et FinancierAzer Aze100% (1)

- Contabilitate Si IFRS CanadaDocument326 pagesContabilitate Si IFRS CanadaViziniuc IonelPas encore d'évaluation

- La Gestion Pour Les NulsDocument6 pagesLa Gestion Pour Les NulsYann GAUTHIERPas encore d'évaluation

- Résumé Comptabilité Financiére 1 2021-2022Document26 pagesRésumé Comptabilité Financiére 1 2021-2022bechir bouanziPas encore d'évaluation

- Comptabilité1Document11 pagesComptabilité1Pierre Benoit NdongPas encore d'évaluation

- Analyse Financiere TCR SIG BILANDocument22 pagesAnalyse Financiere TCR SIG BILANhafedPas encore d'évaluation

- Projet de Fin D'études Sous Le Thème: Le Diagnostic FinancierDocument74 pagesProjet de Fin D'études Sous Le Thème: Le Diagnostic FinancierDAZIAKAMALPas encore d'évaluation

- Le Besoin en Fonds de RoulementDocument40 pagesLe Besoin en Fonds de RoulementRania MfarrejPas encore d'évaluation

- Travaux de Fin D Exercice PDFDocument81 pagesTravaux de Fin D Exercice PDFItto MohaPas encore d'évaluation