Académique Documents

Professionnel Documents

Culture Documents

Cash Flow Business Case Example

Transféré par

Rafin AqsaTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Cash Flow Business Case Example

Transféré par

Rafin AqsaDroits d'auteur :

Formats disponibles

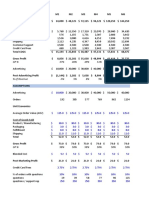

Net Cash Flow

Y0 1 2 3 4 5 6 7 8 9 10 Totals

Net Capital Costs

Capital Project Name $ (8,000,000) $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ (8,000,000)

Total Capital $ (8,000,000) $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ (8,000,000)

Operating and Maintenance Costs

Cost 1 $ (750,000) $ (750,000) $ (750,000) $ (750,000) $ (750,000) $ (750,000) $ (750,000) $ (750,000) $ (750,000) $ (750,000) $ (7,500,000)

Cost 2 $ (250,000) $ (250,000) $ (250,000) $ (250,000) $ (250,000) $ (250,000) $ (250,000) $ (250,000) $ (250,000) $ (250,000) $ (2,500,000)

Escalation of Costs $ (20,000) $ (40,400) $ (61,208) $ (82,432) $ (104,081) $ (126,162) $ (148,686) $ (171,659) $ (195,093) $ (218,994) $ (1,168,715)

Total Costs $ - $ (1,020,000) $ (1,040,400) $ (1,061,208) $ (1,082,432) $ (1,104,081) $ (1,126,162) $ (1,148,686) $ (1,171,659) $ (1,195,093) $ (1,218,994) $ (11,168,715)

Revenue and Operating Benefits

New Revenue $ 250,000 $ 250,000 $ 250,000 $ 250,000 $ 250,000 $ 250,000 $ 250,000 $ 250,000 $ 250,000 $ 250,000 $ 2,500,000

Benefit 1 $ 1,500,000 $ 1,500,000 $ 1,500,000 $ 1,500,000 $ 1,500,000 $ 1,500,000 $ 1,500,000 $ 1,500,000 $ 1,500,000 $ 1,500,000 $ 15,000,000

Benefit 2 $ 750,000 $ 750,000 $ 750,000 $ 750,000 $ 750,000 $ 750,000 $ 750,000 $ 750,000 $ 750,000 $ 750,000 $ 7,500,000

Escalation of Benefits $ 55,000 $ 111,210 $ 168,657 $ 227,367 $ 287,369 $ 348,691 $ 411,362 $ 475,412 $ 540,872 $ 607,771 $ 3,233,711

Total Benefits and Revenue $ - $ 2,555,000 $ 2,611,210 $ 2,668,657 $ 2,727,367 $ 2,787,369 $ 2,848,691 $ 2,911,362 $ 2,975,412 $ 3,040,872 $ 3,107,771 $ 28,233,711

Cash Flow Before Taxes $ (8,000,000) $ 1,535,000 $ 1,570,810 $ 1,607,449 $ 1,644,935 $ 1,683,288 $ 1,722,529 $ 1,762,677 $ 1,803,753 $ 1,845,779 $ 1,888,776 $ 9,064,996

Income Tax Calculation

Depreciation Expense $ (1,600,000) $ (2,560,000) $ (1,536,000) $ (921,600) $ (921,600) $ (460,800) $ - $ - $ - $ - $ (8,000,000)

Operating Cost $ (1,020,000) $ (1,040,400) $ (1,061,208) $ (1,082,432) $ (1,104,081) $ (1,126,162) $ (1,148,686) $ (1,171,659) $ (1,195,093) $ (1,218,994) $ (11,168,715)

Operating Benefits $ 2,555,000 $ 2,611,210 $ 2,668,657 $ 2,727,367 $ 2,787,369 $ 2,848,691 $ 2,911,362 $ 2,975,412 $ 3,040,872 $ 3,107,771 $ 28,233,711

Net Income Taxes $ - $ 26,000 $ 395,676 $ (28,579) $ (289,334) $ (304,675) $ (504,692) $ (705,071) $ (721,501) $ (738,312) $ (755,511) $ (3,625,998)

Cash Flow After Taxes $ (8,000,000) $ 1,561,000 $ 1,966,486 $ 1,578,869 $ 1,355,601 $ 1,378,613 $ 1,217,837 $ 1,057,606 $ 1,082,252 $ 1,107,467 $ 1,133,266 $ 5,438,997

Discounted Cash Flow (After Tax) $ (8,000,000) $ 1,445,370 $ 1,685,945 $ 1,253,357 $ 996,407 $ 938,261 $ 767,444 $ 617,103 $ 584,707 $ 554,009 $ 524,921 $ 1,367,525

Business Case Results: Assumptions:

NPV of Cash Flow $ 1,367,525 Cost Escalation Factor 2.00%

IRR 12.1% Benefit Escalation Factor 2.20%

Profitability Index 1.17 Income Tax Rate 40.00%

Simple Payback 5 Years 2 Months Discount Rate 8.00%

Discounted Payback 7 Years 6 Months

Copyright 2017 Money-zine.com

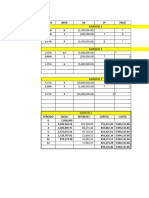

Depreciation Expense

Y0 1 2 3 4 5 6 7 8 9 10 Totals

Net Capital Costs (8,000,000.00) (8,000,000.00)

Depreciation Expense (1,600,000.00) (2,560,000.00) (1,536,000.00) (921,600.00) (921,600.00) (460,800.00) - - - - (8,000,000.00)

Depreciation - 5 Year (MACRS) 20.00% 32.00% 19.20% 11.52% 11.52% 5.76%

Copyright 2017 Money-zine.com

Payback Calculation

Y0 1 2 3 4 5 6 7 8 9 10 Totals

Simple Cash Flow $ 8,000,000 $ 1,561,000 $ 1,966,486 $ 1,578,869 $ 1,355,601 $ 1,378,613 $ 1,217,837 $ 1,057,606 $ 1,082,252 $ 1,107,467 $ 1,133,266

Cumulative Simple Payback $ 1,561,000 $ 3,527,486 $ 5,106,355 $ 6,461,956 $ 7,840,569 $ 9,058,406 $ 10,116,013 $ 11,198,264 $ 12,305,732 $ 13,438,997

Discounted Cash Flow $ 8,000,000 $ 1,445,370 $ 1,685,945 $ 1,253,357 $ 996,407 $ 938,261 $ 767,444 $ 617,103 $ 584,707 $ 554,009 $ 524,921

Cumulative Discounted Payback $ 1,445,370 $ 3,131,315 $ 4,384,672 $ 5,381,080 $ 6,319,340 $ 7,086,784 $ 7,703,887 $ 8,288,594 $ 8,842,604 $ 9,367,525

Copyright 2017 Money-zine.com

Vous aimerez peut-être aussi

- IAS 40 Immeubles de Placement CHKDocument15 pagesIAS 40 Immeubles de Placement CHKMed Naceur Tiliouine100% (1)

- Etat de Rapprochement Bancaire 2Document8 pagesEtat de Rapprochement Bancaire 2hakim fayçalPas encore d'évaluation

- TD3 Alizeo CorrigeDocument3 pagesTD3 Alizeo CorrigeAziz AbassiPas encore d'évaluation

- Port A Cabin Case Study SolutionDocument123 pagesPort A Cabin Case Study SolutionKamilPas encore d'évaluation

- Exercices1-Corrigé Compta Fin Avancée NdrosoDocument8 pagesExercices1-Corrigé Compta Fin Avancée NdrosoNy Aina RabePas encore d'évaluation

- Virement International PDFDocument4 pagesVirement International PDFJuniorPas encore d'évaluation

- Modele Excel Budget de TresorerieDocument32 pagesModele Excel Budget de Tresorerieachille TOIMAPas encore d'évaluation

- Maitriser La Comptabilite Bancaire Dans Luemoa 1608793819Document4 pagesMaitriser La Comptabilite Bancaire Dans Luemoa 1608793819Daouda CAMARAPas encore d'évaluation

- Metier ComptableDocument32 pagesMetier ComptableSiméon Bakary GuilavoguiPas encore d'évaluation

- Etudes Des Prix Produits Peintures PinayDocument70 pagesEtudes Des Prix Produits Peintures PinayHenriiQue Ø NdiiayePas encore d'évaluation

- CNR & Calcul RetraiteDocument11 pagesCNR & Calcul RetraiteКари МедPas encore d'évaluation

- Budget FestivalDocument12 pagesBudget FestivalAyulenPas encore d'évaluation

- Laboratoire Microsoft SUPINFO 2010, 1st ProjectDocument26 pagesLaboratoire Microsoft SUPINFO 2010, 1st ProjectMickaelGOETZPas encore d'évaluation

- La Taxe Sur La Valeur Ajout e Partie 2 1651169408Document17 pagesLa Taxe Sur La Valeur Ajout e Partie 2 1651169408Mael DIAKHITEPas encore d'évaluation

- TDR - Digitalisation Des Services Municipaux de La Mairie d'ANEHODocument9 pagesTDR - Digitalisation Des Services Municipaux de La Mairie d'ANEHOAudreyPas encore d'évaluation

- 22-23 Pré-Test PR EXAMEN GESTION ICAA2Document2 pages22-23 Pré-Test PR EXAMEN GESTION ICAA2Aïcha DjaoPas encore d'évaluation

- Presentation AxelorDocument43 pagesPresentation AxelorMohamed DarjaPas encore d'évaluation

- Copie de Declaration de La Taxe Professionnelle - ExcelDocument10 pagesCopie de Declaration de La Taxe Professionnelle - ExcelyoussritaPas encore d'évaluation

- Post A StatusDocument5 pagesPost A StatusMohamed Gueye FallPas encore d'évaluation

- 23 - Dossier - Projet - Vierge - ApiDocument30 pages23 - Dossier - Projet - Vierge - ApiAdrian RenglePas encore d'évaluation

- Business Plan Logement Rti-02-2024Document47 pagesBusiness Plan Logement Rti-02-2024mariekone79Pas encore d'évaluation

- Selection D'un Cabinet Pour L'accompagnement A La Mise en Place D'un Security Operation Center - SocDocument14 pagesSelection D'un Cabinet Pour L'accompagnement A La Mise en Place D'un Security Operation Center - Soccompte job100% (1)

- ITIL V3 - Guide CompletDocument10 pagesITIL V3 - Guide Completomar2022Pas encore d'évaluation

- Tableau de Reporting Excel Gratuit Controle de GestionDocument1 pageTableau de Reporting Excel Gratuit Controle de GestionHassan100% (1)

- 72-Hours Exercise 2Document3 pages72-Hours Exercise 2fiseco4756Pas encore d'évaluation

- 3 Statement ModelDocument6 pages3 Statement ModelAmit JainPas encore d'évaluation

- Blank Investment Appraisal Practice Questions WorkbookDocument49 pagesBlank Investment Appraisal Practice Questions Workbookhunaid.ayeshaPas encore d'évaluation

- Tugas Akuntansi ExcelDocument2 pagesTugas Akuntansi ExcelMuhammad Aminudin SarbinPas encore d'évaluation

- Modèle de Feuille de Calcul-CourseraDocument3 pagesModèle de Feuille de Calcul-CourseraScribdTranslationsPas encore d'évaluation

- Case2ExcelHarrisSeafood - Part 1 & 2Document23 pagesCase2ExcelHarrisSeafood - Part 1 & 2MANISHA SINGHPas encore d'évaluation

- Class Cash Flow - Longevity For LifeDocument2 pagesClass Cash Flow - Longevity For Lifeapi-623352013Pas encore d'évaluation

- Finance - Capital BudgetingDocument2 pagesFinance - Capital BudgetingObaid RehmanPas encore d'évaluation

- Mat Financiera Amortizacion y Gradientes VPNDocument13 pagesMat Financiera Amortizacion y Gradientes VPNdayannaPas encore d'évaluation

- Financial TemplateDocument11 pagesFinancial Templateroland schimttPas encore d'évaluation

- Flux de Trésorerie Du Dossier MinervaDocument9 pagesFlux de Trésorerie Du Dossier MinervaScribdTranslationsPas encore d'évaluation

- Copie de 1707652025448 - Classeur1 (1) ExamDocument13 pagesCopie de 1707652025448 - Classeur1 (1) ExamfdakkakiPas encore d'évaluation

- GF EX2 Correction Cas Bookonline2Document4 pagesGF EX2 Correction Cas Bookonline2maghribi40000Pas encore d'évaluation

- Corporate Finance Case Study WorkingDocument13 pagesCorporate Finance Case Study WorkingScribdTranslationsPas encore d'évaluation

- 04 - Projet ImmobilierDocument7 pages04 - Projet ImmobilierAmeliePas encore d'évaluation

- SdasdDocument3 pagesSdasdAlvin AlmuhandisPas encore d'évaluation

- Cash Flow EstimationsDocument4 pagesCash Flow Estimationsmaaiq007Pas encore d'évaluation

- M208 Budget D'investissementDocument2 pagesM208 Budget D'investissementHAMMOU KAMELPas encore d'évaluation

- GF EX2 Correction Cas Bookonline2Document4 pagesGF EX2 Correction Cas Bookonline2najib abou RjeilyPas encore d'évaluation

- Etude de CasDocument1 pageEtude de CasOussama BenyoussefPas encore d'évaluation

- Analyse Budgetaire CJPS Kor Mai A Decembre 2022Document67 pagesAnalyse Budgetaire CJPS Kor Mai A Decembre 2022kaleta deusPas encore d'évaluation

- 2 - Exemple D Annexe FinanciereDocument17 pages2 - Exemple D Annexe FinanciereArland Narcisse Ella NzehPas encore d'évaluation

- Projected Cash Flow Rev0Document1 pageProjected Cash Flow Rev0Reynold DockerPas encore d'évaluation

- Plan Kicks DesarrolloDocument1 pagePlan Kicks DesarrollomicrocheapPas encore d'évaluation

- Tabla de AmortizacionDocument14 pagesTabla de AmortizacionDaniel CamachoPas encore d'évaluation

- Corrige Exercice Cash Flow D'exploitationDocument12 pagesCorrige Exercice Cash Flow D'exploitationRéey'El TooPas encore d'évaluation

- Basic Ecommerce Financial ModelDocument8 pagesBasic Ecommerce Financial ModelAnish ShahPas encore d'évaluation

- Excel ClassworkDocument21 pagesExcel ClassworkBack UpPas encore d'évaluation

- TerminadoDocument231 pagesTerminadoNicolas CáceresPas encore d'évaluation

- Minicase Chapter 10Document5 pagesMinicase Chapter 10Cyrillus EkanaPas encore d'évaluation

- Cas Orion - XLSX 0Document9 pagesCas Orion - XLSX 0clépower 27Pas encore d'évaluation

- LeasingDocument2 pagesLeasingBenjaPas encore d'évaluation

- Activité 2 Évaluation Du ProjetDocument18 pagesActivité 2 Évaluation Du ProjetScribdTranslationsPas encore d'évaluation

- TD Analyse Financiere 3Document5 pagesTD Analyse Financiere 3Naruto UzumakiPas encore d'évaluation

- Renan Pereira Silva AndradeDocument3 pagesRenan Pereira Silva Andradepedro.lopespes01Pas encore d'évaluation

- Correction Examen Final 2019-2020 Avec ExplicationsDocument3 pagesCorrection Examen Final 2019-2020 Avec ExplicationsDiane Berriat0% (1)

- Taller 7Document3 pagesTaller 7valentina.marinpenaPas encore d'évaluation

- Act 6 Matematicas FinancieraDocument10 pagesAct 6 Matematicas FinancieraDiana Carolina PALACIOS NARVAEZPas encore d'évaluation

- Support Evaluation Et Reprise 2Document15 pagesSupport Evaluation Et Reprise 2Abdoulaye Aziz Mariko100% (1)

- Analyse Financiere 5Document40 pagesAnalyse Financiere 5Ahmed CHARIFPas encore d'évaluation

- Correction Série 3 PPTDocument13 pagesCorrection Série 3 PPTmessidkawtarPas encore d'évaluation

- IAS 8 Méthodes Comptables Changements Destimations Comptables Et ErreursDocument42 pagesIAS 8 Méthodes Comptables Changements Destimations Comptables Et Erreurskaisfekih899Pas encore d'évaluation

- Synthèse ComptaDocument161 pagesSynthèse ComptaPaix CulPas encore d'évaluation

- Compta 02 ExoDocument2 pagesCompta 02 Exoandreichirita59Pas encore d'évaluation

- DCG 2021 Ue10 CorrigeDocument30 pagesDCG 2021 Ue10 CorrigeKossonou Eliel-Shalom KouadioPas encore d'évaluation

- Financement Immobilier Partie I Et PartiDocument58 pagesFinancement Immobilier Partie I Et PartikramoPas encore d'évaluation

- Operations Comptables ParticDocument82 pagesOperations Comptables Particlegende androidePas encore d'évaluation

- Actif D'une BanqueDocument21 pagesActif D'une BanqueAnas ABPas encore d'évaluation

- 1 - Petit Écolier - ÉlèveDocument52 pages1 - Petit Écolier - ÉlèveDiane NjoyaPas encore d'évaluation

- Besoins en Fonds de Roulement 1697938907Document8 pagesBesoins en Fonds de Roulement 1697938907mansourdieng1996Pas encore d'évaluation

- Corrigé-Type de L'épreuve de Comptabilité Générale - 231011 - 193709Document4 pagesCorrigé-Type de L'épreuve de Comptabilité Générale - 231011 - 193709Ben Dibal PendyPas encore d'évaluation

- Exemple de Memoire 2Document76 pagesExemple de Memoire 2Taha ElPas encore d'évaluation

- Correction Cca Kenitra - Kadiri YoussefDocument5 pagesCorrection Cca Kenitra - Kadiri Youssefsaadahammam06Pas encore d'évaluation

- EXAMEN 40% Travaux de Fin D Exercice LPSG3 CCA CESAG 2021Document5 pagesEXAMEN 40% Travaux de Fin D Exercice LPSG3 CCA CESAG 2021Christ Fourrier DokponouPas encore d'évaluation

- Plan ComptableDocument3 pagesPlan ComptableArmel Hamidou100% (1)

- Bilan Fonctionnel PDFDocument6 pagesBilan Fonctionnel PDFkaidi chaimaaPas encore d'évaluation

- Traitement Des SubventionsDocument24 pagesTraitement Des SubventionsAnass Lazaar80% (5)

- Les Retraitements D'homogéniétéDocument6 pagesLes Retraitements D'homogéniétéÃk RåmPas encore d'évaluation

- CH 7 Tableaux de Flux de TrésorerieDocument13 pagesCH 7 Tableaux de Flux de TrésorerieLauryne MorvanPas encore d'évaluation

- TDs Comptabilité Bilan v201022Document3 pagesTDs Comptabilité Bilan v201022farid aarabPas encore d'évaluation

- Les CréancesDocument41 pagesLes CréancesSaad JamaaPas encore d'évaluation

- Projet Fin D EtudeDocument25 pagesProjet Fin D EtudeWiam WiPas encore d'évaluation

- Departement de Formation en Gestion Licence Premiere AnneeDocument23 pagesDepartement de Formation en Gestion Licence Premiere AnneeSchilschaPas encore d'évaluation

- Le Plan Comptable Fin 15 JuinDocument21 pagesLe Plan Comptable Fin 15 Juinfalou testPas encore d'évaluation

- Tableau de Calcul BFRN Corrigé 2022Document2 pagesTableau de Calcul BFRN Corrigé 2022Fareh AzeddinePas encore d'évaluation

- MICKY Brahim - ACG - M2 Groupe 4Document14 pagesMICKY Brahim - ACG - M2 Groupe 4Brahim MickyPas encore d'évaluation