Académique Documents

Professionnel Documents

Culture Documents

Practical Case 1 - Project Finance PDF

Transféré par

ScribdTranslationsTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Practical Case 1 - Project Finance PDF

Transféré par

ScribdTranslationsDroits d'auteur :

Formats disponibles

Case study Project Finance

Project Management Specialty

ALTERNATIVE 1: DO NOTHING Project Financing

Situation 0 Case Study 1 - Module 5 - Project Finance By: Garinardy Rodríguez

Rooms 200

Price 70 €

Occupation 50%

Situation 1

Rooms 200

Price 70 €

Occupation 50.00%

Annual decline -30%

Update rate 8%

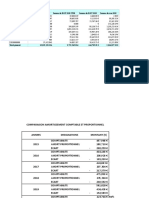

FC / t 0 1 2 3 4 5 6 7 8 9 10

Occupation 50.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00%

Revenues 2,520,000 € 1,764,000 € 1,234,800 € 864,360 € 605,052 € 423,536 € 296,475 € 207,533 € 145,273 € 101,691 € 71,184 €

Fixed costs 100,000 € 100,000 € 100,000 € 100,000 € 100,000 € 100,000 € 100,000 € 100,000 € 100,000 € 100,000 € 100,000 €

Variable costs 226,800 € 158,760 € 111,132 € 77,792 € 54,455 € 38,118 € 26,683 € 18,678 € 13,075 € 9,152 € 6,407 €

Reform - 0 0 0 0 0 0 0 0 0 0

FC FINAL (i) 2,420,000 € 1,664,000 € 1,134,800 € 764,360 € 505,052 € 323,536 € 196,475 € 107,533 € 45,273 € 1,691 € -28,816 €

VAN 6,040,703 €]

ALTERNATIVE A: REFORM WITH

FINANCING

Situation 0

Rooms 200

Price 70 €

Occupation 50%

Situation 1

Rooms 200

Price 70 €

Occupation 60.00%

Annual increase 60%

Update rate 8%

FC / t 0 1 2 3 4 5 6 7 8 9 10

Occupation 50.00% 60.00% 60.00% 60.00% 60.00% 60.00% 60.00% 60.00% 60.00% 60.00% 60.00%

Revenues 2,520,000 € 1,344,000 € 2,150,400 € 3,440,640 € 5,505,024 € 8,808,038 € ########### ########### ########### ########### ###########

Fixed costs 100,000 € 33,333 € 100,000 € 100,000 € 100,000 € 100,000 € 100,000 € 100,000 € 100,000 € 100,000 € 100,000 €

Variable costs 226,800 € 120,960 € 193,536 € 309,658 € 495,452 € 792,723 € 1,268,358 € 2,029,372 € 3,246,995 € 5,195,192 € 8,312,308 €

Reform (8,000,000.00) 4,000,000.00 6,000,000.00 - - - - - - - -

FC FINAL (i) 10,193,200 € -2,810,293 € -4,143,136 € 3,030,982 € 4,909,572 € 7,915,315 € ########### ########### ########### ########### ###########

VAN 115,763,479 €]

ALTERNATIVE B: PROJECT FINANCE

Situation 0

Rooms 200

Price 70 €

Occupation 50%

Situation 1

Rooms 200

Price 70 €

Occupation 50.00%

Annual increase 60%

Update rate 8%

FC / t 0 1 2 3 4 5 6 7 8 9 10

Occupation 50.00% 60.00% 60.00% 60.00% 60.00% 60.00% 60.00% 60.00% 60.00% 60.00% 60.00%

Revenues 2,520,000 € 1,344,000 € 2,150,400 € 3,440,640 € 5,505,024 € 8,808,038 € ########### ########### ########### ########### ###########

Fixed costs 100,000 € 33,333 € 100,000 € 100,000 € 100,000 € 100,000 € 100,000 € 100,000 € 100,000 € 100,000 € 100,000 €

Variable costs 226,800 € 120,960 € 193,536 € 309,658 € 495,452 € 792,723 € 1,268,358 € 2,029,372 € 3,246,99 5,195,19 8,312,308 €

Project Finance (8,000,000.00) - - 3,268,608.00 5,229,772.80 8,367,636.48 - - - - -

FC FINAL (i) 10,193,200 € 1,189,707 € 1,856,864 € -237,626 € -320,201 € -452,322 € ########### ########### ########### ########### ###########

VAN 214,316,140 €]

According to the NPV criteria, financing through PROJECT FINANCE would be more profitable for the hotel remodeling project. Also cash flows with negative amounts are lower in relation to

the FINANCIAL REFORM.

I would only choose a different decision when the project is not able to generate positive cash flows and has to be secured using the strength and solvency of the sponsors.

Vous aimerez peut-être aussi

- Reporting pilier 3 de solvabilité II: Guide pour la production des QRTD'EverandReporting pilier 3 de solvabilité II: Guide pour la production des QRTPas encore d'évaluation

- Cas Pratique 1 - Financement de Projet PDFDocument1 pageCas Pratique 1 - Financement de Projet PDFScribdTranslationsPas encore d'évaluation

- Caz Practic 1 - Project Finance PDFDocument1 pageCaz Practic 1 - Project Finance PDFScribdTranslationsPas encore d'évaluation

- Lecture 3.3. ForecastingDocument17 pagesLecture 3.3. Forecastingsfalcao91Pas encore d'évaluation

- Corrigé D'exam GF 2018 (Partie A)Document2 pagesCorrigé D'exam GF 2018 (Partie A)new seriesPas encore d'évaluation

- Corrigé D'exam GF 2018 (Partie A) - 2Document2 pagesCorrigé D'exam GF 2018 (Partie A) - 2Hasania Ait OuakrimPas encore d'évaluation

- ESCATSADocument8 pagesESCATSALourdes PortaPas encore d'évaluation

- Depreciation + Non Current DebtDocument4 pagesDepreciation + Non Current Debtwangyinuo2580Pas encore d'évaluation

- Cours 2 - Budget Des Actions Marketing Et CommercialesDocument49 pagesCours 2 - Budget Des Actions Marketing Et Commercialesjulien-34820Pas encore d'évaluation

- Dossier 2 Investissement Et RentabilitéDocument1 pageDossier 2 Investissement Et Rentabilitéapi-734398917Pas encore d'évaluation

- Cas Nomolas 4Document33 pagesCas Nomolas 4pjczmgj9nsPas encore d'évaluation

- 2 Cejm Soleil Dans La Maison AliciaDocument2 pages2 Cejm Soleil Dans La Maison AliciaAlicia HonoréPas encore d'évaluation

- Essai ExcellDocument6 pagesEssai ExcellCharly IndomoPas encore d'évaluation

- Corrigé Sujet 2022Document8 pagesCorrigé Sujet 2022célinePas encore d'évaluation

- Act 2contabilidadDocument2 pagesAct 2contabilidadstefanyPas encore d'évaluation

- N Secure Presentation 004Document13 pagesN Secure Presentation 004BOUGDALPas encore d'évaluation

- Bus PlanDocument26 pagesBus PlanAsile PMPas encore d'évaluation

- XL Semaine 2 ÉnoncéDocument5 pagesXL Semaine 2 ÉnoncédshirkoobiPas encore d'évaluation

- Etude de CasDocument3 pagesEtude de CasYàSs MîinaPas encore d'évaluation

- Tableau SIMULATION PROJET IMMO POLYNESIE 25 000eurosDocument5 pagesTableau SIMULATION PROJET IMMO POLYNESIE 25 000eurosPatrice BuissonPas encore d'évaluation

- Tableau de Bord (Les Ventes Par Temps, Par Ville Et Par Boutique)Document7 pagesTableau de Bord (Les Ventes Par Temps, Par Ville Et Par Boutique)BOUZAZIPas encore d'évaluation

- CH20 Tableaux Bord 2Document16 pagesCH20 Tableaux Bord 2jPas encore d'évaluation

- Efecto Bola de NieveDocument6 pagesEfecto Bola de NieveJakoPas encore d'évaluation

- Tempo Diferença N (RCDS) N (RDC)Document5 pagesTempo Diferença N (RCDS) N (RDC)Jorge MoreiraPas encore d'évaluation

- Cours Cout Preetabli Et Budget FlexibleDocument4 pagesCours Cout Preetabli Et Budget FlexibleKan Enos KouakouPas encore d'évaluation

- Contrôle de Gestion - Exercices - Pro - MaxDocument11 pagesContrôle de Gestion - Exercices - Pro - MaxImane SabiriPas encore d'évaluation

- GEMMA Compound Interest CalculatorDocument4 pagesGEMMA Compound Interest CalculatorPatrick DebattistaPas encore d'évaluation

- Simulation Amort Proportionnel20-21 Copie 21-01-2023Document30 pagesSimulation Amort Proportionnel20-21 Copie 21-01-2023issam jendoubiPas encore d'évaluation

- Daiyan RéservoirDocument6 pagesDaiyan RéservoirDanis GoulamhoussenPas encore d'évaluation

- Cas Orion - XLSX 0Document9 pagesCas Orion - XLSX 0clépower 27Pas encore d'évaluation

- 2020 7 Julio Examen Conta SoluciónDocument1 page2020 7 Julio Examen Conta Soluciónpaula pazos cortegosoPas encore d'évaluation

- b3 PPT Intro Pi BP 2Document31 pagesb3 PPT Intro Pi BP 2jadecoste.jlPas encore d'évaluation

- Tarea Puente Diciembre-EmpresaDocument7 pagesTarea Puente Diciembre-EmpresaJavier CabezasPas encore d'évaluation

- GF S5 EX Calculs Actualisation Capitalisation CorrectionDocument6 pagesGF S5 EX Calculs Actualisation Capitalisation Correctionimanesabbar804Pas encore d'évaluation

- Coûts Partiels Et Seuil de Rentabilité - CorrigéDocument10 pagesCoûts Partiels Et Seuil de Rentabilité - Corrigé3ONSORY FFPas encore d'évaluation

- EX1 Gestion de MaintenanceDocument6 pagesEX1 Gestion de MaintenanceMed ABPas encore d'évaluation

- IC Kpi Dashboard Template Free FR2Document14 pagesIC Kpi Dashboard Template Free FR2HassanPas encore d'évaluation

- Soltion TD #2 CD & SRDocument5 pagesSoltion TD #2 CD & SRAnas MadaniPas encore d'évaluation

- Classeur 2Document5 pagesClasseur 2Solange LonkoPas encore d'évaluation

- Classeur 2Document5 pagesClasseur 2Solange LonkoPas encore d'évaluation

- Coût de Production 1500 0.596 893.98 : Charges Hôtel Restaurant Bar TotalDocument2 pagesCoût de Production 1500 0.596 893.98 : Charges Hôtel Restaurant Bar TotalMatéo LucasPas encore d'évaluation

- Business Plan RestaurantDocument20 pagesBusiness Plan Restaurantsamya elbaroudiPas encore d'évaluation

- 2 - Exemple D Annexe FinanciereDocument17 pages2 - Exemple D Annexe FinanciereArland Narcisse Ella NzehPas encore d'évaluation

- Cash Flow EstimationsDocument4 pagesCash Flow Estimationsmaaiq007Pas encore d'évaluation

- Supuestos ResueltosDocument42 pagesSupuestos ResueltosErika PellicerPas encore d'évaluation

- Corrigé Cas AgrimécaDocument2 pagesCorrigé Cas Agrimécasaidbenadh100% (2)

- UE11 2022 CorrigeDocument17 pagesUE11 2022 Corrigenora koibichPas encore d'évaluation

- Resumé PrévisionnelDocument1 pageResumé PrévisionnelAstuconseil CommuPas encore d'évaluation

- Projet Dusine de ChocolatDocument8 pagesProjet Dusine de ChocolatKOUADIO FrankPas encore d'évaluation

- Cómo ELIMINAR Tus DEUDASDocument17 pagesCómo ELIMINAR Tus DEUDASDavid SanchezPas encore d'évaluation

- Classeur 1Document9 pagesClasseur 1fdakkakiPas encore d'évaluation

- Rapport Mensuel Des Recettes Et Dépenses de MorijaDocument3 pagesRapport Mensuel Des Recettes Et Dépenses de MorijapromepromessePas encore d'évaluation

- Etude de FaisabiliteDocument12 pagesEtude de FaisabiliteABDELLAH EL KASBAOUIPas encore d'évaluation

- MF1 1148 Cas Neto Et RivaliDocument6 pagesMF1 1148 Cas Neto Et Rivalinomena.ramaroPas encore d'évaluation

- Classeur 1Document17 pagesClasseur 1Roland Carlos Christian EboloPas encore d'évaluation

- Super EtteDocument6 pagesSuper Ettezakimami65Pas encore d'évaluation

- Comptable RH A RendreDocument5 pagesComptable RH A Rendremodoum469Pas encore d'évaluation

- Business PlanDocument2 pagesBusiness PlanAnass KharrazPas encore d'évaluation

- Corrigé S6 Contrôle de Gestion CC 2015Document2 pagesCorrigé S6 Contrôle de Gestion CC 2015MarcodPas encore d'évaluation

- Cours de Comptabilite Generale 3 Et TDDocument96 pagesCours de Comptabilite Generale 3 Et TDKONE Moussa100% (1)

- Stagnation SpirituelleDocument3 pagesStagnation SpirituelleScribdTranslationsPas encore d'évaluation

- Cas 4 Questions ASICSDocument1 pageCas 4 Questions ASICSScribdTranslationsPas encore d'évaluation

- Examen DD124 2Document8 pagesExamen DD124 2ScribdTranslationsPas encore d'évaluation

- IG2 SHAHID REHAN20191202-3236-11ekn05Document26 pagesIG2 SHAHID REHAN20191202-3236-11ekn05ScribdTranslationsPas encore d'évaluation

- Activité 2 - Cycle CellulaireDocument3 pagesActivité 2 - Cycle CellulaireScribdTranslationsPas encore d'évaluation

- Carte Conceptuelle T8.2Document2 pagesCarte Conceptuelle T8.2ScribdTranslationsPas encore d'évaluation

- Importance Du Leadership en Science de La RéglementationDocument20 pagesImportance Du Leadership en Science de La RéglementationScribdTranslationsPas encore d'évaluation

- M2 - TI - Compétences Pour La Communication Orale Et Écrite PDFDocument5 pagesM2 - TI - Compétences Pour La Communication Orale Et Écrite PDFScribdTranslationsPas encore d'évaluation

- The Air Liquide Airgas Merger Case AnalysisDocument18 pagesThe Air Liquide Airgas Merger Case AnalysisScribdTranslationsPas encore d'évaluation

- Cas de La Perle NoireDocument5 pagesCas de La Perle NoireScribdTranslationsPas encore d'évaluation

- Outils de Simulation PC3 Pour La Prise de DécisionDocument9 pagesOutils de Simulation PC3 Pour La Prise de DécisionScribdTranslationsPas encore d'évaluation

- Étude de Marché de ColunDocument9 pagesÉtude de Marché de ColunScribdTranslationsPas encore d'évaluation

- Examen Final - Administration Financière - Groupe N°11 - CopieDocument10 pagesExamen Final - Administration Financière - Groupe N°11 - CopieScribdTranslationsPas encore d'évaluation

- Pratique EXCELDocument10 pagesPratique EXCELScribdTranslationsPas encore d'évaluation

- Évaluation Des Performances de Coca ColaDocument1 pageÉvaluation Des Performances de Coca ColaScribdTranslationsPas encore d'évaluation

- Exemple de Lettre de Nomination Et Approbation DunDocument2 pagesExemple de Lettre de Nomination Et Approbation DunScribdTranslationsPas encore d'évaluation

- Conception Humaine - 384 LignesDocument7 pagesConception Humaine - 384 LignesScribdTranslationsPas encore d'évaluation

- CHAPELET-POUR-REFROIDIR-LENFANT-DIEU ChapeletDocument19 pagesCHAPELET-POUR-REFROIDIR-LENFANT-DIEU ChapeletScribdTranslationsPas encore d'évaluation

- Questions Banque Unité Virtuelle PC 2Document14 pagesQuestions Banque Unité Virtuelle PC 2ScribdTranslationsPas encore d'évaluation

- ROSAIRE-POUR-SOULEVER-LENFANT-DIEU ChapeletDocument18 pagesROSAIRE-POUR-SOULEVER-LENFANT-DIEU ChapeletScribdTranslationsPas encore d'évaluation

- Matrice de Risques en Cours Sur African Photo SafariDocument15 pagesMatrice de Risques en Cours Sur African Photo SafariScribdTranslationsPas encore d'évaluation

- Fin Man Case Problèmes Analyse Des Ratios FinanciersDocument6 pagesFin Man Case Problèmes Analyse Des Ratios FinanciersScribdTranslationsPas encore d'évaluation

- Test Sommatif en Sciences 5 Avec CorrigéDocument3 pagesTest Sommatif en Sciences 5 Avec CorrigéScribdTranslationsPas encore d'évaluation

- Corporate Finance Case Study WorkingDocument13 pagesCorporate Finance Case Study WorkingScribdTranslationsPas encore d'évaluation

- Exercices Et ProblemesDocument67 pagesExercices Et ProblemesScribdTranslationsPas encore d'évaluation

- Systèmes Économiques DBQ PDFDocument6 pagesSystèmes Économiques DBQ PDFScribdTranslationsPas encore d'évaluation

- Plan de Cours Routine Quotidienne PDFDocument4 pagesPlan de Cours Routine Quotidienne PDFScribdTranslationsPas encore d'évaluation

- Conception Purlin Et Sagrod (NSCP 2015)Document4 pagesConception Purlin Et Sagrod (NSCP 2015)ScribdTranslationsPas encore d'évaluation

- Derniers Travaux Du Dossier CaixabankDocument8 pagesDerniers Travaux Du Dossier CaixabankScribdTranslationsPas encore d'évaluation

- Exercices de Distribution T-Étudiants RésolusDocument4 pagesExercices de Distribution T-Étudiants RésolusScribdTranslationsPas encore d'évaluation

- 50 Versets Combat Spirituel 1Document6 pages50 Versets Combat Spirituel 1Tepuari SimonePas encore d'évaluation

- Ménard Louis - Hermès TrismégisteDocument415 pagesMénard Louis - Hermès Trismégistesandayu100% (4)

- Histoire de La Langue FrancaiseDocument45 pagesHistoire de La Langue FrancaisenaticelPas encore d'évaluation

- Amor Mi Fa Cantar (Codex Rossi, XIVème Siècle)Document1 pageAmor Mi Fa Cantar (Codex Rossi, XIVème Siècle)Yvonnig GuéganPas encore d'évaluation

- Marches PublicsDocument98 pagesMarches PublicschichanPas encore d'évaluation

- Textes À Commenter Roman Xxe SDocument10 pagesTextes À Commenter Roman Xxe SRosa Espinar HerreroPas encore d'évaluation

- NasserDocument7 pagesNasserABAPas encore d'évaluation

- LES Dieux Romains Et GrecqueDocument3 pagesLES Dieux Romains Et GrecquefatimaahloumPas encore d'évaluation

- Sujet Concours 2018 Note AdministrativeDocument31 pagesSujet Concours 2018 Note Administrativeyaopierre jeanPas encore d'évaluation

- Defis Electriques Alleges 2Document5 pagesDefis Electriques Alleges 2GurlInpinkPas encore d'évaluation

- Presentation Prestations Sur BC Appel D OffreDocument12 pagesPresentation Prestations Sur BC Appel D OffreIsmail BEHNANEPas encore d'évaluation

- Dce - PJX - CVP - MNT - n7-Bcd - C - Feuille - 114 - Plan D'implantation Des Equipements Et Des ReseauxDocument1 pageDce - PJX - CVP - MNT - n7-Bcd - C - Feuille - 114 - Plan D'implantation Des Equipements Et Des ReseauxTunisianoCAPas encore d'évaluation

- Carl Gustave Jung - Les Commentaires Des Morts TibetainsDocument20 pagesCarl Gustave Jung - Les Commentaires Des Morts TibetainsDispo Optimo100% (1)

- Presentation Du Groupe Bmce Version FinaleDocument6 pagesPresentation Du Groupe Bmce Version FinaleCharden MouelePas encore d'évaluation

- AdminLB-carte Identite de La Vache PDFDocument1 pageAdminLB-carte Identite de La Vache PDFAngel KissPas encore d'évaluation

- Fiche de Procédure Pénale HDDocument10 pagesFiche de Procédure Pénale HDnouna1nounaPas encore d'évaluation

- Hydraulic Model Tests On A Stormwater Vortex Drop ShaftDocument8 pagesHydraulic Model Tests On A Stormwater Vortex Drop ShaftAdrian Emilio Rizo IbañezPas encore d'évaluation

- Aide À La Rédaction Du Cahier Des Charges GPAODocument9 pagesAide À La Rédaction Du Cahier Des Charges GPAOviolette lajoliefleur100% (1)

- Exemple de Rapport ScrumDocument50 pagesExemple de Rapport ScrumMeryem BakirPas encore d'évaluation

- 607Document48 pages607AlbavonePas encore d'évaluation

- Convention Collective Du Personnel de Service en Vol D'air CanadaDocument292 pagesConvention Collective Du Personnel de Service en Vol D'air Canadascfp4091Pas encore d'évaluation

- Fiche 5ForcesdePorterDocument2 pagesFiche 5ForcesdePorterOumarPas encore d'évaluation

- La Croyance en Le Wahdat Ul WujudDocument39 pagesLa Croyance en Le Wahdat Ul WujudfusukuPas encore d'évaluation

- Jesus Dans L'ancien TestamentDocument1 pageJesus Dans L'ancien TestamentdavidPas encore d'évaluation

- I. Chapitre 1: La Fonction Comptable: La Tenue de ComptabilitéDocument31 pagesI. Chapitre 1: La Fonction Comptable: La Tenue de ComptabilitéIvan NGOMO NANGPas encore d'évaluation

- Historique ScienceDocument3 pagesHistorique Sciencehben04124Pas encore d'évaluation

- Memo DicteeDocument4 pagesMemo DicteeNadine Morel BessierePas encore d'évaluation

- Présence Du Cinéma, n.17Document92 pagesPrésence Du Cinéma, n.17Leticia WeberPas encore d'évaluation

- Marketing One To OneDocument5 pagesMarketing One To Oneisyan100% (1)

- Définition:: 1. Le Taux de Change NominalDocument3 pagesDéfinition:: 1. Le Taux de Change NominalLatifa HarrazPas encore d'évaluation